Finance

What Is FIG Investment Banking

Modified: December 30, 2023

Learn about FIG investment banking, a specialized branch of finance that focuses on providing financial services to the banking and insurance industries. Explore the key roles and functions of FIG investment banking in supporting the growth and stability of the finance sector.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Investment Banking

- Overview of FIG Investment Banking

- Core Functions of FIG Investment Banking

- Differences between FIG Investment Banking and Traditional Investment Banking

- Key Players in FIG Investment Banking

- Services provided by FIG Investment Banks

- Challenges and Opportunities in FIG Investment Banking

- Conclusion

Introduction

Investment banking is a diverse and dynamic industry that plays a crucial role in the global financial system. Within this field, there are various specialized sectors that cater to specific industries and client needs. One such sector is FIG (Financial Institutions Group) investment banking, which focuses on providing specialized financial services to banks, insurance companies, asset managers, and other non-banking financial institutions.

FIG investment banking serves as a vital intermediary between the financial institutions and the capital markets. Its primary objective is to assist clients in raising capital, managing risks, and accessing strategic opportunities. With a deep understanding of the unique challenges and complexities faced by financial institutions, FIG investment banks are well-equipped to provide tailored financial solutions and advisory services.

In recent years, FIG investment banking has gained increasing importance as the financial industry has undergone significant transformations. Technological advancements, regulatory changes, and shifting consumer preferences have created a landscape of both challenges and opportunities for financial institutions. This has propelled the demand for specialized financial advice and expertise, driving the growth of FIG investment banking.

By leveraging their extensive knowledge of the financial sector, FIG investment banks can help financial institutions navigate complex regulatory frameworks, optimize their operations, explore strategic partnerships, and raise capital in an efficient and cost-effective manner. In addition to traditional investment banking services such as mergers and acquisitions, debt and equity financing, and IPO advisory, FIG investment banks also offer specialized services like capital planning, risk management, asset liability management, and regulatory compliance.

FIG investment banking is a highly competitive field that requires a deep understanding of the financial industry, strong analytical skills, and the ability to anticipate and adapt to market trends. Success in this sector is dependent on building strong relationships with clients, understanding their individual needs, and providing innovative solutions that drive value and enhance their competitive advantage.

In this comprehensive guide to FIG investment banking, we will explore the core functions of FIG investment banks, the differences between FIG investment banking and traditional investment banking, the key players in the industry, and the services they offer to financial institutions. Additionally, we will discuss the challenges and opportunities that exist in this rapidly evolving sector.

Definition of Investment Banking

Investment banking is a specialized division within the broader financial industry that offers a range of services to corporations, governments, and other entities. The primary role of investment banks is to facilitate capital raising, provide advisory services, and assist clients in various financial transactions.

Investment banks act as intermediaries between issuers of securities, such as stocks and bonds, and investors who are looking to buy these securities. They play a critical role in helping companies raise capital by underwriting public offerings and private placements. This involves structuring the offering, pricing the securities, and marketing them to potential investors.

