Home>Finance>Where To Find Capital Expenditures On Cash Flow Statement

Finance

Where To Find Capital Expenditures On Cash Flow Statement

Published: December 20, 2023

Looking for capital expenditures on a cash flow statement? Find out where to locate finance-related information and optimize your financial strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Capital Expenditures

- Importance of Capital Expenditures on Cash Flow Statement

- Analyzing Cash Flow Statement for Capital Expenditures

- Sources of Capital Expenditures on Cash Flow Statement

- Operating Activities

- Investing Activities

- Financing Activities

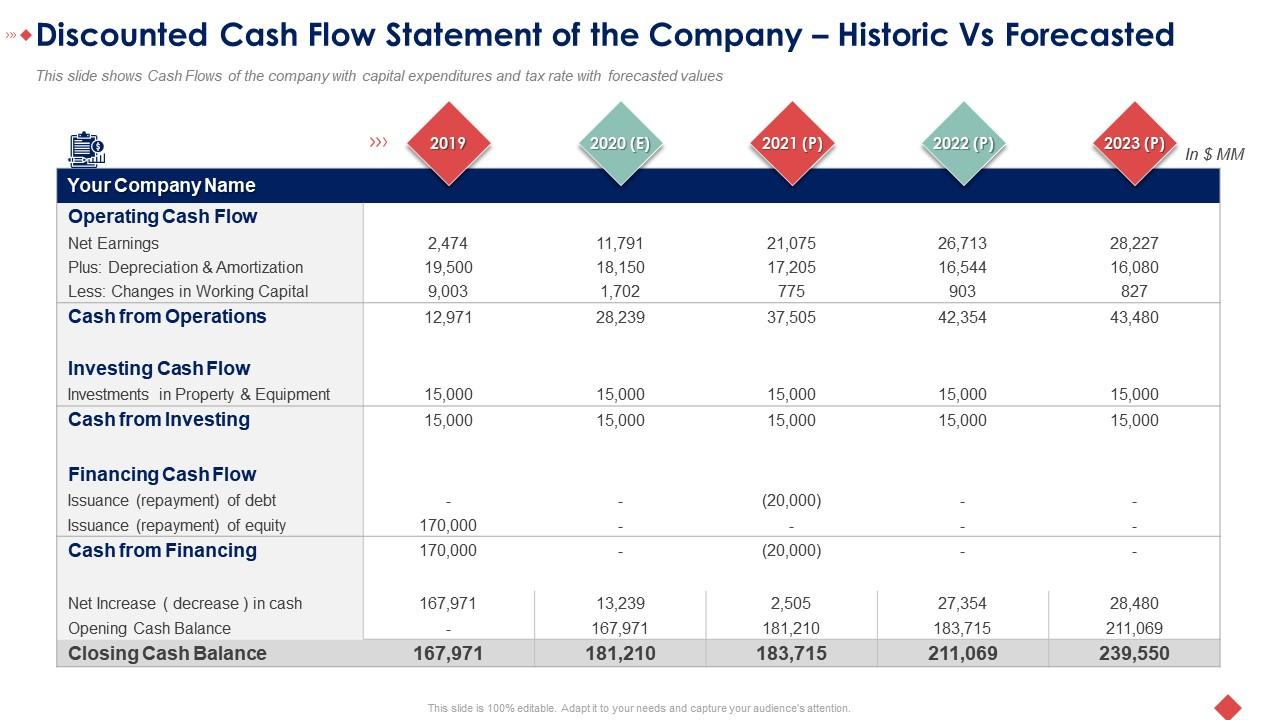

- Examples of Capital Expenditures on Cash Flow Statement

- Conclusion

Introduction

Managing cash flow is a critical aspect of financial management for any business. It involves monitoring and tracking the movement of money into and out of a company to ensure its financial stability and growth. One of the key financial statements that helps in analyzing the cash flow of a business is the Cash Flow Statement.

The Cash Flow Statement provides a comprehensive view of a company’s cash inflows and outflows from operating, investing, and financing activities. It reveals how a business generates and utilizes its cash resources over a specific period of time.

Within the Cash Flow Statement, a particular area of interest for investors and financial analysts is the capital expenditures section. Capital expenditures represent the cash outflows related to long-term assets or investments made by a business. They are crucial for the growth and expansion of a company, as they involve significant cash outlays for acquiring or upgrading assets such as property, plant, and equipment (PP&E).

In this article, we will explore the importance of capital expenditures on the cash flow statement and identify the sources and examples of capital expenditures in different business activities.

Definition of Capital Expenditures

Capital expenditures, often abbreviated as CapEx, refer to the expenses incurred by a company to acquire, upgrade, or maintain long-term assets that are essential for its operations. These assets can include physical assets like buildings, machinery, and vehicles, as well as intangible assets like patents and copyrights.

Capital expenditures are distinguished from revenue expenditures, which are expenses incurred in the day-to-day operations of a business and are typically consumed within the current accounting period. In contrast, capital expenditures are expected to provide benefits to the company over multiple accounting periods.

