Finance

What Are Retained Earnings On Balance Sheet

Modified: December 30, 2023

Learn what retained earnings are and how they impact a company's balance sheet. Get insights into finance and accounting concepts.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

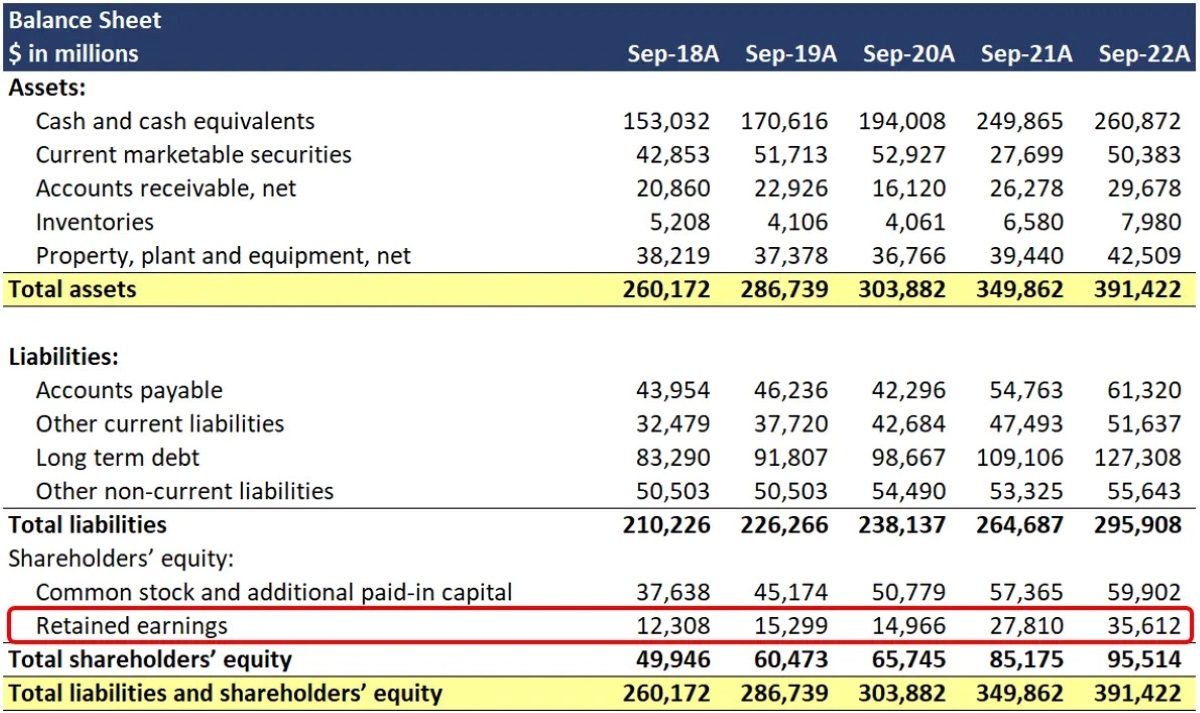

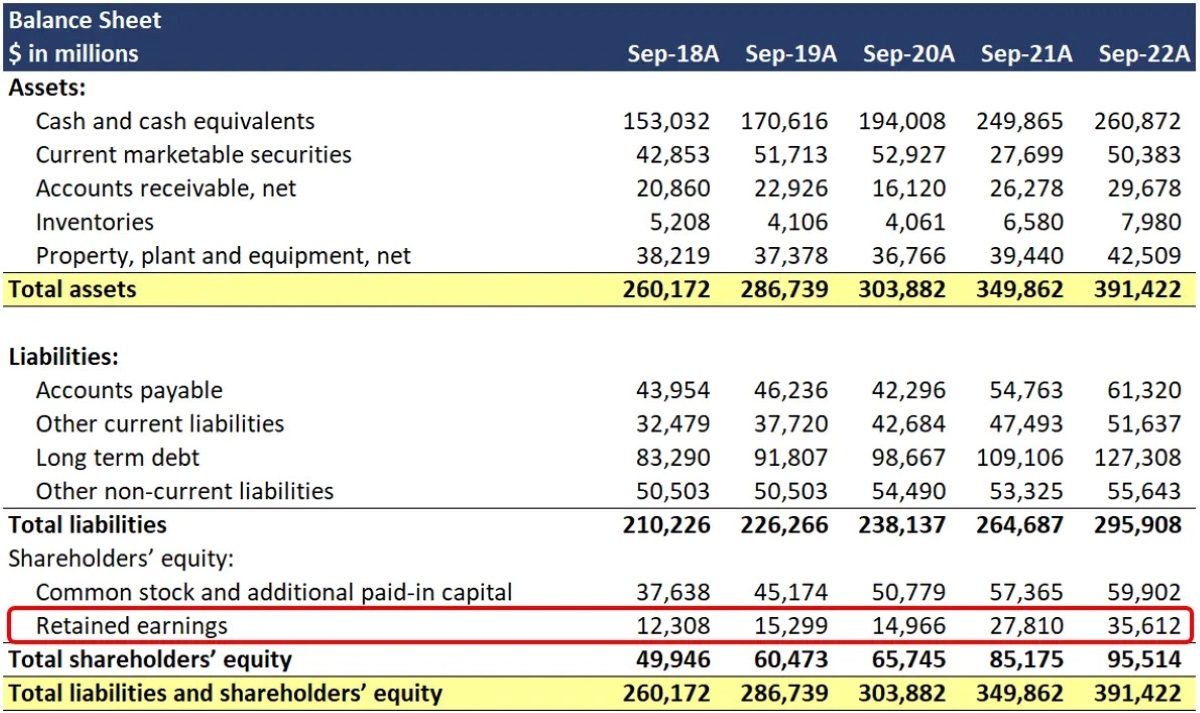

Welcome to our in-depth guide to understanding retained earnings on the balance sheet. Financial statements are essential tools for businesses and investors, providing valuable insights into a company’s financial health and performance. The balance sheet is one of the key financial statements that highlights a company’s assets, liabilities, and shareholders’ equity.

Within the shareholders’ equity section of the balance sheet, you’ll find an important component known as retained earnings. Retained earnings represent the portion of a company’s profits that have been kept or retained rather than distributed to shareholders as dividends. This metric provides valuable information about a company’s ability to generate profits and its reinvestment strategies.

Retained earnings are crucial for a company’s growth and long-term sustainability. By reinvesting profits into the business, companies can finance expansion initiatives, research and development, debt repayment, or acquisitions. Retained earnings also serve as a cushion during challenging times, helping companies withstand economic downturns or financial setbacks.

In this article, we’ll delve into the definition and calculation of retained earnings, explore the factors that affect this metric, analyze its presentation on the balance sheet, and discuss the importance of interpreting retained earnings. Let’s jump right in!

Definition of Retained Earnings

Retained earnings, also known as earned surplus or accumulated earnings, are a measure of a company’s cumulative net profits after subtracting dividends paid to shareholders. It represents the amount of profit that a company has retained and reinvested back into the business since its inception.

Retained earnings are an integral part of a company’s equity, representing the shareholders’ ownership in the firm. As a company generates profits over time, these earnings can be either distributed to shareholders as dividends or reinvested back into the company for future growth opportunities.

