Finance

FAKO Score Definition

Published: November 22, 2023

Learn what FAKO Score means in finance and how it impacts your creditworthiness. Discover how to interpret and improve your FAKO score today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding FAKO Score Definition: What You Need to Know

When it comes to managing your finances, understanding your credit score is crucial. You may already be familiar with the traditional FICO score, but have you ever heard of the term FAKO score? In this blog post, we’ll delve into the FAKO score definition, break down its significance, and provide you with the key takeaways you need to know about it.

Key Takeaways:

- The term “FAKO score” refers to any credit score that is not FICO-generated.

- FAKO scores are often provided by credit monitoring services or websites and may differ from your actual FICO score.

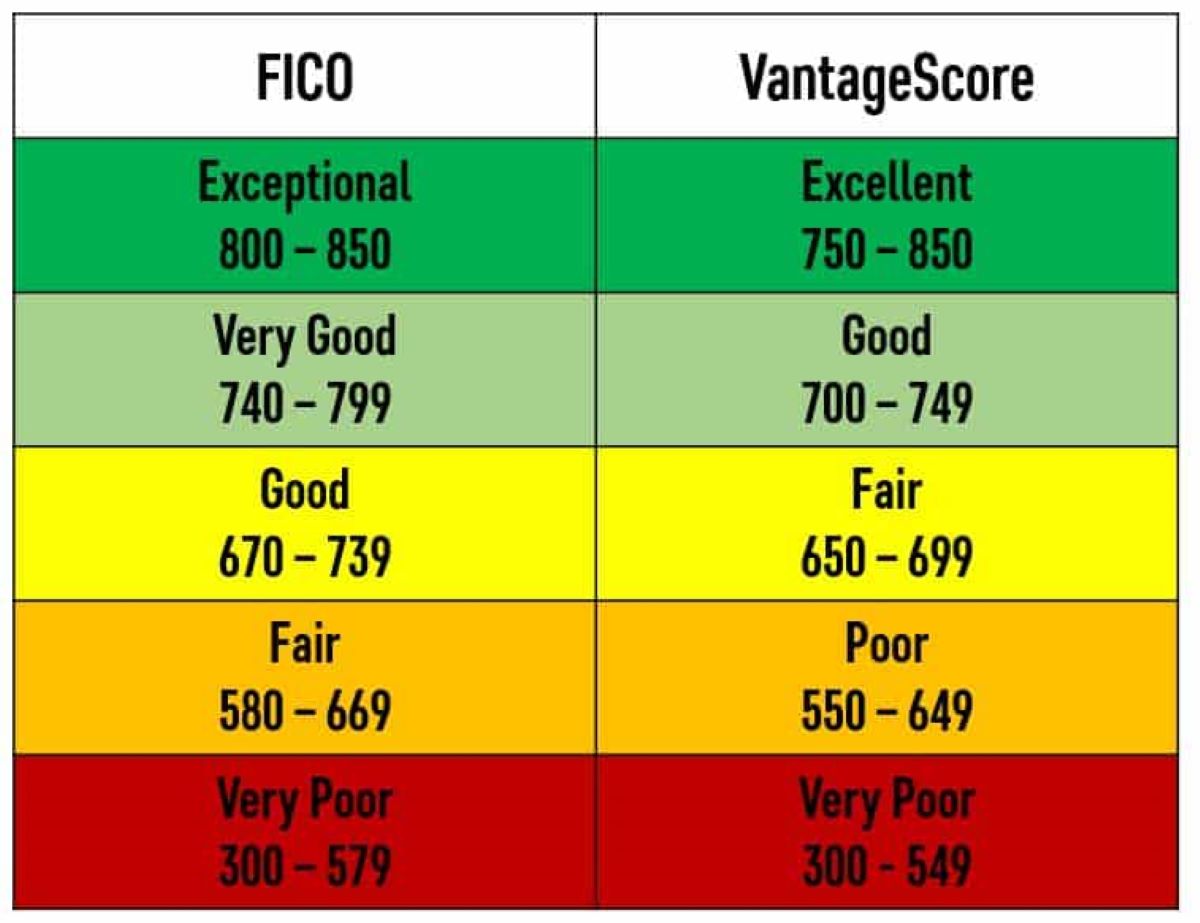

Now, let’s dive deeper into the FAKO score definition. In the world of credit monitoring, FAKO score is a term used to describe any credit score that is not generated by the widely accepted FICO scoring model. While the FICO score is considered the gold standard in creditworthiness assessment, FAKO scores can still provide you with valuable insights into your credit standing.

It’s worth noting that FAKO scores are typically provided by credit monitoring services or websites. These services calculate credit scores using their proprietary algorithms, which may differ from the FICO scoring model. As a result, your FAKO score may not exactly match your FICO score, but it can still give you an indication of where you stand in terms of creditworthiness.

Now that you have a basic understanding of what a FAKO score is, let’s explore why it’s important. Here are a few reasons why you should pay attention to your FAKO score:

- Monitoring your credit: FAKO scores provide a convenient way to keep an eye on your credit health without having to rely solely on your FICO score. By regularly checking your FAKO score, you can track changes in your creditworthiness and identify any potential issues.

- Educational purposes: FAKO scores can serve as a learning tool to help you understand the factors that influence your credit score. These scores often come with detailed explanations or suggestions to help you improve your credit standing.

- Comparing different credit scoring models: FAKO scores can give you a more comprehensive view of your creditworthiness by comparing them to your FICO score. This can help you identify any discrepancies between the two and gain a better understanding of how your credit is evaluated.

In conclusion, while the FICO score remains the most widely recognized credit scoring model, FAKO scores can still be valuable tools for monitoring your credit health and gaining insights into your creditworthiness. Just remember that FAKO scores may not always match your actual FICO score, but they can still provide you with valuable information.

So, the next time you come across the term FAKO score, you’ll know exactly what it means and why it matters. Stay on top of your credit game, empower yourself with knowledge, and make informed financial decisions.