Home>Finance>Average Balance: Definition, How It’s Used And Impact On Interest

Finance

Average Balance: Definition, How It’s Used And Impact On Interest

Published: October 11, 2023

Learn the definition of average balance in finance, how it's utilized, and its impact on interest.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Average Balance: Definition, How It’s Used and Impact on Interest

Finance is a crucial aspect of our lives, and understanding key concepts can make a significant difference in managing our money effectively. One such concept is the average balance – a measure that affects how interest is calculated and can have an impact on your financial goals. In this blog post, we will dive into the definition of average balance, explore how it is used, and discuss its impact on interest rates.

Key Takeaways:

- The average balance is a method used by financial institutions to determine the average amount of funds in an account over a specific period of time.

- It is calculated by summing up the daily balances of an account and dividing it by the number of days in the period.

What is Average Balance?

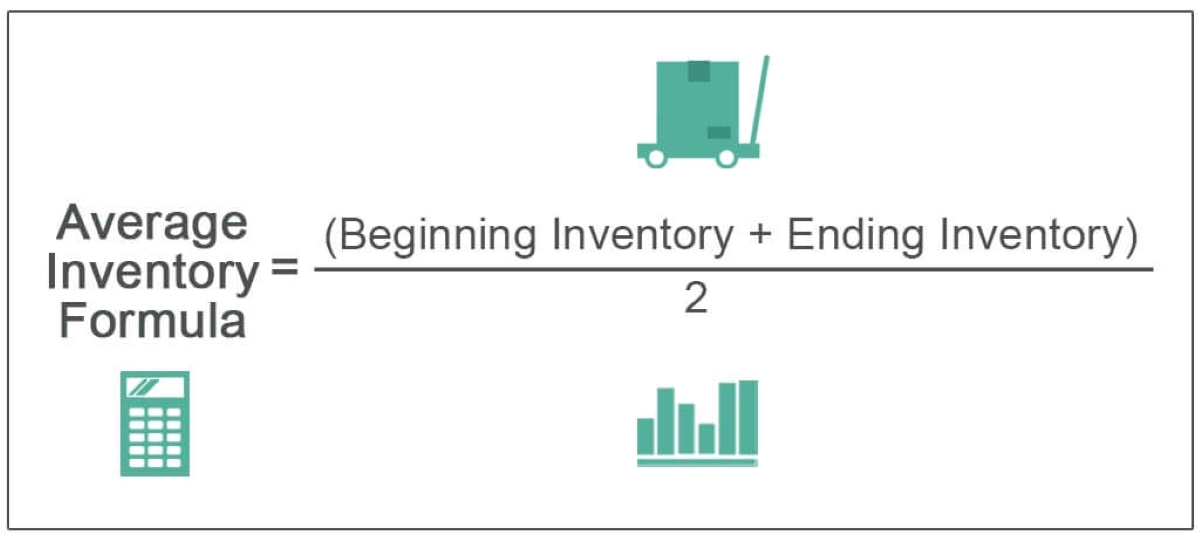

The average balance refers to the average amount of funds in an account over a particular period, typically calculated on a monthly basis. Financial institutions use this measurement to assess an account holder’s overall activity and to determine the appropriate interest rate.

Calculating average balance involves summing up the daily balances of an account for the given period and then dividing it by the number of days in that period. By knowing the average balance of your account, both you and the financial institution can understand the average amount of funds that are available to generate interest.

How is Average Balance Used?

Financial institutions use average balance as a factor in determining the interest rate to be applied to an account. Generally, the higher your average balance, the better the interest rate you may be eligible for. This is because higher average balances indicate a more stable account and present a lower risk to the institution.

Let’s say you have a savings account with a $10,000 average balance, while your friend’s average balance is only $5,000. When the bank calculates the interest earned on your account, the higher average balance may result in a higher interest rate being applied to your funds. This can lead to more substantial returns on your savings over time.

Moreover, average balance is crucial for financial planning and budgeting. By having a clear understanding of your average balance, you can plan your expenses, savings, and investments more effectively. Monitoring your average balance can also help you avoid fees or penalties associated with maintaining a minimum balance requirement in some accounts.

Impact on Interest Rates

The average balance directly influences the interest rate you receive on your accounts. By maintaining a higher average balance, you increase your chances of securing a more favorable interest rate. This can result in a significant impact on the overall growth of your savings and investments.

In addition to earning higher interest, a higher average balance can also open doors to exclusive account features or benefits from the financial institution. Some banks may offer perks, such as waived fees, discounted rates on loans, or access to premium services for customers who maintain a certain average balance in their accounts.

Conclusion

Understanding the concept of average balance is essential in managing your finances effectively. By maintaining a higher average balance, you not only increase the potential for higher interest rates but also gain access to exclusive perks and benefits. Monitoring and managing your average balance can help you make more informed financial decisions and achieve your financial goals more efficiently.

So, take a proactive approach with your finances and pay attention to your average balance. It could be the key to unlocking greater financial growth and opportunities in the future.