Finance

What FICO Score Does Capital One Use

Published: March 6, 2024

Find out which FICO score Capital One uses to evaluate your creditworthiness. Learn more about the impact of your credit score on your financial options.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit scoring, where a three-digit number holds the power to shape your financial journey. In this article, we delve into the realm of FICO scores and their pivotal role in the lending decisions of financial institutions. Specifically, we will explore the relevance of FICO scores in the context of Capital One, a prominent player in the credit card and lending industry.

Understanding how FICO scores function and their significance in the lending landscape is crucial for anyone aiming to navigate the complex terrain of personal finance. Whether you’re eyeing that dream car, contemplating homeownership, or seeking a new credit card, comprehending the inner workings of FICO scores can significantly impact your financial prospects.

So, let’s embark on a journey to demystify FICO scores, unravel the nuances of Capital One’s credit evaluation process, and gain insights into the factors that influence credit decisions. By the end of this exploration, you’ll be equipped with valuable knowledge to steer your financial endeavors with confidence and foresight.

Understanding FICO Scores

At the core of the consumer lending industry lies the FICO score, a numerical representation of an individual’s creditworthiness. Developed by the Fair Isaac Corporation, FICO scores serve as a yardstick for assessing the risk associated with extending credit to consumers. These scores, ranging from 300 to 850, are derived from an intricate evaluation of an individual’s credit history, payment behavior, credit utilization, length of credit history, and the mix of credit types.

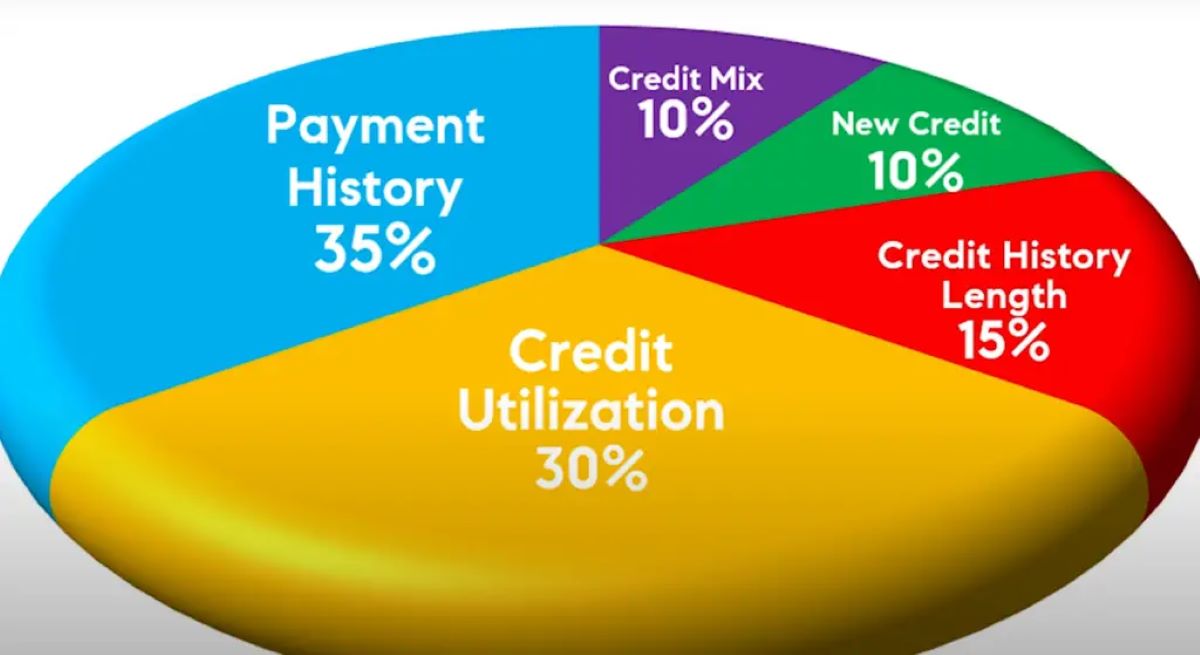

Understanding the components that contribute to FICO scores is imperative for anyone keen on comprehending their financial standing. Payment history holds the most significant weight in determining FICO scores, accounting for approximately 35% of the total score. This underscores the importance of consistent, timely payments on credit accounts, as any delinquencies can significantly dent one’s creditworthiness.

