Home>Finance>Delta Hedging: Definition, How It Works, And Example

Finance

Delta Hedging: Definition, How It Works, And Example

Modified: January 15, 2024

Learn the definition and working of Delta Hedging in finance, along with an example. Understand how this risk management strategy minimizes exposure.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is Delta Hedging?

Delta hedging is a risk management strategy used by investors and traders in the financial markets to minimize the potential loss or exposure to fluctuations in the price of an underlying asset. It involves offsetting the risk of a position by taking an opposing position in related assets or derivatives.

Key Takeaways

- Delta hedging is a risk management strategy used to minimize exposure to price fluctuations in an underlying asset.

- It works by neutralizing the delta of a portfolio through offsetting positions in related assets or derivatives.

How Does Delta Hedging Work?

In order to understand how delta hedging works, it’s important to understand the concept of “delta.” Delta represents the rate at which the price of an option or derivative changes in relation to the price movement of the underlying asset.

Delta hedging works by ensuring that the overall delta of a portfolio remains constant. The idea is to neutralize the delta by taking offsetting positions in other derivatives or assets. Here’s how it works:

- An investor acquires a position in a derivative, such as an options contract, which provides exposure to the price movement of an underlying asset.

- The investor calculates the delta of the derivative. If the delta is positive, it means the derivative’s value will increase as the price of the underlying asset rises. If the delta is negative, it means the derivative’s value will decrease as the price of the underlying asset rises.

- To hedge the position, the investor takes an opposing position in the underlying asset or a related derivative.

- By doing so, the investor neutralizes the delta of the overall portfolio, reducing the risk of losses due to price movements in the underlying asset.

Example of Delta Hedging

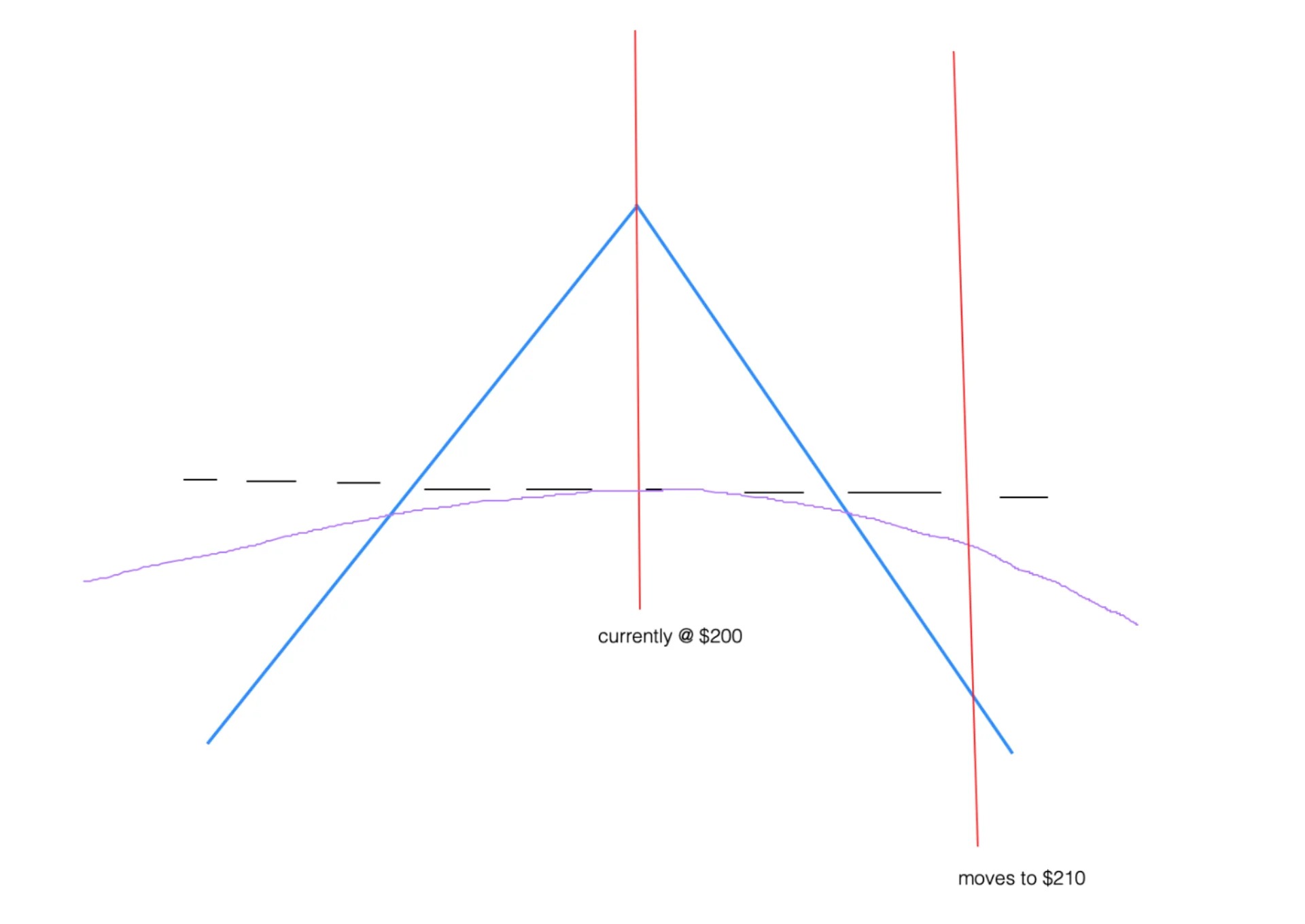

Let’s say an investor owns 100 call options on Company X stock, with a delta of 0.5 for each option. This means that for every 1% increase in the price of Company X stock, the value of the call options is expected to increase by 0.5%.

To hedge this position, the investor decides to sell 50 shares of Company X stock, which has a delta of 1.0. By selling the stock, the investor offsets the positive delta of the call options, reducing the overall delta of the portfolio to zero.

Now, if the price of Company X stock increases by 10%, the investor’s call options will increase in value by 5%, but the 50 shares of stock that were sold will decrease in value by 10%. The net effect is that the investor’s portfolio remains relatively unchanged, effectively hedging against the price movement of the underlying asset.

By employing delta hedging, investors and traders can effectively manage their risk and protect their portfolios from unwanted exposure to market volatility. It is an essential tool in the financial markets for those looking to strike a balance between risk and reward.