Home>Finance>Where To Find Net Credit Sales On Financial Statements

Finance

Where To Find Net Credit Sales On Financial Statements

Modified: February 21, 2024

Looking for net credit sales on financial statements? Find out where to locate this important financial metric in the realm of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Net credit sales is a key financial metric used by businesses to track their revenue from credit sales transactions. It plays a crucial role in understanding the financial health and performance of a company. In this article, we will delve into the concept of net credit sales, discuss its significance in financial statements, and explore how it can be analyzed to gain valuable insights into a company’s operations.

Net credit sales can be defined as the total value of goods or services sold by a company on credit, after deducting any sales returns, allowances, and discounts given to customers. It represents the amount of revenue generated by a business through credit sales, which is an integral component of a company’s overall sales revenue.

Understanding net credit sales is essential for both external stakeholders, such as investors and creditors, as well as internal stakeholders, including management and shareholders. It provides insights into the company’s ability to generate sales volume and evaluate the effectiveness of its credit policies.

Net credit sales is disclosed in the income statement, which is a financial statement that presents the company’s revenues, expenses, and net income or net loss during a specific period. It also influences other financial statements, such as the balance sheet and statement of cash flows, as it impacts the company’s assets, liabilities, and cash flows.

In the following sections, we will explore where net credit sales can be found on financial statements, why it is important, and how it can be analyzed to assess a company’s financial performance. By understanding the significance of net credit sales, investors and other stakeholders can make informed decisions and gain a better understanding of a company’s sales and credit management practices.

Understanding Net Credit Sales

Net credit sales is a financial metric that represents the total value of goods or services sold by a company on credit, after deducting any sales returns, allowances, and discounts given to customers. It is an important indicator of a company’s ability to generate revenue through credit sales transactions.

Credit sales occur when a business allows its customers to purchase goods or services on credit, meaning they do not have to make an immediate payment. Instead, the customer is given a certain period of time, usually 30 days or more, to settle the payment. This allows customers to have more flexibility in managing their cash flow.

However, while credit sales can be beneficial in attracting customers and driving sales, they also come with certain risks. There is always a possibility that customers may default on their payments, leading to bad debts and potential financial losses for the company. Therefore, it is crucial for businesses to carefully evaluate the creditworthiness of their customers and establish appropriate credit policies and controls.

Net credit sales is calculated by subtracting sales returns, allowances, and discounts from the total credit sales. Sales returns refer to the merchandise that is returned by customers due to various reasons, such as defects in the product or dissatisfaction with the purchase. Sales allowances are reductions in the selling price granted to customers as a form of compensation for minor defects or issues with the product. Discounts, on the other hand, are price reductions offered to encourage early payment or to incentivize customers to purchase in larger quantities.

By deducting these factors from the total credit sales, businesses arrive at the net credit sales figure. This represents the actual revenue generated from credit sales, taking into account any adjustments for returns, allowances, and discounts. It reflects the cash inflow that the company can expect to receive from its credit sales transactions.

Understanding net credit sales is important for businesses to evaluate their sales performance and assess the effectiveness of their credit policies. By monitoring changes in net credit sales over time, companies can identify trends and patterns that can help them optimize their credit and sales strategies. Additionally, it provides valuable insights into the company’s ability to collect receivables and manage its cash flow efficiently.

Next, we will explore where net credit sales can be found on financial statements and how it influences other aspects of a company’s financial reporting.

Income Statement

The income statement, also known as the statement of earnings or profit and loss statement, is a financial statement that summarizes a company’s revenues, expenses, and net income or net loss during a specific period. It provides a snapshot of the company’s financial performance and helps stakeholders assess its profitability.

Net credit sales is a crucial component of the income statement, as it represents the revenue generated from credit sales transactions. It is typically listed as a separate line item under the revenue section of the income statement.

The income statement follows a specific structure, starting with the company’s revenue, followed by the cost of goods sold (COGS) or cost of services provided, operating expenses, and finally, the net income or net loss. The net credit sales figure is subtracted from the COGS and other operating expenses to calculate the gross profit and operating profit.

