Finance

Why Is Cash Flow Important

Published: December 20, 2023

Discover the significance of cash flow in finance and why it is crucial for businesses. Learn how to optimize cash flow management for financial success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where cash is king. In the realm of financial management, understanding and managing cash flow is paramount to the success of any business. Cash flow refers to the movement of money in and out of a company, representing the lifeblood and financial stability of the organization.

Cash flow encompasses the inflow and outflow of cash from various sources, such as sales revenue, investments, loans, and expenses. It is a vital metric that indicates the financial health and liquidity of a business. Cash flow management is essential for both small and large businesses, as it impacts decision-making, profitability, and sustainability.

In this article, we will delve into the significance of cash flow, explore various methods of managing cash flow, and discuss strategies for improving cash flow. By the end, you will have a comprehensive understanding of why cash flow is crucial for businesses and how you can optimize it for financial success.

Definition of Cash Flow

Cash flow is a financial term that represents the movement of money in and out of a business over a specific period. It tracks the actual cash that flows into and out of a company’s accounts, providing a comprehensive picture of the company’s liquidity and financial health. Cash flow can be categorized into three main types: operating cash flow, investing cash flow, and financing cash flow.

1. Operating Cash Flow: This refers to the cash generated or consumed by a company’s core operations. It includes revenue from sales, collection of accounts receivable, and payments for operating expenses such as salaries, rent, and utilities. Positive operating cash flow indicates that a company’s operations are generating more cash than they are consuming, which is a favorable sign of financial stability.

2. Investing Cash Flow: This category represents the cash used for investment activities, such as purchasing or selling assets, acquiring or selling investments, and making loans to other entities. Investing cash flow also includes cash received from the sale of assets, dividends from investments, or repayment of loans. Investing cash flow is essential for long-term growth and development of a business.

3. Financing Cash Flow: This component reflects the cash flow related to financing activities, such as obtaining loans, issuing or repurchasing stocks, and paying dividends to shareholders. Financing cash flow also includes the repayment of debt, interest payments, and any capital injections received from investors or shareholders. Proper management of financing cash flow ensures the availability of funds to support the company’s operations and growth.

By analyzing these three types of cash flow, businesses can gain insights into their overall financial performance, liquidity position, and ability to generate positive cash flow. This understanding allows management to make informed decisions regarding expansion, investment opportunities, debt management, and ensuring the company’s financial stability.

Importance of Cash Flow

Cash flow is the lifeblood of any business. It is not only crucial for day-to-day operations but also plays a significant role in determining the long-term success and sustainability of a company. Here are some key reasons why cash flow is important:

1. Financial Stability: Cash flow provides a clear picture of a company’s financial stability and ability to meet its financial obligations. Positive cash flow indicates that a company has enough cash on hand to cover its expenses, debts, and other financial commitments. This financial stability is essential for maintaining the confidence of creditors, investors, and suppliers.

2. Liquidity Management: Effective cash flow management ensures that a company has sufficient liquidity to cover its day-to-day operations. It allows businesses to pay employees, suppliers, and bills on time, prevent inventory shortages, and seize favorable business opportunities. A healthy cash flow also provides a cushion during lean periods or unexpected expenses.

3. Planning and Decision Making: Cash flow analysis helps businesses make informed decisions and plan for the future. By understanding the timing and amount of cash inflows and outflows, companies can develop realistic budgets, set financial goals, and allocate resources effectively. Cash flow projections enable businesses to anticipate potential cash shortages, plan for expansion, and make strategic investments.

4. Debt Management: Cash flow is instrumental in managing debt obligations. It allows businesses to make timely payments on loans, interest, and other financial obligations. A positive cash flow can improve creditworthiness, attract favorable loan terms, and reduce the risk of default. Conversely, poor cash flow can hinder a company’s ability to service its debts, leading to credit issues or even bankruptcy.

5. Investor and Creditor Confidence: Cash flow is a key metric that investors and creditors consider when evaluating a company’s financial health. Positive cash flow indicates that a business is generating sufficient cash from its operations and is capable of repaying debts and providing returns to investors. This confidence can attract additional investment, secure funding, and enhance the company’s reputation in the market.

6. Business Growth and Expansion: Adequate cash flow is vital for business growth and expansion. It allows companies to invest in new projects, purchase equipment, hire additional staff, expand into new markets, and acquire other businesses. Positive cash flow provides the financial resources needed to take advantage of growth opportunities and increase market share.

In summary, cash flow is a critical aspect of financial management. Understanding and effectively managing cash flow enables businesses to maintain stability, make informed decisions, manage debt, attract investment, and fuel growth. By prioritizing cash flow, businesses can ensure their long-term success in a competitive market.

