Finance

How To Add Money To Chime Credit Card

Published: October 26, 2023

Learn how to add money to your Chime credit card and manage your finances effectively. Discover helpful tips and tricks to optimize your financial well-being.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

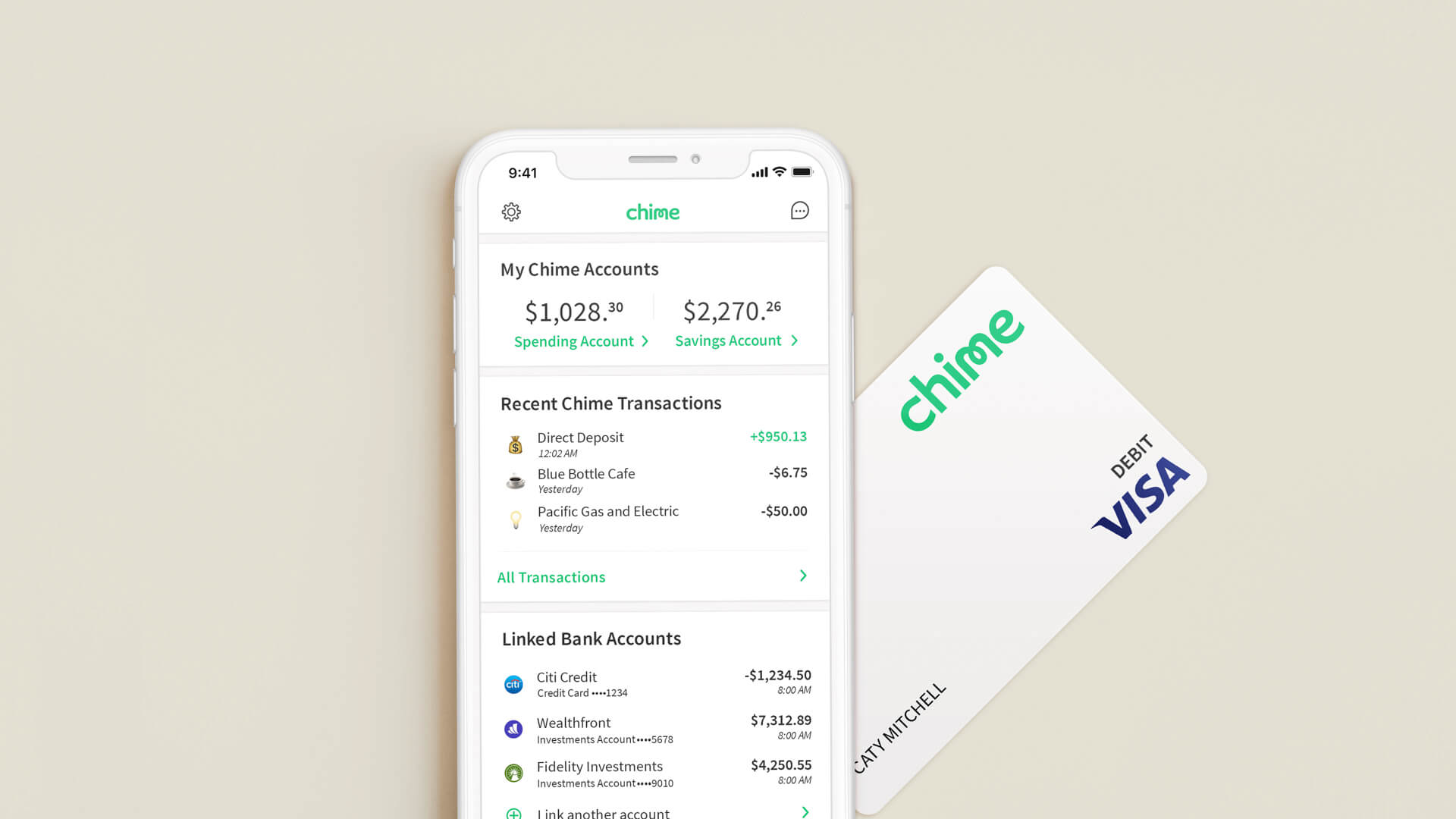

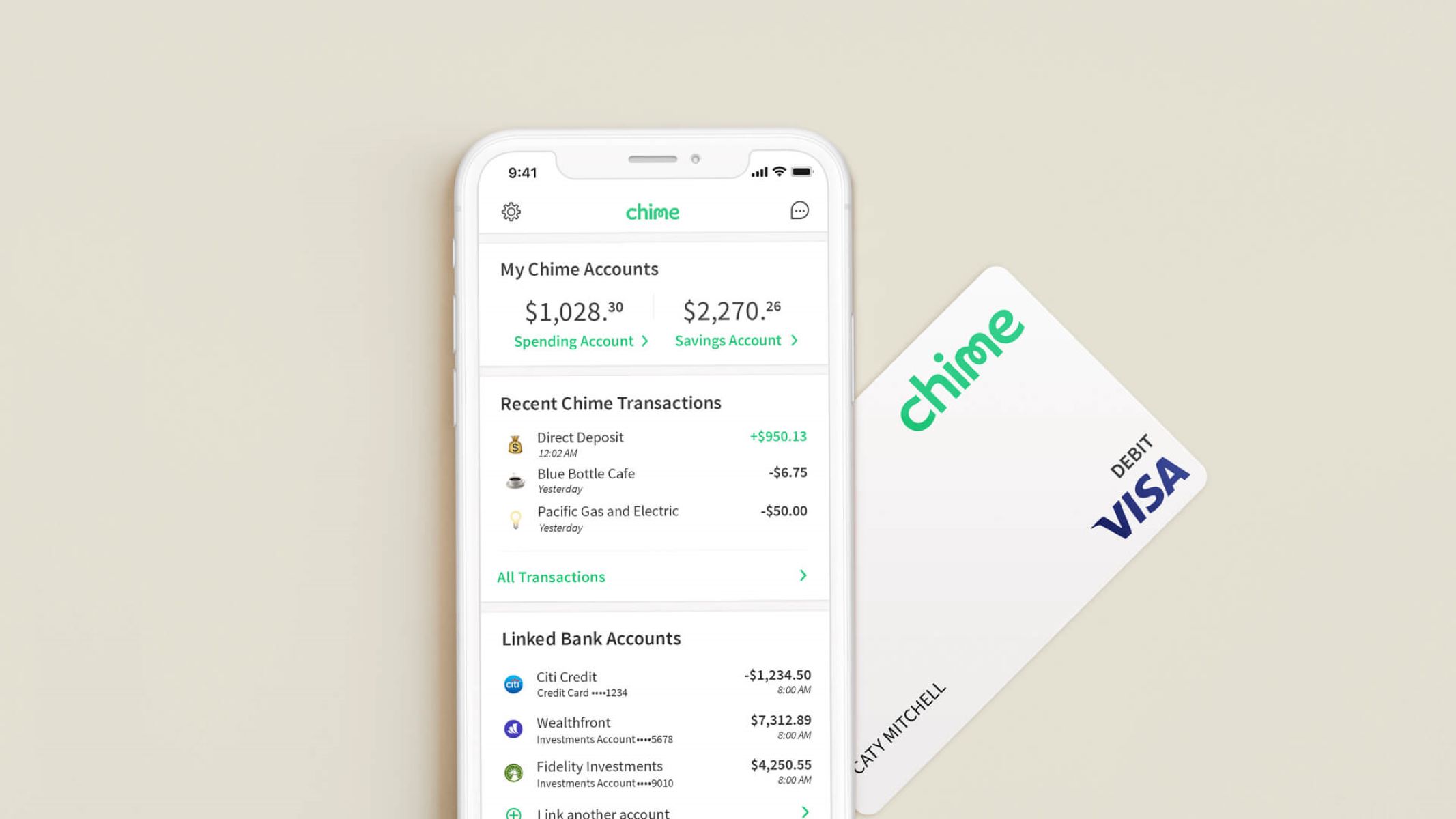

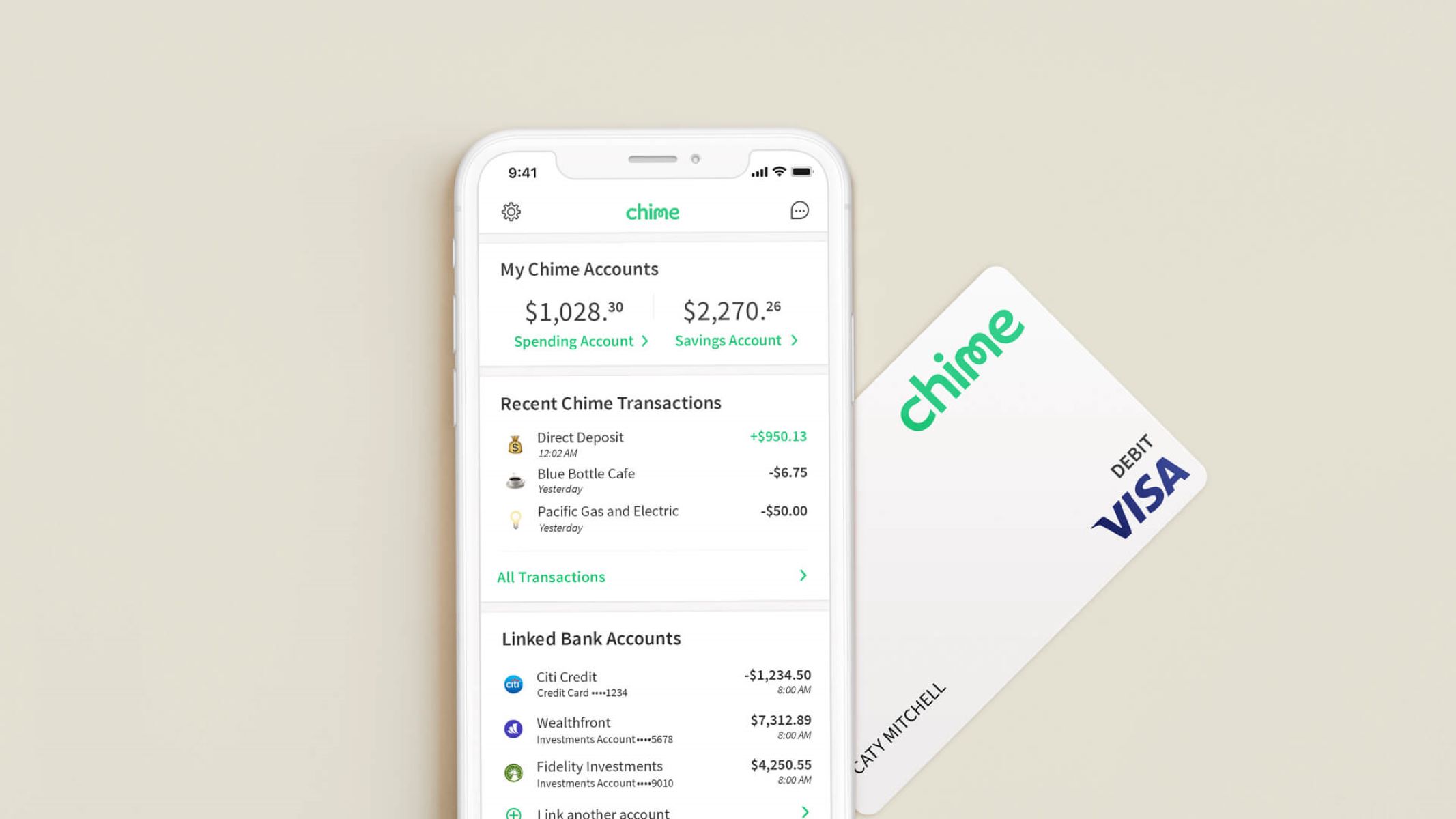

Chime Credit Card is a popular financial tool that offers users a convenient and reliable way to manage their finances. Whether you’re new to Chime Credit Card or are a long-time user, you may be wondering about the various options available for adding money to your card. In this article, we will explore seven different methods that you can use to add funds to your Chime Credit Card.

From direct deposits to mobile check deposits, cash reloads to card-to-card transfers, Chime provides a variety of ways to ensure that you have funds available on your card whenever you need them. Understanding these options and how to utilize them can help you effectively manage your finances and make the most of your Chime Credit Card.

Before we dive into the specifics of each method, it is important to note that the availability and fees associated with each option may vary. It is always a good idea to review the terms and conditions provided by Chime or consult customer service for the most accurate and up-to-date information.