The gross profit is obtained by subtracting the COGS from the net credit sales. It represents the profit derived from the company’s core operations and provides insights into its ability to generate revenue efficiently. Operating expenses, such as salaries, rent, utilities, and marketing expenses, are then deducted from the gross profit to arrive at the operating profit.

Net credit sales is a key measure of a company’s revenue-generating capability, and changes in this figure can provide valuable insights into sales trends, customer behavior, and the effectiveness of the company’s credit policies. It is important to note that net credit sales does not include cash sales or other non-credit transactions.

The income statement helps stakeholders evaluate the profitability and overall financial performance of a company. By analyzing the trends and patterns of net credit sales over a specific period, investors, creditors, and management can assess the company’s sales growth, pricing strategies, and credit management practices. It also helps in benchmarking the company’s performance against industry peers and identifying areas of improvement.

Understanding the income statement and the significance of net credit sales is crucial for investors and stakeholders to make informed decisions. By analyzing the income statement, stakeholders can gain insights into a company’s revenue generation, profitability, and financial stability.

Next, let’s explore how net credit sales impacts the balance sheet, another important financial statement.

Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It presents a summary of the company’s assets, liabilities, and shareholders’ equity. Net credit sales does not appear directly on the balance sheet, but it does have an impact on certain components of this statement.

