Finance

How To Use Paypal Without A Credit Card

Modified: March 1, 2024

Learn how to use PayPal for your financial transactions even without a credit card. Simplify your payment process and enjoy secure online transactions with PayPal today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

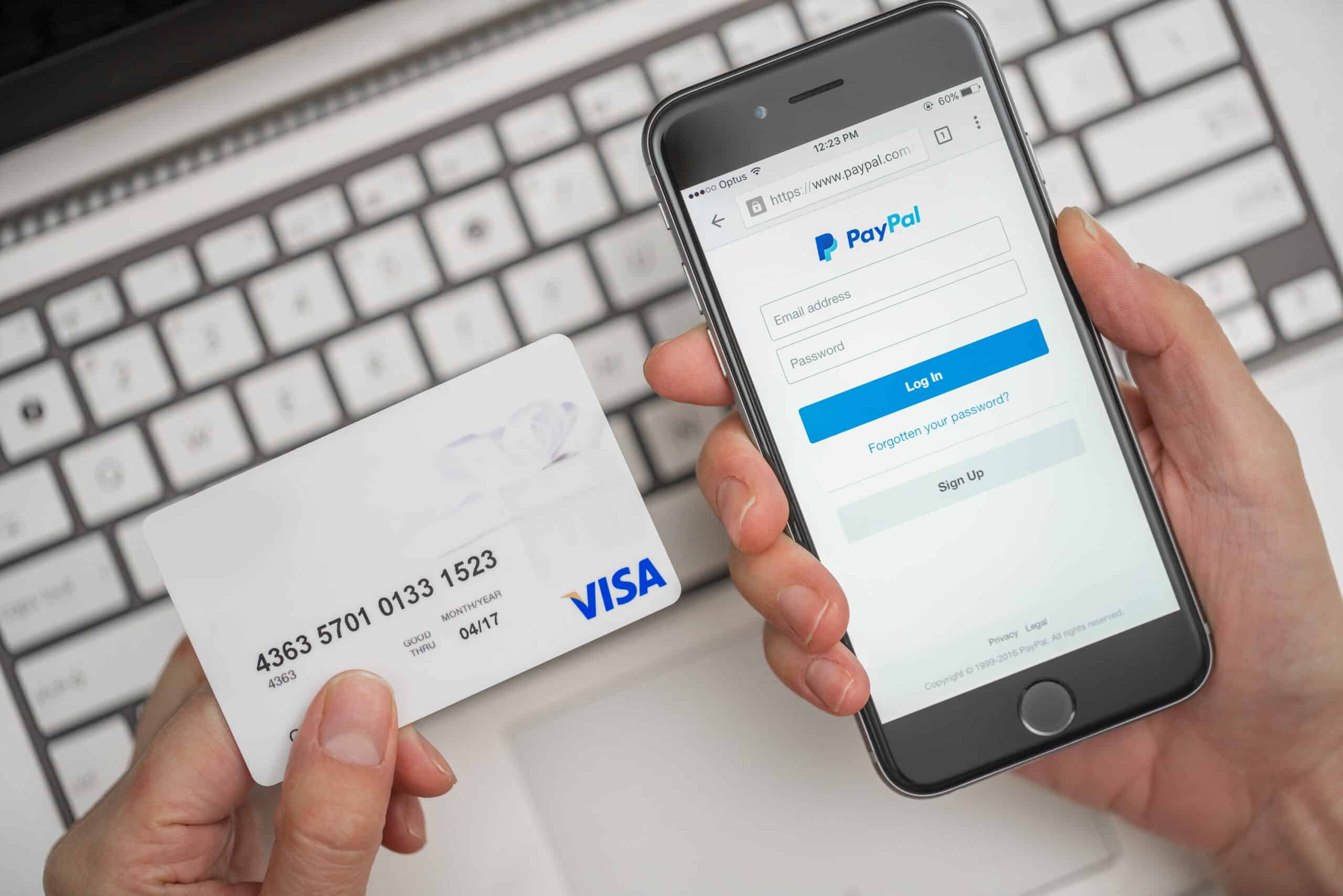

PayPal is a widely used and trusted online payment platform that allows individuals and businesses to securely send and receive money. While many people associate PayPal with credit cards, it is possible to use PayPal without a credit card. Whether you prefer to link PayPal to your bank account, use a debit card, or even receive payments from others, there are multiple methods available for you to enjoy the convenience of PayPal without the need for a credit card.