When a company retains its earnings, it essentially preserves a portion of its profits for reinvestment. This reinvestment can take various forms, such as expanding operations, investing in research and development, paying off debt, or acquiring other companies.

Companies often choose to retain earnings when they believe that reinvesting back into the business will generate future returns that exceed the cost of financing through debt or equity issuance. Retained earnings can serve as a valuable source of internal financing, reducing the reliance on external sources and allowing companies to maintain greater control and flexibility over their operations.

It’s important to note that retained earnings can fluctuate over time, depending on a company’s profitability, dividend policies, and capital allocation decisions. Positive retained earnings indicate that the company has generated profits, while negative retained earnings suggest that the company has accumulated deficits or losses.

Understanding the concept of retained earnings is essential for investors, as it provides insights into a company’s financial performance, growth potential, and dividend-paying capacity. It also reflects management’s decision-making regarding the allocation of profits and reinvestment strategies.

Next, let’s explore how retained earnings are calculated to gain a deeper understanding of this important financial metric.

Importance of Retained Earnings

Retained earnings play a vital role in the financial health and growth of a company. Here are a few key reasons why retained earnings are important:

- Reinvestment for Growth: Retained earnings provide a source of internal financing that companies can utilize to fund expansion initiatives, research and development, and other strategic investments. By reinvesting profits back into the business, companies can fuel their growth and increase their market share.

- Flexibility in Times of Uncertainty: Retained earnings act as a financial cushion during periods of economic downturn or unexpected events. By retaining earnings, companies can build up reserves that can be used to navigate challenging times, maintain operations, and avoid the need for external financing or cost-cutting measures.

- Debt Reduction: Retained earnings can be used to pay off outstanding debt obligations. By reducing debt levels, companies can improve their financial stability, lower interest expenses, and enhance their creditworthiness, thus reducing their reliance on external financing sources.

