Home>Finance>Where Do Dividends Appear On The Financial Statement

Finance

Where Do Dividends Appear On The Financial Statement

Published: January 2, 2024

Learn where dividends appear on the financial statement in our comprehensive guide. Understand the impact of dividends on finance and maximize your investment strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to analyzing a company’s financial health and performance, financial statements play a vital role. These statements provide valuable insights into a company’s revenue, expenses, assets, and liabilities. One crucial aspect of financial statements is the inclusion of dividends, which can impact the overall financial picture of a company.

Dividends are a distribution of a company’s earnings to its shareholders, typically in the form of cash or additional shares. They are often seen as a reward for investors who hold a stake in the company. Understanding where dividends appear on the financial statement is essential for both investors and analysts who want to evaluate the company’s profitability and its commitment to shareholder value.

By examining the financial statements, investors can determine how much cash the company is returning to shareholders and assess its ability to generate consistent profits. Additionally, the information about dividends on the financial statement aids in forecasting future cash flows and making informed investment decisions.

In this article, we will explore where dividends appear on the financial statement and delve into the impact they have on each individual statement. By understanding the placement of dividends within the financial statements, you will develop a clearer picture of a company’s financial activities and gain valuable insights into its financial performance.

The Purpose of Financial Statements

Financial statements are important documents that provide a comprehensive overview of a company’s financial performance and position. They serve several purposes, including:

- Assessing Financial Performance: Financial statements help investors, creditors, and stakeholders evaluate a company’s profitability and growth over a specific period. By analyzing the income statement, for example, stakeholders can assess whether a company is generating consistent revenues and managing its expenses effectively.

- Evaluating Financial Health: Financial statements also aid in assessing a company’s financial health and stability. The balance sheet provides information about a company’s assets, liabilities, and equity, enabling investors and creditors to determine its solvency and ability to meet its financial obligations.

- Making Informed Investment Decisions: Investors rely on financial statements to make informed investment decisions. By reviewing the financials of a company, investors can gain insights into its financial position, growth prospects, and profitability, which can guide their investment choices.

- Comparing Performance: Financial statements allow for performance comparisons between different companies or within the same company over time. By comparing financial ratios or key performance indicators, stakeholders can identify trends, strengths, and weaknesses in the company’s financial performance compared to its peers.

- Fulfilling Regulatory Requirements: Companies are legally obligated to prepare and present accurate financial statements in accordance with accounting standards and regulations. Financial statements ensure transparency and provide stakeholders with reliable information for decision-making.

Overall, financial statements are crucial tools for understanding and analyzing a company’s financial performance, liquidity, and overall financial health. They enable investors, creditors, and stakeholders to make well-informed decisions, assess risk, and evaluate the company’s ability to generate sustainable profits and shareholder value.

What are Dividends?

Dividends are a distribution of a company’s profits or earnings to its shareholders, typically in the form of cash or additional shares. They are one of the key ways in which a company shares its financial success with its owners, the shareholders. Dividends are usually declared by the board of directors and paid out periodically, such as quarterly, semi-annually, or annually.

The primary purpose of dividends is to reward the shareholders for their investment in the company. When a company generates profits, it has the option to reinvest those profits back into the business for growth and expansion or distribute a portion of them as dividends. Dividends can be seen as a way for the company to provide a return on investment to its shareholders.

Dividends can take two main forms:

- Cash Dividends: Cash dividends are the most common type of dividend. These are direct payments made to shareholders in the form of cash, typically based on the number of shares they own. The amount of cash dividend is usually declared as a fixed amount per share, such as $0.25 per share, or as a percentage of the stock’s par value.

- Stock Dividends: Stock dividends, also known as bonus shares or scrip dividends, are dividends paid out in the form of additional shares rather than cash. In this case, shareholders receive additional shares in proportion to their existing holdings. For example, if a company declares a 10% stock dividend, shareholders will receive 10 additional shares for every 100 shares they already own.

It’s important to note that not all companies pay dividends. Some companies, especially those in the growth phase or in industries requiring significant reinvestment, may choose to retain all their earnings for reinvestment in the business. In such cases, the potential for capital appreciation through an increase in the stock price becomes the primary way for shareholders to benefit from their investment.

Understanding dividends is crucial for investors as they provide a regular income stream and can affect the overall return on investment. Dividends can also be an indicator of a company’s financial health and stability. Analyzing the dividend history and payout ratio can provide insights into a company’s profitability and its commitment to returning value to shareholders.

