Home>Finance>Where Do Dividends Go On The Cash Flow Statement

Finance

Where Do Dividends Go On The Cash Flow Statement

Modified: January 5, 2024

Discover the importance of dividends on the cash flow statement in finance. Find out where dividends are recorded and how they impact a company's financials.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a cash flow statement?

- The structure of a cash flow statement

- Understanding dividends

- Different types of dividends

- Where does the payment of dividends appear on the cash flow statement?

- Operating Activities section

- Investing Activities section

- Financing Activities section

- Dividends as a cash outflow

- Impact of dividends on cash flow

- Conclusion

Introduction

Welcome to the world of finance, where understanding how money flows is of utmost importance. In the realm of financial statements, the cash flow statement plays a critical role in providing insights into the movement of cash within a business. It serves as a valuable tool for investors, creditors, and other stakeholders to assess the financial health and performance of a company.

One integral aspect of a company’s financial activities is the payment of dividends to its shareholders. Dividends represent a portion of a company’s profits that are distributed to its shareholders as a reward for their investment. But where exactly do dividends show up on the cash flow statement?

In this article, we will explore the structure and purpose of a cash flow statement and delve into the specific section where dividends are accounted for. We will also discuss the different types of dividends and their impact on the overall cash flow of a company.

By understanding how dividends are presented on the cash flow statement, investors and financial analysts can gain deeper insights into a company’s dividend distribution policy and its effects on cash flow management.

What is a cash flow statement?

A cash flow statement is a financial statement that provides a detailed breakdown of how cash is generated and used by a company during a specific period of time. It presents a comprehensive view of a company’s cash inflows and outflows, allowing stakeholders to evaluate the liquidity and financial stability of the business.

