Finance

Where Are Dividends On Cash Flow Statement

Modified: January 5, 2024

Learn about dividends on cash flow statement and how they impact finance. Find out where dividends are reported and how they affect a company's financials.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Dividends

- Purpose of Cash Flow Statement

- Components of a Cash Flow Statement

- Investing Activities

- Financing Activities

- Operating Activities

- Treatment of Dividends on Cash Flow Statement

- Classification of Dividends

- Example of Dividends on Cash Flow Statement

- Limitations of Cash Flow Statement in Reflecting Dividends

- Conclusion

Introduction

Welcome to the world of finance, where the intersection of money management and strategic decision-making takes center stage. One essential aspect of understanding the financial health of a company is analyzing its cash flow statement. This statement provides valuable insights into how cash moves in and out of a business over a specific period of time.

In the realm of finance, dividends are a commonly discussed topic. Companies often distribute a portion of their profits to shareholders through dividends. But have you ever wondered how dividends are reflected on a cash flow statement? In this article, we will explore the treatment of dividends on a cash flow statement and gain a deeper understanding of their significance in financial reporting.

A cash flow statement is a financial statement that provides information about a company’s cash inflows and outflows. It helps stakeholders evaluate a company’s ability to generate cash and its liquidity position. While other financial statements, such as the income statement and balance sheet, focus on profit and assets, the cash flow statement concentrates solely on cash movements.

The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities. Each section represents a different aspect of a company’s cash flow sources and uses.

Understanding the treatment of dividends on a cash flow statement requires familiarity with the components of the cash flow statement. Therefore, let’s delve into each section and explore how dividends fit into the picture.

Definition of Dividends

Before we dive into how dividends are reflected on a cash flow statement, let’s start by understanding what dividends are. In the realm of finance and investing, dividends are the distribution of a portion of a company’s profits to its shareholders. These distributions are typically made in the form of cash payments, but they can also be in the form of additional shares of stock.

The decision to pay dividends rests with the company’s board of directors and is often influenced by factors such as profitability, available cash, and the company’s growth prospects. Dividends are typically paid to shareholders on a regular basis, such as quarterly or annually, and serve as a way for companies to share their financial success with their owners.

Dividends can be an attractive feature for investors, as they provide a tangible return on their investment. Additionally, dividends can be an indication of a company’s financial stability and its confidence in its future prospects. However, not all companies pay dividends, especially those that are in their early stages of growth and prefer to reinvest their profits back into the business.

It is important to note that dividends are not guaranteed and can fluctuate based on a company’s financial performance and management’s decisions. Some companies may increase or decrease their dividend payments over time, depending on various factors such as economic conditions, industry trends, and internal financial goals.

Now that we have a clear understanding of what dividends are, let’s explore how they are accounted for on a cash flow statement.

Purpose of Cash Flow Statement

The cash flow statement serves a crucial role in financial reporting, providing valuable insights into a company’s cash inflows and outflows. Its primary purpose is to help stakeholders understand and evaluate the cash flow dynamics of a business. Let’s explore the key objectives and benefits of a cash flow statement.

