Finance

How Do Dividends Affect Retained Earnings

Published: January 2, 2024

Learn how dividends impact retained earnings in finance. Understand the relationship between dividends and a company's overall financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Dividends and retained earnings are two key financial concepts that play a crucial role in the management and growth of a company’s capital. Understanding the relationship between these two concepts is essential for investors, business owners, and financial analysts.

Dividends refer to the portion of a company’s profits that is distributed to its shareholders. These can be in the form of cash payments, stock dividends, or other assets. Dividends are often seen as a way for companies to reward their shareholders for their investment and to provide them with a regular income stream.

On the other hand, retained earnings represent the accumulated profits that a company has retained or reinvested back into the business. These earnings are not distributed to shareholders but are instead kept within the company to finance growth initiatives, repay debt, or build cash reserves.

The relationship between dividends and retained earnings is complex and can have a significant impact on a company’s financial position and shareholder value. When a company chooses to pay dividends, it reduces its retained earnings, affecting its ability to reinvest in the business and potentially limiting future growth opportunities.

Companies must carefully consider various factors when deciding whether or not to pay dividends and how much to distribute. These factors include profitability, cash flow, capital requirements, market conditions, growth prospects, and the preferences and expectations of shareholders.

In this article, we will delve deeper into the relationship between dividends and retained earnings and explore the impact of dividends on a company’s financial health and shareholder value. We will also discuss the factors that influence the effect of dividends on retained earnings and provide real-world examples to illustrate this relationship. By understanding the dynamics and implications of dividends and retained earnings, investors and business owners can make informed decisions to optimize their financial strategies.

Definition of Dividends

Dividends are a portion of a company’s profits that is distributed to its shareholders as a return on their investment. They can be in the form of cash payments, stock dividends, or other assets. Companies typically pay dividends to demonstrate their financial strength, reward shareholders, and attract investors.

Dividends are usually declared and approved by a company’s board of directors. The decision to pay dividends and the amount to be paid depend on various factors, including the company’s profitability, cash flow, capital requirements, and growth prospects.

Cash dividends are the most common form of dividends, where shareholders receive a specified amount of money for each share they own. For example, if a company declares a cash dividend of $0.50 per share and an investor owns 100 shares, they will receive $50 as dividend income.

Stock dividends, also known as bonus shares, are paid out in the form of additional shares of the company’s stock. Instead of receiving cash, shareholders receive a proportionate number of additional shares for each share they own. For instance, if a company declares a 10% stock dividend and an investor owns 100 shares, they will receive an additional 10 shares as dividend.

Aside from cash and stock dividends, companies may also distribute dividends in the form of other assets. These can include property, inventory, or even shares of a subsidiary company.

Dividends are often seen as a key factor in calculating the total return on investment for shareholders. In addition to any capital gains realized from selling shares at a higher price, dividends provide a regular income stream that can contribute to investors’ overall returns.

It’s important to note that not all companies pay dividends. Some companies, particularly those in high-growth industries, may reinvest all of their profits back into the business to fund expansion, research and development, or debt repayment. In such cases, the company’s earnings are retained rather than distributed to shareholders.

Understanding the concept of dividends is essential for investors as it helps gauge a company’s financial health and its willingness to reward shareholders. By analyzing a company’s dividend history, investors can assess its stability, profitability, and commitment to providing a return on investment.

