Finance

How To Protect Checking Account

Published: October 28, 2023

Learn the essential steps to safeguard your checking account and keep your finances secure with our comprehensive guide on how to protect your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Maintaining Strong Passwords

- Monitoring Account Activity Regularly

- Setting up Account Alerts

- Being Vigilant with Online and Mobile Banking

- Avoiding Suspicious Emails and Links

- Protecting Personal Information

- Enrolling in Additional Security Measures

- Contacting the Bank in Case of Suspicious Activity

- Conclusion

Introduction

Protecting your checking account is essential to safeguarding your financial well-being. As technology advances, so do the risks associated with online banking and financial transactions. Cybercriminals are constantly finding new ways to gain unauthorized access to bank accounts and steal personal information.

Fortunately, there are several proactive steps you can take to protect your checking account from potential threats. In this article, we will explore various strategies and practical tips to help you ensure the security of your financial accounts.

From maintaining strong passwords to being vigilant with online and mobile banking, each aspect plays a crucial role in strengthening the defense of your checking account. By implementing these measures, you will be better equipped to identify and mitigate potential risks, minimizing the likelihood of falling victim to online fraud or identity theft.

So, let’s dive into the various ways you can safeguard your checking account and gain peace of mind knowing that your finances are protected.

Maintaining Strong Passwords

A strong password is the first line of defense when it comes to protecting your checking account. It is crucial to create a unique and complex password that is difficult for hackers to guess. Here are some tips to help you maintain strong passwords:

- Create a password that is at least 8-12 characters long. Include a combination of uppercase and lowercase letters, numbers, and special characters.

- Avoid using obvious information, such as your name, birthdate, address, or phone number, as part of your password.

- Do not reuse passwords across multiple accounts. Each account should have a unique password.

- Consider using a password manager to securely store and generate complex passwords for you.

- Regularly update your passwords. Aim to change them every few months to enhance security.

Remember, a strong password is a crucial foundation for protecting your checking account. Take the time to create and maintain strong passwords to reduce the risk of unauthorized access to your financial information.

Monitoring Account Activity Regularly

One of the most important steps you can take to protect your checking account is to monitor your account activity regularly. By keeping a close eye on your transactions, you can quickly identify any suspicious or unauthorized activity and take immediate action. Here are some tips on how to effectively monitor your account activity:

- Review your account statements: Carefully review your monthly bank statements, verifying each transaction and ensuring they match your records.

- Check your account online: Take advantage of online banking platforms to regularly check your account activity. Log in frequently and review recent transactions to detect any unauthorized or suspicious activity.