How Do Dividends Affect Financial Statements?

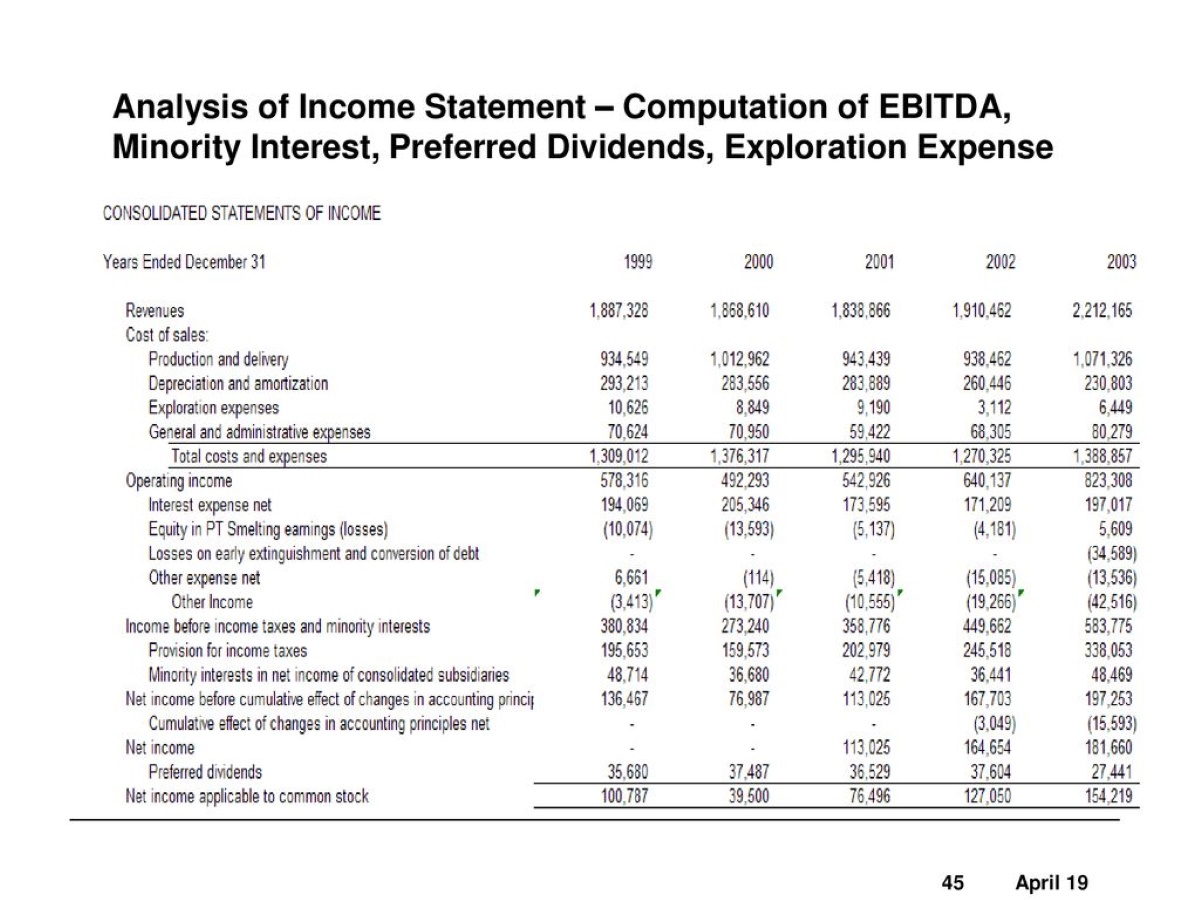

Dividends have a direct impact on a company’s financial statements, specifically the income statement, statement of retained earnings, and balance sheet. Let’s explore how dividends affect each of these financial statements:

Income Statement:

Dividends do not directly appear on the income statement. While they are a distribution of profits, they are not considered an expense. Instead, they are accounted for after net income, as they reduce the retained earnings of the company. As a result, dividends do not affect the company’s operating income or net profit.

Statement of Retained Earnings:

The statement of retained earnings is directly impacted by dividends. Retained earnings represent the accumulated profits that the company has kept rather than distributed to shareholders. When dividends are declared and paid, they are subtracted from the retained earnings. This reduction in retained earnings is reported on the statement of retained earnings, indicating the amount of dividends paid to shareholders.

