Finance

Which FICO Score Do Apartments Use

Published: March 6, 2024

Find out which FICO score apartments use for finance-related decisions. Understand the impact of your credit score on renting a new apartment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the realm of personal finance, the significance of credit scores cannot be overstated. When it comes to securing an apartment rental, your creditworthiness often comes under scrutiny. Apartment rental companies commonly rely on various credit scoring models to assess the financial reliability of potential tenants. One such prominent model is the FICO score, which plays a pivotal role in determining an individual's creditworthiness. Understanding how FICO scores are utilized in the context of apartment rentals is crucial for anyone seeking to secure a lease.

As a prospective tenant, comprehending the relevance of FICO scores in the rental process can empower you to take proactive steps to bolster your creditworthiness. By delving into the intricacies of FICO scores and their implications for apartment rentals, you can gain valuable insights into the factors that influence rental decisions. Furthermore, learning how to enhance your FICO score to meet the criteria set by apartment rental companies can significantly increase your chances of securing your desired accommodation.

In this comprehensive guide, we will explore the role of FICO scores in apartment rentals, shedding light on the factors considered by rental companies and offering actionable tips to improve your creditworthiness. By the end of this article, you will have a clear understanding of how FICO scores impact apartment rentals and the steps you can take to enhance your credit profile for a successful rental application.

Understanding FICO Scores

FICO scores, developed by the Fair Isaac Corporation, are widely used credit scoring models that assess an individual’s credit risk based on their credit history. These scores, ranging from 300 to 850, provide a snapshot of a person’s creditworthiness, with higher scores indicating lower credit risk. Understanding the key components that contribute to FICO scores is essential for comprehending their impact on apartment rentals.

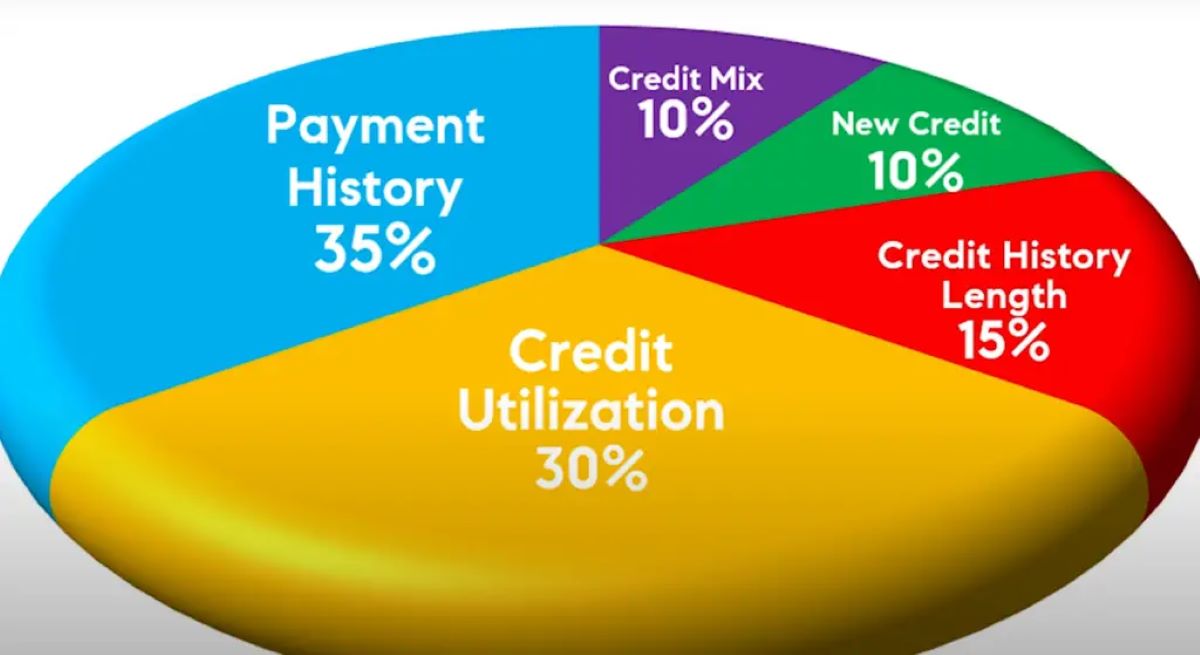

The calculation of FICO scores considers several factors, with payment history carrying significant weight. Timely payments on credit accounts, including loans, credit cards, and other financial obligations, positively influence one’s FICO score. The amount owed, length of credit history, new credit accounts, and the mix of credit types also play crucial roles in determining FICO scores.

It’s important to note that FICO scores are dynamic and can change over time based on an individual’s financial behavior. Regularly monitoring your FICO score and understanding the factors that contribute to its fluctuations can provide valuable insights into your credit standing. This knowledge can empower you to make informed decisions to improve your creditworthiness, which is particularly beneficial when seeking an apartment rental.

