Finance

How To Get A Business Loan From Navy Federal

Modified: December 30, 2023

Looking for financing options for your business? Discover how you can secure a business loan from Navy Federal and take your financial goals to the next level.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Securing a business loan is a crucial step for entrepreneurs looking to start or expand their ventures. However, the process can often be daunting and confusing, leaving many business owners uncertain about where to turn for financial assistance. This is where Navy Federal comes in. Navy Federal Credit Union, the largest credit union in the United States, offers a range of business loan options to help small businesses grow and thrive.

Founded in 1933 and initially serving members of the Navy, Marine Corps, and Coast Guard, Navy Federal has since expanded its membership to include all branches of the military, Department of Defense personnel, and their families. As a member-focused financial institution, Navy Federal understands the unique challenges faced by military members and their families, making it an ideal partner for individuals seeking a business loan.

With its strong commitment to service and competitive rates, Navy Federal provides a streamlined and efficient process for obtaining business loans. Whether you’re looking to start a new venture, fund a growth opportunity, or simply manage day-to-day operations, Navy Federal has a business loan solution to suit your needs.

In this article, we will explore the eligibility requirements, types of business loans offered, application process, loan approval process, loan terms and conditions, repayment options, and tips for a successful loan application with Navy Federal. By understanding the nuances of obtaining a business loan from Navy Federal, you can confidently navigate through the process and secure the necessary funds to propel your business forward.

Eligibility requirements

Before applying for a business loan with Navy Federal, it’s essential to familiarize yourself with the eligibility requirements. Meeting these requirements will improve the chances of your loan application being approved. Here are the key eligibility criteria to consider:

- Membership: Navy Federal Credit Union is a member-based organization. To be eligible for a business loan, you must first become a member. Membership is open to active duty military personnel, veterans, Department of Defense employees, and their families. To join, you will need to provide certain identification documents and meet the credit union’s membership criteria.

- Business ownership: To be eligible for a business loan, you must be the owner or co-owner of a qualifying business entity. This can include sole proprietorships, partnerships, corporations, or limited liability companies. Navy Federal typically provides loans to small businesses operating in various industries.

- Creditworthiness: Navy Federal will assess your creditworthiness to determine your eligibility for a loan. They will review your credit score, credit history, and overall financial health. A higher credit score and a positive credit history increase your chances of approval.

- Financial stability: Demonstrating financial stability is important in securing a business loan. Navy Federal will evaluate your business’s financial statements, including revenue, expenses, and cash flow. They may also consider collateral, such as property or equipment, that can be used to secure the loan.

- Ability to repay: Lastly, Navy Federal will evaluate your ability to repay the loan. They will consider your business’s projected income, existing debts, and any other financial obligations. Providing a well-thought-out business plan that showcases your revenue projections and repayment strategy will strengthen your loan application.

It’s important to note that meeting the eligibility requirements does not guarantee loan approval, as Navy Federal will also consider other factors such as the loan amount, term, and specific loan program you are applying for. Additionally, individual circumstances may vary, so it’s always advisable to consult with a Navy Federal loan officer to assess your specific situation and increase your chances of approval.

Types of business loans offered by Navy Federal

Navy Federal Credit Union understands that different businesses have different financing needs. To cater to a wide range of business owners, Navy Federal offers various types of business loans. Here are some of the key loan options available:

- Term Loans: Navy Federal’s term loans are a popular choice for small business owners who need a lump sum upfront and prefer fixed monthly payments. These loans come with flexible repayment terms and competitive interest rates.

- Business Lines of Credit: A business line of credit is a flexible financing option that allows you to access funds as needed. With a Navy Federal business line of credit, you have the flexibility to borrow and repay funds multiple times, as long as you stay within your approved credit limit. This is especially useful for managing cash flow fluctuations or unexpected expenses.

- Equipment Loans: If your business requires specific equipment or machinery, Navy Federal’s equipment loans can help you finance these purchases. These loans provide funds to acquire, upgrade, or replace equipment necessary for your business operations.

- Commercial Real Estate Loans: For businesses looking to purchase or refinance commercial properties, Navy Federal offers commercial real estate loans. Whether you need office space, retail space, or a warehouse, these loans can provide the necessary funding to acquire or refinance your desired property.

- Business Credit Cards: Navy Federal offers business credit cards that provide a convenient and accessible source of funds for day-to-day business expenses. These cards often come with rewards programs and benefits tailored to the needs of business owners.

