Finance

How To Find APR Formula

Published: March 3, 2024

Learn the APR formula for finance calculations. Understand how to find APR and its significance in financial decision-making. Discover the step-by-step process now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Importance of APR in Financial Decision-Making

- Unveiling the Significance of Annual Percentage Rate

- Deciphering the Components and Calculation of Annual Percentage Rate

- Navigating the Methodology for Determining Annual Percentage Rate

- Empowering Informed Financial Decision-Making Through APR Understanding

Introduction

Understanding the Importance of APR in Financial Decision-Making

When it comes to navigating the complex world of personal finance, understanding the concept of Annual Percentage Rate (APR) is crucial. APR is a key factor in determining the true cost of borrowing, and it plays a significant role in various financial products, including loans, credit cards, and mortgages. By grasping the fundamentals of APR and its calculation, individuals can make informed decisions about their borrowing needs and avoid potential financial pitfalls.

APR represents the annualized interest rate that borrowers pay on their loans and other credit products. Unlike the nominal interest rate, which only reflects the basic interest charged on the principal amount, APR encompasses additional fees and costs associated with borrowing, providing a more comprehensive view of the total borrowing expense. As such, it serves as a critical tool for comparing different loan offers and identifying the most cost-effective financing options.

In this article, we will delve into the intricacies of APR, unravel the APR formula, and explore the methods for calculating APR. By gaining a deeper understanding of APR, readers can empower themselves to make sound financial choices and manage their borrowing effectively.

Understanding APR

Unveiling the Significance of Annual Percentage Rate

Before delving into the complexities of the APR formula and its calculation, it is essential to comprehend the significance of Annual Percentage Rate (APR) in the realm of personal finance. APR serves as a comprehensive yardstick for evaluating the true cost of borrowing, encompassing not only the nominal interest rate but also additional fees and charges associated with a loan or credit product.

One of the key aspects of APR is its role in facilitating transparent and informed decision-making. By providing a holistic view of the borrowing costs, APR enables consumers to compare different loan offers on an equal footing, ultimately aiding them in selecting the most favorable and cost-effective financing option. Whether it pertains to credit cards, mortgages, personal loans, or auto financing, understanding the APR associated with each product is instrumental in making sound financial choices.

Moreover, APR plays a pivotal role in regulatory compliance and consumer protection. Lenders are mandated to disclose the APR associated with their loan products, ensuring that borrowers are fully aware of the total cost of borrowing and can make informed decisions without being blindsided by hidden fees or misleading interest rates. This transparency fosters trust and accountability within the lending landscape, safeguarding consumers from predatory lending practices.

Furthermore, APR empowers borrowers to gauge the affordability of a loan or credit product over the long term. By factoring in all associated costs, including origination fees, closing costs, and other expenses, APR provides a holistic perspective on the financial commitment involved in borrowing, allowing individuals to assess whether the terms align with their budget and financial objectives.

As such, understanding APR is not merely a matter of financial literacy; it is a fundamental tool for making informed and empowered decisions in the realm of borrowing and lending. By unraveling the intricacies of APR, individuals can navigate the financial landscape with confidence, armed with the knowledge to secure favorable loan terms and avoid potential pitfalls.

