Home>Finance>Prepaid Expenses Appear Where On The Balance Sheet

Finance

Prepaid Expenses Appear Where On The Balance Sheet

Modified: February 21, 2024

Learn about prepaid expenses and how they are reported on the balance sheet in finance. Understand where to find them and their impact on financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

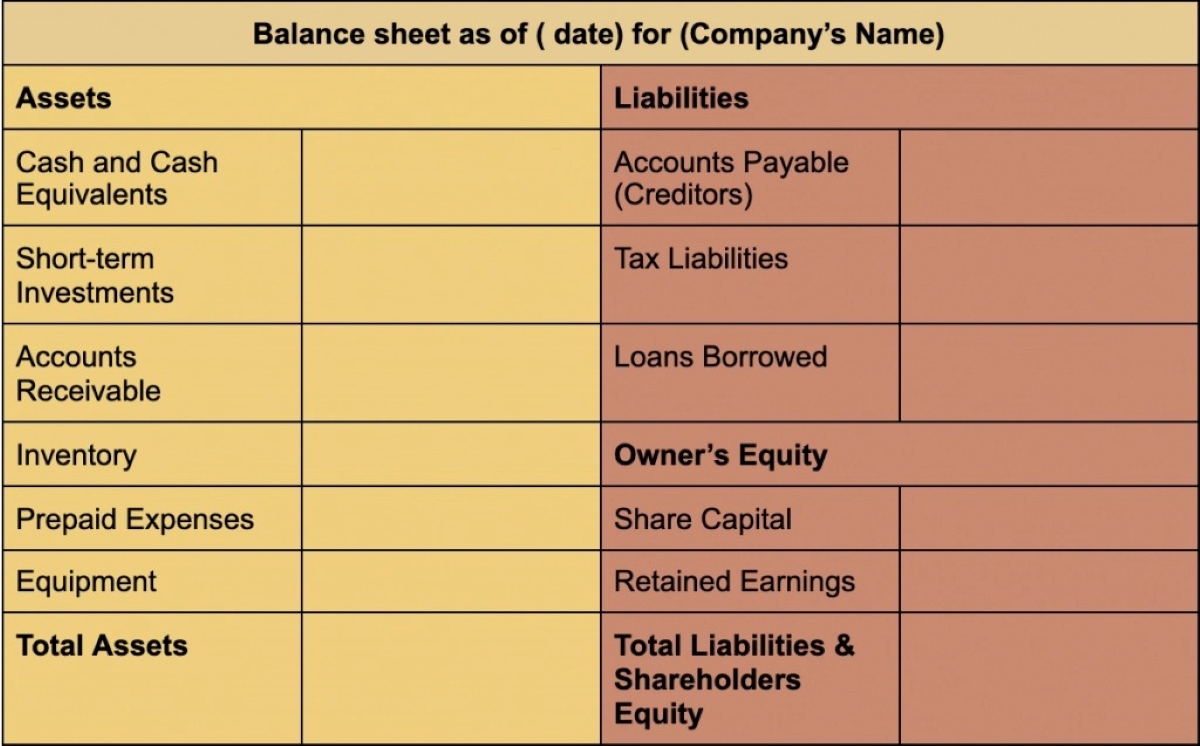

When analyzing a company’s financial statements, one of the critical sections to examine is the balance sheet. It provides a snapshot of a company’s financial position at a specific point in time, including its assets, liabilities, and equity. While most items on the balance sheet are familiar, there are certain items that might not be immediately recognizable, such as prepaid expenses.

In this article, we will explore the concept of prepaid expenses and where they appear on the balance sheet. We will discuss the reasons for having prepaid expenses, their classification, and how they are presented in financial statements. By understanding prepaid expenses, you will gain valuable insights into a company’s financial health and its ability to manage its cash flow efficiently.

Prepaid expenses, also known as prepaid assets or deferred expenses, are payments made by a company in advance for goods or services that will be received in the future. In other words, they represent expenses paid for but not yet used or consumed. Although prepaid expenses are commonly associated with personal finances, they play a significant role in business operations, especially for companies with subscription-based services or long-term contracts.

Businesses often choose to make prepaid expenses to secure better terms, discounts, or rates and to guarantee the availability of necessary items or services. For example, a company might prepay for a year’s worth of office rent to negotiate a lower monthly cost or pay in advance for a specific software subscription to benefit from a reduced annual fee.