Closely trailing payment history is the amount owed, which makes up around 30% of the FICO score. This factor considers the utilization of available credit, with lower credit utilization reflecting positively on the score. The length of credit history, comprising 15% of the score, assesses the duration for which credit accounts have been active, emphasizing the advantages of maintaining longstanding, healthy credit relationships.

Furthermore, credit mix and new credit inquiries collectively contribute to the remaining 20% of the FICO score. A diverse credit portfolio, encompassing a mix of credit cards, installment loans, and mortgages, can bolster one’s credit profile. Conversely, an excessive number of new credit applications within a short timeframe can raise red flags for lenders, potentially lowering the FICO score.

By comprehending the intricate interplay of these components, individuals can gain a clearer perspective on how their financial behaviors and decisions directly influence their FICO scores. This insight is invaluable in steering proactive measures to enhance creditworthiness and secure favorable lending terms.

Types of FICO Scores

It’s essential to recognize that FICO scores are not monolithic; rather, they come in various iterations tailored to specific lending contexts. The most commonly referenced FICO score is the classic FICO Score 8, which draws data from the three major credit bureaus: Equifax, Experian, and TransUnion. This score serves as a benchmark for many lending decisions, encompassing credit cards, auto loans, and mortgages.

Besides the FICO Score 8, there exist specialized FICO scoring models designed to cater to distinct industry needs. For instance, the FICO Auto Score delves deeper into an individual’s auto loan repayment history, offering lenders nuanced insights into the applicant’s creditworthiness within the realm of auto financing. Similarly, the FICO Bankcard Score hones in on credit card-related behaviors, aiding credit card issuers in evaluating applicants for new card approvals and credit limit adjustments.

Moreover, FICO offers industry-specific scores for mortgage lending, known as FICO Scores 2, 4, and 5, each drawing data from a single credit bureau. These scores are tailored to the requirements of mortgage lenders, factoring in nuances specific to mortgage underwriting processes.

As the lending landscape evolves, so do the FICO scoring models. The latest addition, FICO Score 10, incorporates a more comprehensive assessment of credit risk, particularly focusing on the management of revolving credit balances. This updated scoring model aims to provide lenders with a more refined evaluation of an individual’s credit behavior, aligning with the dynamic nature of consumer credit management.

Understanding the diverse array of FICO scores is pivotal for individuals seeking to gauge their creditworthiness within specific lending contexts. By recognizing the nuances of these scoring models, consumers can tailor their financial strategies to align with the criteria most pertinent to their desired credit pursuits, thereby optimizing their chances of securing favorable lending terms.

Capital One’s Use of FICO Scores

Capital One, a prominent player in the financial services industry, relies on FICO scores as a cornerstone of its credit evaluation processes. When individuals apply for credit cards, loans, or other financial products offered by Capital One, their FICO scores play a pivotal role in determining the terms and conditions of the credit extended.

Capital One primarily utilizes the classic FICO Score 8, drawing data from all three major credit bureaus, to assess the creditworthiness of applicants. This widely recognized scoring model provides Capital One with a comprehensive overview of an individual’s credit history, payment behavior, and overall credit management practices.

Besides the FICO Score 8, Capital One may also consider industry-specific FICO scores when evaluating credit applications tailored to distinct financial products. For instance, when assessing applications for auto loans, Capital One may factor in the insights gleaned from the FICO Auto Score, which offers a specialized perspective on an individual’s creditworthiness in the context of auto financing.

Capital One’s reliance on FICO scores underscores the significance of maintaining a healthy credit profile, as these scores profoundly influence the terms and interest rates offered to applicants. Individuals with higher FICO scores are more likely to qualify for favorable interest rates, higher credit limits, and enhanced financial product offerings from Capital One.

Furthermore, Capital One’s utilization of FICO scores extends beyond the initial credit approval process. The ongoing management of credit accounts, including credit limit adjustments, periodic reviews, and account upgrades, often hinges on an individual’s FICO scores. As such, maintaining and improving FICO scores can directly impact the trajectory of one’s relationship with Capital One, potentially unlocking opportunities for expanded credit access and improved financial products.

