Home>Finance>How To Withdraw Money From Discover Credit Card

Finance

How To Withdraw Money From Discover Credit Card

Published: October 23, 2023

Learn how to withdraw money from your Discover credit card with these finance tips and step-by-step instructions. Access your funds easily and efficiently.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Check your credit card balance

- Step 2: Determine your withdrawal options

- Step 3: ATM cash withdrawal

- Step 4: Cashback at a store

- Step 5: Transfer to a bank account

- Step 6: Request a convenience check

- Step 7: Understand fees and limitations

- Step 8: Keep track of your transactions and balances

- Conclusion

Introduction

Discover credit cards are widely recognized for their rewarding cashback programs, exceptional customer service, and competitive interest rates. While these cards are primarily used for making purchases, it’s important to know that you can also withdraw money from your Discover credit card when needed.

This article will guide you through the process of withdrawing money from your Discover credit card, providing you with step-by-step instructions and explaining the various options available to you. Whether you need cash for an emergency or prefer to have some extra funds at your disposal, understanding how to withdraw money from your Discover credit card can be incredibly useful.

It’s important to note that withdrawing money from a credit card should be done sparingly and as a last resort. Credit card withdrawals often come with fees and higher interest rates compared to regular purchases. Therefore, it’s crucial to consider alternatives before resorting to cash withdrawals from your Discover credit card. That being said, if a situation arises where you need cash, it’s helpful to know the options you have and the steps to follow.

So, let’s delve into the step-by-step process of withdrawing money from your Discover credit card, ensuring you have the information and knowledge to make an informed decision when the need arises.

Step 1: Check your credit card balance

Before initiating any withdrawal from your Discover credit card, it’s essential to check your credit card balance. This step will give you a clear understanding of how much credit you have available for withdrawal.

You can check your Discover credit card balance using various methods:

- Online account: Log in to your Discover online account through the Discover website or mobile app to access your account details. Here, you will find your current credit card balance, available credit, and any pending transactions.

- Phone: Call Discover’s customer service number, usually found on the back of your credit card, and follow the prompts to inquire about your credit card balance.

- Monthly statement: Refer to your monthly credit card statement, either in print or electronic format, which provides a summary of your account, including your current balance.

By knowing your credit card balance, you will have a better understanding of how much you can withdraw without exceeding your credit limit. This information is crucial as exceeding your credit limit can result in penalties, fees, and potential damage to your credit score.

Additionally, checking your credit card balance allows you to evaluate whether a withdrawal is a viable option based on your available credit. If your credit card balance is close to or exceeds your credit limit, it may be wise to consider alternative methods of obtaining funds instead of withdrawing from your Discover credit card.

Once you have determined your credit card balance, you can proceed to the next step of exploring the different withdrawal options available to you.

