Home>Finance>How Are Credit Default Swaps Exposure Accounted For In Audits

Finance

How Are Credit Default Swaps Exposure Accounted For In Audits

Published: March 4, 2024

Learn how credit default swaps exposure is accounted for in audits in the finance industry. Understand the auditing process for managing financial risk.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the intricate world of finance, where risk and uncertainty are omnipresent, financial instruments such as credit default swaps (CDS) play a pivotal role in managing and mitigating risks. These derivatives, which gained notoriety during the 2008 financial crisis, allow investors to hedge against the risk of default on loans or bonds. However, the accounting and auditing of credit default swaps exposure present unique challenges that require a deep understanding of financial reporting standards and risk assessment.

As the global financial landscape continues to evolve, the need for transparency and accuracy in financial reporting has become increasingly crucial. This is particularly true for entities that engage in complex financial transactions involving credit default swaps. Understanding how these instruments are accounted for and audited is essential for stakeholders, including investors, regulators, and the public, to gauge the true financial health and risk exposure of an entity.

In this article, we will delve into the intricacies of credit default swaps, explore the accounting methods used to measure their exposure, and examine the auditing processes involved in ensuring their proper disclosure and valuation. By shedding light on these critical aspects, we aim to provide clarity on how credit default swaps exposure is accounted for in audits, offering valuable insights for professionals and enthusiasts in the realms of finance and accounting.

Understanding Credit Default Swaps

Credit default swaps (CDS) are derivative contracts that allow investors to protect themselves against the risk of default on loans or bonds. They function as a form of insurance, where the buyer of the CDS makes periodic payments to the seller in exchange for protection against potential credit events, such as default or restructuring of the underlying debt. In the event of a credit event, the seller compensates the buyer for the loss incurred due to the default.

One of the key features of credit default swaps is that they enable investors to speculate on the creditworthiness of a particular entity or the overall credit market. This means that CDS can be used not only for hedging existing credit exposure but also for taking speculative positions on the credit quality of debt issuers. As a result, credit default swaps have the potential to significantly impact the stability and functioning of financial markets.

It’s important to note that credit default swaps are traded over-the-counter (OTC), which means they are not transacted on formal exchanges. This OTC nature gives rise to concerns about transparency and counterparty risk, as the terms of CDS contracts are often customized and not readily visible to the public. Additionally, the interconnectedness of market participants through CDS transactions has implications for systemic risk, as demonstrated during the 2008 financial crisis.

Understanding the mechanics of credit default swaps is essential for comprehending their accounting and auditing implications. The complex nature of these financial instruments, coupled with their potential impact on financial stability, underscores the need for robust accounting standards and rigorous auditing procedures to ensure transparency, accuracy, and risk mitigation.

Accounting for Credit Default Swaps Exposure

Accounting for credit default swaps (CDS) exposure involves the measurement and recognition of the fair value of these financial instruments on the balance sheet, as well as the disclosure of associated risks in the financial statements. The accounting treatment of CDS is guided by established financial reporting standards, such as the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP) in the United States.

