Home>Finance>Discretionary Investment Management Definition, Benefits & Risks

Finance

Discretionary Investment Management Definition, Benefits & Risks

Published: November 12, 2023

Learn about discretionary investment management in finance, including its benefits and risks. Gain insights into this investment strategy that allows professionals to make investment decisions on your behalf.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Discretionary Investment Management: Definition, Benefits & Risks

Welcome to our Finance category, where we explore various financial concepts and strategies to help you make informed decisions. In this post, we will delve into the world of Discretionary Investment Management – what it means, its benefits, and the risks involved. So, if you’re curious about entrusting your investments to the hands of professionals, read on!

Key Takeaways:

- Discretionary Investment Management involves hiring professionals to manage your investment portfolio on your behalf, based on your financial goals and risk appetite.

- Benefits of Discretionary Investment Management include time savings, expertise of professionals, and personalized investment strategies.

First, let’s define what Discretionary Investment Management is. Essentially, it is a strategy where you delegate the day-to-day management of your investment portfolio to an investment professional, typically a financial advisor or a portfolio manager. These professionals have the knowledge and experience to make informed decisions on your behalf, based on your stated investment goals and risk tolerance.

Benefits of Discretionary Investment Management:

1. Time Savings: By opting for Discretionary Investment Management, you free up valuable time that would otherwise be spent on researching, analyzing, and executing investment decisions. Instead, you can focus on other aspects of your life or business, knowing that your investments are being handled by capable professionals.

2. Expertise of Professionals: Discretionary investment managers are trained professionals with in-depth knowledge of financial markets, investment vehicles, and risk management. They have access to extensive research and analysis tools, enabling them to make well-informed investment choices on your behalf.

3. Personalized Investment Strategies: A key advantage of discretionary management is the customization it offers. The investment professional will take the time to understand your financial goals, risk tolerance, and investment time horizon. They will then develop a tailored investment strategy unique to your circumstances, ensuring that your portfolio aligns with your objectives.

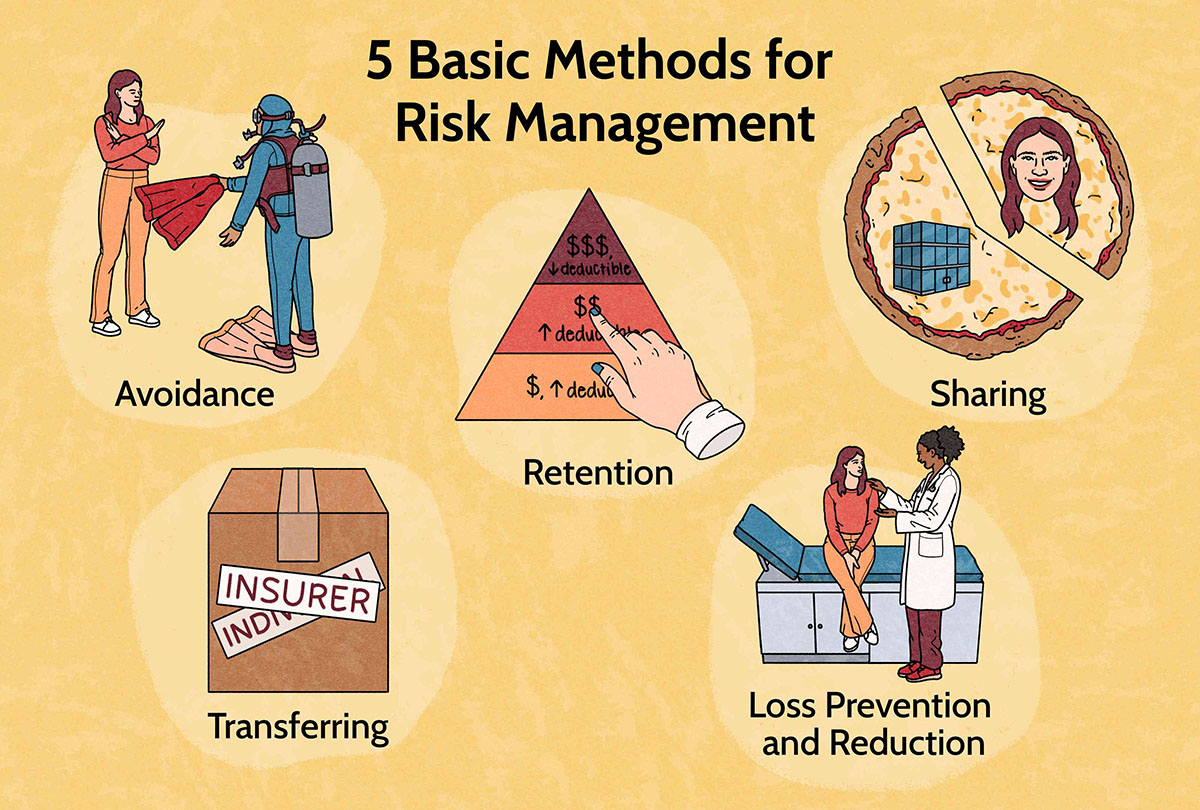

Risks Involved in Discretionary Investment Management:

1. Lack of Control: When you delegate the management of your investments to a third party, you relinquish some level of control and decision-making power. While this can be advantageous for those who prefer a hands-off approach, it may not be suitable for individuals who actively want to be involved in their investment decisions.

2. Potential for Misalignment: Even though investment managers strive to understand your goals and risk tolerance, there is always a possibility that their decisions may not perfectly align with your expectations. It’s essential to maintain open communication with your investment manager and regularly review your portfolio to ensure it remains in line with your evolving needs.

3. Fees and Costs: Discretionary Investment Management typically incurs fees, which can vary depending on the provider and the level of service. It’s crucial to understand the fee structure and evaluate whether the services provided justify the associated costs.

So, should you opt for Discretionary Investment Management? It depends on your individual circumstances, financial goals, and preferences. If you value professional expertise, personalized strategies, and time savings, it may be worth considering. However, ensure you thoroughly research and assess potential investment managers before entrusting them with your hard-earned money.

In conclusion, Discretionary Investment Management can provide numerous benefits, including time savings, access to expertise, and tailored investment strategies. However, it’s essential to be aware of the potential risks involved and to carefully weigh them against the advantages. We hope this post has shed light on this investment approach and helps you make more informed decisions for your financial future.