Finance

How To Read Nonprofit Financial Statements

Published: December 23, 2023

Learn how to interpret and analyze nonprofit financial statements to gain valuable insights into their financial health and performance. Master the basics of finance in the nonprofit sector today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Nonprofit organizations play a vital role in society by addressing various social, environmental, and humanitarian issues. These organizations rely on their funding sources to carry out their missions effectively. To ensure transparency and accountability, nonprofits are required to prepare and publish financial statements that provide a snapshot of their financial health.

However, understanding nonprofit financial statements can be daunting for those without a background in finance. The terminology and complexity of these statements often make them seem like an impenetrable fortress of numbers and jargon. But fear not! In this article, we will demystify nonprofit financial statements and equip you with the knowledge to read and analyze them with confidence.

By gaining the ability to interpret nonprofit financial statements, you can assess an organization’s financial stability and effectiveness. This understanding will enable you to make informed decisions as a donor, board member, volunteer, or anyone interested in supporting nonprofit causes.

This article will provide a comprehensive overview of the three primary nonprofit financial statements: the balance sheet, the income statement, and the statement of cash flows. We will explain what each statement represents, how they are interconnected, and what critical information they reveal about an organization’s financial health.

In addition, we’ll explore the key components of financial statements, such as notes or footnotes, which provide additional context and details about the organization’s financial performance. These notes often disclose important information about the organization’s accounting policies, significant events, and contingent liabilities.

Furthermore, we’ll discuss how to analyze nonprofit financial statements by using common financial ratios and indicators. These ratios help evaluate an organization’s liquidity, solvency, and efficiency, allowing you to assess its financial strengths and weaknesses.

So, whether you’re a donor looking to support causes close to your heart, a potential board member wanting to make informed decisions, or simply interested in understanding how nonprofits manage their finances, this article will provide you with the essential knowledge to navigate the world of nonprofit financial statements.

Understanding Nonprofit Financial Statements

Nonprofit financial statements are formal records that provide a snapshot of an organization’s financial position, performance, and cash flows. They are vital tools for stakeholders to assess the financial health and sustainability of a nonprofit organization.

There are three main types of financial statements that nonprofits produce:

- The Balance Sheet: This statement provides a snapshot of an organization’s financial condition at a specific point in time. It reflects the organization’s assets, liabilities, and net assets (or fund balances). The balance sheet helps assess the organization’s liquidity and solvency.

- The Income Statement: Also known as the statement of activities, the income statement shows an organization’s revenues, expenses, gains, and losses over a specified period. It gives an overview of the organization’s financial performance and whether it has generated a surplus or a deficit.

- The Statement of Cash Flows: This statement provides information about an organization’s cash inflows and outflows during a specific period. It helps assess the organization’s ability to generate cash and its cash management practices.

Let’s explore each of these financial statements in more detail:

