Home>Finance>Compare And Contrast Forward And Futures Contracts: What Are The Three Main Differences?

Finance

Compare And Contrast Forward And Futures Contracts: What Are The Three Main Differences?

Published: December 24, 2023

Discover the key distinctions between forward and futures contracts in finance. Learn about the three main differences and make informed investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing in the financial markets, there are various instruments available to traders and investors. Two popular types of financial contracts are forward contracts and futures contracts. While both serve as agreements to buy or sell assets at a predetermined price in the future, there are significant differences between the two.

In this article, we will delve into the details of forward contracts and futures contracts, highlighting the key differences that exist between them. By understanding these differences, investors can make informed decisions about which contract type is more suitable for their trading or hedging strategies.

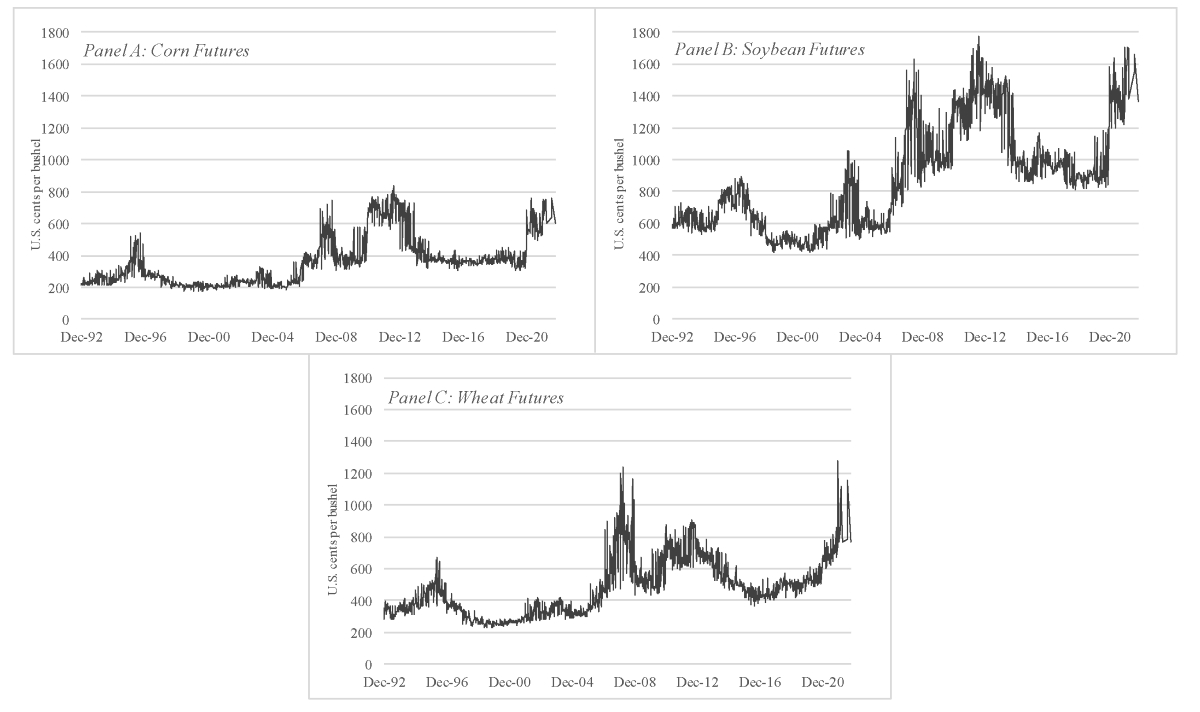

Forward contracts and futures contracts are both derivatives, meaning their value is derived from an underlying asset, such as commodities, currencies, or securities. Both contracts provide a way for market participants to manage risk through the locking in of future prices. However, there are important distinctions in terms of trading venue, settlement, and standardization.

Before delving into the differences, let’s briefly define forward contracts and futures contracts.

Definition of Forward Contracts

A forward contract is a customized agreement between two parties to buy or sell an asset at a specific price on a future date. The terms of a forward contract, including the price, quantity, and delivery date, are negotiated directly between the buyer and seller.

One key characteristic of a forward contract is that it is executed over-the-counter (OTC), which means it is traded directly between the buyer and seller without the involvement of an exchange or intermediary. This allows for greater flexibility in terms of contract customization, as the parties can agree on specific terms that meet their unique needs.

For example, let’s say a farmer expects to harvest a quantity of wheat in three months and wants to lock in a price to protect against potential price fluctuations. The farmer can enter into a forward contract with a food processor to sell the wheat at a predetermined price on a future date.