Managing Cash Flow

Effective cash flow management is vital for the financial health and sustainability of a business. It involves implementing strategies to optimize cash inflows and minimize cash outflows. Here are some key tips for managing cash flow:

1. Monitor Cash Flow Regularly: Stay on top of your cash flow by monitoring it regularly. This includes tracking cash inflows from sales, customer payments, and investments, as well as cash outflows for expenses, loan repayments, and other financial commitments. By understanding the current state of your cash flow, you can identify potential issues early on and take appropriate action.

2. Create a Cash Flow Forecast: Develop a cash flow forecast to predict your future cash flow based on projected revenues and expenses. This forecast will help you anticipate any cash shortfalls or surpluses and allow you to plan ahead. It is essential to regularly update your forecast to reflect changes in your business operations and market conditions.

3. Control Expenses: Analyze your expenses and look for areas where you can cut costs without sacrificing quality or efficiency. Negotiate favorable terms with suppliers, eliminate unnecessary expenses, and find ways to streamline your operations. By managing expenses effectively, you can improve your cash flow position.

4. Optimize Accounts Receivable: Promptly invoice your customers and establish clear payment terms. Encourage early or upfront payments by offering discounts or incentives. Implement a robust accounts receivable management system to track and follow up on outstanding payments. Minimizing overdue invoices can significantly improve cash flow.

5. Manage Inventory: Take a strategic approach to inventory management. Avoid overstocking, as it ties up cash. Regularly review your inventory levels and identify slow-moving or obsolete items. Optimize your ordering process to minimize carrying costs and maximize cash flow efficiency.

6. Negotiate Payment Terms: Negotiate favorable payment terms with suppliers to extend your payment deadlines. This can help improve your cash flow by allowing you to hold onto cash for a longer period. However, it is crucial to maintain good relationships with suppliers and honor your payment commitments.

7. Explore Financing Options: In times of cash flow constraints, consider various financing options to bridge the gap. This may include obtaining a short-term loan, line of credit, or factoring accounts receivable. However, it is important to carefully assess the costs and terms associated with these financing options.

8. Consider Cash Flow Hedging: Depending on your industry, you may face cash flow fluctuations due to seasonality or market volatility. Explore hedging strategies or financial instruments that can help stabilize your cash flow. This may include currency hedging, interest rate swaps, or commodity futures contracts.

9. Plan for Contingencies: Cash flow disruptions can occur due to unexpected events such as economic downturns, natural disasters, or business disruptions. It is important to have a contingency plan and access to emergency funds to navigate through these challenging periods.

10. Utilize Technology and Automation: Leverage technology and automation tools to streamline your cash flow management processes. This includes using accounting software, online payment platforms, and cash flow management applications that can simplify and streamline cash flow tracking and forecasting.

By implementing these cash flow management strategies, businesses can improve their financial stability, optimize cash flow, and create a foundation for long-term success.

Ways to Improve Cash Flow

Optimizing cash flow is a continuous effort for businesses. By implementing several strategies, companies can improve their cash flow position and ensure long-term financial stability. Here are some effective ways to improve cash flow:

1. Accelerate Accounts Receivable: Encourage prompt payment from customers by offering incentives for early payment or implementing stricter credit terms. Send timely and accurate invoices, follow up on overdue payments, and consider offering multiple payment options to make it convenient for customers to settle their invoices quickly.

2. Negotiate Payment Terms with Suppliers: Engage in open and transparent discussions with suppliers to negotiate favorable payment terms. Request extended payment deadlines or negotiate discounts for early payments. By aligning your payment terms with your cash flow cycle, you can manage your cash flow more effectively.

3. Optimize Inventory Management: Conduct a thorough analysis of your inventory to identify excess or slow-moving items. Find ways to minimize carrying costs by implementing just-in-time inventory management or exploring drop-shipping options. Regularly review and adjust your inventory levels to align with customer demand.

4. Control Expenses: Evaluate your expenses and identify areas where you can reduce costs without compromising the quality of your products or services. Renegotiate contracts with suppliers, explore cost-effective alternatives, and eliminate unnecessary expenses. By managing your expenses efficiently, you can free up cash flow for other critical areas of your business.

5. Implement Cash Flow Forecasting and Budgeting: Develop a comprehensive cash flow forecast and budget to track your inflows and outflows. This will allow you to anticipate potential cash flow gaps and make informed decisions. Regularly review and update your forecast to align it with the current business environment.

