Home>Finance>How Do You Calculate Retained Earnings On A Balance Sheet

Finance

How Do You Calculate Retained Earnings On A Balance Sheet

Modified: December 30, 2023

Learn how to calculate retained earnings on a balance sheet in finance. Understand the importance of this financial metric for assessing a company's profitability and growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Retained earnings are a crucial component of a company’s financial health and are prominently featured on the balance sheet. They represent the cumulative net income that a company has retained rather than distributing it to shareholders as dividends. Retained earnings reflect the profitability and growth of a business over time, serving as an indicator of its financial stability and reinvestment capability.

Understanding how to calculate retained earnings on a balance sheet is essential for investors, analysts, and business owners alike. It provides valuable insights into the company’s historical performance and future prospects. By analyzing these figures, stakeholders can gauge the effectiveness of the company’s profitability, dividend policy, and reinvestment strategies.

In this article, we will delve into the intricacies of retained earnings on a balance sheet, discussing their importance, calculation method, and the factors that can impact them. Whether you are a finance professional seeking knowledge or an entrepreneur managing a business, this guide will equip you with the necessary information to interpret and analyze retained earnings effectively.

What are retained earnings?

Retained earnings are a financial metric that represents the accumulated profits a company has retained over time. They are derived from the company’s net income after deducting dividends and other distributions to shareholders. Retained earnings are an important component of the equity section on a company’s balance sheet.

When a company generates profits, it has two primary options: distribute them to shareholders as dividends or reinvest them back into the business. If the company chooses to reinvest the profits, they are added to retained earnings. These funds can be used for various purposes, such as funding expansion plans, undertaking research and development, reducing debt, or acquiring other companies.

Retained earnings provide an indication of a company’s ability to generate profits and its financial strength. A company with consistently increasing retained earnings demonstrates long-term growth and profitability. Conversely, declining or negative retained earnings may raise concerns about the company’s financial performance and sustainability.

Retained earnings play a crucial role in determining a company’s financial health and its capacity for future growth. They are often reviewed by investors, creditors, and analysts to assess the company’s profitability, stability, and potential for generating returns.

It is important to note that retained earnings differ from revenue or sales. Revenue represents the company’s total income from providing goods or services, while retained earnings specifically refer to the amount of net income that has been reinvested back into the company.

Importance of retained earnings on a balance sheet

Retained earnings play a significant role on a company’s balance sheet and provide valuable insights into its financial health and stability. Here are the key reasons why retained earnings are important:

1. Measure of profitability: Retained earnings reflect the company’s profitability over time. Positive retained earnings indicate that the company has generated more income than it has distributed to shareholders as dividends. It is a clear sign that the company has been able to maintain and grow its profits.

2. Indicator of financial stability: Higher retained earnings signify financial stability and strength. It shows that the company has retained a portion of its profits to reinvest in the business instead of relying on external financing or incurring additional debt. This can provide a sense of security to investors, lenders, and other stakeholders.

3. Reinvestment in growth opportunities: Retained earnings provide a source of internal funding for a company’s growth initiatives. By retaining earnings, a company can finance new projects, research and development, acquisitions, or expansion plans without relying heavily on external capital. This allows the company to maintain control over its operations and avoid excessive debt.

4. Dividend payments: Retained earnings are often used to fund dividend payments to shareholders. When a company consistently generates profits and retains a portion of those earnings, it can distribute them to shareholders as dividends. Dividends are a way for investors to receive a return on their investment and can attract investors looking for income-generating stocks.

5. Increase in shareholder equity: Retained earnings contribute to the growth of shareholder equity. This means that as a company continues to retain and reinvest its profits, the value of the company’s shares and the ownership stake of shareholders increase over time.

6. Indicator of future prospects: Analyzing the trend of retained earnings can provide insights into a company’s future growth prospects. Consistent growth in retained earnings suggests that the company has a solid business model, effective financial management, and the ability to generate sustainable profits. This can influence investors’ confidence and attract new capital.

Overall, retained earnings are a crucial element in evaluating a company’s financial performance, stability, and growth potential. It provides a glimpse into how the company has managed its profits and reinvestment strategies over time, ultimately shaping its future prospects.

