Home>Finance>Why Might Individuals Purchase Futures Contracts Rather Than The Underlying Asset

Finance

Why Might Individuals Purchase Futures Contracts Rather Than The Underlying Asset

Published: December 23, 2023

Discover the reasons why individuals opt for futures contracts instead of the underlying asset in the world of finance. Uncover the benefits and opportunities offered by this strategic investment choice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of futures contracts

- Advantages of purchasing futures contracts

- Reasons individuals may choose futures contracts over underlying assets

- Risk mitigation through futures contracts

- Speculative opportunities offered by futures contracts

- Leverage and cost efficiency in futures trading

- Tax considerations when purchasing futures contracts

- Conclusion

Introduction

When it comes to investing in the financial markets, individuals have a variety of options to choose from. One such option is purchasing futures contracts, which offer unique advantages over buying the underlying assets directly. While the concept of futures contracts may seem complex at first, understanding their benefits can help individuals make informed investment decisions.

Futures contracts are essentially agreements to buy or sell a specific asset at a predetermined price on a future date. These contracts are standardized and traded on regulated exchanges, making them highly liquid and easily accessible to investors. The underlying assets can include commodities, currencies, stocks, and bonds, among others.

So why might individuals choose to purchase futures contracts instead of the actual underlying assets? There are several reasons that make futures contracts an attractive option for investors, including risk mitigation, speculative opportunities, leverage, cost efficiency, and tax considerations.

In this article, we will delve into these advantages and explore why individuals may opt for futures contracts over buying the underlying assets directly. Understanding these reasons can help investors make better-informed decisions and potentially enhance their investment strategies.

Definition of futures contracts

Before delving into the reasons why individuals might choose futures contracts, it’s important to have a clear understanding of what futures contracts are and how they work.

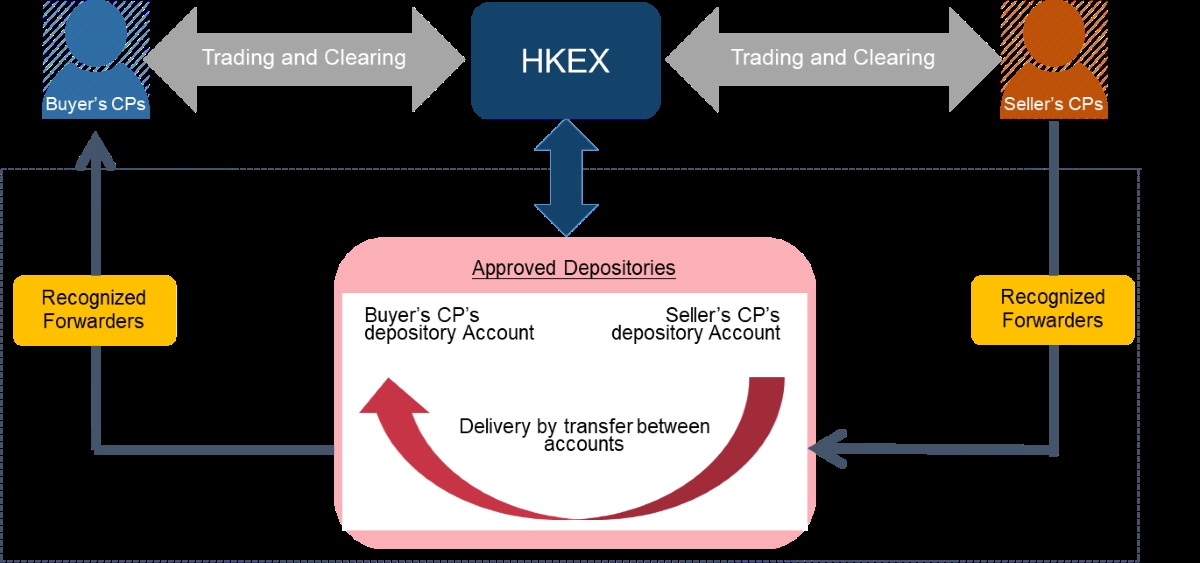

Futures contracts are standardized agreements to buy or sell a specific asset, known as the underlying asset, at a predetermined price on a future date. These contracts are traded on regulated exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX), and are standardized in terms of contract size, delivery date, and quality of the underlying asset.

