Home>Finance>Does A Secured Card Still Build Credit When You Have A Lot Of Debt?

Finance

Does A Secured Card Still Build Credit When You Have A Lot Of Debt?

Published: March 1, 2024

Learn how a secured card can help build credit even with existing debt. Discover strategies to manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Dynamics of Secured Credit Cards and Debt

- Demystifying the Concept of Secured Credit Cards

- Navigating the Influence of Debt on Credit Scores

- Empowering Credit Building Through Secured Cards

- Empowering Strategies for Maximizing the Impact of Secured Credit Cards

- Navigating the Path to Enhanced Creditworthiness

Introduction

Understanding the Dynamics of Secured Credit Cards and Debt

When facing significant debt, the prospect of building or rebuilding credit can seem daunting. However, in such circumstances, a secured credit card can serve as a valuable tool for improving one's credit score. Understanding the interplay between secured cards and existing debt is crucial for making informed financial decisions. In this comprehensive guide, we will delve into the intricacies of secured cards, explore their impact on credit building amidst debt, and provide actionable tips for leveraging secured cards to enhance your financial standing.

Navigating the realm of credit can be complex, especially when grappling with substantial debt. It's essential to unravel the nuances of secured credit cards and their potential to bolster your creditworthiness, even in the face of existing financial obligations. By shedding light on this subject, we aim to empower individuals to make informed choices that can pave the way for a stronger financial future. Let's embark on this enlightening journey to unravel the potential of secured credit cards in the context of debt management and credit building.

Understanding Secured Cards

Demystifying the Concept of Secured Credit Cards

Secured credit cards operate on a simple premise: they require a cash collateral deposit that serves as the credit line for the account. This deposit acts as a form of security for the card issuer, mitigating the risk associated with extending credit to individuals with limited or damaged credit histories. Unlike traditional unsecured credit cards, which solely rely on the cardholder’s creditworthiness, secured cards provide a viable avenue for individuals to establish or rebuild their credit.

These cards function much like regular credit cards, allowing users to make purchases, build credit, and demonstrate responsible financial behavior. However, the crucial distinction lies in the collateral requirement, which provides a safety net for the card issuer in the event of non-payment. It’s important to note that the deposit does not serve as payment for the charges made; rather, it acts as a security measure for the issuer.

Secured cards are particularly beneficial for individuals with limited credit history, a low credit score, or a history of financial setbacks. By responsibly utilizing a secured card, cardholders can exhibit their ability to manage credit effectively, thereby laying the groundwork for improved credit standing over time. These cards offer a practical means of entry into the world of credit, allowing individuals to embark on a journey toward enhanced financial stability and creditworthiness.