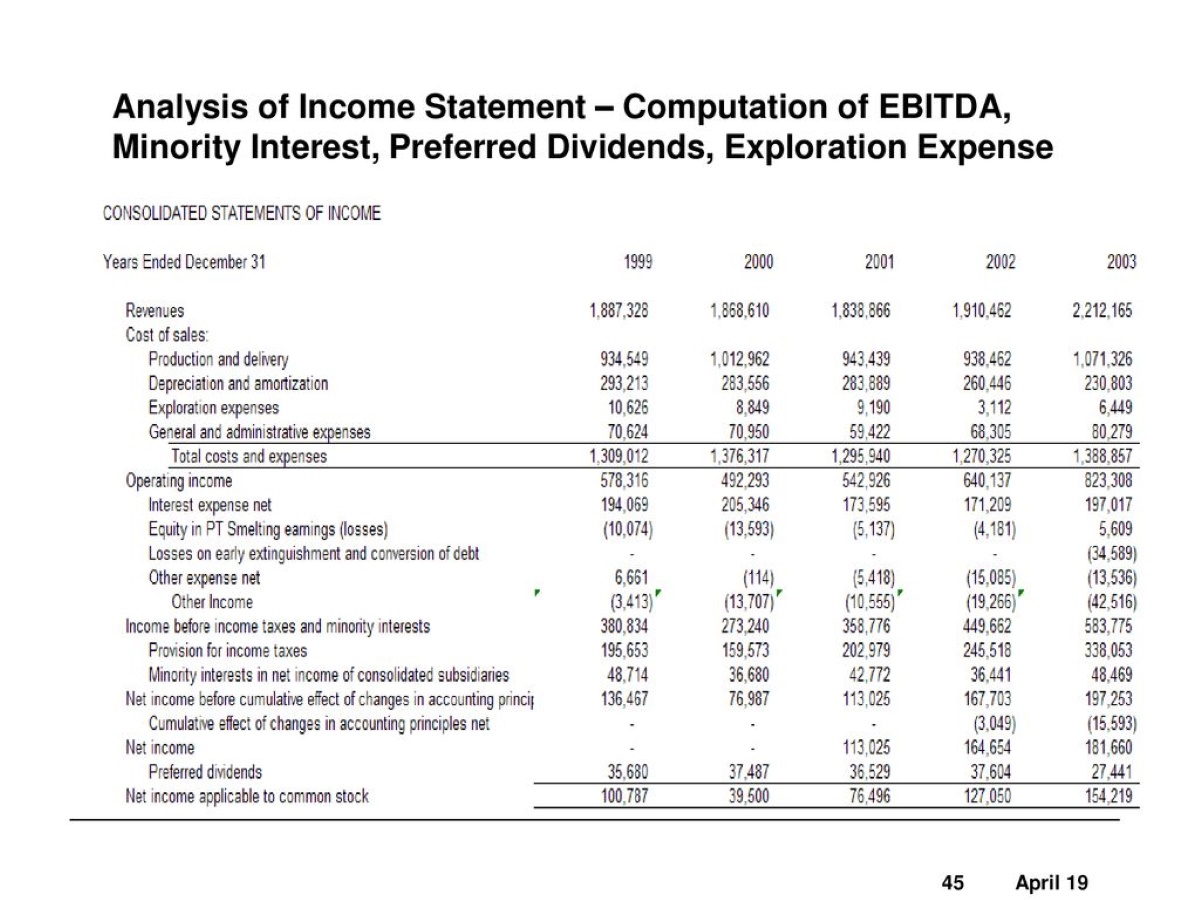

Determining liquidity: One of the main purposes of a cash flow statement is to assess a company’s liquidity position. By analyzing the cash flow from operating activities, investors and creditors can assess whether a company has generated enough cash from its day-to-day operations to cover its expenses and meet its short-term obligations.

Evaluating cash flow sources and uses: The cash flow statement enables stakeholders to identify the sources and uses of cash within a company. It provides a breakdown of cash inflows from operating activities, investing activities, and financing activities. This breakdown helps investors understand how a company generates and utilizes its cash resources.

Assessing financial stability: A cash flow statement also plays a role in assessing a company’s financial stability. It provides insights into a company’s ability to generate consistent and sustainable cash flows over time. By examining the trends in operating cash flow, investors can evaluate the financial health and long-term viability of a company.

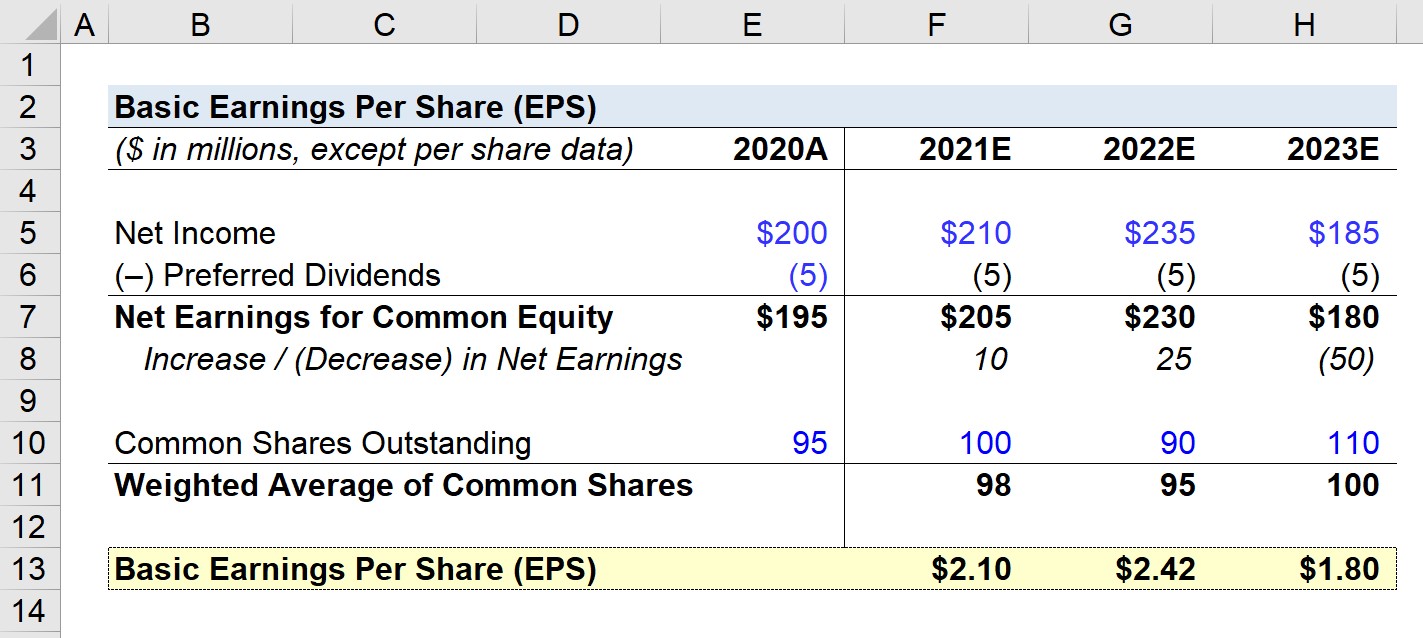

Facilitating investment decisions: Investors use the cash flow statement as a tool to make informed investment decisions. By understanding a company’s cash flow patterns, investors can gauge the potential for future growth, assess the ability to pay dividends, and evaluate the overall financial performance of the company.

