Home>Finance>How Do Silver Futures Contracts Switch Active Months?

Finance

How Do Silver Futures Contracts Switch Active Months?

Published: December 24, 2023

Learn how silver futures contracts switch active months in the world of finance and enhance your understanding of the commodities market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of silver futures contracts, where traders and investors speculate on the future price of silver. These contracts play a vital role in the commodities market, allowing participants to hedge their positions or seek profit from price movements. One key aspect of silver futures contracts is the concept of active months. In this article, we will explore what active months are and how they are switched in the world of silver futures trading.

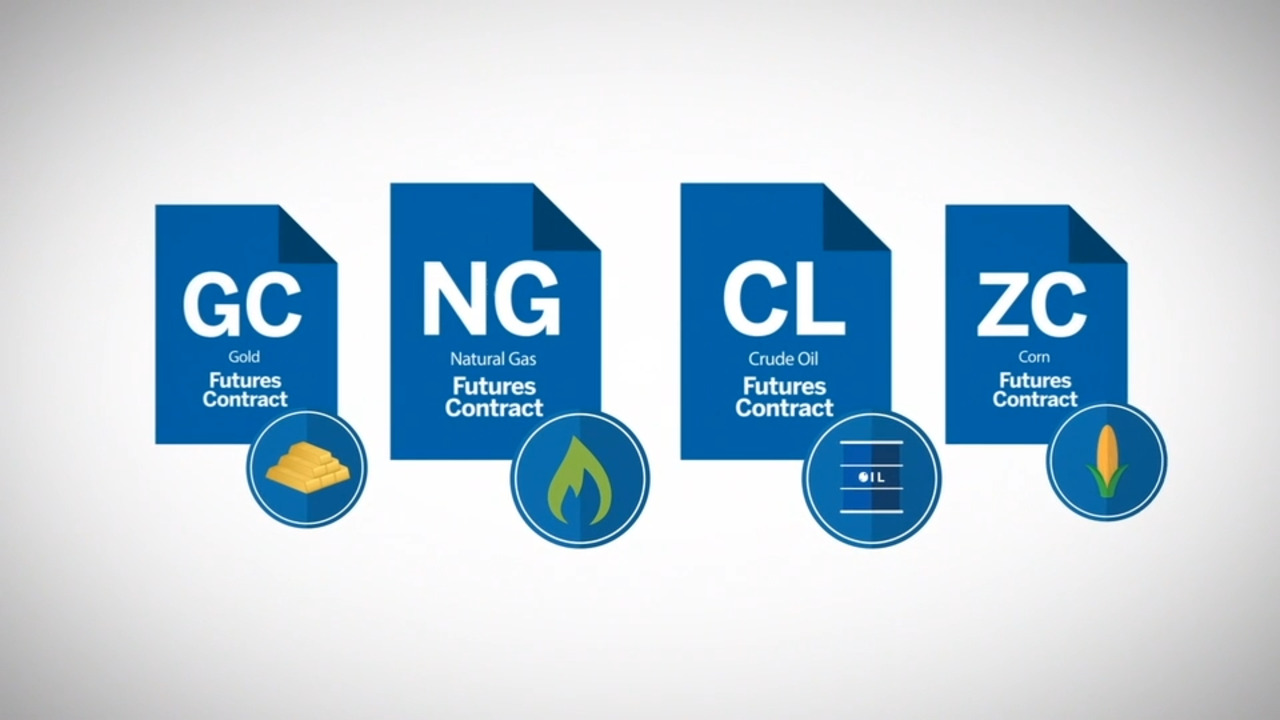

Silver futures contracts are derivative instruments that represent an agreement to buy or sell a specific quantity of silver at a predetermined price and date in the future. These contracts are standardized and heavily regulated by commodity exchanges such as the Chicago Mercantile Exchange (CME) and the Multi Commodity Exchange (MCX).

The concept of active months refers to the specific months in which a particular silver futures contract is traded actively. Each futures contract has a designated active month, which could be the current month, or a future month. For example, a silver futures contract may have an active month of December, meaning it can be actively traded during the month of December.

Now, you might be wondering, how do these active months change? The switching of active months is a necessary process to ensure the smooth functioning of the futures market and provide participants with flexibility in trading. In the following sections, we will delve deeper into the process of switching active months and the factors influencing this change.

Definition of Silver Futures Contracts

Silver futures contracts are financial agreements that allow traders to speculate on the future price of silver. These contracts are standardized and traded on commodity exchanges, where participants can buy or sell them with the expectation of making a profit from the price movement of silver.