Step 2: Determine your withdrawal options

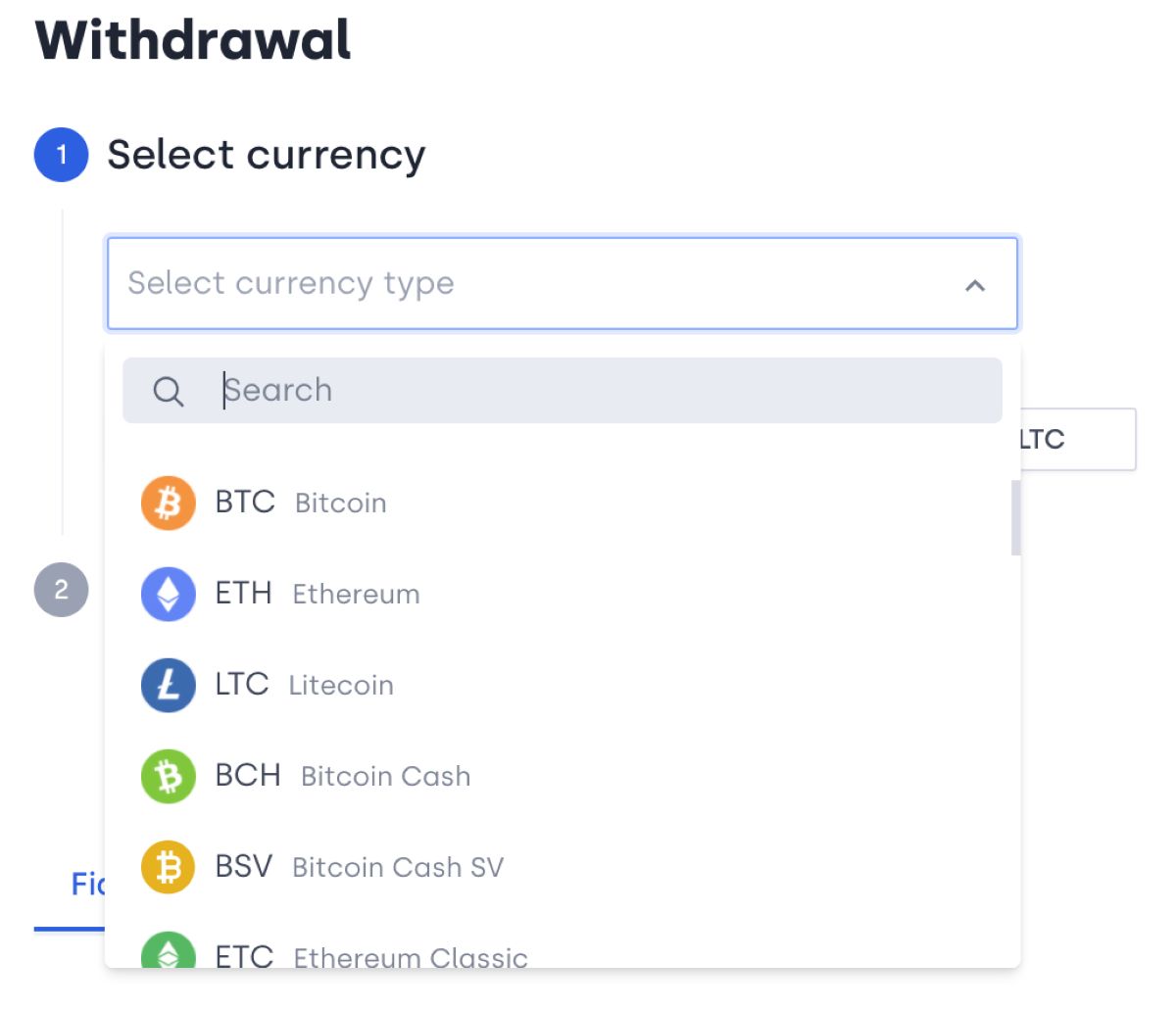

Discover provides several withdrawal options for accessing funds from your credit card. Understanding these options will help you choose the method that best suits your needs and preferences. Here are the main withdrawal options offered by Discover:

- ATM cash withdrawal: With your Discover credit card, you can withdraw cash directly from an ATM. This option allows you to access funds quickly and conveniently. Keep in mind that there may be certain fees associated with ATM cash withdrawals, so it’s important to consider this before making a withdrawal.

- Cashback at a store: Many merchants offer the option to get cash back when making a purchase with your Discover credit card. This means that, in addition to your purchase, you can request a specific amount of cash back, which will be charged to your credit card. This option can be useful if you need a smaller amount of cash and want to avoid ATM withdrawal fees.

- Transfer to a bank account: Discover allows you to transfer funds from your credit card to a linked bank account. This option gives you flexibility in using the funds for various purposes, including making payments or withdrawing cash from your bank account. However, it’s important to note that there may be transfer fees and processing time involved.

- Request a convenience check: Discover offers convenience checks to cardholders, which can be used to withdraw money from your credit card. These checks work similarly to regular checks and can be deposited into a bank account or used to make payments. However, it’s crucial to read the terms and conditions regarding convenience check usage, as there may be fees and interest rates associated with them.

