Finance

How To Get Operating Cash Flow

Published: December 20, 2023

Learn how to improve your operating cash flow with effective finance strategies. Boost your business's financial stability and growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to running a successful business, it’s important to have a solid understanding of your financial health. One key aspect of financial management is knowing how to effectively manage your operating cash flow. Operating cash flow is the lifeblood of your business, providing the necessary funds to cover day-to-day expenses, pay off debts, and invest in growth opportunities.

Operating cash flow, often referred to as OCF, measures the cash generated by a company’s core operations. It reflects the amount of cash that flows into the business as a result of sales and other operating activities, and the amount that flows out to cover expenses such as rent, salaries, and utilities.

Positive operating cash flow indicates that a business is generating enough cash to cover its operational needs, while negative cash flow indicates that the company is spending more than it is earning. It is important to maintain a positive operating cash flow to ensure the ongoing viability and growth of your business.

Managing operating cash flow effectively is crucial for several reasons. First and foremost, it provides the financial stability needed to meet short-term obligations and avoid cash flow crises. A negative cash flow can lead to missed payments, late fees, and damage to your business’s credit rating. On the other hand, a positive cash flow allows for greater flexibility in managing expenses and making strategic investment decisions.

Furthermore, operating cash flow is an important indicator of your business’s profitability and efficiency. By closely monitoring cash flow, you can identify areas of your business that may be draining resources or underperforming. This allows you to make informed decisions to improve operational efficiency and increase profitability.

In this article, we will delve into the intricacies of calculating operating cash flow and explore strategies to enhance your business’s cash flow management. We will also provide real-life examples to illustrate how businesses have successfully improved their operating cash flow. So buckle up and get ready to take control of your financial future!

What is Operating Cash Flow?