Comparing financial performance: The cash flow statement allows for meaningful comparisons between companies within the same industry or sector. By analyzing the cash flow ratios and metrics, such as cash flow from operations to net income or cash flow per share, investors can compare the financial performance and cash flow efficiency of different companies.

Overall, the cash flow statement serves as a vital financial tool that provides a holistic view of a company’s cash flow activities. It helps stakeholders understand the liquidity, cash generation, and financial stability of a company, aiding in investment decision-making and assessment of a company’s overall financial performance.

Components of a Cash Flow Statement

The cash flow statement consists of three main sections: operating activities, investing activities, and financing activities. Each section provides valuable information about the sources and uses of cash within a company. Let’s delve into the details of each component:

-

Operating Activities: This section of the cash flow statement represents the cash flows generated from the core operational activities of a business. It includes cash receipts from sales of goods and services, payments to suppliers and employees, interest and dividend receipts, and income tax payments. Operating activities provide insights into a company’s ability to generate cash from its primary operations and its efficiency in managing working capital.

-

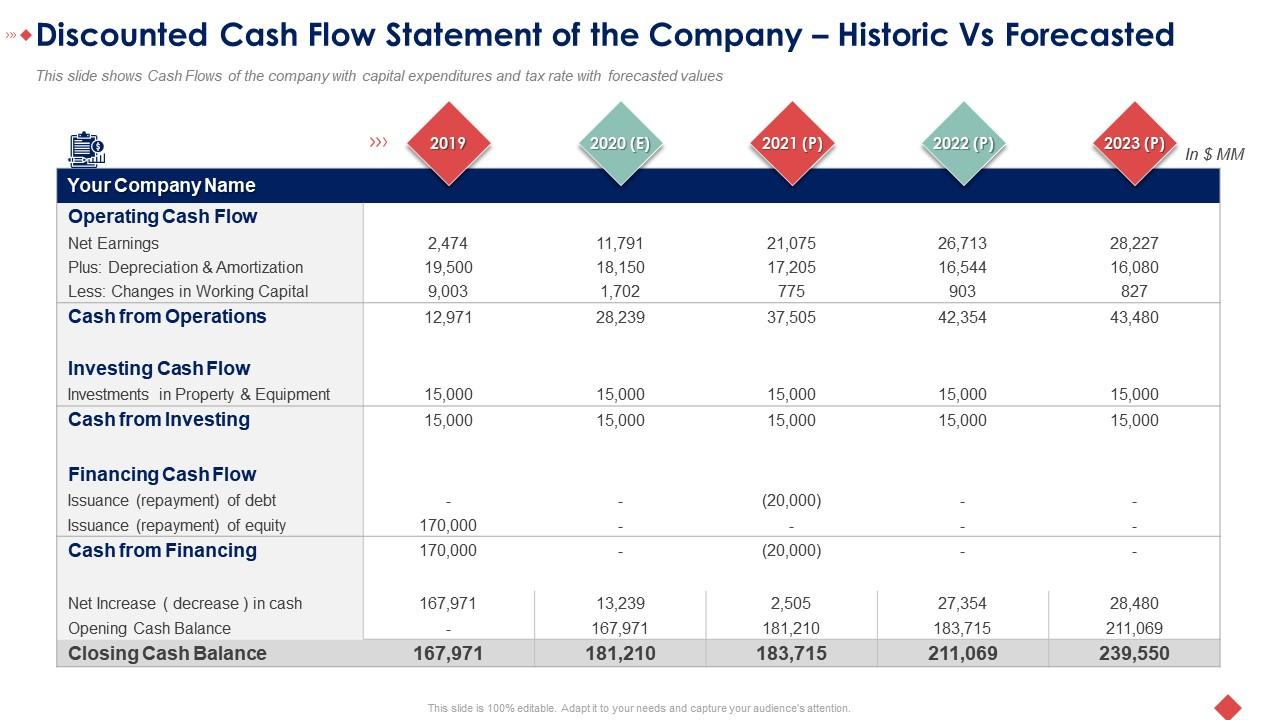

Investing Activities: The investing activities section of the cash flow statement reflects cash flows related to the acquisition or disposal of long-term assets and investments. This includes cash used for the purchase of property, plant, and equipment (capital expenditures), proceeds from the sale of assets or investments, and loans made to other entities. Investing activities provide insights into a company’s investment decisions and its ability to generate future earnings through capital expenditures or strategic investments.

-

Financing Activities: The financing activities section reports the cash flows associated with the company’s external financing sources and payments. This includes cash received from the issuance of debt or equity (such as issuing bonds or shares), cash repayments of debt, payment of dividends to shareholders, and buybacks of company stock. Financing activities provide insights into how a company funds its operations and its approach to capital structure, including its use of debt and equity financing.

By analyzing these three components, stakeholders can gain a comprehensive understanding of how a company generates and uses cash. This information is crucial in assessing the liquidity, financial stability, and investment potential of a business.

Investing Activities

The investing activities section is a key component of the cash flow statement and provides insights into a company’s investment decisions and capital expenditures. It focuses on the cash flows associated with the acquisition or sale of long-term assets and investments.

