Finance

Why Can’t I E-file My Federal Tax Return?

Published: October 29, 2023

Discover the reasons why you may be unable to e-file your federal tax return and find solutions to navigate through any finance-related challenges.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Possible Reasons for Not Being Able to E-file Federal Tax Return

- Unfiled Prior-Year Tax Returns

- Invalid Social Security Number

- Incorrect Filing Status

- Incorrect Adjusted Gross Income (AGI)

- Filing Error or Missing Information

- Tax Return Rejection

- Unpaid Taxes

- Identity Theft Concerns

- Special Circumstances Requiring Paper Filing

- Technical Issues with the IRS E-file System

- State E-file Limitations

- Seeking Professional Assistance

Possible Reasons for Not Being Able to E-file Federal Tax Return

Electronic filing, or e-filing, has revolutionized the way individuals file their federal tax returns. It offers convenience, speed, and accuracy, allowing taxpayers to submit their returns online. However, there are certain situations where taxpayers may encounter difficulties in e-filing their federal tax returns. Let’s explore some possible reasons why you may not be able to e-file.

- Unfiled Prior-Year Tax Returns: If you have unfiled federal tax returns from previous years, the IRS may prevent you from e-filing your current year’s return. It is crucial to file all outstanding returns before attempting to e-file.

- Invalid Social Security Number: Your Social Security number is a unique identifier that the IRS uses to process tax returns. If the SSN entered on your return doesn’t match the information on file with the IRS or contains errors, such as transposed digits, you won’t be able to e-file.

- Incorrect Filing Status: Choosing the wrong filing status can lead to e-file rejections. It’s important to understand the different filing statuses, such as single, married filing jointly, or head of household, and select the correct one based on your circumstances.

- Incorrect AGI (Adjusted Gross Income): E-filing requires entering the correct AGI from your prior year’s tax return to verify your identity. If you input an incorrect AGI, such as mistyping or entering the wrong amount, your attempt to e-file may be rejected.

- Filing Error or Missing Information: E-filing may not be possible if you make errors or omit required information on your tax return. Double-checking your entries and ensuring you provide all necessary details can help avoid this issue.

- Tax Return Rejection: The IRS may reject your e-filed return due to various reasons such as mismatched information or suspected fraud. In such cases, you’ll receive a rejection notice outlining the issue that needs to be resolved before resubmitting your return.

- Unpaid Taxes: If you have outstanding tax liabilities, the IRS may prevent you from e-filing your return. It is important to address your tax debt and make arrangements for payment before attempting to e-file.

- Identity Theft Concerns: If your identity has been compromised or stolen, the IRS may flag your return for further review. This added scrutiny may prevent you from e-filing until the issue is resolved and your identity is confirmed.

- Special Circumstances Requiring Paper Filing: Certain situations, such as filing an amended return, claiming a deceased taxpayer, or submitting a return with a foreign address, may require paper filing and cannot be e-filed.

- Technical Issues with the IRS E-file System: At times, the IRS e-file system may experience technical glitches or maintenance periods, preventing taxpayers from e-filing their returns. It’s advisable to check the IRS website or contact their helpline to determine if there are any known issues.

- State E-file Limitations: While e-filing federal tax returns is widely available, some states may have limitations or requirements for e-filing state tax returns. It’s important to verify the specific guidelines for your state of residence.

- Seeking Professional Assistance: In complex tax scenarios or when facing difficulties with e-filing, seeking help from a tax professional can help determine the underlying issue and provide guidance on the appropriate course of action.

Understanding the possible reasons for not being able to e-file your federal tax return can help you identify and resolve any issues that may arise. It is always beneficial to double-check all the details and consult with a tax professional when needed. Remember, timely and accurate filing of your tax return is crucial to avoid penalties or unnecessary delays in receiving any refunds owed to you.

Unfiled Prior-Year Tax Returns

If you have unfiled federal tax returns from previous years, it is important to address them before attempting to e-file your current year’s return. The Internal Revenue Service (IRS) requires taxpayers to file all outstanding tax returns before participating in the e-filing program.

Unfiled tax returns can have serious consequences, such as penalties, interest charges, and potential legal implications. It’s essential to understand the gravity of this situation and take steps to rectify it.

Here’s what you need to do if you have unfiled prior-year tax returns:

- Gather your documentation: Start by collecting all the relevant documents, such as your W-2 forms, 1099 forms, and any other income statements for the years you missed filing.