On the balance sheet, prepaid expenses are classified as current assets if the benefit will be realized within one year. If the prepaid expense extends beyond one year, it will be classified as a long-term asset. This distinction is essential for financial analysis, as current assets are more liquid and can be easily converted into cash within the short term, while long-term assets provide value over an extended period.

Definition of Prepaid Expenses

Prepaid expenses refer to payments made in advance for goods or services that will be received or used in the future. These expenses are recognized as assets on the balance sheet until they are consumed or utilized. They represent the amount of money a company has paid for an expense that has not yet been incurred.

When a company pays for a prepaid expense, it essentially buys the right to use or receive something in the future. This could include expenses such as prepaid rent, prepaid insurance premiums, or even prepaid advertising or marketing fees.

For example, consider a company that pays $12,000 in rent upfront for the next 12 months. In this case, the $12,000 would be recorded as a prepaid expense on the balance sheet. Each month, as the company utilizes a portion of the prepaid rent, that amount would be recognized as an expense on the income statement, reducing the prepaid expense balance.

The main purpose of recognizing prepaid expenses as assets is to accurately reflect the company’s financial position. By listing prepayments as assets, the company acknowledges that it has already committed resources for future benefits.

It is crucial to differentiate prepaid expenses from regular expenses. Regular expenses are costs that are incurred and recognized in the same accounting period in which they are generated. In contrast, prepaid expenses are expenses that are paid upfront but will be recognized in future accounting periods once the benefit is achieved.

Prepaid expenses are often associated with certain industries or types of businesses. For instance, companies in the real estate industry commonly have prepaid rent expenses, while insurance companies may have prepaid premium expenses.

Understanding the concept of prepaid expenses is important for financial analysis and decision-making. These expenses can have a significant impact on a company’s cash flow, profitability, and overall financial health.

Reasons for Prepaid Expenses

There are several reasons why companies choose to incur prepaid expenses. These reasons vary depending on the industry, business model, and specific circumstances of each organization. Let’s explore some common reasons for prepaid expenses:

- Discounts and Cost Savings: One of the main motivations for prepaid expenses is to take advantage of discounts or cost savings opportunities. Suppliers or service providers often offer incentives for upfront payments, such as reduced rates or discounted prices. By paying in advance, companies can lock in these favorable terms and save money in the long run.

- Supplier Relationships and Negotiations: Prepaying expenses can help strengthen business relationships and improve negotiation power with suppliers. By showing a commitment to long-term partnerships and providing upfront payment, companies can secure priority treatment, better delivery schedules, or preferential treatment when it comes to product availability.

- Ensuring Service or Product Availability: Paying for expenses in advance guarantees the availability of essential goods or services. This is particularly critical for companies that rely on specific materials, equipment, or software to operate. By prepaying, organizations can avoid delays or disruptions caused by inventory shortages or other supply chain issues.

- Budgeting and Cash Flow Management: Prepaid expenses allow companies to allocate their resources and manage cash flow more effectively. By paying upfront, organizations can streamline their budgeting process, knowing that certain expenses are already accounted for and not needing to worry about making periodic payments throughout the year. This helps reduce the administrative burden and provides financial stability.

- Compliance and Legal Obligations: In certain cases, prepaying expenses may be necessary to comply with legal or contractual requirements. For example, insurance premiums are often required to be paid in advance to ensure coverage. Meeting these obligations through prepaid expenses ensures compliance and avoids penalties or legal issues.

Overall, prepaid expenses offer companies various benefits, including cost savings, improved supplier relationships, enhanced financial planning, and operational stability. However, it is essential for businesses to carefully evaluate the financial implications and potential risks associated with prepaying expenses to ensure it aligns with their overall financial goals and strategies.

Classification of Prepaid Expenses on the Balance Sheet

On the balance sheet, prepaid expenses are classified as assets. They represent future economic benefits that the company has already paid for but will receive or consume in the upcoming accounting periods. Prepaid expenses are categorized based on their expected benefits realization timeframe.

The two main classifications of prepaid expenses on the balance sheet are:

- Current Assets: Prepaid expenses that are expected to be utilized or consumed within one year from the balance sheet date are classified as current assets. These are items that the company expects to convert into cash or use up within the normal operating cycle, typically twelve months. Examples of current prepaid expenses include prepaid insurance premiums, prepaid supplies, or prepaid advertising expenses.

