Finance

How Do Investment Banks Raise Capital?

Published: October 18, 2023

Learn how investment banks utilize various strategies and techniques in finance to raise capital and fund projects, ensuring successful financial growth and prosperity.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

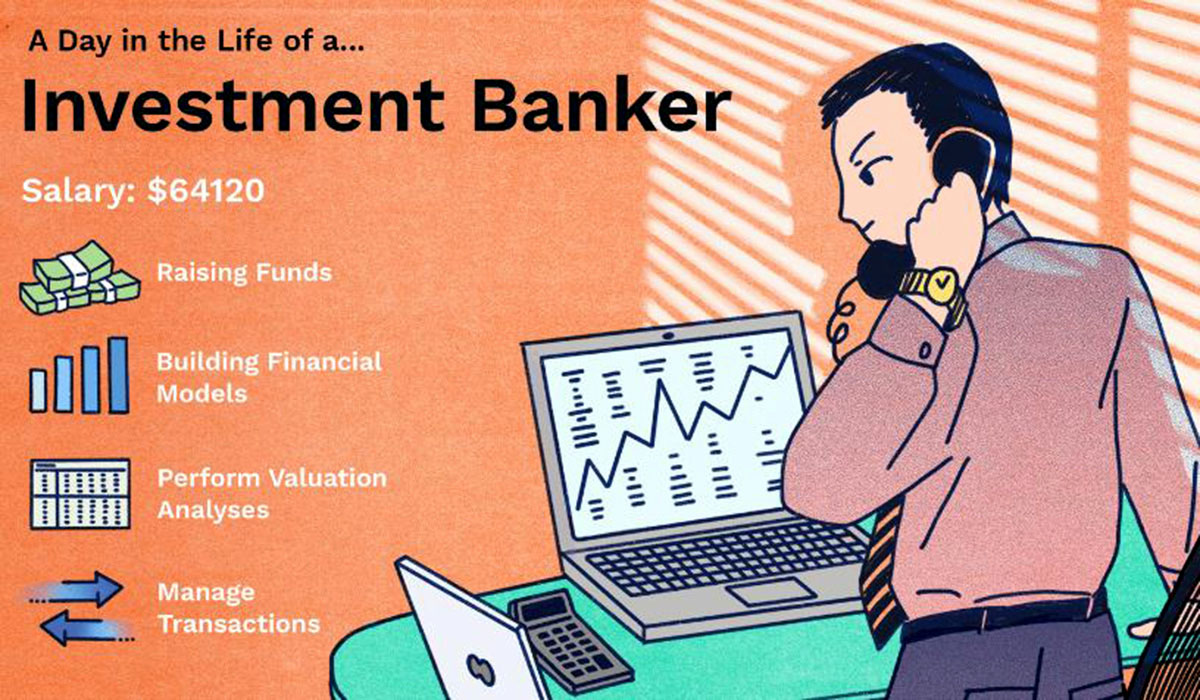

Investment banks play a critical role in the financial ecosystem by assisting companies in raising capital to fuel their growth and execute strategic initiatives. Capital raising is an essential aspect of corporate finance, enabling businesses to fund projects, invest in new ventures, or strengthen their balance sheets. By facilitating the transfer of funds between savers and investors, investment banks serve as intermediaries, connecting entities in need of capital with those seeking investment opportunities.

In this article, we will explore the primary methods that investment banks use to raise capital on behalf of their clients. These methods include debt issuance, equity issuance, initial public offerings (IPOs), secondary offerings, private placements, and hybrid financing instruments. Understanding these strategies is vital for businesses and investors alike, as they provide insights into the mechanisms behind capital raising and the opportunities available in the financial markets.

Before diving into the various methods of capital raising, it is crucial to note that investment banks must comply with regulatory guidelines and market conditions. These factors shape the feasibility and timing of capital raising activities, and investment banks must navigate these landscapes while maximizing value for their clients.

Now, let’s explore the primary methods of capital raising in more detail to gain a deeper understanding of how investment banks help companies obtain the funds they need to succeed.

Primary Methods of Capital Raising

Investment banks employ various strategies to assist companies in raising capital. These methods can be broadly categorized into debt issuance and equity issuance.