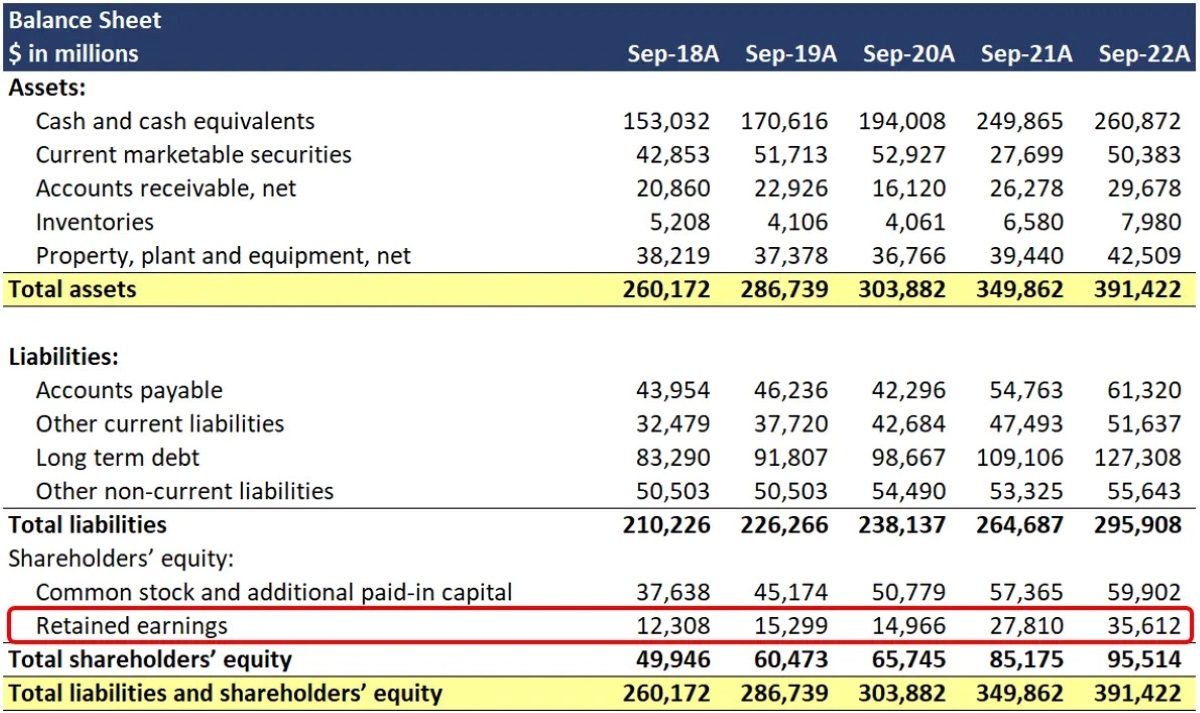

Definition of Retained Earnings

Retained earnings represent the accumulated profits that a company has retained or reinvested back into the business. It is the portion of a company’s net income that is not distributed to shareholders in the form of dividends.

When a company earns profits, it has several options on how to allocate those earnings. One option is to distribute them to shareholders as dividends, while the other option is to retain them within the company. These retained earnings become part of the company’s equity and are reflected on the balance sheet.

Retained earnings play a crucial role in funding a company’s growth initiatives, such as research and development, acquisitions, expanding operations, or purchasing equipment. By reinvesting profits back into the business, companies can strengthen their competitive position, enhance their product offerings, and take advantage of new market opportunities.

Retained earnings also serve as a financial cushion for companies during challenging times. By building up reserves, companies can better withstand economic downturns, unexpected expenses, or temporary declines in profitability.

The amount of retained earnings a company has can vary significantly depending on its profitability and dividend policies over time. Companies that consistently generate high profits and reinvest a smaller portion of those earnings as dividends tend to have larger retained earnings balances.

