Finance

What Is Levered Free Cash Flow

Published: December 21, 2023

Discover the concept of levered free cash flow in finance and understand its importance for evaluating a company's financial performance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance! In this article, we will delve into the concept of levered free cash flow and its significance in financial analysis. If you have ever wondered how businesses evaluate their financial health and make informed decisions, levered free cash flow plays a crucial role in this process.

Free cash flow is a widely used financial metric that measures the cash generated by a company after deducting its operating expenses and capital expenditures. It indicates the amount of cash available to the company to reinvest in its operations, pay off debt, or distribute to shareholders as dividends. However, when a company carries debt on its balance sheet, the concept of levered free cash flow becomes relevant.

Levered free cash flow takes into account the impact of interest and debt repayment on a company’s cash flow. It gives a more accurate representation of the cash available to the company’s stakeholders after accounting for debt obligations. By calculating the levered free cash flow, investors and analysts can better evaluate a company’s financial health and its ability to generate cash in a leveraged environment.

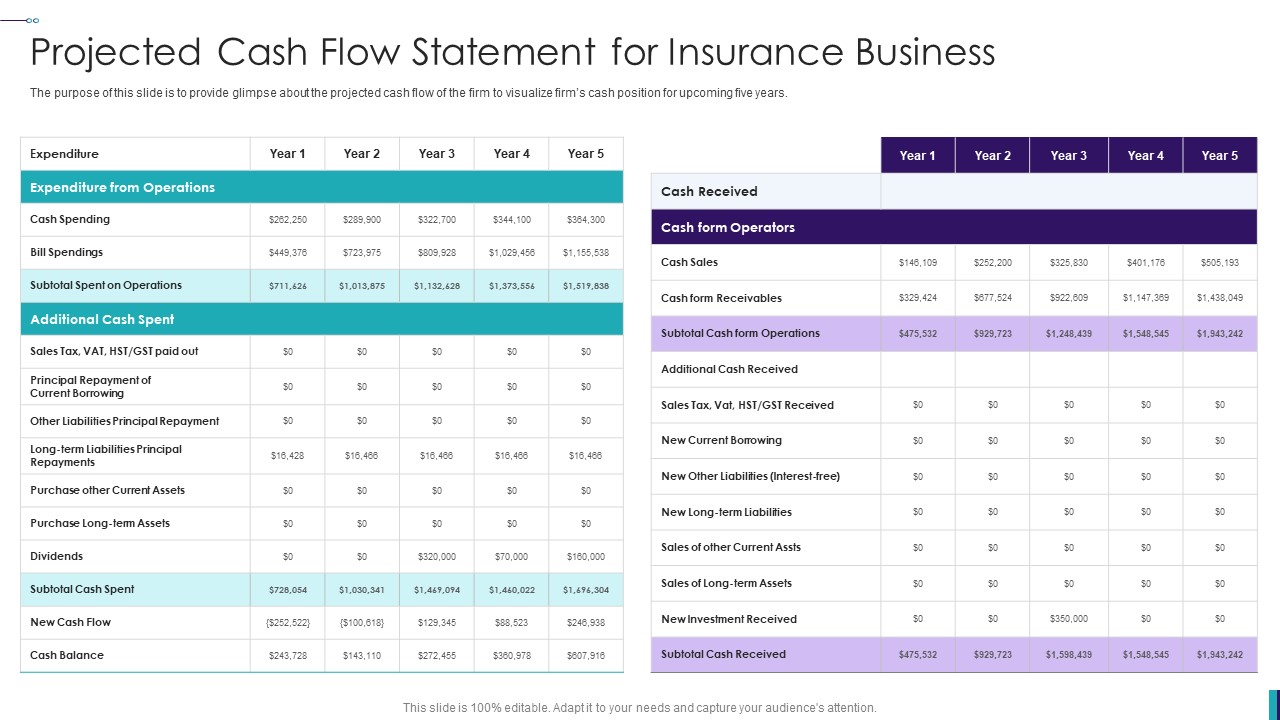

The calculation of levered free cash flow involves several components, including operating cash flow, capital expenditures, interest expense, and debt repayments. This comprehensive analysis provides a clearer picture of the company’s cash flow dynamics and its capacity to meet its financial obligations.