Balance Sheet:

Dividends also affect the balance sheet in two ways. First, they reduce the amount of retained earnings, which is reported under the equity section of the balance sheet. This reduction in retained earnings reflects the distribution of profits to shareholders.

Second, when dividends are paid out in cash, the company’s cash balance is decreased on the asset side of the balance sheet. This reduction in cash is offset by a corresponding decrease in shareholders’ equity in the form of retained earnings, maintaining the balance sheet equation of assets equaling liabilities plus equity.

It’s important to note that the impact of dividends on financial statements depends on the accounting period in which they are declared and paid. For example, if dividends are declared in the current period but paid in the subsequent period, they will only impact the statement of retained earnings in the current period and the balance sheet in the subsequent period when the payment is made.

In summary, dividends affect the financial statements by reducing the retained earnings on the statement of retained earnings and decreasing the cash balance on the balance sheet. Understanding the impact of dividends on financial statements is crucial for investors and analysts in assessing a company’s financial performance and distributing returns to shareholders.

Dividends on the Income Statement

Dividends do not have a direct impact on the income statement. The income statement is a financial statement that shows a company’s revenues, expenses, and net income over a specific period. Dividends, being a distribution of profits to shareholders, are not considered as expenses and therefore, do not affect the calculation of net income.

The income statement starts with the company’s revenues, which are the inflows of economic benefits generated from the sale of goods or services. From the revenues, the expenses are deducted to calculate the company’s operating profit or loss. These expenses include costs related to the production of goods or services, selling and administrative expenses, and other operating expenses.

After deducting all the relevant expenses, the income statement arrives at the company’s net income or net profit. Net income represents the company’s earnings after all expenses have been accounted for. Dividends, however, are not considered an expense because they are a distribution of profits to shareholders, rather than a cost of doing business.

While dividends do not appear on the income statement, they indirectly impact the statement. When dividends are paid out, they reduce the retained earnings of the company. Retained earnings are reported on the statement of retained earnings, which is a separate financial statement that shows the changes in retained earnings over a specific period.

It’s important to note that the amount of dividends paid out by a company may be disclosed in the footnotes or supplementary information accompanying the financial statements, but they are not included in the calculation of net income on the income statement.

Overall, dividends do not have a direct impact on the income statement as they are not considered as expenses. The income statement focuses on a company’s revenues, expenses, and net income, while the distribution of profits to shareholders through dividends is reflected in the statement of retained earnings.