- Prepare the tax returns: Use the appropriate tax forms for each year and carefully fill out the necessary information. You can obtain past-year tax forms from the IRS website or by contacting the IRS directly.

- Calculate any unpaid taxes: If you owe taxes for the unfiled years, it’s important to determine the amount owed. Include any penalties and interest that may have accumulated over time.

- File the tax returns: Once you have completed each tax return, you can submit them by mail to the appropriate IRS address provided in the tax instructions. Be sure to keep copies of all the returns for your records.

- Address any tax liabilities: If you are unable to pay the full amount owed, you have options. You can work with the IRS to set up a payment plan, such as an installment agreement, or explore other alternatives, such as an offer in compromise or currently not collectible status.

- Stay up to date: After filing your prior-year tax returns, make a commitment to stay current on your tax obligations moving forward. This includes filing your tax returns on time and paying any taxes owed by the filing deadline.

By addressing your unfiled prior-year tax returns, you not only fulfill your legal responsibilities but also pave the way for future tax compliance. This will allow you to participate in the e-filing program and enjoy the benefits of electronic tax filing, such as faster processing, reduced errors, and faster refunds, if applicable.

If you find the process of handling unfiled tax returns overwhelming or have specific questions related to your situation, it’s always advisable to consult with a tax professional. They can provide personalized guidance and support as you navigate the process and ensure that you comply with all tax obligations.

Invalid Social Security Number

A valid Social Security number (SSN) is a crucial component of your federal tax return. If your SSN is invalid or contains errors, you may encounter difficulties in e-filing your tax return. Let’s explore what can cause an invalid SSN and how to rectify the issue.

Here are some common scenarios that can result in an invalid SSN:

- Transposed digits: It’s easy to make a simple typographical error when entering your SSN online. Transposing two numbers can render your SSN invalid and prevent you from successfully e-filing your tax return.

- Name change: If you recently changed your name due to marriage, divorce, or any other reasons, and have not updated your SSN with the Social Security Administration (SSA), it could lead to a mismatch between your name and SSN on file.

- Identity theft: In cases of identity theft, the thief may have used your SSN for fraudulent purposes, resulting in the SSA flagging your SSN as invalid to protect your identity.

- Incorrect information on SSA records: It’s possible that incorrect information is on file with the SSA, such as a misspelled name or incorrect birthdate. This can create inconsistencies when compared with the information on your tax return.

If you encounter an invalid SSN issue while attempting to e-file your tax return, it’s important to take the following steps:

- Double-check the entered SSN: Start by carefully reviewing the SSN you entered on your tax return. Verify that all the digits are correct and not transposed. Even a small mistake can result in an invalid SSN.

- Review your Social Security card: If you have your Social Security card, cross-reference the SSN indicated on your tax return with the SSN listed on your card. Ensure they match exactly to avoid any potential discrepancies.

- Contact the Social Security Administration: If you suspect an error with your SSN or if you recently changed your name, it is advisable to reach out to the SSA directly. They can verify the information on file and update it if necessary.

- Resolve identity theft concerns: If you suspect that your SSN may have been compromised, take immediate action by contacting the SSA and reporting the issue to the Federal Trade Commission (FTC). They can guide you on the necessary steps to restore your identity and resolve any tax-related concerns.

- Consider filing a paper return: In certain cases, if you are unable to resolve the invalid SSN issue in a timely manner, you may need to file a paper return instead of e-filing. The paper return requires physical submission via mail but will allow you to proceed with filing your taxes.

Resolving an invalid SSN issue is essential to ensure accurate processing of your tax return. By taking prompt action and verifying the accuracy of your SSN, you can avoid delays in filing your taxes and reduce the potential for further complications or errors.

If you require assistance in resolving an invalid SSN issue or have concerns about your personal tax situation, consulting with a tax professional can provide valuable guidance and support.

Incorrect Filing Status

Choosing the correct filing status is crucial when submitting your federal tax return. The filing status determines the tax rates, deductions, and credits that apply to you. If you select an incorrect filing status, it can lead to e-filing rejections or inaccurate tax calculations. Let’s explore common filing status options and how to ensure you choose the right one.

Here are the five filing status options recognized by the Internal Revenue Service (IRS):

- Single: You can choose the filing status “Single” if you were unmarried, legally separated, or divorced on the last day of the tax year.

- Married Filing Jointly: This filing status is for married couples who want to combine their incomes and deductions on a single tax return. Both spouses must agree to file jointly.