Impact of Debt on Credit Building

Navigating the Influence of Debt on Credit Scores

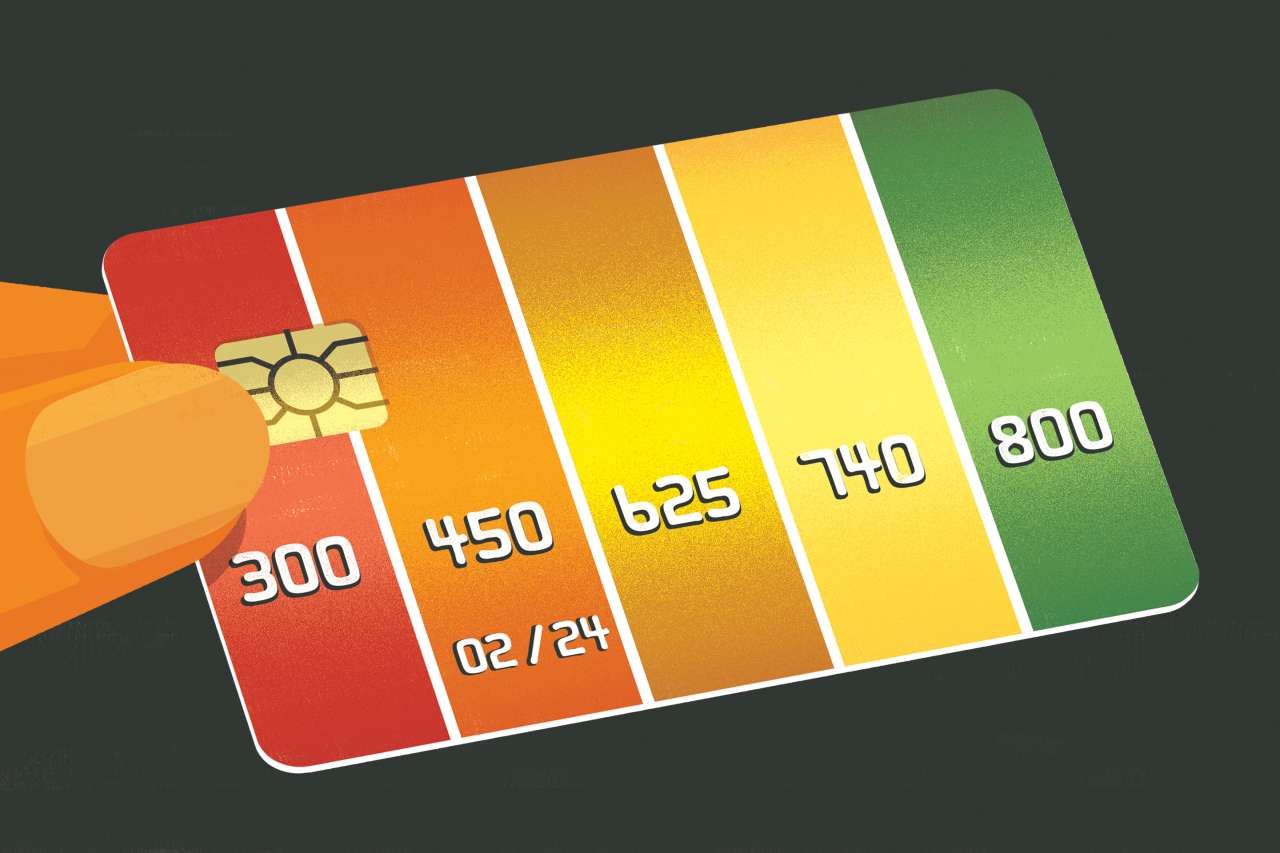

Debt can exert a profound influence on an individual’s credit-building endeavors. High levels of debt, particularly when accompanied by late or missed payments, can significantly impair credit scores. The utilization ratio, which reflects the amount of credit being used in relation to the total available credit, is a key factor in credit scoring models. When this ratio is high, it can signal financial strain and negatively impact credit scores, thereby impeding efforts to improve creditworthiness.

Moreover, the presence of substantial debt can raise concerns among potential lenders, as it may indicate a heightened risk of default. This can hamper one’s ability to secure favorable terms on new credit accounts or loans. Additionally, late payments or defaults on existing debts can inflict lasting damage on credit reports, tarnishing the overall credit profile.

It’s important to recognize that while debt can cast a shadow on credit building, it does not render the pursuit of better credit futile. Rather, it underscores the significance of strategic financial management and the prudent utilization of credit-building tools, such as secured credit cards. By understanding the impact of debt on credit scores, individuals can adopt informed strategies to mitigate its adverse effects and gradually restore their financial standing.

How Secured Cards Can Help

Empowering Credit Building Through Secured Cards

Secured credit cards offer a beacon of hope for individuals grappling with debt and seeking to fortify their credit profiles. Despite the shadow cast by existing financial obligations, secured cards can serve as a catalyst for positive change. By judiciously leveraging these financial instruments, individuals can initiate a transformative journey toward enhanced creditworthiness.

One of the primary ways in which secured cards can facilitate credit building is by providing a structured platform for demonstrating responsible credit management. Through consistent, on-time payments and prudent utilization of available credit, cardholders can showcase their financial reliability, thereby laying the groundwork for credit score improvement. This proactive approach to credit management can gradually overshadow the adverse impact of existing debt, signaling to potential lenders a commitment to sound financial practices.