By recognizing the pivotal role of FICO scores in Capital One’s credit evaluation framework, individuals can proactively manage their credit profiles, cultivate healthy financial habits, and strategically position themselves for favorable credit opportunities within the Capital One ecosystem.

Factors Affecting Credit Decisions

When individuals apply for credit products, including credit cards, loans, and mortgages, various factors come into play in the decision-making processes of financial institutions like Capital One. While FICO scores hold significant sway, several additional elements influence credit decisions, shaping the terms, interest rates, and credit limits extended to applicants.

One pivotal factor is an individual’s income and employment status. Lenders, including Capital One, assess the stability and sufficiency of an applicant’s income to gauge their capacity to repay the credit extended. A steady, verifiable income stream often bolsters an applicant’s creditworthiness, potentially leading to more favorable credit terms.

Additionally, the debt-to-income ratio serves as a critical metric in credit evaluations. This ratio compares an individual’s monthly debt obligations to their gross monthly income, offering insights into their financial obligations relative to their earning capacity. A lower debt-to-income ratio generally signals a healthier financial position, potentially enhancing an applicant’s credit prospects.

Furthermore, the length and depth of an individual’s credit history carry weight in credit decisions. Lenders assess the duration for which credit accounts have been active, alongside the mix of credit types utilized. A lengthy, robust credit history, coupled with responsible credit management practices, can bolster an applicant’s creditworthiness, potentially leading to more favorable credit terms and higher credit limits.

Moreover, the presence of collateral can significantly influence credit decisions, particularly in the context of secured loans and mortgages. Collateral, such as real estate or vehicles, provides lenders with a form of security, potentially mitigating the risk associated with extending credit. Applicants offering collateral may gain access to more favorable interest rates and higher credit limits, reflecting the reduced risk for the lender.

Lastly, the overall financial stability and demonstrated responsible financial behaviors of an applicant play a crucial role in credit decisions. Lenders seek individuals who exhibit prudent money management, timely bill payments, and a demonstrated capacity to navigate financial obligations responsibly. Such attributes can tip the scales in favor of more favorable credit terms and enhanced credit access.

By comprehending the multifaceted factors influencing credit decisions, individuals can strategically position themselves to optimize their credit prospects, cultivate healthy financial habits, and proactively address the criteria that shape lending outcomes.

Conclusion

Embarking on the quest for financial empowerment entails a deep understanding of the pivotal role played by FICO scores and the multifaceted dynamics influencing credit decisions. As we’ve navigated the intricacies of FICO scores and their relevance within Capital One’s credit evaluation framework, it becomes evident that these numerical representations hold profound implications for individuals seeking to access credit products and optimize their financial opportunities.

By unraveling the components that shape FICO scores, individuals can gain valuable insights into the levers influencing their creditworthiness. Payment history, credit utilization, length of credit history, credit mix, and new credit inquiries collectively shape the three-digit numbers that wield immense influence over credit prospects.

Furthermore, recognizing the diverse array of FICO scoring models and Capital One’s reliance on these scores underscores the need for tailored financial strategies aligned with specific credit pursuits. Whether seeking auto financing, credit card approvals, or mortgage lending, understanding the nuances of industry-specific FICO scores can empower individuals to navigate the credit landscape with precision.

Additionally, comprehending the factors affecting credit decisions, including income, debt-to-income ratio, credit history, collateral, and financial stability, equips individuals with the foresight to strategically position themselves for favorable credit outcomes. By proactively addressing these elements, individuals can cultivate healthy financial habits and enhance their creditworthiness, thereby unlocking a spectrum of credit opportunities.

As we conclude this exploration, it’s evident that the fusion of financial acumen and proactive credit management can pave the way for a robust financial future. Armed with a deeper understanding of FICO scores, industry-specific scoring models, and the broader factors shaping credit decisions, individuals can navigate the credit landscape with confidence, leveraging their knowledge to secure favorable credit terms and propel their financial aspirations.

Ultimately, the journey toward financial well-being is anchored in informed decision-making, prudent financial habits, and a strategic approach to credit management. By embracing these principles, individuals can harness the power of FICO scores to not only access credit but also to sculpt a resilient financial foundation, poised for long-term prosperity and stability.