- Dividend Payments: While retained earnings are typically reinvested into the business, they can also be used to pay dividends to shareholders. Companies with a track record of consistent profits and healthy retained earnings often reward their shareholders by distributing a portion of the earnings as dividends. Dividend payments can attract investors and increase shareholder loyalty.

- Attracting Investors: Retained earnings serve as an indicator of a company’s profitability and ability to generate sustainable growth. Companies with strong retained earnings are often viewed favorably by investors, as they demonstrate financial stability and a solid track record of reinvesting profits. This can help attract new investors and support the company’s stock price.

- Shareholder Value Creation: By effectively managing and growing retained earnings, companies can create long-term shareholder value. When retained earnings are reinvested to generate higher profits and increase the company’s overall worth, it benefits the shareholders who hold a stake in the company.

In summary, retained earnings are important for a company’s growth, stability, and ability to weather financial challenges. They provide a flexible source of financing, allow for strategic investments, and contribute to the creation of shareholder value. Monitoring and analyzing retained earnings can provide valuable insights into a company’s financial health and its commitment to long-term sustainability and value creation.

Calculation of Retained Earnings

The calculation of retained earnings is relatively straightforward and can be done using the following formula:

Retained Earnings = Beginning Retained Earnings + Net Income/Loss – Dividends

To calculate retained earnings, you’ll need the following information:

- Beginning Retained Earnings: The balance of retained earnings at the start of the accounting period. This can be found on the previous period’s balance sheet or financial statements.

- Net Income/Loss: The net profit or loss earned by the company during the accounting period. This figure can be obtained from the income statement, which showcases the company’s revenues, expenses, and taxes.

- Dividends: The amount of dividends declared and paid to shareholders during the accounting period. This information can be found in the company’s dividend records or financial statements.

To illustrate the calculation, let’s consider an example:

ABC Company has a beginning retained earnings balance of $100,000. During the accounting period, the company generates a net income of $50,000 and pays out dividends of $10,000. Applying the formula:

Retained Earnings = $100,000 + $50,000 – $10,000 = $140,000

Therefore, ABC Company’s retained earnings at the end of the accounting period would be $140,000.

It’s important to note that if a company incurs a net loss during the accounting period, the calculation of retained earnings would involve subtracting the loss and adding any dividend payments. This can result in a negative retained earnings balance, indicating accumulated deficits or losses.

Understanding the calculation of retained earnings allows investors, analysts, and stakeholders to assess a company’s profitability, dividend policies, and the amount of earnings reinvested in the business. It provides valuable insights into the financial performance and growth trajectory of a company.

Factors Affecting Retained Earnings

Retained earnings can be influenced by various factors that impact a company’s profitability and dividend policies. Understanding these factors is essential for analyzing and interpreting the changes in retained earnings over time. Here are some key factors that can affect retained earnings:

- Profitability: The primary determinant of retained earnings is a company’s profitability. Higher profits contribute to an increase in retained earnings, while losses result in a decrease or negative balance of retained earnings. Factors that influence profitability include sales revenue, cost management, pricing strategies, and productivity levels.

- Dividend Payments: Dividends paid to shareholders have a direct impact on retained earnings. When a company distributes dividends, the amount paid is subtracted from the accumulated profits, reducing the level of retained earnings. Companies with higher dividend payout ratios will have lower retained earnings for reinvestment purposes.

- Capital Expenditures: Capital expenditures, such as investments in property, plant, and equipment, impact retained earnings. These investments are considered long-term assets and are typically funded either through retained earnings or external financing. Higher capital expenditures reduce retained earnings as they reflect a portion of the profits being used for asset acquisition.

- Share Buybacks: Share buybacks, also known as stock repurchases, involve a company buying back shares of its own stock from the market. The repurchased shares are retired, reducing the outstanding shares and increasing the ownership percentage of existing shareholders. Share buybacks impact retained earnings as they reduce the company’s cash reserves, thus affecting the amount available for future dividends or reinvestment.

- Depreciation and Amortization: Depreciation and amortization are non-cash expenses that allocate the cost of assets over their useful life. While these expenses do not directly impact retained earnings, they reduce net income and taxable income, thereby indirectly affecting the amount available for retained earnings.

- Acquisitions and Mergers: If a company engages in acquisitions or mergers, retained earnings can be affected. The purchase of another company can result in goodwill, which is an intangible asset that represents the excess purchase price over the fair value of net assets acquired. Goodwill is not amortized but tested for impairment annually, and any impairment losses can impact retained earnings.