Understanding levered free cash flow is crucial because it helps investors assess the sustainability of a company’s dividend payments, determine its ability to service its debt, and evaluate the potential for future growth. By focusing on the cash generated after deducting interest expense and debt repayment, analysts can gain insights into the company’s financial flexibility and its ability to weather economic downturns or industry-specific challenges.

Moreover, levered free cash flow analysis enables investors to compare companies with differing capital structures on a level playing field. By adjusting for the impact of debt, analysts can make more accurate comparisons and evaluations of companies within the same industry or sector. This analysis helps identify companies that have stronger cash flow generation capabilities and may be better positioned for long-term success.

In the next sections, we will dive deeper into the calculation, importance, uses, and limitations of levered free cash flow. By the end of this article, you will have a thorough understanding of this vital financial metric and its implications for investment decision-making.

Definition of Levered Free Cash Flow

Levered Free Cash Flow (LFCF) is a financial metric that takes into account the impact of a company’s debt and interest payments on its cash flow. It measures the cash available to stakeholders after deducting operating expenses, capital expenditures, interest expense, and debt repayment.

When a company carries debt on its balance sheet, its cash flow dynamics change. Interest payments and debt repayments reduce the cash available for reinvestment in the business or distribution to shareholders. Levered free cash flow adjusts for these debt-related obligations to provide a more accurate representation of a company’s financial health.

The formula for calculating levered free cash flow is:

LFCF = Operating Cash Flow – Capital Expenditures – Interest Expense – Debt Repayments

The components of the formula are as follows:

- Operating Cash Flow: This represents the cash generated from a company’s core operations, such as revenue from sales, minus operating expenses. It indicates the company’s ability to generate cash from its day-to-day activities.

- Capital Expenditures: This includes the money spent on acquiring or upgrading assets required for the company’s operations. It typically includes investments in property, plant, and equipment.

- Interest Expense: This is the amount of interest paid on the company’s debt. It represents the cost of borrowing and impacts the company’s profitability and cash flow.

- Debt Repayments: This refers to the portion of the company’s debt that is repaid during a specific period. It includes principal repayments and reduces the company’s outstanding debt.

The resulting levered free cash flow figure provides insights into the amount of cash available to a company’s stakeholders, including shareholders and debt holders, after considering the impact of debt obligations. It helps assess the company’s ability to meet its financial commitments, invest in growth opportunities, and distribute cash to shareholders.

Levered free cash flow is a valuable metric for investors and analysts as it offers a more comprehensive view of a company’s financial position in a leveraged environment. By accounting for the impact of debt on cash flow, it enables better evaluations and comparisons of companies with varying capital structures. This analysis assists in making informed investment decisions and identifying companies with strong cash flow generation capabilities.

Calculation of Levered Free Cash Flow

The calculation of levered free cash flow involves several components and follows a specific formula. By understanding this calculation, investors and analysts can obtain a clearer picture of a company’s financial health and its ability to generate cash in a leveraged environment.

The formula for calculating levered free cash flow is as follows:

LFCF = Operating Cash Flow – Capital Expenditures – Interest Expense – Debt Repayments

Let’s break down the components of the formula:

- Operating Cash Flow: This represents the cash generated from a company’s core operations, excluding any interest or tax payments. It is calculated by taking the net income and adjusting it for non-cash expenses, such as depreciation and amortization, as well as changes in working capital.

- Capital Expenditures: This includes the money a company spends on acquiring or upgrading its assets, such as property, plant, and equipment. It represents investments made in the business to support its operations and future growth.

- Interest Expense: This refers to the cost of borrowing for the company. It includes the interest payments made on its debt, such as loans or bonds. Interest expense is a crucial factor to consider as it affects the company’s profitability and cash flow.

- Debt Repayments: This represents the portion of the company’s debt that is repaid during a specific period. It includes both principal repayments and any scheduled interest payments. Debt repayments reduce the company’s outstanding debt and impact its cash flow.

Once you have obtained the values for each component, simply subtract the capital expenditures, interest expense, and debt repayments from the operating cash flow to calculate the levered free cash flow.