When you enter into a silver futures contract, you are essentially agreeing to buy or sell a specific quantity of silver at a predetermined price and date in the future. The contract specifies the quality of the silver, the quantity being traded, and the delivery date. It is important to note that most silver futures contracts are settled in cash rather than physical delivery of the metal.

These contracts serve multiple purposes in the financial market. For producers and consumers of silver, futures contracts provide a means of hedging against price fluctuations. Producers can lock in a price for their future silver production, while consumers can secure a price for their future silver needs. This hedging function helps in managing price risk and ensuring stability in the silver market.

On the other hand, speculators and investors participate in silver futures trading for the purpose of making a profit. They analyze market trends, supply and demand factors, and various other indicators to anticipate future price movements. By taking long (buy) or short (sell) positions in silver futures contracts, these market participants aim to capitalize on the price volatility and make profitable trades.

It is worth noting that silver futures contracts are subject to strict regulations to ensure fair and transparent trading. The primary regulatory bodies overseeing silver futures trading include the Commodity Futures Trading Commission (CFTC) in the United States and the Securities and Exchange Board of India (SEBI) in India.

Overall, silver futures contracts play a significant role in the financial market, providing a platform for price discovery, risk management, and speculation. By understanding the dynamics of these contracts, traders and investors can make informed decisions and actively participate in the silver market.

Explanation of Active Months

In the world of silver futures trading, active months refer to specific months during which a particular futures contract is actively traded. Each silver futures contract has designated active months, which can vary depending on the exchange and contract specifications.

Active months are essential because they determine when traders can buy or sell a particular futures contract. For example, a silver futures contract may have active months of January, March, May, July, September, and December. These active months represent the months in which traders can actively participate in trading the contract.

Typically, active months are referred to by their corresponding delivery month. For instance, the active month for a futures contract expiring in January is often abbreviated as “F” or “G” (for first or second half of January, respectively). The active month for a contract expiring in March may be abbreviated as “H” or “J,” and so on.

It is important to note that not all active months have the same level of liquidity or trading volume. Some months may have higher trading activity, while others may have lower participation. Market conditions, supply and demand factors, and other external influences can impact the trading activity in different active months.

Furthermore, active months can vary depending on the type of silver futures contract. Some contracts only have a limited number of active months, while others may have a more extensive range of active months available for trading.

Overall, active months provide structure and organization to the silver futures market. They ensure that traders have specific periods in which they can actively engage in buying or selling silver futures contracts. By having designated active months, the market remains orderly, and participants can plan their trading strategies accordingly.

Process of Switching Active Months

The switching of active months in silver futures contracts is a procedural transition that occurs periodically according to the rules set by the commodity exchange. The process ensures that market participants have a smooth transition from one active month to another. Let’s explore the general process of switching active months:

- Determination of Switching Date: The exchange determines a specific date when the switch from the current active month to the next one will occur. This switching date is usually well in advance, allowing traders to plan their positions accordingly.

- Announcement and Communication: The exchange announces the switching date to market participants through official channels, including their website and trading platforms. This communication ensures that traders are aware of the impending change and can make necessary adjustments to their positions.

- Continued Trading of Current Active Month: Until the switching date, the current active month continues to be actively traded. Traders can continue buying or selling contracts for the current month, with all contractual obligations remaining intact.

- Ceasing Trading of Current Active Month: On the switching date, trading of the current active month ceases. This means that no new positions can be opened for that month.

- Opening Trading for Next Active Month: Simultaneously with the cessation of trading for the current active month, trading for the next active month commences. Traders can now start opening positions for the newly active month.

- Phasing Out of Current Active Month: Even though trading has ceased for the current active month, open positions for that month remain active. Traders with open positions are required to either settle or roll over their contracts before the contract’s expiration date.

- Main Focus on New Active Month: As the new active month becomes the center of attention, trading volume and liquidity gradually shift towards the newly active month. Traders focus on establishing positions in the new month based on their trading strategies and market outlook.

The exact details and timeline of the switching process may differ slightly between exchanges and specific contracts. Traders need to stay informed about the rules and procedures established by the exchange to effectively navigate through the switching of active months in silver futures trading.

Factors Affecting Active Month Switching

The switching of active months in silver futures contracts is influenced by various factors that can impact the trading dynamics of the market. These factors play a significant role in determining when and how the transition between active months occurs. Let’s take a closer look at some of the key factors affecting active month switching:

- Expiration Dates: The expiration dates of the current active month are crucial in determining when the switch to the next active month takes place. As the expiration date approaches, the exchange needs to ensure a smooth transition to the new active month.

- Liquidity: The level of liquidity in a particular active month can also influence the timing of the switch. If trading activity and liquidity are low in the current active month, the exchange may choose to switch to a more active month to ensure sufficient market participation.