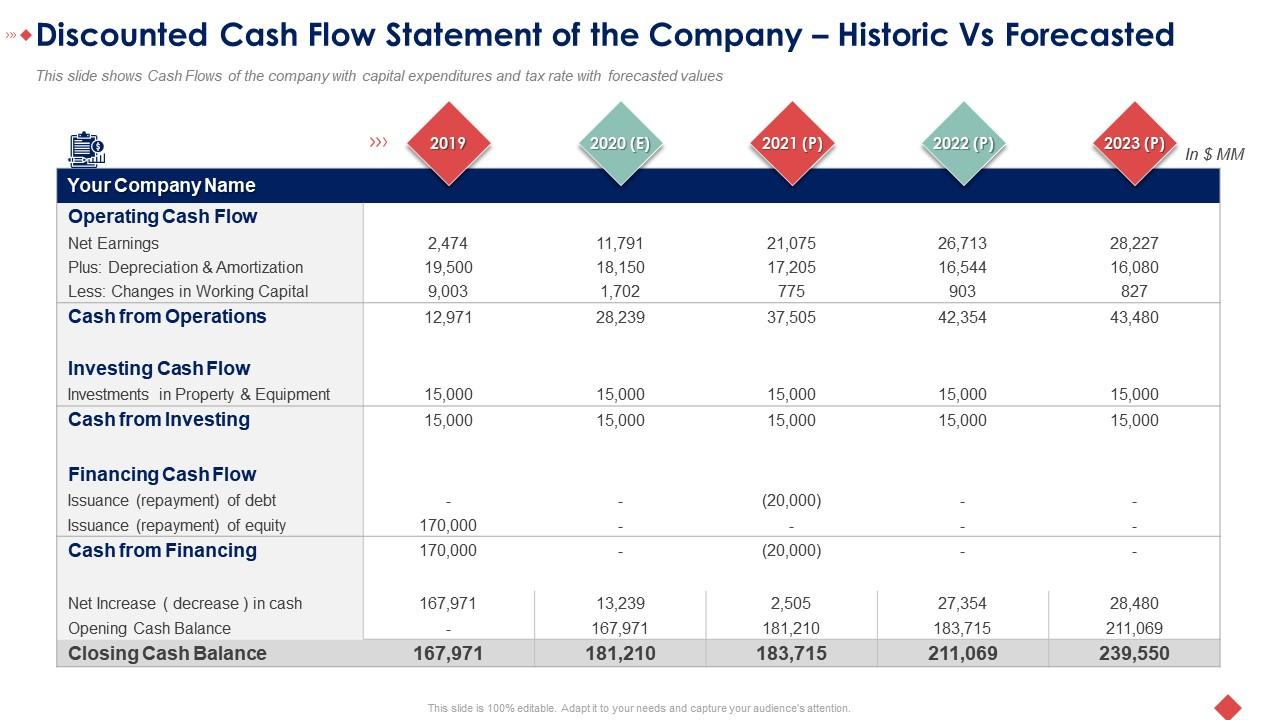

The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities. Each section highlights different sources and uses of cash, providing a holistic picture of the company’s cash flow.

The primary purpose of a cash flow statement is to track the movement of cash, which includes not only the actual currency but also cash equivalents such as short-term investments with high liquidity. By analyzing the cash flow statement, investors can gain insights into how effectively a company generates and manages its cash resources.

Unlike the income statement, which focuses on revenues and expenses, the cash flow statement focuses solely on cash flows. While profitability is essential, a company can face liquidity and financial difficulties if it fails to manage its cash effectively. Therefore, the cash flow statement provides a crucial measure of a company’s ability to meet its financial obligations, invest in growth opportunities, and distribute cash to shareholders.

Furthermore, the cash flow statement acts as a bridge between the balance sheet and the income statement. It reconciles the net income figure from the income statement with the actual cash flows generated by the company. By comparing the net income with the cash provided by operating activities, stakeholders can evaluate the quality of a company’s earnings and the extent to which they are backed by actual cash.

In summary, a cash flow statement is a vital financial statement that provides valuable insights into a company’s cash flow activities. It allows stakeholders to understand how cash is generated and utilized, providing a comprehensive view of a company’s financial health and management of cash resources.

The structure of a cash flow statement

A cash flow statement is typically divided into three main sections: operating activities, investing activities, and financing activities. Each section focuses on a specific aspect of a company’s cash flow and provides information about the sources and uses of cash.

1. Operating Activities: This section reflects cash flows from the company’s core operations, including the buying and selling of goods and services. It includes cash received from customers, cash paid to suppliers and employees, and other operating expenses such as utilities and taxes. Cash flows from operating activities are considered a key indicator of the company’s ability to generate sustainable cash flows from its day-to-day operations.

2. Investing Activities: This section highlights cash flows related to the acquisition or sale of long-term assets, such as property, plant, and equipment, as well as investments in other companies. Examples of cash flows from investing activities include cash spent on purchasing new equipment or buildings and cash received from the sale of assets or investments. This section provides insights into the company’s investment decisions and its potential for future growth or divestment.

3. Financing Activities: This section focuses on cash flows related to the company’s capital structure and financing activities. It includes cash received from issuing stocks or bonds, cash paid as dividends to shareholders, and cash used for repurchasing company shares. Additionally, it includes cash flows related to borrowing or repaying loans. The financing activities section provides insights into the company’s capital raising activities and its distributions to shareholders.

Within each section, cash flows are categorized as either cash inflows or cash outflows. Cash inflows represent increases in cash, while cash outflows represent decreases in cash. The net cash flow for each section is then calculated by subtracting the cash outflows from the cash inflows. Finally, the net cash flows from all three sections are summed to determine the overall change in cash during the reporting period.

It is important to note that the cash flow statement provides information on actual cash flows, rather than accounting-based accruals. This distinction is crucial as it provides a clearer understanding of the company’s liquidity and ability to generate and manage cash.

By analyzing the structure of a cash flow statement, stakeholders can gain a comprehensive view of how a company generates and uses cash across its operations, investments, and financing activities. This information is vital for evaluating a company’s financial health, profitability, and its ability to fund future growth initiatives.