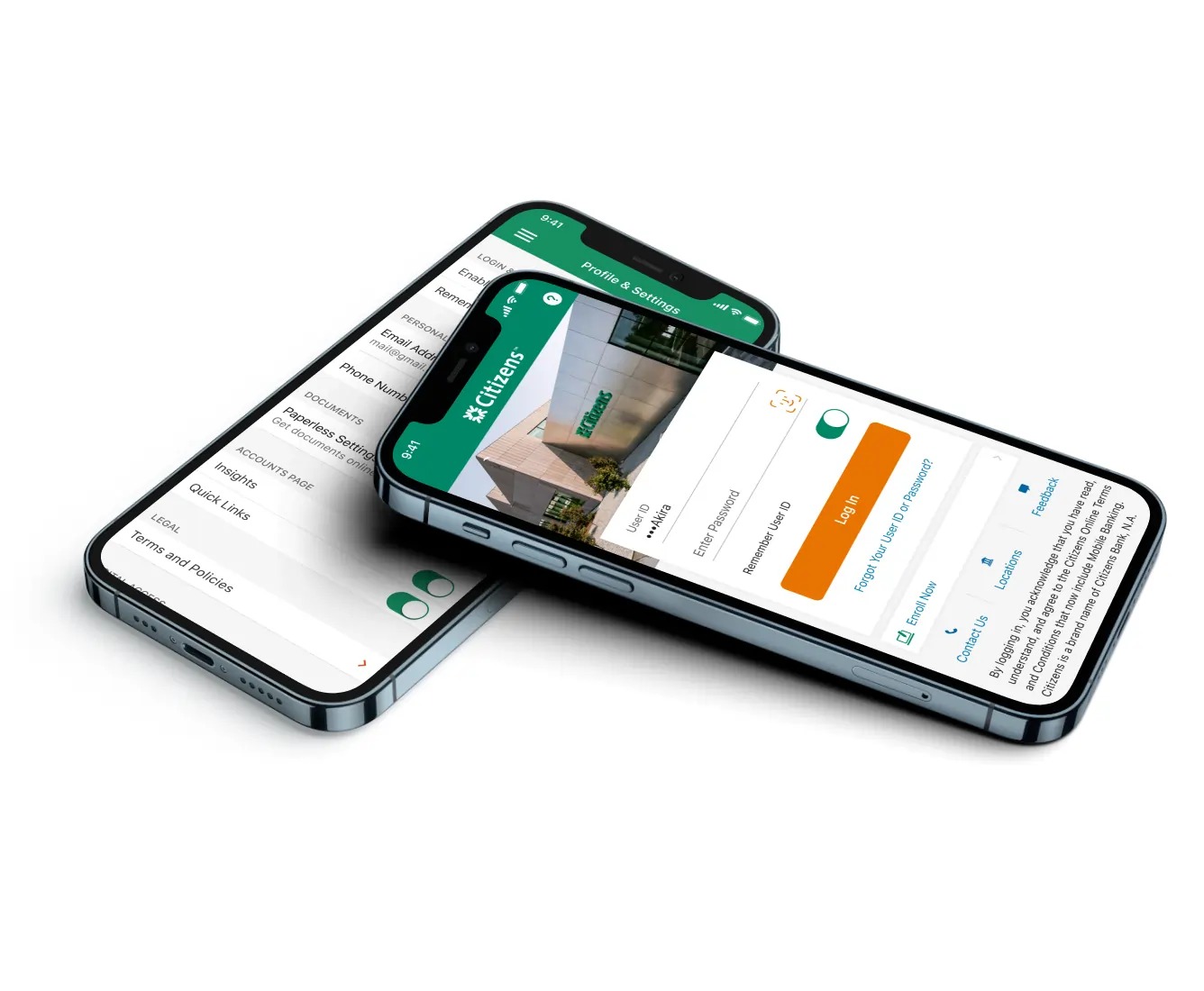

- Set up mobile banking: Install your bank’s mobile banking app on your smartphone or tablet. This allows you to conveniently access your account and monitor transactions on the go.

- Utilize banking alerts: Many banks offer email or text alerts to notify you of specific account activities, such as large withdrawals or unusual transactions. Set up these alerts to stay informed and promptly detect any potential fraudulent activity.

By monitoring your account activity consistently, you can detect any irregularities or unauthorized transactions early on, giving you the opportunity to report them to your bank and take appropriate actions to protect your finances.

Setting up Account Alerts

Setting up account alerts is an effective way to stay informed about the activity on your checking account and to quickly identify any suspicious or unauthorized transactions. The following are some essential account alerts that you should consider enabling:

- Balance Notifications: Receive alerts when your account balance reaches a certain threshold. This can help you avoid overdrafts and keep track of your available funds.

- Transaction Alerts: Get notified whenever a transaction is made on your account. This includes deposits, withdrawals, transfers, and payments. If there is any unauthorized activity, you can take immediate action.

- Card Activity Alerts: If you have a debit card linked to your checking account, set up alerts for any card activity, such as purchases or ATM withdrawals. This can help you detect any fraudulent card usage.

- Security Alerts: Enable security alerts for any changes made to your account settings, such as password changes or updates to your contact information. This ensures that you are notified of any potential security breaches.

