Home>Finance>In What Order Are Financial Statements Prepared

Finance

In What Order Are Financial Statements Prepared

Published: December 22, 2023

Discover the order in which financial statements are prepared in the world of finance. Gain insights into the sequential process and structure of financial reporting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to understanding a company’s financial performance, there are several key documents that provide insights into its financial health. These documents, known as financial statements, are essential tools used by investors, creditors, and stakeholders to evaluate the overall financial position of a business.

In this article, we will explore the order in which financial statements are prepared, shedding light on their respective purposes and the valuable information they disclose. Understanding the sequence of financial statements is crucial for comprehending the flow of financial information and gaining a holistic view of a company’s operations.

The primary financial statements include the balance sheet, income statement, statement of cash flows, and statement of stockholders’ equity. Each of these statements serves a unique purpose, providing specific information about the company’s assets, liabilities, income, expenses, cash flows, and changes in equity.

Additionally, the financial statements are often accompanied by notes or footnotes, which provide additional details and explanations about the numbers and accounting policies followed by the company. These notes are essential for interpreting the financial statements accurately.

By following a specific order in preparing financial statements, companies can present a comprehensive and cohesive picture of their financial performance. This order allows for a logical flow of information and ensures consistency and comparability among different entities.

Now, let’s take an in-depth look at each of the financial statements and their order of preparation, understanding how they contribute to analyzing a company’s financial health.

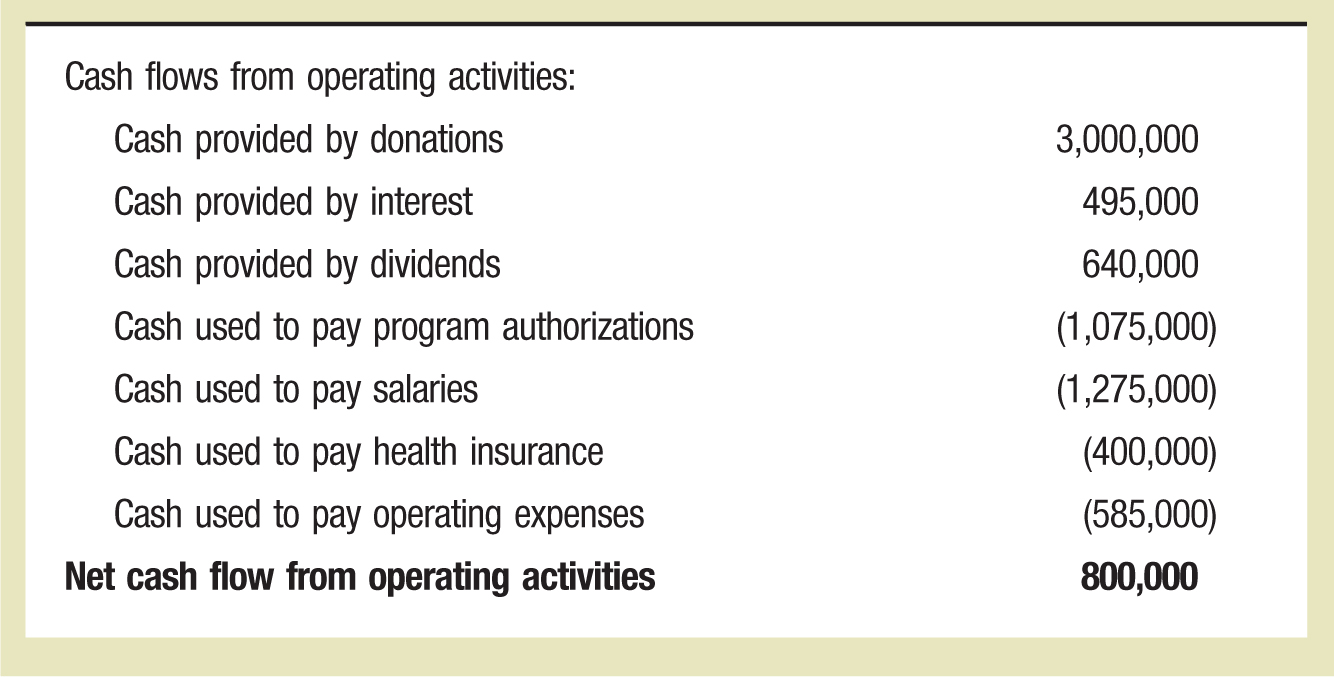

Balance Sheet

The balance sheet, also known as the statement of financial position, is one of the fundamental financial statements that provides a snapshot of a company’s financial standing at a specific point in time. It presents a summary of the company’s assets, liabilities, and shareholders’ equity.

The balance sheet follows the accounting equation: assets = liabilities + shareholders’ equity. This equation highlights the basic principle that a company’s assets are financed by its liabilities and shareholders’ equity.