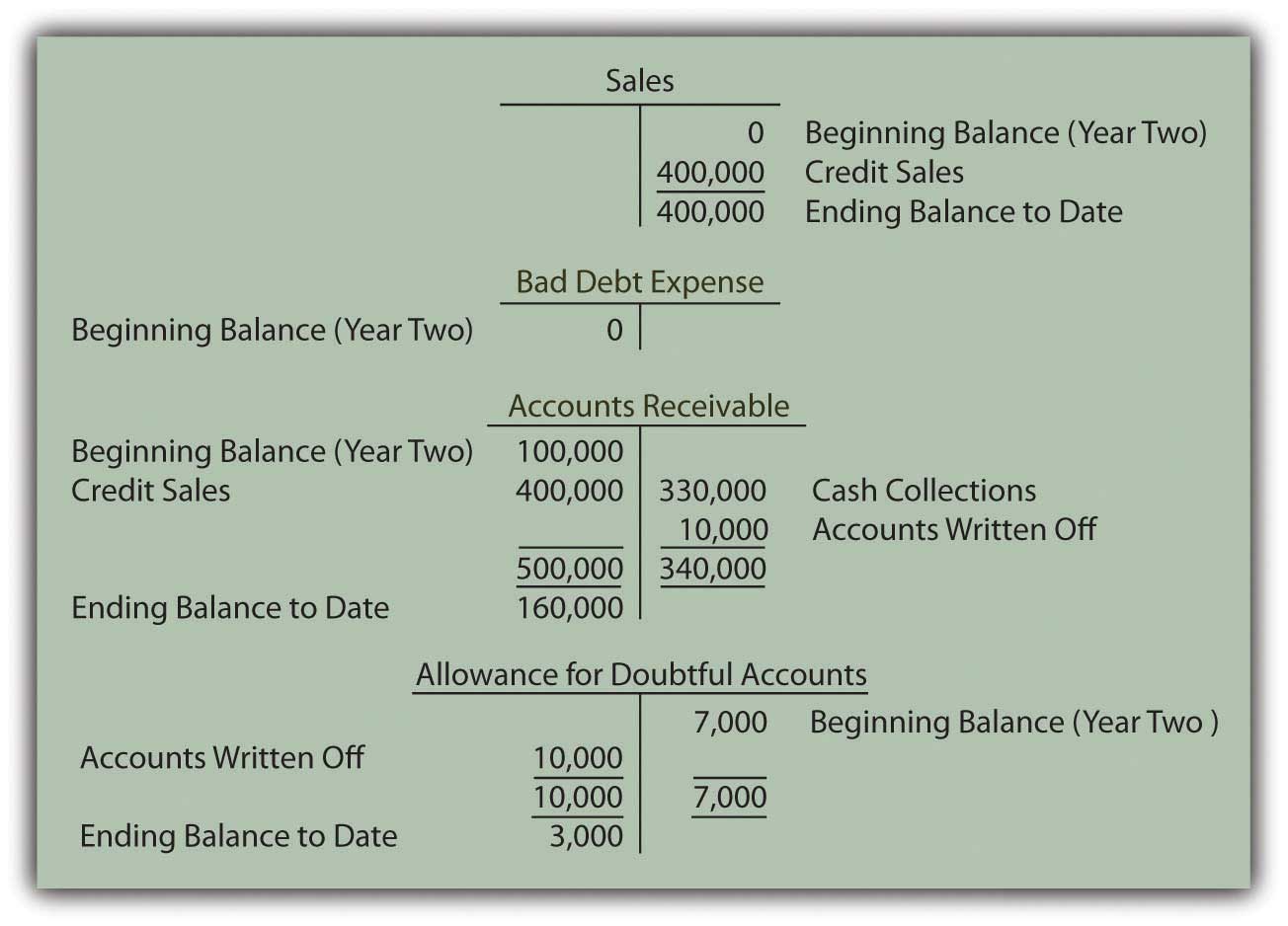

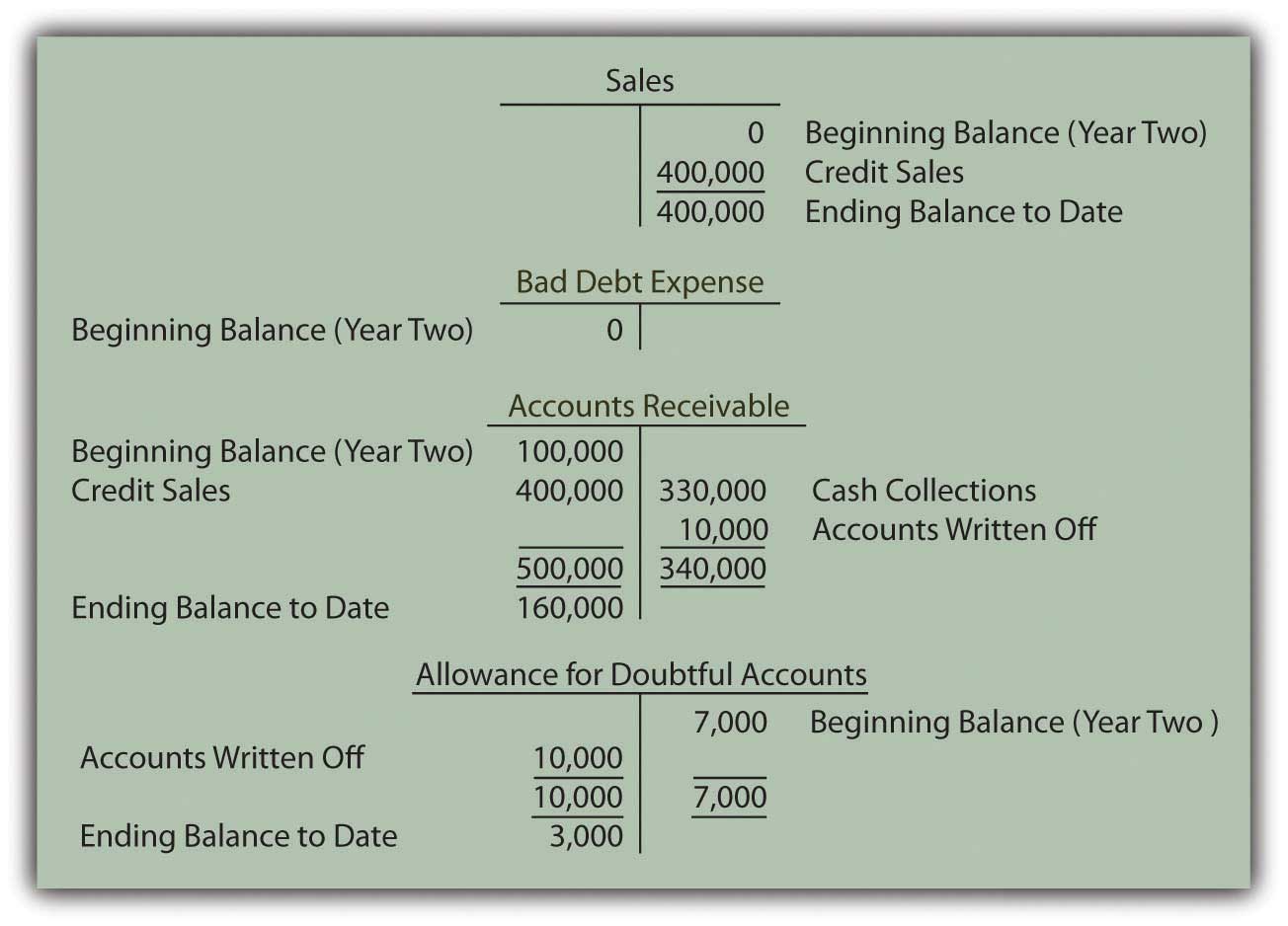

Net credit sales influence the accounts receivable balance, which is listed as a current asset on the balance sheet. Accounts receivable represents the amount owed to the company by its customers for credit sales. An increase in net credit sales will result in a higher accounts receivable balance, as more customers will owe money to the company for their purchases.

On the other hand, if net credit sales decrease, it might indicate a decline in sales or a shift in the company’s sales mix towards cash transactions. This, in turn, can lead to a decrease in the accounts receivable balance on the balance sheet.

Accounts receivable is an important asset for a company, but it also carries some risks. There is always a chance that customers may default on their payments, resulting in uncollectible accounts receivable, also known as bad debt. To minimize this risk, companies often maintain an allowance for doubtful accounts, which is a contra-asset account that reduces the overall value of accounts receivable to reflect the estimated amount that might not be collected.

The allowance for doubtful accounts is calculated based on historical data, industry standards, and the company’s evaluation of its customers’ creditworthiness. The net credit sales figure is a key input in determining the appropriate allowance for doubtful accounts. If sales are expected to result in a higher level of defaults, the company may need to increase its allowance to account for potential bad debts.

The balance sheet also reflects the impact of net credit sales on shareholders’ equity. The net income or net loss resulting from the income statement, which includes net credit sales, is carried over to the balance sheet as part of retained earnings. Retained earnings represent the accumulated profits or losses of the company since its inception, minus any dividends paid to shareholders.