- Married Filing Separately: If you are married but prefer to file your taxes separately from your spouse, you can choose the “Married Filing Separately” status. Note that this filing status has certain limitations.

- Head of Household: This status applies to unmarried individuals who paid more than half the cost of maintaining a home for a qualifying dependent, such as a child or relative.

- Qualifying Widow(er) with Dependent Child: If your spouse passed away within the past two tax years, you may qualify for this filing status if you have a dependent child and meet other specific criteria.

Choosing the correct filing status depends on your marital status and living situation on the last day of the tax year. To ensure you select the right filing status:

- Review your marital status: Determine your marital status based on whether you were married, divorced, or legally separated on the last day of the tax year.

- Evaluate dependents: If you have dependents, consider whether you meet the qualifications for filing as Head of Household or Qualifying Widow(er) with Dependent Child.

- Consider the tax implications: Understand the tax benefits and limitations associated with each filing status. Compare the potential tax savings and refund amounts under different filing statuses.

- Choose the appropriate status: Select the filing status that accurately reflects your situation. If you are uncertain, consult with a tax professional who can provide guidance based on your specific circumstances.

- Update your information: Ensure that you provide accurate information on your tax return, including your filing status, to avoid any discrepancies or rejections when e-filing.

Choosing the correct filing status is crucial for accurate tax reporting and compliance. Take the time to understand the requirements and implications of each filing status to ensure you select the one that best fits your situation. By doing so, you can navigate the e-filing process smoothly and optimize your tax benefits.

Should you have any questions or concerns regarding your filing status or other tax-related matters, it is recommended to consult with a tax professional who can provide personalized advice based on your unique circumstances.

Incorrect Adjusted Gross Income (AGI)

When e-filing your federal tax return, one critical piece of information you need to provide is your Adjusted Gross Income (AGI) from your previous year’s tax return. AGI is the amount of income you report after deducting certain adjustments, such as student loan interest, self-employment expenses, and contributions to retirement accounts.

An incorrect AGI can lead to e-filing rejections or delays in processing your tax return. It is crucial to ensure that you enter the correct AGI to avoid such issues. Here’s what you need to know:

Why is the AGI important?

The AGI acts as a verification tool to confirm your identity and prevent tax fraud. It ensures that you are the legitimate filer and have access to the prior tax return information.

How to find your AGI:

To input the correct AGI when e-filing, you can refer to one of the following sources:

- Prior-year’s tax return: The easiest and most reliable way to find your AGI is to refer to your previous year’s tax return. Look for the line item labeled “Adjusted Gross Income” on the appropriate form (e.g., Form 1040, Form 1040A, or Form 1040EZ).

- Online tax software or tax preparer: If you used tax software or consulted a tax professional to file your previous year’s tax return, the software or preparer should have a copy of your return and can provide you with the accurate AGI.

- IRS online services: The Internal Revenue Service (IRS) provides online services that allow you to access and retrieve your prior-year tax return information. These services include Get Transcript, which provides a transcript of your AGI, or the IRS file retrieval tool used by certain tax software.

What to do if you have an incorrect AGI:

If you realize you have entered an incorrect AGI while e-filing your return, it’s crucial to correct the error to prevent delays or rejections. Here’s how you can address the issue:

- Double-check the entered AGI: Review the AGI you entered to ensure it matches the amount from your previous year’s tax return. Verify that you haven’t accidentally transposed any digits or included any extra characters.

- Use the correct tax year’s AGI: Make sure you’re using the AGI from the appropriate tax year. Each year’s tax return will have a unique AGI, so be cautious not to mix them up.

- Try using your spouse’s AGI (if applicable): If you filed jointly with your spouse in the previous year, you can try using their AGI if you are still unable to retrieve your own.

- File with a paper return: If you’re unable to obtain the correct AGI or resolve the issue promptly, you may need to file a paper return instead of e-filing. Attach any required documents and mail your return to the appropriate IRS address.

It is essential to input the correct AGI when e-filing your tax return to ensure accurate processing. Take the time to verify your AGI from reliable sources, such as your previous year’s tax return or the IRS online services. If you encounter difficulties or uncertainties, consider consulting a tax professional for assistance in resolving the issue.

Filing Error or Missing Information

When e-filing your federal tax return, accuracy is of utmost importance. Filing errors or missing information can lead to rejected returns or delays in processing. To ensure a smooth e-filing process, it is crucial to double-check your tax return for any mistakes or omissions. Let’s explore common filing errors and how to avoid them.