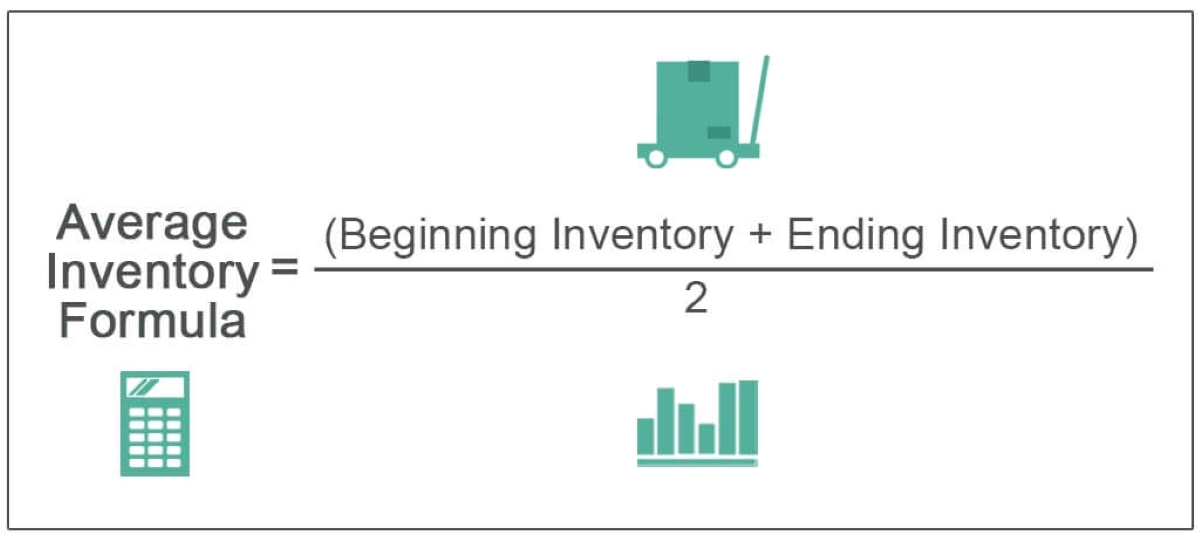

Formula for calculating retained earnings

The formula for calculating retained earnings is relatively straightforward and can be derived from the company’s financial statements. It takes into account the beginning retained earnings, net income or loss, dividends paid, and any other adjustments made during the period.

The basic formula for calculating retained earnings is as follows:

Retained Earnings = Beginning Retained Earnings + Net Income (or Loss) – Dividends – Other Adjustments

Let’s break down each component of the formula:

- Beginning Retained Earnings: This represents the retained earnings balance from the previous accounting period. It can be found on the balance sheet or previous financial statements.

- Net Income (or Loss): Net income refers to the total revenue generated by a company during the accounting period, minus the expenses and taxes. If the company incurs a loss, it is represented as a negative value.

- Dividends: Dividends are the portion of profits that a company distributes to its shareholders. Dividends are considered an outflow of cash and are subtracted from the net income.

- Other Adjustments: Other adjustments include any changes made to the retained earnings account during the accounting period, such as accounting changes, prior period adjustments, or reclassifications. These adjustments can be positive or negative and should be accounted for in the retained earnings calculation.

By using this formula, a company can determine the current balance of retained earnings, which is crucial for assessing its financial position and future growth prospects. It also allows investors, analysts, and stakeholders to analyze the company’s reinvestment strategies and dividend payout policies.

It is important to note that retained earnings can vary from one accounting period to another due to factors such as profitability, dividend decisions, and reinvestment activities. Regularly tracking and analyzing retained earnings can provide valuable insights into a company’s financial performance and its ability to generate sustainable profits over time.

Components of retained earnings calculation

Calculating retained earnings involves taking into account several key components that contribute to the overall balance. Understanding these components is essential for accurately determining the retained earnings figure. Let’s explore the main components involved:

- Beginning Retained Earnings: This represents the retained earnings balance at the start of an accounting period. It is carried forward from the previous period’s balance sheet and serves as the base for the current period’s calculation.

- Net Income (or Loss): Net income is the difference between a company’s total revenue and its expenses during a specific period. It reflects the profitability of the business and is a key factor in determining retained earnings. If a company incurs a loss, it is deducted from the beginning retained earnings.