Most banks offer the option to customize the types of alerts you receive and the delivery method (email, text message, or push notifications). Take advantage of these features and carefully choose the alerts that are most relevant to your needs.

By setting up these account alerts, you will be promptly notified of any suspicious activity on your checking account, allowing you to take immediate action and protect your finances.

Being Vigilant with Online and Mobile Banking

With the convenience of online and mobile banking comes the responsibility of being vigilant and proactive in protecting your checking account. Here are some important tips to help you stay secure while using online and mobile banking:

- Secure Internet Connection: Only access your accounts using trusted and secure internet connections. Avoid using public Wi-Fi networks, as they may be vulnerable to hackers.

- Keep Devices Secure: Ensure that your computer, smartphone, or tablet has up-to-date antivirus and anti-malware software installed. Regularly update your device’s operating system and applications to protect against vulnerabilities.

- Use Official Banking Apps: Download and use the official mobile banking application provided by your bank. Be cautious of third-party apps, as they may compromise the security of your account.

- Enable Two-Factor Authentication: Whenever possible, enable two-factor authentication for your online and mobile banking accounts. This adds an extra layer of security by requiring a second form of verification, such as a unique code sent to your mobile device.

- Be Wary of Phishing Attempts: Be cautious of emails, text messages, or phone calls that request personal or financial information. Legitimate financial institutions will never ask you to provide sensitive information through these channels.

- Log Out and Secure Devices: Always log out of your online banking session when you’re finished. Also, use a passcode or biometric authentication (fingerprint or face recognition) to secure your mobile devices.

By remaining vigilant and following these best practices, you can minimize the risk of unauthorized access to your checking account and protect your financial information while using online and mobile banking services.

Avoiding Suspicious Emails and Links

Emails and links can be a gateway for cybercriminals to gain access to your checking account and personal information. It’s essential to be cautious and avoid falling victim to phishing scams or malicious links. Here are some tips to help you avoid suspicious emails and links:

- Exercise Caution: Be skeptical of emails or messages claiming to be from your bank or financial institution. Always verify the authenticity of the sender before clicking any links or providing personal information.

- Check the Sender’s Email Address: Pay attention to the email address of the sender. Be wary of emails that have a suspicious or unfamiliar email address, as they could be an attempt to deceive you.

- Think Before Clicking: Avoid clicking on links or downloading attachments from unsolicited or suspicious emails. These links may lead to fraudulent websites designed to steal your login credentials or install malware on your device.

- Verify Website Security: Before entering any personal information online, double-check that the website is secure. Look for the padlock icon in the URL bar and ensure that the website’s address begins with “https://” instead of just “http://”.

- Be Cautious of Urgency or Threats: Be wary of emails or messages that contain urgent requests or threats. Phishing attempts often use fear or a sense of urgency to manipulate recipients into providing personal information.

- Keep Software Updated: Regularly update your computer or mobile device’s software, including your web browser and security software. These updates often contain important security patches that can protect against vulnerabilities.

By exercising caution and being proactive in avoiding suspicious emails and links, you can significantly reduce the risk of falling victim to phishing scams and protect your checking account from unauthorized access.

Protecting Personal Information

Protecting your personal information is key to safeguarding your checking account. Cybercriminals can use stolen personal information to commit identity theft and gain unauthorized access to your financial accounts. Here are some essential practices to protect your personal information:

- Be Mindful of Sharing Information: Only provide your personal information to trusted and reputable sources. Be cautious of sharing sensitive details, such as your Social Security number or account numbers, unless it’s necessary and secure.

- Use Strong Security Questions: When setting up security questions for your accounts, avoid using common or easily guessable information. Opt for unique questions and answers that only you would know.

- Protect Your Social Security Number: Safeguard your Social Security number by keeping physical copies in a secure location and only sharing it when absolutely necessary. Avoid carrying your Social Security card in your wallet or purse.

- Shred Sensitive Documents: Shred any documents containing personal information, such as bank statements, credit card bills, or insurance documents before discarding them.