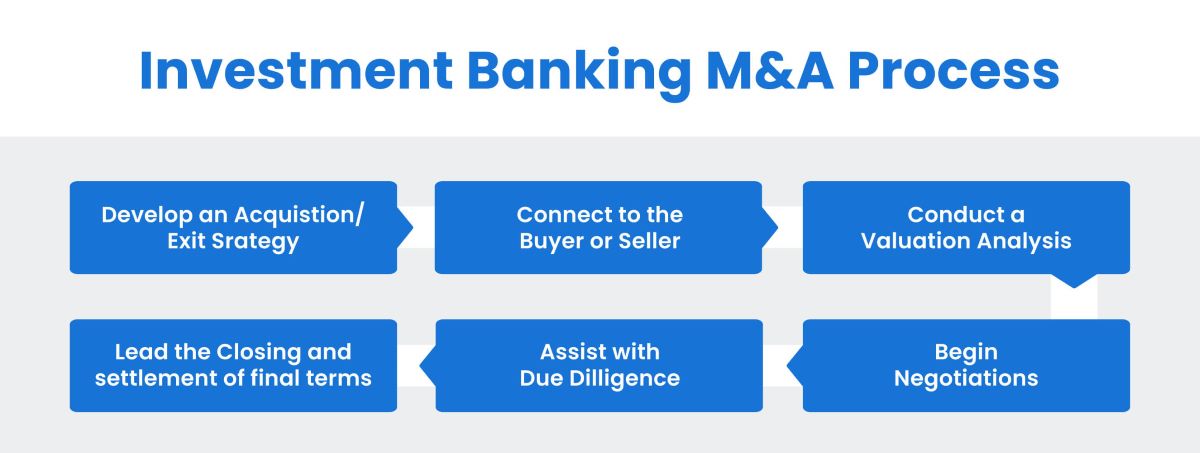

In addition to underwriting, investment banks also provide advisory services to clients on mergers and acquisitions (M&A), restructuring, and other strategic transactions. They analyze the financial health of companies, evaluate potential risks and benefits, and provide recommendations on deal structures and negotiations. Investment banks also assist in the execution of these transactions by providing due diligence, valuation, and facilitating the transaction process.

Another key function of investment banks is to provide market-making services. Market-making involves providing liquidity in financial markets by buying and selling securities to ensure smooth trading. This is particularly important in equity and fixed-income markets, where investment banks act as market makers by maintaining an inventory of securities and quoting bid and ask prices to facilitate transactions.

Furthermore, investment banks engage in proprietary trading, where they use their own capital to buy and sell securities with the intention of generating profits. This speculative trading activity can be highly lucrative but also carries significant risks.

Overall, investment banking is a complex and multifaceted field that requires a deep understanding of financial markets, strong analytical skills, and the ability to navigate complex regulatory environments. The services offered by investment banks are crucial in facilitating the efficient functioning of the global financial system, supporting economic growth, and enabling companies to raise capital and pursue strategic objectives.

Overview of FIG Investment Banking

FIG (Financial Institutions Group) investment banking is a specialized sector within the broader investment banking industry that focuses on catering to the unique needs and challenges of financial institutions. It encompasses a wide range of services tailored specifically for banks, insurance companies, asset managers, and other non-banking financial institutions.

FIG investment banking functions as a strategic partner for financial institutions, providing them with specialized financial advisory and transactional services. The sector has grown in importance in response to the ever-changing landscape of the financial industry, which is marked by regulatory complexities, technological advancements, and evolving customer preferences.

One key aspect of FIG investment banking is assisting financial institutions in capital raising activities. This includes helping clients raise funds through debt and equity financing, structuring and managing public and private offerings, and providing guidance on pricing and investor targeting strategies. FIG investment banks work closely with their clients to understand their financial goals and develop customized capital raising solutions that align with their needs.

In addition to capital raising, FIG investment banking also supports financial institutions in mergers and acquisitions (M&A) and other strategic transactions. This involves providing strategic advice, conducting due diligence, structuring the transaction, and facilitating negotiations. Given the specific challenges faced by financial institutions in the regulatory environment, FIG investment banks possess the expertise to navigate these complexities effectively.

FIG investment banks also play a crucial role in risk management for financial institutions. They assist in assessing and mitigating various types of risks, such as credit risk, market risk, liquidity risk, and operational risk. Using sophisticated risk modeling techniques, FIG investment banks provide valuable insights and guidance to help clients optimize their risk management strategies.

Additionally, FIG investment banking offers specialized services in areas such as asset liability management, regulatory compliance, and financial technology. These services help financial institutions adapt to changing industry dynamics, optimize their operations, and comply with regulatory requirements.

Overall, FIG investment banking operates in a highly specialized niche, serving as a strategic advisor and financial partner to the financial institutions sector. Through its comprehensive range of services, FIG investment banks enable their clients to navigate challenges, exploit opportunities, and achieve their financial objectives in an ever-evolving financial landscape.

Core Functions of FIG Investment Banking

The core functions of FIG (Financial Institutions Group) investment banking revolve around providing specialized financial advisory and transactional services to banks, insurance companies, asset managers, and other non-banking financial institutions. By understanding the unique challenges and intricacies of the financial sector, FIG investment banks offer tailored solutions to help their clients achieve their strategic objectives. Here are the core functions of FIG investment banking:

1. Capital Raising: FIG investment banks assist financial institutions in raising capital through various channels such as debt and equity financing. They help clients identify the most suitable funding options, structure the offering, and access the most appropriate investors to meet their capital needs.

2. Mergers and Acquisitions (M&A): FIG investment banks provide strategic advice and guidance to financial institutions in navigating complex M&A transactions. This includes conducting due diligence, valuations, and negotiating and structuring deals that align with the clients’ growth objectives.

