Finance

How Good Is Mission Lane Credit Card

Published: November 5, 2023

Discover how good the Mission Lane Credit Card is for your personal finance. Compare its benefits and features to make an informed decision.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction:

- Overview of Mission Lane Credit Card:

- Benefits of Using Mission Lane Credit Card:

- Evaluation of Mission Lane Credit Card’s Fees and Interest Rates:

- Mission Lane Credit Card’s Rewards Program:

- Mission Lane Credit Card’s Customer Service:

- Application Process for Mission Lane Credit Card:

- Mission Lane Credit Card’s Security Features:

- Mission Lane Credit Card’s Limitations and Drawbacks:

- Conclusion:

Introduction:

When it comes to managing our finances, having a reliable and trustworthy credit card is essential. In today’s world, where digital transactions have become the norm, having a credit card that not only offers convenience but also comes with beneficial features can make all the difference. One such credit card that has gained popularity in recent years is the Mission Lane Credit Card.

Mission Lane is a financial technology company that focuses on providing accessible and transparent credit options to consumers. Their credit card is designed to cater to individuals with various credit backgrounds, including those who have limited credit history or are working on rebuilding their credit. With a mission to empower people on their financial journey, Mission Lane Credit Card aims to offer a secure and flexible credit card option that meets the needs of a wide range of consumers.

In this article, we will delve deeper into the features, benefits, and limitations of the Mission Lane Credit Card. Whether you are considering applying for this card or simply want to learn more about it, we will provide you with a comprehensive overview to help you make an informed decision.

So, let’s explore what the Mission Lane Credit Card has to offer and determine how good it really is for managing your finances.

Overview of Mission Lane Credit Card:

The Mission Lane Credit Card is a versatile credit card option that comes with a range of features designed to meet the needs of different types of cardholders. Whether you are looking for a card to make everyday purchases, build your credit history, or simply have as a backup for emergencies, the Mission Lane Credit Card aims to provide a reliable and convenient solution.

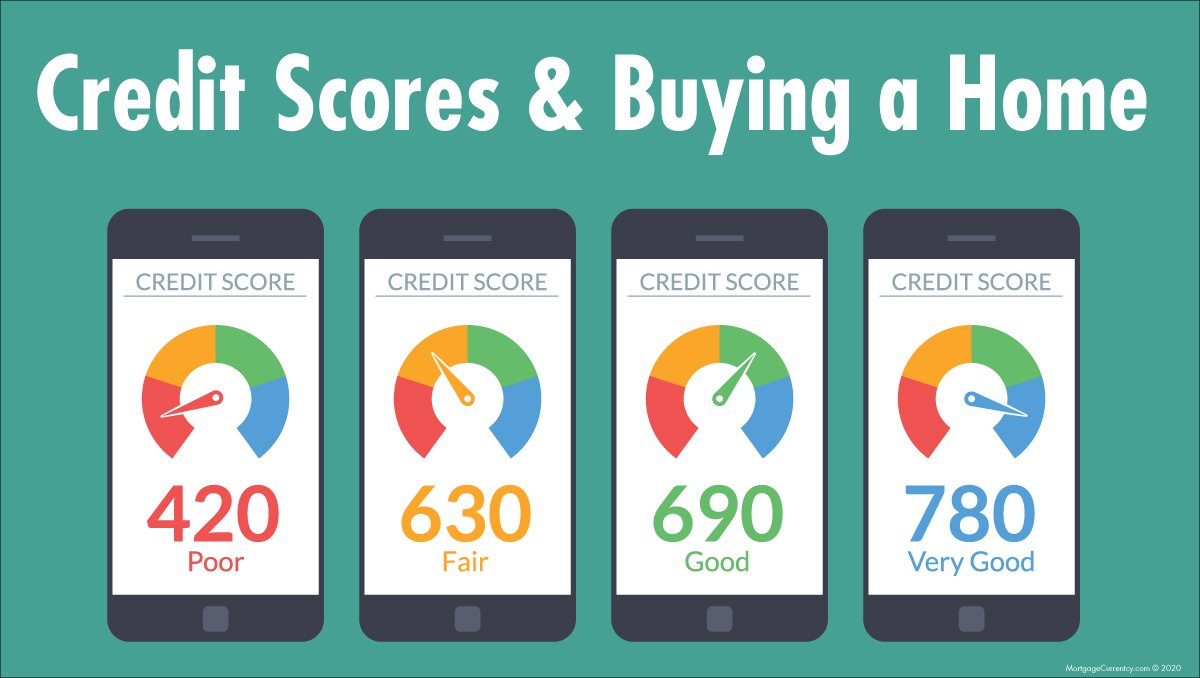

One of the standout features of the Mission Lane Credit Card is its accessibility to individuals with varying credit backgrounds. Unlike some traditional credit cards that require a high credit score for approval, Mission Lane takes a more inclusive approach. They consider factors beyond just your credit score, taking into account your overall financial health and responsible financial behavior. This means that even if you have a limited credit history or have experienced setbacks in the past, you still have a chance of being approved for a Mission Lane Credit Card.