The balance sheet is divided into two main sections: assets and liabilities. The assets section includes both current assets, which are expected to be converted to cash within a year, and long-term assets, which have a longer useful life. Common examples of assets include cash, accounts receivable, inventory, property, plant, and equipment.

On the other side, the liabilities section includes both current liabilities, which are due within a year, and long-term liabilities, which have a longer repayment period. Liabilities represent the company’s obligations to external parties, such as its suppliers, lenders, and other creditors. Examples of liabilities include accounts payable, loans, and bonds payable.

Finally, the shareholders’ equity section represents the residual interest in the company’s assets after deducting its liabilities. It consists of the company’s retained earnings, which are accumulated profits, and the shareholders’ equity contributed by the owners through share capital.

The balance sheet is an essential tool for evaluating a company’s financial health and its ability to meet its financial obligations. It helps stakeholders assess the company’s liquidity, solvency, and overall financial stability. For example, by comparing current assets to current liabilities, analysts can determine if a company has enough liquidity to cover its short-term obligations.

Furthermore, the balance sheet allows investors and creditors to assess the company’s capital structure and evaluate the level of financial leverage. This information is vital for making informed investment decisions and assessing the company’s risk profile.

Overall, the balance sheet provides stakeholders with a comprehensive view of a company’s assets, liabilities, and shareholders’ equity, enabling them to gauge its financial position and make informed decisions about its future prospects.

Income Statement

The income statement, also known as the profit and loss statement or statement of earnings, is a financial statement that provides information about a company’s revenues, expenses, and net income over a specific period of time. It reflects the company’s ability to generate profits from its core operations.

The income statement follows a simple equation: revenues – expenses = net income. It outlines the revenue earned by the company and deducts the various expenses incurred to arrive at the net income figure.

The income statement is typically divided into several sections. The first section reports the company’s revenues, which are the inflows of assets resulting from the sale of goods or services. Revenue can be generated through various sources, such as product sales, service fees, rental income, or interest income.

The next sections outline the company’s expenses, which are the outflows of assets incurred to generate revenue. Expenses can include the cost of goods sold, operating expenses, such as rent, wages, utilities, marketing costs, and other expenses like depreciation and interest expenses.

By subtracting the total expenses from the total revenues, the income statement arrives at the net income or net loss figure. A positive net income indicates that the company has generated more revenue than its expenses, resulting in a profit. Conversely, a negative net income indicates that the company has incurred more expenses than its revenue, resulting in a loss.

The income statement serves several purposes. It helps stakeholders evaluate the profitability and financial performance of a company. Investors use the net income figure to assess the profitability of their investments and make investment decisions. Creditors use the income statement to evaluate the company’s ability to generate profits and repay its debts.

Furthermore, the income statement is also useful for analyzing the trends and patterns in a company’s financial performance over time. By comparing the income statements of different periods, analysts can assess the company’s growth, profitability, and efficiency in managing its expenses.

Overall, the income statement provides valuable insights into a company’s revenue generation, expenses, and profitability. It is a crucial component of the financial statements and is used by investors, creditors, and management to assess the financial health and performance of the company.