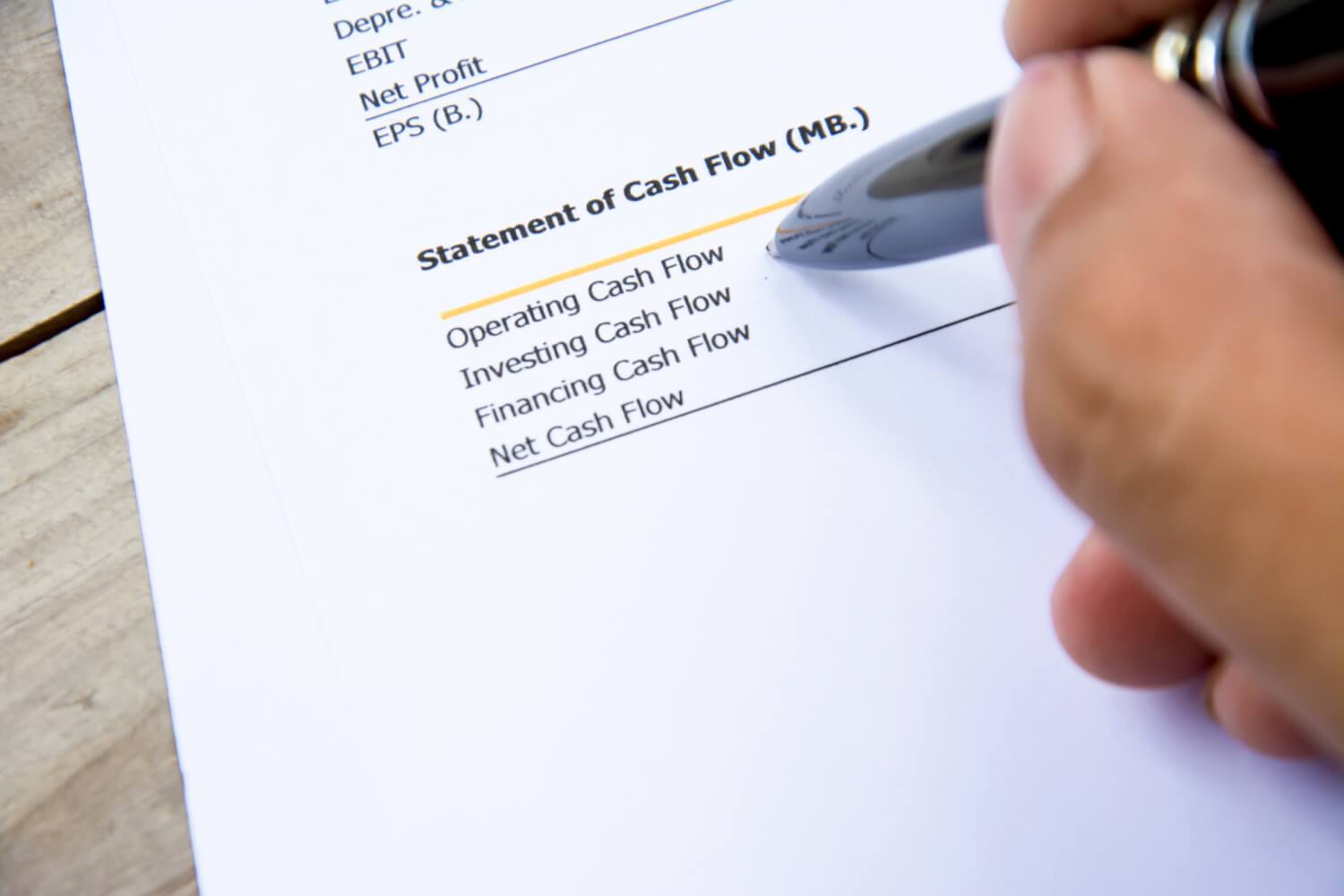

Operating cash flow (OCF) is a financial metric that measures the cash generated or consumed by a company’s core operations during a specific period. It provides valuable insights into the cash flow dynamics of a business and is a vital component in assessing its financial health.

Unlike net income, which is calculated based on accrual accounting principles, operating cash flow focuses solely on the actual cash inflows and outflows related to a company’s day-to-day operations. It reflects the cash generated from sales, the payment of expenses, and other operating activities.

Operating cash flow is beneficial because it helps businesses determine whether they are generating enough cash from their core operations to sustain and grow the business. A positive operating cash flow indicates that a company is generating more cash from its operations than it is spending, which is a positive sign of financial stability. Conversely, a negative operating cash flow indicates that a company’s operations are consuming more cash than they are generating, which could be a cause for concern.

It’s important to note that operating cash flow does not include financing or investment activities. Financing activities involve cash flows related to borrowing or repaying loans, issuing or repurchasing shares, and paying dividends. Investment activities pertain to cash flows associated with the purchase or sale of long-term assets or investments.

By focusing solely on operating activities, operating cash flow provides a clear picture of a company’s ability to generate cash from its primary business operations. It indicates whether a business is able to cover its day-to-day expenses, invest in growth opportunities, and repay debts using funds generated from its core operations.

Operating cash flow is typically reported on a company’s statement of cash flows, which outlines the sources and uses of cash during a given period. It is calculated by starting with net income and making adjustments for non-cash expenses, changes in working capital, and other operating activities.

In summary, operating cash flow is a crucial financial metric that provides insights into the cash flow position of a business. It helps gauge the liquidity and operational efficiency of a company, and is an essential tool for assessing the financial well-being of a business.

Importance of Operating Cash Flow

Operating cash flow is a critical measure of financial health for any business. It provides crucial insights into the cash flow dynamics of a company’s core operations and is vital for managing day-to-day expenses, making strategic decisions, and ensuring the long-term sustainability of the business.

Here are some key reasons why operating cash flow is important:

- Short-Term Obligations: Operating cash flow allows businesses to meet their immediate financial obligations, such as paying suppliers, covering payroll, and settling other short-term liabilities. Having a positive operating cash flow ensures that a company has sufficient cash on hand to handle these obligations promptly, avoiding late fees, penalties, and damaged relationships with vendors and employees.

- Cash Flow Management: By closely monitoring operating cash flow, businesses can better manage their cash flow cycles. This includes optimizing cash inflows by improving collection terms and processes, and conserving cash by negotiating favorable payment terms with suppliers and strategically managing inventory levels. Effective cash flow management is crucial for maintaining financial stability and preventing liquidity crunches.

- Investment Opportunities: Positive operating cash flow provides businesses with the financial capacity to seize strategic investment opportunities. Whether it’s expanding into new markets, investing in research and development, or acquiring new assets, having available cash allows companies to pursue growth initiatives and gain a competitive edge in the market. Companies with stronger operating cash flow are better positioned to weather economic downturns and capitalize on market opportunities.

- Debt Servicing: Operating cash flow is an important factor for lenders and creditors when assessing a company’s creditworthiness. A positive cash flow demonstrates the ability to generate funds to service debt obligations consistently. This can lead to lower borrowing costs, improved credit ratings, and increased access to capital for future financing needs.