3. Risk Management: Financial institutions face a range of risks, including credit risk, market risk, liquidity risk, and operational risk. FIG investment banks offer expertise in risk management strategies, leveraging analytics and modeling techniques to assist clients in mitigating and managing these risks effectively.

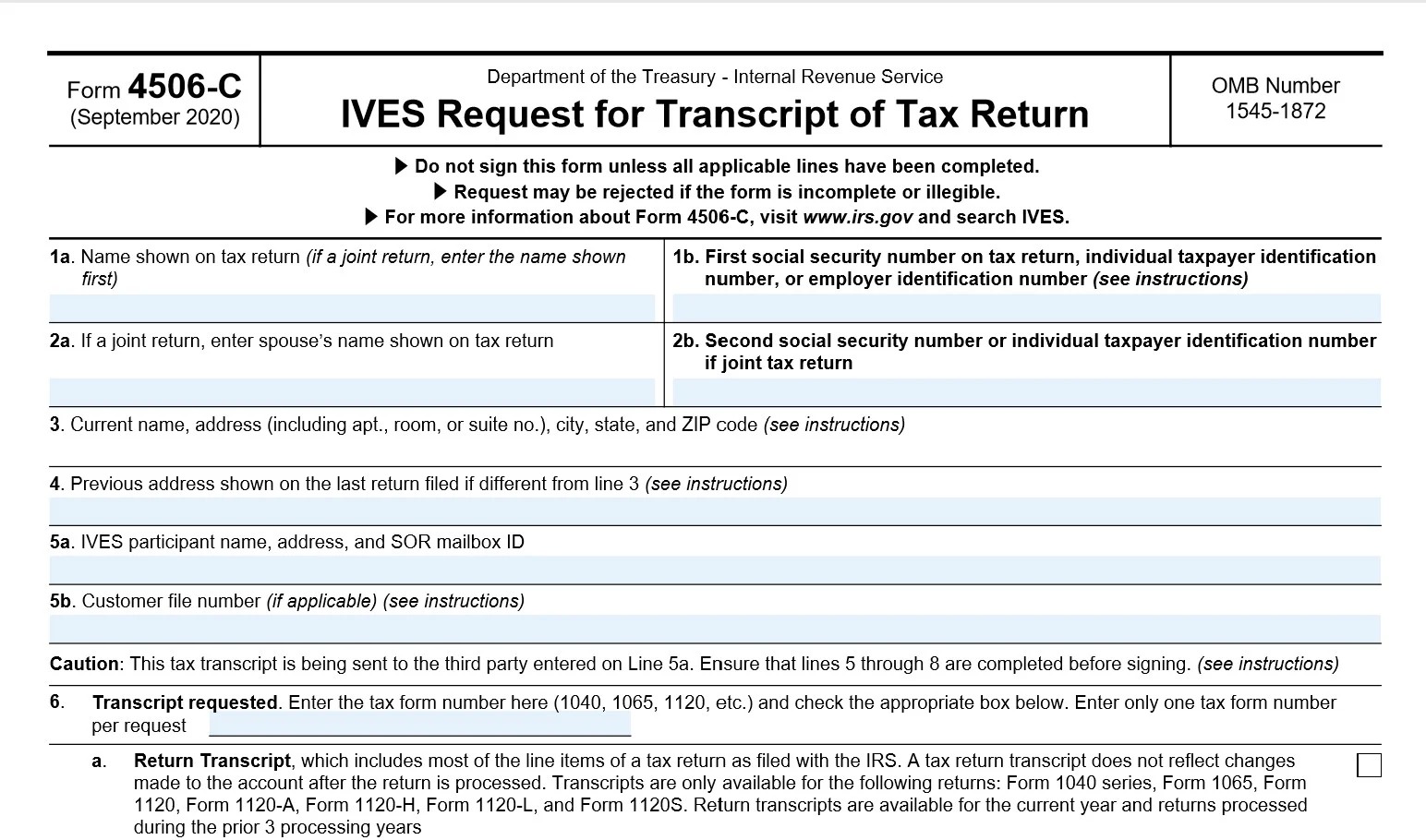

4. Regulatory Compliance: The financial industry is highly regulated, and financial institutions must ensure compliance with a wide array of regulations. FIG investment banks support their clients in interpreting and adhering to regulatory requirements, navigating regulatory frameworks, and implementing robust compliance programs.