6. Explore Financing Options: In times of cash flow constraints, consider financing options to inject cash into your business. This may include obtaining a business line of credit, invoice financing, or equipment leasing. However, ensure that you carefully assess the costs and terms associated with these financing options.

7. Streamline Operations: Identify opportunities to streamline your processes and improve efficiency. Look for ways to automate repetitive tasks, optimize workflow, and eliminate bottlenecks. By improving operational efficiency, you can reduce costs and enhance cash flow.

8. Encourage Cash Sales: Incentivize customers to make cash payments by offering discounts or special promotions. This can help improve your cash flow by reducing reliance on credit sales and minimizing the risk of bad debt.

9. Monitor and Manage Cash Outflows: Keep a close eye on your cash outflows and ensure that all expenditures are necessary and aligned with your business goals. Regularly review your expenses to identify areas where you can cut costs or negotiate better deals.

10. Build Emergency Reserves: Establish an emergency cash reserve to handle unexpected expenses or cash flow disruptions. By setting aside a portion of your cash flow for emergencies, you can ensure that your business remains resilient during challenging times.

Remember, improving cash flow requires a proactive and disciplined approach. By implementing these strategies and regularly monitoring your cash flow, you can improve your financial position, enhance profitability, and create a solid foundation for long-term success.

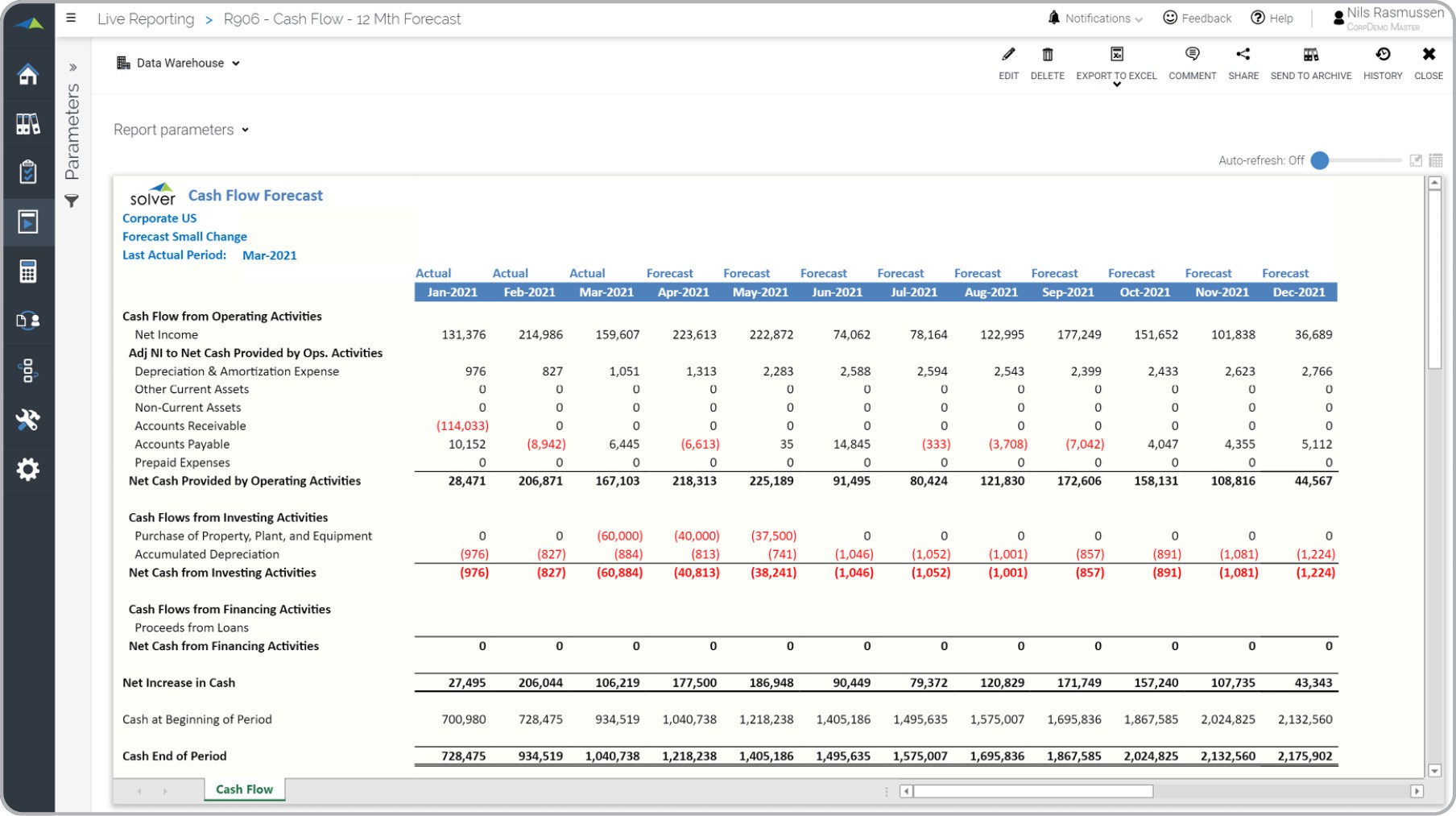

Cash Flow Statement

The cash flow statement is a financial statement that provides a detailed account of the cash inflows and outflows of a company over a specified period of time. It shows how changes in balances of cash and cash equivalents impact the company’s overall cash position. The statement is divided into three main sections: operating activities, investing activities, and financing activities.

1. Operating Activities: This section reports the cash flows generated or consumed from a company’s core operations. It includes cash receipts from sales, interest, dividends, and payments made to suppliers, employees, and other operating expenses. Operating activities reflect the day-to-day cash flow that results from the production and delivery of goods and services.

2. Investing Activities: This section outlines cash flows related to investments in long-term assets and other non-operating activities. It includes cash flows from the purchase or sale of property, plant, and equipment, investments in securities, and proceeds from the sale or maturity of investments. Investing activities highlight the cash flow associated with the acquisition and disposition of assets necessary for business operations.

3. Financing Activities: This section focuses on cash flows resulting from the funding and capital structure of the company. It includes cash flows from borrowing or repaying loans, issuing or repurchasing shares, and paying dividends. Financing activities shed light on the cash flow related to the company’s capital raising and distribution activities.

At the end of each section, the cash flow statement provides a net cash flow, which is the difference between the total cash inflows and outflows in that category. The sum of the net cash flow from operating activities, investing activities, and financing activities gives the overall net increase or decrease in cash for the period.