It’s important to note that forward contracts are not traded on a centralized exchange, which means that they are considered to be over-the-counter instruments. This lack of exchange-traded infrastructure means that counterparty risk plays a significant role in forward contracts. The buyer is reliant on the seller to fulfill their contractual obligations, and vice versa.

The lack of standardization in forward contracts also contributes to counterparty risk. Each contract is tailored to the specific needs of the parties involved, which can lead to difficulties in finding a willing counterparty in the future. Additionally, the absence of a standardized contract means that there is no publicly available pricing or volume information for forward contracts.

Overall, forward contracts offer flexibility and customization but come with inherent risks due to their lack of standardization and reliance on counterparties to fulfill their obligations.

Definition of Futures Contracts

Futures contracts are standardized agreements to buy or sell an asset at a predetermined price on a specified date in the future. Unlike forward contracts, futures contracts are traded on organized exchanges, such as the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE).

One key feature of futures contracts is their standardization. The contracts have predefined specifications, including the size of the contract, the quality of the underlying asset, and the delivery date. This standardization enables easy trading and liquidity, as multiple market participants can easily buy or sell contracts with similar terms.

For example, let’s consider a futures contract for crude oil. The contract may specify that it represents 1,000 barrels of oil of a certain grade, with delivery scheduled for a specific month. The standardized nature of futures contracts ensures that buyers and sellers in the market can easily enter and exit positions without having to negotiate individual terms.

Futures contracts are also marked-to-market on a daily basis. This means that at the end of each trading day, the gains or losses on the contract are settled. If a trader has made a profit, the funds are transferred from the losing party to the winning party. This daily settlement process helps mitigate counterparty risk and ensures that market participants are held accountable for their positions.

Another important aspect of futures contracts is that they allow for easy liquidity. Since futures are traded on exchanges, there is a centralized marketplace where individuals and institutions can buy and sell contracts. This liquidity makes it easier for traders and investors to enter and exit positions with minimal slippage.

Furthermore, futures contracts have standardized pricing and volume information, which is publicly available. This transparency allows market participants to see the current market price and historical trading activity, facilitating price discovery.

In summary, futures contracts are standardized agreements traded on organized exchanges, offering easy liquidity, daily settlement, and transparency. Their standardized nature provides market participants with a level playing field and facilitates efficient trading of derivative instruments.

Difference 1: Trading Venue

One of the key differences between forward contracts and futures contracts is the trading venue on which they are executed. Forward contracts are traded over-the-counter (OTC), directly between two parties, without the involvement of an exchange or intermediary. On the other hand, futures contracts are traded on organized exchanges, such as the Chicago Mercantile Exchange (CME) or the Intercontinental Exchange (ICE).

The OTC nature of forward contracts allows for greater customization and flexibility in terms of contract terms and negotiation. The buyer and seller can agree on specific details, such as the quantity, price, and delivery date, that meet their specific needs. This flexibility can be beneficial for parties looking for tailored agreements or unique transaction structures.

However, the OTC nature of forward contracts also presents certain challenges. One of the primary challenges is counterparty risk, as the fulfillment of the contract relies solely on the creditworthiness and willingness of the counterparties involved. If one party fails to meet their obligations, the other party may suffer financial losses.

In contrast, futures contracts are executed on organized exchanges, which provide a centralized marketplace for individuals and institutions to trade these contracts. The presence of an exchange ensures that there is a regulated and transparent environment for trading. The exchanges act as intermediaries, overseeing the execution, clearing, and settlement of futures contracts.

Being exchange-traded instruments, futures contracts offer several advantages. Firstly, the standardized nature of futures contracts ensures that all contracts of a specific underlying asset are the same. This standardization facilitates ease of trading and price discovery since there are uniform rules for everyone participating in the market.

Secondly, the exchanges also provide a crucial function of guaranteeing the performance of both parties involved in the futures contract. The exchange acts as a counterparty to every trade, reducing the counterparty risk significantly for market participants. This is achieved through the process of daily mark-to-market and the requirement of margin deposits by both buyers and sellers.

Overall, the trading venue is a significant differentiating factor between forward contracts and futures contracts. The OTC nature of forward contracts offers flexibility, but also entails counterparty risk. Futures contracts, being exchange-traded, provide a regulated and transparent marketplace with standardized contracts and reduced counterparty risk.

Difference 2: Settlement Date

Another important difference between forward contracts and futures contracts lies in the settlement date. In a forward contract, the settlement date is predetermined and agreed upon by the buyer and seller at the time of entering into the contract. This settlement date can be any future date, depending on the needs and preferences of the parties involved. The actual delivery of the underlying asset and the exchange of payment occur on this settlement date.