Common Filing Errors:

- Mathematical errors: Simple math mistakes, such as addition or subtraction errors, can occur when manually calculating amounts on your tax return. Using tax software or online tools can help minimize these errors.

- Typos or data entry errors: Transposing digits in your Social Security number or entering incorrect information from your tax forms can result in rejected returns. Carefully review all the details you enter on your tax return, including names, addresses, and financial information.

- Omitted income: Forgetting to include all sources of income, such as freelance work, rental income, or dividends, can lead to discrepancies between the income reported on your tax return and the income reported by third parties to the IRS.

- Missed deductions or credits: Failing to claim all the deductions and credits you are eligible for can result in paying more taxes than necessary. Familiarize yourself with available deductions and credits to ensure you take full advantage of the tax benefits.

- Incorrect bank account information: If you are due a tax refund and choose to have it direct deposited into your bank account, ensure that you provide the correct bank account and routing number. A mistake in this information can result in delayed refunds or funds being deposited into the wrong account.

How to Avoid Filing Errors:

- Use tax software or online tools: Utilize tax preparation software or online tools to automate calculations and minimize mathematical errors. These tools can also help guide you through the e-filing process, reducing the risk of filing errors.

- Review all information: Before submitting your tax return, review all the information you entered, including personal details, income, deductions, and credits. Take the time to ensure accuracy and look for any potential errors.

- Keep organized records: Maintain organized records of your income, expenses, and supporting documents. This will help you accurately report income and claim deductions or credits, preventing missing information.

- Use reliable sources for information: Refer to official IRS publications, guidelines, and reputable sources when seeking information about tax laws, deductions, and credits. This will help ensure you have accurate and up-to-date information.

- Consider professional assistance: If your tax situation is complex or you are unsure about specific tax rules or calculations, seeking the help of a tax professional can provide peace of mind and help you avoid costly mistakes.

Filing errors or missing information can be easily avoided by exercising diligence and attention to detail when e-filing your tax return. Take the time to review your return, double-check all the information, and leverage user-friendly tax software or professional assistance when necessary. By doing so, you can enhance the accuracy of your tax return and increase the likelihood of a hassle-free filing experience.

Tax Return Rejection

Receiving a rejection notification after e-filing your federal tax return can be frustrating and alarming. However, tax return rejections are not uncommon and can typically be resolved by identifying the cause of the rejection and taking appropriate steps to correct the issue. Let’s explore some common reasons why tax returns get rejected and how to address them.

Common Reasons for Tax Return Rejection:

- Incorrect personal information: A simple error in entering personal information, such as your name, Social Security number, or date of birth, can lead to tax return rejection. Ensure that you double-check all personal details before submitting your return.

- Mathematical errors: If your tax calculations do not add up correctly or there are inconsistencies in your numbers, the IRS may reject your return. Using tax software or online tools can help minimize these errors.

- Mismatched information: The information reported on your tax return should match the data available to the IRS. This includes income reported by employers, financial institutions, and other third parties. Any discrepancies can trigger a rejection.

- Invalid dependent information: If you are claiming dependents, it is essential to ensure that the information provided, such as their Social Security numbers and relationship to you, is accurate and matches IRS records.

- Filing status inconsistencies: Your filing status must align with your marital and living situation. If there are discrepancies or inconsistencies, such as filing as “Head of Household” when you do not meet the requirements, your return may be rejected.

- Missing signatures: For a joint return, both spouses must sign electronically or provide necessary signatures on paper returns. Failure to include the required signatures can result in rejection.

- Overdue tax payments: If you have outstanding tax liabilities from previous years, the IRS may reject your current year’s return until you address and resolve the overdue payments.

- Identity theft concerns: In cases where the IRS suspects identity theft, they may reject your return for further investigation. This safeguard protects taxpayers from potential fraudulent activities.

Addressing Tax Return Rejections:

- Review the rejection notice: Carefully read the rejection notice provided by the IRS. It will outline the reason for the rejection and any specific instructions or actions required to correct the issue.

- Correct the error: Identify the cause of the rejection and take the necessary steps to correct the error. This could involve updating personal information, revising calculations, or providing additional documentation.

- Resubmit your tax return: Once you have addressed the issue, make the necessary corrections and resubmit your tax return. Follow the specific instructions provided in the rejection notice for resubmission.

- Seek professional guidance if needed: If you encounter complex issues or are unsure about how to resolve the rejection, consider seeking assistance from a tax professional. They can provide guidance and help navigate the process.