5. Asset Liability Management: Effective management of assets and liabilities is critical for financial institutions. FIG investment banks provide advice and solutions to optimize asset allocation, manage interest rate risk, and balance capital adequacy requirements with profitability objectives.

6. Financial Technology (Fintech): The rapid advancement of technology has brought about significant changes in the financial industry. FIG investment banks help their clients leverage fintech solutions to enhance operational efficiency, improve customer experience, and stay competitive in the evolving digital landscape.

7. Strategic Advisory: FIG investment banks act as trusted advisors to financial institutions, offering strategic guidance on business growth, market expansion, and market positioning. They provide insights and recommendations based on their industry knowledge and help clients seize opportunities for sustainable growth.

8. Financial Restructuring: In times of financial distress or changing business strategies, financial institutions may require restructuring. FIG investment banks assist with debt restructuring, divestitures, asset sales, and other mechanisms to optimize the client’s financial structure and recover value.

These core functions of FIG investment banking enable financial institutions to navigate the complexities of the industry, make informed decisions, and drive growth in a highly competitive and regulated environment.

Differences between FIG Investment Banking and Traditional Investment Banking

While both FIG (Financial Institutions Group) investment banking and traditional investment banking operate within the broader realm of investment banking, there are some notable differences between the two. These differences arise from the unique nature of the clients they serve and the specialized services they offer. Here are the key distinctions:

1. Client Focus: One of the primary differences between FIG investment banking and traditional investment banking lies in their target clients. Traditional investment banking broadly caters to corporations, governments, and other entities across various industries. In contrast, FIG investment banking focuses specifically on serving financial institutions such as banks, insurance companies, and asset managers. This specialization allows FIG investment banks to tailor their services to the unique needs and challenges faced by financial institutions.

2. Advisory Services: Traditional investment banks provide general financial advisory services to a wide array of clients, covering mergers and acquisitions, capital raising, and other strategic transactions. FIG investment banks, on the other hand, offer advisory services that are highly specialized for financial institutions. This includes expertise in risk management, regulatory compliance, asset liability management, and financial technology, all of which require in-depth knowledge of the intricacies of the financial sector.

3. Regulatory Knowledge: Financial institutions face a complex web of regulations that govern their operations. FIG investment banks possess a deep understanding of the regulatory landscape specific to financial institutions. They have specialized teams that stay up-to-date with industry regulations, enabling them to provide regulatory advisory services and assist clients in complying with the intricate requirements of the financial sector. Traditional investment banks, while also knowledgeable about regulations, may not have the same level of expertise in the specific regulatory challenges faced by financial institutions.

4. Market Dynamics: The dynamics of the financial market impact different sectors differently. During times of economic uncertainty or market volatility, financial institutions may face unique challenges. FIG investment banks are well-versed in the particular market dynamics that affect financial institutions, enabling them to provide tailored advice and strategies to navigate these challenges. Traditional investment banks, while experienced in general market trends, may not possess the same level of sector-specific insight.

5. Product Offerings: Due to their specialization, FIG investment banks offer a wider array of products and services that cater specifically to financial institutions. These include capital planning, stress testing, asset management solutions, and specialized risk management products. Traditional investment banks, on the other hand, may have a broader range of product offerings that cater to clients across various industries.

6. Relationship Building: Both FIG investment banking and traditional investment banking rely heavily on building strong relationships with clients. However, the nature of the relationship and the depth of client engagement may differ. FIG investment banks typically foster long-term relationships with their financial institution clients, providing ongoing customized services and maintaining a deep understanding of their unique needs and objectives. Traditional investment banks, due to their broader client base, may engage in shorter-term relationships focused on specific transactions.

While both FIG investment banking and traditional investment banking operate within the investment banking industry, their specialized focus, client base, service offerings, and market knowledge set them apart. Each serves a distinct role in the financial ecosystem, catering to the diverse needs of their respective clients.

Key Players in FIG Investment Banking

FIG (Financial Institutions Group) investment banking is a competitive and specialized sector within the broader investment banking industry. Several key players have emerged as leaders in providing comprehensive financial advisory and transactional services to financial institutions. These players possess deep expertise, extensive networks, and a strong track record in supporting the unique needs of their clients. Here are some of the key players in FIG investment banking:

- Goldman Sachs: As one of the leading investment banks globally, Goldman Sachs boasts a strong FIG investment banking division. The bank offers a wide range of services to financial institutions, including capital raising, M&A advisory, risk management, and regulatory compliance.