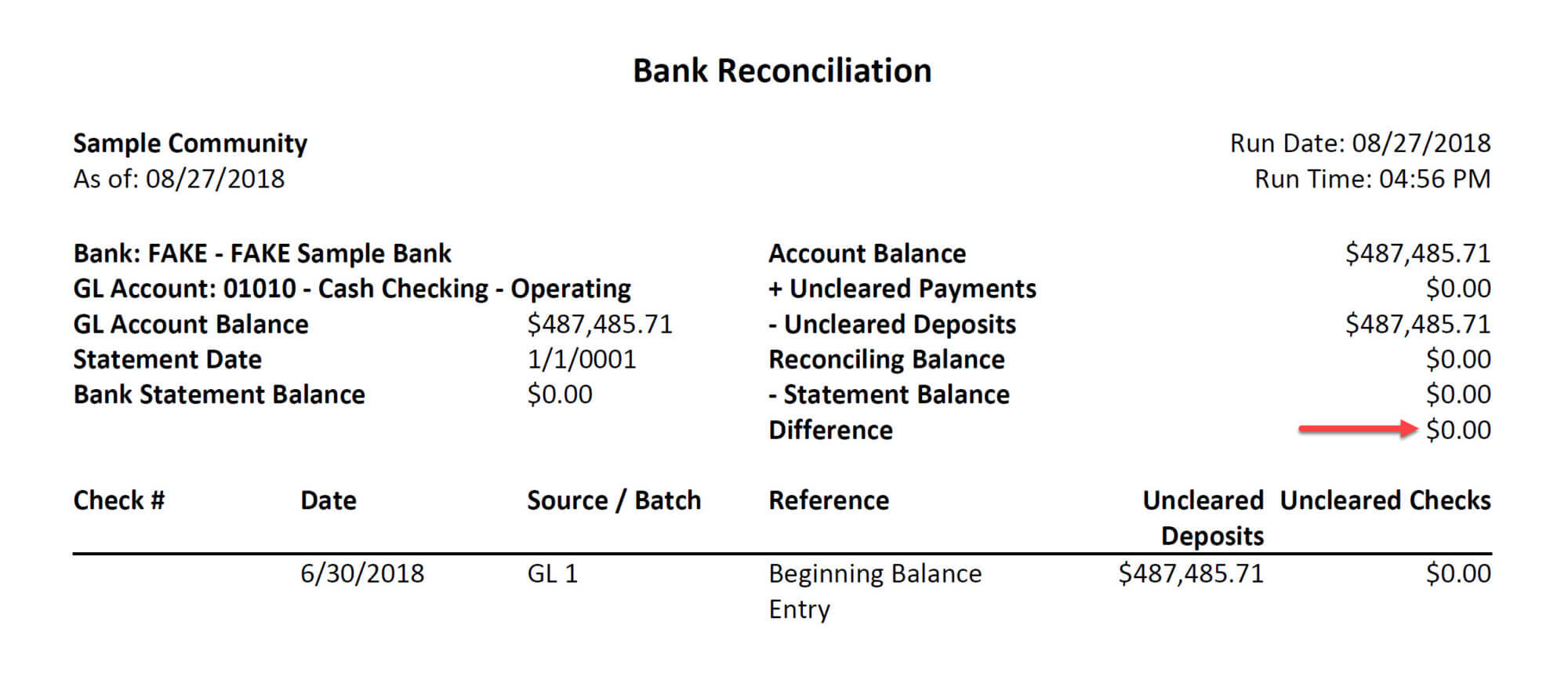

The Balance Sheet

The balance sheet presents an organization’s financial position at a specific point in time, usually the end of the fiscal year. It provides information about the organization’s assets, liabilities, and net assets. Assets include cash, investments, property, equipment, and other resources owned by the organization. Liabilities represent the organization’s debts, obligations, and financial commitments. Net assets, also known as fund balances, show the difference between the organization’s assets and liabilities. They provide an indication of the organization’s financial health, including its unrestricted, temporarily restricted, and permanently restricted funds.

The Income Statement

The income statement summarizes the organization’s revenues, expenses, gains, and losses over a specific period, such as a fiscal year. Revenues include donations, grants, program fees, and other sources of income. Expenses represent the costs incurred by the organization to deliver its programs and services, such as salaries, rent, utilities, and program expenses. The income statement shows whether the organization has generated a surplus (revenues exceed expenses) or a deficit (expenses exceed revenues). It provides insights into the organization’s financial performance and its ability to generate revenue to cover its operating expenses.

The Statement of Cash Flows

The statement of cash flows tracks the movement of cash into and out of the organization during a specific period. It categorizes cash flows into three main categories: operating activities, investing activities, and financing activities. Operating activities include the organization’s day-to-day revenue-generating and expenditure activities. Investing activities represent the organization’s buying or selling of investments or fixed assets. Financing activities reflect cash flows related to borrowing, repaying loans, and issuing or repurchasing shares. The statement of cash flows helps assess the organization’s ability to generate cash, meet financial obligations, and manage cash effectively.

Together, these financial statements provide a comprehensive view of an organization’s financial activities and help stakeholders understand its financial position, performance, and cash flows. They enable donors, board members, regulators, and other stakeholders to make informed decisions about supporting and collaborating with nonprofit organizations.

The Balance Sheet

The balance sheet is one of the fundamental financial statements that provides a snapshot of an organization’s financial position at a specific point in time. It outlines the organization’s assets, liabilities, and net assets, which together display the overall financial health and stability of the nonprofit.

Let’s delve into the key components of a balance sheet:

Assets

Assets represent the resources owned by the nonprofit organization. They can be categorized into current assets and non-current assets.

- Current assets: These are assets that are expected to be converted into cash or used up within a year. Examples include cash and cash equivalents, accounts receivable, inventory, and prepaid expenses. Current assets highlight the organization’s liquidity and its ability to meet short-term financial obligations.

