Home>Finance>How Does Banking Supervision Differ From Banking Regulation?

Finance

How Does Banking Supervision Differ From Banking Regulation?

Modified: December 30, 2023

Understand the distinction between banking supervision and banking regulation in the finance industry. Find out how each plays a vital role in maintaining stability and accountability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Defining Banking Supervision

- Defining Banking Regulation

- Key Differences Between Banking Supervision and Banking Regulation

- Role of Banking Supervision

- Role of Banking Regulation

- Benefits and Limitations of Banking Supervision

- Benefits and Limitations of Banking Regulation

- Importance of Effective Banking Supervision and Regulation

- Conclusion

Introduction

Welcome to the world of finance, where the stability and integrity of the banking system play a crucial role in the overall economy. In order to safeguard the interests of depositors and investors, as well as maintain the stability of the financial system, two key pillars in the industry are banking supervision and banking regulation. While these terms are often used interchangeably, they actually have distinct meanings and functions.

Banking supervision refers to the ongoing oversight and monitoring of banks and other financial institutions by regulatory authorities. This is done to ensure that banks are operating in compliance with established regulations, maintaining sound financial practices, adequately managing risk, and protecting the interests of their customers.

Banking regulation, on the other hand, refers to the set of rules, policies, and guidelines that are implemented by regulatory bodies to govern the operations and activities of banks. These regulations are designed to maintain the stability and integrity of the banking system, protect the interests of stakeholders, and prevent financial misconduct.

While banking supervision and banking regulation are closely related, there are some key differences between the two. In this article, we will explore these differences, as well as the roles, benefits, and limitations of both banking supervision and banking regulation.

Defining Banking Supervision

Banking supervision, as mentioned earlier, refers to the ongoing oversight and monitoring of banks and other financial institutions by regulatory authorities. The primary objective of banking supervision is to ensure the safety and soundness of the banking system, as well as to protect the interests of depositors and investors.

Banking supervisors have the responsibility to enforce compliance with banking laws and regulations. They conduct regular inspections and examinations of banks to assess their financial health, risk management practices, and overall compliance with regulatory requirements.

One of the key functions of banking supervision is to assess and monitor the risks that banks are exposed to. This includes evaluating credit risk, market risk, liquidity risk, and operational risk. By monitoring these risks, supervisors can identify potential vulnerabilities and enforce corrective measures to mitigate them.

Banking supervisors also play a crucial role in ensuring that banks have adequate capital levels. Capital adequacy requirements are put in place to ensure that banks have enough buffer to absorb losses and maintain the confidence of depositors and investors. Supervisors review the capital levels of banks and take appropriate actions if they fall below the required thresholds.

In addition to monitoring risks and capital levels, banking supervisors also oversee compliance with anti-money laundering and counter financing of terrorism (AML/CFT) regulations. They ensure that banks have effective systems and controls in place to detect and prevent financial crimes such as money laundering and terrorist financing.

Overall, banking supervision acts as a safeguard against financial instability and misconduct. It provides an independent oversight mechanism that promotes the stability and integrity of the banking system, ultimately benefiting both the banks themselves and their customers.

Defining Banking Regulation

Banking regulation refers to the set of rules, policies, and guidelines implemented by regulatory bodies to govern the operations and activities of banks. The objective of banking regulation is to maintain the stability and integrity of the banking system, protect the interests of stakeholders, and prevent financial misconduct.

Banking regulations cover various aspects of bank operations, including licensing and establishment requirements, capital adequacy, liquidity management, asset quality, loan classification, and provisioning. These regulations are designed to ensure that banks operate in a safe and sound manner, minimizing the risk of failure or disruption in the financial system.

One of the key areas of banking regulation is capital adequacy. Banks are required to maintain a certain level of capital based on their risk profile and the assets they hold. This capital acts as a cushion to absorb losses and protect depositors and investors in case of financial difficulties.

In addition to capital adequacy, banking regulations also address liquidity management. Banks are required to have sufficient liquidity to meet their obligations as they fall due. This ensures that banks can honor deposit withdrawals and other financial obligations without causing disruptions in the financial system.

Another important aspect of banking regulation is risk management. Banks are required to have robust risk management systems and internal controls in place to identify, measure, and manage various types of risks, including credit risk, market risk, operational risk, and liquidity risk.