Receiving a rejection notice does not necessarily mean that you have done something wrong. Mistakes happen, and the IRS has measures in place to ensure accurate tax reporting. By promptly addressing the rejection and taking the necessary steps to resolve the issue, you can successfully e-file your tax return and continue the processing of your income tax refund.

If you consistently encounter difficulties or are uncertain about the e-filing process, seeking the help of a tax professional can provide valuable insights and support.

Unpaid Taxes

When it comes to e-filing your federal tax return, unpaid taxes can pose a significant obstacle. If you have outstanding tax liabilities, the IRS may prevent you from e-filing your current year’s return. It is important to address any unpaid taxes before attempting to e-file. Let’s explore what you should do if you have unpaid taxes.

Understanding Unpaid Taxes:

Unpaid taxes typically arise when you owe the IRS money from previous years’ tax returns. There are several reasons why you may have unpaid taxes, including underreporting of income, failure to file a tax return, or erroneous deductions or credits claimed. The IRS expects taxpayers to fulfill their tax obligations promptly and addresses unpaid taxes through various enforcement measures.

Steps to Address Unpaid Taxes:

- Assess your tax debt: Begin by determining the exact amount of unpaid taxes you owe, including any interest and penalties that may have accrued. Review your tax notices or contact the IRS to obtain the necessary information.

- Create a plan for repayment: Once you understand the full extent of your tax debt, consider your financial situation and develop a plan to address the unpaid taxes. You may need to explore options such as installment agreements, offers in compromise, or other payment arrangements with the IRS.

- Make payments or negotiate with the IRS: Depending on your financial circumstances, you can take steps to satisfy your unpaid tax debt. You can make payments directly to the IRS, set up a payment plan, or discuss potential alternative arrangements through negotiation.

- Submit your current year’s tax return: After making arrangements or meeting your tax payment obligations, you can proceed with filing your current year’s tax return. Ensure all the necessary information is accurate, including any payment amounts or credits related to your past unpaid taxes.

- Maintain compliance going forward: It is vital to remain compliant with your tax obligations and continue to meet any agreed-upon payment terms or arrangements. Timely filing of your tax returns and consistent payment of taxes owed will help avoid further issues.

Addressing unpaid taxes is crucial not only for your ability to e-file your tax return but also to minimize potential penalties and interest charges. It’s important to remember that unpaid taxes can have long-term consequences, including tax liens, wage garnishments, and damage to your credit score. Therefore, it is advisable to take proactive steps to address and resolve any unpaid tax liabilities.

If you find yourself unable to navigate the process or need assistance in dealing with unpaid taxes, it is recommended to seek the guidance of a tax professional or reach out to the IRS directly. They can provide personalized advice based on your specific situation and help you find a path towards resolving your tax debt.

Identity Theft Concerns

Identity theft is a serious concern that can impact various aspects of your life, including your taxes. If your identity has been compromised or stolen, the IRS may flag your tax return for further review, which can prevent you from e-filing until the issue is resolved. It’s important to be aware of identity theft concerns and take steps to protect yourself.

Signs of Identity Theft:

Identity theft can manifest in different ways, and it’s essential to be vigilant for any suspicious activity. Some signs that your identity may have been compromised include:

- Unexpected denial of credit or loan applications

- Unexplained withdrawals or charges on your financial accounts

- Receiving tax forms for income you didn’t earn

- Notification of a data breach from a company or organization where your information is stored

- IRS notification that more than one tax return was filed using your Social Security number

Steps to Address Identity Theft:

- Contact the IRS: If you suspect or confirm identity theft, reach out to the IRS Identity Theft Protection Specialized Unit at 1-800-908-4490. They can guide you through the necessary steps to address the issue and protect your tax account.

- File an Identity Theft Affidavit: Complete IRS Form 14039, Identity Theft Affidavit, to report the theft and alert the IRS. This form can help initiate an investigation into the fraudulent activities associated with your identity.

- Secure your personal information: Take steps to safeguard your personal information, such as keeping your Social Security number secure, regularly monitoring your financial accounts, and utilizing strong passwords for online accounts.

- Monitor your credit: Stay vigilant by monitoring your credit reports for any suspicious activity or new accounts opened in your name. Consider placing a fraud alert or freezing your credit to protect yourself from further harm.

- Follow official guidance: Stay informed by regularly visiting the IRS website or subscribing to their alerts for updates on identity theft issues and recommended steps to take.

