Home>Finance>How Do I Set Up Automatic Investments On Vanguard?

Finance

How Do I Set Up Automatic Investments On Vanguard?

Modified: December 30, 2023

Learn how to set up automatic investments on Vanguard for easy and convenient finance management. Take control of your savings and watch your investments grow

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Logging into your Vanguard account

- Step 2: Navigating to the “Buy & sell” section

- Step 3: Selecting the automatic investment option

- Step 4: Choosing your funding source

- Step 5: Selecting the investment option

- Step 6: Setting up your automatic investment plan

- Step 7: Confirming and reviewing your automatic investment details

- Step 8: Completing the setup process

- Conclusion

Introduction

Setting up automatic investments on Vanguard is a convenient and efficient way to grow your wealth over time. Vanguard offers a wide range of investment options, including mutual funds, ETFs, and individual stocks, allowing you to tailor your investment strategy to meet your financial goals.

Automatic investments, also known as recurring investments, allow you to automate the process of regularly investing a predetermined amount of money into your chosen investments. By setting up automatic investments on Vanguard, you can take advantage of dollar-cost averaging, which is a strategy that involves investing the same amount of money at regular intervals, regardless of the share price. This approach can help reduce the impact of market fluctuations and potentially enhance long-term returns.

Whether you are a seasoned investor or just starting your investment journey, setting up automatic investments on Vanguard can help simplify your financial planning and ensure consistency in your investment strategy. In this article, we will guide you through the step-by-step process of setting up automatic investments on Vanguard, enabling you to make the most of this valuable feature.

Step 1: Logging into your Vanguard account

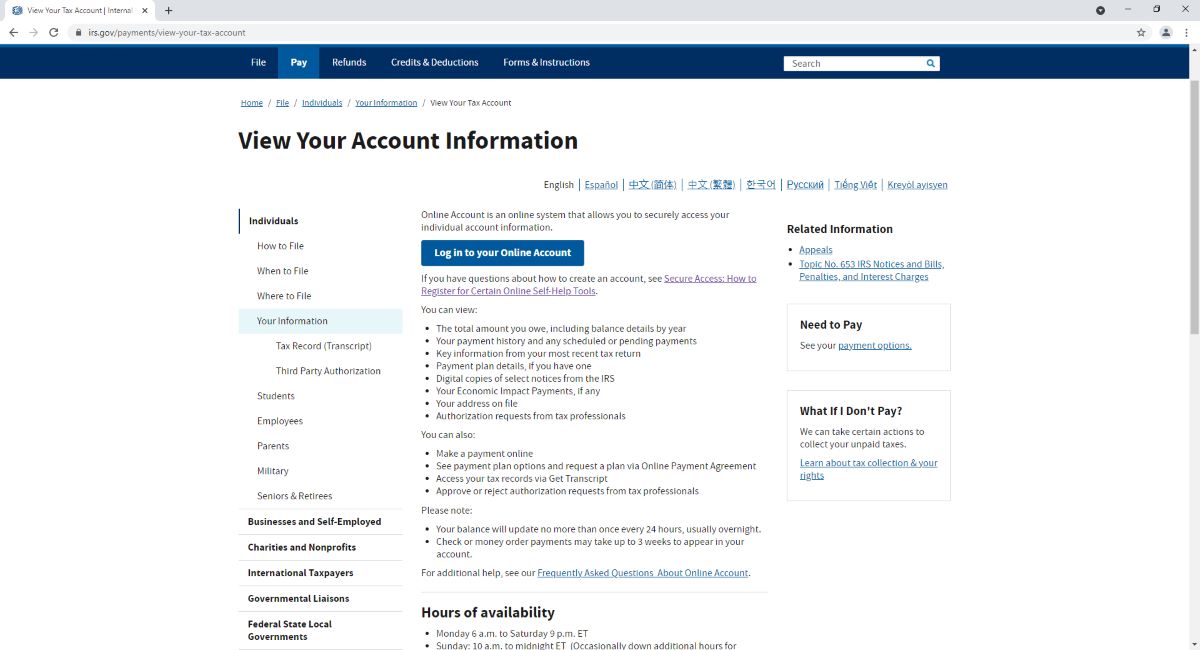

The first step to setting up automatic investments on Vanguard is to log into your Vanguard account. If you don’t have an account, you will need to create one by visiting the Vanguard website and following the instructions to sign up.

Once you have your Vanguard account, go to the Vanguard homepage and click on the “Log on” button at the top right corner of the screen. Enter your username and password in the designated fields, then click “Log on” to access your account.

It’s important to use strong, unique passwords and enable two-factor authentication to protect your Vanguard account from any unauthorized access. Remember to keep your login credentials in a secure place and avoid sharing them with anyone.

If you encounter any login issues or have forgotten your password, Vanguard provides support and assistance options to help you regain access to your account. Follow the instructions provided on the login page to resolve any login-related issues.

Once you have successfully logged into your Vanguard account, you are ready to move on to the next step and begin setting up automatic investments.