- Dividends: Dividends are the portion of a company’s profits that is distributed to shareholders. When calculating retained earnings, dividends are subtracted from the net income. It is important to note that not all companies distribute dividends, and in such cases, the dividend component will be zero.

- Other Comprehensive Income (OCI): OCI includes gains and losses that are not included in net income but directly affect shareholders’ equity. Examples include currency translation adjustments, changes in the value of available-for-sale securities, and pensions adjustments. OCI is sometimes included in the retained earnings calculation, depending on accounting standards and the company’s policies.

- Other Adjustments: Other adjustments may include items like corrections of accounting errors, changes in accounting policies, or gains/losses from discontinued operations. These adjustments are typically considered when preparing the retained earnings statement to ensure the accuracy of the final figure.

By considering these components, companies can accurately calculate their retained earnings for a given accounting period. This calculation provides valuable insight into the financial health of the business and its ability to generate profits, sustain growth, and distribute dividends.

It is worth noting that the specific components and their treatment may vary depending on accounting standards, industry practices, and company-specific factors. Therefore, it is essential to refer to the company’s financial statements and accounting policies for precise details related to the calculation of retained earnings.

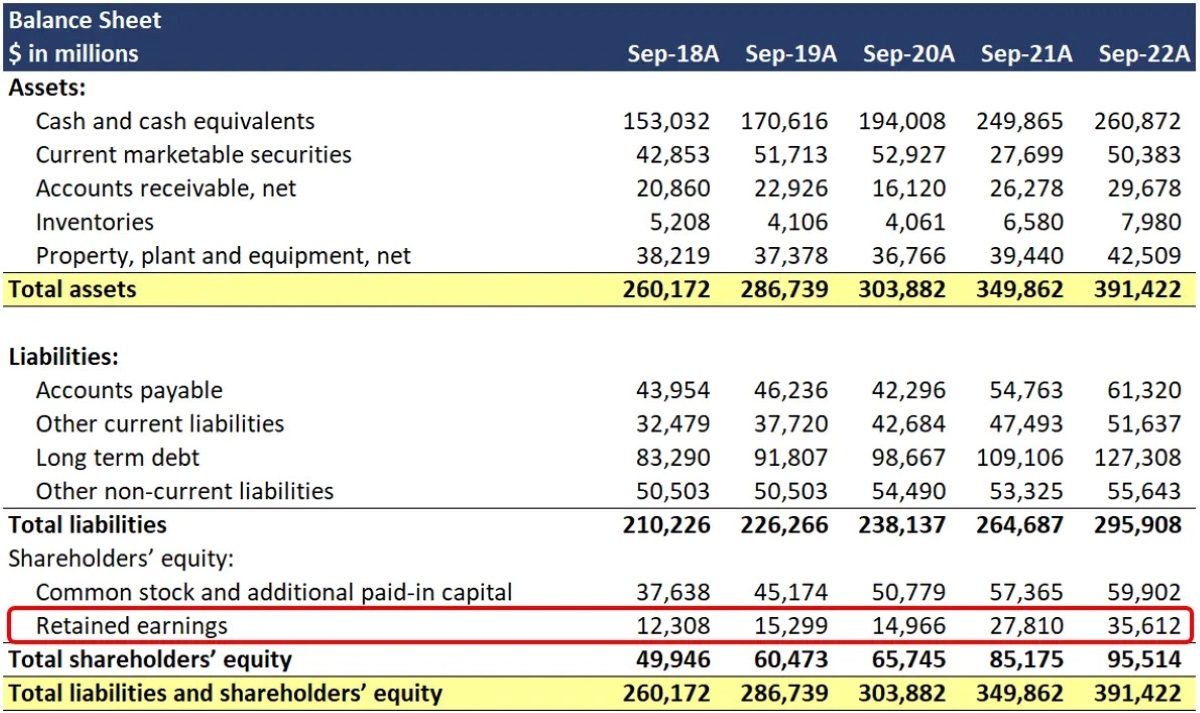

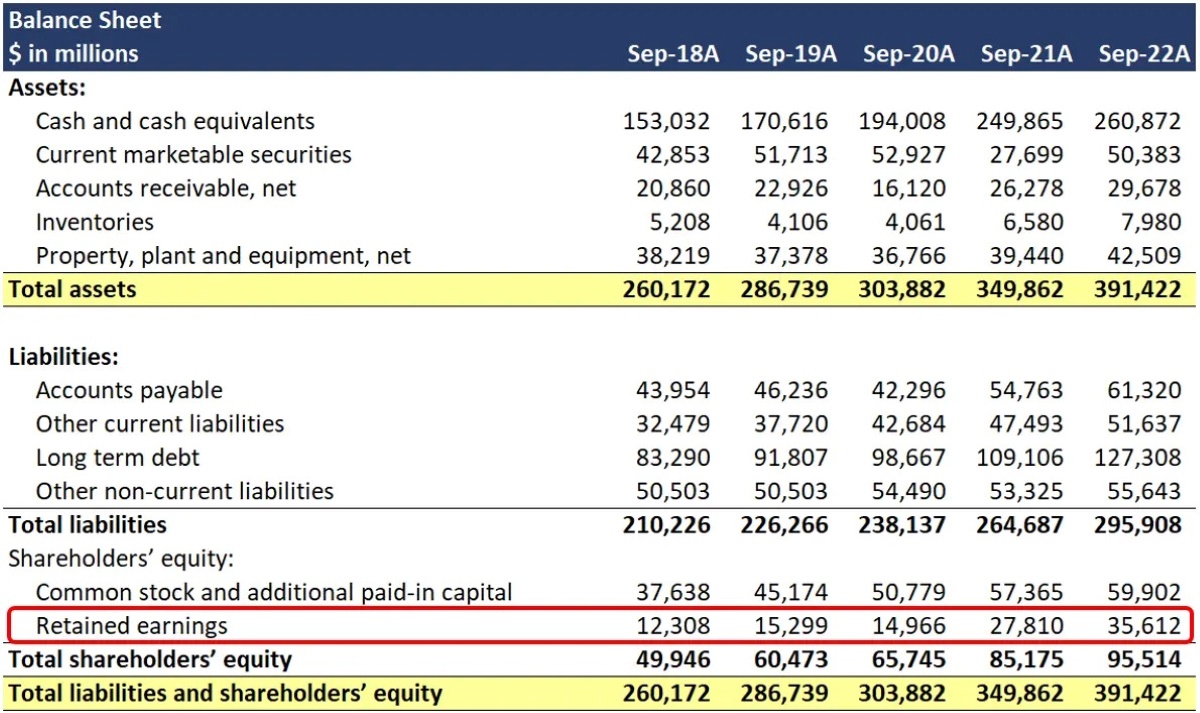