Another notable feature of the Mission Lane Credit Card is its flexibility when it comes to credit limits. Once approved, you are provided with a credit limit that reflects your financial circumstances and creditworthiness. However, the best part is that Mission Lane allows you to request a credit limit increase after a certain period of responsible card usage. This feature can be beneficial for those looking to improve their credit utilization ratio and have access to additional credit when needed.

In terms of acceptance, the Mission Lane Credit Card is widely accepted at millions of locations worldwide. Whether you are shopping online, making in-store purchases, or traveling abroad, you can rely on the convenience and acceptance of the Mission Lane Credit Card. This makes it a versatile option for all your financial needs.

Furthermore, the Mission Lane Credit Card offers an easy-to-use mobile app and online account management tools. This allows you to monitor your transactions, track your spending, make payments, and access customer support anytime, anywhere. With a user-friendly interface and intuitive features, managing your Mission Lane Credit Card is hassle-free.

Overall, the Mission Lane Credit Card provides an inclusive and flexible credit card option that caters to a diverse range of consumers. With its accessibility, flexibility, wide acceptance, and user-friendly features, the Mission Lane Credit Card proves to be a convenient tool for managing your finances.

Benefits of Using Mission Lane Credit Card:

Using the Mission Lane Credit Card provides several benefits that can enhance your financial management and improve your overall creditworthiness. Let’s explore some of the key advantages of having a Mission Lane Credit Card:

- Accessible Approval Process: One of the major benefits of the Mission Lane Credit Card is its inclusive approval process. Unlike traditional credit cards that primarily consider your credit score, Mission Lane takes into account various factors such as your overall financial health and responsible financial behavior. This means that even if you have a limited credit history or have faced credit challenges in the past, you still have a chance of being approved for a Mission Lane Credit Card.

- Opportunity to Build Credit: For individuals looking to establish or improve their credit history, the Mission Lane Credit Card offers a valuable opportunity. By using the card responsibly and making timely payments, you can demonstrate your creditworthiness and build a positive credit profile. This can be particularly beneficial if you are a young adult or have recently experienced financial setbacks.

- Flexible Credit Limits: The Mission Lane Credit Card provides flexibility when it comes to credit limits. After being approved for the card, you are assigned a credit limit that aligns with your financial circumstances. However, Mission Lane also allows you to request a credit limit increase after a certain period of responsible card usage. This feature can be advantageous if you need access to additional credit for larger purchases or emergencies.

- Wide Acceptance: The Mission Lane Credit Card is widely accepted at millions of locations worldwide. Whether you are shopping online or making in-store purchases, you can rely on the convenience and acceptance of the Mission Lane Credit Card. Additionally, if you frequently travel internationally, having a widely accepted credit card can be highly beneficial.

- Convenient Mobile App and Online Account Management: The Mission Lane Credit Card offers a user-friendly mobile app and online account management tools. With these features, you can easily monitor your transactions, track your spending, make payments, and access customer support. These tools provide convenience and flexibility in managing your Mission Lane Credit Card account on the go.

- Financial Education: Mission Lane is committed to helping cardholders improve their financial literacy. The company offers educational resources and tools to help you better understand credit, budgeting, and responsible financial management. By utilizing these resources, you can enhance your financial knowledge and make informed decisions about your finances.

Overall, the Mission Lane Credit Card provides several benefits that make it a valuable tool for managing your finances. From its inclusive approval process and credit-building opportunities to its wide acceptance and convenient account management tools, the Mission Lane Credit Card offers a range of advantages for cardholders.

Evaluation of Mission Lane Credit Card’s Fees and Interest Rates:

Before deciding on a credit card, it’s crucial to evaluate the fees and interest rates associated with it. Let’s take a closer look at the fees and interest rates of the Mission Lane Credit Card:

Annual Fee: One of the notable aspects of the Mission Lane Credit Card is that it does not charge an annual fee. This can be a significant advantage, especially for individuals looking to minimize their credit card expenses.

