Finance

How To Find Retained Earnings Accounting

Modified: December 30, 2023

Learn how to find and calculate retained earnings in accounting with this comprehensive guide. Understand the importance of finance and maximize profitability for your business.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Retained Earnings

- Importance of Retained Earnings in Accounting

- Accounting Equation and Retained Earnings

- Methods to Calculate Retained Earnings

- Factors Affecting Retained Earnings

- Understanding Retained Earnings Statement

- Analyzing Retained Earnings Trends

- Example of Retained Earnings Calculation

- Conclusion

Introduction

In the realm of finance and accounting, understanding the concept of retained earnings is crucial. Retained earnings play a vital role in reflecting a company’s financial health and stability. This key metric provides insights into how effectively a business is utilizing its profits to grow and reinvest.

Retained earnings can be defined as the accumulated net profits or losses of a company that are not distributed to its shareholders as dividends. Instead, these earnings are retained within the company to finance future growth, repay debts, or invest in new projects. By retaining earnings, a company can bolster its financial stability, enhance its market position, and pursue strategic initiatives.

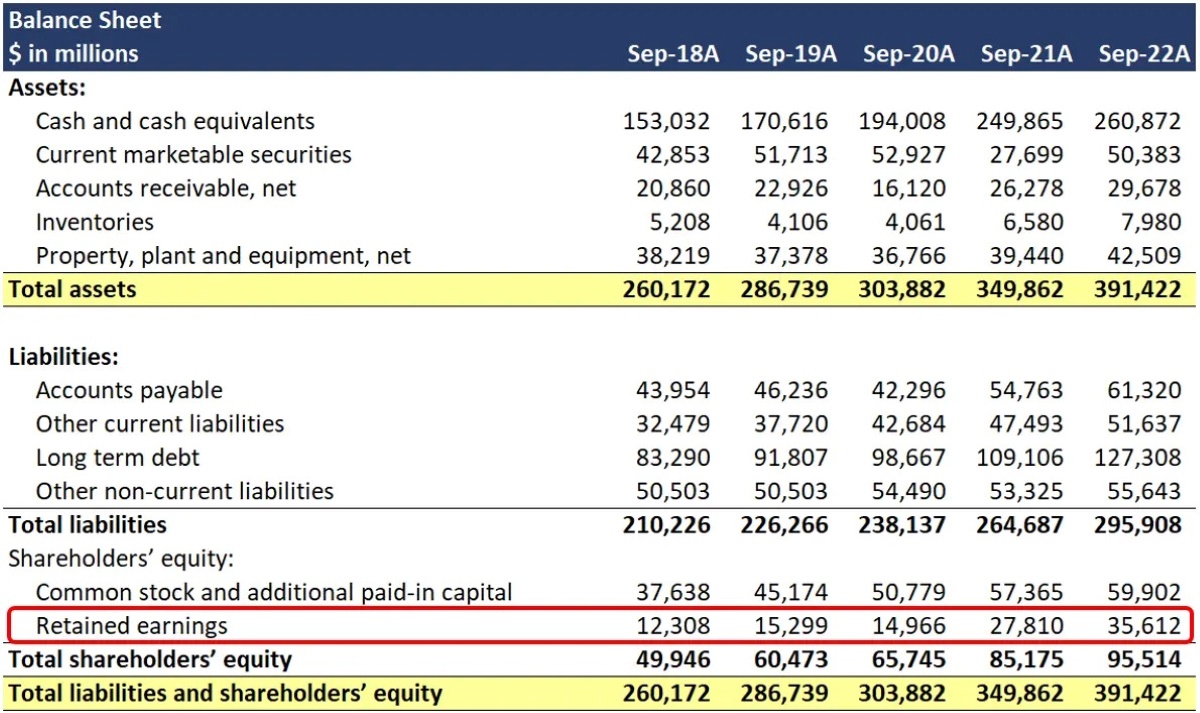

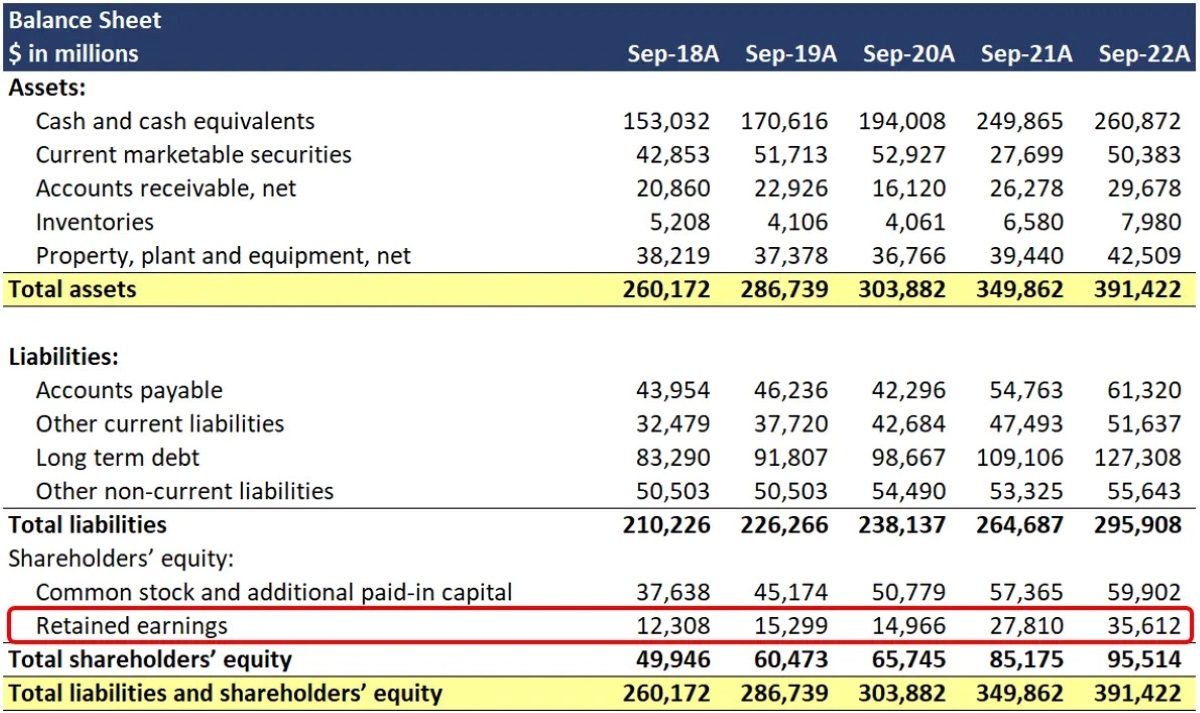

Retained earnings are an essential component of a company’s balance sheet, specifically listed under the shareholder’s equity section. It represents the cumulative total of net profits earned by the company since its inception, minus any dividends paid out to shareholders.

Understanding how to calculate, interpret, and analyze retained earnings is crucial for investors, financial analysts, and business owners alike. By delving into the intricacies of retained earnings accounting, individuals can gain valuable insights into a company’s financial trajectory, growth potential, and dividend policy.

In this comprehensive guide, we will explore the concept of retained earnings, its significance in accounting, and various methods to calculate and analyze this metric. Whether you are a seasoned finance professional or a curious investor, this article will equip you with the knowledge you need to navigate the realm of retained earnings and make informed financial decisions.

Definition of Retained Earnings

Retained earnings, also known as accumulated earnings or accumulated profits, refer to the portion of a company’s net income that is retained for reinvestment purposes rather than being distributed to shareholders as dividends. It represents the cumulative earnings that have been reinvested back into the business since its inception.

Retained earnings are considered an integral part of a company’s financial structure, as they contribute to the overall equity of the company. They can be thought of as a reservoir of funds that can be used to finance future growth opportunities, research and development, debt repayment, or acquisitions.

Companies accumulate retained earnings over time by generating profits and not distributing them to shareholders as dividends. This accumulation is essential for sustaining and growing the company’s operations in the long run. It allows the company to build a financial cushion, increase its asset base, and fuel expansion initiatives.

Retained earnings can have a significant impact on a company’s valuation and investor perception. A company with a healthy and consistently growing retained earnings balance demonstrates its ability to generate profits and reinvest them efficiently. This, in turn, may attract investors, increase shareholder confidence, and enhance the company’s overall market value.