The cash flow statement is an essential tool for assessing a company’s liquidity, financial health, and ability to generate cash. It complements the income statement and balance sheet, providing a comprehensive view of the company’s financial position. Investors, creditors, and financial analysts use the cash flow statement to evaluate a company’s cash flow generation, debt repayment capacity, and potential for future investment.

By analyzing the cash flow statement, businesses can identify any cash flow bottlenecks, assess their cash conversion cycle, and make informed decisions to improve their cash flow management. It also helps in budgeting, forecasting, and strategic planning, enabling companies to allocate their resources effectively and achieve their financial objectives.

Cash Flow Forecasting

Cash flow forecasting is a financial management tool that helps businesses predict their future cash inflows and outflows. It involves estimating the timing and amount of cash that will be received and paid out over a specific period, typically on a monthly or quarterly basis. Cash flow forecasting allows businesses to anticipate potential cash shortages or surpluses and make informed decisions to optimize their cash flow management.

Here are the key steps in cash flow forecasting:

1. Collect and Analyze Historical Data: Start by gathering historical financial data, including past cash flows, sales revenue, expenses, and payment patterns. Analyze this data to identify trends, seasonal variations, and any factors that may impact cash flow in the future. Historical data serves as a foundation for accurate cash flow projections.

2. Estimate Cash Inflows: Forecast the expected cash inflows by considering factors such as sales revenue, customer payments, interest income, and other sources of cash. Take into account any anticipated changes, such as new product launches, marketing campaigns, or changes in business conditions that may impact cash receipts.

3. Predict Cash Outflows: Estimate the anticipated cash outflows by considering various expenses such as supplier payments, employee salaries, operating costs, loan repayments, taxes, and other financial commitments. Analyze historical data and future plans to ensure accuracy in forecasting cash outflows.

4. Incorporate Non-Operating Cash Flows: Consider non-operating cash flows, such as the proceeds from the sale of assets, investments, or loans. These non-core activities can have a significant impact on cash flow and should be factored into the forecast to provide an accurate representation of the overall cash position.

5. Adjust for Timing Differences: It is important to consider the timing differences between when cash is received and when it is paid out. For example, a customer may take longer to pay an invoice than expected, or a supplier may offer extended payment terms. Adjust the cash flow forecast to account for these timing differences to ensure accuracy.

6. Update and Review Regularly: Cash flow forecasting is not a one-time exercise. It should be updated regularly to reflect changes in the business environment, market conditions, and any internal factors that may impact cash flow. Review the forecast periodically to compare projected cash flows with actual results, and adjust the forecast as necessary.