Interest Rates: The interest rates on the Mission Lane Credit Card can vary depending on your creditworthiness. It is important to note that the card is designed to cater to individuals with various credit backgrounds, including those who are working on rebuilding their credit. Therefore, if you have a lower credit score, you may be subject to higher interest rates compared to those with better credit scores. It’s essential to carefully review the interest rates associated with the card and consider your ability to manage and pay off any outstanding balances.

Foreign Transaction Fees: If you frequently travel abroad or make purchases in foreign currencies, it’s important to consider the foreign transaction fees associated with the Mission Lane Credit Card. These fees are typically a percentage of the transaction amount and can add up, especially if you frequently engage in international transactions. However, it is worth noting that some Mission Lane Credit Card options may waive foreign transaction fees, so it’s crucial to check the specific terms and conditions of the card.

Late Payment and Penalty Fees: Like any credit card, the Mission Lane Credit Card charges late payment and penalty fees for missed or late payments. It’s important to be aware of these fees and make timely payments to avoid unnecessary charges. Additionally, Mission Lane provides notifications and reminders to help you stay on top of your payments, minimizing the risk of incurring late payment fees.

Cash Advance Fees: If you plan to use the Mission Lane Credit Card for cash advances, it’s important to consider the associated fees. Cash advances often incur higher interest rates and transaction fees compared to regular purchases. It’s crucial to evaluate the terms and conditions for cash advances and consider the potential costs involved.

Overall, the Mission Lane Credit Card offers several advantages when it comes to fees and interest rates. It does not charge an annual fee, and the interest rates vary based on creditworthiness. However, it’s important to carefully review the terms and conditions, understand the applicable fees, and consider your financial capability to manage any potential charges. By being aware of the associated fees and interest rates, you can make informed decisions and effectively manage your Mission Lane Credit Card.

Mission Lane Credit Card’s Rewards Program:

The Mission Lane Credit Card offers a rewards program that allows cardholders to earn points or cash back on their eligible purchases. Let’s examine the details of the Mission Lane Credit Card’s rewards program:

Earning Rewards: With the Mission Lane Credit Card, you can earn rewards on every eligible purchase you make. The specific details of the rewards program may vary, so it’s important to review the terms and conditions of your specific card. Typically, you earn a certain number of points or a percentage of cash back on qualifying transactions. These rewards can add up over time and provide benefits for cardholders who frequently use their credit card.

Redeeming Rewards: The Mission Lane Credit Card rewards program typically offers multiple options for redeeming your earned points or cash back. Common redemption options include statement credits, gift cards, merchandise, and travel rewards. You can choose the option that best suits your preferences and financial goals. Some cards may also offer the flexibility to redeem rewards for experiences or charitable donations.

Special Offers and Promotions: In addition to the ongoing rewards program, the Mission Lane Credit Card may offer special promotions or limited-time offers to cardholders. These can include bonus points, increased cash back rates, or exclusive discounts with partner merchants. These promotions provide added value to cardholders and can enhance the overall rewards potential.

Additional Perks and Benefits: Beyond the rewards program, the Mission Lane Credit Card may include additional perks and benefits that enhance the overall cardholder experience. These can include features like extended warranty protection, purchase protection, and travel insurance. It’s important to review the specific benefits associated with your card and take advantage of these additional perks.

While the specific details of the Mission Lane Credit Card’s rewards program may vary, it provides an opportunity for cardholders to earn valuable rewards on their everyday spending. Whether it’s points that can be redeemed for statement credits or cash back that can be used for future purchases, the rewards program adds value and incentivizes card usage. By maximizing your rewards potential and taking advantage of special offers and promotions, you can make the most of your Mission Lane Credit Card’s rewards program.

Mission Lane Credit Card’s Customer Service:

When it comes to managing your credit card, having reliable and responsive customer service is crucial. The Mission Lane Credit Card aims to provide excellent customer service to its cardholders. Let’s take a closer look at the key aspects of the Mission Lane Credit Card’s customer service:

Multiple Contact Channels: Mission Lane offers multiple channels through which cardholders can reach out for assistance. Whether you have a question, need help with a transaction, or want to report a lost or stolen card, you can contact Mission Lane’s customer service team through phone, email, or online chat. This provides flexibility and convenience in accessing the support you need.

Knowledgeable and Supportive Representatives: Mission Lane’s customer service team consists of knowledgeable representatives who are trained to assist with various aspects of the credit card. They can provide information about your account, guide you through the card’s features and benefits, and answer any questions or concerns you may have. The representatives strive to offer prompt and helpful assistance to ensure a positive customer experience.