There are several characteristics that define a capital expenditure:

- Long-term Nature: Capital expenditures are investments in assets that provide value to a business over an extended period of time, typically beyond one year.

- Asset Acquisition or Improvement: Capital expenditures are made for the purchase or enhancement of assets, whether tangible or intangible, that are expected to contribute to the company’s growth and generate future cash flows.

- Significant Cost: Capital expenditures involve substantial cash outflows as they often require considerable investments in resources, infrastructure, or technology.

- Non-recurring: Capital expenditures are not part of regular operational expenses and are usually incurred on a one-time or infrequent basis.

It is important to accurately identify and classify capital expenditures on the cash flow statement to provide a clear picture of a company’s investment in its infrastructure and future growth opportunities.

Importance of Capital Expenditures on Cash Flow Statement

The inclusion of capital expenditures on the cash flow statement is crucial for several reasons. It provides valuable insights into a company’s financial health and future growth prospects. Here are some key reasons why capital expenditures are important on the cash flow statement:

- Measurement of Investment in Long-term Assets: Capital expenditures reflect the amount of money a company invests in acquiring or improving long-term assets. By tracking these expenses on the cash flow statement, investors and analysts can assess the company’s commitment to long-term growth and its ability to maintain and enhance competitive advantage.

- Analysis of Cash Flow Patterns: Monitoring capital expenditures over time allows stakeholders to identify patterns in a company’s cash outflows. It helps to evaluate the timing and scale of investments, which can provide insights into the company’s strategic decisions, growth plans, and risk management strategies.

- Assessment of Capital Allocation: The cash flow statement offers visibility into how a company allocates its financial resources. By examining the capital expenditures section, investors can evaluate management’s prioritization of investments and determine whether the company is directing sufficient funds towards assets that create long-term value.

- Identification of Operational Efficiency: Capital expenditures can indicate the efficiency and effectiveness of a company’s operations. If a company regularly invests in improving or upgrading its assets, it suggests a commitment to optimizing productivity, reducing costs, and enhancing overall operational performance.

- Evaluation of Future Cash Flows: Capital expenditures are investments in assets that are expected to generate future cash inflows. By analyzing these expenses on the cash flow statement, investors can assess the potential return on these investments and estimate the cash flows they are likely to generate in the future.

In summary, capital expenditures play a vital role in understanding a company’s financial position, growth prospects, and strategic priorities. Monitoring and analyzing the capital expenditures section on the cash flow statement helps stakeholders make informed investment decisions, evaluate the company’s ability to fund growth, and assess its long-term sustainability.

Analyzing Cash Flow Statement for Capital Expenditures

When analyzing the cash flow statement for capital expenditures, there are a few key components to consider:

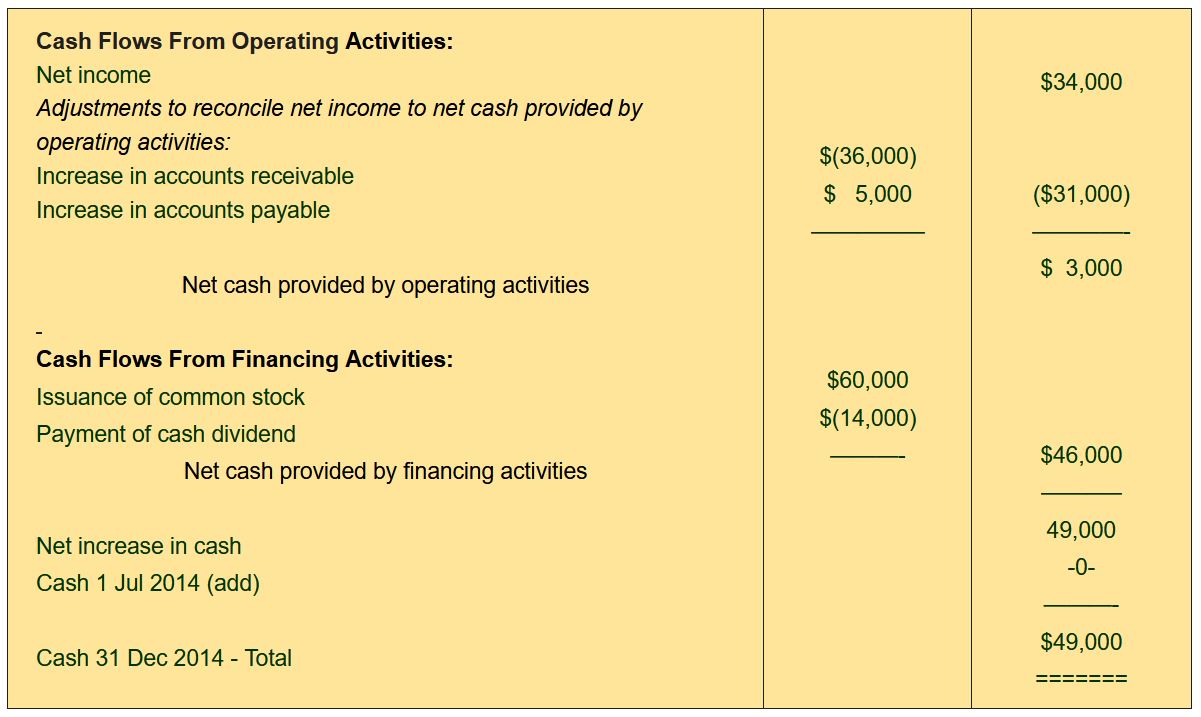

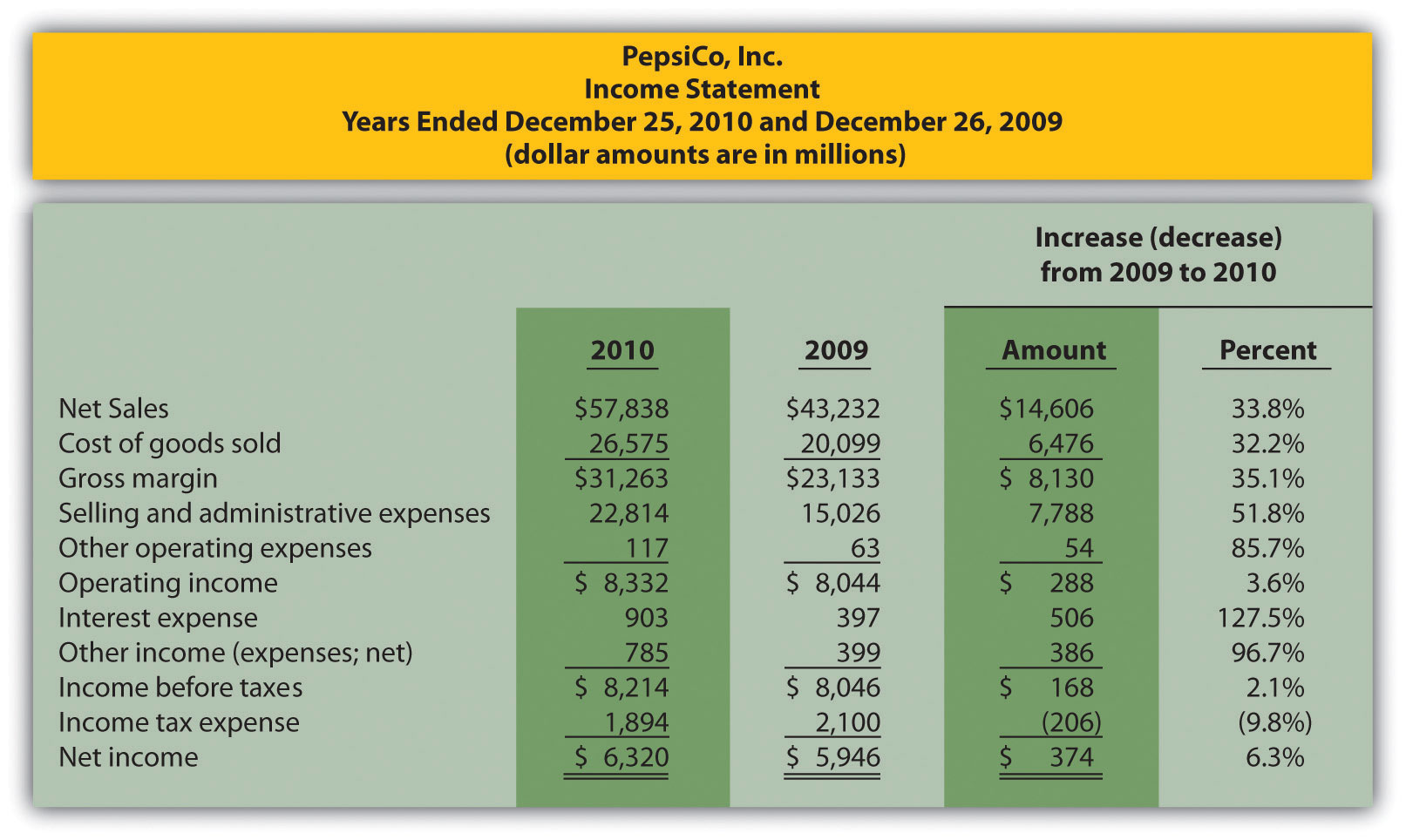

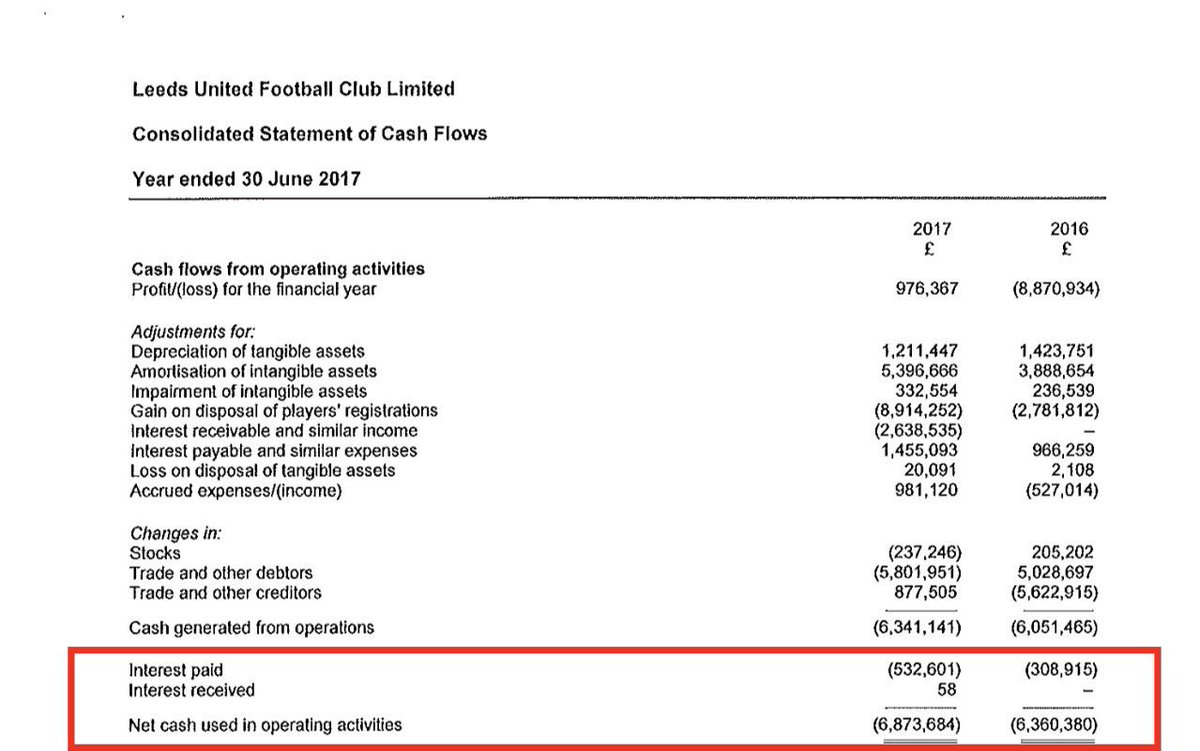

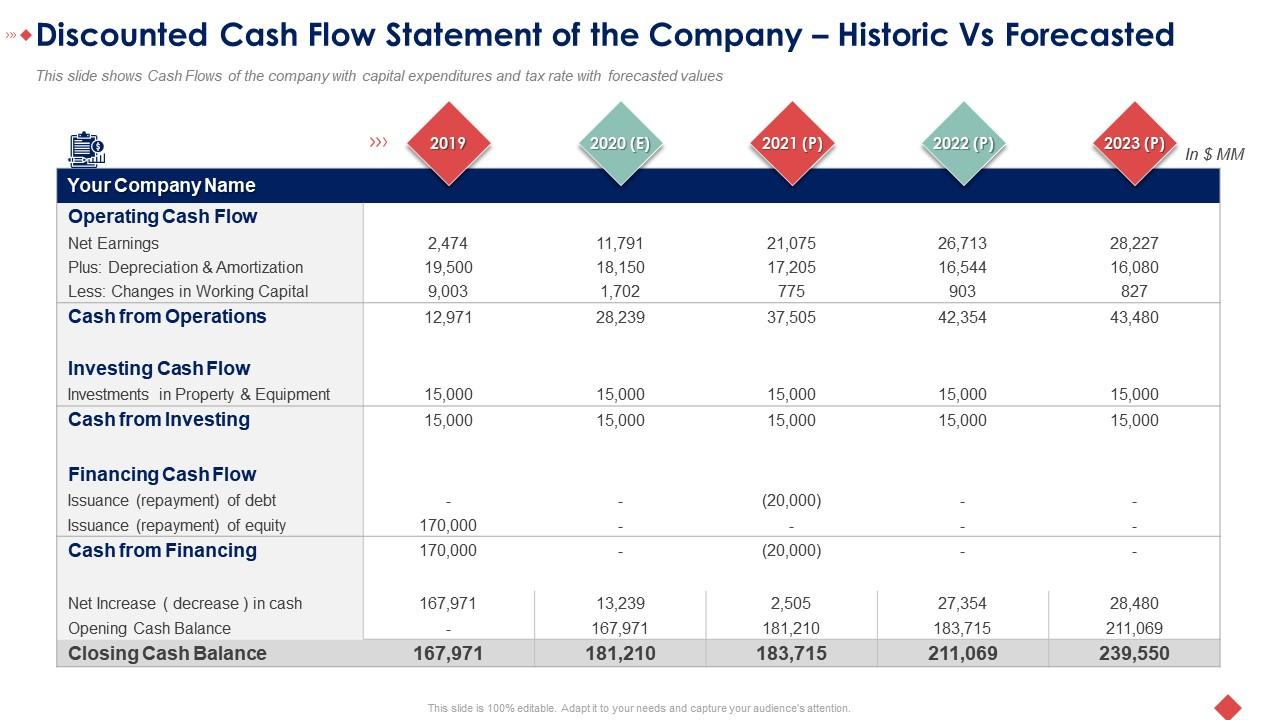

- Net Cash from Operating Activities: The cash flow from operating activities section shows the cash generated or used by a company’s core operations. It includes items such as revenue, expenses, and changes in working capital. Positive net cash from operating activities indicates that the company’s operations are generating sufficient funds to cover its day-to-day expenses, including capital expenditures.

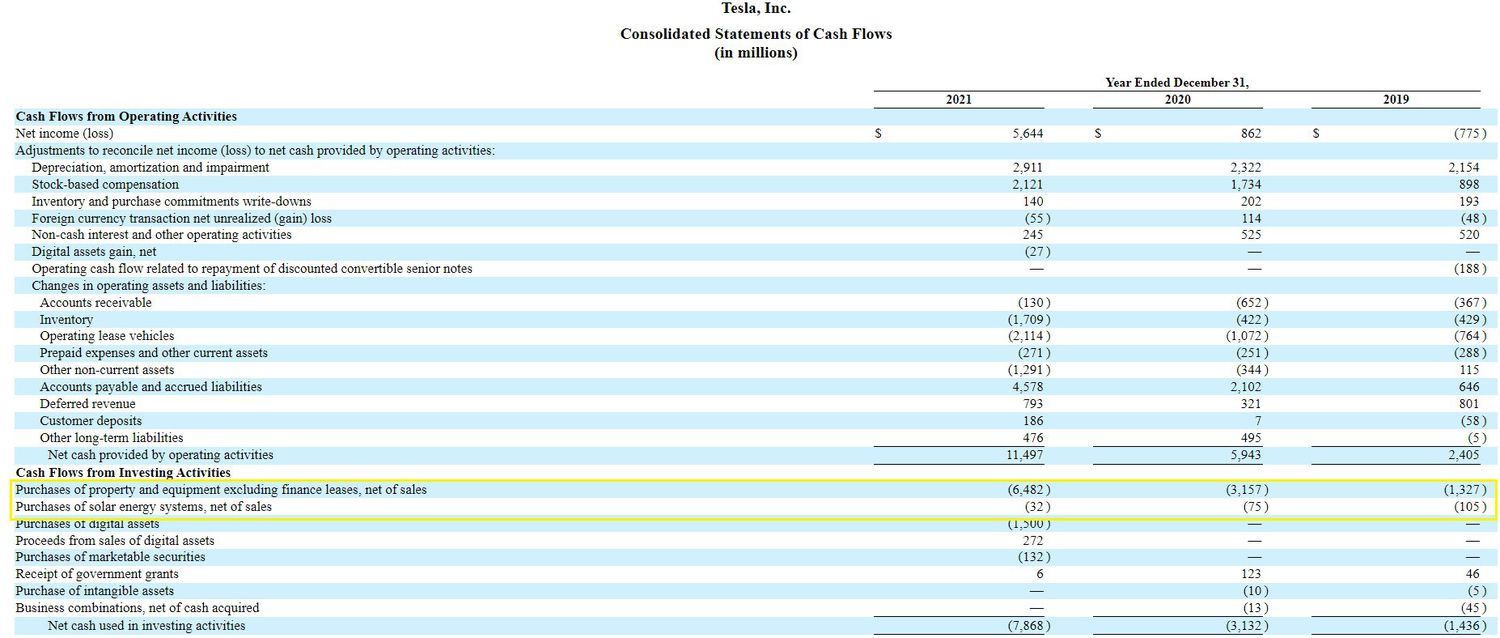

- Net Cash from Investing Activities: The cash flow from investing activities section reports the cash flow related to the buying or selling of assets. Capital expenditures are typically listed as cash outflows in this section, as they involve investing in long-term assets. Analyzing this section allows investors to assess the company’s investment activities and the scale of its capital expenditures.

- Net Cash from Financing Activities: The cash flow from financing activities section represents cash flow resulting from activities related to a company’s financing, such as issuing or repurchasing stocks, borrowing or repaying debt, or paying dividends. Analyzing this section is important as it can provide insights into how a company is funding its capital expenditures. For example, if a company is consistently relying on debt financing to fund capital expenditures, it may signal higher risk and potential future challenges in managing debt obligations.

- Change in Cash Balance: The net change in cash and cash equivalents is calculated by summing the net cash from operating activities, investing activities, and financing activities. This figure represents the overall change in a company’s cash position during the reporting period. A negative change in cash balance may indicate that a company is spending more on capital expenditures than it is generating from its operations, potentially requiring additional financing sources.