- Long-Term Assets: Prepaid expenses that will be realized beyond the one-year period are classified as long-term assets. These are expenses that will not be utilized or consumed within the normal operating cycle. Examples of long-term prepaid expenses include long-term prepaid rent, prepaid royalties, or prepaid software licenses.

Classification of prepaid expenses is crucial for financial analysis and decision-making. It provides insights into the liquidity and financial health of a company. Current assets, including current prepaid expenses, are easily convertible into cash and play a vital role in determining a company’s short-term financial stability. On the other hand, long-term assets, such as long-term prepaid expenses, represent a portion of the company’s future economic benefits and indicate its ability to generate value over an extended period.

It is important to note that the specific classification of prepaid expenses may vary depending on accounting standards, industry practices, and company policies. The distinction between current and long-term assets helps stakeholders understand the timing and nature of the prepaid expenses and facilitates effective financial decision-making.

When analyzing a company’s balance sheet, investors, creditors, and other stakeholders assess the composition and proportion of prepaid expenses in relation to other assets. This evaluation helps to determine the company’s ability to manage cash flow, its financial obligations, and the potential impact on profitability and overall financial performance.

Presentation of Prepaid Expenses on the Balance Sheet

Prepaid expenses are presented on the balance sheet as assets. They are typically listed under the current assets section or the long-term assets section, depending on their expected benefits realization timeframe.

Under the current assets section, prepaid expenses that will be utilized or consumed within one year from the balance sheet date are reported. These expenses are often listed alongside other current assets such as cash, accounts receivable, and inventory. The specific label for prepaid expenses may vary across different companies and industries, but it is commonly denoted as “Prepaid Expenses” or “Prepaid Assets.”

In contrast, prepaid expenses that have a benefits realization timeframe exceeding one year are reported under the long-term assets section of the balance sheet. They are listed alongside other long-term assets like property, plant, and equipment, and investments. The specific label for long-term prepaid expenses may vary, but it is typically referred to as “Long-term Prepaid Expenses” or “Deferred Expenses.”

Whether classified as current or long-term assets, prepaid expenses are recorded at their original cost or the amount paid. This reflects the resources already committed by the company in anticipation of future benefits. As the prepaid expenses are utilized or consumed, their value is gradually recognized as an expense on the income statement, reducing the prepaid expense balance.

It is common for companies to provide additional details or breakdowns of prepaid expenses within the notes to the financial statements. This gives stakeholders a more comprehensive understanding of the nature and breakdown of the prepaid expenses. For example, companies may disclose the specific types of expenses prepaid, the duration of the prepayment, or any significant terms or conditions associated with the prepayments.

When analyzing the presentation of prepaid expenses on the balance sheet, investors and creditors pay attention to the proportion of prepaid expenses in relation to total assets. This analysis helps assess a company’s financial stability, liquidity, and its ability to manage its cash flow and financial obligations. Stakeholders also consider the changes in prepaid expenses over time to evaluate trends and identify any potential risks or opportunities.

Understanding the presentation of prepaid expenses on the balance sheet is crucial for stakeholders when assessing the financial health and performance of a company. It provides valuable insights into the company’s resource allocation, financial planning, and commitment to future benefits.

Example of Prepaid Expenses on the Balance Sheet

Let’s consider an example to illustrate how prepaid expenses are presented on the balance sheet. Imagine a company called XYZ Inc. which operates in the software industry. XYZ Inc. has prepaid for annual software licenses worth $60,000.

On XYZ Inc.’s balance sheet, the prepaid expense of $60,000 would be listed under the current assets section if the software licenses are expected to be consumed within one year. It would appear alongside other current assets such as cash, accounts receivable, and inventory.

The presentation of the prepaid expense on the balance sheet could look like this:

Current Assets

- Cash $100,000

- Accounts Receivable $50,000

- Inventory $80,000

- Prepaid Expenses $60,000

Alternatively, if XYZ Inc. prepaid for software licenses that extend beyond one year, the prepaid expense of $60,000 would be classified as a long-term asset.

Long-Term Assets

- Property, Plant, and Equipment $500,000

- Investments $200,000

- Goodwill $150,000

- Long-term Prepaid Expenses $60,000

In both cases, the prepaid expense represents the payment made in advance for the software licenses. As the company starts utilizing the licenses and recognizing the related expense, the prepaid expense balance will decrease accordingly.