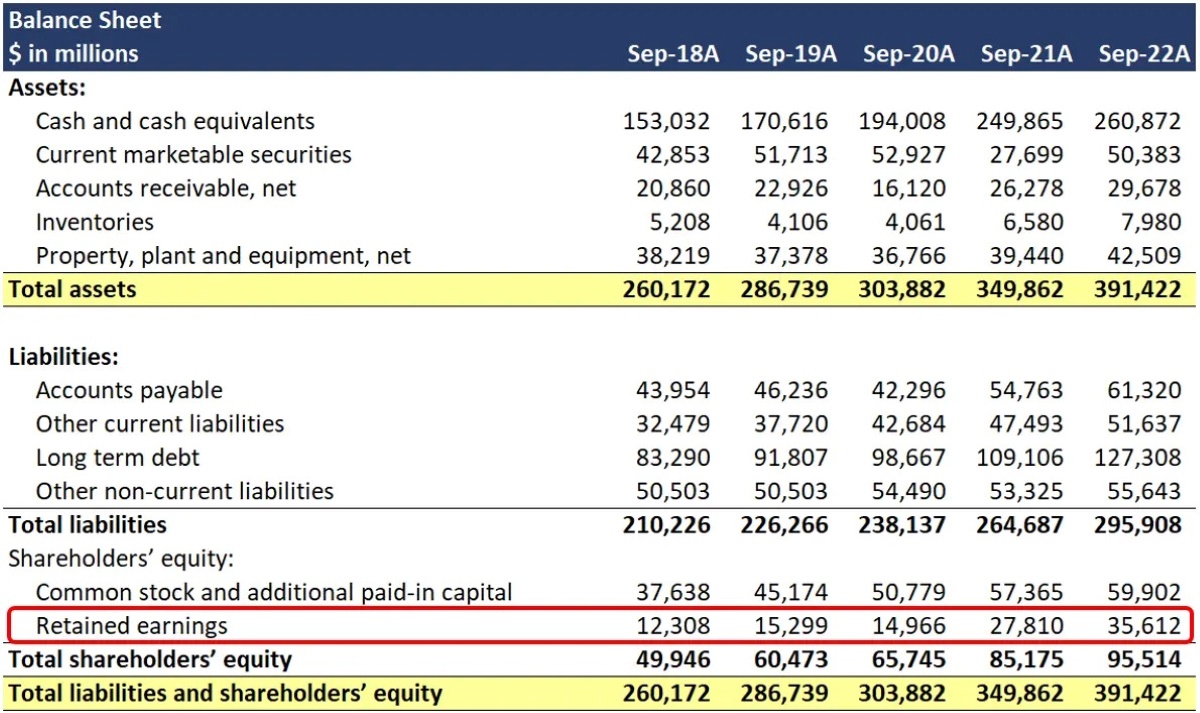

Retained earnings are a crucial measure of a company’s financial health and its ability to generate sustainable growth. Investors and analysts often consider the trend and growth rate of retained earnings over time as an indicator of the company’s profitability, efficiency, and long-term sustainability.

It’s important to note that retained earnings can also be impacted by factors such as losses, write-offs, or changes in accounting rules. In case a company incurs losses, it may deplete its retained earnings and even result in a negative retained earnings balance, known as accumulated deficit.

Overall, understanding the concept of retained earnings is important for investors and analysts as it provides insights into a company’s financial strategies, capital allocation decisions, and its ability to generate long-term value for shareholders.

Relationship Between Dividends and Retained Earnings

The relationship between dividends and retained earnings is intertwined and plays a crucial role in shaping a company’s financial position and its ability to grow and generate value for shareholders.

Dividends and retained earnings are two ways in which a company can allocate its profits. When a company earns profits, it can choose to distribute a portion of those earnings to shareholders as dividends or retain them within the business.

When dividends are paid to shareholders, they reduce the amount of retained earnings. This is because dividends are essentially a transfer of funds from the company’s equity to the shareholders. The retained earnings account on the company’s balance sheet decreases, reflecting the distribution of profits to shareholders.

On the other hand, when a company retains earnings and does not distribute dividends, it increases the amount of retained earnings. This accumulation of profits can be utilized to fund future growth initiatives, such as research and development, expansion, debt repayment, or building cash reserves.

The decision to pay dividends or retain earnings is influenced by various factors, including the company’s financial objectives, cash flow position, profitability, growth prospects, and the preferences and expectations of shareholders. Companies in mature industries with stable cash flows often choose to pay regular dividends to reward shareholders and maintain investor confidence. On the flip side, companies in high-growth sectors may decide to retain earnings to reinvest in the business and drive future expansion.

It’s important to strike a balance between paying dividends and retaining earnings. While dividends can provide immediate value to shareholders in the form of cash or additional shares, retaining earnings can fuel long-term growth and increase a company’s value. By reinvesting profits back into the business, companies can enhance their product offerings, enter new markets, acquire competitors, or invest in research and development to stay ahead of competition.

Furthermore, the relationship between dividends and retained earnings can also impact a company’s access to capital. Investors and lenders may evaluate a company’s dividend history and its ability to retain earnings when making investment decisions. Companies that consistently pay dividends and have a track record of retaining earnings may be viewed more favorably by investors, potentially attracting additional capital to fund future growth.