Understanding dividends

Dividends are a form of payment made by a company to its shareholders as a distribution of profits. They are typically declared by the company’s board of directors and can be paid out in the form of cash, additional shares of stock, or other assets.

Dividends serve as a mechanism for companies to share their financial success with shareholders. By distributing a portion of their profits, companies reward shareholders for their ownership and provide them with a direct return on their investment. Dividends can enhance the attractiveness of owning shares in a company, especially for income-focused investors.

Dividends can vary in frequency and amount. Some companies pay dividends on a regular basis, usually quarterly, while others may choose to distribute dividends annually or irregularly. The amount of the dividend payment is determined by the company’s dividend policy and is influenced by various factors, such as profitability, cash flow, and investment opportunities.

It’s important to note that not all companies pay dividends. Some younger or high-growth companies may choose to reinvest their profits back into the business to fund expansion or research and development activities. These companies may prefer to allocate their resources towards future growth opportunities rather than distributing cash to shareholders.

Dividends play a significant role in attracting and retaining investors. They can provide a steady income stream for investors seeking regular cash flow. Dividend payments are especially important for income-oriented investors, such as retirees or those who rely on investment income to meet their financial needs.

When evaluating dividends, investors often look at two key metrics: the dividend yield and the dividend payout ratio. The dividend yield measures the annual dividend payment relative to the share price, while the dividend payout ratio represents the proportion of earnings paid out as dividends. These metrics can help investors assess the sustainability and attractiveness of a company’s dividend policy.

Overall, dividends are an important component of a company’s financial activities. They allow companies to share their profits with shareholders and provide investors with a stream of income. Understanding dividends and their impact on a company’s cash flow is crucial for investors to make informed investment decisions and assess the financial health of a company.

Different types of dividends

When it comes to dividends, there are several different types that companies may choose to distribute to their shareholders. These types of dividends can vary based on various factors, including the company’s financial position, tax regulations, and the preferences of its shareholders. Let’s explore some of the common types of dividends:

- Cash dividends: Cash dividends are the most common type of dividend. These dividends are paid out to shareholders in the form of cash from the company’s profits. Cash dividends provide shareholders with immediate access to the company’s earnings and can be used for personal expenses or reinvested in other investments.

- Stock dividends: Instead of cash, some companies may choose to pay dividends in the form of additional shares of stock. Stock dividends increase the number of shares shareholders own but do not typically result in an immediate increase in overall wealth. However, they can provide an opportunity for shareholders to accumulate more shares and benefit from potential future price appreciation.

- Scrip dividends: Scrip dividends, also known as dividend reinvestment plans (DRIPs), offer shareholders the option to receive additional shares of stock instead of cash dividends. These additional shares are typically issued at a discount to the current market price. Scrip dividends allow shareholders to automatically reinvest their dividends and potentially benefit from compounded returns over time.

- Property dividends: In some cases, companies may distribute dividends in the form of assets, such as property or securities of other companies. Property dividends are less common compared to cash dividends and are typically used when a company wants to divest a non-core asset or has unique opportunities to distribute specific assets to its shareholders.

- Special dividends: Special dividends are one-time or irregular dividend payments that are not part of the company’s regular dividend policy. These dividends are often paid when a company experiences a significant increase in profitability, sells a valuable asset, or receives a large cash windfall. Special dividends are intended to distribute excess cash to shareholders and can be a pleasant surprise for investors.

It’s important to note that not all companies pay dividends, and the types of dividends distributed can vary significantly between companies. The choice of dividend type depends on various factors, such as the company’s financial position, strategic objectives, and the preferences of its shareholders.

Before investing in a company, it’s crucial to understand the types of dividends it offers, as well as its dividend policy. This knowledge allows investors to align their investment goals with the company’s distribution strategy and make informed decisions about dividend income and potential capital appreciation.