- Morgan Stanley: With a reputation for its expertise in M&A transactions, Morgan Stanley has a robust FIG investment banking division. The bank provides strategic advisory services, capital market solutions, and risk management solutions to financial institutions.

- JPMorgan Chase: JPMorgan Chase is a prominent player in FIG investment banking, offering a comprehensive suite of services to financial institutions. The bank specializes in capital raising, asset management, regulatory compliance, and risk management for its FIG clients.

- Bank of America Merrill Lynch: Bank of America Merrill Lynch has a strong presence in FIG investment banking and offers a range of services to financial institutions. These include equity and debt capital markets, M&A advisory, asset liability management, and risk management solutions.

- Citigroup: Citigroup is a global financial institution that provides FIG investment banking services to a wide range of clients. The bank offers capital raising, strategic advisory, and risk management solutions specifically tailored for financial institutions.

- UBS: UBS has a robust FIG investment banking division that caters to financial institutions globally. The bank offers advisory services for capital raising, M&A transactions, risk management strategies, and regulatory compliance.

- Barclays: Barclays has a strong FIG investment banking presence and provides a range of services to financial institutions. Such services include capital raising, balance sheet optimization, regulatory compliance, and risk management solutions.

- Deutsche Bank: Deutsche Bank has a dedicated FIG investment banking group that offers customized solutions to financial institutions. The bank specializes in areas such as capital raising, M&A advisory, risk management, and regulatory compliance.

These key players in FIG investment banking have established themselves as industry leaders through their strong sector-specific expertise, global presence, extensive networks, and track record of successful transactions. However, it is important to note that the landscape of FIG investment banking is dynamic, and emerging players may also provide competitive services to financial institutions.

Services provided by FIG Investment Banks

FIG (Financial Institutions Group) investment banks offer a wide range of specialized financial services tailored to the unique needs and challenges faced by banks, insurance companies, asset managers, and other non-banking financial institutions. These services aim to support the strategic objectives of financial institutions, enhance their operational efficiency, and navigate the complex regulatory landscape. Here are the key services provided by FIG investment banks:

- Capital Raising: FIG investment banks assist financial institutions in raising capital by providing strategic advice and execution capabilities. This includes debt and equity financing, structuring public and private offerings, and accessing a wide network of investors.

- Mergers and Acquisitions (M&A) Advisory: FIG investment banks support financial institutions in various M&A transactions, including acquisitions, divestitures, and strategic partnerships. They provide valuation, due diligence, negotiation support, and deal structuring expertise.

- Risk Management: FIG investment banks offer risk management solutions to financial institutions, helping them evaluate and mitigate risks such as credit risk, market risk, liquidity risk, and operational risk. This includes risk analytics, stress testing, and the development of risk management strategies.

- Regulatory Compliance: FIG investment banks assist financial institutions in navigating complex regulatory frameworks and ensuring compliance with industry-specific regulations. They provide advisory services, regulatory reporting assistance, and help develop robust compliance programs.

- Asset Liability Management (ALM): FIG investment banks offer ALM services to financial institutions to optimize their balance sheets, manage interest rate risk, and ensure compliance with capital adequacy requirements. This includes assisting with asset allocation, liability management, and liquidity planning.

- Financial Technology (Fintech) Solutions: FIG investment banks help financial institutions adopt and leverage fintech solutions to enhance operational efficiency, streamline processes, and improve customer experience. This includes assistance with digital transformation, data analytics, and cybersecurity.

- Strategic Advisory: FIG investment banks provide strategic guidance to financial institutions, helping them navigate market trends, identify growth opportunities, and optimize their business strategies. This includes market research, competitive analysis, and advice on product development and market positioning.

- Capital Planning: FIG investment banks assist financial institutions in developing and executing capital planning strategies to enhance their capital adequacy, optimize their capital structure, and meet regulatory requirements.

- Asset Management: FIG investment banks offer asset management solutions to financial institutions, helping them effectively manage their investment portfolios, optimize returns, and navigate market volatility.

- Financial Restructuring: In times of financial distress or changing business strategies, financial institutions may require restructuring. FIG investment banks provide financial restructuring advice and services, including debt restructuring, asset sales, and capital optimization.