It’s important to note that each company has its unique circumstances and business dynamics that might affect its retained earnings differently. Factors such as industry trends, competition, market conditions, and management decisions can also play a role in shaping retained earnings.

By considering these factors and analyzing changes in retained earnings over time, investors and analysts can assess a company’s financial performance, sustainable growth prospects, and the balance between distributing profits to shareholders and reinvesting back into the business.

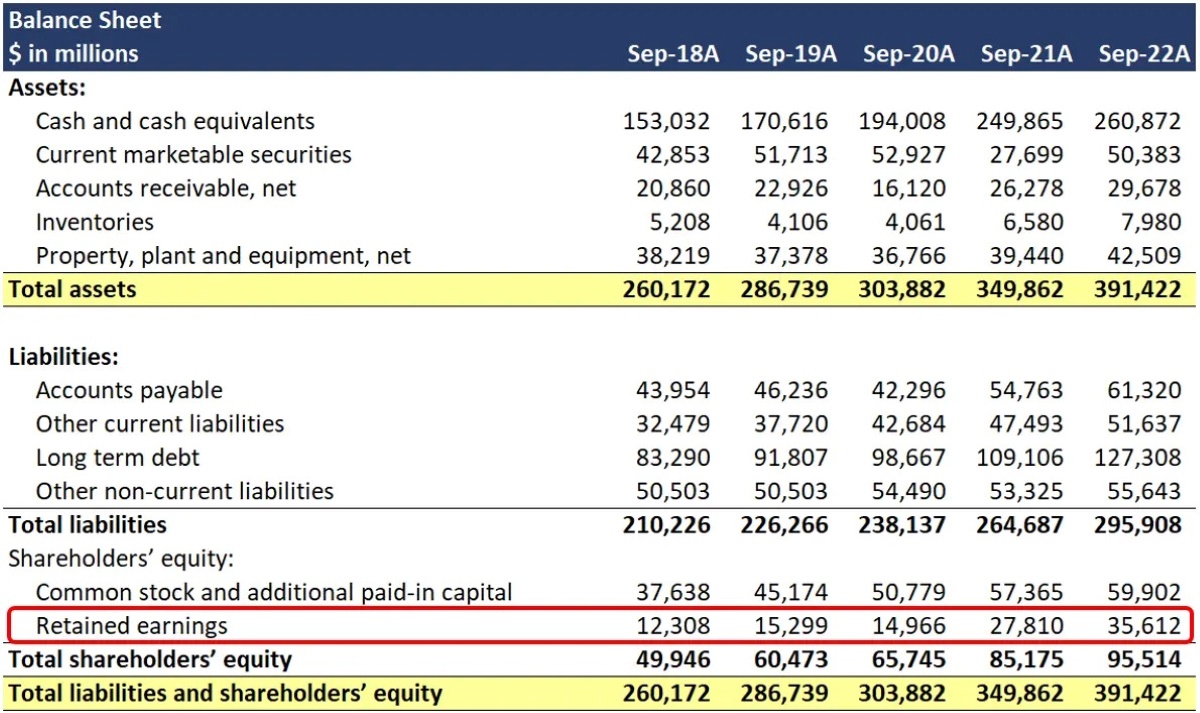

Retained Earnings on the Balance Sheet

Retained earnings are an important component of a company’s balance sheet, specifically within the shareholders’ equity section. The balance sheet provides a snapshot of a company’s financial position, highlighting its assets, liabilities, and shareholders’ equity at a specific point in time.

Within the shareholders’ equity section, you will find a line item for retained earnings. It represents the cumulative amount of profits that have been retained and reinvested in the business since its inception, after accounting for dividends distributed to shareholders.

Retained earnings are typically presented as a separate line item on the balance sheet, below the paid-in capital or contributed surplus. The balance sheet reflects the beginning retained earnings balance at the start of the accounting period, the net income or loss for the period, dividend payouts, and the ending retained earnings balance.

The presentation of retained earnings on the balance sheet is as follows:

Shareholders’ Equity

- Capital Stock or Common Stock

- Additional Paid-in Capital

- Retained Earnings

- Treasury Stock (if applicable)

- Accumulated Other Comprehensive Income

- Total Shareholders’ Equity

The ending retained earnings balance can be carried forward to the next accounting period as the beginning retained earnings balance. This continuity emphasizes the cumulative nature of retained earnings and their role in the company’s overall financial position.

Retained earnings on the balance sheet can reveal important information about a company, such as:

- Financial Performance: Increasing retained earnings indicate a company’s ability to generate profits and maintain a positive growth trajectory over time.