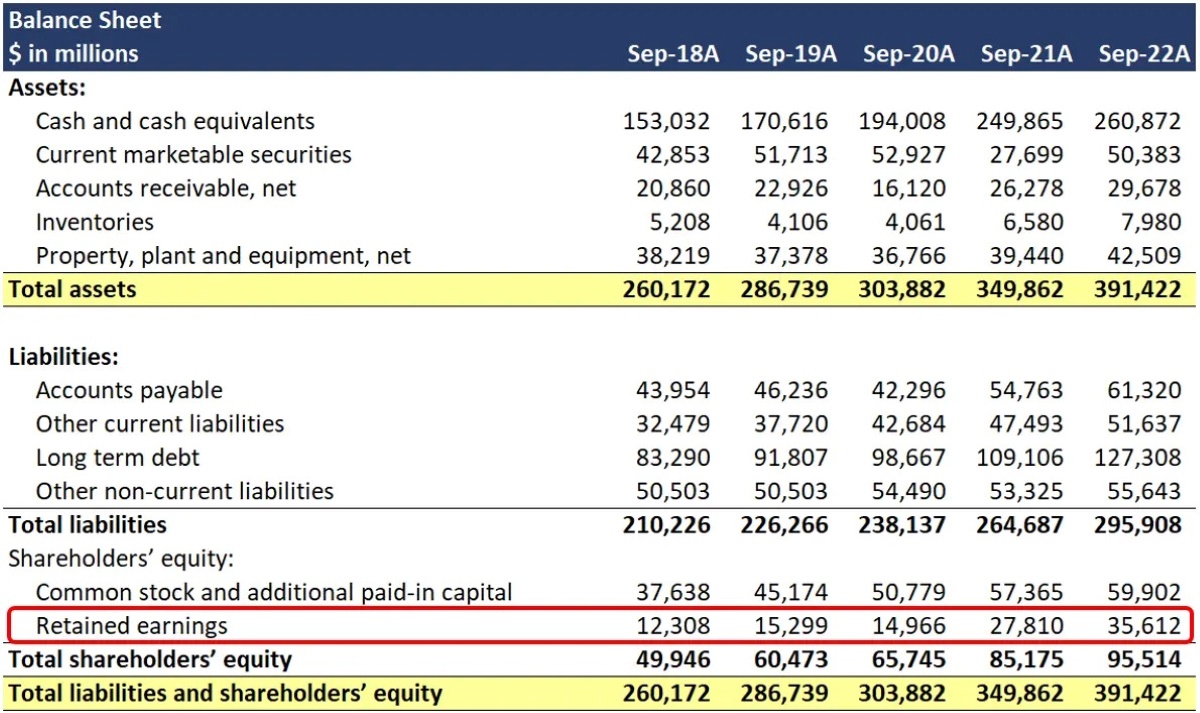

Example of calculating retained earnings on a balance sheet

To illustrate the calculation of retained earnings, let’s consider an example for a fictional company, ABC Corporation.

At the beginning of the fiscal year, ABC Corporation had retained earnings of $500,000. During the year, the company generated a net income of $300,000. Additionally, dividends of $50,000 were paid to shareholders, and there were no other adjustments or comprehensive income.

To calculate the retained earnings at the end of the year, we would use the following formula:

Retained Earnings = Beginning Retained Earnings + Net Income – Dividends

Substituting the values from our example:

Retained Earnings = $500,000 + $300,000 – $50,000

Retained Earnings = $750,000

Therefore, ABC Corporation’s retained earnings at the end of the fiscal year would be $750,000.

This positive figure indicates that the company has generated profits and retained a portion of those profits for potential reinvestment or future dividend payments.

It is important to note that retained earnings can be negative if a company has incurred losses in previous periods or has distributed more dividends than the accumulated profits. For example, if ABC Corporation had a net loss of $100,000 and paid dividends of $150,000, the calculation would be:

Retained Earnings = $500,000 – $100,000 – $150,000

Retained Earnings = -$250,000

In this scenario, the retained earnings of ABC Corporation would be a negative $250,000, indicating that the company has accumulated more losses and dividend distributions than it has earned from operations.