Debt Issuance

Debt issuance involves raising capital by issuing bonds or other debt securities to investors. Companies seeking to raise funds through debt issuance offer fixed-income securities that provide investors with regular interest payments and the return of principal at maturity. Investment banks play an instrumental role in underwriting these debt offerings, ensuring that there is sufficient demand from investors and providing guidance on the pricing and terms of the securities.

Debt issuance offers several advantages to companies. It allows them to access a relatively straightforward and well-established market for borrowing capital, often at lower interest rates compared to other funding options. Additionally, debt financing provides companies with the benefit of tax deductibility on interest payments, reducing their overall cost of capital.

Equity Issuance

Equity issuance involves raising capital by issuing shares of company stock to investors. This method allows companies to sell ownership stakes in the organization, thereby providing investors with the potential for capital appreciation and dividend payments. Investment banks assist in the process of equity issuance by underwriting the stock offerings, advising on the pricing and market conditions, and facilitating the transaction between the company and investors.

Equity issuance can take various forms, including initial public offerings (IPOs), secondary offerings, and private placements.

Debt Issuance

Debt issuance is a common method of capital raising used by companies to raise funds through the sale of debt securities. Investment banks play a crucial role in facilitating this process by helping companies determine the appropriate debt structure, underwriting the securities, and ensuring a successful issuance.

Bond Issuance

One of the most prevalent forms of debt issuance is through the issuance of bonds. Bonds are fixed-income securities that represent loans made by investors to the issuing company. When a company decides to issue bonds, it establishes the terms of the bond, including the interest rate, maturity date, and principal amount. The investment bank then assists in marketing the bonds to potential investors and ensuring that there is sufficient demand for the securities.

Investment-grade bonds are those issued by companies or governments with high credit ratings, indicating a low risk of default. These bonds typically offer lower interest rates due to the lower level of risk associated with the issuer. High-yield bonds, on the other hand, are issued by companies with lower credit ratings, and they offer higher yields to compensate investors for the increased risk.

Benefits of Debt Issuance

Debt issuance offers several advantages for companies seeking capital:

- Flexibility: Companies have the flexibility to customize the terms of the debt, such as the interest rate and maturity, to suit their specific needs.

- Lower cost of capital: Debt typically has a lower cost of capital compared to equity financing, as companies only need to pay interest rather than providing an ownership stake in the company.

- Tax advantages: Interest payments on debt are often tax-deductible, resulting in reduced tax obligations for the issuing company.

- Predictable cash flow: Debt financing involves fixed interest payments and a predetermined maturity date, providing companies with a predictable cash flow structure.

However, it is important to note that debt issuance also carries certain risks. Companies must ensure that they can meet their interest payments and repay the principal amount at maturity. Failure to do so may result in the company defaulting on its obligations, damaging its creditworthiness and potentially leading to legal and financial consequences.

Overall, debt issuance is a widely utilized method of capital raising due to its flexibility, favorable cost of capital, and tax benefits. Investment banks play a crucial role in guiding companies through the debt issuance process, assisting in structuring the debt, marketing the securities, and ensuring the successful completion of the transaction.

Equity Issuance

Equity issuance is another primary method of capital raising that allows companies to raise funds by selling ownership stakes in the organization. Investment banks play a pivotal role in facilitating equity issuance by assisting companies in determining the optimal pricing, structuring the offering, and connecting the company with potential investors.

Initial Public Offerings (IPOs)

One of the most well-known forms of equity issuance is through an initial public offering (IPO). An IPO occurs when a company decides to offer its shares to the public for the first time, transitioning from private ownership to a publicly traded company. Investment banks, acting as underwriters, play a crucial role in the IPO process by advising the company on the timing, pricing, and structuring of the offering, and assisting in marketing the shares to potential investors.

Going public through an IPO offers several benefits for companies:

- Access to capital: An IPO provides the company with a significant influx of capital, enabling it to fund growth initiatives, pay off debt, or invest in research and development.

- Liquidity for existing stakeholders: An IPO allows existing shareholders, such as founders and early investors, to sell their shares and realize a return on their investment.

- Enhanced visibility and credibility: Going public increases a company’s visibility and can enhance its reputation and credibility in the market.

Secondary Offerings

Secondary offerings involve the issuance of additional shares by a publicly traded company after the initial public offering. These offerings can be made to raise additional capital for the company or to allow existing shareholders to sell their shares. Investment banks assist in structuring the offering, determining the pricing, and marketing the shares to potential investors.