When determining your withdrawal options, consider factors such as convenience, fees, and availability. Each option has its own advantages and considerations, so it’s important to weigh the pros and cons based on your specific needs.

Now that you are aware of the various withdrawal options, you can proceed to the next step of the process, depending on the method you choose for withdrawing funds from your Discover credit card.

Step 3: ATM cash withdrawal

An ATM cash withdrawal is one of the most common methods for accessing cash from your Discover credit card. It offers convenience and immediate availability of funds. Here’s how you can withdraw cash from an ATM using your Discover credit card:

- Locate an ATM that accepts Discover credit cards. Look for ATMs with the Discover logo or those that display the Diners Club International logo, as Discover is a partner with Diners Club.

- Insert your Discover credit card into the ATM. Follow the on-screen instructions to proceed with the withdrawal.

- Enter your PIN (Personal Identification Number). This is usually a four-digit code that you set up when you received your credit card. If you don’t have a PIN, you can request one by calling Discover’s customer service.

- Select the withdrawal option. Choose the “Cash Withdrawal” option from the ATM menu. You may also have the option to select the desired denominations of the bills you wish to withdraw.

- Enter the amount of cash you want to withdraw. Keep in mind that there may be withdrawal limits set by your credit card issuer. Make sure the amount you request does not exceed your available credit limit.

- Review the transaction details and confirm the withdrawal. The ATM will display the amount you requested and any associated fees. Take note of any fees charged by the ATM operator or your credit card issuer.

- Collect your cash and any printed receipts. Make sure to double-check that you have taken everything before leaving the ATM area.

It’s important to note that ATM cash withdrawals usually incur fees, which can vary depending on the ATM operator or your credit card issuer. These fees are typically a percentage of the withdrawal amount or a fixed fee, so make sure to consider this when deciding the amount of cash to withdraw.

Additionally, keep in mind that ATM cash withdrawals are subject to your credit card’s cash advance limit. This limit may be lower than your overall credit limit, so it’s essential to check your cash advance limit to avoid exceeding it.

Now that you know how to withdraw cash from an ATM using your Discover credit card, you can consider this option when you need immediate access to physical currency. If an ATM cash withdrawal isn’t suitable for your needs, there are alternative methods available, which will be discussed in the following steps.

Step 4: Cashback at a store

If you prefer to avoid ATM fees or need a smaller amount of cash, obtaining cashback at a store while making a purchase with your Discover credit card can be a convenient option. Here’s how you can get cashback at a store:

- Find a store that offers cashback services. Many grocery stores, convenience stores, and retailers provide cashback options at the point of sale.

- Choose the items you wish to purchase. Ensure that the total amount, including the cashback, does not exceed your credit card’s available credit limit.

- When it’s time to pay, present your Discover credit card to the cashier.

- Request the desired cashback amount. Most stores have predetermined cashback options, such as $10, $20, or $40. However, some stores may allow you to request a custom cashback amount within their limits.

- Confirm the cashback request and complete the transaction. The cashier will add the cashback amount to your purchase total, which will be charged to your Discover credit card.

- Proceed to your next destination with the cash you received, along with your purchased items.

It’s important to note that the availability of cashback services may vary by store and location. While many establishments offer this service, it’s always a good idea to confirm with the store before making a purchase if they provide cashback.

Furthermore, keep in mind that cashback at a store usually comes with certain limitations. The amount of cashback you can receive may be capped, and some stores may charge a fee for this service. Additionally, cashback is subject to your available credit and should not exceed your credit limit.

Obtaining cashback at a store is a convenient option if you need a smaller amount of cash and want to avoid ATM fees. However, if this method isn’t suitable for your needs or you require access to a larger sum of money, consider the alternative withdrawal options discussed in the following steps.

Step 5: Transfer to a bank account

If you prefer to have the funds from your Discover credit card deposited directly into your bank account, you can choose the option of transferring money. Here’s how you can transfer money from your Discover credit card to a bank account:

- Ensure that your bank account is linked to your Discover credit card. Contact Discover’s customer service or log in to your online account to link your bank account. This process may require providing your bank account information for verification purposes.