It’s important to note that levered free cash flow calculation may vary depending on the specific financial analysis being performed. Some practitioners may choose to adjust the formula by including or excluding certain items based on their evaluation requirements. Nevertheless, the core components of operating cash flow, capital expenditures, interest expense, and debt repayments remain the key factors in the calculation.

By calculating and analyzing the levered free cash flow, investors and analysts gain insights into a company’s ability to generate cash after accounting for its debt-related obligations. This metric enables them to evaluate the company’s financial flexibility, sustainability of dividend payments, debt-servicing capability, and potential for long-term growth.

Overall, the calculation of levered free cash flow plays a vital role in assessing a company’s financial health and making informed investment decisions.

Importance of Levered Free Cash Flow

Levered Free Cash Flow (LFCF) is a vital financial metric that holds significant importance in evaluating a company’s financial health and its ability to generate cash in a leveraged environment. Here are some key reasons why understanding and analyzing LFCF is crucial:

- Assessing Financial Health: Levered free cash flow provides a more accurate picture of a company’s financial health by considering the impact of debt and interest payments on cash flow. It allows investors and analysts to understand the company’s ability to generate cash after satisfying its debt obligations, providing insights into its overall financial stability.

- Evaluating Dividend Sustainability: Dividend payments are a key consideration for many investors. By analyzing LFCF, investors can assess whether a company has enough cash available to sustain its dividend payments while also meeting its debt obligations. LFCF helps evaluate the sustainability of dividend distributions and provides insights into a company’s commitment to returning value to its shareholders.

- Measuring Debt Servicing Ability: LFCF plays a crucial role in evaluating a company’s ability to service its debt. By considering debt repayments as part of the cash flow calculation, analysts can determine whether the company has sufficient cash flow to make timely interest and principal payments. This information is critical for lenders, bondholders, and investors to assess the company’s creditworthiness and ability to meet its financial obligations.

- Spotting Growth Opportunities: Analyzing LFCF allows investors and analysts to identify companies that have strong cash flow generation capabilities. A positive LFCF indicates that the company has excess cash that can be reinvested in its operations, enabling growth and expansion. Identifying companies with healthy LFCF figures can help uncover potential investment opportunities with robust financial prospects.