It is important to note that retained earnings can also include any accumulated losses or negative profits. In such cases, the balance of retained earnings may be negative, indicating that the company has incurred net losses over time.

Overall, retained earnings provide a measure of the financial strength and resilience of a company. By analyzing the trends and patterns of retained earnings, investors and financial analysts can gauge a company’s profitability, capacity to generate cash flow, and commitment to long-term growth.

Next, let’s explore the significance of retained earnings in accounting and why it holds a critical place in the evaluation of a company’s financial performance and prospects.

Importance of Retained Earnings in Accounting

Retained earnings play a crucial role in accounting as they provide valuable insights into a company’s financial health, growth potential, and overall stability. Here are some key reasons why retained earnings are important in the field of accounting:

- Measure of Profitability: Retained earnings serve as a reflection of a company’s profitability. It indicates how effectively the company has been able to generate and retain profits over time. A consistent increase in retained earnings suggests that the company is generating healthy profits and reinvesting them for future growth.

- Investment in Growth: By retaining earnings, a company can fund its expansion plans and invest in new projects or initiatives. These funds can be utilized for research and development, marketing campaigns, infrastructure improvements, or acquiring new assets. By reinvesting earnings, a company can fuel its growth, enhance its competitive position, and capitalize on emerging market opportunities.

- Financial Stability: Retained earnings contribute to a company’s financial stability. By building up a reserve of funds, a company can strengthen its financial position and mitigate potential risks. Retained earnings act as a buffer during challenging times, providing the company with the flexibility to withstand economic downturns, industry fluctuations, or unexpected expenses.

- Capital Financing: Retained earnings can serve as a valuable source of internal financing for a company. By utilizing retained earnings, a company can reduce its reliance on external funding options such as bank loans or issuing new equity shares. This can help in minimizing debt and maintaining a healthy capital structure.

- Dividend Distribution: Retained earnings also play a role in determining a company’s dividend policy. Companies with ample retained earnings may choose to distribute dividends to shareholders as a way to reward them for their investment and share in the company’s success. On the other hand, companies with limited retained earnings may decide to reinvest the profits back into the business instead of paying dividends.

In summary, retained earnings provide a comprehensive picture of a company’s financial performance, growth strategies, and financial stability. By analyzing this metric, investors, financial analysts, and stakeholders can assess a company’s profitability, capital reinvestment plans, and the potential for future dividends. Retained earnings are an essential tool for evaluating the long-term viability and success of a company in the dynamic business landscape.

Accounting Equation and Retained Earnings

The accounting equation is the foundation of double-entry bookkeeping, and retained earnings are an integral part of this equation. The equation is as follows:

Assets = Liabilities + Shareholders’ Equity

Shareholders’ equity is the residual interest in the assets of a company after deducting its liabilities. It represents the ownership interest of the shareholders. Within the shareholders’ equity section, retained earnings play a crucial role.

Retained earnings are included in the shareholders’ equity because they represent the accumulated profits that have been reinvested back into the business rather than distributed to shareholders as dividends. As a result, an increase or decrease in retained earnings directly impacts the shareholders’ equity of a company.

When a company earns a profit, it increases its retained earnings. This, in turn, increases the shareholders’ equity and the overall value of the company. On the other hand, if a company incurs a net loss, it decreases its retained earnings, leading to a decrease in the shareholders’ equity.

The relationship between the accounting equation and retained earnings can be further understood through the process of recording transactions. When a company generates profits, it records the increase in retained earnings by debiting the retained earnings account and crediting the revenue or income account. This represents the flow of profits into the retained earnings category.

Conversely, when a company distributes dividends to its shareholders, it records the decrease in retained earnings by debiting the retained earnings account and crediting the dividends payable or dividends account. This reflects the outflow of funds from the retained earnings category.

It is important to note that retained earnings can also be affected by other transactions such as stock repurchases, stock issuances, and adjustments for certain accounting changes or corrections. These transactions impact the retained earnings balance and, consequently, the shareholders’ equity.

The accounting equation, along with the inclusion of retained earnings, provides a comprehensive snapshot of a company’s financial position. It demonstrates the relationship between the company’s assets, debts, and the residual interest of the shareholders. Retained earnings serve as a key component in determining the equity stake of the shareholders and play a significant role in measuring a company’s financial health and value.

