Home>Finance>Common Size Balance Sheet: Definition, Formula, Example

Finance

Common Size Balance Sheet: Definition, Formula, Example

Published: October 30, 2023

Learn about the definition, formula, and example of a common size balance sheet in finance. Understand its importance in analyzing a company's financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Common Size Balance Sheet: Definition, Formula, Example

Finance is a broad field, encompassing various aspects of managing money, assets, and liabilities. One crucial tool used in financial analysis is the common size balance sheet. In this blog post, we will break down what a common size balance sheet is, its formula, provide examples, and highlight its significance in understanding a company’s financial health.

Key Takeaways:

- A common size balance sheet is a financial statement that expresses each line item as a percentage of total assets.

- It helps in comparing the financial structure between different companies or analyzing trends within a single company over time.

What is a Common Size Balance Sheet?

A common size balance sheet is a financial statement that presents the percentages of each line item relative to the total assets of a company. By expressing all the elements as a proportion of total assets, it allows for better comparison between companies of different sizes and industries. It also helps in analyzing trends within a company over time, providing valuable insights into changes in the company’s financial structure.

Formula for Common Size Balance Sheet

The formula for creating a common size balance sheet is relatively simple. All you need to do is take each line item’s value and divide it by the company’s total assets, then multiply by 100 to express it as a percentage.

Common Size (%) = (Line Item / Total Assets) * 100

Example of Common Size Balance Sheet

Let’s consider a hypothetical company XYZ Corp. Below is a simplified common size balance sheet for XYZ Corp.:

| Assets | Amount (USD) | Common Size (%) |

|---|---|---|

| Cash and Cash Equivalents | 100,000 | 10% |

| Accounts Receivable | 200,000 | 20% |

| Inventory | 150,000 | 15% |

| Property, Plant, and Equipment | 500,000 | 50% |

| Total Assets | 950,000 | 100% |

In the example above, each asset is expressed as a percentage of the total assets. This allows us to see the relative importance of each asset category in the company’s overall financial structure.

Significance of Common Size Balance Sheet

The common size balance sheet is a powerful tool in financial analysis. It helps identify patterns, trends, and potential areas of concern within a company’s financial structure. Here are a few key reasons why understanding the common size balance sheet is beneficial:

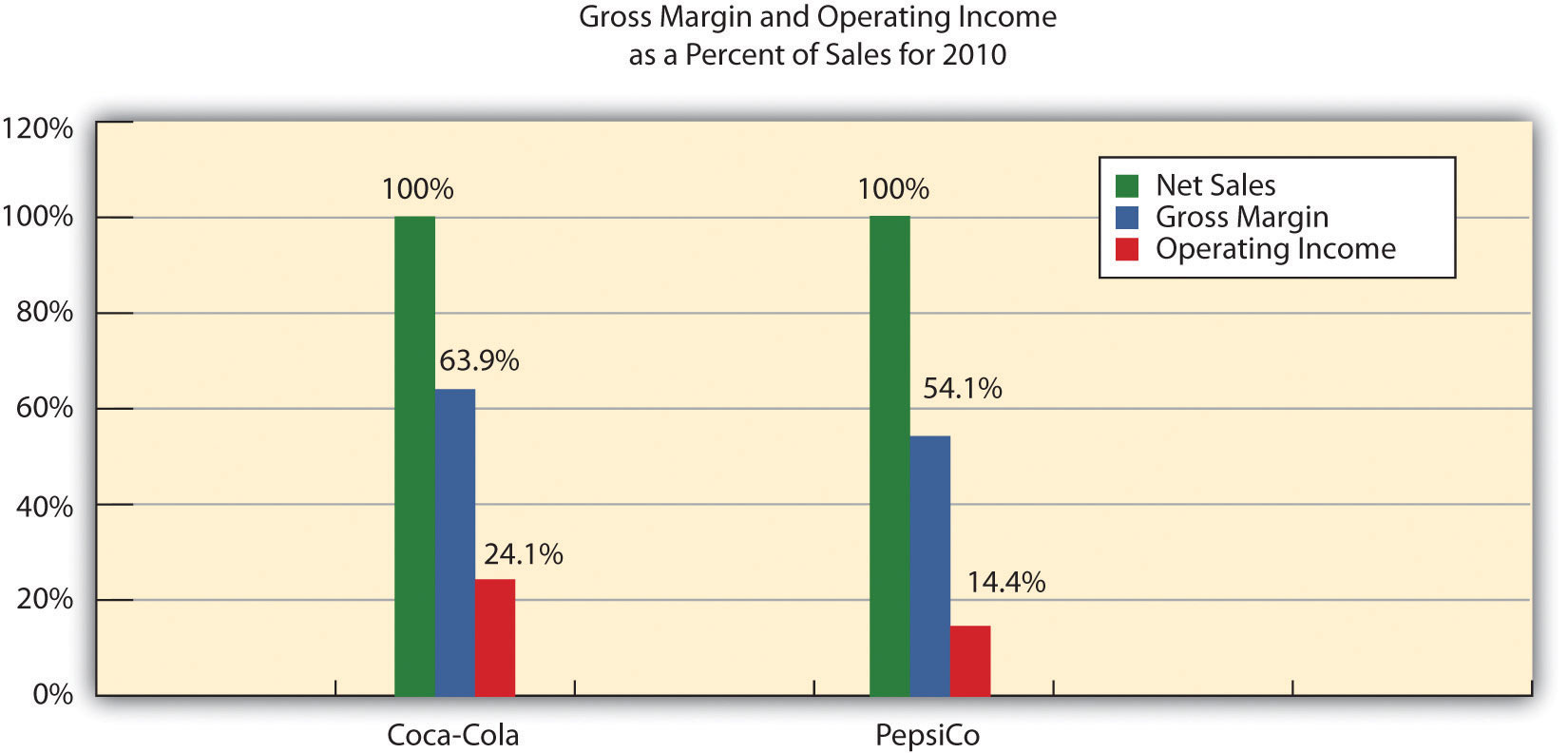

- Comparison: By expressing each line item as a percentage of total assets, it becomes easier to compare companies of different sizes and industries, facilitating more accurate benchmarking.

- Trend Analysis: Looking at common size balance sheets over multiple periods can reveal trends in how a company allocates its resources and changes in its financial structure.

- Identifying Imbalances: Significant variations in proportions can indicate imbalances that may need attention, such as over-reliance on a particular asset category or excessively high debt levels.

By utilizing the common size balance sheet, financial analysts, investors, and business owners can gain deeper insights into a company’s financial health and make better-informed decisions.

So, the next time you come across a common size balance sheet, remember its purpose, formula, and significance. Understanding this financial statement will prove valuable in evaluating a company’s financial structure and overall performance.