Finance

How Do I Set Up Apple Savings Account

Published: November 26, 2023

Learn how to set up an Apple savings account and manage your finances with ease. Start saving for the future and achieve your financial goals today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Benefits of Apple Savings Account

- Requirements for Setting Up an Apple Savings Account

- Steps to Set Up an Apple Savings Account

- Adding Funds to an Apple Savings Account

- Monitoring and Managing an Apple Savings Account

- Withdrawals and Transfers from an Apple Savings Account

- FAQs about Apple Savings Account

- Conclusion

Introduction

Welcome to the world of Apple Savings Account, a convenient and secure way to manage your finances and save for the future. The Apple Savings Account is a virtual savings account offered by Apple, known for their innovative technology and user-friendly interfaces. Whether you’re a tech-savvy individual or simply looking for a smarter way to save, the Apple Savings Account is designed to meet your needs.

With the Apple Savings Account, you can enjoy a host of benefits that make saving easy and rewarding. From competitive interest rates to seamless integration with other Apple products and services, this account is built to enhance your financial wellbeing. Plus, with the added convenience of online and mobile banking, managing your savings has never been more convenient.

Setting up an Apple Savings Account is straightforward, requiring only a few prerequisites and a simple application process. Once you’ve opened your account, adding funds is as simple as a few clicks, and you can easily monitor and manage your savings through the intuitive interface. In this article, we’ll guide you through the process of setting up an Apple Savings Account and provide you with important tips to make the most out of your savings journey.

So, whether you’re saving for that dream vacation, a down payment on a home, or simply building an emergency fund, join us as we explore the world of Apple Savings Account and discover how this powerful financial tool can help you achieve your money-saving goals.

Benefits of Apple Savings Account

The Apple Savings Account offers a range of benefits that make it a smart choice for individuals looking to manage their finances and achieve their saving goals. Here are some key advantages of having an Apple Savings Account:

- Competitive Interest Rates: The Apple Savings Account offers competitive interest rates, which means your money can grow faster compared to traditional savings accounts. This can help you maximize your savings and reach your financial goals sooner.

- Seamless Integration with Apple Products: As an Apple Savings Account holder, you can enjoy seamless integration with other Apple products and services. This means you can easily track your savings progress, set up automatic transfers, and access your account from your iPhone, iPad, or Mac.

- Convenience of Online and Mobile Banking: With the Apple Savings Account, you can manage your funds conveniently from the comfort of your home or on the go. Whether you need to check your balance, transfer funds, or set up savings goals, it can all be done through the user-friendly online and mobile banking platforms.

- Security and Protection: Your funds in the Apple Savings Account are protected by robust security measures, ensuring that your money is safe and secure. Apple employs advanced encryption technology and multi-factor authentication to protect your account from unauthorized access.

- No Monthly Fees: Unlike some traditional savings accounts, the Apple Savings Account typically does not charge monthly maintenance fees. This means you can save more without worrying about additional costs eating into your savings.

- Flexible Saving Options: Whether you want to save for a specific goal or build an emergency fund, the Apple Savings Account offers flexibility in setting up and managing multiple savings goals. You can allocate funds to different goals and track your progress easily.

With these benefits, the Apple Savings Account provides a superior savings experience that combines convenience, security, and growth potential. It’s an excellent tool to help you take control of your finances and build a brighter financial future.

Requirements for Setting Up an Apple Savings Account

Opening an Apple Savings Account is a straightforward process, but there are a few requirements that you’ll need to meet. Here are the key requirements for setting up an Apple Savings Account:

- Age: You must be at least 18 years old to open an Apple Savings Account. This ensures that you have the legal capacity to enter into a financial agreement.

- Identification: You will need to provide a valid government-issued identification document, such as a passport or driver’s license. This is to verify your identity and comply with regulatory requirements.

- Residential Address: You will be required to provide proof of your residential address, such as a utility bill or a bank statement. This is necessary for address verification and to comply with anti-money laundering regulations.

- Social Security Number or Tax Identification Number: You will need to provide your social security number (SSN) or tax identification number (TIN). This information is required for tax reporting purposes.

- Funding Account: You will need to have a bank account from which you can transfer funds to your Apple Savings Account. This can be a checking account or another savings account held in your name.

- Apple ID: To set up an Apple Savings Account, you will need to have an Apple ID. If you don’t have one, you can easily create it during the account setup process.

Meeting these requirements ensures that you have the necessary documentation and personal information to open an Apple Savings Account. Once you have gathered all the required information, you can move forward with the account setup process. It’s worth noting that additional documentation or steps may be required depending on your location and the specific policies of the financial institution offering the Apple Savings Account.