Now, let’s take a closer look at the available methods for adding money to your Chime Credit Card.

Option 1: Direct Deposit

One of the easiest and most convenient ways to add money to your Chime Credit Card is through direct deposit. With this method, you can have your paycheck, government benefits, or other recurring income automatically deposited into your Chime account.

To set up direct deposit, you will need to provide your employer or benefits provider with your Chime account and routing numbers. These can be found in the Chime mobile app or on the Chime website. Once the direct deposit is set up, the funds will be deposited into your Chime account on your designated payday.

Direct deposit offers several advantages. It eliminates the need for paper checks, reduces the risk of lost or stolen checks, and allows you to access your funds faster. In addition, Chime does not charge any fees for direct deposits, making it a cost-effective option for adding money to your Chime Credit Card.

It is important to note that the availability of direct deposit may vary depending on your employer or benefits provider. Be sure to check with them to see if direct deposit is an option and to provide them with the required account information.

With direct deposit, you can enjoy the convenience and reliability of having your income deposited directly into your Chime account, making funds available on your Chime Credit Card without any hassle.

Option 2: Bank Transfer

If you have funds in another bank account, you can easily transfer money to your Chime Credit Card through a bank transfer. This method allows you to move money from your existing bank account to your Chime account, making it accessible on your Chime Credit Card.