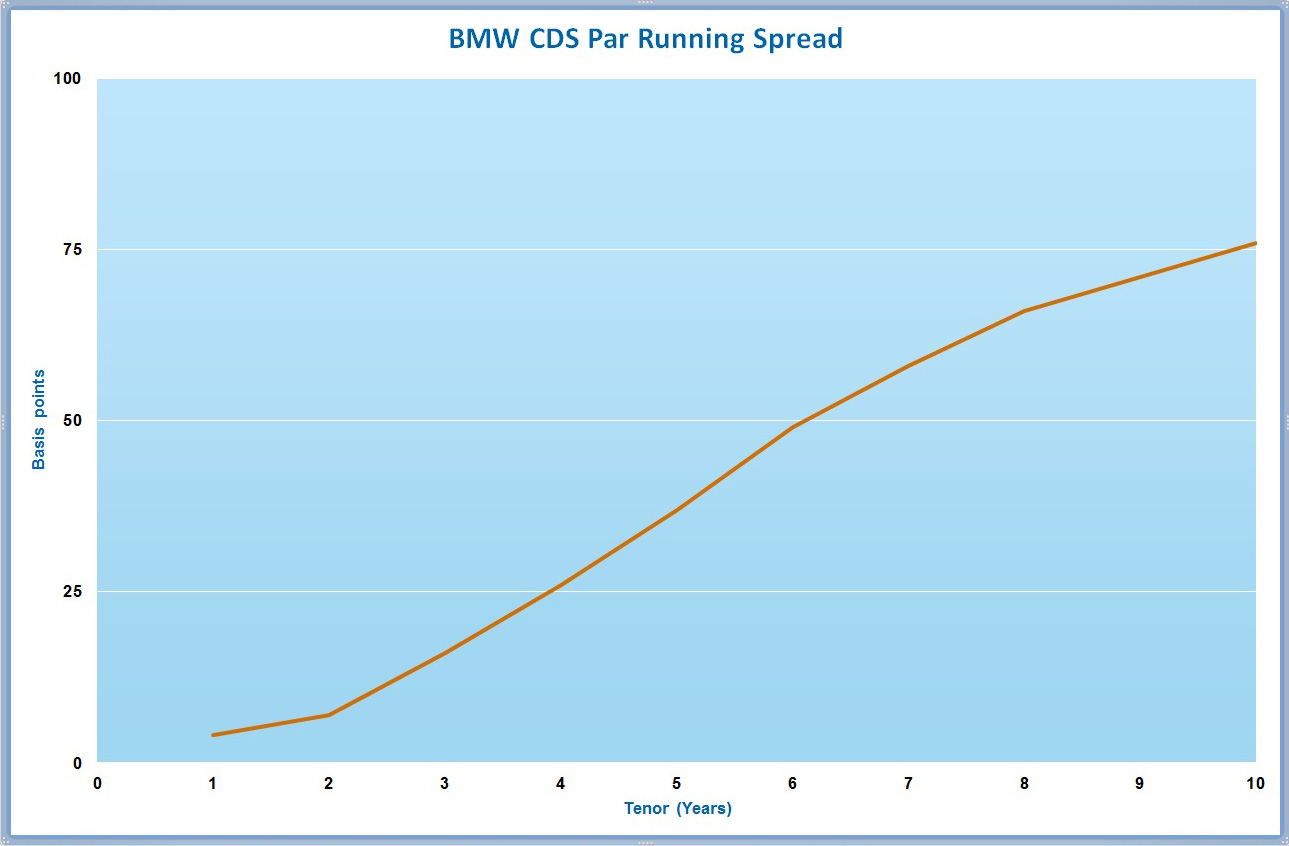

Under these standards, entities are required to assess the fair value of their credit default swaps at each reporting date. The fair value is determined by considering factors such as the credit quality of the reference entity, the term of the CDS contract, prevailing market interest rates, and the likelihood of credit events occurring. Changes in the fair value of CDS exposure are recognized in the income statement, resulting in periodic gains or losses that reflect the fluctuations in credit risk and market conditions.

Furthermore, entities must provide extensive disclosures in the footnotes to the financial statements regarding their credit default swaps exposure. These disclosures typically include information on the notional amount of CDS contracts, the fair value of the contracts, the credit quality of the reference entities, and the nature of the entity’s involvement in CDS transactions, among other relevant details. The goal of these disclosures is to enhance transparency and enable stakeholders to assess the potential impact of credit default swaps on an entity’s financial position and risk profile.

It’s important to recognize that the accounting for credit default swaps can be complex, particularly when dealing with customized or structured CDS transactions. Entities must exercise judgment and apply valuation techniques that reflect the unique characteristics of their CDS exposure, while adhering to the principles of prudence and faithful representation in financial reporting.

