Finance

How To Check GOAT Credit

Modified: February 21, 2024

Learn how to check your GOAT credit with our comprehensive guide. Manage your finances effectively and stay ahead in the game.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Gather Required Information

- Step 2: Access the GOAT Credit Platform

- Step 3: Log in to Your Account

- Step 4: Navigate to the Credit Checking Section

- Step 5: Enter Personal Information

- Step 6: Review Your Credit Report

- Step 7: Understand Credit Score and Factors

- Step 8: Check for Errors or Discrepancies

- Step 9: Take Necessary Actions

- Step 10: Monitor Your Credit Regularly

- Conclusion

Introduction

Welcome to the world of credit! Understanding and managing your credit is an essential aspect of your financial well-being. Building a good credit history can open doors to countless opportunities, from securing a loan for a dream home to obtaining favorable interest rates on credit cards and other financial products. To keep track of your creditworthiness, you need to regularly check your credit report and score.

GOAT Credit, a leading online platform, provides individuals with access to their credit reports and scores. By leveraging this powerful tool, you can gain insights into your financial health and identify areas for improvement. In this article, we will guide you through the step-by-step process of checking your GOAT Credit report.

Whether you’re a first-time user or a seasoned individual looking to keep tabs on your credit, this article is here to help. By following our instructions, you’ll be able to navigate the GOAT Credit platform with ease and gain a comprehensive understanding of your credit standing.

Step 1: Gather Required Information

Before you begin the process of checking your GOAT Credit, it’s important to gather the necessary information. This will ensure a smooth and efficient experience as you access your credit report. Here are the key details you’ll need:

- Personal Information: Make sure you have your full name, date of birth, and social security number on hand. These details are crucial for verification purposes.

- Contact Details: Have your current address, phone number, and email address readily available. It’s important to keep your contact information up to date.

- Account Information: If you have any existing accounts or credit products, such as credit cards or loans, gather the account numbers and relevant information. This will help you in cross-referencing your credit report.

By having all the necessary information ready, you’ll be able to save time and avoid frustration during the credit checking process. Once you have gathered these details, you can proceed to the next step of accessing the GOAT Credit platform.

Step 2: Access the GOAT Credit Platform

Now that you have all the required information, it’s time to access the GOAT Credit platform. Follow these steps:

- Open your preferred web browser on your computer or mobile device.

- Type in the URL for GOAT Credit in the address bar.

- Click on the link to the GOAT Credit website.

Alternatively, you can search for GOAT Credit in a search engine and click on the official website link in the search results.

Once you have accessed the GOAT Credit platform, you will be one step closer to checking your credit report and score. The platform is designed to be user-friendly, making it easy for both new and experienced users to navigate.

Continue to the next step to log in to your GOAT Credit account and begin the credit checking process.

Step 3: Log in to Your Account

After accessing the GOAT Credit platform, the next step is to log in to your account. If you are a first-time user, you will need to create an account before proceeding. Here’s how:

- Look for the “Sign In” or “Log In” button on the GOAT Credit homepage.

- Click on the button to access the login page.

- If you already have an account, enter your registered email address or username and your password in the designated fields.

- If you are a new user, look for the “Sign Up” or “Register” link and follow the instructions to create your account. You will typically be asked to provide your personal information and create a password.

- Once you have entered your login credentials, click on the “Log In” button.

If your email address and password are correct, you will be successfully logged in to your GOAT Credit account. From here, you will have access to various features and tools, including the ability to check your credit report and score.

If you encounter any issues with logging in, make sure you have entered the correct email address and password. If you still have trouble, look for the “Forgot Password” or “Reset Password” link on the login page to reset your password.

With your account successfully logged in, you’re ready to proceed to the next step of navigating to the credit checking section.

Step 4: Navigate to the Credit Checking Section

Once you are logged in to your GOAT Credit account, it’s time to navigate to the credit checking section. Follow these steps:

- Look for a tab or menu option that says “Credit Report” or “Credit Checking”. This is typically located at the top of the page or in a sidebar menu.

- Click on the “Credit Report” or “Credit Checking” tab to access the credit checking section.

Depending on the layout of the GOAT Credit platform, you may be presented with additional options or submenus within the credit checking section. Take a moment to familiarize yourself with the available features and tools.