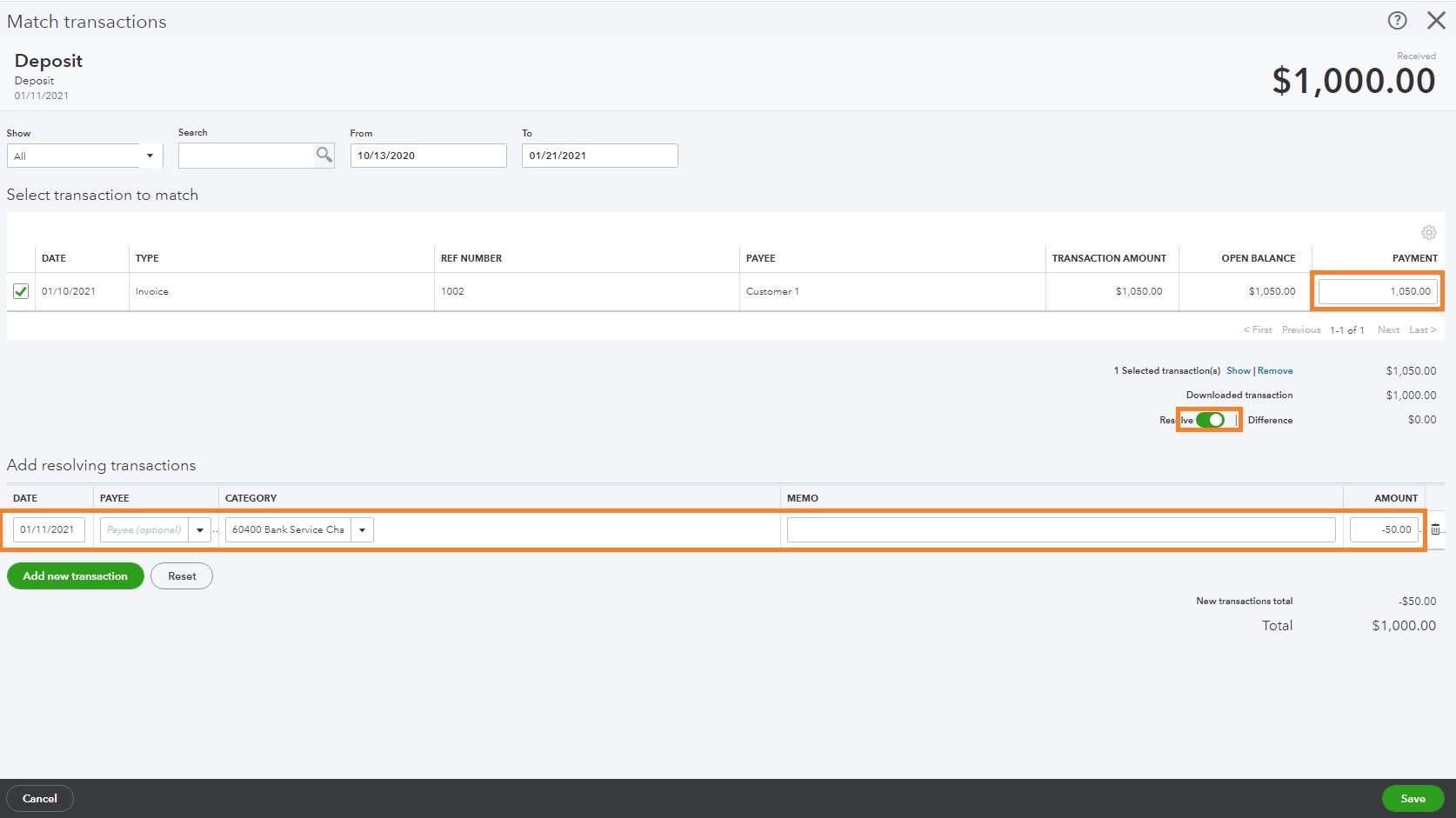

To initiate a bank transfer, you will need to link your external bank account to your Chime account. This can typically be done through the Chime mobile app or website by providing the necessary account and routing numbers. Once the accounts are linked, you can transfer money from your external bank account to your Chime account.

Bank transfers offer flexibility and convenience, allowing you to move funds at your convenience. It is important to note that while Chime does not charge any fees for incoming transfers, your external bank may have its own fees associated with sending the transfer. Be sure to check with your external bank for any applicable fees.

With bank transfers, you can easily add money to your Chime Credit Card from your existing bank accounts, providing you with greater control over your finances and ensuring that your Chime Credit Card is funded and ready to use.

Option 3: Mobile Check Deposit

Another convenient way to add money to your Chime Credit Card is through mobile check deposit. This method allows you to deposit physical checks into your Chime account using your smartphone or tablet.

To use mobile check deposit, you will need to have the Chime mobile app installed on your device. Simply launch the app and select the “Deposit” option. Follow the prompts to take a photo of the front and back of the check, enter the check amount, and submit the deposit. Once the deposit is approved, the funds will be added to your Chime account and made available on your Chime Credit Card.

Mobile check deposit offers convenience and eliminates the need to physically visit a bank or ATM to deposit a check. It allows you to add funds to your Chime Credit Card quickly and securely, saving you time and effort.

It is important to note that there may be limits on the amount of money you can deposit via mobile check deposit and that holds may be placed on deposited checks for a short period of time. Additionally, Chime does not charge any fees for mobile check deposits, but there may be fees associated with returned or uncollectible checks. Check the terms and conditions provided by Chime for more information.

By taking advantage of the mobile check deposit feature, you can easily and conveniently add money to your Chime Credit Card with just a few taps on your smartphone or tablet.

Option 4: Reload Networks and Retailers

If you prefer a more traditional approach, you can add money to your Chime Credit Card through reload networks and participating retailers. Chime has partnered with various reload networks and retailers to provide convenient cash loading options.

Reload networks, such as Green Dot or MoneyGram, allow you to add funds to your Chime Credit Card by visiting a participating retailer. Simply bring cash to the retailer, provide your Chime card information, and the cash will be loaded onto your Chime Credit Card. This method is ideal for individuals who prefer using cash or who do not have access to a bank account for other transfer methods.

In addition to reload networks, Chime has also partnered with retailers that offer cash loading services. Retailers such as CVS, Walgreens, and Walmart allow you to add money to your Chime Credit Card at their cash registers or self-service kiosks.

While reload networks and participating retailers offer convenience, it is important to note that there may be fees associated with this method. Reload network fees can vary depending on the retailer and the amount being loaded, so it is recommended to check with the specific reload network or retailer for fee information.

By utilizing reload networks and participating retailers, you can easily add money to your Chime Credit Card using cash, providing a convenient option for individuals who prefer the traditional method of handling their finances.

Option 5: Money Transfers

Another method to add money to your Chime Credit Card is through money transfers. Money transfers allow you to send funds from another Chime account or from an external bank account directly to your Chime Credit Card.