Step 2: Navigating to the “Buy & sell” section

After logging into your Vanguard account, the next step is to navigate to the “Buy & sell” section. This is where you can access the features and tools related to investing and managing your portfolio.

To find the “Buy & sell” section, look for the main menu or navigation bar on the Vanguard website. Depending on the layout and design of the website, the location of the menu may vary. However, it is typically located at the top or side of the page.

Once you have located the menu, hover your mouse over the “Investing” or “Buy & sell” option. This will reveal a dropdown menu with various investment-related options. Click on the “Buy & sell” option to proceed.

Alternatively, some Vanguard accounts may have a dedicated “My Accounts” or “Portfolio” page where you can find the “Buy & sell” section. Look for these options in the main menu or sidebar and click on them to access the relevant page.

Upon navigating to the “Buy & sell” section, you will have access to a range of investment options and tools. This is where you will be able to set up automatic investments, as well as make manual trades or adjustments to your portfolio.

Take a moment to explore the different features within the “Buy & sell” section to familiarize yourself with the layout and options available to you. This will ensure a smoother experience as you proceed with setting up your automatic investments on Vanguard.

Step 3: Selecting the automatic investment option

Once you have accessed the “Buy & sell” section on your Vanguard account, the next step is to locate and select the automatic investment option. This feature allows you to establish a recurring investment plan that will automatically invest a predetermined amount of money at regular intervals.

In the “Buy & sell” section, look for a tab or link that mentions automatic investments or recurring investments. Vanguard may use different terminology, so it’s important to carefully scan the page and menus to find the appropriate option.

Click on the automatic investment option to proceed to the setup process. This will typically open a new page or window where you can configure the details of your automatic investment plan.

Before proceeding, it’s important to understand any requirements or restrictions associated with automatic investments on Vanguard. Some funds or investment options may have specific eligibility criteria or minimum investment amounts. Familiarize yourself with these details to ensure a smooth setup process.

Additionally, it’s worth noting that Vanguard may charge certain fees or expenses related to automatic investments. Review the fee structure to understand any costs associated with setting up and maintaining your automatic investment plan.

Once you are ready, move on to the next step to choose your funding source for the automatic investments. This will determine where the money will be withdrawn from for the recurring investments.

Step 4: Choosing your funding source

When setting up automatic investments on Vanguard, it’s important to choose the funding source from which the money will be withdrawn for your recurring investments. Vanguard offers several options for funding sources, including bank accounts and money market settlement funds.

To choose your funding source, navigate to the appropriate section within the automatic investment setup process. Vanguard typically provides clear instructions and options for selecting the funding source.

If you wish to link a bank account, you will need to provide the necessary information, such as your bank’s routing number and your account number. This information ensures that Vanguard can transfer the funds securely from your bank account for your automatic investments.

Alternatively, Vanguard may provide the option to use a money market settlement fund as your funding source. Money market funds are low-risk, highly liquid investment options that aim to preserve capital and provide a stable return. By using a money market settlement fund as your funding source, you can ensure that the cash is readily available for your automatic investments.

Consider your personal preferences, financial goals, and liquidity needs when choosing your funding source. If you are unsure about which option to select, Vanguard’s customer support or online resources can provide guidance and information to help you make an informed decision.

Once you have chosen your funding source, move on to the next step to select the specific investment option for your automatic investments.

Step 5: Selecting the investment option

After choosing your funding source for automatic investments on Vanguard, the next step is to select the specific investment option or options in which you want to allocate your funds. Vanguard offers a wide range of investment choices, including mutual funds, ETFs, individual stocks, and more.

To select your investment option, navigate to the appropriate section within the automatic investment setup process. Vanguard will typically provide a search bar or a list of available options for you to choose from.

If you are unsure about which investment option to select, consider your investment objectives, risk tolerance, and time horizon. Vanguard provides detailed information and resources about each investment option, including performance history, expense ratios, and investment strategies. Take the time to research and evaluate the options to make an informed decision.

It’s important to note that Vanguard may have eligibility criteria or investment minimums for certain funds or investment options. Ensure that the option you choose aligns with any requirements to proceed smoothly with the automatic investment setup process.

Additionally, you have the flexibility to select multiple investment options for your automatic investments. Vanguard allows you to allocate different percentages or dollar amounts to each option, providing you with a diversified portfolio that aligns with your investment goals.

Once you have selected your investment option(s), proceed to the next step to set up your automatic investment plan with specific details such as the investment amount and frequency.

Step 6: Setting up your automatic investment plan

Setting up your automatic investment plan on Vanguard involves specifying the details of your recurring investments, such as the investment amount and frequency. This step is crucial to ensure that your investments align with your financial goals and preferences.

Within the automatic investment setup process, you will typically be prompted to enter the investment amount for each recurring investment. This could be a fixed dollar amount or a percentage of your total investment. Consider your budget, cash flow, and investment objectives when determining the appropriate investment amount.