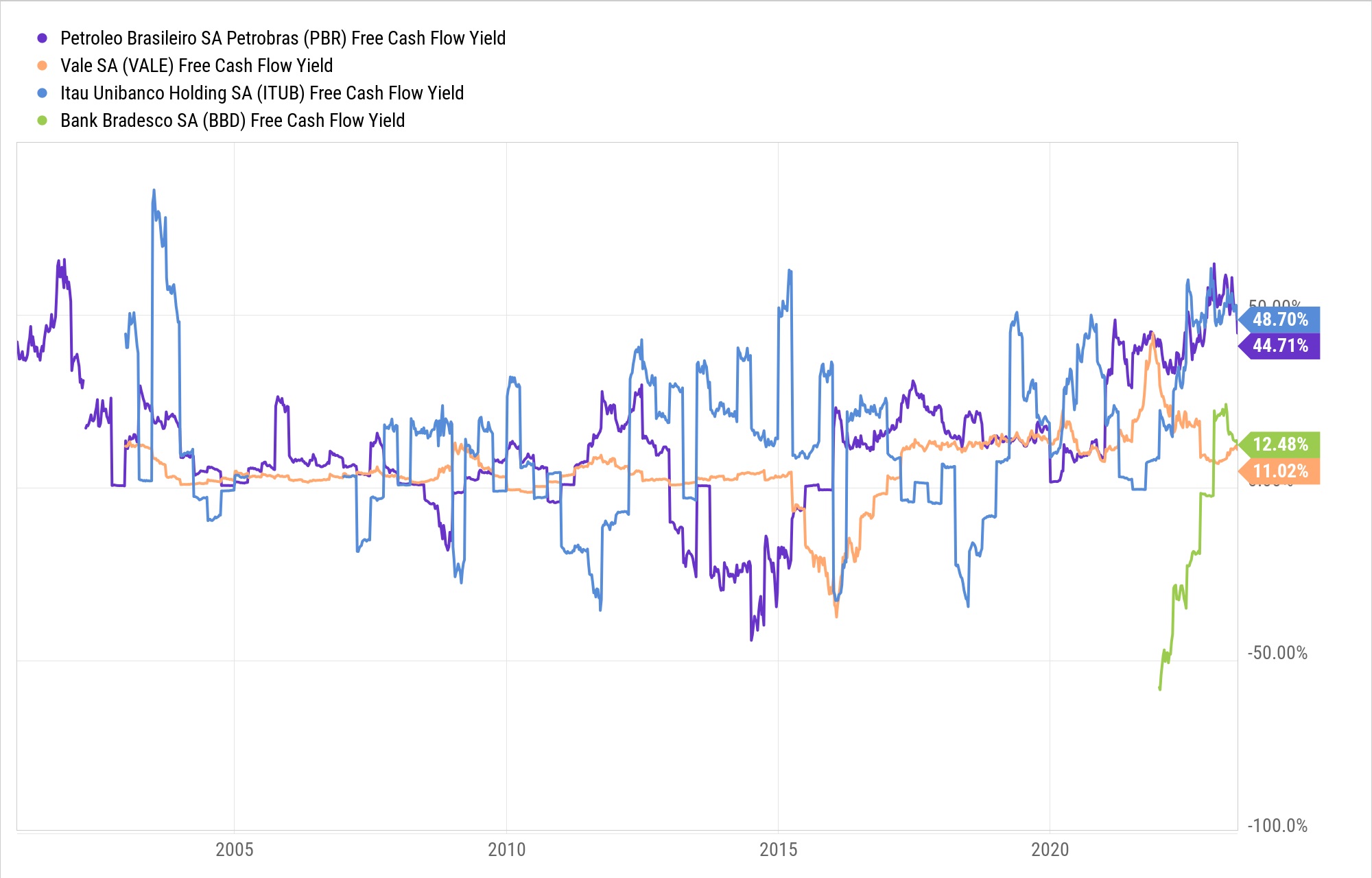

- Comparing Companies on a Level Playing Field: Companies with different capital structures can have varying cash flow dynamics. By adjusting for debt-related expenses, LFCF enables meaningful comparisons and evaluations of companies within the same industry or sector. This analysis helps identify companies that have a better ability to generate cash and make informed investment decisions.

Ultimately, the importance of levered free cash flow lies in its ability to provide a comprehensive assessment of a company’s financial health, debt-servicing capability, dividend sustainability, growth prospects, and ability to weather economic challenges. By considering the impact of debt on cash flow, LFCF offers valuable insights for investors and analysts, enabling them to make well-informed decisions and assess the long-term viability of a company.

Uses of Levered Free Cash Flow Analysis

Levered Free Cash Flow (LFCF) analysis is a powerful tool used by investors and analysts to evaluate the financial health and performance of a company. Here are some of the key uses of levered free cash flow analysis:

- Evaluating Investment Returns: LFCF analysis helps investors assess the potential returns on their investments. By examining the amount of cash available to shareholders after considering debt-related obligations, investors can determine the company’s capacity to generate cash and distribute it as dividends. Comparing LFCF figures across different investment opportunities allows investors to prioritize investments with better return prospects.

- Assessing Financial Strength: LFCF analysis is crucial for evaluating a company’s financial strength and its ability to meet its debt obligations. By considering the impact of interest expense and debt repayments on cash flow, analysts can gauge the company’s cash flow stability and determine if it has sufficient funds to service its debt. This analysis is especially important for lenders and credit rating agencies when evaluating a company’s creditworthiness.

- Measuring Growth Potential: LFCF analysis offers insights into a company’s growth potential. A positive LFCF suggests that the company generates more cash than it requires for its day-to-day operations and debt obligations. This excess cash can be reinvested in the business to fund expansion initiatives, research and development, or strategic acquisitions. Evaluating LFCF enables investors and analysts to identify companies with the financial resources to fuel future growth.

- Comparing Companies: Companies with different capital structures may have varying cash flow dynamics. LFCF analysis allows for better comparisons among companies within the same industry or sector by adjusting for the impact of debt. It provides a more accurate assessment of their free cash generation abilities, enabling investors and analysts to identify companies that are more efficient in generating cash and have a competitive advantage.