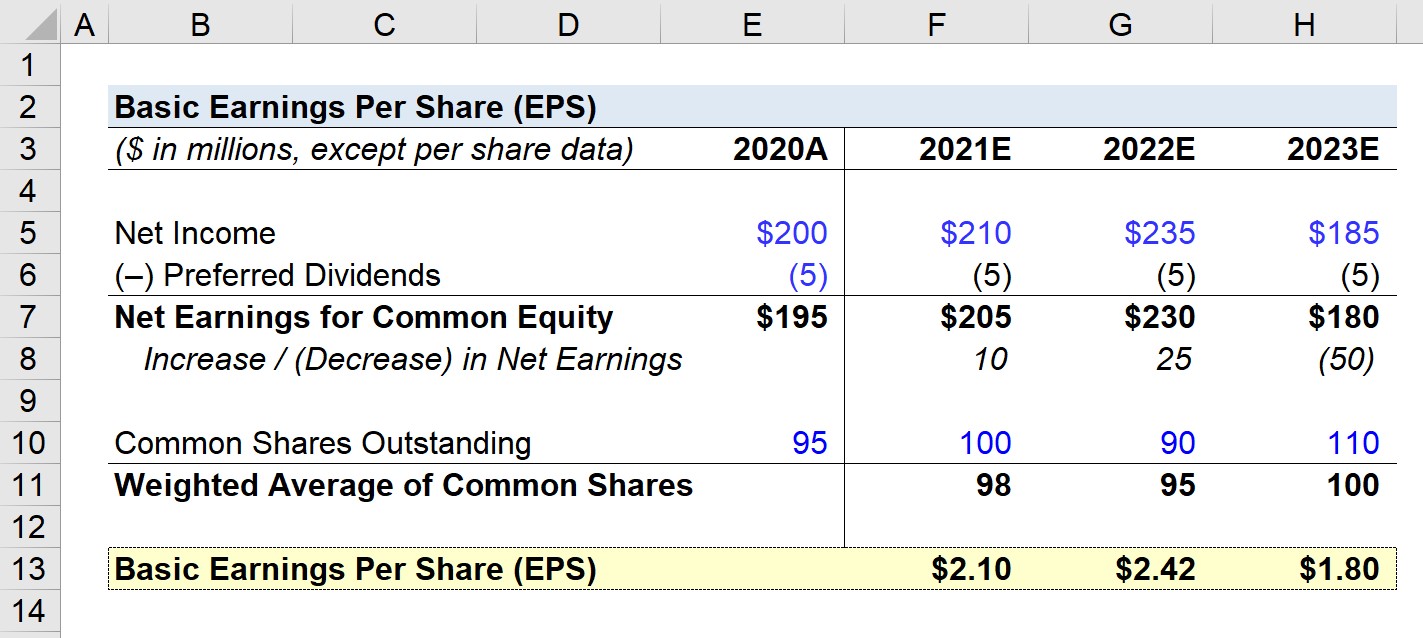

Dividends on the Statement of Retained Earnings

The statement of retained earnings is a financial statement that shows the changes in a company’s retained earnings over a specific period. Retained earnings represent the accumulated profits that the company has kept rather than distributed to shareholders in the form of dividends. The statement of retained earnings provides insights into how a company’s earnings have been retained or distributed to shareholders.

Dividends have a direct impact on the statement of retained earnings. When dividends are declared and paid to shareholders, they are subtracted from the company’s retained earnings. This reduction in retained earnings reflects the distribution of profits to shareholders.

The statement of retained earnings starts with the beginning balance of retained earnings at the beginning of the period. This balance represents the accumulated profits from previous years that have not been distributed as dividends. From the beginning balance, any adjustments such as prior period corrections or accounting changes are made.

Next, the net income for the period is added to the beginning balance. Net income represents the company’s earnings after deducting all expenses from its revenues. It contributes to the growth of retained earnings. The net income is often derived from the income statement.

Once the net income is added, any dividends declared and paid during the period are subtracted. Dividends reduce the retained earnings because they represent a distribution of profits to shareholders. The amount of dividends paid is listed as a separate line item, typically under the “Dividends” or “Distribution of Earnings” category.

Finally, the ending balance of retained earnings is calculated by adding the net income and subtracting the dividends from the beginning balance. The ending balance represents the accumulated profits that the company has retained at the end of the period, which will serve as the beginning balance for the subsequent period.

The statement of retained earnings thus provides a summary of the changes in retained earnings during the period, incorporating the impact of net income and dividends. It helps stakeholders understand how the company’s profits have been retained or distributed to shareholders and provides insights into the company’s dividend policy and commitment to returning value to investors.

In summary, dividends have a direct impact on the statement of retained earnings by reducing the accumulated profits that have not been distributed to shareholders. This statement provides a comprehensive view of a company’s retained earnings and reflects the distribution of profits through dividends.