Investing activities include cash flows related to:

- Purchase and sale of property, plant, and equipment (PP&E): This refers to the cash spent on acquiring or constructing fixed assets like buildings, machinery, and vehicles, as well as the cash received from selling or disposing of such assets. These investments in PP&E reflect a company’s commitment to expand its operational capacity and improve its efficiency.

- Acquisition and sale of other businesses: Cash flows related to acquiring or selling other businesses, including subsidiaries or equity investments in other companies, are also included in this section. These transactions can have a significant impact on a company’s financial position and strategic direction.

- Investments in financial instruments: This includes cash flows from purchases and sales of financial assets and investments such as stocks, bonds, and other securities. Investments in financial instruments can provide additional income or capital appreciation, and their purchase or sale affects a company’s cash flow position.

- Loans made to others: Cash provided to borrowers, either in the form of loans or advances, is considered an investing activity. Such loans represent investments made by the company, and the cash received from repayment of these loans is considered a cash inflow in this section.

The investing activities section helps stakeholders understand a company’s investment strategy and its commitment to long-term growth and expansion. By analyzing the cash flows in this section, investors can assess the company’s capital allocation decisions and evaluate its ability to generate returns from its investments.

It’s important to note that investing activities are distinct from operating activities, which focus on the day-to-day cash flows related to a company’s core business operations. Investing activities, on the other hand, deal with cash flows related to larger, longer-term investments that impact the company’s asset base and future earnings potential.

By analyzing the investing activities section alongside other components of the cash flow statement, stakeholders can gain a comprehensive understanding of a company’s cash flow dynamics and investment priorities. This information is valuable for evaluating a company’s growth prospects and making informed investment decisions.

Financing Activities

The financing activities section of the cash flow statement provides insights into how a company raises and uses funds from external sources. It focuses on cash flows related to the company’s financing decisions and capital structure.

Financing activities include cash flows related to:

- Issuance and repayment of debt: Cash received from the issuance of debt, such as bonds or loans, is considered a cash inflow in this section. Conversely, cash payments made to repay debt or interest expenses are considered cash outflows. These activities reflect a company’s borrowing activities and its financial leverage.

- Issuance and repurchase of equity: Cash received from the issuance of company stock, such as common shares or preference shares, is considered a cash inflow in this section. Conversely, cash used for share repurchases or dividend payments is considered cash outflows. These activities reflect a company’s equity financing decisions and its distribution of profits to shareholders.

- Payment of dividends: Cash payments made to shareholders as dividends to distribute a portion of the company’s profits are considered cash outflows in the financing activities section. Dividend payments provide a return on investment to the company’s shareholders and reflect management’s decision to distribute earnings.

The financing activities section helps stakeholders understand a company’s approach to capital structure, including its reliance on debt or equity financing. It also provides insights into the company’s commitment to returning value to its shareholders through dividend payments.

By analyzing the financing activities section, investors can evaluate the financial health and stability of a company. They can assess the company’s ability to access external sources of capital, manage its debt obligations, and provide returns to its shareholders.

It’s important to note that financing activities are distinct from operating activities and investing activities. Operating activities pertain to the cash flows generated from the company’s core business operations, while investing activities involve cash flows related to long-term asset acquisition or divestment. Financing activities, on the other hand, deal with cash flows related to the company’s external financing activities.

By examining the financing activities section alongside the other components of the cash flow statement, stakeholders can gain a comprehensive understanding of a company’s cash flow dynamics and its financial strategies. This information is valuable for assessing a company’s capital structure, financial stability, and the potential risks and rewards associated with its financing decisions.