Within the credit checking section, you will find the tools necessary to view your credit report and score. This is where you can gain valuable insights into your financial standing, including your credit history, accounts, and any negative marks that may be affecting your creditworthiness.

Now that you have successfully navigated to the credit checking section, it’s time to move on to the next step and enter your personal information to retrieve your credit report.

Step 5: Enter Personal Information

In this step, you will need to enter your personal information to retrieve your credit report. Follow these instructions:

- Look for a form or fields where you can enter your personal information. Common information required includes your full name, date of birth, and social security number.

- Carefully enter each piece of information, double-checking for accuracy.

- If prompted, provide any additional details such as your current address, phone number, or email address. This will help in verifying your identity and delivering the credit report to the correct person.

- Once you have entered all the necessary information, click on the “Submit” or “Check Now” button to process your request.

It’s important to note that GOAT Credit takes data privacy and security seriously. They use encryption and other measures to protect your personal information, so you can feel confident in providing the required details to access your credit report.

After submitting your personal information, the platform will typically take a few moments to retrieve your credit report. Sit tight and wait for the process to complete. Once the retrieval is successful, you will be able to move on to the next step and review your credit report.

Now that you have entered your personal information, let’s move on to the exciting part – reviewing your credit report and gaining insights into your financial health.

Step 6: Review Your Credit Report

Now that you have successfully entered your personal information, it’s time to review your credit report. This report provides a detailed overview of your credit history, including your credit accounts, payment history, and any negative marks that may be impacting your credit score. Follow these steps:

- Once your credit report is retrieved, it will be displayed on your screen. Take a moment to familiarize yourself with the layout and sections of the report.

- Review the personal information section to ensure that your name, date of birth, and other identifying details are accurate. Any errors in this section should be addressed immediately.

- Go through each account listed on your credit report. Check for any discrepancies in terms of account balances, payment history, or delinquencies. Ensure that all the accounts listed are indeed yours.

- Pay attention to the payment history section. This will show whether you have made your payments on time or if you have any late or missed payments. Timely payments contribute positively to your credit score.

- Look for any negative marks such as bankruptcies, collections, or public records. These can significantly impact your creditworthiness and may require further action.

As you review your credit report, it’s essential to understand that occasional errors or discrepancies may occur. If you come across any inaccuracies, it’s critical to take immediate action to rectify them.

By thoroughly reviewing your credit report, you can gain a better understanding of your financial standing and identify areas where you can improve. This knowledge will empower you to make informed decisions to manage and enhance your credit health.

Now that you have reviewed your credit report, let’s move on to understanding your credit score and the factors that influence it.