Private Placements

In some cases, companies may choose to raise capital through private placements, which involve offering shares or other equity instruments to a select group of investors. Private placements are typically conducted with institutional investors, such as private equity firms, venture capital funds, or high-net-worth individuals. Investment banks play a crucial role in identifying potential investors, negotiating the terms of the private placement, and facilitating the transaction.

Benefits of Equity Issuance

Equity issuance offers several advantages for companies:

- Capital infusion: Equity issuance provides companies with a significant injection of capital, enabling them to fund expansion plans and strategic initiatives.

- Flexible financing: Equity financing does not require repayment like debt financing, offering companies more flexibility in managing their financial obligations.

- Access to expertise: By partnering with investment banks, companies can leverage their expertise and market knowledge to optimize the equity issuance process.

However, it is important to keep in mind that equity issuance dilutes existing shareholders’ ownership stakes and can result in the loss of control for the company’s founders and management team. Companies must carefully consider the trade-offs between equity financing and other forms of capital raising when determining the most appropriate funding strategy.

Overall, equity issuance, whether through IPOs, secondary offerings, or private placements, provides companies with access to substantial capital and the potential for future growth. Investment banks play a critical role in ensuring a successful equity issuance process, helping companies navigate the complexities of the market and connect with potential investors.

Initial Public Offerings (IPOs)

An Initial Public Offering (IPO) is a significant event for a company as it marks the transition from being privately owned to becoming a publicly traded entity. IPOs are an essential method of equity issuance that allows companies to raise capital by offering their shares to the public for the first time. Investment banks play a crucial role in guiding companies through the IPO process, from the initial planning stages to the successful completion of the offering.

Process of an IPO

The IPO process typically involves several key steps:

- Preparation: Before initiating the IPO, the company and its investment bank(s) will conduct extensive due diligence, including financial audits, legal compliance reviews, and market research to assess the company’s readiness to go public.

- Underwriting: Investment banks act as underwriters and help the company determine the offering price, the number of shares to be issued, and the overall structure of the offering. They also assist in preparing the necessary regulatory filings, such as the prospectus, which provides information about the company’s finances, operations, and risks to potential investors.

- Marketing and roadshow: Investment banks are responsible for marketing the IPO to potential investors. This involves conducting a roadshow, where company representatives and investment banks meet with institutional investors to present the company’s investment case and answer questions.

- Pricing and allocation: The investment bank(s) work closely with the company to determine the final offering price based on the demand and market conditions. They allocate shares to institutional investors and individual investors who subscribed to the offering.

- Listing: Once the shares are priced and allocated, the company’s shares are listed on a stock exchange, making them available for trading by the public.

Benefits of an IPO

For companies, conducting an IPO offers several advantages:

- Access to capital: By going public, the company can raise substantial funds that can be used for various purposes, such as financing growth initiatives, expanding operations, or paying off debt.

- Liquidity for stakeholders: An IPO allows the company’s existing shareholders to sell their shares, providing them with liquidity and the opportunity to realize a return on their investment.

- Enhanced visibility and credibility: Going public increases the company’s profile and visibility, attracting attention from investors, customers, and potential business partners. It can also enhance the company’s credibility by complying with the stringent regulatory requirements and transparency standards required for a public company.

It is important to note that going public through an IPO also carries certain challenges and considerations. The company must meet regulatory requirements, adhere to ongoing reporting and compliance obligations, and navigate the expectations of public shareholders. The decision to go public should be carefully evaluated with the assistance of skilled investment banks to ensure it aligns with the company’s strategic goals and long-term vision.

Overall, IPOs are a significant milestone for companies seeking to raise capital and gain access to the public markets. Investment banks play a vital role in guiding companies through the complex IPO process, providing expertise, market insights, and support to help ensure a successful and well-executed offering.

Secondary Offerings

In addition to Initial Public Offerings (IPOs), companies have the option to raise additional capital through secondary offerings. Secondary offerings occur when a publicly traded company issues new shares after its initial listing. Investment banks play a crucial role in facilitating secondary offerings by assisting with the structuring, pricing, and marketing of the offering.