The APR Formula

Deciphering the Components and Calculation of Annual Percentage Rate

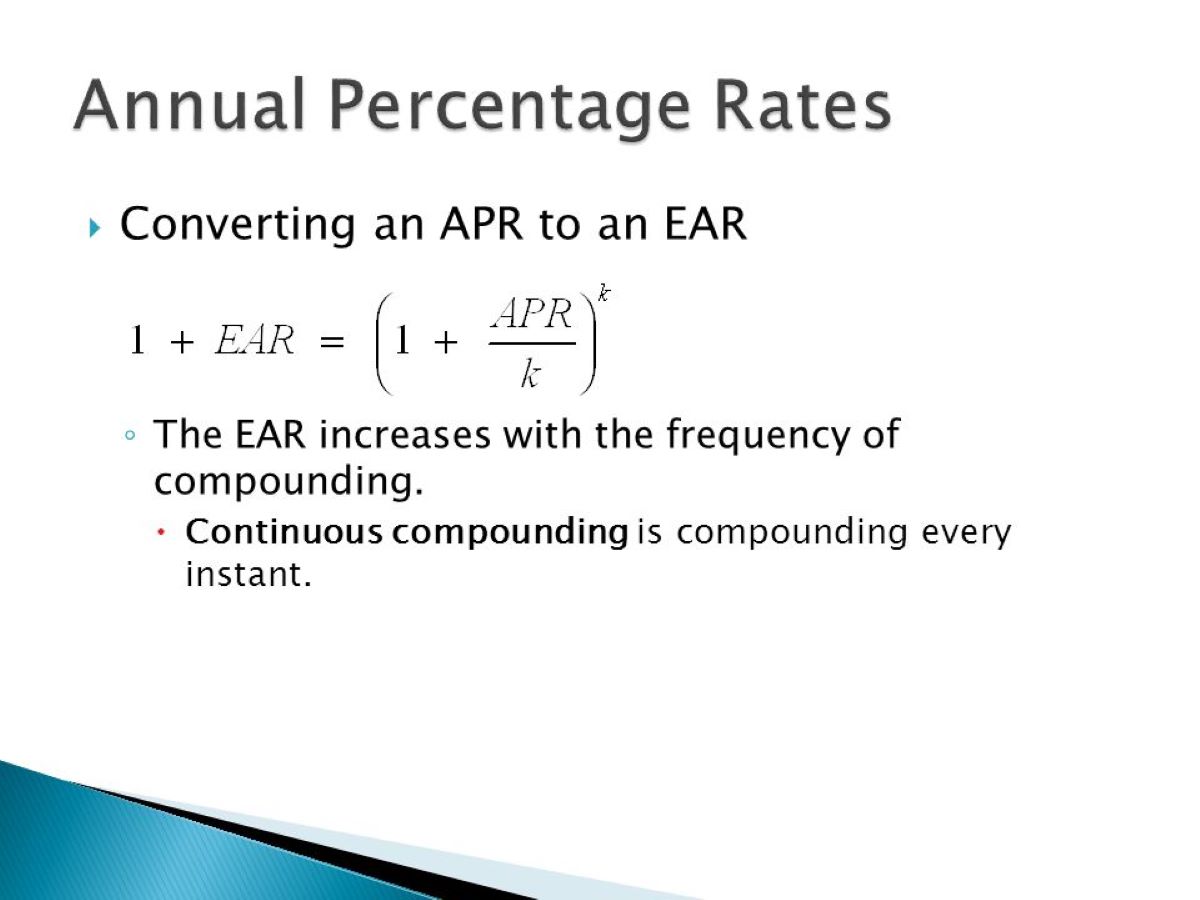

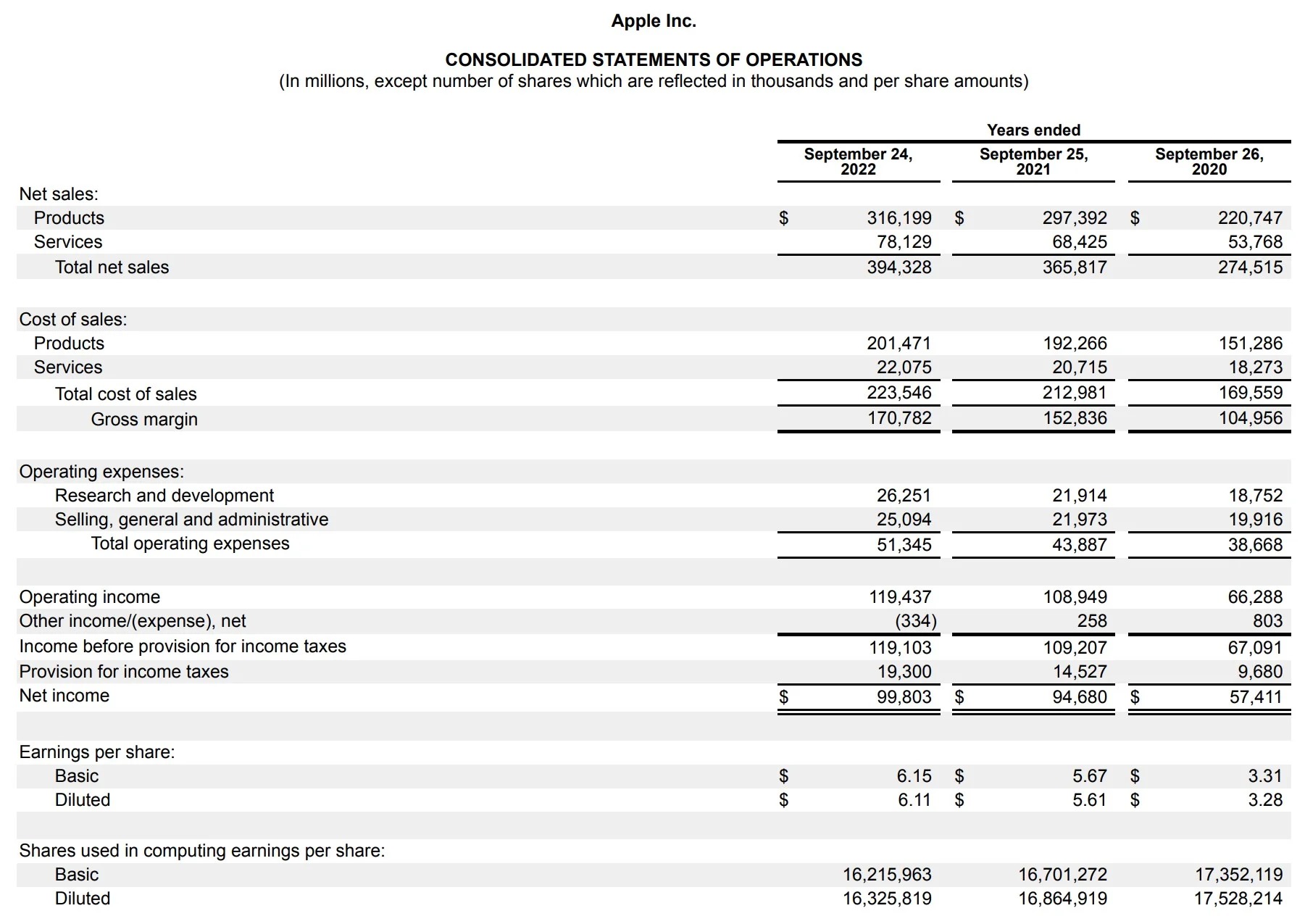

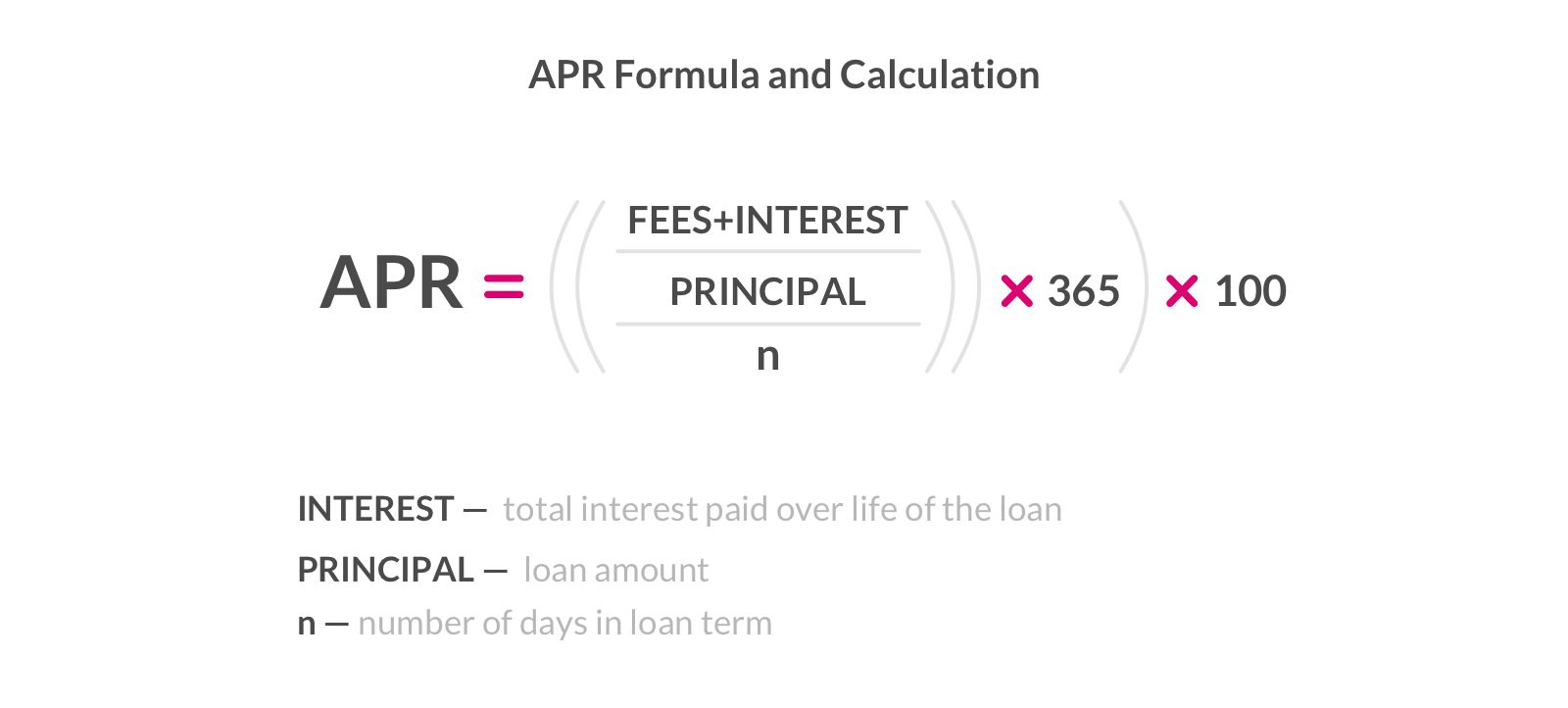