If a company consistently generates positive net credit sales, it contributes to an increase in net income and, subsequently, an increase in retained earnings on the balance sheet. This indicates a profitable operation and enhances the financial health of the company.

Understanding the relationship between net credit sales and the balance sheet helps stakeholders assess the company’s liquidity, creditworthiness, and overall financial stability. By analyzing the accounts receivable turnover ratio, which compares net credit sales to the average accounts receivable balance, stakeholders can gain insights into the efficiency of the company’s credit and collection processes.

Next, we will explore how net credit sales impact the statement of cash flows, providing information about the company’s cash inflows and outflows.

Statement of Cash Flows

The statement of cash flows is a financial statement that provides information about the cash inflows and outflows of a company during a specific period. It helps stakeholders understand how a company generates and uses its cash resources, which is important for assessing its liquidity and ability to meet financial obligations.

While net credit sales is not directly reported on the statement of cash flows, it does have an impact on the cash flow from operations section, which is a significant component of this statement.

The cash flow from operations section starts with the net income from the income statement and makes adjustments for any non-cash items included in the net income. These adjustments include depreciation and amortization expenses, changes in working capital, and other non-cash expenses or gains.

Changes in net credit sales can affect the operating cash flow by influencing the accounts receivable balance. An increase in net credit sales will lead to an increase in accounts receivable, which represents cash that is yet to be collected. As a result, the change in accounts receivable will be subtracted from the net income in the cash flow from operations section, as it indicates a use of cash.