Types of Secondary Offerings

There are two main types of secondary offerings:

- Follow-on Offerings: Follow-on offerings involve the issuance of additional shares by a company that is already publicly traded. The proceeds from the offering go directly to the company, and the new shares are typically offered to both institutional investors and retail investors.

- Offerings by Selling Shareholders: In some cases, a secondary offering may involve existing shareholders, such as founders, employees, or early investors, selling their shares. The proceeds from these offerings go to the selling shareholders rather than the company itself.

Reasons for Secondary Offerings

There are several reasons why a company might choose to conduct a secondary offering:

- Capital Expansion: Secondary offerings enable companies to raise additional capital to fund growth initiatives, acquire new assets or businesses, or invest in research and development.

- Balance Sheet Strengthening: Companies may conduct a secondary offering to enhance their financial position by reducing debt levels or improving liquidity.

- Ownership Diversification: Secondary offerings that involve selling shareholders allow them to monetize their investments, diversify their portfolios, or provide an exit strategy for early investors.

Process of a Secondary Offering

The process of a secondary offering is similar to that of an IPO, albeit with some variations:

- Planning and Preparation: The company, in collaboration with the investment bank(s), determines the details of the offering, including the number of shares to be offered and the pricing.

- Marketing and Investor Outreach: Investment banks help market the secondary offering to potential investors, which may include institutional investors, retail investors, or both. They also assist in conducting roadshows and investor presentations to generate interest.

- Pricing and Allocation: The investment bank(s) work with the company to determine the final offering price based on investor demand and market conditions. Shares are then allocated to investors who have expressed interest in participating in the offering.

- Listing and Trading: Once the offering is completed, the newly issued shares are listed and made available for trading on the stock exchange.

Benefits of Secondary Offerings

Secondary offerings offer several advantages for companies:

- Access to Additional Capital: Secondary offerings provide companies with a means to raise funds without incurring debt. This capital can be used for various purposes, such as expansion, acquisitions, or debt repayment.

- Liquidity for Selling Shareholders: In cases where existing shareholders are selling their shares, a secondary offering provides them with an opportunity to monetize their investments.

- Enhancement of Market Position: A successful secondary offering can increase a company’s visibility and attract new investors, enhancing its overall market position.

However, it’s important to note that conducting a secondary offering may dilute existing shareholders’ ownership stakes, potentially impacting the company’s stock price and shareholder value. Companies must carefully evaluate the timing and size of the offering to minimize any adverse effects.

Overall, secondary offerings are a valuable tool for companies to raise additional capital and support their growth objectives. Investment banks play a crucial role in assisting companies through the process, providing guidance and expertise to ensure a successful offering.

Private Placements

In addition to public offerings, companies also have the option to raise capital through private placements. Private placements involve the sale of securities to a select group of investors, typically institutional investors, private equity firms, venture capital funds, or accredited individuals. Investment banks play a critical role in facilitating private placements, assisting companies in structuring the offering, selecting suitable investors, and negotiating the terms of the placement.

The Process of Private Placements

The process of a private placement typically involves the following steps:

- Planning and Strategy: The company, along with its investment bank(s), determines the amount of capital to be raised, the type of securities to be issued, and the target investors.

- Investor Identification: The investment bank(s) assist in identifying and targeting potential investors who are likely to have an interest in the company’s offering. This may involve leveraging their network and conducting extensive research.

- Due Diligence: The investment bank(s) conduct due diligence on behalf of the potential investors to assess the viability and risks associated with the company’s business and the terms of the private placement.

- Structuring and Pricing: The investment bank(s) work closely with the company to determine the appropriate structure and pricing of the private placement to attract investors while maximizing the company’s capital-raising objectives.

- Negotiation and Documentation: The investment bank(s) facilitate the negotiation and documentation process between the company and the investors, ensuring that the terms and conditions of the private placement are agreed upon by all parties involved.

- Completion: Once the private placement is finalized, the company receives the capital from the investors in exchange for the issuance of the securities.

Advantages of Private Placements

Private placements offer several advantages for companies seeking to raise capital:

- Customization: Private placements allow companies to tailor the terms and conditions of the offering to meet their specific needs and the preferences of the investors.

- Efficiency: Private placements typically have a shorter timeline compared to public offerings, allowing companies to raise capital relatively quickly.