These services provided by FIG investment banks cater specifically to the needs and challenges faced by financial institutions, leveraging sector-specific expertise, regulatory knowledge, and deep understanding of the financial industry. Through these services, FIG investment banks play a crucial role in helping financial institutions achieve their strategic objectives and stay competitive in a rapidly evolving environment.

Challenges and Opportunities in FIG Investment Banking

FIG (Financial Institutions Group) investment banking operates in a dynamic and ever-evolving environment, presenting both challenges and opportunities for financial institutions and FIG investment banks. Understanding and navigating these factors are crucial for success in the sector. Here are some key challenges and opportunities in FIG investment banking:

Challenges:

- Regulatory Complexity: The financial industry is highly regulated, and financial institutions face a myriad of compliance requirements. FIG investment banks must stay abreast of evolving regulatory frameworks across various jurisdictions, ensuring that their clients comply with the complex web of regulations.

- Technological Disruption: Rapid advancements in technology are reshaping the financial industry. Embracing innovation and adopting fintech solutions is essential for both financial institutions and FIG investment banks to remain competitive. However, integrating new technologies and addressing cybersecurity risks can pose challenges.

- Market Volatility: Financial institutions are exposed to market fluctuations that can impact their performance and stability. FIG investment banks need to assist their clients in managing market risks effectively, including credit risk, liquidity risk, and interest rate risk.

- Competition: The FIG investment banking landscape is highly competitive, with numerous players vying for market share. Differentiating oneself through sector-specific expertise, innovative solutions, and strong client relationships is vital to thrive in this competitive environment.

- Evolving Customer Expectations: With changing customer preferences and increased access to digital banking, financial institutions must adapt and enhance their customer experience. FIG investment banks can support their clients by providing insights into customer trends and helping them develop strategies to improve customer engagement and retention.

Opportunities:

- Digital Transformation: The rise of digital banking presents opportunities for financial institutions to streamline processes, enhance efficiency, and deliver personalized services. FIG investment banks can help their clients embrace digital transformation and leverage technology to gain a competitive edge.

- Industry Consolidation: Continued industry consolidation provides opportunities for FIG investment banks to assist financial institutions in mergers, acquisitions, and strategic partnerships. FIG investment banks can offer their expertise in negotiating and structuring deals to help clients capitalize on consolidation trends.

- Regulatory Expertise: The complex and ever-changing regulatory landscape offers opportunities for FIG investment banks to provide advisory services and solutions to financial institutions. FIG investment banks with strong regulatory expertise can support their clients in ensuring compliance and navigating regulatory challenges effectively.

- Risk Management: As financial institutions face evolving risks, there is an opportunity for FIG investment banks to provide innovative risk management solutions. This includes advanced analytics, stress testing, and the development of tailored risk mitigation strategies.

- International Expansion: Financial institutions increasingly seek growth opportunities in international markets. FIG investment banks can help clients navigate regulatory frameworks, conduct market research, and establish strategic alliances to facilitate successful international expansion.

By addressing these challenges and capitalizing on emerging opportunities, FIG investment banks can position themselves as trusted advisors and valuable partners to financial institutions, supporting their growth, managing risks, and fostering long-term success.

Conclusion

FIG (Financial Institutions Group) investment banking plays a vital role in the financial industry, catering to the unique needs and challenges faced by financial institutions such as banks, insurance companies, and asset managers. With its specialized expertise and tailored services, FIG investment banking provides strategic advisory, capital raising, risk management, and regulatory compliance solutions, among others, to help financial institutions navigate a complex and ever-changing landscape.

FIG investment banking differs from traditional investment banking in its focus on financial institutions and its sector-specific knowledge. By understanding the intricacies of the financial sector, FIG investment banks offer specialized services that cater to the particular needs and regulatory requirements of financial institutions.

The sector faces several challenges, including regulatory complexities, technological disruption, market volatility, competition, and evolving customer expectations. However, these challenges also present opportunities for FIG investment banks to demonstrate their value by providing regulatory expertise, innovative solutions, risk management services, and support for digital transformation.

In conclusion, FIG investment banking is a dynamic and specialized sector that offers critical financial services to financial institutions. The sector continues to evolve in response to regulatory changes, technological advancements, and shifting market dynamics. By addressing challenges, embracing opportunities, and providing specialized expertise, FIG investment banks can establish themselves as trusted advisors and valued partners to financial institutions, supporting their growth, resilience, and long-term success in a rapidly evolving and highly regulated industry.