Resolving identity theft concerns can be a complex and time-consuming process. It’s crucial to act swiftly to minimize the damage and protect your financial well-being. While dealing with identity theft, you may need to file your tax return by mail instead of e-filing and provide supporting documentation as requested by the IRS.

Remember, prevention is key when it comes to identity theft. Stay vigilant, ensure the security of your personal information, and promptly report any suspicions or indications of identity theft. By taking proactive measures, you can help safeguard your identity and minimize the risk of tax-related fraud.

If you require additional guidance or assistance in resolving identity theft concerns, consider consulting with a tax professional or reaching out to organizations that specialize in identity theft assistance.

Special Circumstances Requiring Paper Filing

While electronic filing has become the norm for most taxpayers, there are certain situations where paper filing is necessary. These special circumstances may require additional documentation or specific forms that cannot be accommodated through e-filing. If you find yourself in one of these situations, it’s important to be aware of the requirements and exceptions for paper filing your federal tax return.

Common Special Circumstances:

- Amended returns: If you need to correct information on a previously filed tax return, you must submit an amended return. These forms, such as Form 1040-X, can only be filed on paper and cannot be e-filed.

- Deceased taxpayer: When filing for a deceased taxpayer, certain forms and documentation are required, such as the final tax return (Form 1040), the deceased taxpayer’s Social Security number, and the date of death.

- Foreign address: If you have a foreign address, you may need to file your tax return on paper due to different filing requirements, tax treaties, or specific forms related to international taxation.

- Claiming certain tax credits or deductions: Certain tax credits or deductions may have specific requirements or supporting documentation that cannot be accommodated through e-filing. This may include forms related to education credits, adoption expenses, or energy-related incentives.

- Exceptional circumstances: In some exceptional circumstances, the IRS may require you to file on paper. This may be due to an IRS system issue, being mandated to file on paper as part of a settlement agreement, or other unique circumstances.

Steps for Paper Filing:

- Obtain the necessary forms: Determine which forms and schedules are required for your specific circumstances. You can download these forms from the IRS website, request them by mail, or obtain them from a local IRS office or tax professional.

- Complete the forms: Carefully fill out the forms and provide accurate information. Follow the instructions provided with the forms and ensure that you include any required schedules or supporting documentation.

- Make copies for your records: Before submitting your paper return, make copies of all the documents and forms for your records. This will ensure that you have a personal copy of the information you submitted.

- Mail the completed return: Ensure that you mail your completed tax return to the appropriate IRS address as specified in the instructions. It’s recommended to use certified mail or a reputable delivery service to track the delivery of your return.

- Monitor status and follow up: Keep track of the progress of your paper return and check the status using the IRS’s Where’s My Refund? tool or by contacting the IRS directly if needed.

While paper filing may seem more time-consuming or less convenient than e-filing, it is essential to follow the correct procedures when special circumstances require it. By adhering to the specific requirements for paper filing, you can ensure compliance with IRS regulations and avoid any potential delays or issues with your tax return.

If you have questions or concerns about paper filing in special circumstances, it may be helpful to consult with a tax professional or contact the IRS directly for guidance.

Technical Issues with the IRS E-file System

As with any system, technical glitches can occasionally occur with the IRS e-file system. These issues can create hurdles for taxpayers attempting to e-file their federal tax returns. While the IRS works diligently to maintain a smooth e-filing process, it’s important to be aware of possible technical issues and know how to navigate them.

Common Technical Issues:

- System downtime or maintenance: The IRS periodically schedules maintenance periods or experiences temporary system outages to improve functionality and address technical issues. It’s advisable to check the IRS website or official communications for any planned downtime.

- High volume of e-filed returns: During peak tax season, the e-file system may experience a high volume of traffic, which can result in delays or slower processing times. It’s important to remain patient and check for updates on the status of your e-filed return.

- Software compatibility issues: Occasionally, certain tax software programs may face compatibility issues with the IRS e-file system, resulting in difficulties or rejection of the e-filed returns. Staying up to date with software updates and ensuring compatibility can help mitigate these issues.

- Submission errors or rejections: Errors or omissions in the tax return itself can result in rejections from the IRS e-file system. It’s important to review the return for accuracy and resolve any errors before attempting to e-file.

- Electronic signature or PIN issues: E-filing requires the use of an electronic signature or Personal Identification Number (PIN) for authentication purposes. Issues with the electronic signature or PIN can prevent successful e-filing.

