Finance

How To Find Sales In Accounting

Published: October 9, 2023

Learn how to find sales in accounting and improve your finance skills with our comprehensive guide. Start optimizing your financial performance now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance and accounting, sales play a crucial role in measuring the success and growth of a business. Sales are the lifeline of any company, as they directly contribute to revenue generation and profitability. Understanding and accurately tracking sales in accounting is essential for making informed business decisions, evaluating performance, and preparing financial statements.

However, finding and analyzing sales data in accounting can sometimes be a daunting task. With multiple transactions, varying payment methods, and complex bookkeeping systems, ensuring accuracy and efficiency in capturing sales information becomes crucial.

In this article, we will explore the importance of finding sales in accounting and discuss various methods that can help in effectively tracking and analyzing sales data. Whether you are a business owner, accountant, or financial analyst, this guide will provide valuable insights into how to find sales and utilize them for financial analysis and decision-making.

Now, let’s dive into the world of sales accounting and discover the significance of accurately tracking sales within an organization.

Understanding Sales in Accounting

In accounting, sales refer to the exchange of goods or services for money or other forms of payment. It represents the revenue generated by a business through its operations. Sales can be categorized into different types based on the nature of the transaction, such as retail sales, wholesale sales, or online sales.

When it comes to accounting for sales, it is essential to have a clear understanding of the various components involved. One crucial aspect is the recognition of revenue. According to generally accepted accounting principles (GAAP), revenue should be recognized when it is earned and realizable. This means that revenue should be recognized when the goods or services are delivered, and there is a reasonable expectation of payment.

Another important consideration is the valuation of sales. In accounting, sales are typically recorded at their fair value, which is the amount at which a willing buyer and a willing seller would agree to the transaction. This ensures that the financial statements accurately represent the economic value of the sales generated by the business.

In addition to the recognition and valuation of sales, it is also essential to consider any associated costs or expenses. For example, if a business incurs costs to produce or deliver the goods or services sold, these costs should be deducted from the sales revenue to determine the gross profit. This helps in assessing the profitability of the sales transactions and calculating the appropriate tax liability.