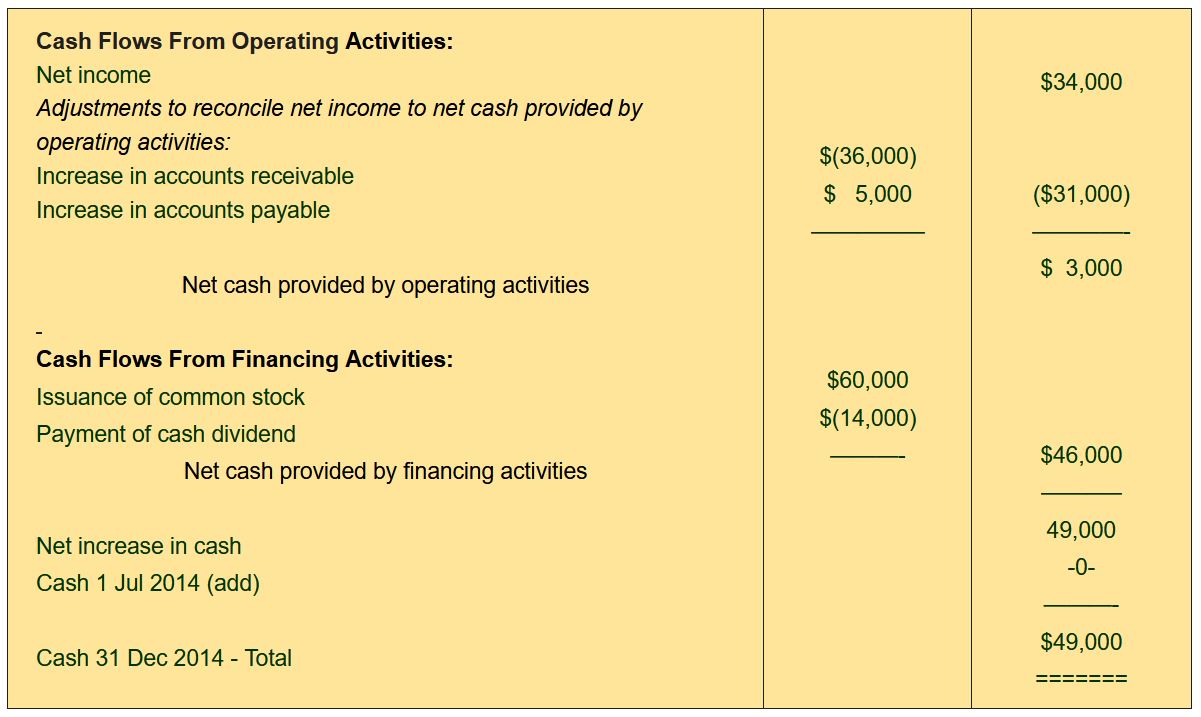

Dividends on the Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It consists of assets, liabilities, and shareholders’ equity. Dividends, as a distribution of profits to shareholders, have an impact on both the equity and asset sections of the balance sheet.

On the equity side of the balance sheet, dividends affect the retained earnings component. Retained earnings represent the accumulated profits that the company has retained rather than distributed as dividends. When dividends are declared and paid, they reduce the retained earnings. This reduction in retained earnings is reported under the equity section of the balance sheet, reflecting the distribution of profits to shareholders.

For example, if a company has accumulated retained earnings of $500,000 and declares and pays $50,000 in dividends, the balance sheet will show retained earnings of $450,000. The reduction in retained earnings represents the amount of profits that have been distributed to shareholders in the form of dividends.

On the asset side of the balance sheet, dividends also impact the cash balance. When dividends are paid out, the company’s cash balance is reduced. This reduction in cash is reflected as a decrease in the asset section of the balance sheet, maintaining the balance sheet equation of assets equaling liabilities plus equity.

For example, if a company has a cash balance of $200,000 and pays $50,000 in dividends, the balance sheet would show a reduced cash balance of $150,000. This decrease in cash represents the outflow of funds to shareholders in the form of dividends.

It’s important to note that the impact of dividends on the balance sheet depends on the accounting period in which they are declared and paid. If dividends are declared in the current period but paid in the subsequent period, the liability for dividends payable will be recorded on the balance sheet until the payment is made. Once the dividends are paid, the liability is reduced, and the cash balance is subsequently reduced as discussed above.

Overall, dividends affect the balance sheet by reducing the retained earnings on the equity side and decreasing the cash balance on the asset side. Understanding the impact of dividends on the balance sheet helps stakeholders assess a company’s financial health, its commitment to shareholder value, and the allocation of profits to various stakeholders.

Conclusion

Dividends play a significant role in a company’s financial statements and overall financial performance. Understanding where dividends appear on the financial statement helps investors and analysts assess a company’s profitability and its commitment to returning value to shareholders.

While dividends do not have a direct impact on the income statement, they affect the statement of retained earnings and the balance sheet. The statement of retained earnings reflects the reduction in retained earnings when dividends are declared and paid, providing insights into the distribution of profits to shareholders. On the balance sheet, dividends reduce the retained earnings under equity and decrease the cash balance, reflecting the outflow of funds to shareholders.

Financial statements are crucial tools for evaluating a company’s financial health, stability, and performance. By analyzing the impact of dividends on these statements, investors can assess a company’s ability to generate sustainable profits, its commitment to shareholder value, and its overall financial position.

It’s important to note that not all companies pay dividends, as some may choose to reinvest their profits back into the business for growth and expansion. For investors seeking regular income, dividends can provide a steady income stream, while for others, the potential for capital appreciation becomes the primary driver of returns.

In conclusion, dividends are an integral part of a company’s financial statements, reflecting the distribution of profits to shareholders. By understanding where dividends appear on the financial statement, investors and analysts can gain valuable insights into a company’s financial activities, profitability, and commitment to shareholder value.