Home>Finance>How Do Retained Earnings Link The Income Statement And Balance Sheet?

Finance

How Do Retained Earnings Link The Income Statement And Balance Sheet?

Published: March 2, 2024

Learn how retained earnings connect the income statement and balance sheet in finance. Understand the impact on financial performance and shareholder equity.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the intricate connections between financial statements is crucial for comprehending a company's financial health. One such vital link exists between the income statement and the balance sheet, and it is facilitated by retained earnings. Retained earnings play a pivotal role in showcasing how a company's profits are utilized or reinvested. This article delves into the significance of retained earnings in connecting the income statement and the balance sheet, shedding light on their impact on financial analysis.

Retained earnings represent the cumulative net income of a company that has been retained for reinvestment into the business rather than distributed as dividends to shareholders. This figure is a key component of the balance sheet, reflecting the company's accumulated profits over time. Understanding how retained earnings tie into the income statement and the balance sheet is essential for investors, financial analysts, and stakeholders seeking to gauge a company's financial performance and future prospects.

By exploring the role of retained earnings in financial statements, we can gain valuable insights into a company's profitability, dividend policy, and overall financial strategy. Let's embark on a journey to unravel the intricate relationship between retained earnings, the income statement, and the balance sheet, and discover the pivotal role they play in financial analysis.

Understanding Retained Earnings

Retained earnings, a crucial component of the shareholders’ equity section on the balance sheet, represent the cumulative amount of net income that a company has retained over time. This figure is the accumulation of the company’s profits that have not been distributed to shareholders in the form of dividends. Essentially, retained earnings reflect the portion of the company’s earnings that is reinvested in the business to fuel growth, finance expansion initiatives, repay debts, or weather economic downturns.

Retained earnings serve as a testament to a company’s historical profitability and its ability to generate sustainable earnings. Positive retained earnings indicate that the company has been profitable over time, while negative retained earnings may signal sustained losses or dividend distributions exceeding the net income. Understanding the dynamics of retained earnings is essential for investors, as it provides insights into the company’s dividend policy, growth prospects, and financial stability.

Furthermore, retained earnings are a vital source of internal financing for companies, as they enable businesses to fund operations, invest in new projects, or mitigate financial challenges without relying solely on external capital sources. By retaining a portion of its profits, a company can bolster its financial resilience and pursue strategic initiatives, thereby enhancing its long-term competitiveness in the market.

It is important to note that while retained earnings signify the reinvestment of profits, they also reflect the opportunity cost of not distributing dividends to shareholders. Companies must strike a balance between retaining earnings for future growth and rewarding shareholders with dividends to maintain investor confidence and attract potential investors.

Overall, understanding retained earnings is integral to comprehending a company’s financial history, its approach to managing profits, and its capacity to navigate economic fluctuations. By delving into the nuances of retained earnings, investors and stakeholders can glean valuable insights into a company’s financial decisions and its potential for sustained growth and profitability.

Linking Retained Earnings to the Income Statement

The relationship between retained earnings and the income statement is intricately woven into the fabric of a company’s financial performance. The income statement, also known as the profit and loss statement, provides a snapshot of a company’s revenues, expenses, and profits over a specific period. It serves as a dynamic record of the company’s operational activities and their impact on its financial position. Retained earnings, as a component of the balance sheet, are influenced by the net income or net loss reported in the income statement.

When a company generates positive net income, a portion of that income is typically retained rather than distributed as dividends to shareholders. This retained portion contributes to the growth of retained earnings on the balance sheet. Conversely, if a company incurs a net loss, it depletes its retained earnings, reducing the cumulative amount of profits available for reinvestment. Therefore, the income statement directly influences the trajectory of retained earnings, reflecting the company’s ability to generate profits and sustain its operations.

Moreover, the income statement provides insights into the factors driving changes in retained earnings. For instance, by analyzing the components of the income statement such as revenue, expenses, and taxes, stakeholders can discern the sources of a company’s profitability and evaluate its operational efficiency. Understanding how retained earnings are impacted by the income statement enables investors and analysts to gauge the company’s capacity to generate sustainable earnings and its commitment to reinvesting in its growth.