Where does the payment of dividends appear on the cash flow statement?

When a company pays dividends to its shareholders, the associated cash flows are reflected in the cash flow statement. The specific section where dividends appear depends on the nature of the dividend payment and the classification system used by the company. Let’s explore the different sections of the cash flow statement where dividend payments may be accounted for:

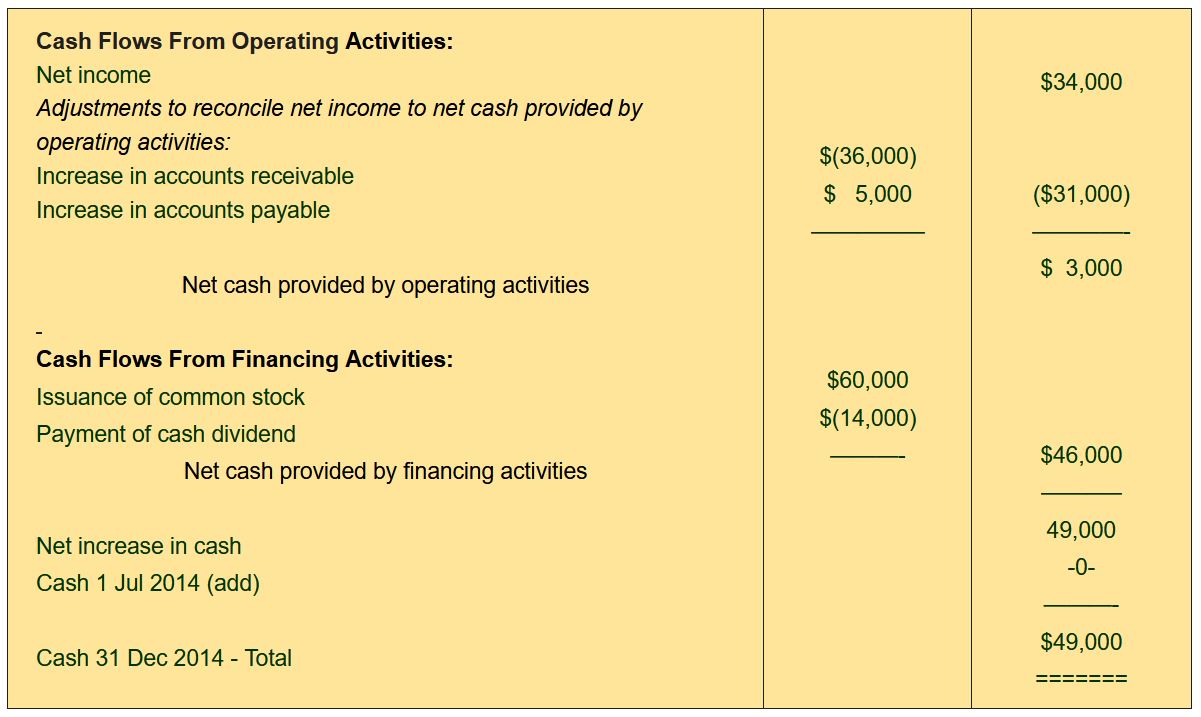

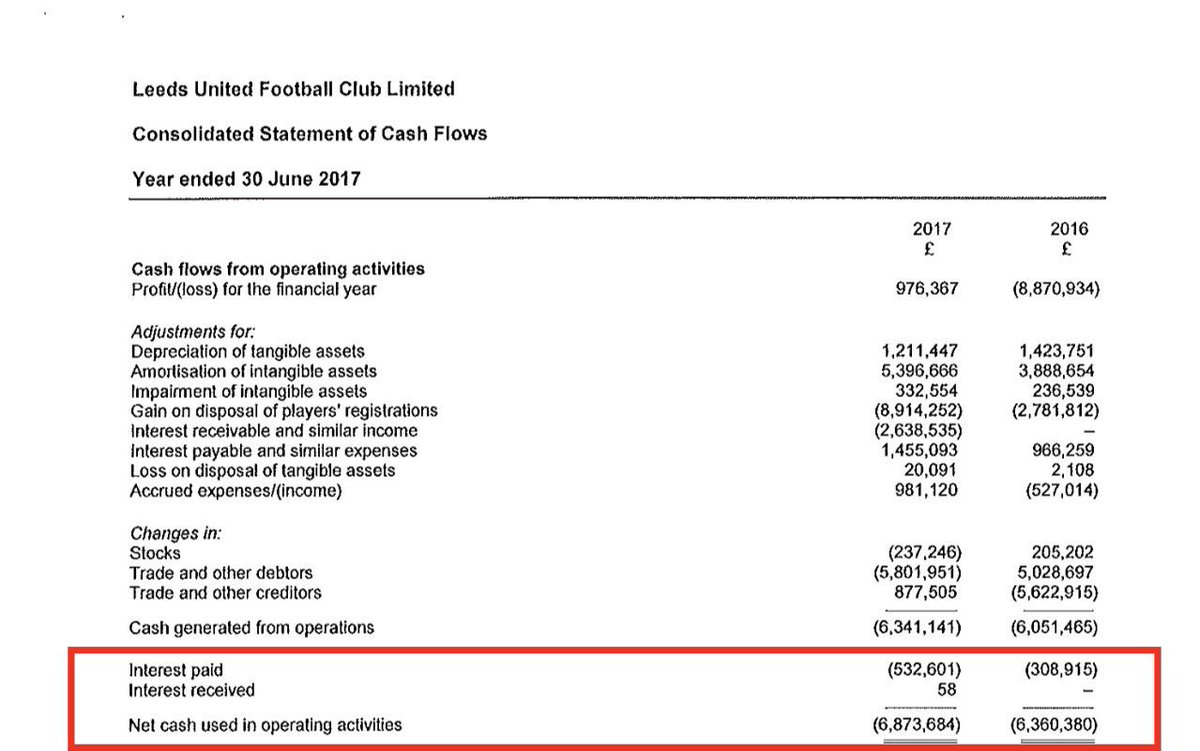

Operating Activities section: In most cases, dividends paid to shareholders are classified as a cash outflow from financing activities rather than operating activities. However, there may be instances where dividend payments are directly related to the company’s core operations. For example, if a company operates in the financial sector or manages investment portfolios, dividend payments received from investments may be categorized as operating activities.

Investing Activities section: Dividend payments made to shareholders do not typically appear in the investing activities section of the cash flow statement. This section focuses on cash flows related to the acquisition or sale of long-term assets, investments, or other investment-related activities. Dividend payments are considered a distribution of profits rather than investment activities and are therefore not included in this section.

Financing Activities section: The payment of dividends is primarily recorded in the financing activities section of the cash flow statement. This section captures cash flows related to the company’s capital structure, such as issuing or repurchasing stock, taking on or repaying debt, and distributing cash dividends to shareholders. Dividend payments represent a cash outflow from financing activities as they involve distributing profits to shareholders.

Within the financing activities section, dividend payments are usually reported as a separate line item under “Dividends Paid” or a similar category. This line item is subtracted from the total cash flow to determine the net cash flow from financing activities. The inclusion of dividend payments in this section allows stakeholders to assess the company’s dividend distribution policy and its impact on its cash reserves.

It’s worth noting that the classification and presentation of dividend payments on the cash flow statement may slightly vary between companies. Companies are required to adhere to specific accounting standards when preparing their financial statements, which may influence the specific presentation and disclosure of dividend payments.

By examining the cash flow statement’s financing activities section, investors and stakeholders can gain insights into how a company manages its cash resources and its commitment to distributing profits to shareholders through dividends.