Furthermore, banking regulations play a crucial role in consumer protection. They establish guidelines for fair lending practices, disclosure of financial information, handling of customer complaints, and protection of customer data. These regulations aim to ensure that customers are treated fairly and their interests are adequately protected.

Overall, banking regulation provides a framework of rules and standards that govern the behavior and operations of banks. It promotes transparency, stability, and accountability within the banking system, contributing to the overall health and trustworthiness of the financial sector.

Key Differences Between Banking Supervision and Banking Regulation

While banking supervision and banking regulation are closely related and work in tandem to ensure the stability of the banking system, there are some key differences between the two. These differences lie in their scope, focus, and methods of implementation. Let’s explore the main distinctions:

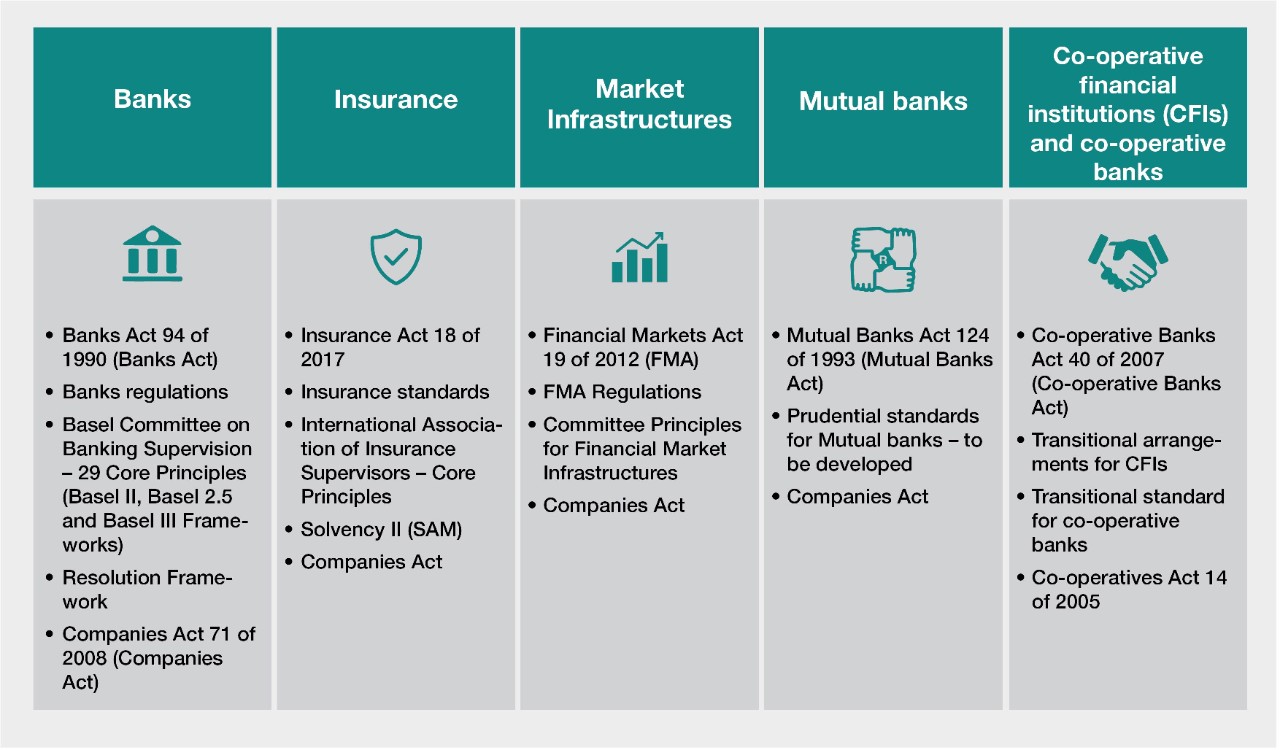

Scope: Banking supervision primarily focuses on the ongoing oversight and monitoring of banks and financial institutions. It involves conducting inspections, examinations, and assessments to ensure compliance with regulations and to identify potential risks. On the other hand, banking regulation refers to the set of rules, policies, and guidelines that govern the entire banking industry. It encompasses licensing requirements, capital adequacy standards, risk management guidelines, consumer protection rules, and other regulatory frameworks.