- Flexibility: Private placements provide companies with flexibility in the types of securities offered, as well as the ability to structure the investment in a way that aligns with the company’s strategic goals.

- Targeted Approach: Private placements allow companies to approach a specific group of investors who are likely to have a genuine interest in the company and its business, potentially leading to a higher success rate in securing capital.

Considerations for Private Placements

It is important to note that private placements have their considerations and limitations:

- Restricted Investor Pool: Private placements are generally limited to sophisticated investors, such as institutional investors or accredited individuals, who meet specific eligibility criteria.

- Limited Marketability: Unlike publicly traded securities, securities issued through private placements may have limited liquidity and may not be freely tradable.

- Legal and Regulatory Compliance: Companies must comply with applicable securities laws and regulations when conducting private placements to ensure that they are conducted in a legally compliant manner.

Overall, private placements offer a flexible and efficient method for companies to raise capital from select investors. Investment banks play a critical role in facilitating the private placement process, providing guidance, expertise, and access to their network of investors to help companies secure the necessary funding.

Hybrid Financing Instruments

Hybrid financing instruments are innovative financial instruments that combine characteristics of both debt and equity. These instruments offer companies flexibility in their capital structure and can be attractive for investors seeking unique investment opportunities. Investment banks play a vital role in structuring and facilitating transactions involving hybrid financing instruments.

Convertible Bonds

Convertible bonds are a common type of hybrid financing instrument that combines the features of debt and equity. These bonds offer investors the right to convert their bonds into a predetermined number of shares of the issuing company. Initially, convertible bonds function as debt, providing investors with regular interest payments. However, at the option of the investor, the bonds can be converted into equity, allowing investors to participate in any potential future upside of the company’s stock price.

Convertible bonds provide companies with the advantage of raising debt capital at a potentially lower interest rate compared to traditional bonds. Moreover, they offer investors the opportunity to potentially benefit from stock price appreciation.

Preferred Stock

Preferred stock is another hybrid financing instrument that combines elements of both debt and equity. Preferred stock represents ownership in a company but typically does not have voting rights. However, it provides shareholders with a higher claim on company assets and earnings compared to common stock. Additionally, preferred stock usually pays a fixed dividend, similar to interest payments on debt, before any dividends are paid to common shareholders.

Preferred stock allows companies to raise capital without diluting existing ownership in the same way as issuing additional common stock. It is attractive to investors seeking a regular income stream and a certain level of protection in the event of company liquidation or bankruptcy.

Warrants

Warrants are options that give the holder the right, but not the obligation, to purchase a specified number of shares at a predetermined price within a designated period. Warrants are often issued as part of a debt or equity offering and are typically valid for several years. They can be detached from the underlying security and traded separately. If the investor exercises the warrant, they have the opportunity to purchase shares at a predetermined price, allowing them to participate in the company’s potential future growth.

Warrants benefit companies by providing an additional incentive for investors to participate in their offerings. They can enhance the overall attractiveness of the offering by allowing investors to potentially benefit from future stock price appreciation.

Benefits of Hybrid Financing Instruments

Hybrid financing instruments offer several benefits for companies and investors:

- Flexibility: Hybrid instruments allow companies to tailor their financing to meet their specific needs, combining the features of debt and equity in a way that suits their financial goals.

- Lower Cost of Capital: The use of hybrid instruments can provide companies with access to capital at a potentially lower cost compared to traditional debt financing.

- Attractive Investment Opportunities: For investors, hybrid financing instruments present unique investment opportunities that offer a blend of fixed income potential and the upside potential of equity participation.

However, it’s important for companies and investors to carefully consider the terms, risks, and potential dilution associated with hybrid financing instruments before entering into such transactions. Investment banks play a crucial role in structuring and advising on the use of these instruments, ensuring that they align with the company’s financial objectives and provide value to investors.

Other Capital Raising Strategies

In addition to debt and equity issuance, there are several other capital raising strategies that companies can explore to meet their funding needs. These strategies can provide alternative avenues for raising capital, allowing companies to diversify their funding sources. Investment banks play a crucial role in advising and facilitating these strategies to ensure their successful execution.

Mezzanine Financing

Mezzanine financing is a hybrid form of financing that combines elements of debt and equity. It typically involves providing a company with subordinated debt that ranks below traditional senior debt in terms of priority of repayment. Mezzanine financing often includes equity warrants or options, allowing the lender to convert their debt into equity if certain conditions are met.