- Supporting Investment Decisions: LFCF analysis plays a significant role in supporting investment decisions. By considering the impact of debt on cash flow, analysts can evaluate a company’s financial soundness, its ability to generate cash, and its potential for long-term success. This analysis provides investors with valuable insights to make informed investment decisions based on a company’s financial health and cash flow generation capabilities.

In summary, levered free cash flow analysis has multiple uses in assessing investment returns, measuring financial strength, evaluating growth potential, comparing companies, and supporting investment decisions. By considering the impact of debt on cash flow, it provides a comprehensive view of a company’s financial health and helps investors and analysts make well-informed decisions in the dynamic world of finance.

Limitations of Levered Free Cash Flow

While levered free cash flow (LFCF) analysis is a valuable tool for evaluating a company’s financial health and performance, it is important to be aware of its limitations. Here are some of the key limitations to consider:

- Dependency on Assumptions: LFCF analysis heavily relies on various assumptions, such as future growth rates, cost of capital, and interest rates. Small changes in these assumptions can significantly impact the calculated free cash flow figures and subsequent analyses. It’s crucial to review and critically assess the underlying assumptions to ensure the accuracy of the LFCF analysis.

- Sensitivity to Changes in Working Capital: Fluctuations in a company’s working capital, such as inventory levels, accounts receivable, and accounts payable, can affect its cash flow. LFCF analysis assumes constant working capital levels, which may not always reflect the dynamic nature of a company’s operations. Changes in working capital can impact the accuracy of the calculated LFCF figure.

- Exclusion of Non-Cash Expenses: LFCF analysis does not account for non-cash expenses, such as depreciation and amortization. While these expenses do not directly impact cash flow, they represent a portion of the company’s operating costs. Excluding these expenses from the analysis may not provide a holistic view of the company’s overall financial performance.

- Lack of Consideration for Timing of Cash Flows: LFCF analysis considers the overall cash flow generated by a company, but it doesn’t take into account the timing of these cash flows. It is important to consider when the cash is received or spent, as timing can affect a company’s liquidity and ability to meet its financial obligations.

- Insufficient Consideration for Industry-specific Factors: LFCF analysis may not adequately address industry-specific nuances and risks. Different industries may have varying capital requirements, working capital dynamics, and debt structures. A one-size-fits-all approach to LFCF analysis may not capture the specific challenges and opportunities of a particular industry.

- Exclusion of Future Investments and Capital Expenditures: LFCF analysis focuses on the cash generated after deducting operating expenses, interest payments, and debt repayments. However, it may not consider the future investments and capital expenditures necessary for a company’s growth. By excluding these future expenses, the analysis may not capture the full picture of a company’s long-term viability.

Despite these limitations, levered free cash flow analysis can still provide valuable insights into a company’s financial health and performance. It is essential to consider these limitations and complement the analysis with other financial metrics and qualitative assessments to form a well-rounded understanding of a company’s overall financial position.

Conclusion

Levered Free Cash Flow (LFCF) analysis is a critical tool for investors and analysts in evaluating the financial health and performance of a company. By considering the impact of debt and interest payments on cash flow, LFCF provides a more comprehensive assessment of a company’s ability to generate cash in a leveraged environment.

Through the calculation of LFCF, investors can assess a company’s financial strength, debt-servicing capability, dividend sustainability, growth potential, and overall financial stability. This analysis enables better comparisons among companies with different capital structures and facilitates more informed investment decision-making.

However, it is important to recognize the limitations of LFCF analysis. These include its reliance on assumptions, lack of consideration for timing of cash flows, exclusion of non-cash expenses, insensitivity to industry-specific factors, and exclusion of future investments and capital expenditures. It is essential to use LFCF analysis in conjunction with other financial metrics and qualitative assessments to obtain a holistic view of a company’s financial position.

In conclusion, leveraging free cash flow analysis is a powerful tool that provides valuable insights into a company’s financial health, debt obligations, and cash flow generation capabilities. By analyzing LFCF, investors, analysts, and lenders can make informed decisions regarding investment opportunities, creditworthiness, and financial stability. However, it is imperative to approach LFCF analysis with a critical mindset and consider its limitations in order to gain a thorough understanding of a company’s financial situation.