Focus: Banking supervision is primarily concerned with assessing the safety and soundness of individual banks. It focuses on evaluating risks, capital levels, liquidity management, and compliance with regulations. Banking regulation, on the other hand, takes a broader approach and is concerned with the overall stability of the banking system. It aims to prevent systemic risks and promote the integrity of the system as a whole.

Methods of Implementation: Banking supervision is implemented through regular inspections, examinations, and assessments of individual banks conducted by supervisory authorities. These authorities have the power to take corrective actions if they identify non-compliance or weaknesses in a bank’s operations. In contrast, banking regulation is implemented through the establishment of legal frameworks, rules, and standards that all banks must adhere to. Compliance with these regulations is generally overseen by regulatory bodies or agencies.

Responsibilities: The primary responsibility of banking supervisors is to ensure the safety and soundness of individual banks and protect the interests of depositors and investors. They monitor risks, assess capital adequacy, and enforce compliance with regulations. On the other hand, the main responsibility of banking regulators is to establish and enforce the regulatory framework that governs the entire banking industry. They design and implement regulations to maintain stability, prevent misconduct, and protect the interests of stakeholders.

Interaction: Banking supervision and banking regulation work in close coordination and overlap in many areas. Banking supervisors rely on regulatory frameworks to guide their assessments and enforcement actions. At the same time, regulators rely on the feedback and findings of banking supervisors to assess the effectiveness of their regulations and make necessary adjustments.

Overall, while banking supervision and banking regulation have distinct roles and responsibilities, they are complementary and work together to ensure the stability, integrity, and safety of the banking system.

Role of Banking Supervision

The role of banking supervision is vital in maintaining the stability and integrity of the banking system. It encompasses several key functions that contribute to the overall health and safety of individual banks and the financial system as a whole. Let’s explore the key roles of banking supervision:

1. Oversight and Monitoring: Banking supervision involves the ongoing oversight and monitoring of banks and financial institutions. Supervisory authorities conduct regular inspections, examinations, and assessments to ensure that banks are operating in compliance with applicable laws, regulations, and industry best practices.

2. Risk Assessment and Management: Banking supervisors play a crucial role in assessing and managing risks that banks are exposed to. They evaluate various types of risks, such as credit risk, market risk, liquidity risk, and operational risk. Through risk assessments, supervisors identify potential vulnerabilities and take measures to mitigate risks.

3. Capital Adequacy and Financial Soundness: Banking supervisors review the capital levels of banks to ensure they have sufficient capital to absorb potential losses. By enforcing capital adequacy requirements, supervisors promote financial soundness and resilience within the banking system. They also monitor the financial health and viability of banks by analyzing financial statements, conducting stress tests, and assessing profitability.

4. Compliance and Consumer Protection: Banking supervisors enforce compliance with regulations related to consumer protection, fair lending practices, and the prevention of financial crimes such as money laundering and terrorist financing. They ensure that banks have robust systems and controls in place to protect the interests of customers and prevent fraudulent activities.

5. Resolution and Crisis Management: In the event of a bank failure or financial crisis, banking supervisors play a key role in resolution and crisis management. They develop and implement resolution frameworks that outline the procedures for resolving failed banks, protecting depositors, and minimizing any potential systemic disruptions.

6. International Cooperation: Banking supervision often requires international cooperation, especially for banks with cross-border operations. Supervisory authorities collaborate with their counterparts in other jurisdictions to ensure effective supervision and regulation of globally active banks. This cooperation helps to mitigate risks and maintain global financial stability.

Overall, the role of banking supervision is to promote the safety and soundness of individual banks, protect the interests of depositors and investors, and maintain the stability of the banking system. By closely monitoring banks and enforcing compliance with regulations, banking supervisors contribute to the overall health and resilience of the financial sector.

Role of Banking Regulation

Banking regulation plays a crucial role in establishing the rules and framework that govern the operations and activities of banks. Its primary objective is to maintain the stability and integrity of the banking system, protect the interests of stakeholders, and prevent financial misconduct. Here are the key roles of banking regulation:

1. Stability and Systemic Risk: One of the primary roles of banking regulation is to maintain the stability of the banking system. It sets capital adequacy requirements, liquidity management guidelines, and risk management standards to ensure that banks maintain a strong financial position. By mitigating systemic risks, such as excessive leverage and interconnectedness, banking regulation helps prevent financial crises and disruptions.