Operating Activities section

The operating activities section of the cash flow statement is a crucial component that reflects the cash flows generated from a company’s core operations. It provides valuable insights into how effectively a company manages its working capital and generates cash from its day-to-day activities. While dividends paid to shareholders are not typically classified as operating activities, there are instances where dividend payments may be directly related to the company’s core operations.

In certain industries, such as financial services or investment management, dividend payments received from investments may be considered operating cash flows. This is because the primary business activity of these companies involves managing investment portfolios, and the dividend income received forms a significant part of their revenue stream. In such cases, dividend payments received would be classified as cash inflows from operating activities.

However, for most companies in other industries, dividend payments made to shareholders are not directly connected to their core operations and are therefore not categorized as operating cash flows. Instead, they are recorded as cash outflows from financing activities, as dividends represent a distribution of profits to shareholders.

The operating activities section of the cash flow statement primarily includes cash flows related to the following:

- Cash received from the sales of goods or provision of services to customers

- Cash payments to suppliers and vendors for purchases of goods and services

- Cash payments to employees for wages, benefits, and other compensation

- Cash payments for taxes, utilities, rent, and other operating expenses

- Cash interest received or paid related to operating activities

- Changes in working capital items such as accounts receivable, accounts payable, and inventory

These cash flows represent the day-to-day financial activities of the company, showcasing how it generates and uses cash to sustain its operations. The operating activities section provides a valuable measure of a company’s ability to generate consistent and sustainable cash flows from its core business activities.

While dividend payments made to shareholders may not fall under the operating activities section, understanding the operating cash flow generated by a company is crucial for assessing its financial health and stability. Positive operating cash flow indicates that a company’s core operations are generating sufficient cash to cover its expenses, repay debts, invest in growth, and potentially distribute dividends to shareholders.

By analyzing the operating activities section of the cash flow statement in conjunction with other financial statements, investors and stakeholders can evaluate a company’s ability to generate cash, measure profitability, manage working capital, and identify potential risks or opportunities within its core operations.

Investing Activities section

The investing activities section of the cash flow statement focuses on the cash flows related to a company’s investments in long-term assets and other investment activities. This section provides insights into the company’s capital expenditures, acquisitions, and divestments. While dividend payments made to shareholders are not classified as investing activities, dividend income received from investments may be included in this section.

The investing activities section captures cash flows related to the following:

- Capital expenditures: Cash outflows for the purchase or improvement of long-term assets, such as property, plant, and equipment. This includes investments in infrastructure, facilities, machinery, and technology.

- Proceeds from the sale of assets: Cash inflows from the sale or disposal of long-term assets, including property, plant, and equipment, as well as investments in other companies.

- Investments in marketable securities: Cash outflows for the purchase of marketable securities, such as stocks or bonds, held for investment purposes.

- Proceeds from the sale of marketable securities: Cash inflows from the sale of marketable securities.

- Acquisitions and mergers: Cash outflows for the acquisition of other companies or interests in other businesses.

It’s important to note that while dividend payments made by a company are typically classified as cash flows from financing activities, any dividend income received from investments in other companies may be included in the investing activities section. This is because dividend income received from investments can be considered a return on investment and is therefore related to the company’s investing activities.

The primary purpose of the investing activities section is to provide stakeholders with insights into how a company is deploying its capital to support growth, acquire new assets, or invest in other businesses. By analyzing the cash flows in this section, investors can determine whether a company is pursuing strategic investments and effectively managing its capital allocation.

The investing activities section plays a vital role in assessing a company’s long-term sustainability and growth potential. Positive cash flow from investing activities indicates that the company is making prudent investment decisions and potentially expanding its operations, while negative cash flow may indicate divestment or a conservative approach to investment.

By analyzing the investing activities section of the cash flow statement in conjunction with other financial statements, investors and stakeholders can gain insights into a company’s investment strategy, its commitment to growth, and the potential impact of those investments on its future cash flows and profitability.