Steps to Address Technical Issues:

- Check for IRS notifications: Consult the IRS website or subscribe to their alerts for any announced technical issues, downtime, or updates regarding the e-file system.

- Review and resolve errors: If your e-filed return is rejected due to errors or omissions, carefully review any error messages or notifications. Adjust the return accordingly and resubmit for e-filing.

- Consider alternative e-filing methods: If you encounter persistent technical issues with the IRS e-file system, explore other e-file options, such as using different tax software or platforms that offer e-filing services.

- File a paper return if necessary: If technical issues persist or you are unable to resolve them, consider filing a paper return instead. Ensure that you provide all necessary documentation and mail the return to the appropriate IRS address.

- Contact IRS e-file support: If all else fails, contact the IRS e-file support team for assistance. They can provide guidance and help troubleshoot technical issues you may be facing.

While technical issues with the IRS e-file system can be frustrating, it’s important to remain patient and proactive in resolving any challenges that arise. Staying updated on IRS communications and taking necessary steps to address technical issues can help ensure a smoother e-filing experience.

If you continue to encounter technical difficulties or require further support, don’t hesitate to reach out to the IRS directly or consult with a tax professional who can provide expert guidance.

State E-file Limitations

While e-filing has become widely available for federal tax returns, it’s important to note that there may be limitations when it comes to e-filing state tax returns. Each state has its own regulations and requirements for electronic filing, and not all states may offer e-filing options for all types of tax returns. It’s important to be aware of these limitations and understand the options available for e-filing your state tax return.

Common State E-file Limitations:

- Specific e-file forms: Some states may have limitations on which forms or types of tax returns can be e-filed. For example, certain complex tax forms or schedules may require a paper filing due to additional documentation or state-specific requirements.

- State-specific tax laws: Each state has its own tax laws and regulations, which may impact the availability of e-filing options. Some states may require additional verification or documentation that cannot be accommodated through e-filing.

- Income thresholds: Some states may limit e-filing to individuals or businesses below a certain income threshold. If your income exceeds the threshold set by the state, you may be required to file a paper return.

- Complex tax situations: Certain complex tax situations, such as multi-state income or special deductions, may not be supported by the state e-filing system. In such cases, paper filing may be required to ensure accurate reporting and compliance.

Steps to Address State E-file Limitations:

- Review state-specific guidelines: Visit the website of your state’s tax department to familiarize yourself with the guidelines and limitations for e-filing state tax returns. Understand which forms and situations may require a paper filing.

- Research state-approved e-file providers: If your state offers limited e-filing options, check if there are state-approved e-file providers or software specifically designed for your state’s tax returns. These providers may offer additional features or support for specific state requirements.

- Consider professional tax assistance: If your state tax situation is complex or falls within the limitations of e-filing, consulting with a tax professional experienced in state tax returns can help ensure accurate filing and compliance with state regulations.

- Follow state-specific instructions for paper filing: If you are unable to e-file your state tax return due to limitations, carefully follow the instructions provided by the state tax department for paper filing. Submit the necessary forms and documentation according to the guidelines.

Understanding the limitations and options for e-filing state tax returns is crucial to ensure compliance with state tax regulations. Be sure to familiarize yourself with your state’s specific guidelines and explore alternative solutions if e-filing is not possible. By following the instructions provided by your state tax department and seeking professional assistance when needed, you can navigate the state tax filing process smoothly and accurately.

If you have questions or concerns about e-filing your state tax return, it’s advisable to consult with a tax professional or reach out to your state’s tax department for further guidance.

Seeking Professional Assistance

When navigating the complexities of tax filing, seeking professional assistance can be a wise decision. Tax professionals, such as Certified Public Accountants (CPAs) or Enrolled Agents (EAs), have the expertise and knowledge necessary to guide you through the process and help optimize your tax situation. Here are some key reasons to consider seeking professional assistance.

Expertise and Knowledge:

Tax professionals possess in-depth knowledge of tax laws, regulations, and filing requirements. They stay current with ever-changing tax codes and can provide guidance tailored to your unique financial circumstances. Their expertise can help ensure accurate tax reporting and maximize your eligible deductions and credits.

Complex Tax Situations:

If you have complex tax situations, such as self-employment income, rental properties, or investment gains, professional assistance can be invaluable. Tax professionals can navigate intricate tax laws and regulations specific to your situation, ensuring accurate reporting and optimizing tax benefits.