2. Consumer Protection: Banking regulation focuses on safeguarding the interests and rights of consumers. It establishes rules and guidelines for fair lending practices, transparent disclosure of financial information, handling of customer complaints, and protection of personal data. These measures aim to ensure that consumers are treated fairly, have access to reliable financial services, and are protected from abusive practices.

3. Risk Management and Prudential Standards: Banking regulation sets prudential standards and guidelines for risk management practices within banks. It requires banks to develop robust systems and controls for identifying, measuring, and managing various risks, including credit risk, market risk, operational risk, and liquidity risk. By promoting sound risk management practices, banking regulation helps banks operate in a safe and responsible manner.

4. Capital Adequacy and Risk Buffers: Banking regulation establishes capital adequacy standards that banks must adhere to. These standards ensure that banks maintain sufficient capital levels to absorb unforeseen losses and withstand financial shocks. By enforcing these requirements, banking regulation enhances the resilience of banks and helps protect depositors and investors from potential harm.

5. Licensing and Supervision: Banking regulation governs the process of licensing and supervising banks. It sets out the criteria and procedures for obtaining a banking license, ensuring that only qualified and reputable entities enter the banking industry. Additionally, banking regulation establishes the framework for ongoing supervision of banks, including inspections, examinations, and reporting requirements, to ensure ongoing compliance with regulations and to detect any potential abnormalities or misconduct.

6. Compliance with International Standards: Banking regulation also includes compliance with international standards and frameworks, such as those set by the Basel Committee on Banking Supervision. These standards ensure consistency and harmonization across different jurisdictions, promote global financial stability, and reduce the potential for regulatory arbitrage.

Overall, banking regulation serves as an essential mechanism for maintaining the stability and integrity of the banking system. It sets the guidelines and standards that banks must follow, promotes responsible practices, protects consumers, and mitigates risks, ultimately contributing to a healthy and well-functioning financial sector.

Benefits and Limitations of Banking Supervision

Banking supervision plays a crucial role in maintaining the stability and integrity of the banking system. It offers several benefits, but also has certain limitations. Let’s explore the advantages and challenges associated with banking supervision:

Benefits of Banking Supervision:

1. Stability: Banking supervision contributes to the overall stability of the banking system. By monitoring and managing risks, supervisors help prevent excessive risk-taking and ensure that banks maintain sound and prudent business practices. This, in turn, enhances the stability and resilience of banks, reducing the likelihood of financial crises.

2. Consumer Protection: Banking supervision promotes consumer protection by ensuring that banks adhere to regulations that safeguard the interests of customers. Supervisors monitor and enforce compliance with standards related to fair lending practices, transparent disclosures, and privacy protection. This helps maintain trust and confidence in the banking sector, enhancing consumer well-being.

3. Risk Mitigation: Through ongoing monitoring and risk assessments, banking supervision helps identify and mitigate potential risks within the banking system. Supervisors develop frameworks and guidelines to manage risks such as credit risk, market risk, and operational risk. By enforcing risk management practices, supervisors reduce the vulnerability of banks to financial shocks and enhance their ability to weather economic downturns.

4. Financial Soundness: Banking supervision promotes the financial soundness of individual banks by enforcing capital adequacy requirements. This ensures that banks maintain sufficient capital levels to absorb losses and protect depositors and investors. By monitoring the financial health of banks and taking necessary corrective actions, supervisors enhance the overall financial stability of the banking sector.

5. International Cooperation: Banking supervision fosters international cooperation among regulatory authorities. This collaboration helps address cross-border risks, facilitates information sharing, and promotes consistent supervisory standards. International cooperation allows supervisors to effectively monitor and regulate banks with global operations, minimizing regulatory arbitrage and contributing to global financial stability.

Limitations of Banking Supervision:

1. Regulatory Capture: There is a risk of regulatory capture, where financial institutions exert undue influence over the regulatory process. This can lead to lax enforcement and inadequate supervision, undermining the effectiveness of banking supervision in ensuring compliance and preventing misconduct.

2. Information Asymmetry: Banking supervision relies on the accuracy and completeness of information provided by banks. However, there may be information asymmetry between banks and supervisors, as banks may withhold or misrepresent information. This can hamper the effectiveness of banking supervision in identifying and addressing risks accurately.

3. Rapidly Evolving Risks: The banking sector is constantly evolving, along with the risks it faces. New and complex financial instruments, technological advancements, and global interconnectedness pose challenges for banking supervisors. Keeping pace with these evolving risks requires continuous updating of supervisory frameworks and skill sets, which can be resource-intensive.