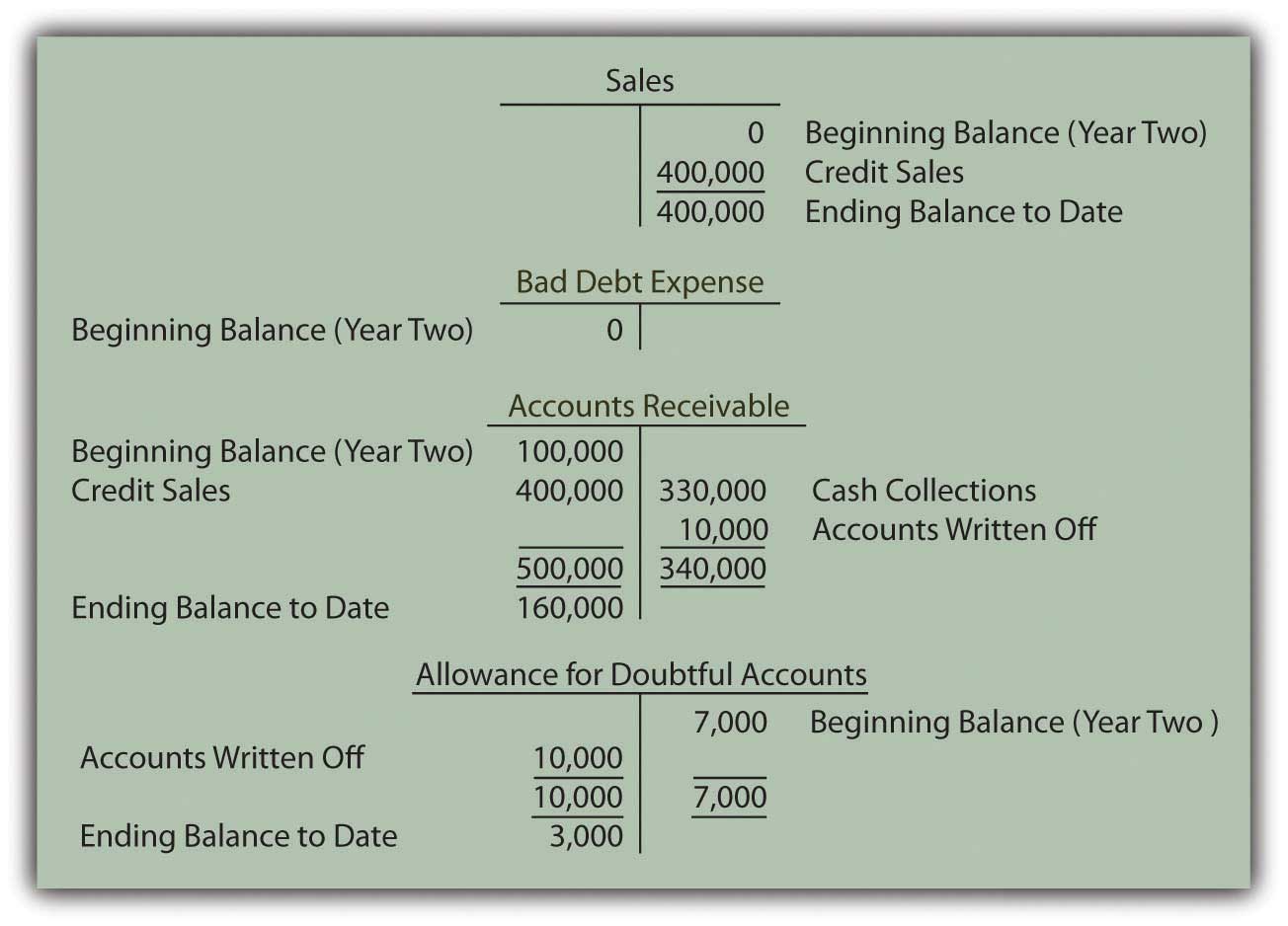

Understanding sales in accounting also involves familiarity with the different methods of tracking and recording sales. This can include the use of sales invoices, accounting software, sales reports, bank statements, and sales records. By leveraging these tools and techniques, businesses can maintain accurate and up-to-date sales data, aiding in financial analysis, forecasting, and decision-making processes.

Now that we have established a foundation in understanding sales in accounting, let’s explore why finding sales is crucial for businesses.

Importance of Finding Sales in Accounting

Tracking and finding sales in accounting is of utmost importance for businesses for several compelling reasons:

- Revenue Assessment: Finding sales allows businesses to accurately evaluate their revenue generation. Revenue is a key performance indicator that reflects the effectiveness of a company’s operations. By tracking sales, businesses can assess the success of their products or services and identify areas for improvement.

- Profitability Analysis: Sales data is vital for analyzing the profitability of a business. By comparing sales revenue with associated costs and expenses, such as production costs, overhead expenses, and marketing expenditures, companies can determine their gross profit margin. This critical financial metric helps identify areas of inefficiency and supports strategic decision-making.

- Financial Reporting: Finding sales is crucial for accurate financial reporting. Sales information is required to prepare income statements, balance sheets, and cash flow statements. These financial statements provide a snapshot of a company’s financial health and performance, which is important for stakeholders, investors, and lenders.

