Home>Finance>What Is Form 1040-X? Definition, Purpose, How To File With IRS

Finance

What Is Form 1040-X? Definition, Purpose, How To File With IRS

Published: November 27, 2023

Learn the definition, purpose, and step-by-step process of filing Form 1040-X with the IRS. Understand its importance in finance and ensure accurate tax reporting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What Is Form 1040-X? Definition, Purpose, How to File With IRS

When it comes to your finances, staying on top of your taxes is crucial. However, even the most diligent taxpayers can make mistakes. Fortunately, the Internal Revenue Service (IRS) understands this and provides a solution in the form of Form 1040-X. But what exactly is Form 1040-X, and how can it help you rectify tax filing errors? In this blog post, we will explore the definition, purpose, and process of filing Form 1040-X with the IRS.

Key Takeaways:

- Form 1040-X is used to correct errors or make changes to a previously filed tax return.

- Filing Form 1040-X should be done within three years of the original tax filing or two years from the date you paid the tax, whichever is later.

What Is Form 1040-X?

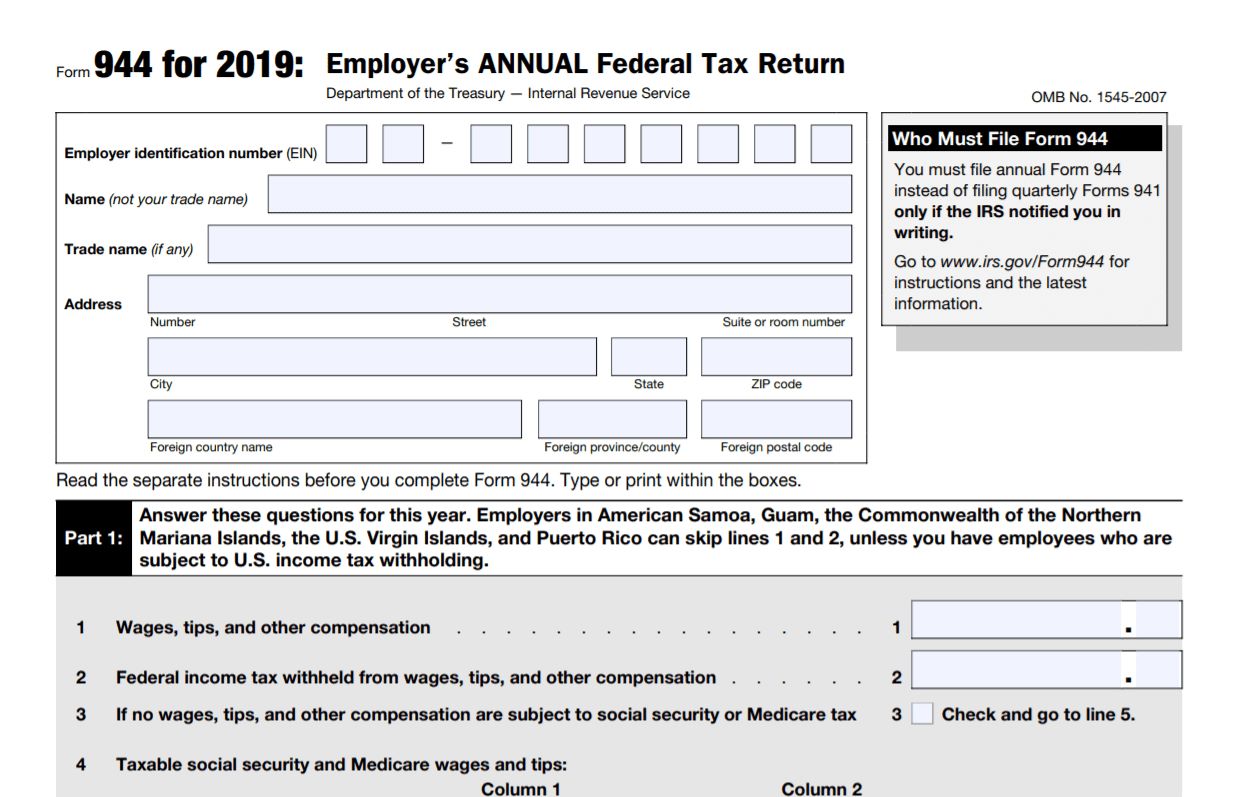

Form 1040-X, also known as the Amended U.S. Individual Income Tax Return, is the form taxpayers use to correct mistakes or make adjustments to their previous tax filings. Whether you overlooked a deduction, misreported income, or missed a credit, Form 1040-X allows you to reconcile the error and ensure accuracy in your tax records.

Purpose of Form 1040-X

The primary purpose of Form 1040-X is to make corrections or provide additional information that was omitted or incorrect in your original tax return. This form allows you to amend your return and rectify any discrepancies that may affect the amount of tax you owe or the refund you’re entitled to.