Now that you understand the requirements, let’s move on to the steps involved in setting up your Apple Savings Account.

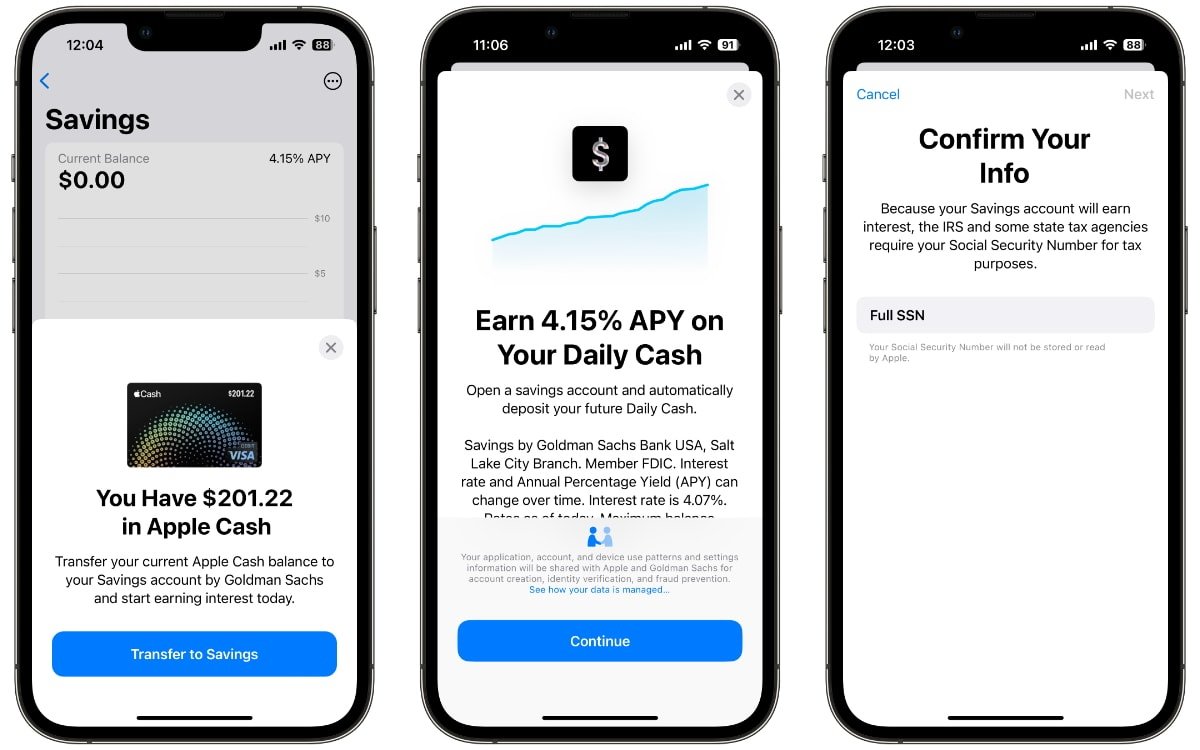

Steps to Set Up an Apple Savings Account

Setting up an Apple Savings Account is a simple and user-friendly process. Following these steps will guide you through opening your account:

- Visit the Apple Savings Account website: Start by visiting the official website of the financial institution offering the Apple Savings Account. Look for the section or page dedicated to opening a new account.

- Click on “Open an Account”: Once you’re on the account opening page, locate the “Open an Account” button and click on it to initiate the application process.

- Provide Personal Information: You will be prompted to enter your personal information, including your full name, date of birth, address, social security number or tax identification number, and contact information. Ensure that you provide accurate and up-to-date information.

- Set Up your Apple ID: If you don’t have an Apple ID, you will need to create one during the account setup process. Follow the instructions provided to create your Apple ID and set a secure password to protect your account.

- Agree to Terms and Conditions: Read through the terms and conditions of the Apple Savings Account carefully. If you agree to them, tick the checkbox or click on the “I Agree” button to proceed with the application.

- Verify your Identity: To verify your identity, you may be asked to upload scanned copies or photos of your identification documents, such as your passport or driver’s license. Follow the instructions provided and ensure that the documents are clear and legible.

- Fund your Account: Once your application has been submitted, you will need to fund your Apple Savings Account. You can do this by initiating a transfer from your linked bank account. Follow the instructions provided to complete the transfer.

- Confirmation and Account Activation: After successfully funding your Apple Savings Account, you will receive a confirmation email or notification. This will indicate that your account has been successfully opened and is now active.