Each futures contract specifies the quantity of the underlying asset that will be delivered or received, as well as the price at which the transaction will occur. For example, a futures contract for crude oil might specify the delivery of 1,000 barrels of oil at a price of $60 per barrel.

It’s important to note that futures contracts are different from options contracts. While futures contracts obligate the buyer and seller to complete the transaction by a specific date, options contracts provide the buyer with the right, but not the obligation, to buy or sell the underlying asset.

The expiration date of a futures contract is a crucial aspect to consider. It represents the date by which the buyer and seller must fulfill their obligations. At expiration, the contract settles either through physical delivery of the underlying asset or through a cash settlement.

It’s worth mentioning that most futures contracts are not held until expiration. Instead, they are actively traded in the market, allowing investors to close their positions before the expiration date by entering into offsetting trades.

Overall, futures contracts provide investors with a standardized and regulated way to participate in the price movements of various assets. They offer flexibility, liquidity, and transparency, making them a popular choice for both institutional and individual investors.

Advantages of purchasing futures contracts

Purchasing futures contracts offers several advantages for investors, making them a valuable tool in their investment arsenal. Let’s explore some of the key benefits:

- Liquidity and accessibility: Futures contracts are traded on regulated exchanges, providing high liquidity and ease of access. This means that investors can easily buy or sell these contracts at prevailing market prices, ensuring efficient and timely execution of trades.

- Hedging and risk management: One of the primary advantages of futures contracts is their ability to hedge against price fluctuations. By locking in a price for the future delivery of an asset, investors can mitigate the risk of price volatility. This is particularly useful for businesses involved in commodities, such as oil producers or farmers, who can use futures contracts to protect against adverse price movements.

- Diversification opportunities: Futures contracts cover a wide range of assets, including commodities, currencies, and financial instruments. This allows investors to diversify their portfolios and reduce the impact of any single asset’s performance on their overall investment strategy.

- Transparency and price discovery: Futures markets are transparent, with real-time price information available to all participants. This transparency ensures fair pricing and efficient price discovery, benefiting both buyers and sellers.

- Flexibility: Futures contracts offer flexibility in terms of contract sizes, delivery dates, and types of underlying assets. This enables investors to tailor their positions to their specific investment objectives and risk appetite.

- Margin trading: Futures contracts provide the opportunity for leverage, allowing investors to control a larger position with a smaller initial investment. This magnifies potential profits but also increases the risk of losses, so caution should be exercised when using leverage.

- Efficient price execution: Due to the centralized clearing mechanism of futures contracts, there is no need to negotiate prices with counterparties. Each contract is standardized, ensuring a fair and efficient execution process.

By taking advantage of these benefits, investors can enhance their investment strategies, manage risks, and potentially achieve better returns. However, it’s important to thoroughly understand the mechanics of futures trading and conduct proper research before engaging in these markets.

Reasons individuals may choose futures contracts over underlying assets

While buying the underlying assets directly may be the more conventional approach, there are several reasons why individuals may opt for futures contracts instead:

- Liquidity and ease of trading: Futures contracts are highly liquid and traded on regulated exchanges, providing easy access and efficient execution of trades. This liquidity allows investors to quickly enter or exit positions without the complexities and potential illiquidity of directly buying or selling the underlying assets.

- Lower transaction costs: Trading futures contracts typically involves lower transaction costs compared to buying and selling the physical underlying assets. These lower costs are attributable to factors like reduced administrative expenses, centralized clearing, and standardization of contract terms.

- Capital efficiency: By purchasing futures contracts, individuals can achieve capital efficiency. Instead of tying up a significant amount of capital by buying the actual underlying assets, investors can control a larger position with a smaller initial investment. This leverage allows for potentially higher returns on investment.

- Short selling opportunities: Futures contracts enable investors to engage in short selling, which means profiting from a decline in the value of the underlying asset. This ability to profit from falling prices can be advantageous in bearish market conditions and can enhance investment strategies that seek to profit from market downturns.

- Access to diverse markets: Futures contracts provide individuals with access to a wide range of markets that may be otherwise difficult or costly to participate in. From commodities like oil and gold to currencies, stock market indices, and interest rates, futures contracts offer exposure to various asset classes, allowing for greater opportunities for diversification and risk management.