- Dividend Policy: By comparing the amount of retained earnings to the dividend payments, investors can gauge the company’s dividend policy and its willingness to distribute profits to shareholders.

- Reinvestment Strategies: Higher retained earnings suggest that a company is reinvesting profits back into the business for future growth opportunities.

- Financial Stability: A healthy level of retained earnings provides a financial cushion and demonstrates the company’s ability to withstand economic downturns or unexpected financial challenges.

Analyze the balance sheet’s retained earnings along with other financial statements to gain a comprehensive understanding of a company’s financial health, profitability, and strategic focus.

Analysis and Interpretation of Retained Earnings

Retained earnings are a crucial metric for investors, analysts, and stakeholders as they provide valuable insights into a company’s financial performance, growth prospects, and dividend policies. Analyzing and interpreting retained earnings can help assess a company’s long-term sustainability, reinvestment strategies, and shareholder value creation. Here are key aspects to consider when analyzing retained earnings:

- Trend Analysis: Examining the trend in retained earnings over multiple periods can reveal a company’s historical performance and growth trajectory. Increasing retained earnings indicate a profitable and growing company, while decreasing or negative retained earnings might suggest challenges or losses.

- Comparison with Industry Peers: Comparing a company’s retained earnings to industry peers can offer insights into its relative performance and competitiveness. Higher retained earnings compared to peers may indicate a more successful reinvestment of profits and a stronger financial position.

- Dividend Payout Ratio: Calculating the dividend payout ratio, which is the proportion of earnings distributed as dividends, can provide insights into a company’s dividend policies. A lower payout ratio means a higher retention of earnings for reinvestment, while a higher ratio suggests a focus on rewarding shareholders through dividends.

- Reinvestment Strategies: Analyzing the use of retained earnings for reinvestment purposes can shed light on a company’s growth plans. Assessing whether the retained earnings are being allocated towards research and development, acquisitions, or capital expenditures can provide insights into the company’s strategic initiatives and future growth potential.

- Financial Stability: Examining the level of retained earnings can indicate a company’s ability to weather financial challenges. A higher level of retained earnings acts as a financial cushion, providing stability and flexibility during economic downturns or unexpected market disruptions.

- Growth Potential: Higher retained earnings can signify a company’s ability to internally finance growth opportunities. Companies with substantial retained earnings may have an advantage in pursuing expansion initiatives or making strategic investments without excessive reliance on external financing.

It’s important to consider industry-specific factors, market conditions, and the company’s overall financial health while interpreting retained earnings. Additionally, comparing retained earnings to other financial metrics such as return on equity (ROE) and earnings per share (EPS) can provide a more comprehensive analysis of a company’s financial performance and shareholder value creation.

However, it’s crucial to note that interpreting retained earnings solely based on numeric figures can be misleading. It’s essential to consider the company’s overall business strategy, market positioning, management’s decision-making, and industry-specific dynamics to gain a holistic understanding of retained earnings.

By analyzing and interpreting retained earnings in conjunction with other financial metrics and qualitative factors, investors and stakeholders can make informed investment decisions, assess a company’s future growth prospects, and evaluate its ability to generate sustainable shareholder value.

Conclusion

Retained earnings on the balance sheet are a critical component of a company’s financial health and performance. They represent the cumulative profits that have been retained and reinvested in the business, showcasing the company’s ability to generate profits and its commitment to long-term sustainability.

Understanding and analyzing retained earnings provide valuable insights into a company’s growth potential, dividend policies, and financial stability. By assessing trends in retained earnings, comparing them to industry peers, and analyzing factors that influence their changes, investors and stakeholders can make informed decisions and evaluate a company’s overall financial health and prospects.

Retained earnings are not solely a financial metric but also a reflection of management’s strategies and the company’s reinvestment plans. Companies with higher retained earnings often have more flexibility to finance growth initiatives and weather economic downturns. However, it’s important to consider the specific circumstances of each company, such as industry dynamics and management decisions, when interpreting retained earnings.

An in-depth analysis of retained earnings should also consider other financial metrics, such as dividend payout ratios and reinvestment strategies, to gain a comprehensive understanding of a company’s financial performance and shareholder value creation. This holistic approach allows for a more comprehensive evaluation of a company’s potential for long-term success.

In conclusion, retained earnings on the balance sheet provide a glimpse into a company’s financial journey, profitability, and reinvestment efforts. It serves as a valuable tool for investors, analysts, and stakeholders to assess a company’s financial health, growth potential, and commitment to creating sustainable shareholder value.