Finance

Asset Value Per Share Definition

Published: October 9, 2023

Learn the definition of asset value per share in finance. Discover how it is calculated and its significance for investors.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Asset Value Per Share: Definition and Importance

Finance is a broad field encompassing various aspects of managing money, investing, and understanding the value of assets. One crucial concept within finance is asset value per share. In this blog post, we will explore the definition and importance of asset value per share, providing you with valuable insights to enhance your financial understanding.

Key Takeaways:

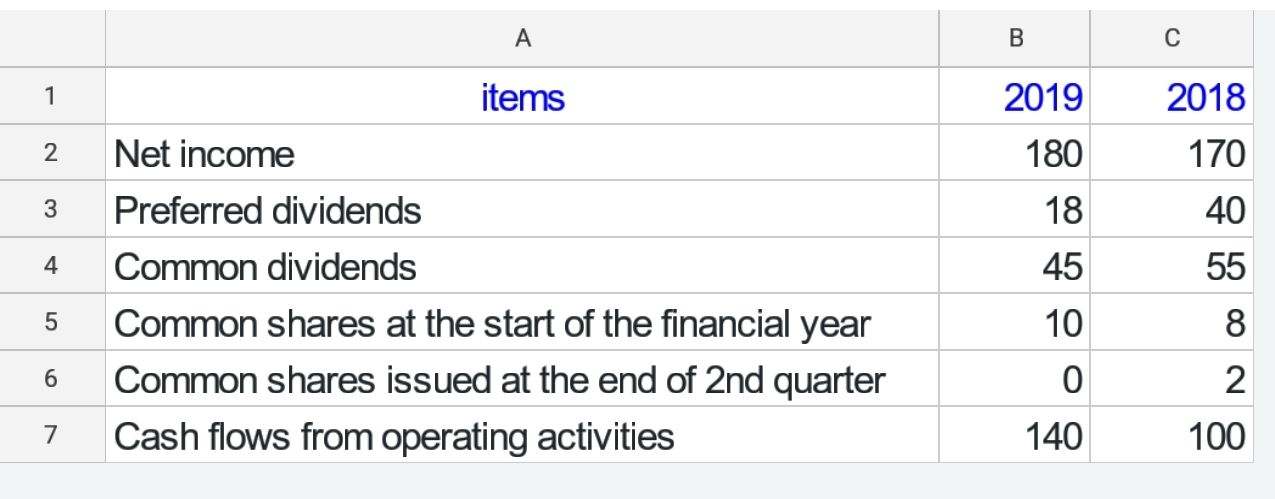

- Asset value per share is a financial metric used to determine the net asset value of a company divided by its outstanding shares.

- This metric helps investors assess the value of each share they own in a company, providing insights into the company’s financial health.

Asset value per share can be defined as the net asset value (NAV) of a company divided by the total number of outstanding shares. The net asset value represents the total value of a company’s assets, including cash, investments, physical assets, and liabilities. By dividing this value by the number of shares, investors can gauge the value of each individual share they own.

Now, you might wonder, why is asset value per share important? Here are a couple of key reasons:

- Assessing Investment Potential: Asset value per share helps investors evaluate the attractiveness of an investment opportunity. If the asset value per share is higher than the market price per share, it may indicate that the stock is undervalued and could present a buying opportunity.

- Monitoring Company Performance: Tracking changes in asset value per share over time can provide insights into a company’s financial health and management effectiveness. Increasing asset value per share indicates growth and profitability, while a decreasing value may indicate declining performance or potential financial issues.

Understanding asset value per share is particularly important in relation to other financial metrics. For example, comparing the asset value per share to the company’s earnings per share (EPS) can help investors determine if the stock is over or undervalued relative to its profitability. Additionally, analyzing asset value per share in conjunction with the price-to-earnings (P/E) ratio can provide a more comprehensive assessment of a company’s value.

In conclusion, asset value per share is a valuable metric for investors to assess the value of their shares in a company. As you delve deeper into the world of finance, understanding this concept will help you make informed investment decisions and monitor the financial performance of companies you are interested in.