How to File Form 1040-X with the IRS

Filing Form 1040-X involves a straightforward process, but it’s crucial to follow the instructions carefully to ensure accuracy. Here’s a step-by-step guide on how to file Form 1040-X:

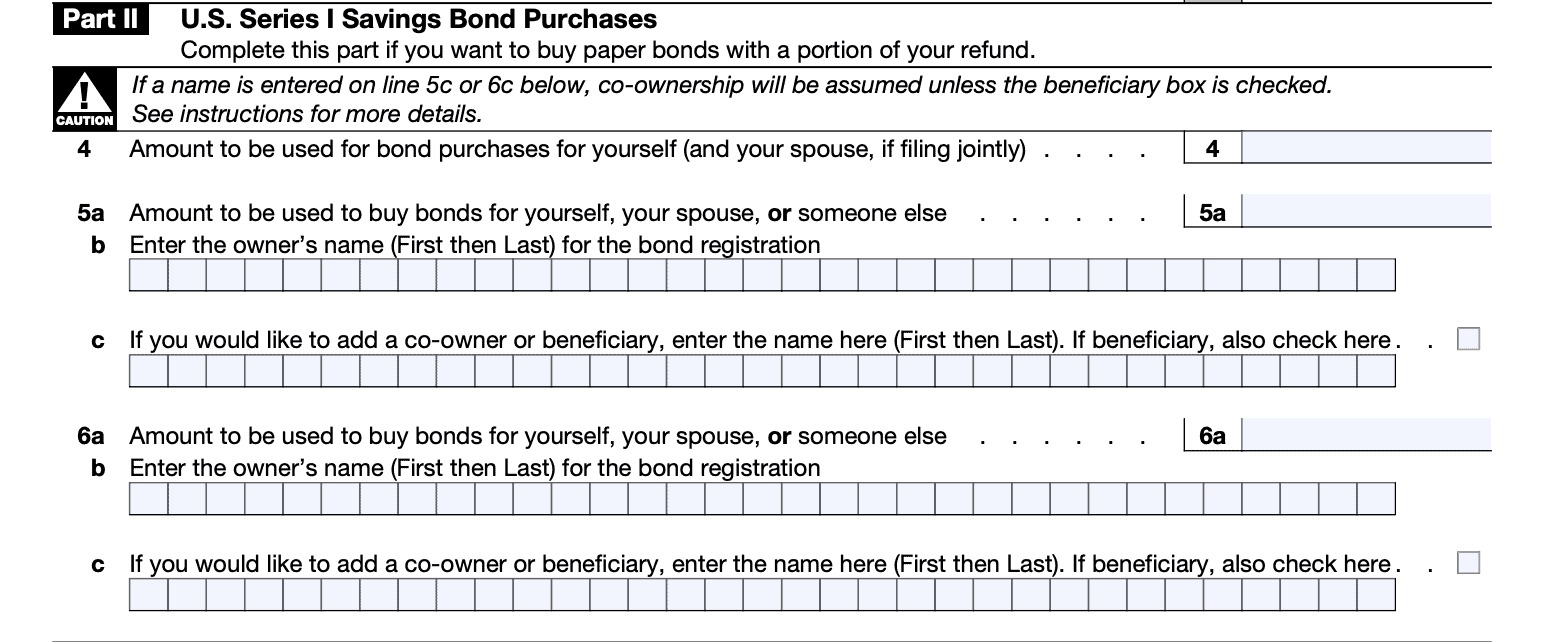

- Gather Documentation: Collect all the documents related to the original tax return, including W-2 forms, 1099 forms, and any additional schedules or attachments.

- Obtain a Copy of Form 1040-X: Download or request a copy of Form 1040-X from the IRS website or by calling their toll-free number.

- Complete Form 1040-X: Fill out the necessary fields on Form 1040-X, including your personal information, the year you are amending, and the details of the corrections or changes you are making.

- Attach Supporting Documents: Include any necessary supporting documents, such as updated schedules or additional forms that are affected by the changes being made.

- Double-Check and Sign: Review the completed form and supporting documents to ensure accuracy. Then, sign and date the form.

- Submit the Form: Mail the completed Form 1040-X and any supporting documents to the appropriate IRS address. Make sure to use certified mail or a trusted delivery service to track your submission.

It’s important to note that Form 1040-X must be filed on paper and cannot be submitted electronically. Additionally, be aware that filing Form 1040-X may result in changes to your tax liability, potentially impacting your refund or the amount of tax you owe. Ensuring accuracy in your amended return is crucial, so it’s always a good idea to seek professional assistance or consult with a tax expert if you have any doubts or complex changes to make.

Conclusion

If you’ve discovered errors or omissions in a previously filed tax return, Form 1040-X is an invaluable tool that allows you to correct your mistakes and ensure the accuracy of your tax records. By following the step-by-step process outlined above, you can easily file Form 1040-X with the IRS and address any discrepancies in your original tax filing. Remember, staying proactive and rectifying errors promptly will help you maintain financial stability and peace of mind.