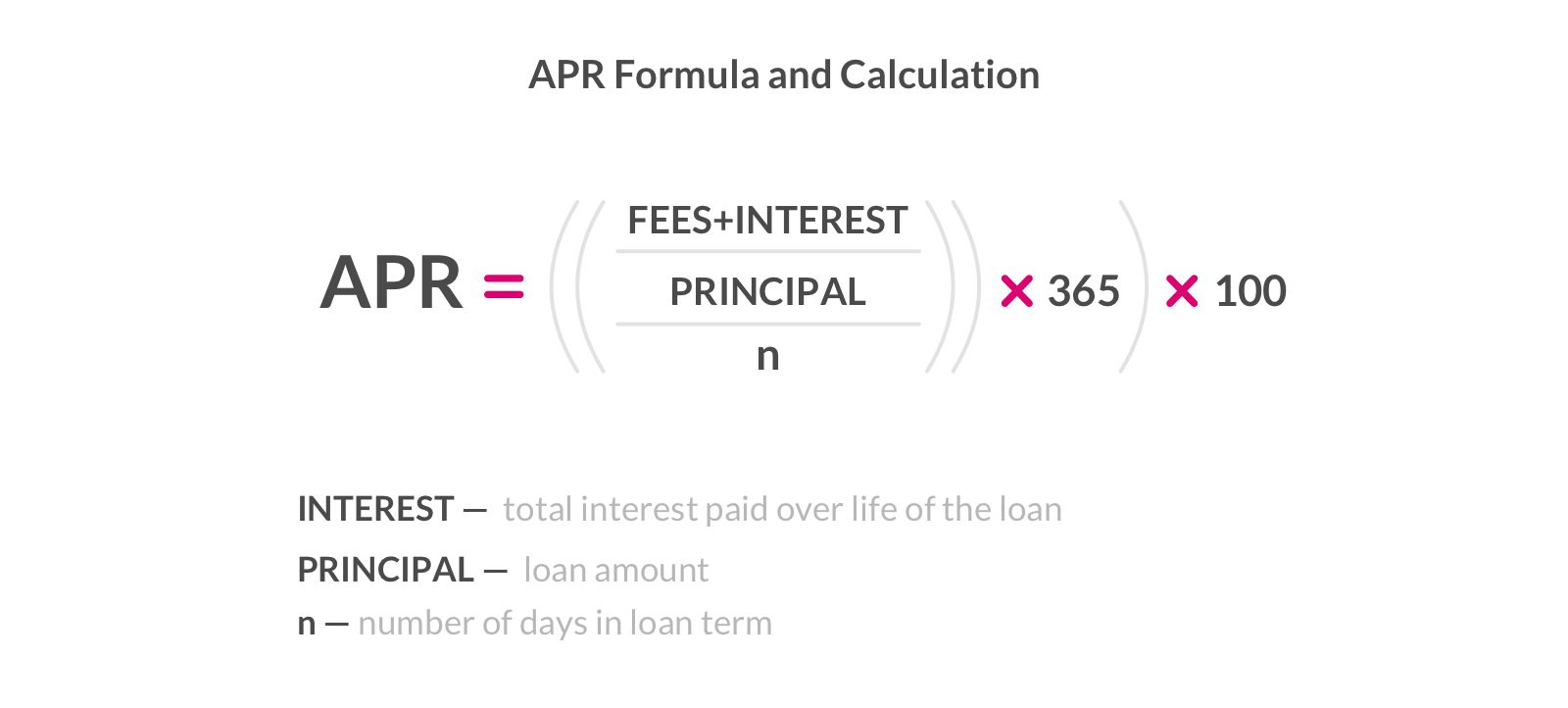

At the core of understanding Annual Percentage Rate (APR) lies the intricate formula that encapsulates the total borrowing costs associated with a financial product. The APR formula is designed to provide a comprehensive representation of the annualized interest rate, inclusive of additional fees and charges, thereby offering a more accurate assessment of the true cost of borrowing.