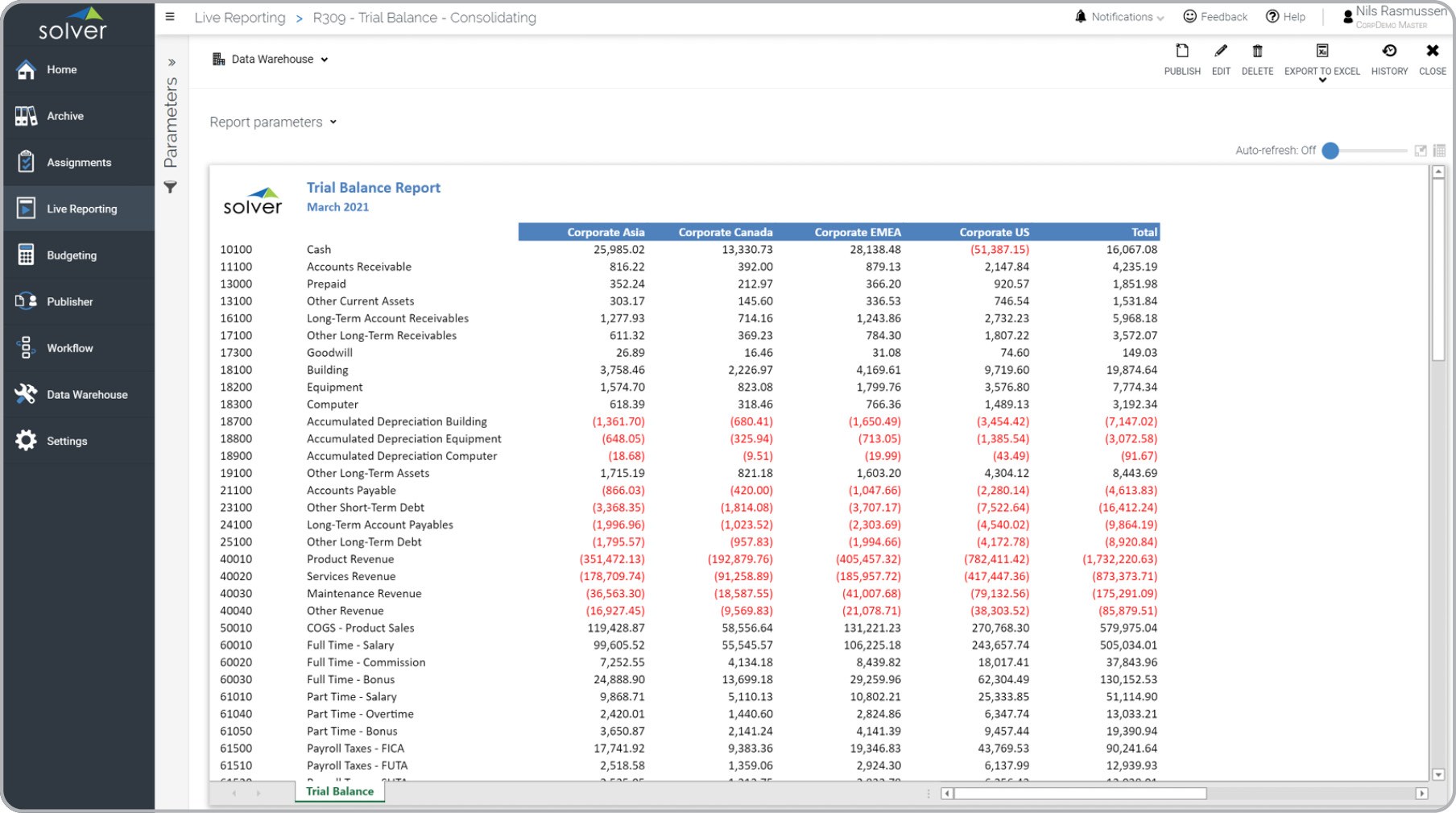

Statement of Cash Flows

The statement of cash flows is a financial statement that provides information about the cash inflows and outflows of a company during a specific period of time. It highlights the sources and uses of cash and helps stakeholders understand how cash is generated and utilized in the business.

The statement of cash flows is divided into three main sections: operating activities, investing activities, and financing activities.

The operating activities section reflects the cash flows generated from the company’s core operations, such as the sale of goods or services. It includes cash received from customers, cash paid to suppliers and employees, and other operating cash flows, such as interest received or paid and taxes paid.

The investing activities section shows the cash flows related to the purchase or sale of long-term assets, such as property, plant, and equipment, as well as investments in other companies. Cash inflows in this section may come from the sale of assets or the collection of loans made to other entities, while cash outflows may result from the acquisition of new assets or investments.

The financing activities section includes cash flows related to the company’s financing activities, such as issuing or repurchasing equity shares, borrowing or repaying loans, and paying dividends. Cash inflows in this section may result from issuing new shares or taking on debt, while cash outflows may occur due to dividend payments or share repurchases.

The statement of cash flows is a valuable tool for assessing a company’s liquidity and its ability to generate cash. It helps stakeholders identify the sources of cash, evaluate the company’s cash flow patterns, and assess its cash position.

Investors can use the statement of cash flows to determine if a company can generate enough cash to cover its operating expenses, investments, and debt obligations. They can also evaluate the company’s ability to generate free cash flow, which is the cash remaining after all investments and expenses are covered.

Creditors use the statement of cash flows to assess the company’s ability to repay its loans and meet its financial obligations. They analyze the company’s cash flow from operating activities to ensure that it can generate sufficient cash to repay its debts.

In addition, the statement of cash flows allows stakeholders to evaluate the effectiveness of a company’s financial management. It shows how well the company utilizes its cash resources, and it provides insights into its capital allocation decisions.

Overall, the statement of cash flows complements the balance sheet and income statement by providing a comprehensive view of a company’s cash flows. It assists stakeholders in understanding the financial health and cash flow dynamics of the business.

Statement of Stockholders’ Equity

The statement of stockholders’ equity, also known as the statement of changes in equity, is a financial statement that provides information about the changes in a company’s equity accounts over a specific period of time. It outlines the contributions made by shareholders, the company’s net income or loss, and any dividends or distributions during the period.

The statement of stockholders’ equity typically includes several components. The first component is the beginning balance of equity, which represents the equity balance at the start of the period. This balance includes the retained earnings from previous periods and the contributed capital from shareholders.