Operating Activities

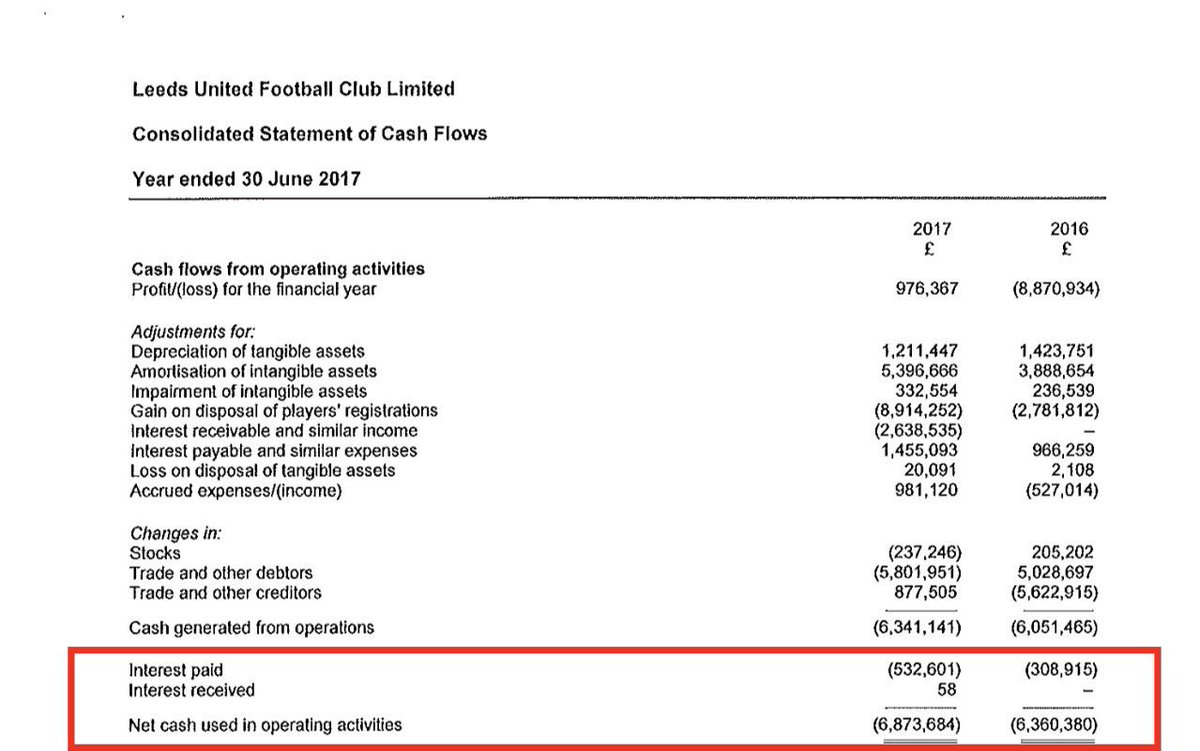

The operating activities section is a critical component of the cash flow statement that provides insights into a company’s cash flows from its core business operations. It focuses on the cash inflows and outflows directly related to the company’s day-to-day operations.

Operating activities include cash flows related to:

- Sales of goods and services: Cash received from customers in exchange for the sale of goods or provision of services is considered a cash inflow in this section. The primary revenue-generating activities of a company are reflected in this category.

- Payments to suppliers and employees: Cash payments made to suppliers for inventory, raw materials, and services, as well as cash payments to employees for salaries and wages, are considered cash outflows in this section. These expenses are essential for the operation of the business.

- Interest and dividend receipts: Cash received as interest on loans or investments, as well as cash received as dividends from other companies, is considered a cash inflow in this section. These receipts are typically earned as a result of the company’s financial holdings.

- Income tax payments: Cash payments made to settle income tax liabilities are considered cash outflows in this section. This category reflects the company’s tax obligations and the impact on its cash flow.

The operating activities section provides valuable insights into a company’s ability to generate cash from its core operations. It helps stakeholders evaluate the profitability, efficiency, and sustainability of the company’s business model.

By analyzing the operating activities section, investors can assess the company’s ability to generate consistent cash flows over time and cover its day-to-day expenses. It also allows for the identification of any cash flow issues or trends that may impact the company’s financial performance.

It’s important to note that operating activities are distinct from investing activities and financing activities, which focus on longer-term transactions and external sources of funds. Operating activities represent the ongoing cash flows directly tied to the company’s primary business operations.

By examining the operating activities section alongside the other components of the cash flow statement, stakeholders can gain a comprehensive understanding of the company’s cash flow dynamics, profitability, and operational efficiency. This information helps investors assess the company’s financial health, cash flow sustainability, and ability to generate value from its core operations.

Treatment of Dividends on Cash Flow Statement

Dividends are a significant aspect of a company’s financial activities. However, the treatment of dividends on a cash flow statement differs based on the classification of dividends and the reporting framework followed by the company. Let’s explore the two common methods of dividend presentation on the cash flow statement:

-

Direct method: Under the direct method, dividends paid to shareholders are classified as cash outflows in the financing activities section of the cash flow statement. This approach provides a clear and transparent representation of cash flows related to dividends. It highlights the company’s distribution of profits to shareholders and its impact on cash flow. The direct method is more intuitive for users of financial statements, as it directly shows the actual cash flows related to dividends.

-

Indirect method: The indirect method of disclosing dividends on the cash flow statement involves adjustments to net income. Dividends paid to shareholders are added back to the net income figure in the operating activities section. This adjustment aims to remove the non-cash component of dividend payments from the net income calculation. While the indirect method is accepted under accounting standards, it does not provide a straightforward representation of cash flows related to dividends. Users of financial statements need to make additional calculations to ascertain the actual cash flow impact of dividends.

It’s important to note that the treatment of dividends on the cash flow statement may vary based on the reporting framework used by the company and the requirements of relevant accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Therefore, it is essential to refer to the specific financial statements and disclosures of a company to determine the exact treatment of dividends.

Regarding the decision of dividend payment impacting the cash flow statement, it is worth mentioning that dividends themselves do not directly affect the operating cash flow of a company. This is because dividends are typically paid from the company’s retained earnings, which are part of the financing activities section. However, the decision to pay dividends can indirectly impact a company’s cash flow by reducing the available cash for other purposes, such as reinvestment in the business or debt repayment.

It is important for investors and stakeholders to understand the treatment of dividends on the cash flow statement to obtain a comprehensive view of a company’s financial activities and its cash flow dynamics. By considering the specific methodology employed by a company and the classification of dividends, users of financial statements can accurately assess the impact of dividends on a company’s cash flow position.

Classification of Dividends

Dividends can be classified into different categories based on various factors, including the nature of the payment and the purpose behind the distribution. Understanding the classification of dividends is important for analyzing a company’s financial health and its approach to shareholder returns. Let’s explore some common classifications of dividends:

-

Cash Dividends: The most common type of dividend is cash dividends, where a company distributes a portion of its profits to shareholders in the form of cash payments. Cash dividends are typically declared and paid on a regular basis, such as quarterly or annually, and they represent a direct return on investment for shareholders.

