Finance

How To Find My Credit Card APR

Published: March 3, 2024

Learn how to find and calculate your credit card APR with our comprehensive finance guide. Understand the importance of APR and how it affects your finances. Discover tips for managing and reducing your credit card APR.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding Credit Card APR

Understanding Credit Card APR

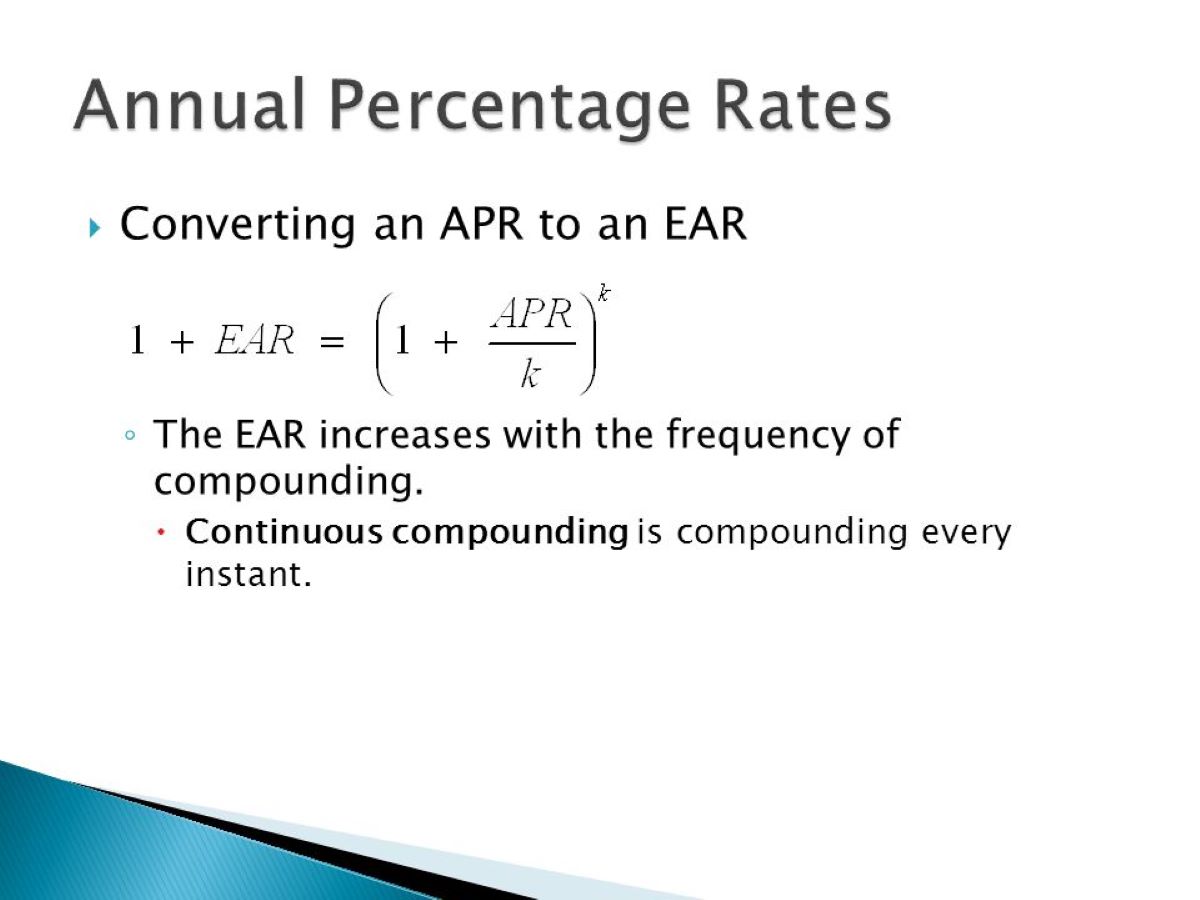

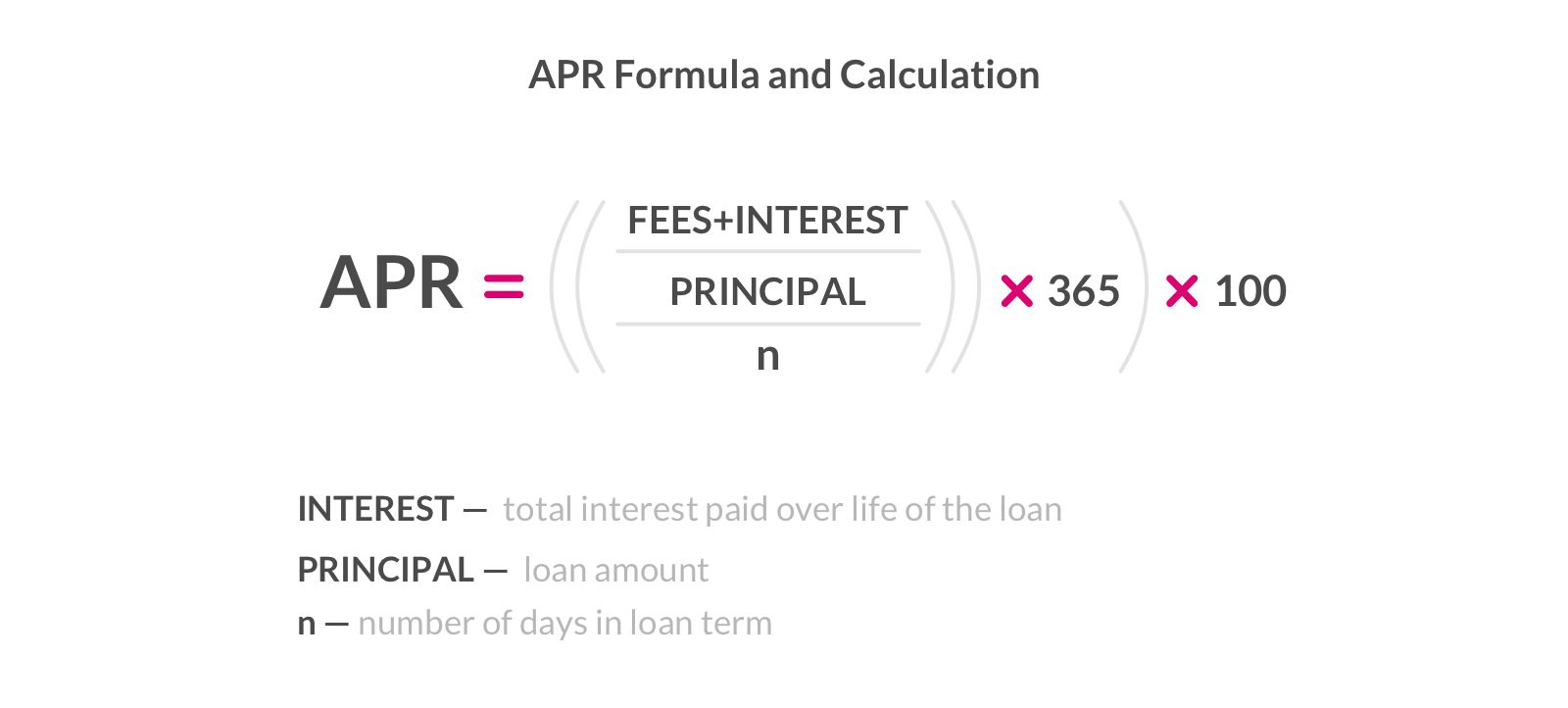

Understanding the Annual Percentage Rate (APR) on your credit card is crucial for managing your finances effectively. The APR represents the annual cost of borrowing funds through your credit card, including interest and additional fees. It’s essential to comprehend the nuances of APR to make informed decisions about your credit card usage and repayment strategies.

When evaluating your credit card APR, it’s important to differentiate between the various types of APR that may apply to different transactions. For instance, your credit card may have separate APRs for purchases, balance transfers, and cash advances. Each of these APRs can impact your overall cost of borrowing and should be carefully considered before engaging in these transactions.

Moreover, credit card APRs can be fixed or variable. A fixed APR remains consistent throughout the year, providing predictability for monthly interest charges. On the other hand, a variable APR fluctuates based on the prime rate, which can lead to changes in your interest expenses over time. Understanding the nature of your credit card’s APR is essential for anticipating potential fluctuations in your repayment obligations.

It’s important to note that the APR is not the sole factor influencing the cost of borrowing on your credit card. Additional fees, such as annual fees, late payment fees, and balance transfer fees, can contribute to the overall expense of using your credit card. Therefore, a comprehensive understanding of the terms and conditions associated with your credit card is essential for managing your financial commitments effectively.

By comprehending the intricacies of credit card APRs, consumers can make informed decisions about their credit card usage, repayment strategies, and potential cost-saving measures. This knowledge empowers individuals to navigate the financial landscape with confidence, enabling them to optimize their credit card usage while minimizing unnecessary expenses.

Checking Your Credit Card Statement

Checking Your Credit Card Statement

Reviewing your credit card statement regularly is a fundamental practice for maintaining financial awareness and managing your credit card APR effectively. Your credit card statement provides a comprehensive overview of your transactions, balances, and crucial details that directly impact your credit card APR.

When examining your credit card statement, pay close attention to the section that outlines your APR and how it applies to different types of transactions. Understanding the specific APRs associated with purchases, balance transfers, and cash advances can help you gauge the potential costs of utilizing your credit card for various financial activities.