4. Cross-Border Challenges: Supervising banks with cross-border operations can present challenges due to differing legal and regulatory frameworks across jurisdictions. Coordination and cooperation among supervisory authorities becomes crucial to effectively monitor and regulate these institutions.

5. Compliance Costs: The compliance costs associated with banking supervision can be significant, especially for smaller banks with limited resources. The implementation of regulatory requirements and the need for regular reporting and examinations can impose financial and administrative burdens on banks, potentially impacting their profitability.

Despite these limitations, the benefits of banking supervision in promoting stability, protecting consumers, and mitigating risks outweigh the challenges. Continual efforts are being made to enhance the effectiveness and efficiency of banking supervision to adapt to the evolving landscape of the banking industry.

Benefits and Limitations of Banking Regulation

Banking regulation plays a crucial role in maintaining the stability and integrity of the banking system. It offers several benefits, but also has certain limitations. Let’s explore the advantages and challenges associated with banking regulation:

Benefits of Banking Regulation:

1. Stability and Systemic Risk Mitigation: One of the primary benefits of banking regulation is its ability to promote stability and mitigate systemic risks within the banking system. By establishing prudential standards and guidelines, regulations ensure that banks maintain sufficient capital, manage risks effectively, and adhere to sound business practices. This helps prevent excessive risk-taking and reduces the likelihood of financial crises.

2. Consumer Protection: Banking regulation focuses on protecting the interests of consumers. It establishes rules and guidelines to ensure fair lending practices, transparency in disclosure, and privacy protection. Regulations also provide mechanisms for resolving customer complaints and grievances. These measures enhance consumer confidence in the banking system and safeguard their financial well-being.

3. Sound Risk Management: Banking regulation ensures that banks have robust risk management frameworks in place. It sets guidelines for identifying, measuring, and managing various types of risks, such as credit risk, market risk, and operational risk. By enforcing these risk management practices, regulations promote a safer and more resilient banking sector.

4. Prudential Standards: Banking regulations establish prudential standards for capital adequacy, liquidity management, asset quality, and risk diversification. These standards help banks maintain a strong financial position and withstand unexpected shocks. By setting these standards, regulations enhance the stability and soundness of individual banks and the banking system as a whole.

5. Financial Soundness: Through capital requirements and other regulations, banking regulation ensures that banks maintain sufficient capital levels to absorb potential losses. This promotes financial soundness and protects the interests of depositors and investors. Regulated banks are more likely to be resilient and able to honor their financial obligations even during challenging economic conditions.

Limitations of Banking Regulation:

1. Compliance Costs: The implementation of banking regulations can be costly for banks, particularly smaller institutions with limited resources. Compliance costs include hiring personnel, investing in technology, and enhancing internal control systems to ensure adherence to regulations. These costs can affect the profitability and competitiveness of banks, especially in a highly regulated environment.

2. Regulatory Burden: Excessive regulation can create a burden on banks, diverting their resources and attention away from core operations and customer service. A complex regulatory framework can be challenging to understand and navigate, particularly for smaller banks with limited compliance expertise.

3. Regulatory Arbitrage: Banks may engage in regulatory arbitrage to exploit regulatory loopholes, resulting in unintended consequences and potential risks. Regulatory arbitrage refers to the practice of taking advantage of differences in regulations between jurisdictions to achieve more favorable outcomes. This can undermine the effectiveness of banking regulations and pose challenges for regulatory authorities.

4. Innovation Constraints: Stringent regulations may hamper innovation within the banking industry. While regulations aim to safeguard stability and consumer protection, they can also stifle creativity and prevent banks from adopting new technologies and business models that could enhance efficiency and customer experience. Striking the right balance between regulation and innovation is essential.

5. Regulatory Capture: There is a potential risk of regulatory capture, where regulatory bodies may become influenced or controlled by the banks they are supposed to regulate. This can lead to weak enforcement, inadequate supervision, and a lack of accountability, undermining the effectiveness of banking regulation.

Despite these limitations, banking regulation plays a crucial role in promoting stability, protecting consumers, and maintaining the integrity of the banking system. The ongoing refinement and adaptation of regulations are necessary to address challenges and strike the right balance between financial stability and industry innovation.