- Non-current assets: These are assets that have a longer life span and are not expected to be liquidated or consumed within a year. Examples include property, equipment, investments, and intangible assets. Non-current assets demonstrate the organization’s long-term financial stability and capacity.

Liabilities

Liabilities are the financial obligations and debts incurred by the nonprofit organization. Like assets, liabilities are divided into current liabilities and non-current liabilities.

- Current liabilities: These are the organization’s short-term obligations that are due within a year. Examples include accounts payable, accrued expenses, and short-term loans. Current liabilities indicate the organization’s ability to meet its immediate financial obligations.

- Non-current liabilities: These are the organization’s long-term debts and obligations that are not due within a year. Examples include long-term loans, bonds, and lease liabilities. Non-current liabilities reflect the organization’s long-term financial commitments.

Net Assets

Net assets (also called fund balances) represent the residual interest in the organization’s assets after deducting its liabilities. Net assets are divided into three categories:

- Unrestricted net assets: These are funds that are not subject to any donor-imposed restrictions. They are available to fund the organization’s ongoing operations and programs.

- Temporarily restricted net assets: These are funds that have donor-imposed restrictions, which limit their use to specific purposes or time frames. They are released from restrictions as the conditions specified by the donors are met or over time.

- Permanently restricted net assets: These are funds that have permanent donor-imposed restrictions and cannot be spent by the organization. Generally, the investment earnings generated by these funds are used to support the organization’s programs.

By analyzing the balance sheet, stakeholders can assess an organization’s financial stability, liquidity, and its ability to meet its financial obligations. A robust balance sheet with healthy assets, manageable liabilities, and adequate net assets showcases a financially sound organization. However, if the balance sheet displays excessive liabilities, limited assets, or negative net assets, it may indicate financial challenges that need to be addressed.

Keep in mind that the balance sheet is just one aspect of the overall financial picture of a nonprofit organization. Analyzing the balance sheet in conjunction with other financial statements and considering the organization’s mission, objectives, and external factors will provide a more comprehensive understanding of its financial health.