- Profitability and Efficiency: Operating cash flow provides valuable insights into a company’s profitability and operational efficiency. By comparing operating cash flow to net income, businesses can identify discrepancies and analyze the impact of non-cash items and changes in working capital on their overall financial performance. This analysis helps improve expense management, identify areas of inefficiency, and optimize revenue generation.

Overall, operating cash flow is a fundamental indicator of a business’s financial viability and stability. It allows companies to navigate short-term challenges, make informed strategic decisions, and position themselves for long-term success in a rapidly changing business landscape.

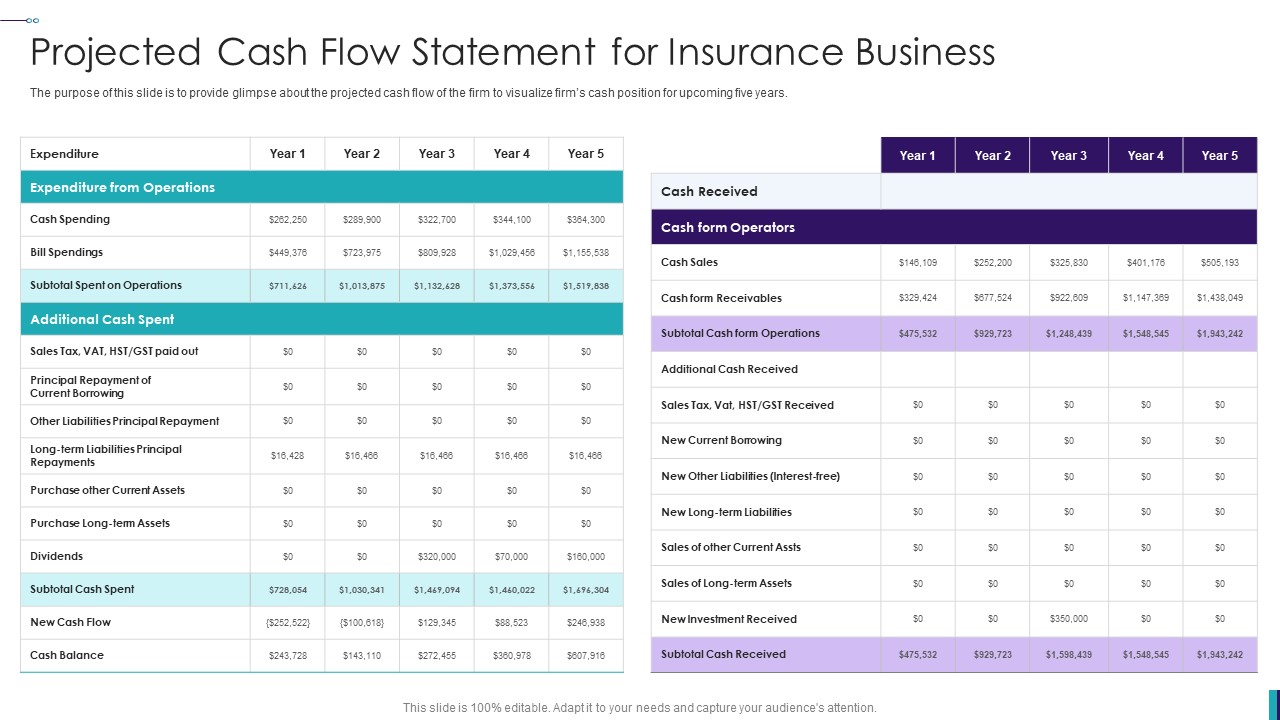

Calculating Operating Cash Flow

Calculating operating cash flow is an essential step in gauging the financial health of a business. It involves analyzing the cash generated or consumed by a company’s core operations during a specific period. While the calculation may vary depending on the accounting methodology used, the general formula for calculating operating cash flow is as follows:

Operating Cash Flow = Net Income + Non-Cash Expenses – Changes in Working Capital

Let’s break down each component of the formula:

- Net Income: This represents the profit generated by a company during a specific period, typically calculated using accrual accounting principles. Net income can be found on a company’s income statement.

- Non-Cash Expenses: These are expenses that do not involve the actual outflow of cash, such as depreciation and amortization. Non-cash expenses are added back to net income because they do not impact a company’s cash position.

- Changes in Working Capital: Working capital reflects the difference between a company’s current assets and its current liabilities. It includes items such as accounts receivable, accounts payable, inventory, and other short-term assets and liabilities. Changes in working capital consider the movement of these items from one period to another. An increase in working capital represents a use of cash, while a decrease represents a source of cash.