Benefits of cash flow forecasting include:

- Identifying potential cash flow gaps or surpluses in advance

- Helping with budgeting and financial planning

- Aiding in decision-making, such as timing of investments or financing

- Assisting in securing financing from lenders and investors

- Enabling businesses to proactively manage cash flow and liquidity

Cash flow forecasting provides businesses with valuable insights into their future cash position, allowing them to take proactive steps to optimize their cash flow management. By accurately forecasting cash inflows and outflows, businesses can ensure they have adequate liquidity to meet their financial obligations, seize growth opportunities, and navigate through any potential cash flow challenges.

Case Studies on Cash Flow Management

Examining real-life case studies can provide valuable insights into effective cash flow management strategies. Let’s explore two examples of companies that implemented successful cash flow management techniques:

1. Case Study: Company A

Company A, a manufacturing company, was struggling with cash flow challenges due to slow-paying customers and high inventory levels. To improve its cash flow, the company implemented the following strategies:

- Tightened Accounts Receivable Management: Company A implemented more rigorous procedures for invoicing and collections. They offered incentives for early payments and developed a system to track and follow up on overdue invoices. As a result, customer payments became more timely, improving cash inflows.

- Optimized Inventory Management: The company analyzed its inventory levels and implemented a just-in-time inventory management system. By reducing excess inventory and carefully monitoring demand, they were able to free up cash flow that was previously tied up in inventory.

- Renegotiated Supplier Contracts: Company A worked with suppliers to negotiate improved payment terms. By extending payment deadlines, the company was able to better match cash outflows with cash inflows, easing the strain on cash flow.

- Implemented Cash Flow Forecasting: The company developed a cash flow forecasting system to anticipate potential cash flow gaps and surpluses. This allowed them to proactively manage their cash flow and make informed decisions regarding expenses and investments.

By implementing these strategies, Company A was able to improve its cash flow position, reduce reliance on borrowing, and achieve greater financial stability.

2. Case Study: Company B

Company B, a service-based startup, faced cash flow challenges due to long payment cycles and high operating expenses. To address these issues, the company implemented the following cash flow management strategies:

- Implemented Invoice Factoring: To improve cash flow, Company B started using invoice factoring, a financing tool that allows businesses to sell their accounts receivable to a third-party provider. This enabled them to access immediate cash flow by receiving upfront payments for their outstanding invoices.

- Reduced Operating Expenses: The company scrutinized its operating expenses and identified areas where costs could be cut without compromising the quality of services. They renegotiated contracts and explored alternative vendors to achieve significant cost savings.

- Strengthened Customer Relationships: Company B prioritized building strong relationships with its clients. They provided exceptional service and maintained regular communication to ensure customer satisfaction. This resulted in more timely payments, reducing cash flow delays.

- Implemented Cash Flow Monitoring: The company implemented a robust cash flow monitoring system to closely track inflows and outflows on a weekly basis. This allowed for real-time visibility into cash flow and helped identify potential cash flow bottlenecks or surpluses.

By adopting these measures, Company B successfully improved its cash flow, managed its expenses more effectively, and created a more sustainable financial footing for future growth.

These case studies emphasize the importance of implementing tailored cash flow management strategies that address specific issues and challenges faced by businesses. By evaluating their own unique circumstances and implementing proven techniques, companies can enhance their cash flow management and achieve better financial outcomes.

Conclusion

Cash flow management is a critical aspect of financial success for any business. Understanding the importance of cash flow and implementing effective strategies to manage and optimize it are essential for long-term sustainability. By maintaining positive cash flow, businesses can ensure financial stability, meet their financial obligations, and seize growth opportunities.

Throughout this article, we have explored various aspects of cash flow management, including the definition of cash flow, its importance, and ways to improve cash flow. We also discussed the significance of the cash flow statement and cash flow forecasting in providing insights into a company’s financial health and aiding in decision-making.

Managing cash flow requires monitoring inflows and outflows, controlling expenses, optimizing accounts receivable and inventory, and exploring financing options when necessary. By implementing these strategies, businesses can enhance their cash flow position, minimize financial stress, and make informed decisions to drive growth and profitability.

Furthermore, real-life case studies have highlighted how companies have successfully navigated cash flow challenges and improved their financial position. These examples demonstrate that with the right strategies, businesses can overcome cash flow obstacles and achieve financial stability.

In conclusion, by prioritizing cash flow management and implementing appropriate strategies, businesses can ensure their long-term viability, weather financial uncertainties, and position themselves for success in a competitive market. Regular monitoring, forecasting, and adjustments are key to maintaining a healthy cash flow and achieving sustainable growth.

Remember, cash is the lifeblood of any business, and effective cash flow management is the key to its survival and prosperity.