Methods to Calculate Retained Earnings

Calculating retained earnings involves capturing the net profits or losses accumulated by a company over a specific period. There are a few different methods to calculate retained earnings, depending on the available information and the desired level of detail. Here are some commonly used methods:

- Simplified Method: The simplified method involves taking the beginning retained earnings balance and adding the net income for the period while subtracting any dividends paid out. The formula is as follows: Retained Earnings = Beginning Retained Earnings + Net Income – Dividends. This method provides a straightforward calculation but may not capture all the relevant factors contributing to the change in retained earnings.

- Comprehensive Method: The comprehensive method takes into account various factors that impact retained earnings in addition to net income and dividends. It considers other adjustments such as prior period adjustments, changes in accounting policies, and corrections of errors. The formula for the comprehensive method is: Retained Earnings = Beginning Retained Earnings + Net Income – Dividends + Adjustments. This method provides a more detailed and accurate calculation of retained earnings but requires access to complete financial statements and supporting information.

- Statement of Retained Earnings: Another method to calculate retained earnings is by preparing a statement of retained earnings. This statement outlines the changes in retained earnings over a specific period and provides a summary of the factors impacting the balance. The statement typically includes the beginning retained earnings balance, net income, dividends, and any adjustments. By reviewing the statement of retained earnings, stakeholders can easily track the changes in retained earnings from one period to another.

- Financial Management Systems: Many companies use financial management systems or accounting software to automate the calculation of retained earnings. These systems typically integrate with the company’s general ledger and automatically update the retained earnings balance based on the input of financial transactions such as revenues, expenses, gains, and losses. Using such systems helps ensure accurate and timely calculations, reducing the margin for potential errors or omissions.

It’s important to note that the method used to calculate retained earnings may vary based on factors such as the size of the company, the complexity of its financial transactions, and the reporting requirements imposed by regulatory bodies.

Regardless of the method used, calculating retained earnings is essential for assessing a company’s financial performance, determining its capacity for reinvestment, and evaluating its dividend policy. By accurately calculating retained earnings, stakeholders can better understand the financial position and growth potential of a company.

Factors Affecting Retained Earnings

Retained earnings can be influenced by various factors that impact a company’s financial performance and decision-making. It is essential to understand these factors as they shed light on the dynamics of retained earnings and provide insights into a company’s dividend policy and future growth potential. Here are some key factors that can affect retained earnings:

- Net Income: Net income is a primary driver of retained earnings. If a company generates higher profits, it will increase its retained earnings. Conversely, if a company incurs net losses, it will decrease its retained earnings. Net income is influenced by various factors such as revenues, expenses, operating efficiency, and market conditions.

- Dividend Policy: The dividend policy adopted by a company can significantly impact its retained earnings. If a company decides to distribute a larger portion of its profits as dividends, it will lead to a decrease in retained earnings. Conversely, if a company retains a larger portion of its earnings for reinvestment, it will increase its retained earnings. The dividend policy is influenced by factors such as profitability, cash flow requirements, growth prospects, and shareholders’ expectations.

- Reinvestment and Capital Allocation: The amount of earnings a company chooses to reinvest back into the business can have a direct impact on retained earnings. If a company consistently reinvests a significant portion of its earnings in growth opportunities, research and development, or acquisitions, it will result in lower retained earnings. Conversely, if a company maintains a conservative approach to reinvestment, it will lead to higher retained earnings.

- Impact of Accounting Changes: Changes in accounting policies, regulations, or reporting standards can affect the calculation of retained earnings. Adjustments due to changes in revenue recognition methods, inventory valuation, or impairment assessments can have an impact on the balance of retained earnings. It is essential to consider the effects of accounting changes when analyzing the trends and patterns of retained earnings over time.

- Acquisitions or Divestitures: Mergers, acquisitions, or divestitures can significantly impact retained earnings. When a company acquires or divests a subsidiary or business segment, the profits or losses associated with that entity may be directly reflected in retained earnings. These transactions can result in a significant change in the balance of retained earnings.