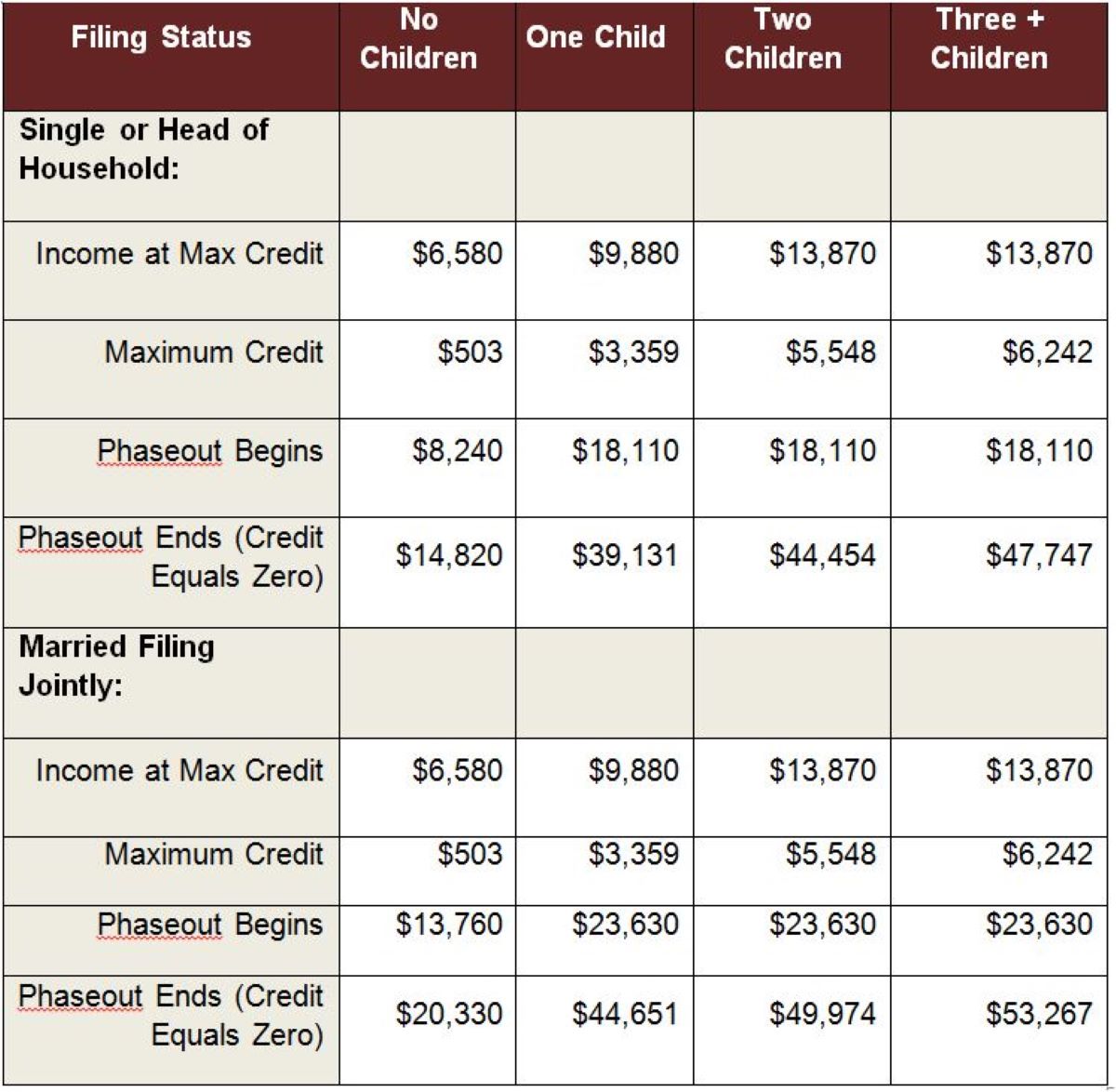

- Tax Compliance: For tax purposes, businesses need to report their sales accurately. Tracking sales helps determine the taxable income and calculate the appropriate amount of taxes owed. Failure to accurately report sales can lead to penalties, fines, and potential legal issues.

- Forecasting and Planning: Sales data provides valuable insights for forecasting future sales and planning business strategies. By analyzing historical sales trends and market conditions, businesses can make informed projections and develop effective marketing campaigns, production plans, and inventory management strategies.

- Business Growth: Tracking sales allows businesses to identify growth opportunities. By understanding which products or services are selling well and which are underperforming, companies can focus their efforts on high-demand areas and consider expanding their offerings or entering new markets.

- Customer Insights: Sales data provides valuable information about customer behavior and preferences. By analyzing sales patterns, businesses can identify their target audience, tailor marketing efforts, and improve customer satisfaction. This enables businesses to enhance customer relationships and build brand loyalty.

The importance of finding sales in accounting cannot be overstated. It is a fundamental aspect of financial management and business success. By effectively tracking and analyzing sales data, businesses can make informed decisions, improve profitability, and position themselves for long-term growth and sustainability.

Now that we understand the importance of finding sales, let’s explore various methods that can be utilized to track and find sales in accounting.

Methods for Finding Sales in Accounting

There are several methods that businesses can employ to effectively track and find sales in accounting. Here are five commonly used methods:

- Reviewing Sales Invoices: Sales invoices are important documents that detail the products or services sold, the quantity, the price, and the payment terms. Reviewing sales invoices allows businesses to track individual sales transactions and maintain a record of customer purchases. By organizing and categorizing sales invoices, businesses can easily calculate total sales revenue and identify any discrepancies or outstanding payments.

- Analyzing Accounting Software: Many businesses utilize accounting software to streamline their financial processes and record sales transactions. Accounting software provides features such as sales order management, invoicing, and inventory tracking. By analyzing the data within the accounting software, businesses can generate sales reports, monitor sales trends, and gain valuable insights into their sales performance.

- Examining Sales Reports: Sales reports consolidate sales data from various sources and provide a comprehensive overview of the company’s sales activity. These reports can include information on total sales revenue, sales by product or service, sales by customer segment, and sales by geographical region. By regularly examining sales reports, businesses can monitor their performance, identify growth opportunities, and make data-driven decisions.