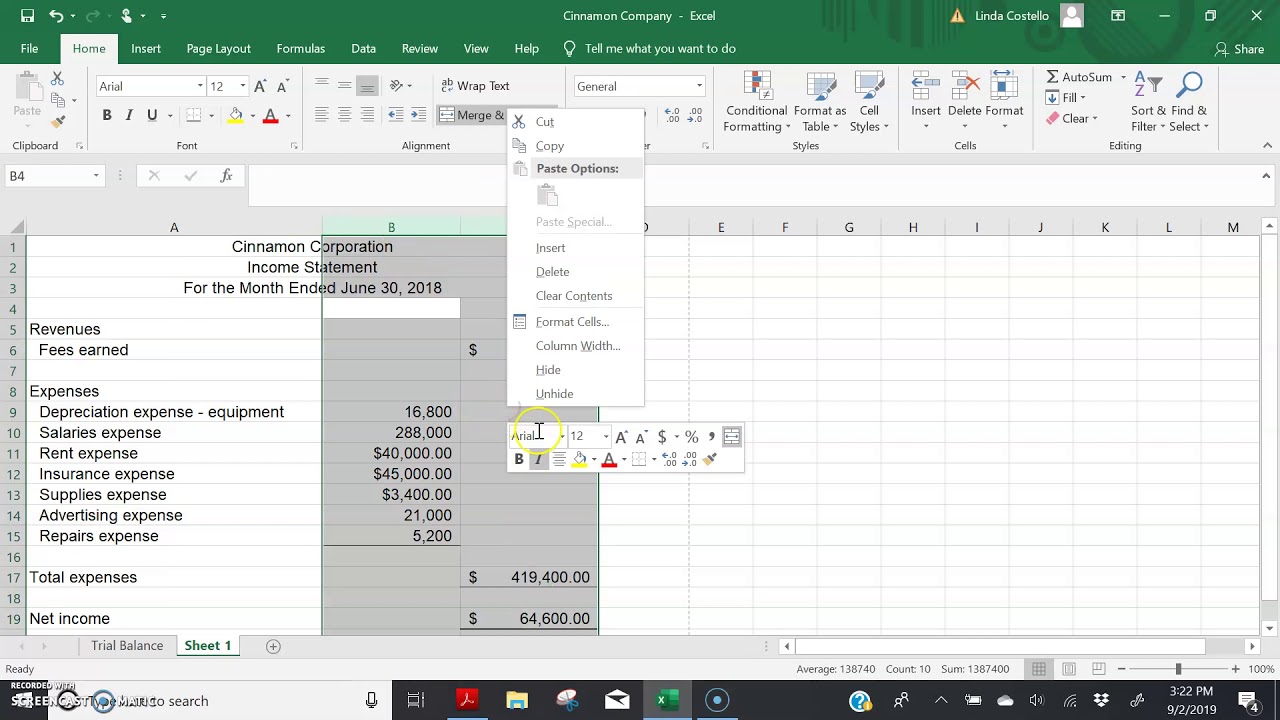

The Income Statement

The income statement, also known as the statement of activities, provides a summary of an organization’s revenues, expenses, gains, and losses over a specific period. It offers insights into the financial performance of the nonprofit and whether it has generated a surplus or a deficit.

Let’s explore the key components of an income statement:

Revenues

Revenues, also referred to as income or support, represent the inflow of funds or economic benefits to the nonprofit organization. These can include donations, grants, program fees, membership dues, fundraising events, and other sources of income. Revenues are classified into three main categories:

- Operating revenues: These are revenues generated from the nonprofit’s primary activities, such as program service fees or sales of goods or services related to its mission.

- Contributed revenues: These are revenues received from external sources, such as donations, grants, sponsorships, or in-kind contributions.

- Investment and other revenues: These are revenues derived from investments, rent, royalties, or other miscellaneous income sources.

Expenses

Expenses are the costs incurred by the nonprofit in carrying out its programs and activities. They can include salaries and benefits, rent, utilities, supplies, professional services, marketing, and other operational expenses. Expenses are typically classified into program expenses, administrative expenses, and fundraising expenses. Program expenses are directly related to the organization’s mission and the delivery of its programs and services.

Gains and Losses

Gains and losses are additional components that appear on the income statement. Gains represent increases in the organization’s net assets resulting from activities other than its primary operations, such as the sale of assets or investments. Losses, on the other hand, represent decreases in net assets due to activities not directly related to the nonprofit’s core operations.

Surplus/Deficit

The surplus or deficit is the net result of comparing revenues and gains with expenses and losses. If revenues and gains exceed expenses and losses, the nonprofit generates a surplus. This surplus can be reinvested in the organization’s programs or saved for future use. Conversely, if expenses and losses exceed revenues and gains, the nonprofit incurs a deficit, indicating a financial shortfall that needs to be addressed.

By analyzing the income statement, stakeholders can assess the financial performance and effectiveness of the nonprofit organization. A positive surplus indicates that the organization has generated enough resources to cover its expenses and support its mission. On the other hand, a consistent deficit may suggest financial challenges that require attention.

It’s important to note that the income statement provides a snapshot of financial performance over a specific period, but it may not capture the full extent of the organization’s impact or long-term sustainability. Evaluating the income statement alongside other financial statements, as well as considering the organization’s mission, strategic goals, and external factors, will provide a more well-rounded understanding of its financial position and performance.

The Statement of Cash Flows

The statement of cash flows is a financial statement that provides information about the cash inflows and outflows of a nonprofit organization during a specific period. It helps stakeholders understand how the organization generates and uses cash, assess its liquidity, and evaluate its cash management practices.

Let’s explore the key components of a statement of cash flows:

Operating Activities

Operating activities represent the cash flows generated or utilized from the nonprofit’s day-to-day operations. These activities include cash received from program fees, donations, grants, and other revenue sources, as well as cash paid for salaries and benefits, program expenses, rent, utilities, and other operational expenses. The net result of these operating activities provides insights into the organization’s ability to generate cash from its core operations.

Investing Activities

Investing activities reflect the cash flows related to the acquisition or disposal of long-term assets and investments. This can include purchases or sales of property, equipment, or other fixed assets, as well as the purchase or sale of investments such as stocks or bonds. The cash flows from investing activities help stakeholders understand the organization’s investment decisions and assess its long-term financial stability.

Financing Activities

Financing activities represent the cash flows related to financing the nonprofit’s operations and activities. This includes cash received from borrowing, the issuance of bonds or stocks, and cash payments for debt repayment, share repurchases, or dividend distributions. The financing activities section of the statement of cash flows helps evaluate the organization’s capital structure, debt management, and overall financial sustainability.