For example, if two parties enter into a forward contract to buy and sell a specific quantity of oil, they may agree to settle the contract six months from the date of initiation. On the settlement date, the buyer will take physical delivery of the oil and pay the agreed-upon price to the seller.

In contrast, futures contracts have standardized settlement dates that are set by the exchange on which they are traded. These settlement dates are usually on a monthly or quarterly basis, depending on the specific futures contract. Traders can choose the contract month that aligns with their trading strategy or investment objectives.

Standardized settlement dates in futures contracts contribute to the liquidity and efficiency of the market. By having a common settlement date that applies to all market participants, buyers and sellers can enter and exit positions easily, knowing that there will always be a counterparty willing to trade at that specific time.

Furthermore, futures contracts do not necessarily require physical delivery of the underlying asset. Most futures contracts are cash-settled, meaning that there is no physical exchange of the asset. Instead, the settlement is based on the difference between the contract price and the spot price of the underlying asset at the time of settlement.

This cash settlement feature of futures contracts allows traders and investors to profit or incur losses without actually owning or delivering the underlying asset. It provides a convenient way to gain exposure to various assets without the logistical challenges associated with physical delivery.

To summarize, forward contracts have a settlement date that is negotiated between the buyer and seller, whereas futures contracts have standardized settlement dates determined by the exchange. Additionally, futures contracts may allow for cash settlement, eliminating the need for physical delivery of the underlying asset.

Difference 3: Standardization

The third key difference between forward contracts and futures contracts is the level of standardization. Forward contracts are highly customizable, with the terms and conditions of the contract negotiated directly between the buyer and seller. This means that each forward contract can have unique specifications, including the quantity, price, delivery date, and even the underlying asset itself.

For example, in a forward contract between a buyer and seller of wheat, they can determine the exact quantity of wheat, the price at which it will be bought or sold, and the specific delivery date that suits their individual needs. This flexibility of customization allows market participants to tailor the contract to their specific requirements.

In contrast, futures contracts are standardized instruments. This means that all contracts of a specific futures contract have identical terms and conditions. The standardized nature of futures contracts ensures that there is a level playing field for all market participants and simplifies the trading process.

Specific details, such as the quantity of the underlying asset, the delivery date, and the quality of the asset, are predetermined and set by the exchange on which the futures contract is traded. This standardization helps create a transparent and efficient market where buyers and sellers can easily enter and exit positions without the need for extensive negotiation.

The standardization of futures contracts also facilitates price discovery. Since all contracts have the same terms, pricing information and trading volume are publicly available. Market participants can easily determine the fair market value of the underlying asset based on the prevailing futures contract prices.

Futures contracts also have standardized contract sizes. For example, a crude oil futures contract typically represents a fixed quantity of barrels of oil, such as 1,000 barrels. This standardized contract size allows for ease of trading and calculation of profits or losses.

Overall, the standardization of futures contracts provides market liquidity, transparency, and ease of trading. Forward contracts, on the other hand, offer customization and flexibility but lack the standardized framework that futures contracts provide.

Conclusion

In conclusion, forward contracts and futures contracts are both valuable financial instruments for managing risk and speculating on the future price movements of underlying assets. However, there are significant differences between the two that investors and traders should be aware of.

Forward contracts are customized agreements between two parties, traded over-the-counter (OTC), and provide flexibility in terms of contract terms and negotiation. They are not standardized and involve counterparty risk. On the other hand, futures contracts are standardized agreements traded on organized exchanges. They have predetermined settlement dates, standardized contract terms, and reduced counterparty risk.

The trading venue is different for these two contracts, with forward contracts being OTC and futures contracts being exchange-traded. This distinction impacts factors such as customization, liquidity, and transparency. Additionally, the settlement date differs between forward contracts (based on negotiations) and futures contracts (standardized dates set by the exchange).

Lastly, the level of standardization is another key difference between the two. Forward contracts offer flexibility in tailoring contract terms, while futures contracts have standardized terms and contract sizes, providing liquidity and facilitating price discovery.

It’s important for investors to understand these differences when considering which contract type to utilize. Factors such as the desired level of customization, risk tolerance, and access to liquidity will play a role in the decision-making process. Both forward contracts and futures contracts have their advantages and disadvantages, and the suitability will depend on individual trading or hedging strategies.

Ultimately, whether choosing forward or futures contracts, market participants should carefully assess their risk appetite, investment goals, and market conditions to make informed decisions and manage their positions effectively.