It is important to note that the linkage between retained earnings and the income statement underscores the interdependence of a company’s financial statements. The income statement not only influences the amount of retained earnings but also reflects the company’s profitability, which is a key determinant of its long-term sustainability and ability to create value for its shareholders.

In essence, the income statement serves as a pivotal bridge connecting the operational performance of a company to the accumulation of retained earnings, offering valuable insights into the company’s financial health and its strategic allocation of profits for future endeavors.

Linking Retained Earnings to the Balance Sheet

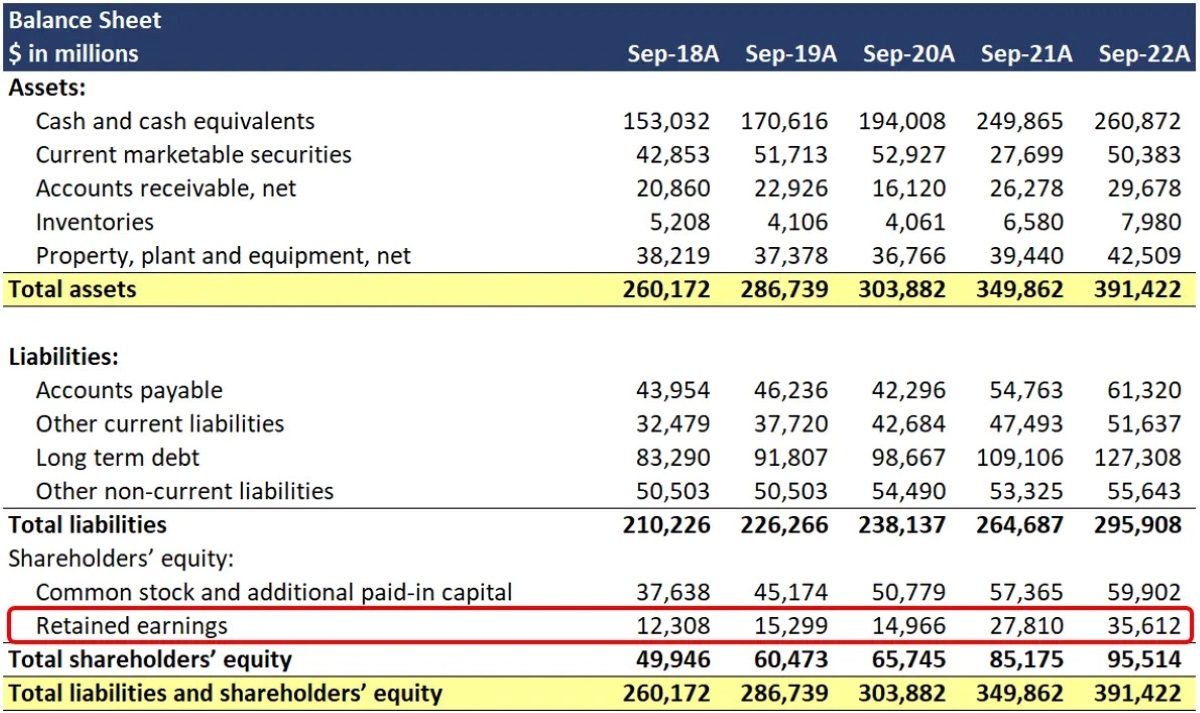

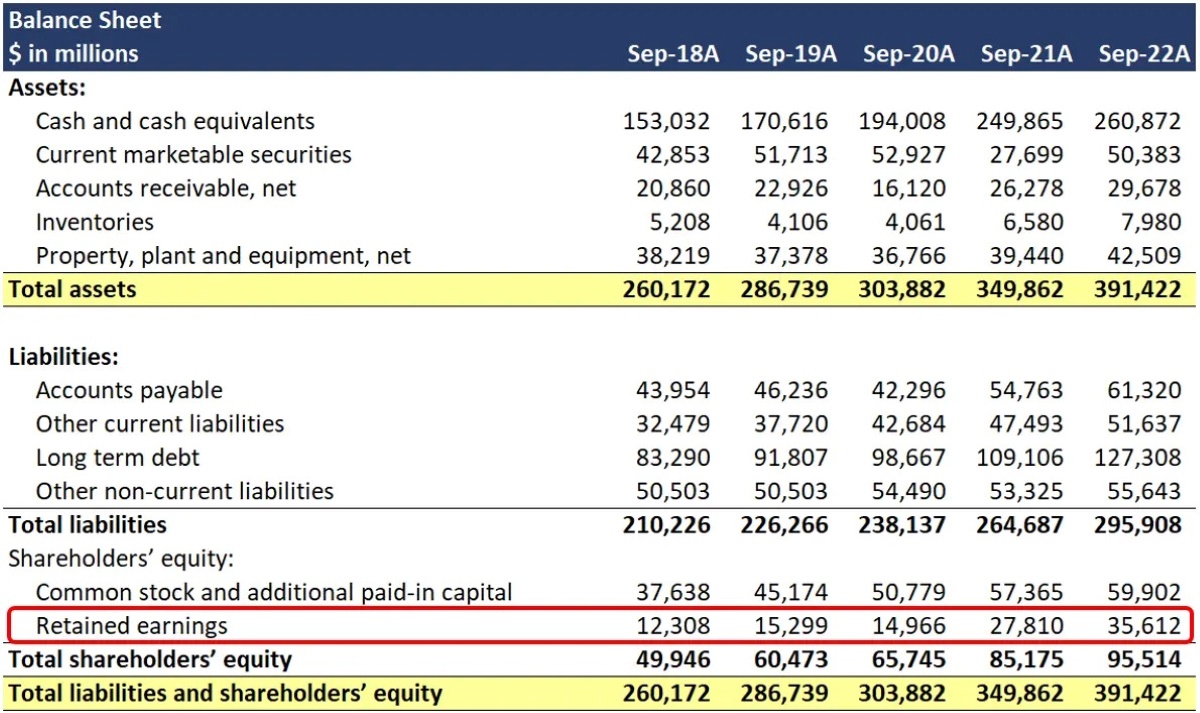

Retained earnings hold a prominent position on the balance sheet, playing a crucial role in depicting a company’s financial strength and its historical accumulation of profits. The balance sheet, also known as the statement of financial position, provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. It serves as a reflection of the company’s financial position and its sources of funding, including the retained earnings.

Retained earnings, listed under shareholders’ equity, represent the cumulative net income that a company has retained over time, after accounting for dividend distributions. Therefore, the balance sheet acts as a repository of the company’s retained earnings, showcasing the total amount of profits that have been reinvested into the business. This linkage between retained earnings and the balance sheet underscores the pivotal role of retained earnings in contributing to the company’s equity and overall financial stability.

Furthermore, the balance sheet provides a comprehensive view of how retained earnings are utilized within the company’s financial structure. It illustrates how the accumulated profits, represented by retained earnings, contribute to the company’s overall equity position. Positive retained earnings bolster the shareholders’ equity, signifying the company’s ability to generate profits and reinvest them for future growth. On the other hand, negative retained earnings, indicating accumulated losses or dividend distributions exceeding the net income, can impact the shareholders’ equity and raise concerns about the company’s financial health.

By examining the balance sheet, investors and analysts can assess the composition of shareholders’ equity and understand the impact of retained earnings on the company’s overall financial standing. Additionally, the balance sheet facilitates the comparison of retained earnings with other components of equity, such as additional paid-in capital and treasury stock, providing a comprehensive insight into the sources and allocation of the company’s equity capital.