- Efficient risk management: Futures contracts provide effective risk management tools. Investors can use these contracts to hedge against price fluctuations in the underlying assets, protecting themselves from potential losses. This is especially useful for businesses or individuals who have exposure to price volatility and want to ensure a more predictable outcome.

- Tax advantages: In certain jurisdictions, there may be tax advantages associated with trading futures contracts as opposed to buying and selling the underlying assets. It is important to consult with a tax professional to understand the specific tax implications and benefits in one’s own country or region.

These reasons highlight the unique advantages and opportunities that futures contracts offer to individuals as an alternative to purchasing the underlying assets directly. By leveraging the liquidity, cost efficiency, and diverse market access provided by futures contracts, individuals can enhance their investment strategies, manage risks, and potentially optimize their returns.

Risk mitigation through futures contracts

Futures contracts provide investors with effective tools for mitigating risks associated with price fluctuations in the underlying assets. Here are some ways in which futures contracts can be used for risk management:

- Hedging against price volatility: One of the primary reasons individuals choose futures contracts is to hedge against price volatility. By taking a long or short position in futures contracts for an underlying asset, investors can protect themselves from potential losses caused by adverse price movements. For example, a farmer can enter into a futures contract for corn to hedge against a potential drop in corn prices.

- Locking in prices: Futures contracts allow investors to lock in prices for future delivery of the underlying asset. This can be beneficial for businesses that rely on specific commodities or raw materials for their operations. By entering into futures contracts, they can secure prices in advance, ensuring cost predictability and safeguarding against potential price increases.

- Reducing business risks: Companies that engage in international trade face risks related to currency fluctuations. By using currency futures contracts, businesses can hedge against exchange rate movements and protect themselves from unexpected losses due to currency volatility.

- Portfolio diversification: Futures contracts cover a wide array of asset classes, including commodities, currencies, stock market indices, and interest rates. By incorporating futures contracts into their portfolios, investors can diversify their holdings, reducing the impact of any single asset’s performance on their overall investment strategy. This diversification helps mitigate risk by spreading investments across different sectors or markets.

- Managed risk exposure: Futures contracts enable investors to manage their risk exposure effectively. By carefully selecting the appropriate futures contracts and position sizes, investors can align their risk tolerance and investment objectives. This active risk management allows for better control over potential losses and helps protect against adverse market conditions.

It is crucial to note that while futures contracts offer risk mitigation benefits, they also carry their own risks. The market movements can lead to unexpected losses, and the use of leverage in futures trading can amplify these losses. Therefore, it is important for individuals to thoroughly understand the risks involved, conduct proper research, and consider seeking professional advice prior to engaging in futures trading.

Additionally, risk management through futures contracts requires active monitoring and adjustment of positions as market conditions evolve. Rebalancing and adjusting hedge positions are essential steps to ensure the effectiveness of risk mitigation strategies.

Overall, futures contracts provide individuals with valuable opportunities to manage and mitigate risks in their investment portfolios. Through careful use and proper risk assessment, investors can protect themselves from adverse price movements and improve their overall risk-adjusted returns.

Speculative opportunities offered by futures contracts

In addition to risk management and hedging purposes, futures contracts also offer individuals various speculative opportunities. Speculation involves taking positions in futures contracts based on anticipated price movements, with the goal of profiting from these price changes. Here are some key speculative opportunities offered by futures contracts:

- Capitalizing on market trends: Futures contracts enable individuals to take advantage of trending markets. By identifying emerging trends in specific asset classes, such as commodities or stock market indices, investors can enter into futures contracts to profit from anticipated price movements. For example, if an investor expects the price of gold to rise due to geopolitical tensions, they can take a long position in gold futures contracts to potentially benefit from the price increase.

- Arbitrage opportunities: Futures contracts can present opportunities for arbitrage, which is the practice of profiting from price discrepancies between different markets. Arbitrageurs seek to buy futures contracts on one exchange at a lower price and simultaneously sell contracts on another exchange at a higher price, thereby making a risk-free profit. These opportunities arise due to temporary imbalances in supply and demand or variations in pricing across different exchanges.