Net Cash Flow

The statement of cash flows concludes with the net cash flow, which is the overall change in the organization’s cash position during the specified period. It is calculated by summing the cash flows from operating, investing, and financing activities. A positive net cash flow indicates an increase in cash resources, while a negative net cash flow represents a decrease in cash resources.

By analyzing the statement of cash flows, stakeholders can gain a deeper understanding of the nonprofit’s cash management practices and its ability to generate and utilize cash effectively. It helps assess the organization’s liquidity, cash flow generation, and ability to meet its financial obligations.

It’s important to note that the statement of cash flows, combined with other financial statements, provides a comprehensive picture of the organization’s financial performance and allows stakeholders to make informed decisions. Evaluating the statement of cash flows in conjunction with the balance sheet and income statement provides a holistic view of the organization’s financial activities and assists in understanding its overall financial health and sustainability.

Notes to the Financial Statements

Notes to the financial statements, also known as footnotes, provide additional information and disclosures that accompany the main financial statements. They offer clarification and context, helping stakeholders better understand the organization’s financial performance and position. These notes are an essential part of the financial reporting process and provide valuable insights into the nonprofit’s accounting policies, significant events, and potential risks and contingencies.

Here are some key aspects covered in the notes to the financial statements:

Accounting Policies

The notes to the financial statements outline the accounting policies adopted by the nonprofit. These policies explain how the organization recognizes, measures, and reports its assets, liabilities, revenues, and expenses. It helps stakeholders understand the principles and methods employed in the preparation of the financial statements, ensuring consistency and comparability.

Significant Events

The notes may disclose significant events that occurred during the reporting period or subsequent to the balance sheet date. These events can include changes in leadership, mergers or acquisitions, legal proceedings, or other material events that could impact the nonprofit’s financial position or operations. Such disclosures assist stakeholders in understanding the potential risks and opportunities associated with the organization.

Related Party Transactions

Related party transactions refer to transactions that the nonprofit engages in with individuals or organizations related to the organization, such as board members, key management personnel, and their close family members. These notes provide details about the nature of these transactions and any potential conflicts of interest that may arise. Understanding related party transactions allows stakeholders to assess the fairness and transparency of financial dealings within the organization.

Contingencies

Contingencies refer to potential liabilities or obligations that may arise in the future, depending on the outcome of uncertain events. The notes to the financial statements disclose details about contingent liabilities, legal disputes, or potential financial risks that may impact the nonprofit’s financial position. These disclosures enable stakeholders to evaluate the potential impact of contingencies on the organization’s financial health and decision-making.

It is crucial for stakeholders to review and consider the information provided in the notes to the financial statements alongside the main financial statements. The notes provide additional context and transparency, helping stakeholders make informed assessments about the nonprofit’s financial performance, position, and risks.

Understanding the information presented in the notes enhances the overall understanding of the organization’s financial statements and contributes to more accurate analysis and decision-making.

Analyzing Nonprofit Financial Statements

Analyzing nonprofit financial statements is essential for stakeholders to gain insights into the organization’s financial health, performance, and sustainability. While each financial statement provides valuable information, a holistic analysis involves considering all financial statements together and utilizing key financial ratios and indicators.

Common Ratios and Indicators

Here are some commonly used financial ratios and indicators to analyze nonprofit financial statements:

- Liquidity ratios: These ratios assess the organization’s ability to meet short-term financial obligations. Common liquidity ratios include the current ratio (current assets divided by current liabilities) and the quick ratio (cash and cash equivalents plus short-term investments divided by current liabilities).

- Solvency ratios: These ratios determine the organization’s long-term financial stability and ability to meet long-term obligations. Key solvency ratios include the debt-to-equity ratio (total liabilities divided by total net assets) and the long-term debt ratio (long-term debt divided by total assets).

- Efficiency ratios: These ratios measure how effectively the nonprofit utilizes its resources. Examples include program expense ratio (program expenses divided by total expenses), fundraising efficiency ratio (fundraising expenses divided by contributions), and administrative expense ratio (administrative expenses divided by total expenses).

- Revenue and expense trends: Analyzing the organization’s revenue and expense trends over time provides insights into its financial stability and sustainability. Assessing the growth rate of revenue sources, such as donations or program fees, and monitoring expense trends relative to revenue changes helps evaluate financial performance.