Financing Activities section

The financing activities section of the cash flow statement focuses on cash flows related to a company’s capital structure and financial activities. This section provides insights into how a company raises and distributes cash to investors and creditors. Dividend payments made to shareholders are typically categorized as cash outflows within the financing activities section.

The financing activities section captures cash flows related to the following:

- Issuance of equity: Cash inflows from the issuance of common stock or preferred stock.

- Repurchase of equity: Cash outflows for the repurchase of the company’s own shares.

- Issuance of debt: Cash inflows from the issuance of bonds, loans, or other debt securities.

- Repayment of debt: Cash outflows for the repayment of principal amounts owed to creditors.

- Dividends paid: Cash outflows for the distribution of profits to shareholders in the form of dividends.

Dividend payments made to shareholders represent a cash outflow from financing activities since they involve distributing profits to the owners of the company. The cash outflows for dividends paid are often reported as a separate line item under “Dividends Paid” or similar categories within the financing activities section.

The financing activities section provides valuable insights into how a company manages its capital structure, raises funds, and distributes cash to its investors. Positive cash flow from financing activities may indicate that the company is effectively raising capital and generating returns for shareholders.

Investors and stakeholders can analyze the financing activities section to assess a company’s financial health, its ability to meet its debt obligations, and its commitment to shareholders. A company with healthy cash flows from financing activities may be seen as more capable of honoring its financial obligations and rewarding its shareholders with dividends.

This section also highlights the capital decisions made by the company, such as issuing or repurchasing shares and taking on or repaying debt. Analyzing the financing activities section in conjunction with other financial statements can provide meaningful insights into a company’s financial strategy, its approach to capital management, and its ability to maintain a sustainable dividend policy.

By understanding the financing activities section of the cash flow statement, investors can gain a comprehensive view of how a company raises and uses capital, the impact of dividend payments on the company’s cash flows, and the overall financial strength of the business.

Dividends as a cash outflow

Dividends represent a significant cash outflow for a company as they involve the distribution of profits to shareholders. When a company declares and pays dividends, it has an immediate impact on its cash flow. Dividends are typically classified as a cash outflow within the financing activities section of the cash flow statement.

As a cash outflow, dividend payments reduce the company’s available cash resources. The payment of dividends represents a commitment to shareholders, rewarding them for their investment in the company. Dividend payments can take the form of cash, additional shares of stock, or other assets.

Companies that have a consistent history of paying dividends tend to prioritize providing returns to shareholders. Dividend payments are often determined based on various factors, including the company’s profitability, cash flow position, and dividend policy. The decision to pay dividends reflects not only the company’s financial performance but also its commitment to shareholders and its belief in the sustainability of its profits.

Dividends as a cash outflow can impact a company’s overall financial position and its ability to invest in growth initiatives or meet other financial obligations. Companies must strike a balance between rewarding shareholders with dividends and retaining enough cash to fund capital expenditures, repay debt, and support future expansion.

Dividend payments are closely monitored by investors and financial analysts. They serve as an indicator of a company’s financial health and its ability to generate consistent cash flow. Stable or increasing dividend payments can be seen as a positive sign, reflecting the company’s profitability and potential for generating future returns. On the other hand, a decrease or elimination of dividends may be viewed as a cause for concern, signaling potential financial difficulties or a shift in the company’s priorities.

It’s worth noting that not all companies pay dividends. Some companies, especially in the early stages of growth or high-growth industries, may choose to reinvest their profits back into the business to fund expansion or research and development activities. These companies prioritize reinvestment to drive future growth rather than distributing cash to shareholders.

In summary, dividends represent a cash outflow as they involve the distribution of profits to shareholders. Dividend payments impact a company’s cash flow position and are reflected in the financing activities section of the cash flow statement. Analyzing dividend payments provides insights into a company’s financial performance, commitment to shareholders, and its ability to balance rewarding investors with maintaining a healthy financial position.

