Home>Finance>What Is Unlevered Free Cash Flow (UFCF)? Definition And Formula

Finance

What Is Unlevered Free Cash Flow (UFCF)? Definition And Formula

Published: February 14, 2024

Learn the definition and formula for Unlevered Free Cash Flow (UFCF) in finance. Understand how this metric helps evaluate a company's financial performance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Unlevered Free Cash Flow (UFCF)

When it comes to understanding the intricacies of finance, one important concept that often comes up is Unlevered Free Cash Flow (UFCF). But what exactly is UFCF and why is it so crucial for businesses and investors? In this blog post, we will delve into the definition and formula of UFCF to help demystify this concept.

Key Takeaways:

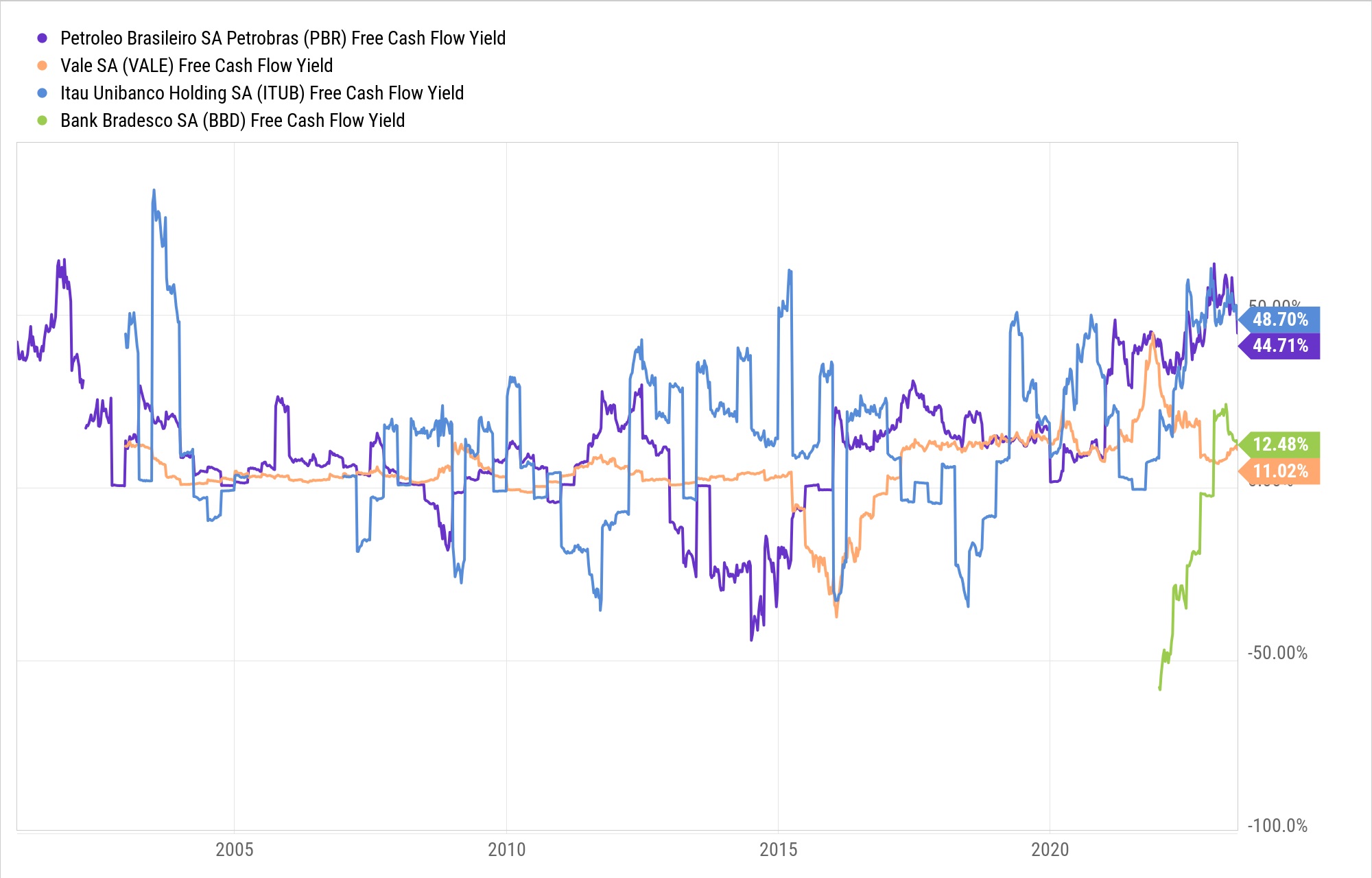

- Unlevered Free Cash Flow (UFCF) is a financial metric that calculates the cash generated by a business before taking into account the effects of debt and interest payments.

- UFCF is an essential tool for evaluating the financial health and value of a company, as it provides insights into its ability to generate cash from its core operations.

So, what exactly is Unlevered Free Cash Flow (UFCF)? Essentially, it refers to the amount of cash a company generates from its operations that is available to all stakeholders, including debtors and equity holders, before accounting for any interest payments or taxes. UFCF is a more comprehensive measure of a company’s profitability than traditional earnings as it takes into account not only revenue and expenses but also the company’s investments in capital assets and working capital.

To calculate UFCF, you need to follow a simple formula:

UFCF = Operating Cash Flow – Capital Expenditures

Let’s break down the components of this formula:

- Operating Cash Flow: This refers to the cash flowing into the company from its core operations, such as sales, minus the cash flowing out as expenses, excluding interest and taxes.

- Capital Expenditures: This represents the amount of cash that a company spends on acquiring or maintaining its capital assets, such as equipment, buildings, or technology.

By subtracting the capital expenditures from the operating cash flow, we arrive at the Unlevered Free Cash Flow (UFCF). This metric helps assess a company’s ability to generate cash from its operations, which is crucial for reinvesting in the business, paying off debts, or distributing dividends to shareholders.

Key Takeaways:

- Unlevered Free Cash Flow (UFCF) is a financial metric that calculates the cash generated by a business before taking into account the effects of debt and interest payments.

- UFCF is an essential tool for evaluating the financial health and value of a company, as it provides insights into its ability to generate cash from its core operations.

In conclusion, Unlevered Free Cash Flow (UFCF) is a vital concept in finance that allows businesses and investors to evaluate a company’s cash-generating potential without the influence of debt. By understanding UFCF and how to calculate it, stakeholders can gain a clearer picture of a company’s financial health and make informed decisions. So, the next time you come across UFCF in your financial analysis, you’ll have a solid understanding of what it represents and why it matters.