Online Self-Service Tools: In addition to the availability of customer service representatives, Mission Lane also provides online self-service tools to empower cardholders to manage their accounts independently. Through the online portal or mobile app, you can access your account information, review transactions, make payments, and update personal details. These self-service tools offer convenience and efficiency in managing your Mission Lane Credit Card.

Timely and Effective Issue Resolution: Mission Lane is committed to addressing and resolving any issues or concerns raised by cardholders in a timely and effective manner. Whether it’s a billing dispute, a technical glitch, or a general inquiry, their customer service team strives to provide satisfactory resolutions. Open lines of communication and diligent follow-ups ensure that any problems are addressed promptly.

Educational Resources: Mission Lane goes beyond basic customer service by offering educational resources to help cardholders improve their financial knowledge. These resources, which may include articles, blog posts, and budgeting tools, can assist you in making informed financial decisions and maximizing the benefits of your credit card.

The Mission Lane Credit Card’s customer service is designed to offer support, guidance, and solutions to cardholders. With multiple contact channels, knowledgeable representatives, online self-service tools, and a commitment to timely issue resolution, Mission Lane aims to provide an excellent customer service experience. By leveraging these resources, you can have peace of mind knowing that assistance is readily available when you need it.

Application Process for Mission Lane Credit Card:

Applying for the Mission Lane Credit Card is a straightforward process, designed to provide accessibility to a wide range of individuals. Let’s walk through the steps involved in the application process:

- Visit the Mission Lane Website: To begin the application process, visit the official Mission Lane website. You can find detailed information about the credit card and access the application page.

- Provide Personal Information: The application form will require you to provide personal information, including your full name, date of birth, residential address, and contact details. Mission Lane uses this information to assess your eligibility for the credit card.

- Financial Information: In addition to personal information, you will be asked to provide details about your employment, income, and expenses. This information helps Mission Lane evaluate your financial capacity and determine your creditworthiness.

- Submit Documentation: Mission Lane may require supporting documentation as part of the application process. This may include identification documents, proof of address, or income verification. Ensure that you have these documents ready to upload or send to Mission Lane for verification purposes.

- Review and Agreement: Before submitting your application, carefully review the terms and conditions associated with the Mission Lane Credit Card. Understand the interest rates, fees, and other obligations that come with the card. By submitting your application, you indicate your understanding and agreement to these terms.

- Application Decision: Once your application is submitted, Mission Lane will review your information and make a decision regarding your credit card application. The review process may take a few days, during which Mission Lane will assess your creditworthiness and overall financial situation.

- Approval and Card Delivery: If your application is approved, you will receive notification from Mission Lane. The credit card will then be mailed to your designated address. It’s important to activate the card once received and set up your online account for convenient access and management.

- Application Status Updates: If there are any delays or additional information required during the application review, Mission Lane will communicate with you regarding the status of your application. Be sure to check your email or provided contact information regularly for any updates.

The application process for the Mission Lane Credit Card is designed to be simple and accessible. By providing accurate and complete information, submitting any required documentation, and reviewing the terms and conditions, you can increase your chances of a successful application. If you have any questions or need assistance during the process, the Mission Lane customer service team is available to help.

Mission Lane Credit Card’s Security Features:

Ensuring the security of your financial information is of utmost importance when it comes to credit cards. The Mission Lane Credit Card prioritizes the protection of cardholders’ data and offers several security features to safeguard your account. Let’s explore some of the key security measures put in place by Mission Lane:

- Secure Online Transactions: The Mission Lane website and mobile app employ industry-standard encryption technology to secure your online transactions. This means that any sensitive data transmitted between your device and Mission Lane’s servers is encrypted, reducing the risk of unauthorized access.

- Fraud Monitoring: Mission Lane has robust fraud detection and monitoring systems in place to identify and prevent unauthorized activity on your credit card account. Their systems constantly analyze patterns and transactions, allowing for prompt detection of any suspicious activity. If any fraudulent activity is detected, Mission Lane will take appropriate measures to address the issue and protect your account.

- Zero Fraud Liability: As a cardholder, you are protected by Mission Lane’s zero fraud liability policy. This means that if your credit card is lost or stolen and used for unauthorized transactions, you are not held responsible for any fraudulent charges. It’s crucial to report any potential fraudulent activity promptly to Mission Lane’s customer service to ensure swift action in resolving the issue.