Step 7: Understand Credit Score and Factors

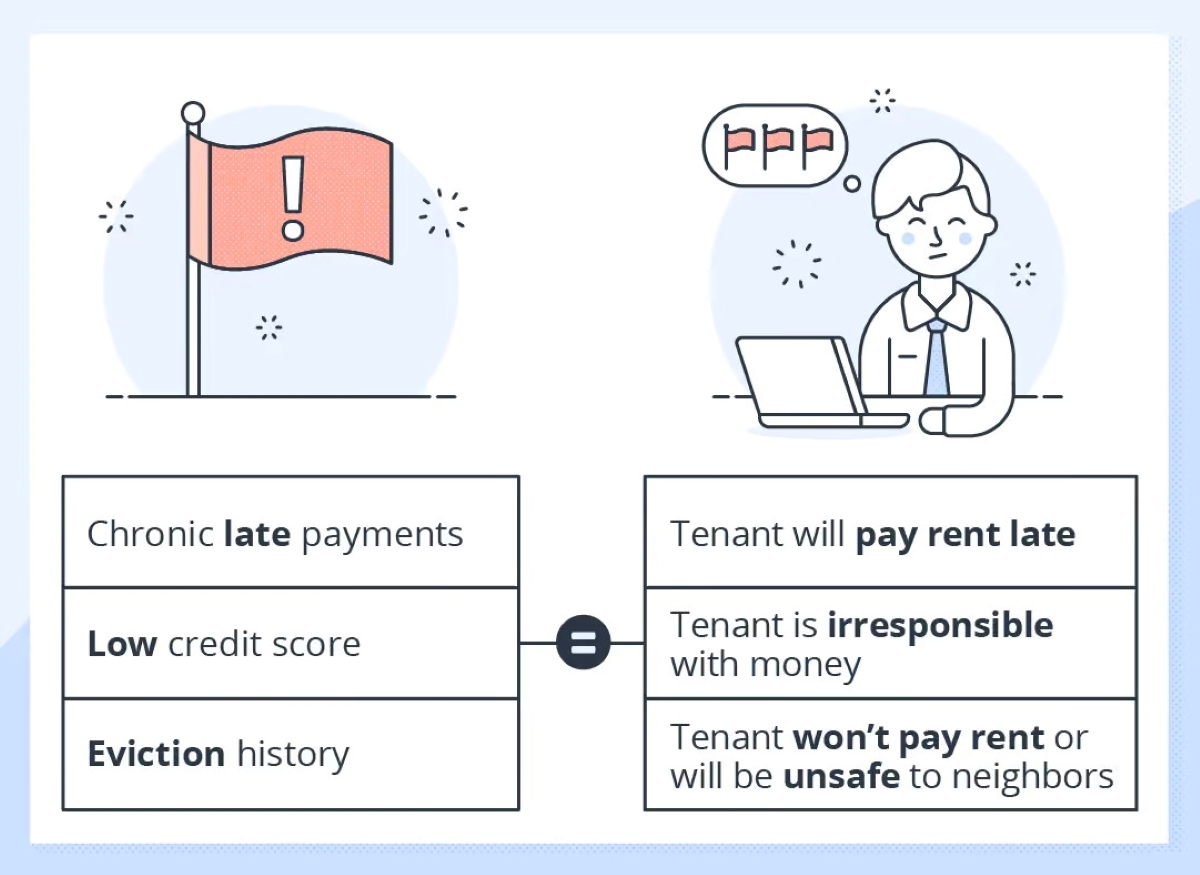

After reviewing your credit report, it’s crucial to understand your credit score and the factors that influence it. Your credit score is a numerical representation of your creditworthiness and is used by lenders to assess the risk of extending credit to you. Here’s what you need to know:

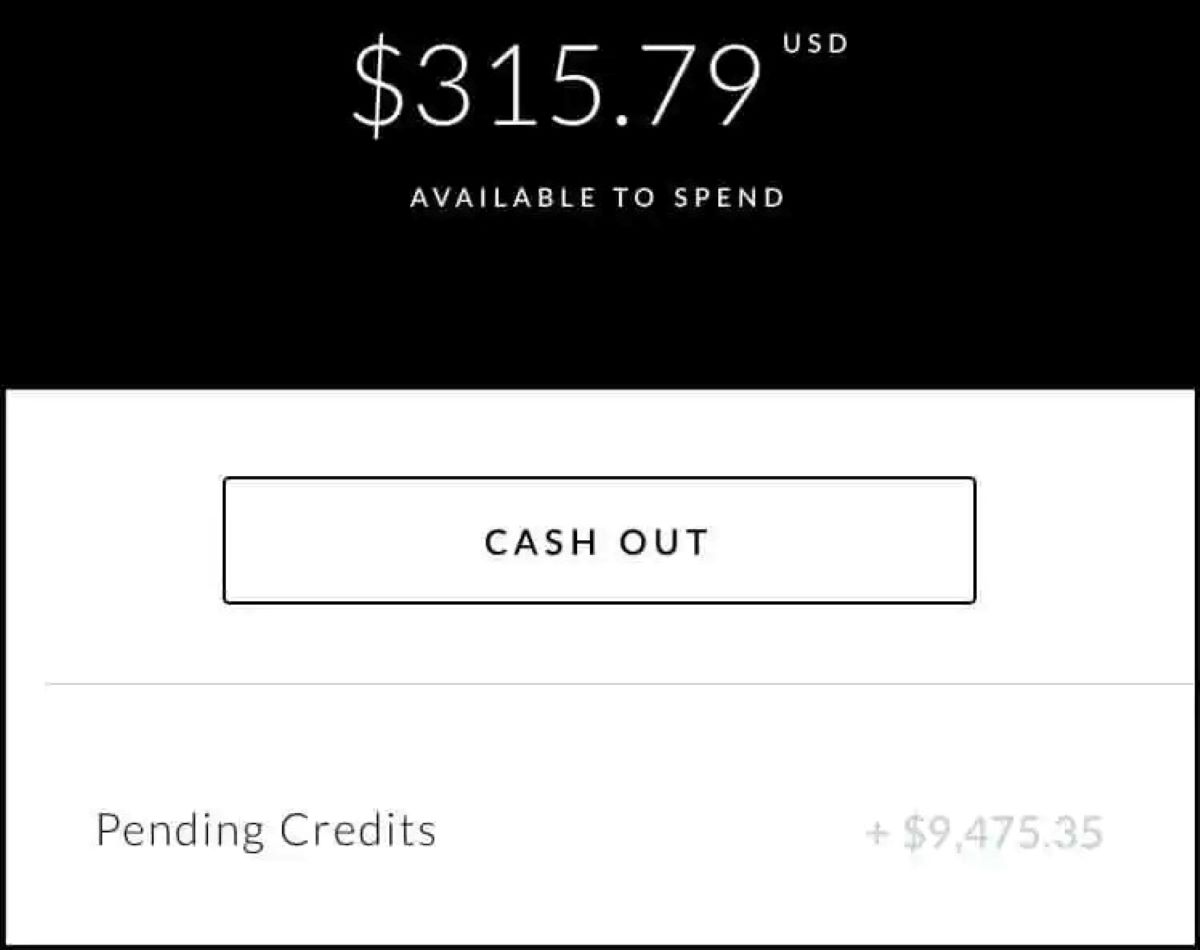

- Find your credit score on the GOAT Credit platform. It is usually displayed prominently alongside your credit report.

- Take note of the range in which your credit score falls. Credit scores typically range from 300 to 850, with a higher score indicating better creditworthiness.

- Understand the factors that contribute to your credit score. These typically include payment history, debt utilization, length of credit history, credit mix, and new credit inquiries.

- Pay attention to the specific areas of improvement highlighted by GOAT Credit, if available. This can help you focus on the factors that are holding back your credit score.

By understanding your credit score and the factors that influence it, you can take proactive steps to improve your creditworthiness. For example, paying your bills on time, reducing your debt, and maintaining a good credit utilization ratio can positively impact your credit score over time.

It’s important to note that different lenders may use different credit scoring models, and their criteria for loan approvals may vary. Nevertheless, a strong credit score is generally advantageous in obtaining better loan terms and interest rates.

Now that you have a clear understanding of your credit score and the factors affecting it, let’s move on to the next step of checking for errors or discrepancies in your credit report.

Step 8: Check for Errors or Discrepancies

Checking your credit report for errors or discrepancies is an important step in maintaining the accuracy of your credit history. Mistakes on your report can negatively impact your credit score and potentially affect your ability to obtain credit in the future. Follow these steps to identify and address any errors:

- Thoroughly review each section of your credit report, including personal information, accounts, and payment history.

- Check for any misspellings, incorrect addresses, or inaccurate personal details. Even a small error in your personal information could lead to confusion or mistaken identity.

- Look for any accounts that you don’t recognize or accounts that should have been closed but are still listed as open. This could indicate fraudulent activity or an error in reporting.

- Ensure that the payment history for each account accurately reflects your payment behavior. If you have made payments on time but it is reported as late, or if a payment is missing altogether, it’s crucial to address it.

- Keep an eye out for any negative marks, such as collections or bankruptcies, that are not accurate or have been resolved. These should be updated or removed from your credit report.

If you discover any errors or discrepancies, it’s important to take action to correct them. Start by documenting the specific details of the error, including any supporting documentation you may have. Contact GOAT Credit directly to report the error and provide them with the necessary information. They will guide you through the dispute process and work with the relevant credit bureaus to investigate and rectify the mistake.

Remember, it’s your right to have accurate and up-to-date information on your credit report, so don’t hesitate to take steps to correct any errors that you come across.

Now that you have checked for errors or discrepancies, let’s move on to the next step and discuss the necessary actions you can take based on the findings of your credit report.