The fundamental components of the APR formula encompass not only the nominal interest rate but also the various fees and expenses incurred in obtaining the loan or credit. These may include origination fees, points, mortgage insurance, and other costs directly attributable to the borrowing arrangement. By incorporating these elements, the APR formula aims to present a holistic view of the financial commitment entailed in the borrowing process.

Mathematically, the APR formula involves the aggregation of the total finance charges over the life of the loan, divided by the loan amount, and then annualized. This computation allows for the standardization of borrowing costs on an annual basis, enabling consumers to compare different loan offers and credit products with varying terms and fee structures.

Furthermore, the APR formula takes into account the timing and frequency of payments, ensuring that the compounding effects of interest and fees are accurately reflected in the annualized rate. This level of precision is paramount in providing borrowers with a clear understanding of the long-term financial implications of their borrowing decisions.

It is important to note that while the APR formula offers a comprehensive representation of borrowing costs, it may not encompass certain variable expenses, such as fluctuating interest rates in the case of adjustable-rate mortgages. As such, consumers should exercise prudence and consider the potential impact of changing market conditions when evaluating loan offers based on APR.

By unraveling the intricacies of the APR formula, borrowers can gain a deeper appreciation for the multifaceted nature of borrowing costs and make informed comparisons among diverse loan products. This understanding empowers individuals to navigate the financial landscape with clarity and confidence, ultimately enabling them to secure financing arrangements that align with their long-term financial goals.