- Spread trading: Futures contracts allow for spread trading, where investors simultaneously take long and short positions in related contracts. For example, an investor can take a long position in corn futures contracts while simultaneously taking a short position in wheat futures contracts. By betting on the price relationship between these two commodities, investors can potentially profit from the spread narrowing or widening.

- Opportunistic trading during market events: News events, economic releases, and geopolitical developments can trigger significant price movements in various markets. Futures contracts provide individuals with the ability to quickly react to these events and capitalize on the resulting price volatility. Traders who can accurately anticipate the impact of these events on asset prices can potentially make profitable trades by taking advantage of short-term market fluctuations.

- Seasonal trading: Certain commodities have predictable seasonal price patterns. Futures contracts offer individuals the opportunity to capitalize on these patterns. For example, agricultural commodities like corn or soybeans might exhibit higher prices during planting or harvest seasons. By monitoring historical price trends and using seasonal analysis, traders can potentially profit from these recurring patterns by taking positions in corresponding futures contracts.

These speculative opportunities are not without risks. Speculating in futures markets requires a thorough understanding of market dynamics, analysis of supply and demand factors, and a disciplined approach to risk management. It’s important to remember that while substantial profits can be made through speculative trading in futures contracts, losses can also occur if the anticipated price movements do not materialize as expected.

Individuals considering speculating in futures contracts should employ proper risk management strategies, conduct thorough research, and stay updated on market trends and events that may impact the underlying assets. Diversification of speculative positions and the use of appropriate risk-control tools, such as stop-loss orders, are also vital to manage potential risks.

Overall, the speculative opportunities offered by futures contracts can be enticing for individuals seeking potential profit opportunities in the financial markets. However, it is essential to approach speculative trading responsibly and with a well-informed strategy.

Leverage and cost efficiency in futures trading

Futures trading offers unique advantages in terms of leverage and cost efficiency, providing individuals with opportunities to maximize their investment exposure while minimizing transaction costs. Here’s a closer look at these benefits:

- Leverage: One of the key attractions of futures trading is the leverage it provides. A futures contract allows an investor to control a larger position with a smaller initial investment, offering the potential for amplified returns. For instance, instead of purchasing the underlying asset outright, an investor can buy a futures contract for a fraction of the asset’s value, leveraging their capital to gain exposure to a larger position. While leverage can amplify profits, it is important to note that it can also increase potential losses, making risk management a vital aspect of futures trading.

- Cost efficiency: Futures trading is often more cost-efficient compared to directly buying and selling the underlying assets. This cost efficiency stems from several factors. Firstly, futures contracts are traded on regulated exchanges with standardized contract terms, which reduces administrative and negotiation costs. Secondly, futures contracts typically have lower transaction costs, including commissions and fees, compared to purchasing and holding the actual assets. Additionally, futures trading allows investors to easily enter and exit positions, providing flexibility and liquidity without the potential expenses associated with physical asset ownership.

- Margin requirements: Futures contracts require investors to deposit an initial margin, which is a fraction of the contract’s total value. This margin serves as collateral to cover potential losses. The use of margin allows traders to control larger positions with a smaller upfront investment. However, it’s crucial to understand that trading on margin also involves potential risks, as losses can exceed the initial margin deposit. Margin requirements are set by the exchanges and vary depending on the contract’s volatility and other market factors.

- Rolling over contracts: As futures contracts have expiration dates, investors need to roll over their positions if they wish to maintain exposure beyond the contract’s expiration. Rolling over involves closing the existing contract and simultaneously opening a new contract with a later expiration date. This process allows investors to avoid physical delivery of the underlying asset and continue their position in the market. Rolling over contracts offers cost efficiency since it avoids the costs associated with taking physical delivery of the asset.

- Access to diverse markets: Futures trading provides individuals with access to various asset classes and markets that may be otherwise challenging or costly to trade directly. From commodities to currencies, stock market indices, and interest rates, futures contracts offer a wide range of market opportunities under one roof. This access facilitates portfolio diversification and allows investors to take advantage of differing market conditions across various sectors.

While leverage and cost efficiency can be advantageous in futures trading, it is essential to approach these benefits with caution. Potential losses can be magnified when leverage is employed, and careful risk management is necessary to protect against adverse market movements. Additionally, as with any investment, individuals should thoroughly research and understand the dynamics of the markets they wish to trade in and consider consulting with a financial professional.