Each loan option has its own unique features and benefits. Navy Federal Credit Union aims to provide business owners with the flexibility and financial support they need to achieve their goals. It’s important to carefully consider the specific requirements and terms of each loan type to determine the best fit for your business.

Additionally, Navy Federal’s team of dedicated loan officers can provide personalized guidance and assist you in selecting the most appropriate loan option based on your business’s needs and financial situation.

Application process

Applying for a business loan with Navy Federal is a straightforward process that can be completed online or in person. To ensure a smooth and efficient application, follow these steps:

- Prepare necessary documentation: Before starting the application, gather all the required documentation. This may include your business plan, financial statements, tax returns, bank statements, and other supporting documents. Having these ready will expedite the application process.

- Visit the Navy Federal website or branch: Navy Federal offers the convenience of applying for a business loan online through their website. Alternatively, if you prefer a face-to-face interaction, you can visit a Navy Federal branch to begin the application process.

- Complete the application form: Whether applying online or in person, you will need to fill out a loan application form. This form will require personal and business information, including your name, contact details, business structure, and financial information.

- Submit the application: After completing the form, review it for accuracy and submit it along with the required documentation. If you are applying online, you can upload the documents directly through the Navy Federal website. If applying in person, provide the documents to the loan officer.

- Wait for loan processing: Once your application is submitted, Navy Federal will review the information provided, verify your eligibility, and assess your creditworthiness. This process may take some time, so be patient while they evaluate your application.

- Receive loan decision: After completing the review process, Navy Federal will inform you of their loan decision. If approved, you will receive a loan offer detailing the loan amount, interest rate, and other terms and conditions. If your application is declined, they will provide you with the reasons for the decision.

- Accept the loan offer: If you are satisfied with the loan offer and wish to proceed, carefully review the terms and conditions. If everything is in order, accept the offer by signing the loan agreement.

- Receive and use the funds: Once you have accepted the loan offer and signed the agreement, Navy Federal will disburse the funds to your designated account. You can then use the funds as planned for your business expenses.

Throughout the application process, Navy Federal’s loan officers are available to answer any questions and provide guidance. They can help you navigate through the paperwork, ensure that you meet all the requirements, and keep you informed of the status of your application.

By following the application process diligently and providing accurate and complete information, you increase your chances of a successful loan application with Navy Federal.

Required documentation

When applying for a business loan with Navy Federal, you will need to provide certain documentation to support your loan application. Having these documents ready in advance will help streamline the application process. While specific requirements may vary depending on the loan program and your individual circumstances, here is a general list of the documentation typically required:

- Business plan: A comprehensive business plan that outlines your company’s mission, goals, target market, competition, and financial projections is essential. This document provides a roadmap for your business and helps demonstrate your understanding of the industry and your capacity to repay the loan.