- Chip Technology: The Mission Lane Credit Card is equipped with chip technology, also known as EMV technology. This technology adds an extra layer of security to your transactions. When making in-person purchases at chip-enabled terminals, the chip creates a unique transaction code that cannot be easily replicated, making it more difficult for fraudsters to clone your card.

- Fraud Alerts: Mission Lane offers optional fraud alert notifications to help you stay informed about any suspicious activity on your account. These alerts can be delivered via email, text message, or push notifications through the mobile app. By promptly receiving and reviewing these alerts, you can take immediate action in the event of any fraudulent activity.

- Card Lock and Replacement: If you misplace your Mission Lane Credit Card or suspect it has been lost or stolen, you can quickly lock the card through the mobile app or by contacting customer service. This feature ensures that no further transactions can be made on the card until it is found or replaced. Mission Lane also offers a simple process for card replacement to minimize any disruption in your financial management.

By implementing these security features, Mission Lane aims to protect its cardholders from fraud and unauthorized access to their credit card accounts. The combination of secure online transactions, fraud monitoring, zero fraud liability, chip technology, fraud alerts, and card lock and replacement options provide peace of mind and reassurance when using the Mission Lane Credit Card.

Mission Lane Credit Card’s Limitations and Drawbacks:

While the Mission Lane Credit Card offers numerous benefits and features, it’s important to consider its limitations and drawbacks before applying. Let’s explore some of the potential limitations associated with the Mission Lane Credit Card:

- Interest Rates: Depending on your creditworthiness, the interest rates on the Mission Lane Credit Card can be relatively high compared to other credit cards. It’s essential to carefully review the interest rates and consider your ability to manage and pay off any outstanding balances to avoid accruing significant interest charges.

- Annual Percentage Rate: The Mission Lane Credit Card may have a higher annual percentage rate (APR) compared to other credit cards. This means that if you carry a balance on your card, the interest charges can accumulate quickly, potentially increasing the overall cost of your purchases.

- Fees: While the Mission Lane Credit Card does not charge an annual fee, it’s important to be aware of other potential fees. Late payment fees, cash advance fees, and foreign transaction fees may apply. Understanding these fees and their impact on your financial management is crucial for responsible credit card use.

- Credit Limit: The initial credit limit for the Mission Lane Credit Card may be lower compared to other credit cards. While you can request a credit limit increase after a certain period of responsible card usage, the initial limit may restrict your purchasing power, especially if you are looking to make larger purchases or consolidate existing debt.

- Limited Reward Program: The Mission Lane Credit Card’s rewards program may have limitations in terms of earning potential and redemption options. It’s crucial to review the specific terms and conditions of the rewards program to ensure it aligns with your spending habits and financial goals.

- Credit Accessibility: While the Mission Lane Credit Card aims to provide access to individuals with varying credit backgrounds, it’s important to note that approval is not guaranteed. Depending on your individual circumstances, such as recent bankruptcy or ongoing delinquencies, you may not meet the criteria for approval.

It’s vital to carefully evaluate these limitations and drawbacks in relation to your financial needs and goals. Consider your ability to manage credit responsibly, your financial capability to handle interest charges, and your expectations regarding rewards and credit limits. By thoroughly understanding the limitations and drawbacks, you can make an informed decision about whether the Mission Lane Credit Card is the right choice for you.

Conclusion:

The Mission Lane Credit Card offers several benefits and features that make it an attractive option for managing your finances. With its inclusive approval process, flexible credit limits, wide acceptance, and user-friendly account management tools, the Mission Lane Credit Card aims to cater to a diverse range of consumers.

By responsibly using the Mission Lane Credit Card, cardholders have the opportunity to build or improve their credit history, access valuable rewards programs, and benefit from additional perks and benefits. The Mission Lane Credit Card’s commitment to customer service ensures that cardholders have access to knowledgeable representatives who can assist with any inquiries or concerns.

However, it’s important to consider the limitations and drawbacks of the Mission Lane Credit Card as well. The potential for higher interest rates, certain fees, and initial credit limit restrictions are factors to take into account. It’s crucial to carefully review the terms and conditions and assess your financial capability to manage any potential charges associated with the card.

In conclusion, if you are seeking a credit card that offers accessibility, flexibility, and the opportunity to build credit, the Mission Lane Credit Card may be a suitable choice. As with any financial product, it’s essential to evaluate your own financial situation, goals, and preferences before making a final decision. By conducting thorough research and understanding the features, benefits, limitations, and potential costs associated with the Mission Lane Credit Card, you can confidently determine if it aligns with your needs and helps you achieve your financial goals.