Following these steps will ensure a smooth and hassle-free process of setting up your Apple Savings Account. It’s important to provide accurate information and follow the instructions carefully to avoid any delays or complications during the account opening process.

With your Apple Savings Account set up, the next step is to start adding funds and watching your savings grow. Let’s explore how you can add funds to your account in the next section.

Adding Funds to an Apple Savings Account

Once you have successfully set up your Apple Savings Account, it’s time to start adding funds and watch your savings grow. Here are a few common methods to add funds to your account:

- Electronic Funds Transfer (EFT): One of the most common ways to add funds to an Apple Savings Account is through an electronic funds transfer. You can link your existing bank account to your Apple Savings Account and initiate transfers directly from your bank’s online or mobile banking platform. Simply specify the amount you want to transfer and the destination account as your Apple Savings Account.

- Direct Deposit: If you receive wages or regular income through direct deposit, you can set up your Apple Savings Account as the deposit destination. Contact your employer or the entity responsible for your direct deposits and provide them with your Apple Savings Account details. This way, a portion of your earnings will be deposited directly into your savings account.

- Mobile Check Deposit: Some financial institutions offering the Apple Savings Account may provide a mobile check deposit feature. This allows you to deposit physical checks into your savings account by simply taking a photo of the check using the institution’s mobile banking app. This method saves you the hassle of physically visiting a branch or mailing in the check.

- In-Person Deposits: Depending on the financial institution, you may have the option to make in-person deposits at a branch location. This is particularly useful if you receive cash or checks that cannot be deposited electronically.

- Automatic Transfers: To ensure consistent and regular savings, you can set up automatic transfers from your linked bank account to your Apple Savings Account. This way, a predetermined amount will be transferred at specified intervals, allowing you to save effortlessly.

When adding funds to your Apple Savings Account, it’s important to consider any transfer fees or limits that may apply. Some financial institutions may impose transaction fees for certain types of transfers, so it’s crucial to familiarize yourself with the specific policies of your account provider.

Now that you know how to add funds to your Apple Savings Account, let’s move on to how you can monitor and manage your savings in the next section.