In this article, we will explore various ways to use PayPal without a credit card. We’ll discuss how to link PayPal to a bank account, use a debit card with PayPal, receive payments from others, and even apply for a PayPal Cash Card. By familiarizing yourself with these different methods, you’ll be able to take full advantage of all the benefits that PayPal offers, even if you don’t have a credit card.

So, if you’re ready to dive into the world of PayPal without a credit card, keep reading to discover the different options available to you.

Method 1: Linking PayPal to a Bank Account

One of the easiest ways to use PayPal without a credit card is by linking it to your bank account. This method allows you to transfer funds directly from your bank to your PayPal account and vice versa.

To link your bank account to PayPal, follow these simple steps:

- Log in to your PayPal account. If you don’t have one yet, you can easily create a new account on the PayPal website.

- Once you’re logged in, navigate to the “Wallet” section.

- Next, click on the “Link a bank account” option.

- You’ll be prompted to enter your bank account details, such as your account number and bank routing number. Make sure to double-check the information to ensure accuracy.

- After entering the required information, PayPal will send a verification code to your bank account. Check your bank statement or online banking platform to find the code.

- Enter the verification code in the appropriate field on the PayPal website.

- Once the verification process is complete, you will be able to transfer funds between your PayPal account and your bank account.

By linking your bank account to PayPal, you can easily add funds to your PayPal balance or withdraw money from your PayPal account to your bank. This method provides a convenient way to make online purchases or receive money from others, all without the need for a credit card.

It’s important to note that linking a bank account to PayPal may take a few business days to complete. However, once the process is finished, you’ll have a seamless connection between your PayPal account and your bank account, opening up a world of online payment possibilities.

Method 2: Using a Debit Card with PayPal

If you have a debit card, you can easily use it with PayPal to make secure online transactions. A debit card is linked to your bank account and allows you to make purchases with funds directly from your account.

To use your debit card with PayPal, follow these steps:

- Login to your PayPal account or create a new account if you don’t have one already.

- In the “Wallet” section, click on the “Link a debit or credit card” option.

- Provide the necessary information, including your debit card number, expiration date, and the security code on the back of the card.

- Once you’ve added your debit card, PayPal will send a verification code to your card statement. Check your statement or online banking platform to find the code.

- Enter the verification code in the appropriate field on the PayPal website to complete the process.

Once your debit card is linked to your PayPal account, you can use it to make purchases online as long as the merchant accepts PayPal as a payment method. When you select PayPal at checkout, you’ll have the option to choose your debit card as the funding source. This allows you to make payments without the need for a credit card.

Using a debit card with PayPal offers several advantages. First, it allows you to keep track of your spending directly from your bank account. Second, it eliminates the need for a credit card, providing a convenient option for individuals who prefer not to use credit. Finally, it adds an extra layer of security to your online transactions, as PayPal’s advanced encryption and fraud protection measures help keep your information safe.

Keep in mind that when you use your debit card with PayPal, the transaction is processed as a debit transaction, which means the funds are immediately deducted from your bank account. It’s essential to ensure that you have sufficient funds in your account before making a purchase to avoid any overdraft fees or declined transactions.

By linking your debit card to PayPal, you can enjoy the flexibility and convenience of online payments without the need for a credit card.

Method 3: Receiving Payments from Others

In addition to making payments, PayPal also allows you to receive payments from others, even if you don’t have a credit card. This feature is especially useful for freelancers, small businesses, and individuals who receive money for products or services.

To receive payments without a credit card on PayPal, follow these simple steps:

- Log in to your PayPal account or create a new account if you don’t have one.