Step 9: Take Necessary Actions

After reviewing your credit report and addressing any errors or discrepancies, it’s time to take necessary actions to improve your credit standing. Here are some crucial steps you can take:

- If you identified any errors or inaccuracies on your credit report, initiate the dispute process. Contact GOAT Credit and provide them with the details of the error. They will work with the credit bureaus to investigate and correct the mistake.

- If you have any outstanding debts or delinquencies, develop a plan to address them. Set up a budget, prioritize your payments, and work towards paying off your debts. Timely payments can have a positive impact on your credit score.

- If you have a high credit utilization ratio, consider reducing your debt. Aim to keep your credit card balances below 30% of the total credit limit. Paying down your balances can help improve your creditworthiness.

- Stay on top of your payment deadlines. Late or missed payments can negatively impact your credit score. Set up reminders or automatic payments to ensure that you make payments on time.

- Monitor your credit regularly. Use the GOAT Credit platform to check your credit report periodically, keeping an eye out for any changes or new accounts that you don’t recognize. Early detection of potential issues can help you take appropriate action.

Improving your credit score takes time and effort, but by taking these necessary actions, you will be on your way towards a stronger credit profile. Remember to be patient and persistent as you work towards your financial goals.

Finally, as you continue to take these necessary actions, regularly monitor your credit to track your progress and ensure the accuracy of your credit report. This brings us to the final step, which emphasizes the importance of ongoing credit monitoring.

Step 10: Monitor Your Credit Regularly

Monitoring your credit on a regular basis is essential for maintaining a healthy credit profile. It allows you to stay updated on any changes, detect potential errors or fraudulent activity, and track your progress towards improving your creditworthiness. Here’s how you can effectively monitor your credit:

- Continue to use the GOAT Credit platform to access your credit report and score periodically. Consider checking your credit every three to six months, or more frequently if you’re actively working on improving your credit.

- Review each new credit report for any changes or updates. Ensure that your personal information is correct and that all accounts and transactions are accurately reflected.

- Monitor your credit score to track any improvements or declines. Look for patterns or changes in your credit behavior that may have influenced your score.

- Set up credit alerts or notifications on the GOAT Credit platform. Receive alerts when there are significant changes to your credit report, such as new accounts opened in your name or sudden drops in your credit score.

- Regularly review your banking and credit card statements for any unauthorized charges or suspicious activity. Report any discrepancies immediately to protect yourself against identity theft or fraud.

By staying vigilant and actively monitoring your credit, you can promptly address any issues that arise and take appropriate action. This proactive approach allows you to protect your creditworthiness and maintain control over your financial well-being.

Remember, your credit profile is a reflection of your financial responsibility, so it’s crucial to consistently monitor and manage it. By doing so, you can make informed decisions and take steps to improve your creditworthiness over time.

Congratulations! You have successfully completed all the steps to check your GOAT Credit and gain a comprehensive understanding of your credit report and score. By following these steps and taking the necessary actions, you are well on your way to maintaining a healthy credit profile and achieving your financial goals.

Remember, building good credit takes time and discipline. Stay proactive, manage your finances responsibly, and you’ll be setting yourself up for a bright financial future.

Author: Your Name

Conclusion

Checking your GOAT Credit report is a valuable step in gaining insights into your financial health and establishing a strong credit foundation. By following the ten steps outlined in this guide, you have learned how to access the GOAT Credit platform, navigate through the credit checking section, review your credit report, understand your credit score and factors, check for errors or discrepancies, take necessary actions, and monitor your credit regularly.

Monitoring your credit and taking necessary actions to improve your creditworthiness are ongoing processes. It requires vigilance, discipline, and a commitment to financial responsibility. With the information you have gained from your GOAT Credit report, you can make informed decisions and take steps to boost your credit score over time.

Remember to regularly review your credit report to ensure its accuracy, address any errors or discrepancies, and monitor for any suspicious activity. By maintaining a positive credit history, you can enhance your chances of securing loans, obtaining favorable interest rates, and enjoying financial freedom.

Lastly, use the knowledge and insights gained from this guide to empower yourself in making smart financial decisions. Monitor your credit, stay informed, and take proactive steps towards improving your creditworthiness. With time and dedication, you can achieve your financial goals and build a strong foundation for a secure financial future.

Congratulations on taking the first step towards a better understanding of your credit! Now, go forth and make the most of your newfound knowledge.

Author: Your Name