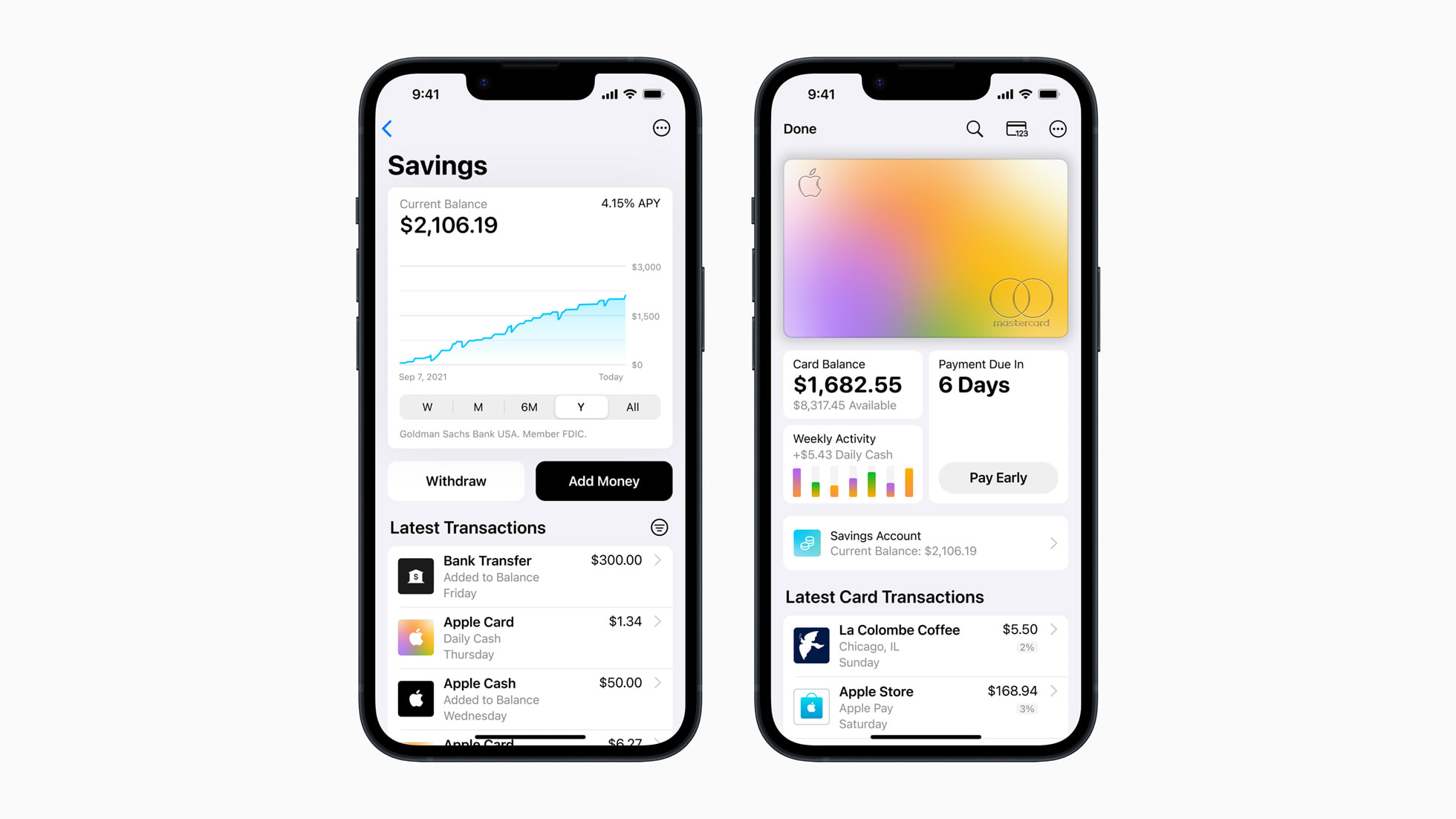

Monitoring and Managing an Apple Savings Account

Monitoring and managing your Apple Savings Account is essential to stay on top of your savings goals and make the most of your financial journey. Here are some practical tips for effectively monitoring and managing your account:

- Regularly Check your Account Balance: Make it a habit to check your Apple Savings Account balance regularly. This allows you to track your progress, ensure that your deposits are correctly reflected, and monitor any withdrawals or transfers from your account.

- Set Up Account Alerts: Take advantage of account alert features offered by your financial institution. These alerts can notify you about important account updates, such as when a deposit has been made, when your balance falls below a certain threshold, or when any transaction occurs involving your account.

- Review Account Statements: Reviewing your monthly or periodic account statements is crucial to ensure accurate record-keeping and identify any errors or discrepancies. Take the time to carefully review each statement and reconcile it with your own records.

- Utilize Online and Mobile Banking Tools: Leverage the online and mobile banking tools provided by your financial institution to manage your Apple Savings Account effectively. You can use these tools to transfer funds, set savings goals, create automatic transfers, and track your progress towards your financial objectives.

- Adjust Savings Goals as Needed: Life circumstances and financial goals may change over time. Regularly assess your savings goals and make adjustments as necessary. Whether it’s increasing your saving amount or modifying your target date, staying flexible with your goals can help you adapt to changing circumstances.

- Explore Additional Features and Benefits: Some Apple Savings Accounts may offer additional features and benefits, such as the ability to earn rewards or access special offers. Take the time to explore these features and take advantage of any opportunities to further boost your savings.

- Keep Your Contact Information Updated: Ensure that your contact information, such as your email address and phone number, is up to date. This will ensure that you receive important account notifications and communications from your financial institution.

By actively monitoring and managing your Apple Savings Account, you can stay informed about your financial progress and make informed decisions to achieve your savings goals. The convenience of online and mobile banking, coupled with powerful account management tools, makes it easier than ever to stay in control of your savings journey.

Now, let’s explore the process of making withdrawals or transfers from your Apple Savings Account in the next section.

Withdrawals and Transfers from an Apple Savings Account

Withdrawing funds or initiating transfers from your Apple Savings Account is a straightforward process. Here are the important details to keep in mind:

- Withdrawal Limits: Apple Savings Accounts typically have withdrawal limits in place. These limits may restrict the number of withdrawals you can make within a certain period, such as per month or per statement cycle. It’s important to be aware of these limits to avoid any potential fees or restrictions.

- Electronic Transfers: One common method to withdraw funds or transfer money from an Apple Savings Account is through electronic transfers. This can be done by linking another external bank account and initiating the transfer online or through your financial institution’s mobile app.

- In-Person Withdrawals: Some financial institutions offer the option of making in-person withdrawals at their branch locations. If you require cash or need a certified check, you may visit a local branch and make a withdrawal directly from your Apple Savings Account.

- Transfer Fees: Be aware that certain types of transfers or withdrawals from an Apple Savings Account may be subject to fees. These fees could vary depending on the financial institution and the specific terms of your account. Familiarize yourself with any applicable fees to avoid surprises.