In essence, the balance sheet serves as a vital link that portrays the culmination of retained earnings and their influence on the company’s financial structure. It offers a holistic view of how retained earnings contribute to the company’s equity, underscoring their significance in shaping the company’s financial position and providing a foundation for future growth and strategic initiatives.

Importance of Retained Earnings in Financial Analysis

Retained earnings hold immense significance in financial analysis, serving as a key metric for evaluating a company’s financial performance, growth prospects, and capital management strategies. Understanding the importance of retained earnings in financial analysis provides valuable insights for investors, analysts, and stakeholders seeking to assess a company’s long-term sustainability and its ability to generate value.

One of the primary roles of retained earnings in financial analysis is as an indicator of a company’s profitability and its capacity to generate sustainable earnings. Positive retained earnings signify that the company has been profitable over time, reflecting its ability to generate net income and reinvest a portion of it into the business. This not only demonstrates the company’s historical profitability but also suggests its potential for future growth and value creation.

Moreover, retained earnings offer valuable insights into a company’s dividend policy and its approach to returning value to shareholders. Companies with substantial retained earnings may have the flexibility to allocate funds for dividend payments, share buybacks, or strategic investments, thereby enhancing shareholder value. On the other hand, negative retained earnings or a declining trend in retained earnings could raise concerns about the company’s ability to sustain dividend payments and maintain investor confidence.

Additionally, retained earnings play a pivotal role in internal financing and capital management. Companies often rely on retained earnings as a source of funding for expansion initiatives, research and development projects, debt repayment, and operational expenses. The accumulation of retained earnings reflects the company’s ability to self-finance its growth and mitigate the reliance on external capital sources, thereby enhancing its financial resilience and independence.

Furthermore, analyzing the trend of retained earnings over time provides insights into the company’s financial stability and risk management. A consistent growth in retained earnings suggests prudent financial management and a sustainable business model, while erratic or declining retained earnings may indicate financial challenges or inefficiencies in capital allocation.

Overall, the importance of retained earnings in financial analysis lies in its role as a barometer of a company’s profitability, dividend policy, growth potential, and financial resilience. By delving into the dynamics of retained earnings, stakeholders can gain a comprehensive understanding of a company’s financial trajectory, strategic priorities, and its capacity to create long-term value for its shareholders and stakeholders.

Conclusion

In conclusion, the intricate link between retained earnings, the income statement, and the balance sheet forms the backbone of financial analysis, offering profound insights into a company’s financial performance, growth trajectory, and capital management strategies. Retained earnings, as a reflection of a company’s accumulated profits, play a pivotal role in connecting the income statement and the balance sheet, thereby shaping the narrative of a company’s financial story.

By understanding the nuances of retained earnings, investors, financial analysts, and stakeholders can decipher the historical profitability of a company, its dividend policy, and its capacity to reinvest in future growth. The income statement serves as a dynamic canvas that influences the trajectory of retained earnings, showcasing the company’s ability to generate sustainable earnings and its commitment to reinvestment. Meanwhile, the balance sheet encapsulates the culmination of retained earnings, depicting their impact on the company’s equity and financial structure.

Retained earnings not only serve as a testament to a company’s historical profitability but also offer valuable insights into its dividend policy, internal financing capabilities, and long-term sustainability. They are a barometer of a company’s financial health, providing a foundation for informed decision-making and strategic analysis.

Therefore, the importance of retained earnings in financial analysis cannot be overstated. They serve as a compass, guiding stakeholders through the labyrinth of financial statements and offering a comprehensive view of a company’s past performance and future potential. By unraveling the intricate relationship between retained earnings, the income statement, and the balance sheet, stakeholders can gain a deeper appreciation of a company’s financial narrative, its strategic priorities, and its capacity to create enduring value.

In essence, retained earnings are not just figures on a balance sheet; they are a testament to a company’s resilience, prudence, and potential for sustained growth. As stakeholders navigate the realm of financial analysis, the significance of retained earnings illuminates the path toward informed decision-making, strategic foresight, and a profound understanding of a company’s financial landscape.