Furthermore, your credit card statement highlights any changes in your APR, ensuring that you are informed about fluctuations that may impact your repayment obligations. If your credit card issuer adjusts your APR, the statement serves as a notification, prompting you to assess the implications of the change on your overall cost of borrowing.

Aside from the APR details, your credit card statement presents a summary of your outstanding balances and the corresponding interest charges. By reviewing this information, you can gain insights into the financial impact of maintaining certain balances on your credit card, allowing you to make informed decisions about repayment and debt management.

Moreover, scrutinizing your credit card statement enables you to identify any unauthorized or erroneous charges, safeguarding you against potential financial discrepancies and fraudulent activities. This proactive approach to monitoring your transactions contributes to financial security and ensures that your credit card APR is calculated accurately based on legitimate activities.

Overall, checking your credit card statement regularly empowers you to stay informed about your credit card APR, transaction details, and potential changes that may affect your financial obligations. By cultivating this habit, you can proactively manage your credit card usage, optimize your repayment strategies, and maintain a clear understanding of your financial standing.

Contacting Your Credit Card Issuer

Contacting Your Credit Card Issuer

When seeking clarity or assistance regarding your credit card’s Annual Percentage Rate (APR), reaching out to your credit card issuer can provide valuable insights and guidance. Whether you have inquiries about your current APR, are exploring options to lower your APR, or require clarification on the factors influencing your APR, direct communication with your credit card issuer can be immensely beneficial.

Initiating contact with your credit card issuer allows you to gain a comprehensive understanding of the specific APR terms and conditions associated with your credit card. By speaking with a customer service representative, you can inquire about the different types of APR applicable to your card, including those for purchases, balance transfers, and cash advances. Additionally, you can seek clarification on whether your APR is fixed or variable, enabling you to anticipate potential changes in your interest expenses.

Furthermore, discussing your credit card APR with your issuer presents an opportunity to explore potential strategies for lowering your APR. In some cases, demonstrating responsible credit behavior, such as making timely payments and maintaining a favorable credit score, may position you to negotiate a lower APR with your issuer. Understanding the criteria that influence APR adjustments and eligibility for reduced rates empowers you to take proactive steps towards managing your credit card expenses effectively.

Should you encounter challenges related to your credit card APR, such as unexpected increases or discrepancies in the application of your APR to specific transactions, contacting your credit card issuer promptly can facilitate the resolution of these issues. By addressing concerns in a timely manner, you can mitigate potential financial implications and ensure that your credit card APR accurately reflects your financial activities.

Overall, reaching out to your credit card issuer serves as a proactive approach to understanding, managing, and potentially optimizing your credit card APR. By leveraging the resources and support offered by your issuer, you can gain clarity on your APR, explore opportunities for cost-saving measures, and address any concerns that may impact your financial well-being.

Researching Online Options

Researching Online Options

Exploring online resources can provide valuable insights and options for understanding and managing your credit card’s Annual Percentage Rate (APR). With a plethora of financial websites, forums, and educational platforms available, conducting online research empowers you to access a wealth of information and diverse perspectives on credit card APRs.

When delving into online resources, consider visiting reputable financial websites and blogs that offer comprehensive guides and articles on credit card APRs. These platforms often provide detailed explanations of APR concepts, breakdowns of different types of APR, and practical tips for optimizing your credit card APR based on your financial goals and circumstances.

Additionally, participating in online forums and communities dedicated to personal finance and credit management can offer valuable insights from individuals who have firsthand experience with credit card APRs. Engaging in discussions and seeking advice from these communities can provide practical strategies, potential pitfalls to avoid, and nuanced perspectives on navigating credit card APRs effectively.