- Once your bank account is linked, access your Discover online account.

- Go to the “Transfer” or “Manage Transfers” section. This section allows you to initiate the transfer from your Discover credit card to your linked bank account.

- Enter the amount of money you wish to transfer. Make sure that the amount does not exceed your available credit limit on your Discover credit card.

- Review the transfer details and confirm the transaction. Take note of any fees associated with the transfer, as Discover may charge a fee for this service.

- Allow some time for the transfer to be processed. The duration can vary depending on your financial institution, and it may take up to a few business days for the funds to appear in your bank account.

- Monitor your bank account to ensure the transfer is successful. Once the funds have been transferred, you can access them through your bank account as you normally would.

Transferring money from your Discover credit card to a bank account provides versatility in how you can utilize the funds. Whether you need the money for bill payments, cash withdrawals, or other financial obligations, having it in your bank account offers flexibility.

It’s important to note that transferring funds from your credit card to a bank account may incur fees. Additionally, be mindful of any interest charges that may apply, especially if your credit card carries a higher cash advance interest rate. Consider the fees and interest rates associated with this option before initiating the transfer.

Now that you know how to transfer money from your Discover credit card to a bank account, you can utilize this method when you prefer to have the funds available in your bank for various financial needs.

Step 6: Request a convenience check

If you need to withdraw money from your Discover credit card and prefer a method similar to writing a check, you can request a convenience check. Discover provides convenience checks to cardholders, which can be used to withdraw money or make payments. Here’s how you can request a convenience check:

- Contact Discover’s customer service. You can find the customer service number on the back of your credit card or on the Discover website.

- Inform the representative that you would like to request a convenience check. They will guide you through the process and verify your account information.

- Specify the amount that you would like to receive through the convenience check. Make sure the amount does not exceed your available credit limit.

- Confirm the address to which the convenience check should be mailed. Ensure that the address is accurate and up to date.

- Be aware of any fees or interest rates associated with convenience checks. Discover may charge a fee for issuing the check, and the check itself may be subject to a higher interest rate compared to regular credit card purchases.

- Wait for the convenience check to be delivered to your specified address. This process may take a few business days.

- Once you receive the convenience check, you can use it as you would a regular check. You can deposit it into your bank account or use it to make payments to merchants or individuals.

It’s important to read and understand the terms and conditions regarding convenience check usage. Keep in mind that convenience checks may have expiration dates and may be subject to additional fees or terms specified by Discover. Familiarize yourself with these details to ensure you are aware of any potential charges or limitations.

Requesting a convenience check offers the flexibility of using the funds for various purposes. However, be cautious when using convenience checks as they can be subject to higher interest rates and fees. Consider the potential costs associated with convenience checks before deciding to use them.

Now that you know how to request and use a convenience check, you have another option for withdrawing money from your Discover credit card when needed.

Step 7: Understand fees and limitations

Before proceeding with any method of withdrawing money from your Discover credit card, it’s crucial to understand the fees and limitations associated with these transactions. Being aware of these factors will help you make informed decisions and avoid any unexpected charges. Here are some important things to consider:

- ATM fees: When withdrawing cash from an ATM using your Discover credit card, you may incur fees charged by the ATM operator. These fees can vary depending on the ATM and location. It’s important to check the fees associated with the specific ATM you plan to use to minimize any additional charges.

- Cash advance fees: Cash withdrawals from your Discover credit card are typically processed as cash advances. This means that you may be charged a cash advance fee for each withdrawal, which is often a percentage of the total amount withdrawn. Familiarize yourself with the cash advance fee charged by Discover before opting for this method of withdrawal.

- Interest rates: Cash advances from credit cards often have higher interest rates compared to regular purchases. It’s essential to understand the interest rate associated with cash advances on your Discover credit card. Keep in mind that interest starts accruing immediately on cash advances, so paying off the balance promptly will help minimize interest charges.