By grasping the nuances of FICO scores and the variables that shape them, individuals can take proactive steps to maintain or enhance their credit profiles, thereby increasing their attractiveness to apartment rental companies. This understanding serves as a foundation for navigating the rental process and making informed financial choices to bolster one’s creditworthiness.

FICO Scores and Apartment Rentals

Apartment rental companies often utilize FICO scores as a key metric to evaluate the financial reliability of prospective tenants. A higher FICO score generally signals responsible financial behavior and a lower credit risk, which is appealing to landlords and property management firms. When applying for a lease, individuals with strong FICO scores are more likely to be viewed favorably by rental companies, potentially increasing their chances of securing their desired accommodation.

Understanding the specific FICO score requirements set by apartment rental companies is crucial for individuals seeking to rent a property. While the exact score thresholds may vary among landlords and property management firms, having a good or excellent FICO score significantly enhances one’s prospects during the rental application process. It’s important to note that a favorable FICO score can not only facilitate the approval of a rental application but also potentially lead to more favorable lease terms and conditions.

Furthermore, individuals with lower FICO scores may encounter challenges when seeking to rent an apartment. Rental companies may perceive lower scores as indicative of higher credit risk, potentially leading to increased scrutiny or even denial of the rental application. As such, understanding the role of FICO scores in the rental process is instrumental in preparing for a successful application and addressing any credit-related concerns proactively.

Given the impact of FICO scores on apartment rentals, individuals should prioritize maintaining and enhancing their credit profiles to meet the criteria set by rental companies. By doing so, they can position themselves as desirable tenants and increase their chances of securing the rental property of their choice. Moreover, being cognizant of the influence of FICO scores on the rental process empowers individuals to take strategic steps to improve their creditworthiness and present themselves as reliable and responsible tenants.

Factors Considered by Apartment Rental Companies

When evaluating rental applications, apartment rental companies take various factors into account to assess the financial reliability of prospective tenants. While FICO scores play a pivotal role, rental companies consider additional elements to make informed leasing decisions.

1. Credit History: In addition to FICO scores, rental companies review applicants’ credit histories to gain insights into their financial behaviors, including past payment patterns, outstanding debts, and credit utilization. A positive credit history, characterized by consistent and responsible financial management, can bolster one’s application, while a history of delinquencies or defaults may raise concerns.

2. Income and Employment Stability: Verifying applicants’ income and employment stability is crucial for rental companies to ensure that tenants have the financial means to meet their lease obligations. Demonstrating a stable income and employment history can strengthen an individual’s rental application, instilling confidence in their ability to fulfill rent payments.

3. Rental History: Previous rental experiences are often considered, with rental companies seeking insights into applicants’ rental payment histories, adherence to lease agreements, and overall tenancy conduct. A positive rental history, characterized by on-time payments and responsible tenancy, can enhance an individual’s credibility as a prospective tenant.

4. Background Checks: Rental companies may conduct background checks to assess applicants’ criminal records and rental-related infractions. Maintaining a clean record can positively influence the leasing decision, highlighting an individual’s trustworthiness and suitability as a tenant.

5. References and Recommendations: Providing references from previous landlords or reputable individuals can offer valuable endorsements of an applicant’s character and reliability. Positive recommendations can reinforce an individual’s suitability as a tenant, potentially mitigating concerns related to credit or rental history.

Understanding the multifaceted evaluation criteria employed by apartment rental companies underscores the importance of presenting a well-rounded and favorable rental application. While FICO scores hold significance, addressing other factors within one’s control, such as maintaining a positive credit history, demonstrating financial stability, and cultivating strong rental references, can substantially strengthen one’s position as a desirable tenant.

How to Improve Your FICO Score for Apartment Rentals

Enhancing your FICO score is a proactive step that can significantly bolster your prospects when applying for apartment rentals. By focusing on key areas that influence FICO scores, individuals can work toward improving their credit profiles and positioning themselves as attractive tenants in the eyes of rental companies.

1. Payment Discipline: Consistently making on-time payments on credit accounts, loans, and bills is pivotal for improving FICO scores. Timely payments demonstrate financial responsibility and positively impact creditworthiness. Setting up automatic payments or reminders can help individuals stay on track with their financial obligations.

2. Credit Utilization: Managing credit card balances and keeping credit utilization low can contribute to FICO score improvement. Aim to keep credit card balances well below the credit limits, as high utilization can negatively affect credit scores. Paying down debts and avoiding maxing out credit lines are prudent strategies to optimize credit utilization.