Conversely, if net credit sales decrease, the accounts receivable balance will decrease as well, resulting in a positive adjustment to the net income for the change in accounts receivable. This indicates a source of cash and contributes to the cash flow from operations.

Monitoring the cash flow from operations is crucial for assessing a company’s ability to generate cash from its core operations. Positive cash flow from operations indicates that the company is efficiently converting its sales into cash and has the potential to meet its financial obligations. Conversely, negative cash flow from operations may suggest that the company is facing difficulties in collecting its receivables, managing its inventory, or controlling its expenses.

In addition to the cash flow from operations, the statement of cash flows also includes the cash flow from investing activities and financing activities. These sections provide insights into the company’s capital expenditure, investment decisions, and financing activities such as issuing or repurchasing equity and debt.

Understanding the relationship between net credit sales and the statement of cash flows helps stakeholders assess a company’s cash flow generation, liquidity, and financial stability. By analyzing the cash flow from operations and monitoring changes in accounts receivable, investors, creditors, and management can gain valuable insights into the company’s ability to manage its cash flow and meet its financial obligations.

Next, we will discuss the importance of net credit sales in financial analysis and decision-making.

Importance of Net Credit Sales

Net credit sales play a significant role in financial analysis and decision-making for businesses. It provides valuable insights into a company’s revenue generation, credit management practices, and overall financial performance. Here are some key reasons why net credit sales are important:

Revenue Generation: Net credit sales represent a substantial portion of a company’s total revenue. By tracking and analyzing net credit sales, businesses can assess their sales growth, identify customer trends, and evaluate the effectiveness of their sales and marketing strategies. It helps companies understand how well they are performing in terms of generating revenue through credit sales.

Credit Management: Monitoring net credit sales is crucial for evaluating a company’s credit management practices. It helps assess the company’s ability to assess customer creditworthiness, establish appropriate credit terms, and ensure timely payments from customers. By analyzing net credit sales and accounts receivable, businesses can identify potential bad debts, adjust their allowance for doubtful accounts, and maintain a healthy cash flow.

Liquidity and Cash Flow: Changes in net credit sales directly impact a company’s liquidity and cash flow. An increase in net credit sales leads to higher accounts receivable, which represents cash that is yet to be collected. Managing accounts receivable effectively is crucial for generating sufficient cash flow to meet operational expenses and financial obligations. Monitoring net credit sales helps companies evaluate their ability to convert credit sales into cash and maintain a healthy cash flow position.

Financial Performance: Net credit sales significantly influence a company’s income statement, balance sheet, and statement of cash flows, which are key financial statements used to assess a company’s financial performance. By analyzing net credit sales along with other financial metrics, stakeholders can gain insights into the company’s profitability, efficiency, and overall financial health. It helps investors, creditors, and management in making informed decisions and evaluating the company’s growth potential.

Business Planning: Understanding net credit sales is essential for effective business planning and forecasting. It helps companies anticipate sales volumes, plan inventory levels, manage production capacity, and make informed decisions regarding credit policies, pricing strategies, and sales promotions. Net credit sales data, when combined with market trends and customer behavior analysis, provides critical inputs for strategic business planning and decision-making processes.

Competitive Analysis: Net credit sales data can also be used for benchmarking and competitive analysis. By comparing net credit sales figures with industry peers or competitors, businesses can assess their market share, identify areas of improvement, and analyze their competitive position. It helps identify market trends, customer preferences, and potential growth opportunities for the company.

Overall, net credit sales provide essential information for evaluating a company’s revenue generation, credit management, and financial performance. By analyzing this metric and its impact on financial statements, stakeholders can make more informed decisions, mitigate risks, and drive business growth.

In the next section, we will discuss how net credit sales can be analyzed to gain valuable insights into a company’s financial performance and credit management.