If you have a friend or family member who also has a Chime account, you can easily transfer money between your Chime accounts. Simply provide your friend or family member with your Chime account information, such as your username or email address associated with your Chime account. They can then initiate a transfer from their Chime account to your Chime Credit Card, instantly adding funds to your card.

If you have funds in an external bank account, you can also transfer money to your Chime Credit Card. Simply link your external bank account to your Chime account using the Chime mobile app or website. Once linked, you can initiate a transfer from your external bank account to your Chime Credit Card. The funds will be deposited into your Chime account and made available on your Chime Credit Card.

It is important to note that while Chime does not charge any fees for incoming transfers, your external bank may have its own fees associated with sending the transfer. Additionally, there may be limits on the amount of money you can transfer at once. Check with your external bank for any applicable fees and transfer limits.

With money transfers, you can easily add funds to your Chime Credit Card from another Chime account or from an external bank account, providing you with flexibility and convenience in managing your finances.

Option 6: Cash Reloads

If you prefer to add money to your Chime Credit Card using cash, cash reloads offer a simple and convenient option. With cash reloads, you can visit a participating retailer and load funds onto your Chime Credit Card in-person.

Chime has partnered with retailers like Walmart, CVS, and Walgreens, which offer cash reload services. When you visit these locations, you can bring cash and provide your Chime Credit Card to the cashier or use self-service kiosks to load the funds onto your card. The cash will be instantly added to your Chime Credit Card balance, making it available for immediate use.

It’s important to note that while cash reloads provide a quick way to add money to your Chime Credit Card, there may be fees associated with this service. The fees can vary depending on the retailer and the amount being loaded, so it’s advisable to check with the specific retailer for fee information.

Cash reloads are particularly useful for individuals who prefer to use cash or those who may not have access to a bank account. With cash reloads, you can conveniently add funds to your Chime Credit Card using cash, ensuring that you have money available for your financial needs.

Option 7: Chime Card-to-Card Transfer

Another convenient method for adding money to your Chime Credit Card is through a Chime Card-to-Card transfer. This feature allows you to transfer funds from another Chime account holder directly to your Chime Credit Card.

If you have a friend, family member, or anyone you know who also has a Chime account, you can easily initiate a Card-to-Card transfer. Simply provide them with your Chime account details, such as your username or email associated with your Chime account. They can then initiate a transfer from their Chime account to your Chime Credit Card.

Chime Card-to-Card transfers are instant, allowing the funds to be added to your Chime Credit Card immediately. This method is not only convenient if you need to receive funds quickly but also beneficial when you want to split expenses or send money to someone who also uses Chime.

It’s important to note that Chime does not charge any fees for Card-to-Card transfers. However, it’s recommended to communicate with the sender to ensure that they are aware of any potential fees their bank may charge for initiating the transfer.

With Chime Card-to-Card transfers, you can easily and securely receive funds from another Chime account holder, providing a fast and convenient way to add money to your Chime Credit Card.

Conclusion

Adding money to your Chime Credit Card is a straightforward process with several convenient options available. Whether you prefer direct deposit, bank transfers, mobile check deposits, reload networks and retailers, money transfers, cash reloads, or Chime Card-to-Card transfers, Chime offers a range of methods to suit your needs.

Direct deposit provides a seamless way to have your income automatically deposited into your Chime account, ensuring that your Chime Credit Card is always funded. Bank transfers allow you to move funds from another bank account to your Chime account, providing flexibility and control over your finances.

Mobile check deposits make it easy to add money by simply taking photos of your checks and submitting them through the Chime mobile app. Reload networks and participating retailers offer cash loading options, ideal for those who prefer handling finances with cash.

Money transfers allow you to receive funds from another Chime account holder or transfer money from an external bank account directly to your Chime Credit Card, providing quick and convenient ways to add funds.

Lastly, cash reloads offer the convenience of adding money to your Chime Credit Card using cash at participating retailers, ensuring that you have access to funds even without a bank account.

It’s important to consider the fees associated with some of these methods and review the terms and conditions provided by Chime for accurate and up-to-date information.

By utilizing these various options, you can effectively manage your finances and have funds readily available on your Chime Credit Card. Choose the method that best suits your needs, and enjoy the convenience and flexibility that Chime offers for adding money to your Chime Credit Card.