-

Stock Dividends: In some cases, instead of distributing cash, a company may issue additional shares of stock to its shareholders as a dividend. These stock dividends provide shareholders with additional ownership in the company but do not result in an immediate cash payment. They are usually distributed as a percentage of existing shares owned by shareholders.

-

Property Dividends: Property dividends involve the distribution of assets other than cash or stock to shareholders. This can include tangible assets such as inventory, equipment, or real estate. Property dividends are less common compared to cash dividends or stock dividends and are typically associated with specific industries or situations.

-

Scrip Dividends: Scrip dividends allow shareholders to choose between receiving dividends in the form of additional shares or in cash. This gives investors the flexibility to decide their preferred method of receiving the dividend payout. Scrip dividends are often used by companies to manage their cash flow and provide options to shareholders.

It’s essential to note that the classification of dividends may vary depending on the reporting framework and regulatory requirements in different countries. Companies may also have their own specific dividend policies and practices that dictate the classification and distribution of dividends.

Understanding the classification of dividends provides insights into a company’s approach to shareholder returns and its overall financial strategy. Cash dividends are the most common and straightforward form of dividend, while stock dividends and property dividends may be employed in specific situations. Scrip dividends offer flexibility to shareholders in choosing the form of the dividend.

By considering the classification of dividends, investors can evaluate a company’s dividend policy, assess the impact of dividend distributions on the company’s cash flow and financial position, and make informed decisions regarding their investment in the company.