- Withdrawal Penalties: In some cases, accessing funds before a specific maturity date or meeting certain requirements may result in withdrawal penalties. For example, if you have a certificate of deposit (CD) as part of your Apple Savings Account, early withdrawal might trigger penalties or loss of interest earned. Read the terms and conditions of your savings account carefully to understand any associated penalties.

- Timeframes for Transfers: Depending on your financial institution and the method of transfer, the time it takes for funds to be transferred from your Apple Savings Account to another account can vary. Electronic transfers between linked accounts are typically faster, while requests for physical checks may take longer due to mailing and processing times.

Remember to keep track of your withdrawals and transfers to maintain accurate records and to ensure that they align with your savings goals. Regularly review your account statements to verify that any withdrawals or transfers have been correctly processed and reflected in your account.

It’s important to note that individual financial institutions may have different withdrawal and transfer policies for their Apple Savings Accounts. Therefore, it’s always advisable to consult the specific terms and conditions provided by your chosen institution.

Now that we have covered the withdrawals and transfers, let’s address some frequently asked questions about Apple Savings Accounts in the next section.

FAQs about Apple Savings Account

Here are some frequently asked questions about Apple Savings Accounts:

- 1. Can I open an Apple Savings Account if I don’t own any Apple products?

- 2. Is my money safe in an Apple Savings Account?

- 3. Can I link my Apple Savings Account to my Apple Pay?

- 4. Are there any fees associated with an Apple Savings Account?

- 5. Can I open multiple Apple Savings Accounts?

- 6. How often do interest rates on Apple Savings Accounts change?

- 7. Can I close my Apple Savings Account?

Yes, you can open an Apple Savings Account even if you don’t own any Apple products. The account is accessible through online and mobile banking platforms, which are compatible with a wide range of devices.

Apple Savings Accounts offered by reputed financial institutions are typically insured by the Federal Deposit Insurance Corporation (FDIC) up to the maximum allowed limit per depositor per institution. This means that your money is protected in the event of bank failure, subject to FDIC rules and regulations.

While the exact integration of Apple Pay with Apple Savings Accounts may vary depending on the financial institution, many banks offer the option to link your Apple Savings Account to Apple Pay. This allows you to make convenient and secure payments using your linked account through Apple Pay.

Apple Savings Accounts typically do not charge monthly maintenance fees. However, specific fees, such as transfer fees or overdraft fees, may be applicable. It’s important to review the terms and conditions of your account or contact your financial institution for a comprehensive understanding of any associated fees.

It depends on the policies of the financial institution offering the Apple Savings Account. Some institutions may allow customers to open multiple savings accounts, each with its own unique account number and savings goal.

Interest rates on Apple Savings Accounts can change periodically and are influenced by various factors, including market conditions and the policies of the financial institution. It’s advisable to regularly check with your institution or review their website for any updates on interest rates.

Yes, you typically have the option to close your Apple Savings Account if needed. Contact your financial institution for the specific process and any requirements associated with closing the account.

If you have additional questions or concerns about Apple Savings Accounts, it’s best to reach out to your chosen financial institution directly for personalized assistance and clarification.

Now, let’s wrap up our discussion on Apple Savings Accounts in the final section.

Conclusion

In conclusion, the Apple Savings Account offers a range of benefits and features that make it an attractive choice for individuals looking to manage their money and save for the future. With competitive interest rates, seamless integration with Apple products, and the convenience of online and mobile banking, this account provides a user-friendly and efficient way to achieve your financial goals.

Setting up an Apple Savings Account is a simple process, requiring a few prerequisites and completing an easy application. Once your account is set up, you can start adding funds using electronic transfers, direct deposits, mobile check deposits, or in-person deposits. It’s important to monitor and manage your account regularly, reviewing balances, setting alerts, and adjusting savings goals as needed.

When it comes to withdrawals and transfers, you can utilize electronic transfers, in-person withdrawals, or automatic transfers to access your funds. Be aware of withdrawal limits, transfer fees, and any potential penalties associated with early withdrawals or account closures.

To address any specific concerns or queries, we covered frequently asked questions about Apple Savings Accounts. Remember, while this article provides a general overview, it’s always important to consult the specific policies and terms of your chosen financial institution for accurate and up-to-date information.

With its innovative features and user-friendly interface, the Apple Savings Account empowers individuals to take control of their finances and work towards their saving goals. So, whether you’re saving for a dream vacation, a down payment on a home, or simply building an emergency fund, the Apple Savings Account can be a valuable tool to help you achieve your financial aspirations.