- Withdrawal limits: Your Discover credit card may have specific withdrawal limits in place. Make sure to check these limits to ensure that your desired withdrawal amount falls within the permitted range. Exceeding the withdrawal limit can result in declined transactions or additional fees.

- Convenience check fees: When requesting a convenience check from Discover, there may be fees associated with issuing the check. These fees can vary, so it’s important to inquire about the exact cost before proceeding. Additionally, convenience checks might have higher interest rates compared to regular credit card purchases, so be mindful of the interest charges that may apply.

Understanding these fees and limitations will prevent any surprises and help you manage your finances effectively. It’s essential to be aware of the potential costs involved and consider alternative options if the fees outweigh the benefits of using your Discover credit card for cash withdrawals.

By keeping these factors in mind, you can make educated decisions when withdrawing money from your Discover credit card and avoid any unnecessary fees or charges.

Step 8: Keep track of your transactions and balances

Once you have withdrawn money from your Discover credit card, it’s crucial to keep track of your transactions and balances. This step will help you stay on top of your finances and ensure that you are aware of your credit card usage. Here’s how you can effectively manage and monitor your transactions:

- Review your credit card statements: Take the time to carefully review your monthly credit card statements. These statements provide a detailed overview of your transactions, including cash withdrawals, and can help you track your expenses and monitor your credit card balance.

- Monitor your online account: Log in to your Discover online account regularly to view your credit card activity and transaction history. This will enable you to keep tabs on your withdrawals, check your balance, and gain insights into your spending patterns.

- Set up transaction alerts: Discover offers the option to set up transaction alerts, which can be sent to your email or mobile phone. These alerts can notify you when there is a withdrawal, a high balance, or any suspicious activity on your credit card. Take advantage of these alerts to stay informed and detect any unauthorized transactions promptly.

- Track your cash withdrawals: Keep a separate record or use a personal finance app to track your cash withdrawals. This will help you monitor your spending, ensure accuracy in your financial records, and plan your budget accordingly.

- Stay within your credit limit: Keep a close eye on your available credit and make sure your withdrawals, along with your other credit card transactions, do not exceed your credit limit. Going over your credit limit can lead to additional fees, penalties, and potential damage to your credit score.

- Pay your credit card balance on time: It’s crucial to make timely payments towards your credit card balance, including any cash advance amounts, to avoid accruing interest charges. By paying your balance in full or at least the minimum payment by the due date, you can maintain good financial standing and avoid unnecessary interest fees.

By actively monitoring your transactions and balances, you will have a clear understanding of your financial situation and be able to identify any issues or discrepancies promptly. This level of awareness will empower you to make informed financial decisions and maintain control over your credit card usage.

With these steps in mind, you can effectively track your transactions and balances, ensuring that you stay on top of your financial obligations when withdrawing money from your Discover credit card.

Conclusion

Knowing how to withdraw money from your Discover credit card can provide you with the flexibility and convenience of accessing funds when needed. While it’s important to keep in mind that cash withdrawals should be done sparingly and as a last resort, understanding the available options and the steps involved can be valuable.

In this article, we have covered the step-by-step process of withdrawing money from your Discover credit card. We explored various methods, including ATM cash withdrawals, cashback at a store, transfers to a bank account, and convenience checks. Each method offers its own advantages and considerations, so it’s essential to choose the option that aligns with your specific needs.

Additionally, we discussed important factors such as fees, limitations, and the need to keep track of your transactions and balances. Being aware of these aspects will help you make informed decisions, avoid unnecessary charges, and maintain control over your credit card usage.

Remember, when withdrawing money from your Discover credit card, it’s important to consider alternatives and evaluate your financial circumstances. Cash withdrawals often come with fees, higher interest rates, and potential consequences on your credit score. Whenever possible, explore other options such as using your debit card, relying on emergency savings, or seeking assistance from financial institutions.

By understanding the process of withdrawing money from your Discover credit card and taking a mindful approach to your finances, you can make informed decisions that align with your financial goals and priorities.

Ultimately, responsible financial management is key. Use your Discover credit card and its withdrawal options wisely, keeping your long-term financial well-being in mind.