Impact of dividends on cash flow

Dividends have a direct impact on a company’s cash flow, as they represent a cash outflow from the company’s available funds. When a company pays dividends to its shareholders, it reduces its cash reserves and affects its overall cash position. Understanding the impact of dividends on cash flow is crucial for evaluating a company’s financial health and cash management.

The payment of dividends reduces the amount of cash that a company has available for other purposes such as reinvestment, debt repayment, or funding new projects. Dividends are typically funded from a company’s retained earnings, which are the accumulated profits that have not been paid out as dividends or reinvested back into the business.

Dividend payments can affect a company’s cash flow in several ways:

- Cash outflow: Dividend payments represent a direct cash outflow from the company’s cash reserves. This reduces the amount of cash available for other uses, such as investments or debt reduction.

- Reduced reinvestment: By paying dividends, a company may have less cash available for reinvestment back into the business. This can impact the company’s ability to fund new projects, expand operations, or invest in research and development.

- Impact on financing decisions: Dividend payments can influence a company’s financing decisions. For example, if a company pays out a significant amount of its earnings as dividends, it may need to rely on external financing sources, such as issuing debt or equity, to fund its growth or capital expenditures.

- Perception of financial health: Dividends can affect how investors and stakeholders perceive a company’s financial health. Regular, consistent, and increasing dividend payments can signal a stable and profitable company, which may attract investors seeking reliable income streams. On the other hand, a decrease or elimination of dividends may lead to concerns about the company’s financial position or growth prospects.

The impact of dividends on cash flow depends on various factors, including the company’s dividend policy, profitability, cash reserves, and investment opportunities. Companies must strike a balance between rewarding shareholders with dividends and ensuring they have enough cash to meet their financial obligations and pursue growth initiatives.

Investors and financial analysts closely monitor a company’s ability to generate sufficient cash flow to cover dividend payments. If a company consistently pays dividends that exceed its cash flow from operations, it may need to rely on other sources of cash, such as debt or asset sales, to support its dividend payments.

In summary, dividend payments have a direct impact on a company’s cash flow by reducing its available cash reserves. The decision to pay dividends affects a company’s ability to reinvest, finance growth, and meet other financial obligations. Understanding the impact of dividends on cash flow is essential for evaluating a company’s financial health and its commitment to shareholder returns.

Conclusion

The payment of dividends and its appearance on the cash flow statement play a vital role in understanding the financial health and management of a company. Dividends represent a distribution of profits to shareholders and have a direct impact on a company’s cash flow. While dividend payments are typically classified as a cash outflow within the financing activities section of the cash flow statement, it’s important to note that dividends received from investments may be categorized differently based on the company’s operations and industry.

By analyzing the cash flow statement, investors and stakeholders can gain valuable insights into how a company generates and uses cash. The cash flow statement offers a comprehensive view of cash flows from operating, investing, and financing activities. Understanding the distinct sections of the cash flow statement, investors can evaluate a company’s ability to generate sustainable cash flows from its core operations, make strategic investments, and manage its capital structure effectively.

Dividend payments influence a company’s cash reserves and impact its financial flexibility. Companies need to strike a balance between rewarding shareholders with dividends and retaining sufficient cash for growth initiatives, debt management, and other financial obligations. Regular and increasing dividend payments signal a company’s financial strength and commitment to shareholders, while fluctuations or decreases may raise concerns about the company’s financial stability.

Ultimately, the cash flow statement provides valuable insights into a company’s dividend distribution policy, its financial strength, and management of cash resources. By analyzing the cash flow statement in conjunction with other financial statements, investors can make informed decisions about investing, assess the company’s financial health, and gain a deeper understanding of how dividends contribute to the overall cash flow dynamics of a business.

In summary, understanding where dividends appear on the cash flow statement and the impact they have on a company’s cash flow is crucial for evaluating a company’s financial performance, its commitment to shareholders, and its ability to manage its cash resources effectively.