- Accumulated Other Comprehensive Income (AOCI): AOCI refers to the cumulative gains or losses that are not recognized in the income statement but rather recorded directly in the equity section of the balance sheet. Changes in AOCI due to items such as foreign currency translation adjustments, unrealized gains or losses on investments, or pension liabilities can impact retained earnings indirectly.

These factors and their interplay highlight the dynamic nature of retained earnings. It is crucial for stakeholders to consider the various factors that can influence retained earnings when analyzing a company’s financial performance, dividend policy, and outlook. By understanding these factors, investors, financial analysts, and management can gain a deeper understanding of a company’s ability to generate profits, its reinvestment strategies, and its long-term financial stability.

Understanding Retained Earnings Statement

The retained earnings statement, also known as the statement of retained earnings, provides a detailed overview of the changes in a company’s retained earnings balance over a specific period. This financial statement helps stakeholders gain insights into how a company has utilized its profits for reinvestment, dividends, and other adjustments. Understanding the retained earnings statement is crucial for evaluating a company’s financial performance, growth strategies, and dividend policies.

The retained earnings statement typically includes the following components:

- Beginning Retained Earnings: The beginning retained earnings balance is the retained earnings balance at the start of the period covered by the statement. It represents the accumulated earnings from previous periods that were not distributed as dividends.

- Net Income: Net income is the company’s total revenue minus its total expenses for the period. It represents the profit generated by the company during that specific period. Net income is an essential component of the retained earnings calculation, as it contributes to the increase in retained earnings.

- Dividends: Dividends refer to the portion of the company’s profits that is distributed to shareholders. Dividends can be in the form of cash, additional shares, or other assets. Dividends reduce the retained earnings balance, as they represent a distribution of profits to shareholders instead of being retained within the company.

- Net Changes: The net changes in retained earnings reflect the difference between the beginning retained earnings balance, net income, and dividends. It summarizes the overall change in retained earnings for the period covered by the statement.

- Ending Retained Earnings: The ending retained earnings balance is the resulting balance after incorporating the net changes. It represents the retained earnings balance at the end of the period covered by the statement.

The retained earnings statement helps stakeholders understand how a company’s profits are being utilized. A positive net income and a smaller dividend distribution indicate that the company is reinvesting more earnings back into the business, leading to an increase in retained earnings. Conversely, a negative net income or a larger dividend distribution will result in a decrease in retained earnings.

By analyzing the retained earnings statement over multiple periods, stakeholders can identify trends and patterns in a company’s profit retention and dividend policy. Consistently increasing retained earnings can indicate a company’s ability to generate profits and reinvest them for future growth. On the other hand, declining retained earnings may suggest a company’s challenges in generating profits or its decision to distribute more dividends.

Understanding the retained earnings statement is vital for investors, financial analysts, and management. It provides valuable insights into a company’s financial performance, capital reinvestment strategies, and shareholder value creation. By reviewing this statement, stakeholders can assess a company’s profitability, dividend stability, and long-term financial health.

Analyzing Retained Earnings Trends

Analyzing retained earnings trends is a crucial step in evaluating a company’s financial performance and growth trajectory. By examining the patterns and changes in retained earnings over time, stakeholders can gain valuable insights into a company’s profitability, reinvestment strategies, and dividend policies. Here are some key aspects to consider when analyzing retained earnings trends:

- Growth Rate: Calculate the growth rate of retained earnings over multiple periods to determine the company’s ability to generate profits and retain them for future use. A consistent and positive growth rate indicates a healthy financial position and potential for future expansion.

- Profitability Ratios: Evaluate the profitability ratios such as return on equity (ROE) and return on assets (ROA) in conjunction with retained earnings. A higher ROE and ROA, combined with increasing retained earnings, suggest efficient utilization of resources and strong financial performance.

- Reinvestment Strategies: Assess how much of the earnings are being reinvested back into the business for expansion, research and development, or acquisitions. Analyze whether the company is strategically allocating its profits for long-term growth or if a significant portion is being distributed as dividends.

- Dividend Stability: Examine the stability and consistency of dividend payments in relation to retained earnings. A company that consistently pays dividends while maintaining or increasing its retained earnings balance indicates a sustainable dividend policy and financial stability.

- Industry Comparison: Compare the retained earnings trends of the company with its peers in the same industry. This analysis helps provide context and assess the company’s performance relative to its competitors.