In summary, dividends and retained earnings are integral components of a company’s financial strategy. While dividends provide immediate value to shareholders, retained earnings enable a company to reinvest in the business and drive long-term growth. The decision on whether to pay dividends or retain earnings is influenced by numerous factors, and finding the right balance is crucial for maximizing shareholder value and ensuring the company’s sustainable growth.

Impact of Dividends on Retained Earnings

Dividends have a direct impact on a company’s retained earnings. When dividends are paid to shareholders, they reduce the amount of retained earnings on the company’s balance sheet.

Dividends are essentially a distribution of profits from the company’s equity to its shareholders. By paying dividends, the company is transferring funds to the shareholders and decreasing the amount of retained earnings available for reinvestment in the business.

For example, if a company has retained earnings of $1 million and decides to pay out $200,000 in dividends, the retained earnings balance will decrease to $800,000. The $200,000 is no longer available for the company to use for future investments, expansion, or debt repayment.

This reduction in retained earnings can impact a company’s future growth prospects. The retained earnings account serves as a source of internal financing for future projects and initiatives. By retaining earnings, companies can accumulate capital to fund research and development, marketing campaigns, acquisitions, or capital expenditures.

However, when a company pays dividends, it reduces its ability to undertake these growth opportunities. If a company consistently pays out a significant portion of its profits in dividends, it may have limited retained earnings that can be used for reinvestment. This can hinder the company’s ability to invest in new products, technologies, or enter new markets.

On the other hand, paying dividends can also have positive effects on a company’s financial position. Dividends can attract investors and signal confidence in the company’s profitability and stability. A history of regular dividends can increase shareholder loyalty and potentially enhance the company’s stock price.

Furthermore, paying dividends may be seen as a way to distribute excess cash to shareholders when the company does not have attractive investment opportunities or when the shareholders have a preference for regular income. By returning profits to shareholders, companies can reward their investors for their capital contributions and provide them with a consistent income stream.

The impact of dividends on retained earnings can vary depending on a company’s financial objectives, cash flow position, profitability, growth prospects, and the preferences and expectations of shareholders. The balance between paying dividends and retaining earnings is a strategic decision that requires careful consideration of these factors.

In summary, dividends directly impact a company’s retained earnings by reducing the amount available for reinvestment in the business. While paying dividends may enhance shareholder loyalty and provide immediate value to investors, it can limit a company’s ability to fund future growth initiatives. Thus, companies must strike a balance between paying dividends and retaining earnings to optimize their financial strategies and drive long-term value creation.

Factors Influencing the Effect of Dividends on Retained Earnings

Several factors can influence the effect of dividends on a company’s retained earnings. These factors play a crucial role in determining the amount of retained earnings available for reinvestment in the business.

1. Profitability: The level of profitability is a key factor influencing the effect of dividends on retained earnings. Companies with higher profits have more flexibility to pay dividends without significantly impacting their retained earnings. Conversely, companies with lower profits may need to retain a larger portion of their earnings to fund operations and future growth.

2. Cash flow position: The cash flow position of a company is another critical factor in determining the effect of dividends on retained earnings. Companies with strong cash flow are better able to pay dividends while still maintaining sufficient funds for reinvestment. On the other hand, companies with limited cash flow may need to prioritize retaining earnings to meet operating expenses or fund investment opportunities.

3. Growth prospects: The growth prospects of a company also influence the effect of dividends on retained earnings. Companies with significant growth opportunities may choose to retain a larger portion of their earnings to invest in research and development, acquisitions, or expansion. In contrast, companies with limited growth prospects or in mature industries may pay higher dividends as they have fewer opportunities for reinvestment.

4. Capital requirements: Companies with high capital requirements, such as those in capital-intensive industries like manufacturing or infrastructure, may need to retain more earnings to finance equipment purchases or infrastructure development. These companies may pay lower dividends to ensure they have sufficient funds for capital investments.

5. Debt obligations: Companies with high levels of debt may prioritize using their earnings to service debt payments and reduce their leverage. In such cases, these companies may choose to retain a larger portion of their earnings and pay lower dividends to strengthen their financial position and reduce their interest expenses.