By summing net income with non-cash expenses and adjusting for changes in working capital, operating cash flow provides a more accurate picture of a company’s cash generation from its core operations.

It’s important to note that different industries or accounting standards may have variations in calculating operating cash flow. Additionally, it’s advisable to consult with a financial professional or accountant to ensure accurate interpretation and application of the formula in specific business contexts.

Once the calculation is complete, the resulting operating cash flow value can be interpreted as a measure of a company’s ability to generate cash from its operations after accounting for non-cash transactions and changes in working capital. A positive operating cash flow signifies that a company has generated more cash from its operations than it has spent, indicating a healthy financial position. On the other hand, a negative operating cash flow suggests that a company’s operations have consumed more cash than they have generated, highlighting potential cash flow concerns.

Regularly calculating operating cash flow and monitoring its trends over time is crucial for understanding the financial stability, performance, and growth potential of a business.

Enhancing Operating Cash Flow

Enhancing operating cash flow is a key objective for businesses looking to improve their financial stability and maximize their potential for growth. By optimizing cash flow generation from core operations, businesses can ensure a steady and reliable source of funds to meet their obligations, invest in future initiatives, and build a strong financial foundation. Here are some strategies to enhance operating cash flow:

- Improve Revenue Generation: Increasing sales and revenue is a direct way to boost operating cash flow. This can be achieved by implementing effective marketing and sales strategies, expanding into new markets, improving customer retention, or introducing new products or services that align with customer needs and preferences.

- Manage Costs and Expenses: Controlling costs and expenses is essential for maintaining a healthy cash flow. Businesses should regularly review their expenses and identify areas where savings can be made, such as renegotiating contracts with suppliers, optimizing inventory levels, or implementing cost-saving measures without compromising quality or customer service.

- Streamline Operations: Improving operational efficiency can have a significant impact on cash flow. Businesses can identify bottlenecks or inefficiencies in their processes and implement measures to streamline operations, reduce waste, optimize resource allocation, and improve productivity. This can include adopting technology solutions, implementing lean methodologies, and empowering employees to contribute to continuous improvement efforts.

- Manage Receivables: Timely collection of accounts receivable is crucial for maintaining a positive cash flow. Implementing efficient billing and collection processes, offering incentives for early payment, and establishing clear credit terms and policies can help improve cash inflows and reduce the risk of bad debts.

- Optimize Inventory Management: Effective inventory management is essential for reducing carrying costs and improving cash flow. Analyzing demand patterns, implementing just-in-time inventory systems, and optimizing reorder points can help minimize excess inventory and improve inventory turnover, freeing up cash that would otherwise be tied up in inventory.

- Negotiate Payment Terms: Negotiating favorable payment terms with suppliers can help extend payment periods, providing businesses with additional time to convert inventory into cash before paying suppliers. This can improve the cash conversion cycle, allowing companies to maintain a positive cash flow position while still meeting their financial obligations.

- Control Capital Expenditures: Evaluating and prioritizing capital expenditures is crucial for managing cash flow. Businesses should carefully assess the return on investment and the necessity of any capital expenditures and consider alternative financing options, such as leasing, to preserve cash flow.

- Monitor and Manage Working Capital: Managing working capital effectively is essential for maintaining a healthy cash flow. This involves optimizing the management of accounts receivable, accounts payable, and inventory to ensure that cash is efficiently utilized and not tied up in unnecessary working capital components.

By implementing these strategies, businesses can enhance their operating cash flow and ensure a more solid financial position. However, it’s important to note that each business is unique, and the effectiveness of these strategies may vary depending on the industry, market conditions, and specific business circumstances. Regular cash flow analysis, monitoring, and adjustment are crucial to refining and improving cash flow management over time.

Strategies to Improve Operating Cash Flow

Improving operating cash flow is essential for the financial health and sustainability of a business. By implementing effective strategies, businesses can optimize their cash flow management and ensure a steady stream of cash to meet their obligations and support growth. Here are some strategies to consider:

- Shorten Accounts Receivable cycles: Streamline your billing and collections process to encourage prompt payment from customers. Offer incentives for early payment, institute clear credit terms, and follow up on overdue payments to improve cash inflows.

- Extend Accounts Payable cycles: Negotiate extended payment terms with suppliers to align payments with your cash flow. This helps to conserve cash and improve your working capital position.