Calculating retained earnings provides insights into a company’s financial performance and its ability to generate profits. It is an important metric for investors, lenders, and analysts to understand a company’s financial health and growth prospects.

Factors affecting retained earnings

Retained earnings can be influenced by various factors that impact a company’s financial performance and decision-making. Understanding these factors is crucial for comprehending the dynamics behind changes in retained earnings. Let’s explore some of the key factors that can affect retained earnings:

- Profitability: The primary driver of retained earnings is the company’s profitability. Higher profits result in increased retained earnings, as more income is available for reinvestment or dividend distribution. Conversely, if a company experiences a decline in profitability or incurs losses, it will have a negative impact on retained earnings.

- Dividend Policy: A company’s dividend policy plays a significant role in determining retained earnings. The decision to pay dividends reduces the amount of profits that are retained. Companies with a more conservative dividend policy may retain a larger portion of their earnings, leading to higher retained earnings. Conversely, a company with a more aggressive dividend policy will have a lower level of retained earnings.

- Reinvestment Strategies: Companies can choose to reinvest their profits back into the business to fuel growth. The extent of reinvestment in research and development, expanding operations, or acquiring other companies can impact retained earnings. When companies reinvest a substantial portion of their profits, it leads to lower retained earnings as compared to companies that reinvest a smaller portion.