It’s important to note that the specific presentation of prepaid expenses may vary depending on the company’s accounting policies and industry practices. The key aspect is to accurately classify and report prepaid expenses to provide transparency and information to stakeholders.

Analyzing the example above, stakeholders can assess XYZ Inc.’s financial health by examining the proportion of prepaid expenses to other assets. This analysis helps determine the company’s liquidity, the extent of its commitment to future expenses, and its ability to manage cash flow effectively.

Understanding the presentation of prepaid expenses on the balance sheet is crucial for stakeholders to gain insights into a company’s financial position and make informed decisions about its financial health and performance.

Treatment of Prepaid Expenses in Financial Statements

Prepaid expenses have a specific accounting treatment in the financial statements. They are initially recorded as assets on the balance sheet when the payment is made. However, as these prepaid expenses are consumed or utilized over time, their value is gradually recognized as an expense on the income statement.

The accounting treatment of prepaid expenses involves two main financial statements:

- Balance Sheet: As mentioned earlier, prepaid expenses are initially recorded on the balance sheet as assets. They are classified as either current assets or long-term assets, depending on the expected benefits realization timeframe. The respective prepaid expense account’s balance decreases as the expenses are utilized, while the related expense account on the income statement increases.

- Income Statement: The consumption or utilization of the prepaid expense is recognized as an expense on the income statement over the period it benefits the company. This expense is matched with the revenues generated during the same period to accurately reflect the company’s profitability. The expense is typically categorized under the relevant expense account, such as rent expense, insurance expense, or advertising expense, depending on the nature of the prepaid item.

Here’s an example to illustrate the treatment of prepaid expenses in financial statements:

Let’s say a company prepaid $12,000 for a year’s worth of rent. On the balance sheet, the prepaid expense account would initially show a $12,000 asset. Each month, as the company consumes a portion of the prepaid rent, it recognizes a $1,000 rent expense on the income statement. This reduces the balance of the prepaid expense account by $1,000, reflecting the amount of prepaid rent utilized.

The income statement would include the following entry for each month:

- Rent Expense: $1,000

Over the course of the year, the entire prepaid expense of $12,000 would be gradually recognized as an expense on the income statement, reflecting the monthly portion of rent consumed.

The treatment of prepaid expenses in financial statements is crucial for accurately representing a company’s financial performance and ensuring the matching of expenses with the corresponding revenues. It provides transparency and helps stakeholders understand the timing and impact of prepaid expenses on the company’s profitability.

By analyzing the financial statements, investors, creditors, and other stakeholders can gain insights into the company’s expense management, cash flow, and overall financial health.

Conclusion

Prepaid expenses play a significant role in a company’s financial statements, particularly on the balance sheet. They represent payments made in advance for goods or services that will be utilized or consumed in the future. Understanding prepaid expenses allows stakeholders to gain insights into a company’s financial health, cash flow management, and resource allocation.

In this article, we have explored the concept of prepaid expenses and their significance in financial reporting. We have discussed the reasons why companies choose to incur prepaid expenses, such as cost savings, supplier relationships, and budgeting advantages. We have also examined the classification of prepaid expenses as current assets or long-term assets on the balance sheet, based on their expected benefits realization timeframe.

The presentation of prepaid expenses on the balance sheet is important for stakeholders to assess a company’s financial stability and liquidity. Analyzing the proportion of prepaid expenses to total assets provides valuable insights into a company’s commitment to future expenses and its ability to manage cash flow effectively.

Furthermore, we have covered the treatment of prepaid expenses in financial statements, including the recording of these expenses as assets on the balance sheet and their subsequent recognition as expenses on the income statement. This accounting treatment ensures that expenses are matched with the corresponding revenues, accurately reflecting the company’s profitability.

In conclusion, prepaid expenses serve as an indicator of a company’s financial management and commitment to future benefits. Analyzing and understanding the nature and scope of prepaid expenses enables stakeholders to make informed decisions about the company’s financial health and performance. By considering these factors, investors, creditors, and other stakeholders can evaluate the impacts of prepaid expenses on a company’s overall financial position and cash flow management.

In summary, prepaid expenses are an important aspect of financial analysis, and their proper recognition and presentation on the balance sheet provide valuable insights into a company’s financial condition and future obligations.