Importance of Effective Banking Supervision and Regulation

Effective banking supervision and regulation are of utmost importance for the stability, integrity, and soundness of the banking system. They play a crucial role in safeguarding the interests of depositors, investors, and the overall economy. Let’s explore the significance of effective banking supervision and regulation:

1. Financial Stability: Effective banking supervision and regulation contribute to the overall financial stability by mitigating risks, promoting prudent financial practices, and preventing excessive risk-taking. They help ensure that banks maintain sufficient capital, manage risks effectively, and adhere to sound business practices. This enhances the resilience of banks and reduces the likelihood of financial crises or disruptions that can have far-reaching consequences for the economy as a whole.

2. Consumer Protection: Effective banking supervision and regulation play a crucial role in protecting the interests of consumers. They establish rules and guidelines to ensure fair lending practices, transparent disclosure of financial information, and privacy protection. These measures help maintain trust and confidence in the banking system, ensuring that consumers are treated fairly and their financial well-being is safeguarded.

3. Risk Mitigation: Effective supervision and regulation help identify, assess, and manage risks within the banking sector. Supervisors conduct regular inspections and risk assessments to identify potential vulnerabilities and enforce corrective measures. By monitoring risks such as credit risk, market risk, operational risk, and liquidity risk, supervisors can proactively mitigate these risks and prevent their negative impact on banks and the financial system.

4. Investor Confidence: Effective banking supervision and regulation contribute to investor confidence in the banking sector. Regulations ensure that banks maintain sufficient capital levels and adhere to risk management practices, providing assurance to investors that their funds are safe and protected. This trust and confidence attract investment in the banking industry and support overall economic growth.

5. Sound Corporate Governance: Effective supervision and regulation promote sound corporate governance in banks. Regulations establish guidelines and requirements for board composition, risk committees, internal controls, and audits. These measures enhance transparency, accountability, and ethical conduct within banks, contributing to their long-term stability and trustworthiness.

6. International Cooperation: Effective banking supervision and regulation require international cooperation and coordination among regulatory authorities. Global financial institutions and interconnectedness demand collaboration among supervisors across jurisdictions to effectively monitor and regulate banks with cross-border operations. International cooperation enables the sharing of information, enhances consistency in regulatory standards, and minimizes regulatory arbitrage.

7. Economic Growth: Strong and effective banking supervision and regulation provide the foundation for a healthy and thriving economy. A stable and well-regulated banking sector facilitates financial intermediation, supports capital formation, and promotes efficient allocation of resources. It instills confidence in the financial system and encourages investment, fostering economic growth and development.

Overall, effective banking supervision and regulation are essential for maintaining financial stability, protecting consumers, managing risks, and promoting investor confidence. Their role in ensuring the integrity and soundness of the banking system is critical for the overall health and resilience of the economy.

Conclusion

In conclusion, banking supervision and banking regulation are two key pillars in maintaining the stability and integrity of the banking system. While they are distinct concepts, they work together in harmony to ensure the safety and soundness of individual banks and the overall financial system.

Banking supervision involves the ongoing oversight and monitoring of banks by regulatory authorities. It focuses on assessing risks, enforcing compliance with regulations, and promoting the stability of individual banks. Effective banking supervision plays a crucial role in maintaining financial stability, protecting consumers, and managing risks within the banking sector.

Banking regulation, on the other hand, establishes the rules, policies, and guidelines that govern the operations and activities of banks. It sets the framework within which banking supervision operates. Strong banking regulation contributes to financial stability, ensures consumer protection, promotes sound risk management practices, and supports investor confidence.

Both banking supervision and banking regulation offer numerous benefits, including stability, consumer protection, risk mitigation, and investor confidence. They provide a framework for prudent financial practices, transparency, and accountability within the banking industry. However, they also face limitations, such as compliance costs, regulatory burden, and potential regulatory capture.

The importance of effective banking supervision and regulation cannot be overstated. They are essential for maintaining financial stability, protecting consumers, managing risks, and promoting investor confidence. They help foster a resilient banking sector that supports economic growth and contributes to the overall well-being of the economy.

Continual efforts to improve and adapt banking supervision and regulation are necessary to address emerging risks, technological advancements, and evolving customer needs. Striking the right balance between stability and innovation, effective supervision, and proportionate regulation is key to ensuring a robust and trusted banking system.