- Reconciling Bank Statements: Reconciling bank statements is an important method for confirming sales and ensuring accuracy in accounting records. By comparing the sales entries in the accounting system with the deposits recorded in the bank statement, businesses can identify any discrepancies or missing transactions. This process helps reconcile the cash inflows from sales and ensures that all sales have been properly recorded.

- Consulting Sales Records: Maintaining organized and accessible sales records is crucial for finding and tracking sales in accounting. Sales records include information on customer details, sales dates, transaction amounts, and payment methods. By consulting these records, businesses can verify sales information, retrieve historical data, and analyze sales trends over time.

By utilizing these methods, businesses can effectively track and find sales in accounting. It is important to establish robust systems and processes to ensure the accuracy and completeness of sales data. Regularly reviewing and analyzing sales information enables businesses to make informed decisions, identify areas for improvement, and drive financial success.

In the next section, we will summarize the key points covered in this article and emphasize the importance of finding sales in accounting.

Reviewing Sales Invoices

Reviewing sales invoices is a fundamental method for finding and tracking sales in accounting. Sales invoices provide detailed information about individual transactions, including the products or services sold, quantities, prices, and payment terms. By carefully examining sales invoices, businesses can ensure accurate recording of sales and maintain a record of customer purchases.

Here are some key steps to effectively review sales invoices:

- Verify Accuracy: It is essential to verify the accuracy of sales invoices by cross-checking the details against the actual transactions. Ensure that the products or services listed on the invoice match what was actually sold, and the prices and quantities are correct. Any discrepancies or errors should be promptly addressed to maintain accurate sales records.

- Organize and Categorize: Proper organization and categorization of sales invoices simplify the process of tracking and analyzing sales. Create a systematic filing or digital storage system for sales invoices, making it easy to retrieve specific invoices when needed. Categorize sales invoices based on factors such as customer, product type, or time period to facilitate data analysis.

- Track Outstanding Payments: Sales invoices also provide information about payment terms and due dates. Regularly review sales invoices to identify any outstanding payments or late payments. Follow up with customers to ensure timely receipt of payment, as this directly impacts cash flow and financial stability.

- Identify Discrepancies: Reviewing sales invoices allows businesses to identify discrepancies and resolve them promptly. Discrepancies can include pricing errors, incorrect quantities or discounts, or missing information. By addressing these issues, businesses can ensure accurate sales reporting and prevent any potential financial or customer service issues.

- Analyze Sales Patterns: Sales invoices can provide valuable insights into sales patterns and trends. By analyzing the data within sales invoices, businesses can identify top-selling products or services, analyze customer preferences, and assess the effectiveness of pricing and promotions. This information enables businesses to optimize marketing strategies, inventory management, and overall business performance.

Reviewing sales invoices is a crucial component of tracking and finding sales in accounting. It helps ensure accuracy, maintain proper documentation, and gain valuable insights into sales performance. By implementing effective review processes, businesses can streamline their accounting practices and make informed decisions to drive success.

Next, we will explore another method for finding sales in accounting – analyzing accounting software.

Analyzing Accounting Software

Analyzing accounting software is an efficient and modern method for finding and tracking sales in accounting. Accounting software plays a crucial role in automating financial processes, including recording sales transactions, generating invoices, and tracking customer payments. By analyzing the data within accounting software, businesses can access comprehensive sales information and gain valuable insights into their sales performance.

Here are some key steps to effectively analyze accounting software for sales:

- Select a Suitable Accounting Software: Choose an accounting software that is well-suited for your business needs. Look for software that offers robust features for recording sales transactions, generating invoices, and generating sales reports. Consider factors such as affordability, scalability, and integration with other business systems.

- Set Up Sales Management Features: Configure the accounting software to capture relevant sales information. Set up features such as sales order management, inventory tracking, and customer relationship management (CRM) integration. This will enable you to track and manage the entire sales process, from order creation to fulfillment and invoicing.

- Generate Sales Reports: Accounting software allows businesses to generate various sales reports that provide insights into sales performance. Common sales reports include sales by product, sales by customer, sales by region, and sales by time period. Generate these reports regularly to monitor sales trends, identify top-selling products or services, and assess the effectiveness of sales strategies.