Calculating APR

Navigating the Methodology for Determining Annual Percentage Rate

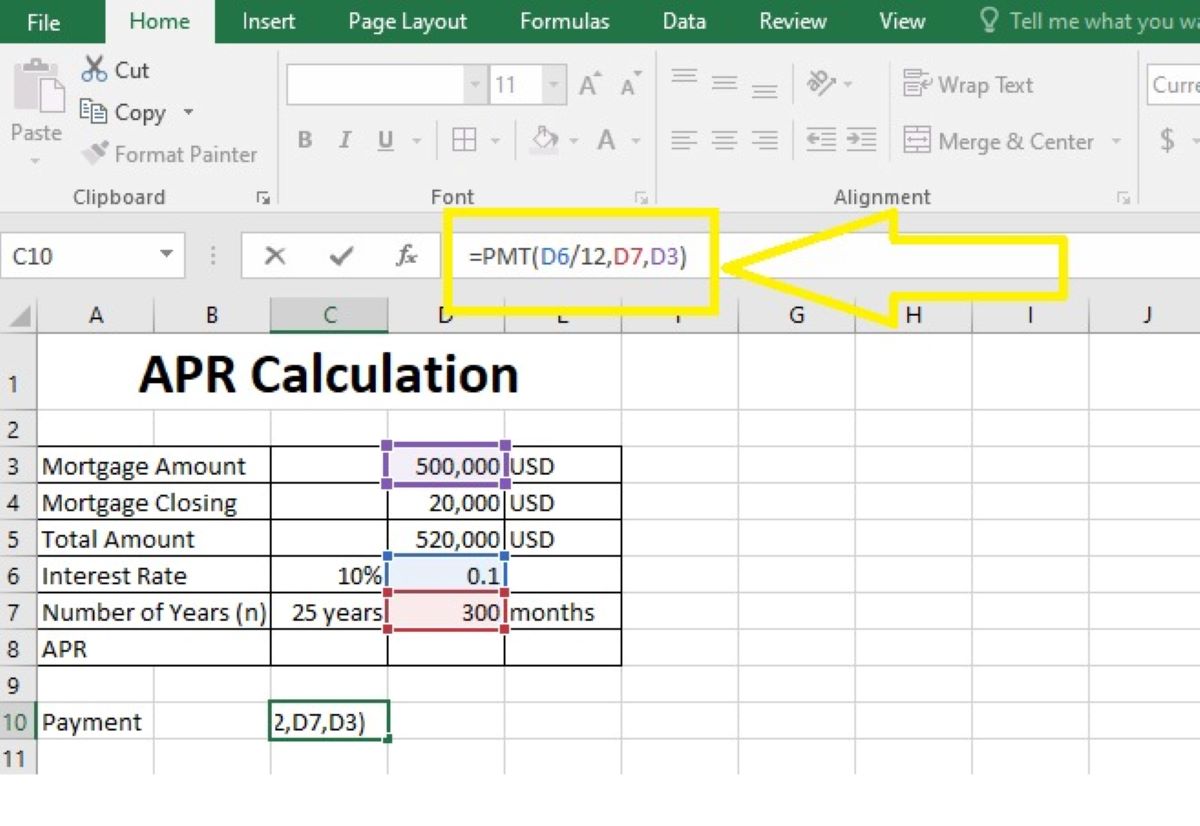

Calculating the Annual Percentage Rate (APR) involves a systematic approach that integrates the various components of borrowing costs into a standardized annualized representation. By unraveling the methodology for determining APR, borrowers can gain insights into the true cost of their loans and credit products, enabling informed decision-making and financial prudence.

The process of calculating APR begins with gathering comprehensive information regarding the loan or credit terms, including the nominal interest rate, any upfront fees or points, as well as the frequency and timing of payments. These details serve as the foundation for computing the total borrowing costs and deriving the annualized representation of the interest rate.

One of the key steps in calculating APR is accounting for the total finance charges, which encompass not only the interest accrued over the loan term but also any additional fees or costs incurred in the borrowing arrangement. By aggregating these expenses and factoring in the loan duration, borrowers can obtain a comprehensive view of the total cost of borrowing, paving the way for accurate APR computation.

Furthermore, the timing and frequency of payments play a crucial role in the APR calculation. Whether the loan entails monthly, quarterly, or semi-annual payments, the compounding effects of interest and fees must be meticulously incorporated to derive the annualized representation of borrowing costs. This meticulous approach ensures that the calculated APR accurately reflects the true expense of the loan on an annual basis.

It is important to note that the methodology for calculating APR may vary based on the type of loan or credit product. For instance, mortgages and auto loans may entail distinct considerations in APR computation, particularly when accounting for closing costs, mortgage insurance, or other specific expenses associated with the respective financing arrangements.

By embracing a methodical approach to calculating APR, borrowers can equip themselves with the knowledge to discern the true cost of borrowing and make informed comparisons among diverse loan offers. This financial acumen empowers individuals to navigate the lending landscape with confidence, enabling them to secure financing arrangements that align with their long-term financial objectives.

Conclusion

Empowering Informed Financial Decision-Making Through APR Understanding

As we conclude our exploration of Annual Percentage Rate (APR) and its significance in the realm of personal finance, it becomes evident that a comprehensive understanding of APR is pivotal in making informed and empowered financial decisions. By unraveling the intricacies of APR, borrowers can navigate the borrowing landscape with clarity and prudence, ultimately securing financing arrangements that align with their long-term financial goals.

APR serves as a beacon of transparency and comparability, enabling consumers to gauge the true cost of borrowing across diverse loan offers and credit products. By encapsulating not only the nominal interest rate but also additional fees and charges, APR provides a holistic representation of borrowing costs, fostering an environment of informed decision-making and financial accountability.

Moreover, the APR formula, with its meticulous aggregation of borrowing expenses and annualization of interest rates, offers borrowers a standardized metric for evaluating loan offers and credit products. This methodology empowers individuals to make apples-to-apples comparisons, ultimately facilitating the selection of the most favorable and cost-effective financing options.

By delving into the methodology for calculating APR, borrowers can gain insights into the nuanced process of deriving the annualized representation of borrowing costs. This methodical approach equips individuals with the knowledge to discern the true expense of their loans and credit products, enabling them to make sound financial choices aligned with their budget and long-term objectives.

In essence, understanding APR transcends mere financial literacy; it embodies a fundamental tool for navigating the borrowing landscape with confidence and prudence. Armed with this knowledge, borrowers can shield themselves from potential pitfalls, secure favorable loan terms, and embark on their financial journeys with clarity and assurance.

As we embrace the multifaceted nature of personal finance, the comprehension of APR stands as a cornerstone of financial empowerment, enabling individuals to tread the path of borrowing and lending with insight, transparency, and informed decision-making.