By analyzing these sections of the cash flow statement, investors and analysts can gain insights into the company’s ability to generate cash, its investment activities, and the impact of capital expenditures on its overall cash position. It helps to assess the financial stability, growth potential, and long-term sustainability of the business.

Sources of Capital Expenditures on Cash Flow Statement

The cash flow statement provides a breakdown of the sources of capital expenditures, categorizing them into different business activities. Understanding these sources is essential for analyzing how a company funds its long-term asset acquisitions and improvements. The primary sources of capital expenditures on the cash flow statement include:

- Operating Activities: Capital expenditures can be funded through internally generated cash flows from operating activities. This can include profits from ongoing operations, cash received from customers, and other cash inflows generated through day-to-day business activities. However, it is important to note that relying solely on operating activities to finance capital expenditures may be limited in certain cases where the cash generated may not be sufficient.

- Investing Activities: Companies often raise external financing to support capital expenditures through investing activities. This can involve borrowing funds from financial institutions or issuing bonds or shares to raise capital. The cash obtained through these funding sources is then used to acquire or upgrade long-term assets, such as property, equipment, or technology.

- Financing Activities: Companies may also utilize financing activities to fund capital expenditures. This can involve raising funds through issuing equity or debt securities or taking on long-term loans from financial institutions. The cash generated from these financing activities can be directed towards acquiring or maintaining long-term assets.

It is important to note that the proportion of capital expenditures funded through each source may vary depending on the company’s financial situation, industry, growth strategy, and available financing options. Some companies may rely heavily on internally generated cash flows, while others may seek external financing to fund their capital expenditure requirements.

Furthermore, the capital structure of a company, including its debt and equity mix, can impact the availability and cost of funds for capital expenditures. A company with strong cash reserves or access to low-cost financing options might choose to self-finance a larger portion of its capital expenditures, whereas a company with limited internal resources might rely more on external financing.

Overall, the cash flow statement provides transparency into the sources of capital expenditures and gives stakeholders a deeper understanding of how a company funds its long-term asset investments.

Operating Activities

In the context of the cash flow statement, operating activities refer to the cash flows generated or used by a company’s core business operations. Capital expenditures related to operating activities typically involve investments in assets directly tied to the company’s primary operations. These can include the purchase, upgrade, or maintenance of equipment, machinery, buildings, or technology systems.

Operating activities generate cash inflows and outflows that are necessary for the day-to-day functioning of the business. Some key sources and uses of cash in operating activities are:

- Cash Inflows: Cash receipts from sales of goods or services, interest and dividends received, and other income generated by the company’s core operations contribute to the cash inflows from operating activities. These inflows provide the company with the funds required to finance its capital expenditures.

- Cash Outflows: Cash payments for various expenses are considered cash outflows from operating activities. These can include payments for inventory, salaries and wages, rent, utilities, taxes, and other operational costs. Additionally, cash payments for the acquisition or maintenance of long-term assets, which are essential for the business’s operations, are also considered cash outflows under operating activities.

It is important to note that capital expenditures related to operating activities are viewed as investments in the company’s infrastructure or equipment to enhance productivity, efficiency, and competitiveness. These expenditures are directly tied to the core operations and are expected to generate future cash inflows or cost savings.

Analyzing the capital expenditures in the operating activities section of the cash flow statement provides insights into a company’s commitment to maintaining and improving its operational capabilities. It helps investors and analysts assess the company’s ability to sustain and grow its business by investing in assets that contribute to revenue generation and profitability.

Understanding the sources and uses of cash within operating activities allows stakeholders to evaluate the efficiency of the company’s capital expenditure decisions, the effectiveness of its operational processes, and the potential impact on future cash flows.

Investing Activities

Investing activities, as reflected in the cash flow statement, involve the acquisition or disposal of long-term assets that are not directly related to a company’s core operations. Within this section, capital expenditures are categorized as cash outflows, representing the investments made in acquiring or upgrading these assets.

Some key aspects of investing activities related to capital expenditures include:

- Purchase of Long-Term Assets: Investing activities encompass the use of cash to acquire long-term assets, such as property, plant, and equipment (PP&E), as well as investments in other companies or securities. These capital expenditures are aimed at expanding the company’s capabilities, diversifying its business, or earning returns on investment.

- Proceeds from Disposal of Assets: When a company sells or disposes of its long-term assets, the resulting cash inflows are reported in the investing activities section. These proceeds may come from the sale of properties, equipment, or investments. Such inflows can help offset the cash outflows incurred in acquiring new assets.

Examining the investing activities section of the cash flow statement provides insight into a company’s capital expenditure strategy and its willingness to invest in long-term assets. By analyzing this section, investors and analysts can:

- Assess the scale and timing of the company’s capital expenditures. Understanding the cash outflows associated with acquiring or upgrading long-term assets provides insights into the company’s investment plans and growth prospects.

- Evaluate the effectiveness of the company’s capital allocation decisions. By examining the return on investment for the assets acquired, stakeholders can assess the company’s ability to generate future cash flows or create value for shareholders.