- Optimize inventory management: Carefully manage inventory levels to avoid overstocking or stockouts. Analyze demand patterns, implement just-in-time inventory systems, and negotiate favorable terms with suppliers to reduce carrying costs and improve cash flow.

- Review and optimize pricing strategies: Regularly evaluate your pricing structure to ensure you are maximizing profitability while remaining competitive. Conduct market research, analyze costs, and consider implementing dynamic pricing strategies to improve cash flows.

- Control operating expenses: Review your operating expenses regularly to identify cost-saving opportunities. Look for ways to streamline processes, renegotiate contracts with suppliers, and reduce discretionary spending without compromising quality or customer service.

- Reduce fixed costs: Identify areas where fixed costs can be reduced or eliminated. Evaluate your office space needs, explore cost-saving measures for utilities and maintenance, and consider outsourcing certain tasks to lower expenses and improve cash flow.

- Invest in technology: Implementing technology solutions can streamline operations, improve efficiency, and reduce costs. Automating manual tasks, implementing cloud-based systems, and leveraging software solutions can significantly improve cash flow management.

- Forecast and plan: Develop robust cash flow forecasting models to anticipate cash flow gaps and surpluses. By planning ahead, you can proactively manage your cash flow and take appropriate measures to cover any shortfalls or invest any surpluses.

- Consider alternative financing options: Explore financing options like lines of credit, business loans, or invoice factoring to bridge cash flow gaps. These options can provide immediate cash injections to cover expenses or invest in growth opportunities while maintaining positive cash flow.

- Negotiate contracts and terms: Review your contracts with suppliers, vendors, and service providers to identify opportunities for cost savings. Negotiating better pricing, discounts, or longer payment terms can help improve cash flow and reduce expenses.

Remember, every business is unique, and not all strategies may be applicable or effective for each situation. It’s important to carefully evaluate your specific circumstances and consult with financial experts or advisors to implement the most suitable strategies to improve your operating cash flow.

Monitoring and Managing Operating Cash Flow

Monitoring and managing operating cash flow is crucial for maintaining the financial health of a business. By regularly analyzing cash flow patterns and implementing effective management strategies, businesses can ensure the ongoing availability of cash to meet their obligations and support growth. Here are some key steps to monitor and manage operating cash flow:

- Regular Cash Flow Analysis: Conduct a thorough analysis of your cash flow statement on a regular basis. Compare current cash flow data with historical trends to identify any significant variations or potential cash flow issues.

- Use Cash Flow Forecasts: Develop cash flow forecasts to project future cash inflows and outflows. This allows you to anticipate potential shortfalls or surpluses and make informed decisions to manage cash flow proactively.

- Set Cash Flow Targets: Establish realistic cash flow targets based on your business goals and financial requirements. Setting specific targets helps you track your progress and allows for timely adjustments if necessary.

- Implement Cash Flow Measures: Put in place specific measures to improve and optimize operating cash flow. These may include strategies such as optimizing inventory management, negotiating payment terms with suppliers, or fine-tuning expense control.

- Monitor Key Performance Indicators (KPIs): Identify and track key performance indicators related to cash flow, such as days sales outstanding (DSO), cash conversion cycle (CCC), and liquidity ratios. These KPIs provide valuable insights into the efficiency of your cash flow management.

- Stay on Top of Receivables: Regularly monitor and follow up on accounts receivable. Implement robust invoicing processes, promptly address late payments, and develop relationships with customers to improve payment terms and reduce outstanding balances.

- Evaluate and Manage Payables: Keep an eye on accounts payable to optimize payment terms with suppliers. Strive for a balance between prompt payment and cash preservation to improve cash flow management.

- Review and Adjust Pricing: Regularly evaluate your pricing strategy to ensure it aligns with your cash flow objectives. Consider adjusting prices if necessary to maintain profitability and improve cash flow.

- Avoid Overleveraging: Manage debt obligations prudently to avoid excessive interest payments that can strain cash flow. Monitor debt levels and consider refinancing options if it would improve cash flow management.

- Implement Cash Flow Policies: Establish clear policies and procedures for cash flow management. This includes streamlining workflows, setting guidelines for expense approval, and implementing effective controls to prevent cash leakage or fraud.

By regularly monitoring operating cash flow and implementing effective management strategies, businesses can proactively address cash flow challenges, seize growth opportunities, and optimize financial performance. It’s essential to maintain a continuous focus on cash flow management and adapt strategies as necessary to ensure the long-term success and sustainability of the business.