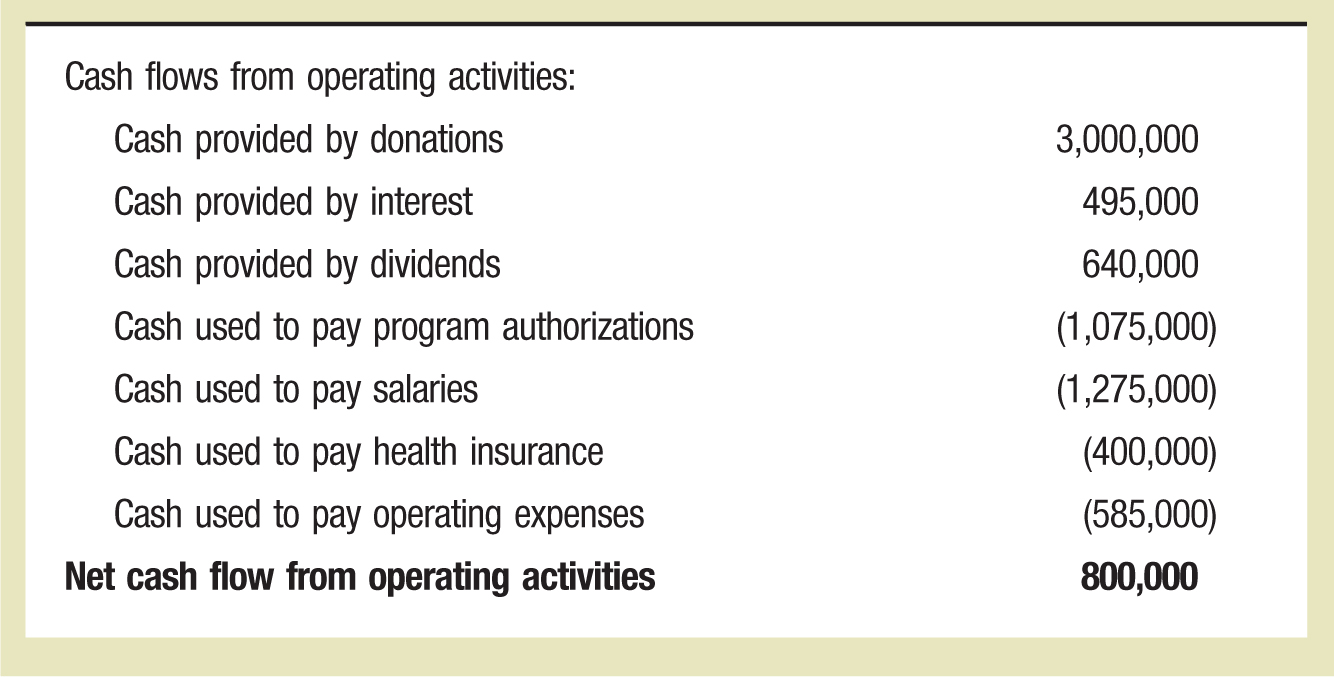

Example of Dividends on Cash Flow Statement

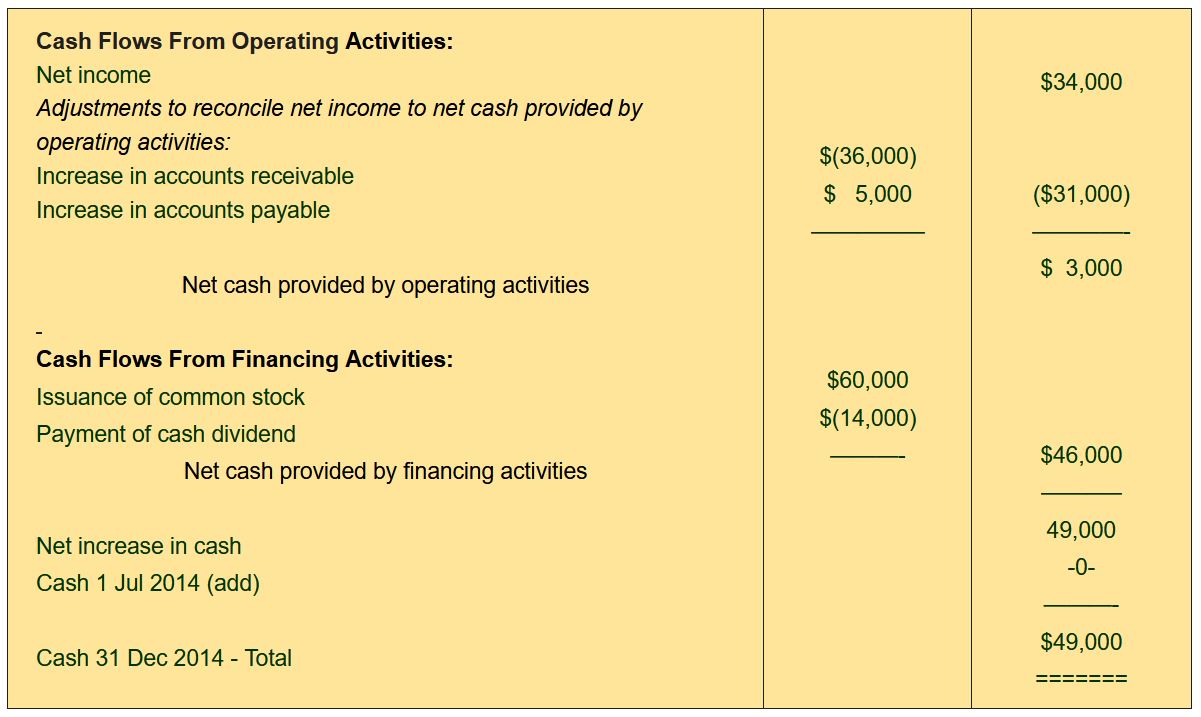

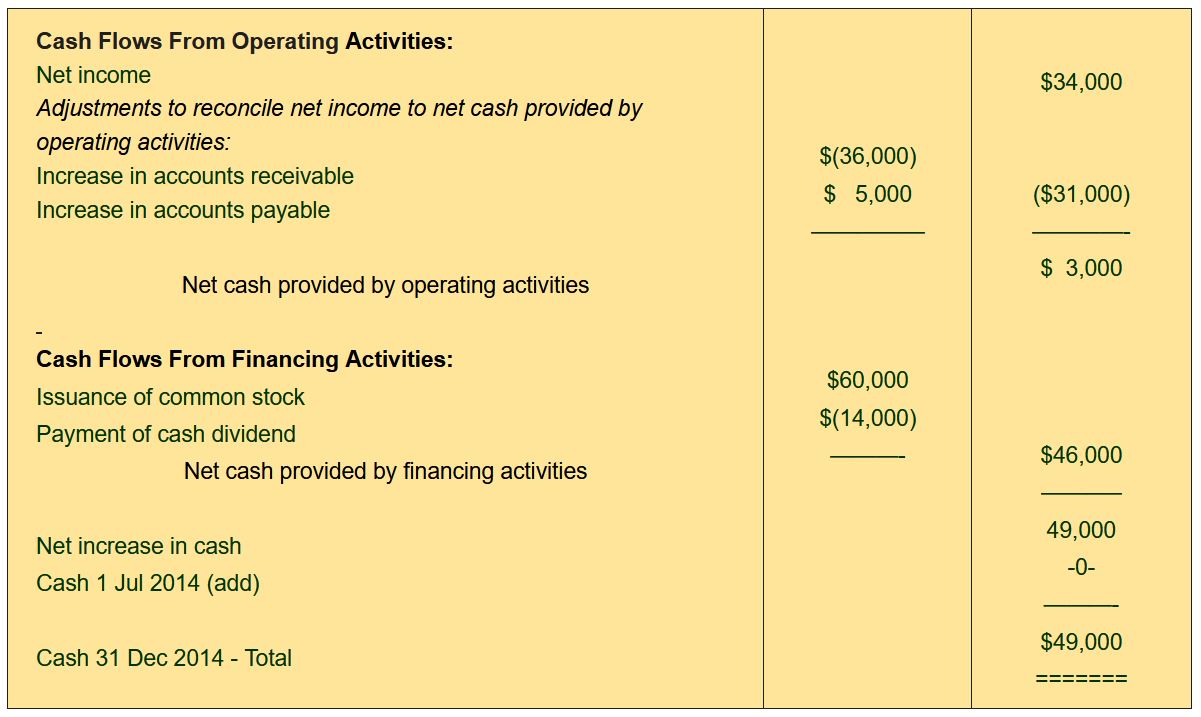

To illustrate how dividends are reflected on a cash flow statement, let’s examine a hypothetical example of a company called ABC Corporation. In this example, ABC Corporation has the following financial information for a specific period:

- Net income: $500,000

- Depreciation expense: $100,000

- Accounts receivable decrease: $50,000

- Accounts payable increase: $25,000

- Dividends paid to shareholders: $75,000

Using this information, let’s analyze how dividends are treated on the cash flow statement:

-

Operating Activities: On the cash flow statement, ABC Corporation will start with net income, which is $500,000. However, since depreciation is a non-cash expense, it will be added back to the net income. The decrease in accounts receivable will be added, and the increase in accounts payable will be subtracted. This adjustment will provide the company’s cash flow from operating activities. Suppose the net adjustments result in a net increase in cash of $75,000 from operating activities.