- External Factors: Consider external factors that may impact retained earnings, such as economic conditions, industry trends, regulatory changes, or market competition. These factors can influence a company’s profitability and its ability to retain earnings.

- Influence of Accounting Changes: Take into account any accounting changes or adjustments that may have affected the retained earnings balance. Changes in accounting policies can impact the comparability of retained earnings over different periods.

- Management Guidance and News: Stay informed about any management guidance or news releases that provide insight into the company’s future plans, growth strategies, or dividend outlook. This information can help in understanding the company’s intentions regarding the use of retained earnings.

By paying attention to these factors and performing a thorough analysis of retained earnings trends, stakeholders can make informed decisions regarding investment, financial planning, and evaluating a company’s overall financial health.

It is important to remember that analyzing retained earnings trends should be done in conjunction with other financial metrics and considerations. Retained earnings are just one piece of the puzzle and should be evaluated alongside profitability, cash flow, debt levels, and other relevant factors to form a comprehensive view of a company’s financial standing.

Example of Retained Earnings Calculation

To understand how retained earnings are calculated, let’s consider a hypothetical example for a fictional company called XYZ Corporation. Here are the relevant figures for the past three years:

- Beginning Retained Earnings (Year 1): $500,000

- Net Income (Year 1): $200,000

- Dividends Paid (Year 1): $50,000

- Beginning Retained Earnings (Year 2): $650,000

- Net Income (Year 2): $300,000

- Dividends Paid (Year 2): $75,000

- Beginning Retained Earnings (Year 3): $875,000

- Net Income (Year 3): $400,000

- Dividends Paid (Year 3): $100,000

Using the information above, we can calculate the retained earnings for each year:

Year 1: Beginning Retained Earnings + Net Income – Dividends

$500,000 + $200,000 – $50,000 = $650,000

Year 2: Beginning Retained Earnings + Net Income – Dividends

$650,000 + $300,000 – $75,000 = $875,000

Year 3: Beginning Retained Earnings + Net Income – Dividends

$875,000 + $400,000 – $100,000 = $1,175,000

In this example, the retained earnings for XYZ Corporation at the end of Year 1 is $650,000, at the end of Year 2 is $875,000, and at the end of Year 3 is $1,175,000.

By analyzing the trend in retained earnings, we can observe that the company’s retained earnings have consistently increased over the three-year period. This indicates that the company is generating profits and retaining a portion of those profits for future use, such as reinvestment or growth initiatives.

Furthermore, we can see that the dividends paid out by the company have also increased over the years, reflecting a portion of the earnings being distributed to shareholders. However, the retained earnings have still managed to grow due to the company’s strong profitability.

This example highlights the importance of analyzing the retained earnings calculation and trends to gain insights into a company’s financial performance, dividend policy, and ability to generate and retain profits over time.

Conclusion

Retained earnings are a vital aspect of financial management and accounting for any company. They represent accumulated profits that have not been distributed to shareholders as dividends but instead reinvested back into the business. Analyzing retained earnings provides valuable insights into a company’s financial stability, growth potential, and dividend policy.

Throughout this article, we have explored the definition and importance of retained earnings in accounting. We have seen how retained earnings are a measure of profitability, financial stability, and future growth prospects. By calculating retained earnings and examining trends, stakeholders can evaluate a company’s financial performance, capital reinvestment strategies, and dividend stability.

Factors such as net income, dividend policy, reinvestment strategies, accounting changes, and industry trends significantly affect retained earnings. Understanding these factors allows stakeholders to interpret the dynamics of retained earnings accurately and make well-informed decisions.

Furthermore, the preparation and analysis of a retained earnings statement help stakeholders track the changes in retained earnings over time and gain a comprehensive view of a company’s financial position. This statement provides a clear picture of the beginning and ending retained earnings balances, as well as the net income and dividends that have influenced the retained earnings balance.

In conclusion, retained earnings are a crucial aspect of a company’s financial landscape. By understanding and analyzing retained earnings, investors, financial analysts, and management can assess a company’s profitability, reinvestment strategies, and dividend policies. This knowledge plays a significant role in making informed decisions about investment, financial planning, and evaluating a company’s overall financial health and sustainability in the dynamic business environment.