- Seasonal Demand: Seasonal variations in silver demand can impact the preference for certain active months. For example, if there is typically higher demand for silver in a specific month due to industrial or jewelry purposes, that month may be favored as the new active month.

- Market Sentiment: Market sentiment, including factors such as economic indicators, geopolitical events, and market trends, can influence the choice of the next active month. The exchange may consider current market conditions and trader sentiment when deciding to switch to a new active month.

- Supply and Demand Dynamics: Supply and demand imbalances in the silver market can also play a role in active month switching. If there is a shortage or surplus of silver, the exchange may prioritize a month that aligns with the prevailing supply and demand dynamics.

- Market Efficiency: The efficiency and functionality of the silver futures market are essential considerations when switching active months. The exchange aims to ensure that the market remains efficient, transparent, and accessible to all participants during the transition.

It is important to note that these factors may vary in significance depending on the specific contract and exchange. Market participants should stay informed about the factors that influence active month switching to make informed trading decisions.

By understanding the factors mentioned above, traders can gain insights into the reasons behind active month switching and anticipate future changes. Additionally, staying updated with market news, economic indicators, and exchange announcements can provide valuable information on potential active month switches in the silver futures market.

Impact of Active Month Switching on Traders

The switching of active months in silver futures contracts can have a direct impact on traders’ positions, strategies, and overall market participation. Traders need to be aware of the consequences of active month switching and adjust their trading approach accordingly. Here are some of the key impacts of active month switching on traders:

- Position Management: Traders with open positions in the expiring active month need to manage their positions before the contract’s expiration date. They have the option to either settle their contracts or roll them over into the new active month. Active month switching requires traders to evaluate their exposure and take appropriate action to maintain their desired market exposure.

- Adjustment of Trading Strategies: Active month switching can require traders to readjust their trading strategies and adapt to new market conditions. The transition to a new active month may come with changes in liquidity, pricing patterns, and market dynamics. Traders need to analyze these changes and modify their strategies accordingly to stay profitable in the evolving market environment.

- Market Liquidity and Participation: Active month switching may impact the overall liquidity and participation levels in the market. As trading activity shifts from the expiring active month to the new active month, there may be a temporary decline in liquidity and trading volume. Traders need to assess the impact on order execution, market depth, and bid-ask spreads, as it can influence their trading decisions.

- Market Volatility: The switch to a new active month can sometimes lead to increased market volatility. Traders should be prepared for potential price fluctuations and higher volatility during the transition period. It is essential to closely monitor the market and adjust risk management strategies to account for heightened volatility and potential impact on trading positions.

- Timing of Entry and Exit Points: Active month switching can affect the timing of entry and exit points for traders. They need to carefully analyze the impact of the switch on price patterns and market sentiment. Timing becomes crucial for traders looking to enter or exit positions, as the market dynamics may change with the switch to a new active month.

- Trading Costs: Active month switching can also have implications for trading costs. Traders should consider the impact of any rollover fees or transaction costs associated with moving positions from the expiring active month to the new active month. Managing trading costs is essential for maintaining profitability and optimizing trading performance.

It is crucial for traders to stay informed about active month switching schedules, market announcements, and market volatility during the transition period. Traders should adapt their trading strategies, manage their positions effectively, and monitor market conditions to navigate the impact of active month switching successfully.

By understanding and anticipating the potential impact of active month switching on their trading activities, traders can make informed decisions and capitalize on the opportunities presented by the evolving dynamics of the silver futures market.

Conclusion

Active month switching is a crucial aspect of silver futures contracts, allowing for the efficient functioning of the market and providing traders with trading flexibility. Understanding the process and factors influencing active month switching is essential for traders looking to navigate the silver futures market successfully.

We explored how silver futures contracts represent agreements to buy or sell silver at a predetermined price and date in the future. The concept of active months refers to the specific months during which a particular futures contract is actively traded. The switching of active months occurs according to predetermined rules and helps maintain order and liquidity in the market.

Factors such as expiration dates, liquidity, seasonal demand, market sentiment, supply and demand dynamics, and market efficiency can influence the timing of active month switching. Traders need to stay informed about these factors to make informed trading decisions and adjust their strategies accordingly.

The switching of active months can have various impacts on traders. It requires careful position management, adjustment of trading strategies, consideration of market liquidity and participation, evaluation of market volatility, timing of entry and exit points, and management of trading costs.

In conclusion, active month switching is a fundamental process in silver futures trading. It is crucial for traders to understand and adapt to the changes associated with active month switching to effectively navigate the market and maximize their trading opportunities. By staying informed, analyzing market conditions, and adapting their strategies, traders can leverage the dynamics of active month switching to their advantage in the silver futures market.