-

Investing Activities: The example doesn’t provide any specific information related to investing activities, so we assume there are no cash flows in this section.

-

Financing Activities: Here, we consider the dividends paid by ABC Corporation to its shareholders. Since dividends are cash outflows, the amount of dividends paid, $75,000, will be reported in the financing activities section as a negative cash flow.

When we combine the cash flow from operating activities and the cash flow from financing activities, the total change in cash for the period will be $75,000 (from operating activities) minus $75,000 (dividends paid) equals zero. This means that ABC Corporation did not experience any net change in cash for the period.

In summary, on the cash flow statement, dividends paid to shareholders are reported as cash outflows in the financing activities section. They are presented separately from other cash flow activities to provide transparency and highlight the impact of dividend distributions on a company’s cash flow position.

This example demonstrates how dividends are treated on a cash flow statement and how they contribute to the overall financial picture of a company.

Limitations of Cash Flow Statement in Reflecting Dividends

While the cash flow statement provides valuable insights into a company’s cash inflows and outflows, it has certain limitations when it comes to reflecting dividends. It’s essential to understand these limitations when analyzing a company’s financial health and dividend distribution. Here are some key limitations of the cash flow statement in reflecting dividends:

-

Timing of cash flows: The cash flow statement reports cash flows when they occur, not necessarily when they are earned or incurred. This means that dividends declared in one period may be paid in a subsequent period. Therefore, the cash flow statement might not accurately reflect the timing of dividend payments, which can impact the interpretation of a company’s dividend distribution policy.

-

Dividend accruals: The cash flow statement focuses on cash transactions rather than accruals. As a result, it may not capture the accrual of dividends declared but not yet paid. The cash flow statement only reflects the actual cash outflow once the dividend payment has been made, which may not align with the period in which the dividends were declared.

-

Non-cash dividends: The cash flow statement primarily deals with cash flows, so it may not fully capture non-cash dividends. Non-cash dividends, such as stock dividends or property dividends, do not involve a direct cash outflow but still impact the ownership interests or asset allocation of the shareholders. The cash flow statement may not provide a comprehensive view of these non-cash dividend distributions.

-

Dividend reinvestment: Companies may offer dividend reinvestment plans, allowing shareholders to reinvest dividends back into the company by purchasing additional shares. This reinvestment of dividends does not result in a cash outflow and isn’t reflected in the cash flow statement. Therefore, the cash flow statement may not fully capture the impact of dividend reinvestment programs on a company’s cash flow dynamics.

-

Dividend payment source: The cash flow statement doesn’t specify the source of funds for dividend payments. Dividends can be paid from various sources, including current cash flows, retained earnings, or even external financing. Without additional information, the cash flow statement alone may not indicate the extent to which a company relies on its cash reserves or external financing to fund dividend payments.

Despite these limitations, the cash flow statement remains a valuable tool in assessing a company’s cash flow position and financial performance. However, complementing the analysis with other financial statements and disclosures can provide a more comprehensive understanding of a company’s dividend policy, timing of dividend payments, and the impact of dividends on its overall financial health.

It’s important for investors and stakeholders to consider these limitations when interpreting a company’s cash flow statement and to review additional information, such as dividend declarations and shareholder communications, to gain a more complete understanding of dividend distributions.

Conclusion

The treatment of dividends on a cash flow statement is an important aspect of financial reporting that provides insights into a company’s cash flow dynamics and dividend distribution practices. Dividends are classified based on their nature, such as cash dividends, stock dividends, property dividends, or scrip dividends. Depending on the reporting framework, dividends are presented either directly as cash outflows in the financing activities section or indirectly as an adjustment to net income in the operating activities section.

While the cash flow statement is a valuable tool for assessing a company’s cash flow position, it has limitations when it comes to reflecting dividends. These limitations include the timing of cash flows, the treatment of dividend accruals, the inclusion of non-cash dividends, and the lack of information on the source of funds for dividend payments. Therefore, investors and stakeholders should consider these limitations and complement their analysis with additional financial statements and disclosures to gain a comprehensive understanding of a company’s dividend policy and its impact on cash flow.

Understanding the treatment of dividends on a cash flow statement is crucial for evaluating a company’s financial health, assessing its ability to generate cash, and making informed investment decisions. By analyzing the cash flow statement alongside other financial indicators, such as profitability, liquidity, and overall financial strategy, investors can gain valuable insights into a company’s dividend distribution practices and its commitment to maximizing shareholder returns.

In conclusion, the cash flow statement provides a snapshot of a company’s cash inflows and outflows, including the treatment of dividends. It allows stakeholders to assess a company’s cash flow dynamics, financial stability, and distribution of profits to shareholders. With a clear understanding of how dividends are reflected on the cash flow statement, investors can make more informed decisions and gain a deeper perspective on a company’s financial performance and dividend-related activities.