Mezzanine financing offers companies the advantage of accessing additional capital without diluting existing ownership. It can be an attractive option for companies with strong cash flows and growth prospects that may not meet all the requirements of traditional debt financing.

Crowdfunding

Crowdfunding has emerged as a popular alternative capital raising strategy, particularly for startups and small businesses. It involves raising funds from a large number of individuals or investors through online platforms. Crowdfunding allows companies to showcase their business ideas or products to a wide audience, who can then contribute funds in exchange for rewards or equity in the company.

Crowdfunding offers companies the benefit of accessing funds from a broader pool of investors, including potential customers and supporters. It can also serve as a way to test market interest and validate business concepts before seeking traditional forms of financing.

Asset-Based Financing

Asset-based financing involves securing a loan or credit facility using the company’s assets as collateral. These assets can include accounts receivable, inventory, machinery, or real estate. Asset-based financing allows companies to leverage their physical assets to secure financing, providing lenders with a form of security in case of default.

Asset-based financing is particularly suitable for companies with valuable assets that can be easily assessed and appraised. It allows companies to access capital while minimizing the need for traditional financial statements and strong credit history.

Strategic Partnerships and Joint Ventures

Companies can also raise capital by entering into strategic partnerships or joint ventures with other businesses. These partnerships involve pooling resources, expertise, and capital to pursue mutually beneficial opportunities. Capital infusion can occur through direct investments from the partnering companies or by leveraging the combined assets and capabilities to access financing from external sources.

Strategic partnerships and joint ventures offer companies the advantage of expanding their network, accessing new markets or technologies, and sharing the financial risk with a trusted partner. These collaborations can provide a unique avenue for raising capital while creating long-term value for all parties involved.

Benefits of Other Capital Raising Strategies

Other capital raising strategies offer various benefits for companies:

- Diversification of Funding: Exploring alternative capital raising strategies allows companies to diversify their funding sources, reducing reliance on a single method of financing.

- Access to Niche Investors: Some strategies, such as crowdfunding, provide companies with access to a broad base of investors who may have a particular interest in their industry or product.

- Flexible Financing Options: Other capital raising strategies often offer greater flexibility in terms of deal structure, repayment terms, and investor requirements, allowing companies to tailor financing to their specific needs.

However, it’s important to consider the specific requirements and risks associated with each capital raising strategy. Investment banks can provide valuable insights and guidance in identifying the most appropriate strategy for companies, ensuring that it aligns with their financial goals and maximizes the potential for success.

Conclusion

Raising capital is a crucial aspect of corporate finance, enabling companies to fund growth, pursue strategic initiatives, and strengthen their financial position. Investment banks play a vital role in assisting companies in raising capital through various methods, including debt issuance, equity issuance, initial public offerings (IPOs), secondary offerings, private placements, and hybrid financing instruments.

Debt issuance provides companies with access to a well-established market for borrowing capital, allowing them to customize the terms of the debt and benefit from potentially lower interest rates. Equity issuance, on the other hand, involves selling ownership stakes in the company, providing companies with an opportunity to raise significant capital and allowing investors to participate in the company’s potential future growth.

IPOs offer companies the chance to go public, providing access to the public markets and raising substantial capital from a wide range of investors. Secondary offerings enable companies to raise additional capital from existing shareholders or new investors after the IPO. Private placements offer a more targeted approach, allowing companies to raise capital from select institutional investors or accredited individuals.

Hybrid financing instruments, such as convertible bonds, preferred stock, and warrants, provide companies with flexibility in their capital structure and offer investors unique investment opportunities that combine elements of both debt and equity. Other capital raising strategies, such as mezzanine financing, crowdfunding, asset-based financing, and strategic partnerships, provide alternative avenues for raising capital, allowing companies to diversify their funding sources.

In conclusion, investment banks play a crucial role in helping companies navigate the complex landscape of capital raising. Their expertise, market knowledge, and network of investors enable companies to access the capital they need to fuel their growth and achieve their strategic objectives. By understanding the various methods and strategies for capital raising, companies can make informed decisions and optimize their fundraising efforts, while investment banks provide valuable guidance and ensure successful execution.