- In the “Settings” or “Profile” section, navigate to the “Payment Preferences” option.

- Scroll down to the “Getting paid and managing my risk” section and click on the “Update” or “Edit” link.

- Next, select the option to receive payments with PayPal. You can choose from various methods, such as invoicing, selling products online, or requesting money from others.

- Follow the on-screen instructions to configure your preferred method of receiving payments. This may include providing details such as your email address or creating invoices.

- Once your payment preferences are set up, you can share your PayPal email address or offer PayPal as a payment option to clients or customers.

- When someone sends you a payment through PayPal, the funds will be deposited into your PayPal account balance. You can then transfer the money to your bank account or keep it in your PayPal balance for future purchases.

Receiving payments through PayPal without a credit card offers numerous advantages. It enables you to easily manage your income and track your transactions within the PayPal platform. Additionally, PayPal provides seller protection and dispute resolution services, ensuring that you can safely and confidently accept payments from others.

Whether you’re a freelancer accepting payments for your work, a small business selling products, or an individual collecting money from friends or family, PayPal offers a seamless and secure method for receiving funds without the need for a credit card.

Remember to regularly check your PayPal account to keep track of incoming funds and ensure a smooth payment experience. With PayPal, you can securely receive payments from others and enjoy the convenience that comes with using this trusted online payment platform.