Overall, leverage and cost efficiency make futures trading an attractive option for individuals looking to optimize their investment capital and access diverse markets. When used judiciously and combined with sound risk management strategies, these advantages can potentially enhance investment returns and provide opportunities for portfolio growth.

Tax considerations when purchasing futures contracts

When engaging in futures trading, individuals need to be aware of the tax implications associated with these transactions. While tax laws vary depending on the jurisdiction, here are some general tax considerations to keep in mind:

- Capital gains and losses: Profits or losses from futures trading are generally treated as capital gains or losses for tax purposes. If you sell a futures contract at a higher price than your purchase price, it will result in a capital gain. Conversely, if you sell a contract at a lower price, it will generate a capital loss. The tax rate applied to these gains or losses may vary depending on factors such as the holding period and your overall income level.

- Section 1256 contracts: In some countries, futures contracts are classified as Section 1256 contracts, which have specific tax treatment. Under this classification, 60% of the gains or losses from futures trading are taxed at the long-term capital gains rate, and 40% are taxed at the short-term capital gains rate, regardless of the holding period. This treatment can be advantageous for traders as it provides a blended tax rate on their gains or losses.

- Mark-to-market accounting: In certain jurisdictions, traders may be subject to mark-to-market accounting, which requires them to recognize gains or losses on their futures contracts at the end of each tax year, regardless of whether the contracts have been closed. This means that unrealized gains or losses on open contracts are considered taxable income or deductible losses. Mark-to-market accounting ensures that traders pay taxes on an annual basis, reflecting the current value of their positions.

- Tax deductions and expenses: Individuals engaging in futures trading may be eligible for certain tax deductions and expenses. This can include expenses related to trading, such as platform fees, research materials, and advisory services. However, the deductibility of these expenses may vary depending on the tax laws of the jurisdiction and the individual’s specific circumstances.

- Loss carryovers and offsetting gains: If you have net capital losses from futures trading, you may be able to carry over these losses to future tax years to offset future capital gains. Loss carryforwards can help reduce taxable income in future years and potentially lower your tax liability. However, the rules surrounding loss carryovers can vary, so it is crucial to consult with a tax professional to understand the specific regulations in your jurisdiction.

- Tax reporting requirements: Individuals engaging in futures trading should fulfill their tax reporting obligations. This includes accurately reporting all capital gains and losses from the trading activity on the appropriate tax forms. It is advisable to maintain detailed records of all transactions, including purchase and sale prices, dates, and any related expenses, to ensure accurate tax reporting.

It is important to note that tax laws can be complex and subject to change. Therefore, it is highly recommended to consult with a qualified tax professional who is familiar with the tax regulations in your jurisdiction. They can provide specific guidance tailored to your individual circumstances and help you navigate the tax considerations associated with purchasing futures contracts.

By understanding and effectively managing the tax implications, individuals can ensure compliance with the law while optimizing their tax position in relation to their futures trading activities.

Conclusion

Futures contracts provide individuals with a range of benefits and opportunities in the financial markets. From risk management and hedging to speculative trading and leverage, futures contracts offer a versatile tool for investors seeking to optimize their investment strategies.

By purchasing futures contracts, individuals gain access to highly liquid and regulated markets, allowing for efficient execution of trades. The ability to hedge against price volatility helps mitigate risks and protect against adverse market movements. Additionally, futures contracts provide avenues for speculation, leveraging market trends, and capitalizing on price differentials between markets.

Furthermore, futures trading offers cost efficiency compared to directly buying and selling the underlying assets. Lower transaction costs, margin trading, and easy access to diverse markets contribute to the appeal of futures contracts as a cost-effective investment instrument.

However, individuals engaging in futures trading should be mindful of the tax considerations associated with these transactions. Capital gains, tax treatments of Section 1256 contracts, mark-to-market accounting, tax deductions, and reporting requirements all need to be properly understood and accounted for.

In conclusion, futures contracts provide individuals with valuable tools for risk management, speculation, and capital efficiency in the financial markets. By leveraging their benefits and understanding the associated risks, individuals can optimize their investment portfolios and potentially enhance their returns. However, it is crucial to conduct thorough research, adopt proper risk management strategies, and consider consulting with financial professionals or tax advisors to navigate the complexities of futures trading effectively.