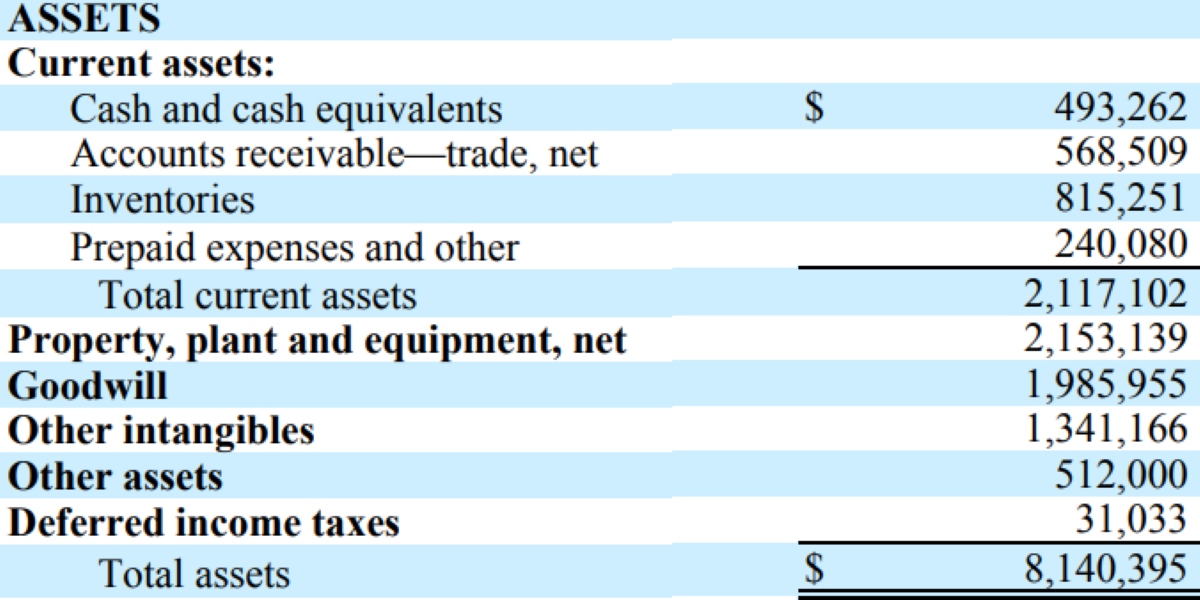

- Financial statements: Navy Federal will require financial statements, including your business’s income statement, balance sheet, and cash flow statement. These statements provide insight into your business’s financial health and stability.

- Tax returns: You will likely need to provide personal and business tax returns for the past two to three years. These returns help verify your income, assess your tax history, and evaluate your overall financial situation.

- Bank statements: Navy Federal may request your personal and business bank statements for the past several months. These statements provide a snapshot of your cash flow, account balances, and financial transactions.

- Legal documents: Depending on the structure of your business, you may need to provide legal documents such as articles of incorporation, partnership agreements, or operating agreements. These documents validate your business’s legal existence and ownership.

- Personal identification: Navy Federal will require personal identification documents for all individuals associated with the loan. This includes driver’s licenses, passports, or other government-issued ID cards.

- Business licenses and permits: In some cases, you may need to provide copies of any necessary business licenses or permits required for your industry or location. These documents demonstrate your compliance with legal and regulatory requirements.

- Collateral documentation: If you plan to use collateral to secure your loan, you will need to provide supporting documentation. This may include property deeds, vehicle titles, or equipment appraisals.

It’s important to note that the specific documents required may vary depending on factors such as the loan type, loan amount, and your business’s unique circumstances. Consult with a Navy Federal loan officer or review the loan application checklist provided by Navy Federal to ensure you have all the necessary documentation for a smooth application process.

Remember to provide clear and legible copies of all documents and keep the originals for your own records. Accurate and complete documentation will help expedite the loan approval process and increase your chances of securing the desired loan amount with Navy Federal.

Loan approval process

Once you have submitted your business loan application to Navy Federal Credit Union, it will go through a comprehensive approval process. Understanding the loan approval process can help you anticipate the timeline and requirements. While specific processes may vary depending on the loan program and individual circumstances, here is an overview of the general loan approval process at Navy Federal:

- Application review: After submitting your application, Navy Federal’s loan officers will review it to ensure that all required information and documentation are complete. They will verify your eligibility based on the loan program and your financial standing.

- Credit check: As part of the approval process, Navy Federal will conduct a credit check to assess your creditworthiness. This involves reviewing your credit score, credit history, and other factors that indicate your ability to repay the loan.

- Financial analysis: Navy Federal will analyze your business’s financial statements, tax returns, and other documentation to evaluate your financial stability. They will assess your cash flow, assets, liabilities, and any existing debts to determine your capacity to repay the loan.

- Collateral evaluation: If you have offered collateral to secure the loan, Navy Federal will assess its value and marketability. This evaluation helps determine the loan-to-value ratio and mitigates risk for both parties.

- Loan committee review: In certain cases, your loan application may be reviewed by a loan committee or underwriting team. This step is more common for larger loan amounts or complex financial situations. The committee will assess your application and supporting documentation to make a final approval decision.

- Loan decision: Once your loan application has undergone all necessary reviews and evaluations, Navy Federal will make a decision regarding your loan. They will inform you whether your application has been approved, declined, or if additional information is needed.

- Loan offer: If your loan application is approved, Navy Federal will provide you with a loan offer outlining the loan amount, interest rate, repayment terms, and any specific conditions. Review this offer carefully to ensure that you understand the terms and conditions.

- Acceptance and funding: If you are satisfied with the loan offer, accept it by signing the necessary documents. Once you have accepted the offer, Navy Federal will disburse the funds to your designated account or help facilitate the necessary steps for the loan to be utilized as intended.