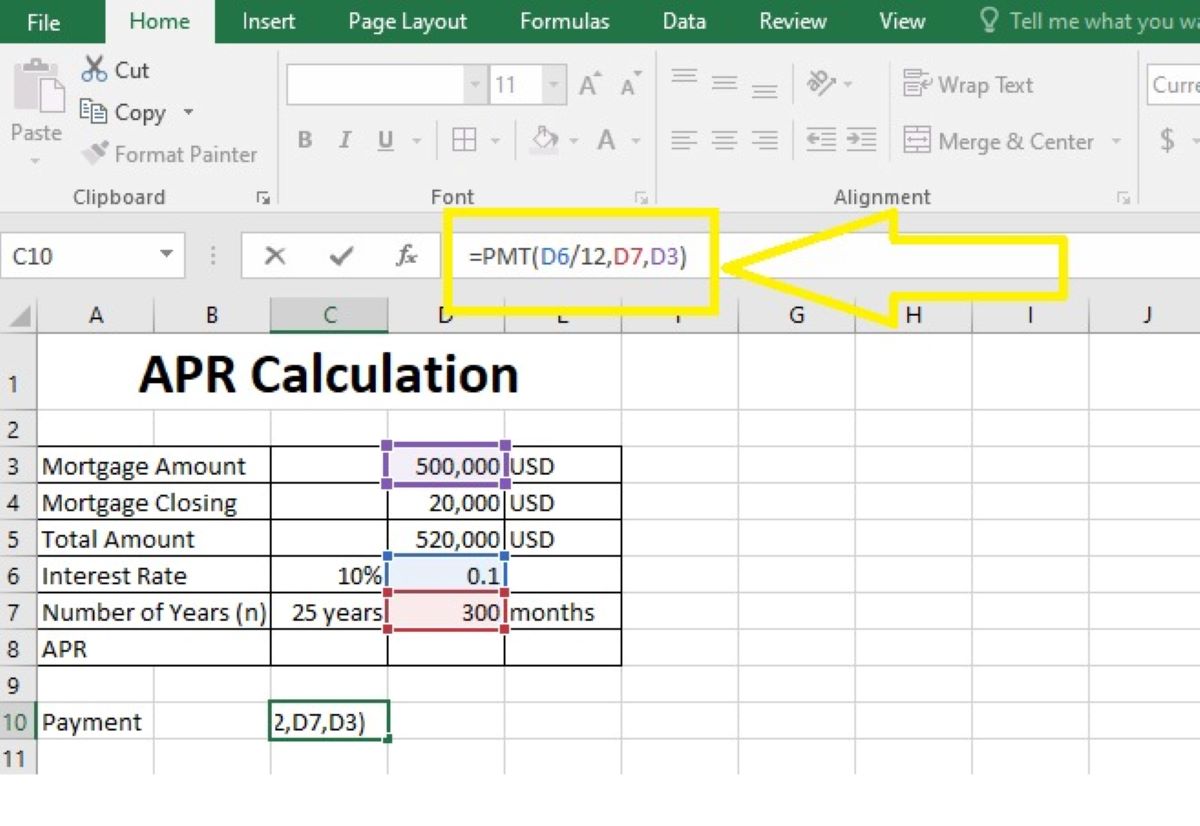

Furthermore, leveraging online tools and calculators designed to estimate the potential costs associated with different credit card APRs can enhance your financial literacy and decision-making. These tools enable you to input various APR scenarios and assess the long-term implications of your credit card APR on your repayment obligations, empowering you to make informed choices about your credit card usage.

Researching online options also entails exploring educational resources provided by financial institutions and regulatory bodies. Many reputable banks and credit card issuers offer detailed information on their websites, including FAQs, educational articles, and interactive tools that elucidate the nuances of credit card APRs and potential strategies for managing them effectively.

By immersing yourself in online resources, you can expand your knowledge of credit card APRs, gain diverse perspectives, and access practical tools to support your financial decision-making. This proactive approach equips you with the insights and strategies needed to navigate your credit card APR with confidence and optimize your financial well-being.

Comparing Different Credit Card APRs

Comparing Different Credit Card APRs

When evaluating credit card options, comparing the Annual Percentage Rates (APRs) offered by different issuers is essential for making informed decisions about your financial commitments. By conducting a thorough comparison of credit card APRs, you can identify favorable terms, potential cost-saving opportunities, and the most suitable card for your individual financial needs.

Start by researching and compiling a list of credit cards that align with your financial goals and credit profile. Utilize online resources, including financial comparison websites and official issuer websites, to gather comprehensive information about the APRs associated with various credit cards. Pay attention to the APRs for purchases, balance transfers, and cash advances, as well as any promotional APR offers that may apply.

As you compare different credit card APRs, consider the distinction between fixed and variable APRs. A fixed APR provides stability in monthly interest charges, while a variable APR is subject to fluctuations based on market conditions. Understanding the nature of the APRs offered by different cards enables you to assess the potential impact on your long-term borrowing costs and financial planning.

In addition to APRs, take note of other fees and features that may influence the overall cost of using a particular credit card. Consider factors such as annual fees, foreign transaction fees, and penalty APRs, as these elements contribute to the comprehensive assessment of a credit card’s affordability and suitability for your financial circumstances.

Furthermore, pay attention to any introductory APR promotions that may be available, as these temporary lower rates can provide opportunities for interest savings, particularly if you plan to utilize balance transfers or make significant purchases within the promotional period. However, it’s crucial to understand the terms and duration of these promotional APR offers to make informed decisions about their potential benefits.

By comparing different credit card APRs comprehensively, you can identify the most advantageous terms, potential cost-saving opportunities, and the optimal fit for your financial preferences. This diligent approach empowers you to select a credit card that aligns with your financial goals and enables you to manage your borrowing costs effectively.