Next, you will specify the frequency of your automatic investments. Vanguard generally offers options such as monthly, quarterly, semi-annually, or annually. Choose the frequency that suits your investment strategy and financial circumstances. Remember, the more frequent the investments, the more consistent your dollar-cost averaging strategy will be.

Furthermore, you may have the option to set specific investment dates for each recurring investment. Vanguard provides flexibility in choosing specific days of the month or certain calendar dates to align with your financial planning. Select the dates that work best for you.

It’s important to note that Vanguard may have certain limitations or requirements for the investment plan setup. For example, there may be minimum investment amounts or specific guidelines for modifying or canceling the plan in the future. Familiarize yourself with these details to avoid any unexpected limitations or charges.

Once you have entered all the necessary details for your automatic investment plan, review the information carefully to ensure its accuracy. This includes double-checking the investment amounts, frequency, and investment options selected.

After reviewing, proceed to the next step to confirm and review your automatic investment details before finalizing the setup process.

Step 7: Confirming and reviewing your automatic investment details

Before finalizing the setup process for your automatic investments on Vanguard, it is important to carefully review and confirm all the details of your investment plan. This step ensures that you have accurately specified your preferences and that the plan aligns with your financial goals.

Upon proceeding to the confirmation page, Vanguard will display a summary of your automatic investment details. This includes the funding source, investment options, investment amount, frequency, and any other specifications you have set.

Take the time to thoroughly review each aspect of your automatic investment plan. Pay close attention to the investment amounts, as well as the total amount that will be invested over time. Ensure that the plan aligns with your desired investment strategy and financial capabilities.

Reviewing the investment options is equally important. Make sure you have selected the appropriate funds or investment options that match your risk tolerance and investment objectives. Consider the diversification and performance history of each option to ensure they align with your investment plan.

If any of the details need to be modified or corrected, Vanguard typically provides an option to edit or update the information. This allows you to make any necessary adjustments before finalizing the setup process.

Additionally, Vanguard may provide a preview feature that allows you to see how your automatic investments will look over time. This can be beneficial in understanding the potential growth of your investments and assessing their impact on your overall portfolio.

Once you have confirmed that all the investment details are accurate and align with your goals, you can proceed to the final step to complete the setup process for your automatic investments.

Step 8: Completing the setup process

After reviewing and confirming your automatic investment details on Vanguard, the final step is to complete the setup process. This step finalizes your automatic investment plan and ensures that your funds will be allocated as specified.

Upon proceeding to complete the setup process, Vanguard may prompt you to review and accept the terms and conditions associated with automatic investments. It is essential to carefully read and understand these terms to ensure compliance with Vanguard’s policies and procedures.

Furthermore, Vanguard may require you to provide additional verification or authorization to proceed with the setup process. This can include confirming your identity or authorizing the withdrawal of funds from your designated funding source. Follow the instructions provided by Vanguard to fulfill any necessary requirements.

Once you have completed all the necessary steps and requirements, Vanguard will provide you with a confirmation of your automatic investment plan setup. This confirmation may be displayed on the screen, sent to you via email, or available for download as a confirmation document.

It is advisable to retain a copy of this confirmation for future reference. It serves as documentation of your automatic investment plan and the specific details you have set up.

After completing the setup process, your automatic investments will commence according to the schedule you have specified. Vanguard will deduct the specified investment amount from your designated funding source at the defined frequency and allocate the funds to the specified investment options.

It’s important to periodically review and monitor your automatic investment plan to ensure that it continues to align with your financial objectives and market conditions. Vanguard provides tools and resources to help you track the performance and manage your investments effectively.

Congratulations! You have successfully completed the setup process for automatic investments on Vanguard. By automating your investments, you can enjoy the benefits of consistent contributions and potentially maximize your long-term wealth creation.

Conclusion

Setting up automatic investments on Vanguard can be a game-changer for your financial journey. It offers a convenient and effective way to consistently build wealth over time. By following the step-by-step process outlined in this guide, you can easily establish your automatic investment plan and start reaping the benefits of disciplined investing.

Automating your investments through Vanguard allows you to take advantage of the power of dollar-cost averaging, reducing the impact of market volatility and potentially enhancing long-term returns. It also helps simplify your financial planning by ensuring consistent contributions to your chosen investment options.

When setting up your automatic investment plan, remember to carefully consider your investment goals, risk tolerance, and financial capabilities. Selecting the appropriate funding source and investment options is crucial for aligning your plan with your specific needs and preferences.

Additionally, regular reviews of your automatic investment plan are essential to ensure ongoing suitability and effectiveness. Keep track of your investments, monitor performance, and make adjustments as necessary to stay on track towards your financial goals.

Vanguard provides a user-friendly platform and a wealth of resources to support your investing journey. Take advantage of their tools, educational materials, and customer support to make the most of your automatic investment plan.

Remember, investing is a long-term commitment. Stay disciplined, stay informed, and stay focused on your financial objectives. With automatic investments on Vanguard, you have taken an important step towards building a more secure and prosperous future.