The loan approval process may take time, varying from a few days to a few weeks, depending on the complexity of your application and the loan program. It’s important to respond promptly to any additional requests for information or documentation from Navy Federal to expedite the process.

During the loan approval process, maintain open communication with Navy Federal’s loan officers and address any questions or concerns they may have. This will help ensure a smooth and efficient approval process, increasing your chances of obtaining the business loan you need for your venture.

Loan terms and conditions

When you secure a business loan from Navy Federal Credit Union, it’s important to understand the specific terms and conditions associated with the loan. These terms will outline the repayment schedule, interest rate, fees, and other crucial details. Here are key points to consider regarding loan terms and conditions:

- Loan amount and duration: The loan agreement will specify the approved loan amount, which is the total sum you will receive from Navy Federal. It will also outline the duration of the loan, typically expressed in months or years.

- Interest rate: The interest rate is the additional amount you will pay on top of the loan amount. It is expressed as an annual percentage rate (APR). The interest rate may be fixed, meaning it remains constant throughout the loan term, or variable, meaning it can fluctuate based on market conditions.

- Repayment schedule: The loan terms will define the repayment schedule, including the frequency of payments and the number of payments required. Payments can be made monthly, quarterly, or according to another agreed-upon schedule.

- Fees and charges: The loan agreement will disclose any fees or charges associated with the loan. This may include origination fees, processing fees, or early repayment penalties. It’s important to understand these fees and factor them into your repayment plan.

- Collateral and guarantees: If your loan is secured by collateral, such as property or equipment, the terms and conditions will outline the details and requirements of the collateral. It may specify the type of collateral and the recourse available to Navy Federal in case of default.

- Prepayment options: The loan terms will specify if there are any prepayment options available. Some loans allow borrowers to make additional payments or pay off the loan balance before the scheduled term ends. Understanding prepayment options can help you save on interest charges.

- Default and late payment consequences: The terms and conditions will outline the consequences of defaulting on the loan or making late payments. This may include additional fees, higher interest rates, or potential legal action.

- Insurance requirements: In certain cases, Navy Federal may require borrowers to obtain insurance for the loan. This can include property insurance, liability insurance, or other coverage to protect both parties in case of unforeseen events.

It’s crucial to thoroughly review and understand the loan terms and conditions before accepting the loan offer. If you have any questions or concerns, do not hesitate to reach out to Navy Federal’s loan officers for clarification. It’s also advisable to consult with a legal or financial advisor to ensure you fully comprehend the implications of the loan terms specific to your business.

By understanding the loan terms and conditions, you can make informed decisions, plan your finances effectively, and ensure a successful repayment journey with Navy Federal.

Repayment options

When you obtain a business loan from Navy Federal Credit Union, you will have various repayment options to consider. These options allow you to choose a repayment method that aligns with your business’s cash flow and financial goals. Here are some common repayment options provided by Navy Federal:

- Fixed monthly payments: This is the most common repayment option, where you make equal payment amounts each month for the duration of the loan term. Fixed monthly payments make budgeting and financial planning easier, as you know exactly how much to allocate towards your loan each month.

- Amortization schedule: An amortization schedule outlines the specific repayment plan for your loan. It breaks down each payment into principal and interest components, showing you how much of each payment goes towards reducing the loan balance and paying interest. This schedule can be valuable in understanding the progress of your loan repayment and how each payment contributes to debt reduction.

- Automatic payments: Navy Federal offers the convenience of setting up automatic payments for your loan. This ensures that your payments are made on time and helps you avoid any potential late fees. You can choose to have funds automatically deducted from your Navy Federal account or set up a recurring payment from an external account.

- Early repayment: If your business experiences unexpected cash inflows or you simply want to pay off your loan faster, Navy Federal generally allows for early repayment. Making extra payments towards your loan principal can help reduce the overall interest paid and shorten the loan term. However, it’s important to review your loan terms and confirm if there are any prepayment penalties or fees associated with early repayment.

- Extension or refinancing: In certain cases, you may find it necessary to extend the loan term or refinance your existing loan. Navy Federal may offer options to modify your loan, such as extending the repayment period or refinancing at a more favorable interest rate. This can help alleviate financial pressure or take advantage of better loan terms.

- Personal assistance: If you encounter financial hardship or have difficulty making loan payments, Navy Federal provides support and guidance. Their loan officers can assist you in exploring options such as loan modifications, deferment, or other alternatives to help you manage your loan obligations successfully.