- Analyze Sales Metrics: Leverage the analytics and reporting capabilities of accounting software to analyze key sales metrics. These metrics can include sales revenue, gross profit margin, average sales per customer, and customer acquisition costs. By analyzing these metrics, businesses can identify areas for improvement, optimize pricing strategies, and evaluate the profitability of sales transactions.

- Integrate with E-commerce Platforms: If your business operates an online store or utilizes e-commerce platforms, consider integrating your accounting software with these platforms. This integration allows for seamless synchronization of sales data between the e-commerce platform and accounting system. It ensures that all sales information is accurately captured, reducing the risk of manual data entry errors.

By analyzing accounting software, businesses can leverage the power of technology to streamline sales tracking and gain valuable insights into their sales performance. The availability of real-time data, automated processes, and advanced reporting capabilities enable businesses to make informed decisions, improve efficiency, and drive revenue growth.

With the rise of digital transformation, accounting software has become an indispensable tool for businesses of all sizes. In the next section, we will explore another method for finding sales in accounting – examining sales reports.

Examining Sales Reports

Examining sales reports is a vital method for finding and tracking sales in accounting. Sales reports provide a comprehensive overview of a business’s sales activity, consolidating data from various sources and presenting it in a concise format. By regularly examining sales reports, businesses can gain valuable insights into their sales performance, identify trends, and make data-driven decisions.

Here are some key steps to effectively examine sales reports:

- Generate Relevant Sales Reports: Determine the specific sales reports that are most relevant to your business needs. Common sales reports include sales by product, sales by customer, sales by region, and sales by time period. Generate these reports using your accounting software or reporting tools to obtain a clear picture of your sales performance.

- Analyze Key Metrics: Analyze key sales metrics presented in the sales reports. These metrics can include total sales revenue, average order value, sales growth rate, and sales conversion rate. By examining these metrics, you can assess the effectiveness of your sales strategies, identify opportunities for improvement, and make informed decisions to drive revenue growth.

- Identify Sales Patterns and Trends: Look for patterns and trends within your sales reports. Are certain products or services consistently top sellers? Are there seasonal fluctuations in sales? Identifying these patterns can help you allocate resources effectively, plan inventory management, and tailor your marketing strategies to capitalize on high-demand periods.

- Compare Sales Performance Over Time: Compare your sales performance across different time periods. This allows you to identify growth or decline in sales and evaluate the success of your sales strategies. By analyzing the changes in sales revenue, you can make adjustments to your marketing campaigns, pricing strategies, or product offerings to drive continued growth.

- Segment Customers for Targeted Marketing: Utilize the customer data within sales reports to segment your customer base. By segmenting customers based on factors such as purchase history, demographics, or buying preferences, you can design targeted marketing campaigns that resonate with specific customer groups. This can lead to increased customer satisfaction, loyalty, and ultimately, higher sales.

Examining sales reports provides valuable insights into your sales performance, enabling data-driven decision-making and strategic planning. Regularly reviewing these reports allows you to stay informed about the health of your sales operations, identify strengths and weaknesses, and take proactive steps to improve overall sales effectiveness.

In the next section, we will explore another method for finding sales in accounting – reconciling bank statements.

Reconciling Bank Statements

Reconciling bank statements is a crucial method for finding and tracking sales in accounting. Bank reconciliation involves comparing the sales entries in your accounting system with the deposits recorded in your bank statement. This process helps identify any discrepancies or missing transactions, ensuring the accuracy of sales records and financial statements.

Here are the key steps to effectively reconcile bank statements for sales:

- Obtain Bank Statements: Obtain the bank statements for the period under review. This could be monthly, quarterly, or annually, depending on your reconciliation schedule. Bank statements provide a detailed record of all incoming customer payments, including credit card payments, electronic transfers, and checks deposited.

- Compare Sales Entries: Compare the sales entries recorded in your accounting system with the deposits reflected in the bank statement. Ensure that the sales amounts and dates match, and there are no discrepancies or missing transactions. Any differences should be investigated and corrected to ensure the accuracy of your sales records.

- Identify Outstanding Deposits: If there are any outstanding customer payments that are not yet reflected in the bank statement, make note of them. These outstanding deposits could be checks that are in transit or electronic transfers that are still pending processing. Keep track of these outstanding deposits and ensure they are included in the subsequent bank statement reconciliation.

- Address Discrepancies: If you encounter any discrepancies between your sales entries and the bank statement, investigate the causes and rectify them promptly. Common discrepancies can include recording errors, bank processing delays, or fraudulent activities. Addressing these discrepancies ensures the accuracy of your financial records and prevents potential financial risks.