The next component is the net income or net loss for the period, which represents the profit or loss generated by the company’s operations during the reporting period. This figure is derived from the income statement and is added to or subtracted from the beginning balance of equity.

Another component of the statement of stockholders’ equity is the additional paid-in capital, which includes any additional funds received from shareholders through the issuance of new shares at a price greater than the par value of the stock.

Dividends or distributions to shareholders are also included in the statement of stockholders’ equity as a decrease in retained earnings. Dividends are payments made to shareholders as a return on their investment in the company. These payments reduce the accumulated profits that are retained in the business.

Additionally, the statement of stockholders’ equity may include other comprehensive income or loss, which represents gains or losses that are not recognized in the income statement. This can include items such as unrealized gains or losses on available-for-sale securities or changes in the value of defined benefit pension plans.

The statement of stockholders’ equity is crucial for understanding the changes in a company’s equity and providing insight into the factors that contribute to those changes. It allows stakeholders to track the company’s financial performance, measure its retained earnings, and assess the impact of stock issuances, net income, and dividends on its equity base.

Investors can utilize the statement of stockholders’ equity to evaluate the company’s profitability and understand how the company’s management allocates funds to shareholders through dividends. It provides transparency about the company’s capital structure and the impact of equity-related transactions.

Overall, the statement of stockholders’ equity provides a comprehensive view of the changes in a company’s equity accounts, reflecting the contributions of shareholders, the company’s net income or loss, any dividends or distributions, and other comprehensive income or loss. It helps stakeholders assess the performance of the company and understand its financial health from an equity standpoint.

Notes to the Financial Statements

The notes to the financial statements, also known as the financial statement footnotes or disclosures, are an integral part of the financial statements. They provide additional details, explanations, and disclosures about the numbers presented in the main financial statements, ensuring transparency and clarity for users.

The purpose of the notes is to explain the accounting policies, assumptions, estimates, and other relevant information that are used in the preparation of the financial statements. They provide essential context and help users understand the underlying details behind the reported numbers.

The notes to the financial statements cover a wide range of topics and may include information about significant accounting policies, such as revenue recognition, inventory valuation, or depreciation methods. They may also provide information about contingencies, legal disputes, or risks and uncertainties that could impact the company’s financial position.

Furthermore, the notes may disclose information about related party transactions, lease commitments, acquisitions or disposals of assets, significant events or changes in the company’s operations, or any subsequent events that occurred after the reporting period but before the financial statements are issued.

These notes are essential for financial statement users, particularly investors and analysts, as they provide a deeper understanding of the company’s financial performance, risks, and future prospects. They help users assess the quality and reliability of the reported financial information.

Additionally, the notes to the financial statements enhance comparability among different entities. They ensure consistency in the application of accounting principles and help users understand any differences or peculiarities in the financial statements of various companies within the same industry.

It is crucial for companies to provide clear and concise notes to the financial statements, presenting information in a manner that is easily understandable and accessible for users. The notes should be organized, referenced appropriately, and cross-referenced to the relevant sections of the financial statements to facilitate easy navigation.

Overall, the notes to the financial statements play an indispensable role in providing additional information and context to the numbers presented in the main financial statements. They ensure transparency, improve understanding, and enable users to make informed decisions based on a comprehensive understanding of the company’s financial position and performance.

Conclusion

Financial statements are crucial tools for understanding a company’s financial performance and position. By following a specific order of preparation, these statements provide valuable insights to investors, creditors, and stakeholders.

The balance sheet presents an overview of a company’s assets, liabilities, and shareholders’ equity, providing a snapshot of its financial position at a given point in time. It helps users assess the company’s liquidity and solvency.

The income statement showcases a company’s revenues, expenses, and net income or loss over a specific period. It allows stakeholders to evaluate the company’s profitability and financial performance.

The statement of cash flows reveals the sources and uses of cash in a company, providing information on its cash-generating ability and cash flow patterns. It helps users assess the company’s liquidity and evaluate its ability to meet its financial obligations.

The statement of stockholders’ equity highlights the changes in a company’s equity accounts, reflecting the contributions of shareholders, net income or loss, dividends, and other comprehensive income or loss. It assists users in assessing the impact of various transactions on the company’s equity base.

Lastly, the notes to the financial statements provide additional details, explanations, and disclosures about the numbers presented in the financial statements. They contribute to transparency, enhance understanding, and help users assess the quality and reliability of the financial information.

Understanding the order in which financial statements are prepared and their respective purposes is vital for effectively interpreting and analyzing the financial health of a company. It allows stakeholders to make informed decisions, evaluate investment opportunities, and assess the company’s financial stability and performance.

By examining and utilizing these financial statements in conjunction with the accompanying notes, investors and stakeholders can gain a comprehensive understanding of a company’s financial position, profitability, and cash flow dynamics, enabling them to make informed decisions and drive long-term success.