Furthermore, secured cards offer a practical means of establishing a positive credit history, which is instrumental in bolstering credit scores. As payment history carries significant weight in credit scoring models, the ability to showcase a pattern of timely payments and responsible credit usage can exert a favorable influence on creditworthiness. This is particularly pertinent for individuals aiming to rebuild their credit in the aftermath of financial challenges.

Additionally, the responsible use of a secured card can contribute to lowering the overall utilization ratio, a pivotal factor in credit scoring. By maintaining a prudent balance between credit utilization and available credit, individuals can mitigate the adverse impact of high debt levels on their credit scores. This gradual reduction in the utilization ratio can pave the way for incremental credit score enhancements, despite the presence of existing debt obligations.

Ultimately, secured cards offer a tangible pathway for individuals to reclaim control over their financial narratives. By harnessing the credit-building potential of secured cards, individuals can transcend the constraints imposed by debt and chart a course toward a brighter financial future.

Tips for Building Credit with a Secured Card

Empowering Strategies for Maximizing the Impact of Secured Credit Cards

When embarking on the journey of credit building with a secured card, strategic and informed approaches can amplify the effectiveness of this financial tool. By integrating the following tips into your credit-building endeavors, you can optimize the impact of a secured card and pave the way for tangible improvements in your credit profile:

- Manage Your Credit Utilization: Aim to keep your credit utilization ratio low by using only a small portion of your available credit. This responsible utilization demonstrates prudent financial management and can positively influence your credit score.

- Make Timely Payments: Consistently submit your payments on time, as this forms a cornerstone of positive credit behavior. Timely payments showcase reliability and can contribute to gradual credit score enhancements.

- Monitor Your Credit Report: Regularly review your credit report to ensure accuracy and identify areas for improvement. Address any discrepancies or errors promptly to maintain the integrity of your credit profile.

- Gradually Increase Your Credit Limit: As your financial stability improves, consider requesting a credit limit increase on your secured card. This can lower your credit utilization ratio and bolster your creditworthiness.

- Exercise Restraint in Applying for New Credit: While it may be tempting to pursue additional lines of credit, refrain from excessive credit applications. Multiple inquiries can impact your credit score and signal financial strain.

- Strategically Transition to an Unsecured Card: Upon demonstrating responsible credit management, explore the possibility of transitioning to an unsecured credit card. This milestone signifies progress in your credit journey and opens avenues for further credit enhancements.

By incorporating these proactive strategies into your approach to using a secured card, you can harness its potential to foster meaningful advancements in your credit standing. With diligence, perseverance, and astute financial management, the transformative impact of a secured card can transcend the constraints of existing debt and illuminate the path toward a stronger financial future.

Conclusion

Navigating the Path to Enhanced Creditworthiness

Amidst the complexities of debt and the pursuit of improved credit, secured credit cards emerge as a beacon of opportunity. These financial instruments offer a viable pathway for individuals to fortify their credit profiles, despite the presence of substantial financial obligations. By understanding the symbiotic relationship between secured cards and credit building, individuals can embark on a transformative journey toward enhanced financial stability and creditworthiness.

While debt can cast a shadow on credit scores, the judicious utilization of secured cards can gradually overshadow its adverse effects. Through responsible credit management, timely payments, and strategic utilization of available credit, individuals can lay the groundwork for incremental credit score enhancements. These proactive measures not only demonstrate financial reliability but also pave the way for a positive credit history, which is instrumental in bolstering creditworthiness.

As individuals navigate the realm of secured credit cards, it is imperative to embrace proactive strategies for optimizing their impact. By managing credit utilization, making timely payments, and monitoring credit reports, individuals can harness the full potential of secured cards in their credit-building endeavors. Furthermore, the prudent transition to an unsecured card, facilitated by responsible credit management, signifies a significant milestone in the journey toward improved credit standing.

Ultimately, the fusion of strategic financial management and the transformative potential of secured credit cards can empower individuals to transcend the constraints imposed by debt and chart a course toward a brighter financial future. By integrating these insights into their financial repertoire, individuals can navigate the intricacies of credit building with confidence, resilience, and a clear vision of the possibilities that lie ahead.