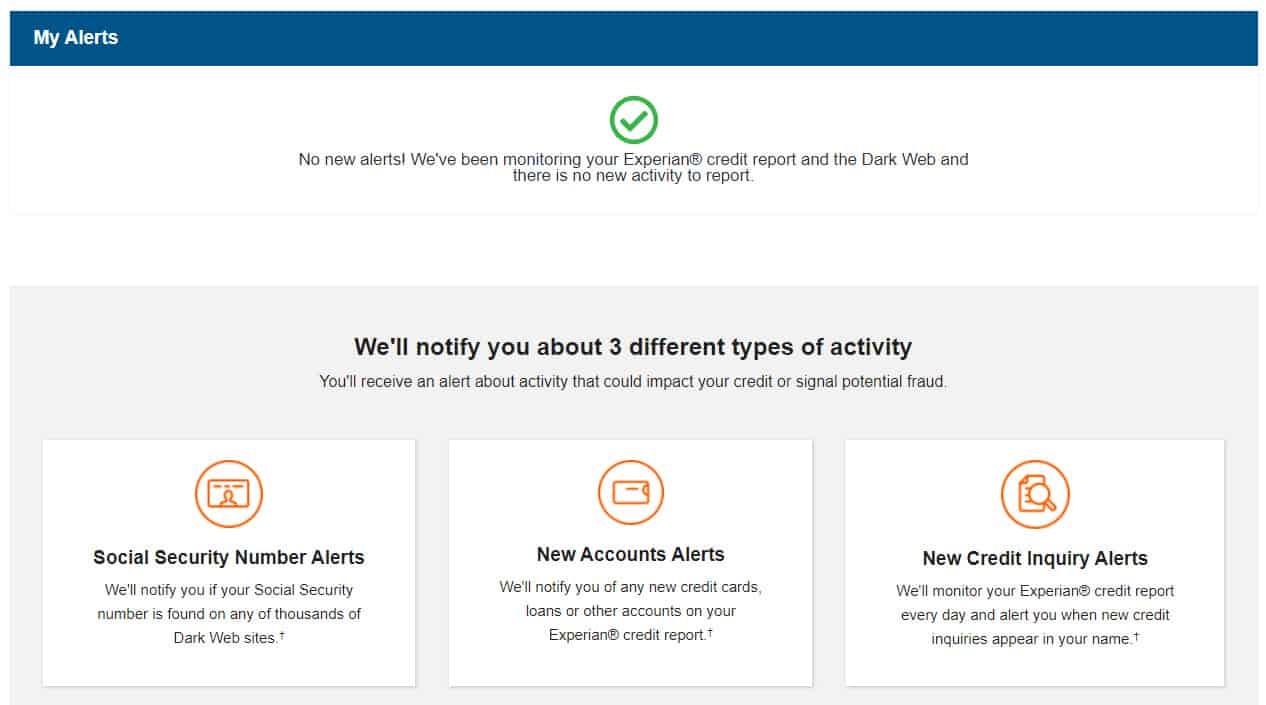

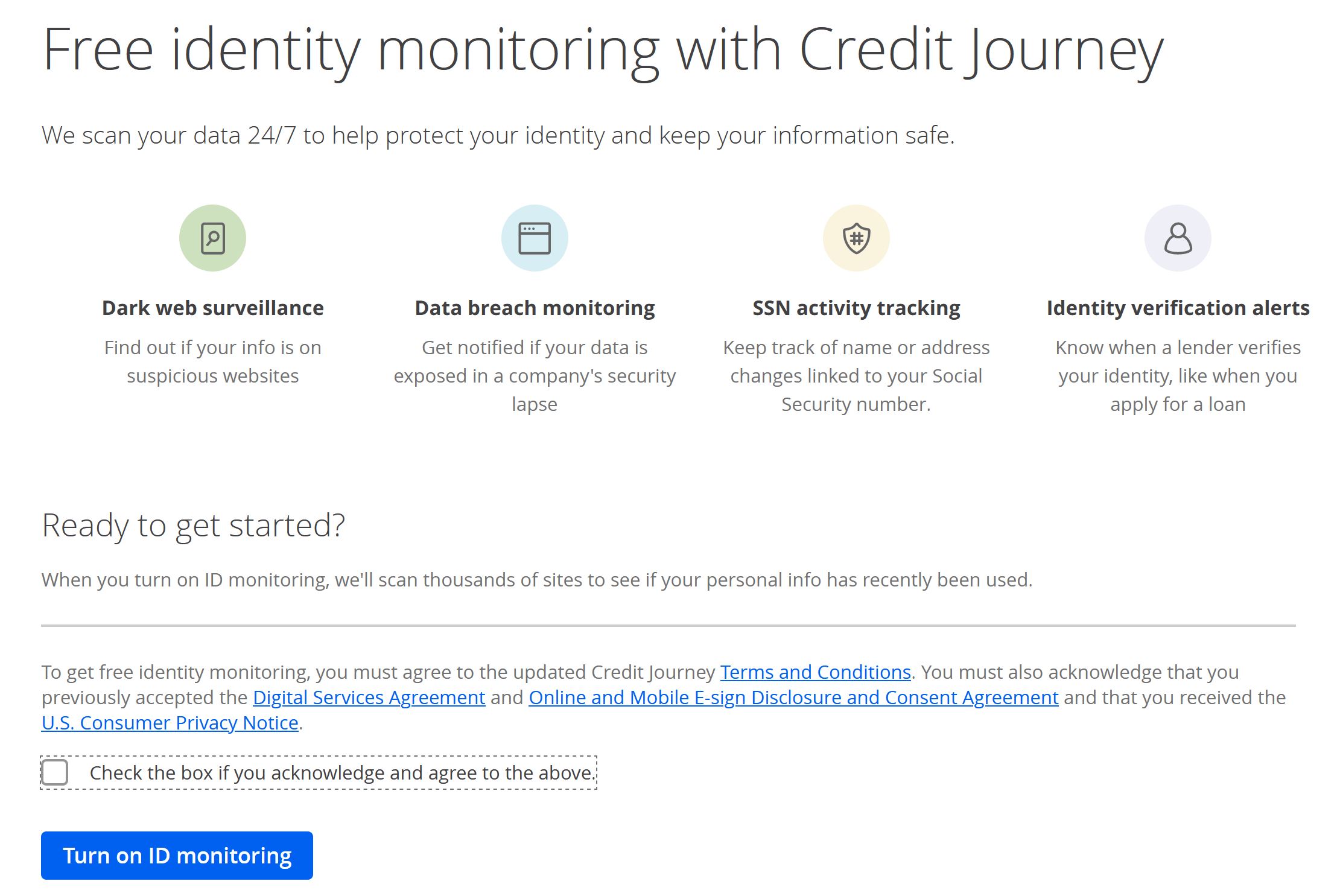

3. Credit Monitoring and Dispute Resolution: Regularly monitoring credit reports allows individuals to identify and address inaccuracies or discrepancies that could impact their FICO scores. Promptly resolving errors and disputing questionable items can help maintain accurate credit profiles, positively influencing credit scores.

4. Limiting New Credit Applications: Excessive credit inquiries and new credit applications within a short timeframe can potentially lower FICO scores. Limiting the frequency of credit applications and inquiries demonstrates responsible credit behavior and minimizes the impact on credit scores.

5. Building Positive Credit History: Establishing a positive credit history over time contributes to FICO score enhancement. This can be achieved by responsibly managing credit accounts, maintaining long-standing credit relationships, and diversifying credit types, showcasing a well-rounded credit portfolio.

6. Seeking Professional Guidance: For individuals facing complex credit challenges, seeking guidance from credit counseling services or financial advisors can offer tailored strategies to improve credit profiles. These professionals can provide personalized insights and actionable steps to address specific credit-related concerns.

By diligently focusing on these aspects, individuals can take proactive measures to enhance their FICO scores, thereby strengthening their eligibility for apartment rentals. Aiming for continuous improvement in credit management and diligently addressing areas that impact FICO scores can pave the way for successful rental applications and favorable leasing outcomes.

Conclusion