- Be Careful on Social Media: Be cautious about the information you share on social media platforms. Avoid posting sensitive details that could be used by cybercriminals to impersonate you or gain access to your accounts.

- Be Selective with Third-Party Apps: Be cautious when granting permissions to third-party applications that request access to your personal information. Only use trusted apps from reputable sources.

By taking these precautions and protecting your personal information, you can significantly reduce the risk of identity theft and protect your checking account from unauthorized access.

Enrolling in Additional Security Measures

In addition to the basic security practices, many banks offer additional security measures that you can enroll in to enhance the protection of your checking account. These measures add extra layers of security and provide added peace of mind. Here are some common additional security measures you should consider enrolling in:

- Multi-Factor Authentication (MFA): Enable multi-factor authentication, such as fingerprint or facial recognition, in addition to your password. This adds an extra layer of verification to ensure that only authorized individuals can access your account.

- Biometric Authentication: If available, opt for biometric authentication methods, such as fingerprint or facial recognition, when accessing your online or mobile banking account. These biometric factors are more secure than traditional passwords or PINs.

- One-Time Passwords (OTP): Some banks offer the option of receiving one-time passwords via text message or email for additional verification during login or certain transactions. Enable this feature to enhance security.

- Security Tokens: Consider using physical or virtual security tokens provided by your bank. These tokens generate unique codes that are required for certain transactions, providing an additional layer of security.

- Secure Messaging: Explore the option of secure messaging within your online banking platform. This allows you to communicate securely with your bank, reducing the risk of interception or unauthorized access to your messages.

By enrolling in these additional security measures, you can significantly enhance the protection of your checking account and minimize the risk of unauthorized access or fraudulent activity.

Contacting the Bank in Case of Suspicious Activity

If you notice any suspicious activity or unauthorized transactions on your checking account, it is crucial to contact your bank immediately. Taking prompt action can help mitigate potential losses and protect your financial well-being. Here are the steps you should take:

- Call Your Bank’s Customer Service: Locate the customer service number of your bank and call them as soon as possible. Inform them of the suspicious activity or unauthorized transactions you have detected on your checking account.

- Provide Relevant Details: When speaking with the bank representative, provide them with specific details about the suspicious activity or unauthorized transactions. Include dates, transaction amounts, and any other pertinent information that can assist in their investigation.

- Follow the Bank’s Instructions: Your bank may guide you on the next steps to take. Follow their instructions closely, which may include freezing your account, changing your passwords, or filing a dispute or fraud claim.

- Monitor Your Account Closely: Keep a close eye on your account activity while the bank investigates the issue. Take note of any additional suspicious transactions and report them to your bank promptly.

- Update Security Measures: After resolving the issue, update your security measures, such as changing your passwords, enabling additional security features, and reviewing your account alerts. This ensures that your account remains protected.

Remember, contacting your bank immediately is crucial in case of suspicious activity or unauthorized transactions. Quick communication can help limit the potential damage and aid in the recovery process.

Conclusion

Protecting your checking account is of utmost importance in today’s digital age. By implementing the strategies and tips outlined in this article, you can significantly enhance the security of your financial information and minimize the risk of unauthorized access or fraudulent activity.

Start by maintaining strong passwords and regularly updating them. Monitor your account activity closely, leveraging online and mobile banking platforms, and setting up account alerts for immediate notifications of any suspicious transactions. Be vigilant when conducting online and mobile banking activities, avoiding suspicious emails and links that could compromise your personal information.

Protect your personal information by being cautious about sharing sensitive details and shredding documents containing personal information. Take advantage of additional security measures offered by your bank, such as multi-factor authentication, biometric authentication, and secure messaging.

If you detect any suspicious activity or unauthorized transactions, contact your bank immediately, providing relevant details for their investigation. Follow their instructions, monitor your account closely, and update your security measures after resolving the issue.

By following these guidelines and staying proactive, you can protect your checking account and finances from potential threats, giving you peace of mind while managing your financial transactions online.