Analyzing Net Credit Sales

Analyzing net credit sales can provide valuable insights into a company’s financial performance, credit management practices, and overall business operations. It allows stakeholders to assess sales trends, customer behavior, and the effectiveness of credit policies. Here are some key factors to consider when analyzing net credit sales:

Trend Analysis: Analyzing the trend of net credit sales over time helps stakeholders understand the company’s sales growth patterns. A consistent upward trend in net credit sales indicates a healthy revenue generation, while a decline or fluctuation may suggest challenges or changes in market conditions. Identifying trends allows businesses to make strategic decisions to boost sales and adjust credit management practices accordingly.

Comparison to Industry Peers: Comparing a company’s net credit sales to its industry peers can provide insights into its market competitiveness. If a company’s net credit sales are significantly higher or lower than industry averages, it may indicate a unique selling proposition, strong customer relationships, or potential areas for improvement. Benchmarking net credit sales against competitors helps identify opportunities and challenges within the market.

Customer Segmentation: Analyzing net credit sales by customer segments helps businesses identify the most profitable customer groups or market segments. Understanding which customer segments contribute the most to net credit sales can help in targeting marketing efforts, refining credit policies, and improving customer retention strategies. It allows businesses to effectively allocate resources and tailor their sales and credit management strategies to specific customer segments.

Days Sales Outstanding (DSO): DSO measures the average number of days it takes for a company to collect payments from its customers after a sale is made. By dividing the accounts receivable balance by the average daily net credit sales, DSO provides insights into the efficiency of a company’s credit and collection processes. A high DSO may indicate difficulties in collecting payments and potential liquidity issues, while a low DSO suggests effective credit management and timely collection of receivables.

Credit Policy Assessment: Analyzing net credit sales allows businesses to evaluate the effectiveness of their credit policies. By monitoring the credit approval process, credit terms, credit limits, and collection efforts, companies can assess their ability to minimize bad debt risk while maximizing sales opportunities. Adjustments to credit policies can be made based on the analysis of net credit sales to strike a balance between revenue generation and credit risk mitigation.

Relationship with Accounts Receivable Turnover: The accounts receivable turnover ratio helps assess the efficiency of a company’s credit and collection processes. It is calculated by dividing net credit sales by the average accounts receivable balance. A higher turnover ratio indicates that the company efficiently collects payments from customers and converts credit sales into cash. By analyzing the relationship between net credit sales and the accounts receivable turnover ratio, businesses can gain insights into the effectiveness of their credit management practices.

Overall, analyzing net credit sales provides valuable information for assessing a company’s financial health, credit management performance, and sales trends. By considering factors such as trend analysis, industry comparisons, customer segmentation, DSO, credit policy assessment, and accounts receivable turnover, stakeholders can make informed decisions, identify areas for improvement, and drive business growth.

Next, we will conclude with a summary of the importance of net credit sales in financial statements and decision-making.

Conclusion

Net credit sales play a crucial role in financial statements and provide valuable insights into a company’s revenue generation, credit management practices, and overall financial performance. By understanding net credit sales and its impact on financial statements such as the income statement, balance sheet, and statement of cash flows, stakeholders can make informed decisions and assess the company’s financial health.

Net credit sales are an indicator of a company’s ability to generate revenue from credit sales transactions. Monitoring net credit sales allows businesses to assess their sales growth, evaluate credit management practices, and make informed decisions regarding credit policies and pricing strategies.

Analyzing net credit sales over time and comparing them to industry peers can help identify trends, market competitiveness, and potential areas for improvement. By segmenting customers, assessing credit policies, and analyzing accounts receivable turnover, businesses can optimize their credit management processes and enhance cash flow efficiency.

Understanding the relationship between net credit sales and financial statements provides valuable information for planning, forecasting, and decision-making. It helps stakeholders evaluate a company’s financial performance, assess liquidity and cash flow, and identify opportunities and risks within the market.

In conclusion, net credit sales are a vital metric to track and analyze for businesses. It provides insights into sales trends, credit management efficiency, and overall financial stability. By leveraging this information, stakeholders can make informed decisions to drive business growth, mitigate risks, and maintain a strong financial position.

Thank you for reading this article on where to find net credit sales on financial statements. We hope that it has provided you with a better understanding of the importance of net credit sales and how they contribute to financial analysis and decision-making.