6. Shareholder preferences: The preferences and expectations of shareholders also influence the effect of dividends on retained earnings. Some shareholders may prefer regular dividend payments, particularly if they rely on the income generated from their investments. Other shareholders may prioritize capital appreciation and growth potential, accepting lower or no dividends to allow the company to reinvest in the business.

7. Legal and regulatory requirements: Companies must also consider legal and regulatory requirements when determining the effect of dividends on retained earnings. Laws and regulations may impose limits on dividend payouts, requiring companies to retain a certain percentage of their earnings as a regulatory requirement.

Overall, these factors collectively influence the decision-making process around dividend payments and their impact on retained earnings. Companies must carefully evaluate their financial position, growth prospects, cash flow, and shareholder expectations to strike a balance that aligns with their strategic objectives and maximizes long-term value creation.

Examples of Dividends’ Effect on Retained Earnings

To illustrate the impact of dividends on retained earnings, let’s consider a few examples:

Example 1: Company A, a mature and profitable company, decides to pay out a cash dividend of $2 per share to its shareholders. The company has 1 million outstanding shares. The total dividend payout in this case is $2 million. As a result, the retained earnings account on Company A’s balance sheet will decrease by $2 million. The reduction in retained earnings reflects the distribution of profits to shareholders.

Example 2: Company B, a high-growth technology company, opts to retain its earnings to fund research and development initiatives. The company earned a net income of $10 million for the year. Instead of paying dividends, Company B decides to reinvest the entire amount back into the business. Consequently, the retained earnings account on Company B’s balance sheet will increase by $10 million. This increase in retained earnings reflects the accumulation of profits for future growth and investment opportunities.

Example 3: Company C, a company in a capital-intensive industry, faces significant capital requirements for expanding its production facilities. The company has retained earnings of $5 million and needs to invest $3 million in new equipment. To finance the capital expenditure, Company C decides to pay a reduced cash dividend of $1 million to its shareholders, retaining $1 million in earnings. In this scenario, the retained earnings account will decrease by $1 million, reflecting the distribution of dividends, while still enabling the company to fund its capital investment.

These examples demonstrate how dividend payments can impact a company’s retained earnings. By paying dividends, companies reduce their retained earnings, limiting their ability to reinvest profits back into the business for growth opportunities. Conversely, when a company retains earnings and does not distribute dividends, it increases its retained earnings, providing a greater pool of capital for future initiatives.

It’s important to note that the impact of dividends on retained earnings can vary depending on a company’s financial objectives, profitability, cash flow position, growth prospects, and other factors. Companies must carefully evaluate these factors and strike a balance between paying dividends and retaining earnings to optimize their financial strategies.

By understanding how dividends affect retained earnings, investors and stakeholders can gain insights into a company’s financial health, dividend policy, and its ability to sustain growth and generate value over the long term.

Conclusion

Understanding the relationship between dividends and retained earnings is crucial for investors, business owners, and financial analysts. Dividends represent a distribution of profits to shareholders, while retained earnings reflect the accumulation of profits that are retained within the company. The interplay between dividends and retained earnings has a significant impact on a company’s financial health, growth prospects, and shareholder value.

Dividends have a direct effect on a company’s retained earnings. When dividends are paid to shareholders, the retained earnings decrease as funds are transferred from the company’s equity to the shareholders. This reduction in retained earnings can limit a company’s ability to reinvest profits back into the business for future growth and expansion.

However, paying dividends can also have positive implications. Dividends can attract investors, reward shareholders, and provide a regular income stream. They can also signal confidence in the company’s profitability and stability, enhancing the company’s reputation and potentially increasing its stock price.

Several factors influence the effect of dividends on retained earnings, including profitability, cash flow position, growth prospects, capital requirements, debt obligations, shareholder preferences, and legal/regulatory requirements. Companies must carefully consider these factors when formulating their dividend policies to strike a balance between providing value to shareholders and retaining earnings for future business needs.

In conclusion, dividends and retained earnings are two essential financial concepts that should be carefully managed for long-term success. Paying dividends can provide immediate value to shareholders, while retaining earnings enables companies to fuel growth and fund future initiatives. Striking the right balance between dividends and retained earnings is crucial for optimizing a company’s financial strategy, maximizing shareholder value, and ensuring sustainable growth in an ever-changing business landscape.