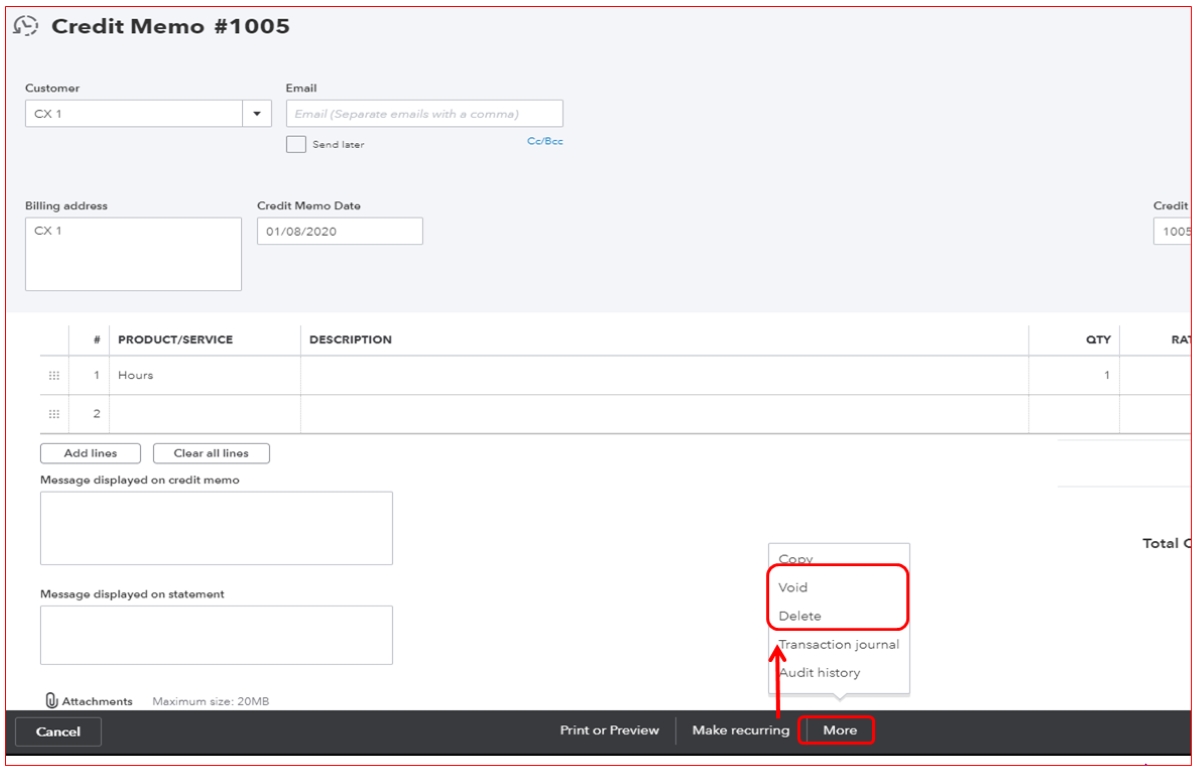

Audit Support:

In the unlikely event of an IRS audit or inquiry, having professional representation provides you with peace of mind and protection. Tax professionals can help you respond to the IRS, navigate the audit process, and work to resolve any issues that arise.

E-filing Guidance:

Tax professionals are well-versed in the e-filing process and can provide guidance and support in preparing and submitting your tax return electronically. They can help ensure accurate completion of the forms, minimize errors, and address any technical issues that may arise.

Tax Planning and Strategies:

Beyond tax filing, tax professionals can assist with proactive tax planning and strategies. They can help you minimize your tax liability, identify potential deductions or credits, and develop long-term tax-saving strategies that align with your financial goals.

Peace of Mind:

Engaging a tax professional takes the burden off your shoulders, giving you confidence that your tax return is in capable hands. They handle the complexity of tax filing, allowing you to focus on other aspects of your life or business.

Personalized Guidance:

Each person’s tax situation is unique. Tax professionals offer personalized guidance based on your individual circumstances, helping you make informed decisions and achieve the best possible outcomes.

When seeking professional assistance, ensure you choose a qualified and reputable tax professional. Consider their credentials, experience, and track record of providing quality service. By collaborating with a tax professional, you gain the expertise and peace of mind necessary to navigate the tax filing process and optimize your financial well-being.

If you decide to seek professional assistance, it’s important to gather all relevant documents and information and be prepared to communicate openly and honestly about your financial situation. This will ensure that the tax professional can effectively assist you in meeting your tax obligations and minimizing your tax liability.