Given the significance of credit default swaps in modern financial markets, the accounting treatment of CDS exposure plays a crucial role in portraying the true financial position of entities and providing insights into their risk management practices.

Auditing Credit Default Swaps Exposure

Auditing credit default swaps (CDS) exposure involves the thorough examination of an entity’s CDS transactions, their valuation, and the related disclosures to provide assurance on the fairness and reliability of the financial statements. Given the complexity and inherent risks associated with CDS, auditors play a critical role in assessing the accuracy of the accounting treatment and the adequacy of disclosures pertaining to CDS exposure.

When auditing CDS exposure, auditors focus on several key areas to ensure compliance with auditing standards and the faithful representation of the entity’s financial position. They assess the entity’s internal controls over CDS transactions, including risk management processes, valuation methodologies, and the monitoring of counterparty credit risk. This evaluation helps auditors understand the entity’s risk management framework and the controls in place to mitigate potential CDS-related risks.

Furthermore, auditors scrutinize the valuation of CDS contracts, examining the methodologies used by the entity to determine the fair value of its CDS exposure. This involves assessing the reasonableness of key assumptions, the reliability of market data used in the valuation process, and the consistency of valuation techniques with applicable accounting standards. Auditors also consider the qualifications and independence of valuation specialists engaged by the entity, if applicable, to ensure the integrity of the valuation process.

Another crucial aspect of auditing CDS exposure is the evaluation of the disclosures provided in the financial statements. Auditors assess the completeness and clarity of the disclosures related to CDS, including the notional amounts of CDS contracts, the fair value of CDS exposure, the nature of the underlying reference entities, and the entity’s risk management policies concerning CDS. This scrutiny aims to verify the transparency and adequacy of information provided to stakeholders regarding the entity’s CDS activities and associated risks.

Given the evolving nature of financial instruments and the complexities surrounding CDS, auditors must stay abreast of regulatory developments, accounting standards, and best practices related to auditing CDS exposure. By conducting rigorous and meticulous audits of CDS transactions, auditors contribute to the credibility and reliability of financial reporting, providing stakeholders with confidence in the entity’s management of CDS-related risks and exposures.

Conclusion

In conclusion, the accounting and auditing of credit default swaps (CDS) exposure represent critical components of financial reporting and assurance, particularly in the context of complex and dynamic financial markets. The understanding of CDS instruments, their accounting treatment, and the auditing processes involved is essential for stakeholders to make informed decisions and assess an entity’s risk profile accurately.

Credit default swaps, serving as risk management tools and speculative instruments, have the potential to significantly impact an entity’s financial position and market stability. As such, the accurate measurement and transparent disclosure of CDS exposure are paramount in providing a true and fair view of an entity’s financial health. Accounting standards require entities to assess the fair value of CDS contracts and provide comprehensive disclosures regarding their CDS activities, enabling stakeholders to evaluate the associated risks and potential impacts on financial performance.

Moreover, the auditing of CDS exposure plays a pivotal role in providing assurance on the reliability of an entity’s financial statements. Auditors meticulously examine an entity’s internal controls over CDS transactions, scrutinize the valuation methodologies used, and evaluate the adequacy of disclosures to ensure compliance with auditing standards and the faithful representation of CDS exposure. By doing so, auditors contribute to the credibility and transparency of financial reporting, instilling confidence in stakeholders and regulators.

As financial markets continue to evolve and innovate, the accounting and auditing of credit default swaps will remain a focal point in the realm of finance and accounting. The dynamic nature of CDS instruments, coupled with their potential impact on systemic risk, underscores the importance of robust accounting standards, rigorous auditing procedures, and ongoing professional development for finance and audit professionals.

By shedding light on the intricacies of CDS exposure accounting and auditing, this article aims to enhance the understanding of these critical processes and their significance in the broader landscape of financial reporting and risk management.