Understanding the interplay between FICO scores and apartment rentals is pivotal for individuals navigating the rental process. FICO scores serve as crucial indicators of creditworthiness, influencing the leasing decisions of apartment rental companies. By comprehending the factors considered by rental firms and the significance of FICO scores in the evaluation process, individuals can proactively enhance their credit profiles to align with the criteria set by landlords and property management firms.

While FICO scores hold substantial weight in rental applications, it is essential to recognize that rental companies assess multiple facets of an individual’s financial background and rental history. Factors such as credit history, income stability, rental track record, and character references collectively contribute to the overall assessment of a prospective tenant. By addressing these elements and maintaining a holistic approach to financial responsibility, individuals can fortify their rental applications and present themselves as reliable and trustworthy tenants.

Moreover, actively working to improve FICO scores through prudent financial management, payment discipline, and credit utilization strategies can yield long-term benefits, extending beyond the realm of apartment rentals. A positive credit profile not only enhances rental prospects but also opens doors to favorable lending terms, insurance premiums, and other financial opportunities.

As individuals strive to secure their desired rental accommodations, the proactive pursuit of a robust credit profile, coupled with a comprehensive understanding of the role of FICO scores, empowers them to navigate the rental landscape with confidence. By leveraging the insights and strategies outlined in this guide, individuals can position themselves for success in the competitive rental market, ultimately realizing their housing goals and establishing a foundation for sustained financial well-being.