- Reconcile Cash Inflows: Reconciling bank statements helps reconcile the cash inflows from sales transactions. It ensures that all customer payments have been accurately recorded and that your sales revenue reflects the actual cash received. This process not only verifies the completeness of your sales records but also aids in identifying any potential cash flow issues.

Reconciling bank statements for sales is an essential practice for maintaining accurate financial records. It helps ensure that sales revenue is properly recorded, deposits are accurately reflected, and discrepancies are promptly addressed. By reconciling bank statements, businesses can maintain financial integrity, improve cash flow management, and make informed decisions based on reliable sales data.

In the final section, we will explore another method for finding sales in accounting – consulting sales records.

Consulting Sales Records

Consulting sales records is a valuable method for finding and tracking sales in accounting. Sales records provide a historical record of customer purchases, sales transactions, and payment details. By consulting these records, businesses can ensure accuracy in sales reporting, retrieve historical data, and gain insights into sales patterns and trends.

Here are the key steps to effectively consult sales records:

- Organize Sales Records: Organize your sales records in a systematic manner to facilitate easy retrieval and analysis. Whether you maintain physical records or use digital storage systems, establish a method to categorize and store sales records by customer, product, date, or any other relevant criteria. This organization ensures efficient access to sales data when needed.

- Retrieve Historical Data: Consulting sales records allows you to retrieve historical sales data. This information is valuable for trend analysis, forecasting, and making informed decisions. By analyzing past sales patterns, you can identify seasonal fluctuations, understand customer buying behaviors, and anticipate future sales trends.

- Track Customer Purchases: Sales records provide a comprehensive view of customer purchases. By tracking customer purchases and analyzing buying patterns, businesses can identify loyal customers, understand their preferences, and personalize marketing efforts. This customer-centric approach can lead to stronger customer relationships, increased customer satisfaction, and higher sales.

- Identify Sales Opportunities: Consulting sales records helps identify sales opportunities that may have been overlooked. By analyzing past sales transactions, you can identify products or services that have consistently performed well and explore ways to promote them further. Additionally, sales records may reveal cross-selling or upselling opportunities that can boost sales revenue.

- Analyze Payment Trends: Sales records provide insights into payment trends and methods used by customers. By tracking payment details, such as cash, credit cards, or electronic transfers, businesses can evaluate the effectiveness of their payment processes and identify any changes in customer payment preferences. This analysis can help optimize payment methods to streamline transactions and improve customer satisfaction.

Consulting sales records is a valuable practice that allows businesses to retrieve historical sales data, gain insights into customer behavior, and identify sales opportunities. By maintaining organized sales records and leveraging them for analysis and decision-making, businesses can optimize their sales strategies, improve customer relationships, and drive revenue growth.

With the completion of this section, we have explored various methods for finding sales in accounting. In the next section, we will conclude the article by summarizing the key points covered and emphasizing the importance of finding sales in accounting.

Conclusion

Finding and tracking sales in accounting is crucial for businesses of all sizes and industries. It allows for accurate financial reporting, informed decision-making, and strategic planning. By utilizing various methods such as reviewing sales invoices, analyzing accounting software, examining sales reports, reconciling bank statements, and consulting sales records, businesses can effectively track and analyze sales data to drive revenue growth and ensure financial stability.

Understanding sales in accounting involves recognizing revenue, valuing sales accurately, and considering associated costs. Sales are recorded through invoices and accounting software, providing a comprehensive record of customer purchases and transaction details. Sales reports consolidate sales data and provide insights into performance metrics, patterns, and trends. Reconciling bank statements ensures the accuracy of sales records and verifies the cash inflows from sales transactions. Consulting sales records provides historical data, tracks customer purchases, and identifies sales opportunities.

The importance of finding sales in accounting cannot be overstated. It allows businesses to assess revenue, analyze profitability, comply with tax regulations, forecast and plan for growth, and gain valuable customer insights. Accurate sales tracking is vital for financial reporting, identifying growth opportunities, and making data-driven decisions that contribute to the success of a business.

By implementing robust systems, leveraging technology, and maintaining organized sales records, businesses can optimize their sales tracking efforts. Regular review and analysis of sales data empower businesses to adapt to market conditions, refine sales strategies, improve customer satisfaction, and stay ahead of the competition.

In conclusion, finding sales in accounting is not merely a task of record-keeping, but a vital practice that contributes to the overall financial health and success of a business. By utilizing effective methods for finding and tracking sales, businesses can unlock their full potential, make informed decisions, and achieve long-term growth and profitability.