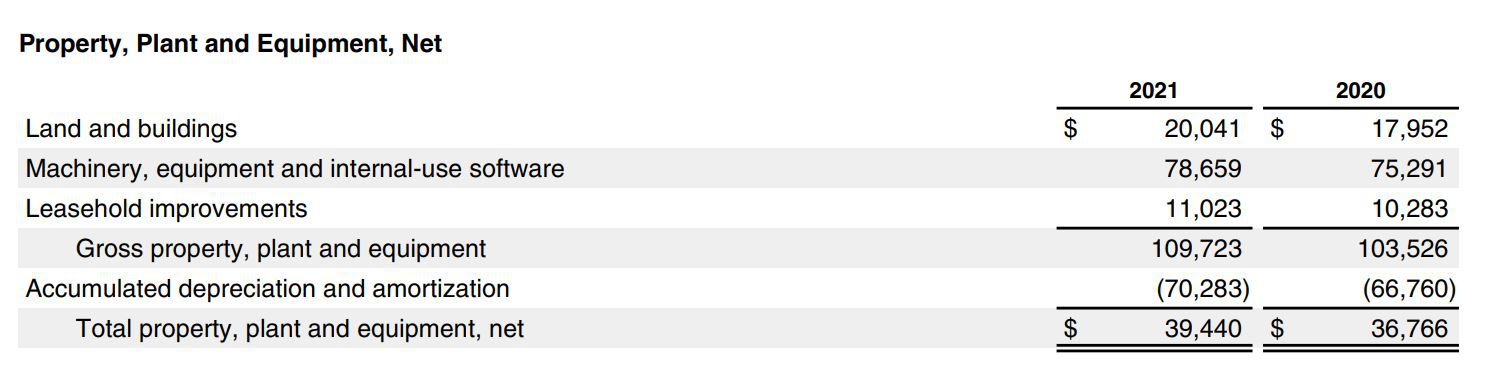

- Capital Expenditures: Capital expenditures, such as investments in equipment, technology, or infrastructure, can have an impact on retained earnings. Higher capital expenditures can reduce the amount of profits available for retention, resulting in lower retained earnings.

- Economic conditions: Economic conditions, such as recessions or fluctuations in market demand, can affect a company’s overall profitability and, in turn, its retained earnings. During challenging economic times, companies may experience reduced profits, leading to lower retained earnings.

- Regulatory and tax environment: Changes in regulatory policies or tax laws can impact a company’s earnings and, consequently, its retained earnings. For example, an increase in corporate tax rates would reduce the profits available for retention, which would lower retained earnings.

It is important to note that these factors interact with each other and can vary from one company to another. Different industries, business strategies, and market conditions can influence the magnitude and direction of these effects on retained earnings.

Monitoring and analyzing the factors affecting retained earnings is essential for understanding a company’s financial performance, its ability to sustain growth, and the potential for generating future returns for shareholders.

Conclusion

Retained earnings are a vital component of a company’s financial standing and contingent on various factors. They reflect the cumulative net income that a company has retained rather than distributing as dividends. Understanding how to calculate retained earnings on a balance sheet is crucial for investors, analysts, and business owners.

Throughout this article, we have explored the significance of retained earnings, the formula for calculating them, and the key components involved – including beginning retained earnings, net income (or loss), dividends, and other adjustments. We have also discussed factors that can impact retained earnings, such as profitability, dividend policy, reinvestment strategies, capital expenditures, economic conditions, and regulatory/tax environment.

Retained earnings serve as an indicator of a company’s profitability, financial stability, and growth potential. By analyzing retained earnings, stakeholders can gauge the effectiveness of a company’s financial management, dividend policy, and reinvestment strategies. Increasing or positive retained earnings indicate consistent profitability and potential for future growth, while declining or negative retained earnings raise concerns about a company’s financial performance and sustainability.

Regularly monitoring and analyzing retained earnings is crucial for understanding a company’s financial health and its ability to generate sustained profits. It provides valuable insights for investors, lenders, and analysts to assess the company’s performance, make informed investment decisions, and evaluate the potential returns on investment.

Remember, retained earnings are just one aspect of a company’s financial picture, and they should be considered in conjunction with other financial indicators and analysis. It is also important to note that retained earnings can vary from one period to another, reflecting changes in profitability, dividend decisions, and reinvestment activities.

In conclusion, retained earnings play a vital role in evaluating a company’s financial performance, stability, and growth potential. By understanding retained earnings and the factors that influence them, stakeholders can gain valuable insights into a company’s financial health and make informed decisions related to investing or managing their business.