- Identify potential risks and opportunities. Changes in the investing activities section can highlight shifts in the company’s strategic focus or potential opportunities for growth or divestment. A significant increase or decrease in capital expenditures may indicate a shift in the company’s expansion plans or its need to divest underperforming assets.

Overall, the investing activities section provides valuable information about a company’s capital expenditure decisions, asset acquisition or disposal, and its long-term investment strategy. Analyzing this section helps stakeholders understand how a company deploys its financial resources to support its growth, diversification, and long-term value creation.

Financing Activities

The financing activities section of the cash flow statement focuses on the sources and uses of cash related to a company’s financing activities, which can include the funding of capital expenditures. This section provides insights into how a company raises capital to support its long-term asset acquisitions or improvements.

Key components of financing activities related to capital expenditures include:

- Issuing Equity: Equity financing involves raising funds by issuing shares of the company’s stock to investors. The cash generated from equity issuance can be used to fund capital expenditures and other long-term investment opportunities. However, it dilutes the ownership stake of existing shareholders.

- Borrowing: Debt financing involves raising funds by borrowing from banks, financial institutions, or issuing bonds or other debt securities. The cash obtained through borrowing can be allocated to finance capital expenditures. However, it comes with the obligation to repay the principal amount along with interest charges.

- Repayment of Debt: The repayment of debt is also categorized under financing activities. When a company makes principal payments on its outstanding debt, it reduces its financial obligations. This allows the company to redirect future cash flows towards capital expenditures or other strategic initiatives.

- Dividends: Cash payments made to shareholders as dividends are considered financing activities. If a company allocates a portion of its cash flow to pay dividends, it may impact the funds available for capital expenditures.

By analyzing the financing activities section of the cash flow statement, investors and analysts can gain insights into how a company funds its capital expenditures and the potential impact on its financial structure. It provides the following benefits:

- Evaluating the company’s reliance on external sources of financing for capital expenditures. A heavy dependence on debt financing may indicate higher financial risk, while a significant equity issuance may signal a shareholder-friendly approach but could dilute ownership.

- Assessing the company’s ability to manage its debt obligations. Monitoring debt repayment activities helps in evaluating the company’s capacity to meet its financial commitments while prioritizing capital expenditures.

- Understanding the impact of dividend payments on capital expenditure funding. If a company prioritizes dividend distributions, it may affect the availability of cash for capital expenditures.

In summary, the financing activities section of the cash flow statement offers valuable insights into how a company raises and manages funds to support its capital expenditures. Analyzing this section helps stakeholders evaluate the company’s financial structure, cash flow management, and its ability to fund long-term asset acquisitions or improvements.