It is crucial to understand the terms and conditions associated with each repayment option and choose the one that best suits your business’s financial situation and objectives. Before selecting a repayment option, assess your cash flow, consider any anticipated changes in your business’s finances, and determine the strategy that aligns with your long-term financial goals.

Communication is key throughout the loan repayment process. If you anticipate any issues or foresee a change in your financial circumstances, contact Navy Federal as soon as possible. They can work with you to find a solution and ensure the repayment process remains manageable for your business.

Tips for a successful loan application

When applying for a business loan with Navy Federal Credit Union, there are several tips that can increase your chances of a successful loan application. By following these guidelines and preparing thoroughly, you can improve the likelihood of securing the financing you need for your business. Here are some valuable tips to consider:

- Understand and meet the eligibility requirements: Familiarize yourself with the eligibility criteria for the loan program you are interested in. Ensure that you meet the necessary qualifications in terms of membership, business ownership, creditworthiness, and financial stability.

- Prepare a comprehensive business plan: Craft a well-thought-out business plan that clearly outlines your objectives, market analysis, financial projections, and repayment strategy. A well-prepared business plan demonstrates your commitment, professionalism, and understanding of your business’s financial aspects.

- Gather and organize required documentation: Collect all the necessary documentation, such as financial statements, tax returns, bank statements, and legal documents. Ensure that they are up-to-date, accurate, and well-organized. Providing complete and organized documentation will expedite the loan application process.

- Maintain good creditworthiness: Keep a close eye on your credit score and maintain a positive credit history. Make payments on time, manage your debts responsibly, and address any issues on your credit report. A strong credit profile enhances your chances of loan approval and can lead to more favorable loan terms.

- Present a strong financial position: Stay on top of your business’s financials by regularly reviewing your financial statements, maintaining healthy cash flow, and managing expenses effectively. Demonstrating financial stability and a solid business model increases your credibility as a borrower.

- Seek professional advice: Consider consulting with a financial advisor or accountant who specializes in small business finances. They can provide valuable insights and guidance, helping you navigate the loan application process and optimize your financial position.

- Communicate with Navy Federal: Establish open lines of communication with Navy Federal’s loan officers. Seek clarification on any concerns or questions you may have about the loan application. Their expertise and guidance can help ensure that you provide accurate information and meet all necessary requirements.

- Prepare for a loan interview: In some cases, Navy Federal may request an interview as part of the loan application process. Be well-prepared for the interview, anticipating questions about your business, financials, and loan purpose. Present yourself professionally and confidently to make a positive impression.

- Be patient and follow up: The loan approval process takes time, so be patient while Navy Federal reviews your application. If there are any delays or issues, follow up with them promptly. Staying proactive and engaged in the process shows your commitment and can help move your application forward.

Remember, successfully obtaining a business loan requires careful preparation, attention to detail, and a proactive approach. By implementing these tips and presenting yourself as a qualified and responsible borrower, you increase your chances of securing the necessary funding for your business’s growth and success.

Conclusion

Navy Federal Credit Union offers a range of business loan options to help entrepreneurs achieve their goals and propel their businesses forward. As the largest credit union in the United States, Navy Federal is committed to serving its members in the military and their families. Whether you need capital to start a new venture, fund expansion plans, or manage day-to-day operations, Navy Federal provides competitive rates, personalized service, and a streamlined application process.

In this article, we explored the eligibility requirements, types of business loans offered, application process, loan approval process, loan terms and conditions, repayment options, and tips for a successful loan application with Navy Federal. By understanding these key aspects, you can navigate the loan application process efficiently and increase your chances of securing the financing your business needs.

Remember to carefully review the loan terms and conditions, including the loan amount, interest rate, and repayment schedule, before accepting any loan offer. Be proactive in maintaining open communication with Navy Federal’s loan officers throughout the application process, and seek professional advice if needed.

By preparing thoroughly, maintaining a strong credit profile, and presenting a solid financial position, you can position yourself for a successful loan application. Following the tips provided, such as preparing a comprehensive business plan and organizing required documentation, will further enhance your chances of securing the desired loan amount with Navy Federal.

Take advantage of the expertise and support offered by Navy Federal throughout the loan process. Their team of dedicated professionals is committed to helping you achieve your business’s financial goals. With the right approach and a strong partnership with Navy Federal, you can secure the funding necessary to drive your business’s growth and success.