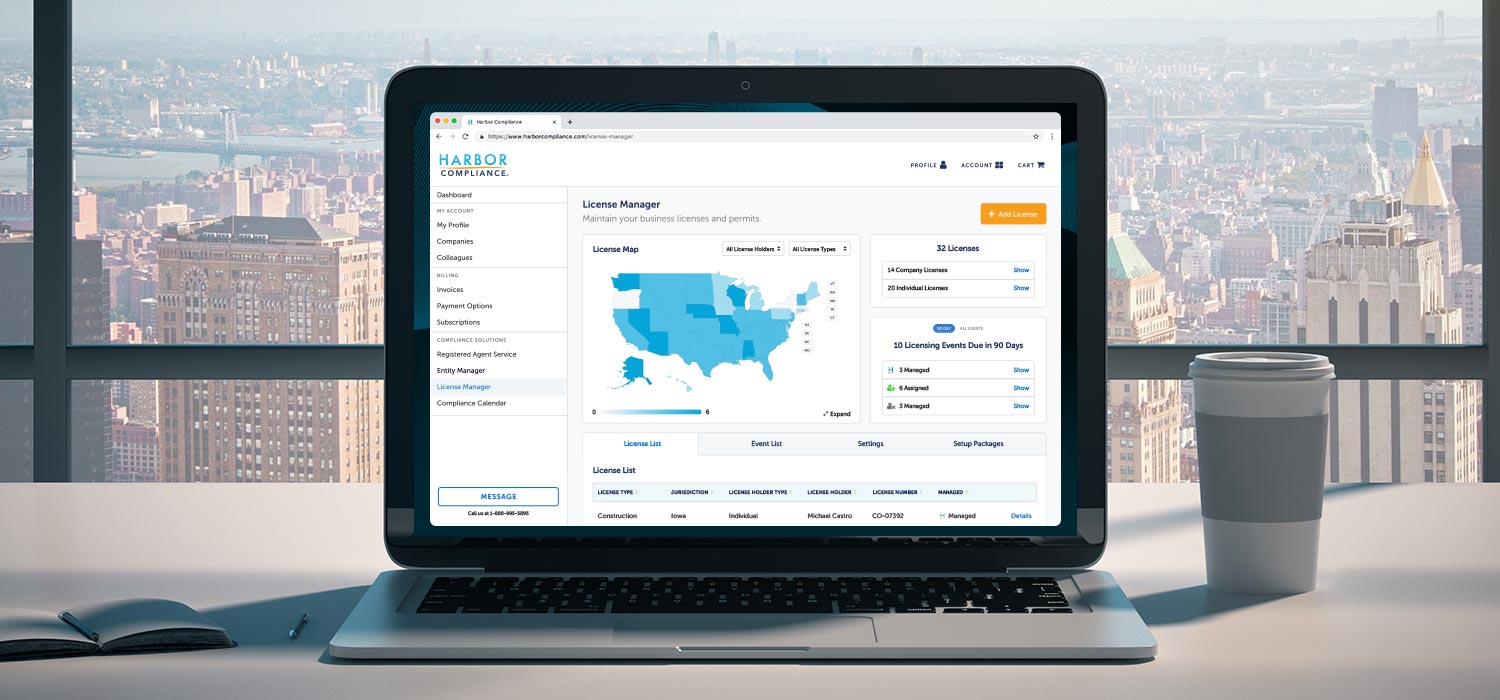

Method 4: Applying for a PayPal Cash Card

If you prefer a physical payment option instead of relying solely on online transactions, you can consider applying for a PayPal Cash Card. The PayPal Cash Card is a prepaid debit card that allows you to access your PayPal balance for payments and withdraw cash from ATMs.

To apply for a PayPal Cash Card, follow these steps:

- Login to your PayPal account and navigate to the “Wallet” section.

- Scroll down to the PayPal Cash Card section and click on the “Get The Card” or “Order Card” button.

- Confirm your mailing address and agree to the terms and conditions.

- Review the fee schedule associated with the PayPal Cash Card, including any monthly fees or transaction charges.

- Submit your application and wait for PayPal to review and process your request.

- Once approved, PayPal will send your PayPal Cash Card to your registered mailing address.

Once you receive your PayPal Cash Card, you can activate it through the PayPal website or mobile app. Once activated, the card will be linked to your PayPal account, allowing you to access your PayPal balance for purchases online or at any point-of-sale terminal that accepts Mastercard.

The PayPal Cash Card also offers the convenience of withdrawing cash from ATMs. You can use your PayPal Cash Card at any ATM that accepts Mastercard, giving you access to your PayPal funds without the need for a credit card or a traditional bank account.

It’s important to note that the PayPal Cash Card is subject to certain fees, including withdrawal fees and foreign transaction fees. Familiarize yourself with the fee schedule and terms associated with the card to understand any costs that may apply.

By applying for a PayPal Cash Card, you can enjoy the benefits of a physical payment method while using your PayPal balance for online purchases and cash withdrawals.

To conclude, you don’t necessarily need a credit card to use PayPal. By linking your bank account, using a debit card, receiving payments from others, or applying for a PayPal Cash Card, you can fully utilize PayPal’s features and convenience while avoiding the need for a credit card. Choose the method that suits your preferences and needs, and enjoy the simplicity and security of using PayPal for your online transactions.

Conclusion

Using PayPal without a credit card is not only possible but also convenient and accessible. Whether you choose to link your bank account, use a debit card, receive payments from others, or apply for a PayPal Cash Card, you have multiple options to enjoy the benefits of PayPal without relying on a credit card.

By linking your bank account to PayPal, you can easily transfer funds between your PayPal balance and your bank account, providing a seamless way to make online purchases or securely receive money. Additionally, using a debit card with PayPal allows you to make payments directly from your bank account without the need for a credit card.

If you’re a freelancer, small business owner, or simply someone who receives payments, PayPal allows you to easily accept money from others without the need for a credit card. By setting up your payment preferences, you can streamline your income and manage your transactions within the PayPal platform.

For those who prefer a physical payment option, the PayPal Cash Card is a great choice. As a prepaid debit card, it offers the flexibility of accessing your PayPal balance for purchases and cash withdrawals from ATMs.

No matter which method you choose, PayPal provides a secure and trusted platform for conducting online transactions. With its advanced encryption and fraud protection measures, you can have peace of mind when making payments or receiving funds without a credit card.

In conclusion, using PayPal without a credit card opens up a world of possibilities for online payments. Whether you’re shopping online, sending money to friends and family, or running a business, PayPal offers a convenient and reliable way to manage your finances. Take advantage of the various methods available and enjoy the flexibility and convenience that PayPal provides, all without the need for a credit card.