Examples of Capital Expenditures on Cash Flow Statement

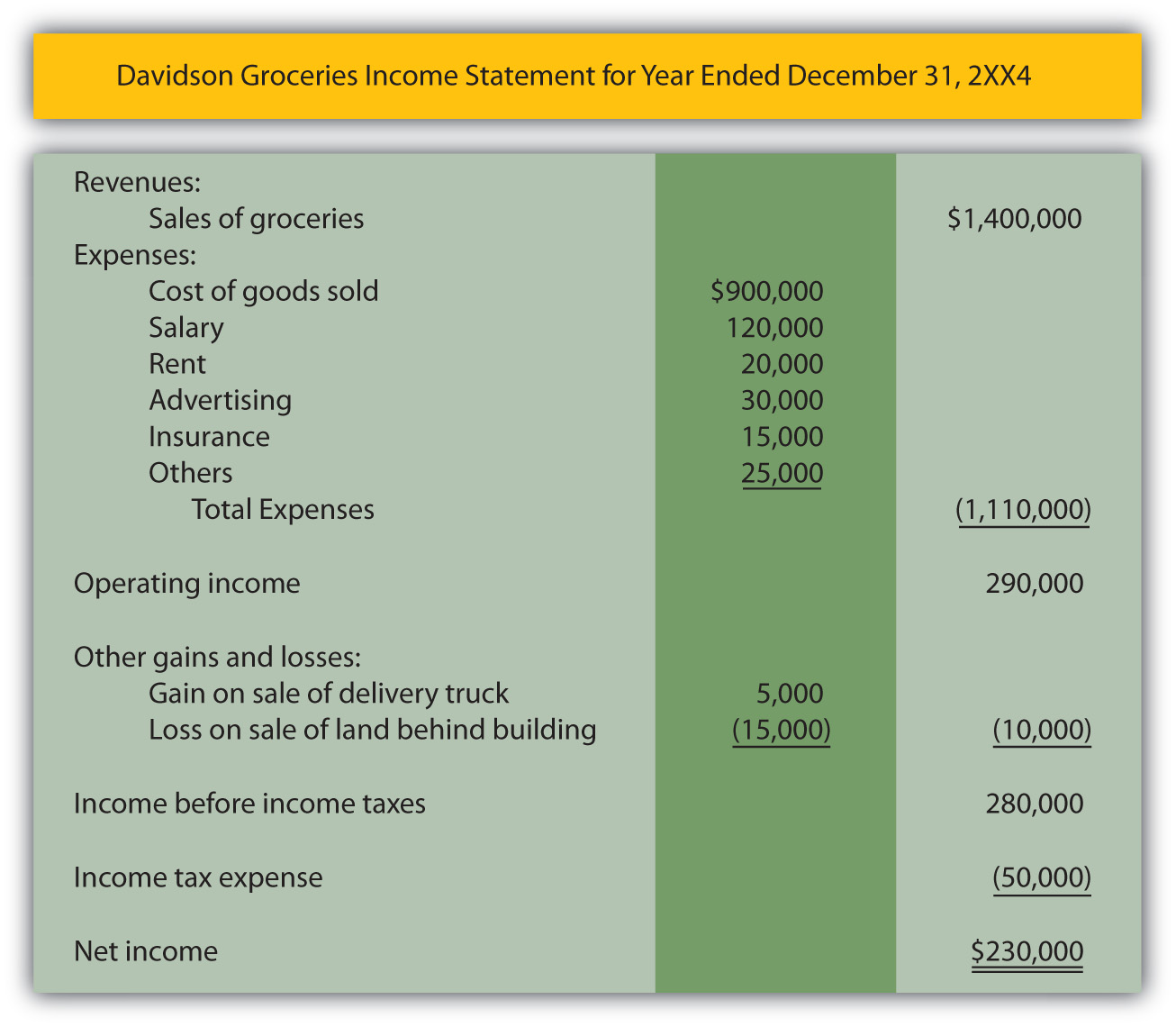

Capital expenditures on the cash flow statement can vary greatly across different industries and companies. Here are some common examples of capital expenditures that may be reported in the cash flow statement:

- Purchase of Property and Buildings: Companies may invest in acquiring new properties or buildings to expand their operations or improve their infrastructure. The cash outflows associated with these purchases would be recorded as capital expenditures in the cash flow statement.

- Investment in Equipment and Machinery: To enhance production capabilities or upgrade outdated equipment, businesses often make investments in new machinery. The cash outflows for the purchase of equipment or machinery would be classified as capital expenditures on the cash flow statement.

- Research and Development (R&D) Expenditures: Companies in technology-driven industries may invest in research and development activities to innovate and develop new products or technologies. These R&D expenditures, which can include expenses related to patents, prototypes, or testing equipment, are often classified as capital expenditures.

- Technology and Software Investments: In the digital age, companies frequently invest in technology infrastructure, software systems, and IT equipment to support their operations and digital transformation efforts. These capital expenditures are categorized as investments in the cash flow statement.

- Acquisition of Intangible Assets: Companies may acquire intangible assets, such as trademarks, copyrights, or licenses, to protect their intellectual property or obtain exclusive rights to certain products or services. The cash outflows for acquiring intangible assets are considered capital expenditures.

- Infrastructure Development: In industries like utilities or transportation, companies may invest in constructing or upgrading infrastructure such as roads, bridges, power plants, or pipelines. The cash outflows for these infrastructure development projects would be reported as capital expenditures.

These examples illustrate the diverse range of capital expenditures that can arise in different sectors and play a significant role in a company’s long-term growth and competitiveness. It is important to note that the specific capital expenditures reported on the cash flow statement will depend on the nature of the business and its strategic priorities.

By analyzing the capital expenditure details provided in the cash flow statement, stakeholders can gain insights into the areas where a company is allocating its financial resources. This analysis helps assess the company’s investment priorities, growth strategies, and their potential impact on future cash flows and profitability.

Conclusion

The inclusion of capital expenditures on the cash flow statement is crucial for understanding a company’s financial health, growth potential, and long-term sustainability. Capital expenditures represent the cash outflows related to the acquisition or improvement of long-term assets that are essential for a company’s operations and future growth.

By analyzing the capital expenditures section of the cash flow statement, stakeholders can gain valuable insights into a company’s investment decisions, its ability to generate cash flows, and its capital allocation strategies. This analysis allows investors and analysts to evaluate the company’s commitment to long-term growth, operational efficiency, and potential for generating future returns.

Furthermore, understanding the sources of capital expenditures on the cash flow statement is crucial. Companies can fund capital investments through internally generated cash flows from operating activities, external financing through investing or financing activities, or a combination of both. The proportion of funding from each source can vary based on the company’s financial situation, industry, growth strategy, and available financing options.

Through careful analysis of the cash flow statement, stakeholders can identify patterns, risks, and opportunities related to capital expenditures. They can assess the company’s financial stability, investment decisions, and its ability to fund growth initiatives while managing debt and shareholder expectations.

In conclusion, the capital expenditures section on the cash flow statement provides a comprehensive view of a company’s investment in long-term assets and its commitment to future growth. This information is vital for making informed investment decisions, evaluating a company’s financial prospects, and understanding its strategic priorities.