Examples of Enhancing Operating Cash Flow

Implementing strategies to enhance operating cash flow can lead to significant improvements in a business’s financial health. Let’s explore some real-life examples of businesses that have successfully enhanced their operating cash flow:

- Improving Accounts Receivable Management: Company A implemented a more rigorous invoicing process, including sending automated reminders for payment and offering incentives for early settlement. This led to a reduction in outstanding receivables and improved cash inflows.

- Negotiating Extended Payment Terms: Company B negotiated longer payment terms with their suppliers, allowing them to improve their cash flow by delaying cash outflows. This gave them more time to convert inventory into revenue and reduced immediate cash flow pressures.

- Optimizing Inventory Levels: Company C analyzed their inventory turnover rate and identified slow-moving or obsolete stock. They implemented a more efficient inventory management system, reduced their inventory levels, and minimized carrying costs. This improved their cash flow by freeing up cash previously tied up in excess inventory.

- Streamlining Processes: Company D identified bottlenecks and inefficiencies in their operations. By streamlining workflows, eliminating redundant tasks, and automating manual processes, they were able to reduce costs and improve productivity. This resulted in cash flow savings and increased overall efficiency.

- Renegotiating Contracts and Expenses: Company E reviewed contracts with vendors and suppliers, identifying opportunities for cost savings. By renegotiating terms, they were able to reduce expenses without compromising quality. The resulting cash flow savings positively impacted their financial position.

- Implementing Cost Control Measures: Company F implemented strict cost control measures throughout the organization. They monitored expenses closely, reducing discretionary spending and optimizing operational costs. This enabled them to generate more cash from their operations, positively impacting operating cash flow.

- Improving Pricing Strategies: Company G conducted a thorough analysis of their products’ pricing to ensure they were maximizing profitability. By adjusting prices for certain products and services, they increased margins and generated additional cash flow, contributing to overall operating cash flow improvement.

- Implementing Technology Solutions: Company H invested in technology solutions to automate processes and improve efficiency. By digitizing manual tasks, they reduced labor costs and improved accuracy. This freed up resources and enhanced cash flow by eliminating unnecessary expenditures.

- Managing Capital Expenditures: Company I carefully analyzed their capital expenditure projects to ensure they aligned with their cash flow objectives. By prioritizing investments and selecting cost-effective alternatives where possible, they conserved cash and improved their overall cash flow position.

- Emphasizing Cash Flow in Decision-making: Company J made cash flow a central consideration in all business decisions, from pricing and product development to resource allocation. This proactive approach to cash flow management ensured that decisions were made with a focus on improving operating cash flow and maintaining financial stability.

These examples highlight the effectiveness of various strategies in enhancing operating cash flow for businesses across different industries. By identifying opportunities for improvement, implementing targeted measures, and monitoring progress, businesses can achieve tangible and sustainable improvements in their cash flow management and overall financial performance.

Conclusion

Operating cash flow is a critical component in managing the financial health and sustainability of a business. It provides valuable insights into the ability of a company to generate cash from its core operations, cover its expenses, and invest in growth opportunities. By closely monitoring and effectively managing operating cash flow, businesses can ensure a reliable and steady source of cash to meet their obligations and support their long-term success.

In this article, we explored the concept of operating cash flow and its significance in business finance. We discussed the importance of operating cash flow in meeting short-term obligations, managing expenses, and evaluating profitability and efficiency. Calculating operating cash flow involves analyzing net income, non-cash expenses, and changes in working capital.

We also explored strategies to enhance operating cash flow, such as improving revenue generation, managing costs and expenses, optimizing inventory management, and negotiating payment terms. By implementing these strategies, businesses can strengthen their cash flow position and improve their financial stability.

Furthermore, we discussed the importance of monitoring and managing operating cash flow on an ongoing basis. By conducting regular cash flow analysis, using cash flow forecasts, and tracking key performance indicators, businesses can proactively identify potential issues, make informed decisions, and optimize their cash flow management strategies.

Lastly, we provided real-life examples of businesses that successfully enhanced their operating cash flow. These examples demonstrated the effectiveness of various strategies, such as improving accounts receivable management, renegotiating contracts, implementing cost control measures, and embracing technology solutions.

In conclusion, operating cash flow is a fundamental aspect of financial management that should not be overlooked. By prioritizing operating cash flow and implementing effective strategies to enhance it, businesses can improve their financial stability, make strategic decisions, and ensure long-term success in a dynamic and competitive business landscape.