- Financial sustainability: Determining the organization’s financial sustainability involves evaluating its ability to generate enough revenue to cover expenses in the long term. This analysis includes assessing the surplus or deficit trends, the diversification of revenue sources, and the organization’s ability to maintain appropriate levels of reserves or endowment funds.

Key Takeaways

When analyzing nonprofit financial statements, it is important to consider the following key takeaways:

- Financial statements provide valuable information about the organization’s financial position, performance, and cash flows.

- Combining all financial statements and considering key ratios and indicators helps assess overall financial health.

- Regularly reviewing trends and comparing ratios to industry benchmarks or previous periods provides insights into the organization’s financial stability and progress.

- Understanding the organization’s mission, strategic goals, and external factors is essential for contextualizing financial information.

- Lastly, it is crucial to analyze financial statements in conjunction with other non-financial information, such as program impact, governance practices, and regulatory compliance.

By analyzing nonprofit financial statements, stakeholders can make informed decisions, assess the organization’s financial viability, identify areas for improvement, and ensure transparency and accountability in the nonprofit sector.

Common Ratios and Indicators

When analyzing nonprofit financial statements, using key financial ratios and indicators helps stakeholders gain a deeper understanding of the organization’s financial health, performance, and efficiency. These ratios provide insights into various aspects of the nonprofit’s financial management and can be compared to industry benchmarks or past performance to assess progress and identify areas of improvement.

Liquidity Ratios

Liquidity ratios assess the nonprofit’s ability to meet its short-term obligations. They measure the organization’s capacity to generate cash quickly to cover immediate liabilities. Some common liquidity ratios include:

- Current Ratio: This ratio is calculated by dividing current assets by current liabilities. It indicates whether the organization has sufficient current assets to cover its current liabilities.

- Quick Ratio: Also known as the acid-test ratio, the quick ratio is calculated by dividing the sum of cash, cash equivalents, and short-term investments by current liabilities. It measures the nonprofit’s ability to meet current obligations without relying on inventory or other non-liquid assets.

Solvency Ratios

Solvency ratios evaluate the organization’s long-term financial stability and ability to meet its long-term obligations. They provide insights into the nonprofit’s capital structure and financial sustainability. Some common solvency ratios include:

- Debt-to-Equity Ratio: This ratio measures the proportion of debt relative to equity and is calculated by dividing total liabilities by total net assets. A lower ratio indicates a healthier balance between debt and equity.

- Long-Term Debt Ratio: The long-term debt ratio is calculated by dividing long-term debt by total assets. It shows the percentage of total assets funded by long-term debt and reflects the organization’s level of financial leverage.

Efficiency Ratios

Efficiency ratios assess how effectively the nonprofit utilizes its resources and funds to achieve its mission. These ratios measure the organization’s operational efficiency and effectiveness. Some common efficiency ratios include:

- Program Expense Ratio: This ratio compares program expenses to total expenses and reflects the percentage of expenses that directly contribute to the organization’s programs and services.

- Fundraising Efficiency Ratio: The fundraising efficiency ratio compares fundraising expenses to contributions received and indicates the efficiency of the nonprofit’s fundraising efforts.

- Administrative Expense Ratio: This ratio compares administrative expenses to total expenses and measures the portion of expenses allocated to administrative functions.

Revenue and Expense Trends

Examining revenue and expense trends over time provides insights into the nonprofit’s financial stability and sustainability. Monitoring the growth rate of revenue sources, such as individual donations, grants, or program fees, and analyzing expense trends relative to revenue changes helps identify financial patterns and assess the organization’s financial performance.

Financial Sustainability

Financial sustainability measures the nonprofit’s ability to generate enough revenue to cover its expenses in the long term. It involves assessing various financial factors, such as surplus or deficit trends, diversification of revenue sources, and the organization’s ability to maintain appropriate levels of reserves or endowment funds. Understanding the nonprofit’s financial sustainability helps stakeholders gauge its long-term viability and ability to fulfill its mission effectively.

When analyzing nonprofit financial statements, it is important to consider these ratios and indicators in conjunction with other relevant information and factors specific to the organization. Comparing ratios to industry benchmarks or previous periods and interpreting them within the broader context of the nonprofit’s goals and external environment enhances the effectiveness of financial analysis and decision-making.

Key Takeaways

When analyzing nonprofit financial statements, there are several key takeaways to keep in mind. Understanding these points will provide valuable insights into the organization’s financial health and help stakeholders make informed decisions:

- Comprehensive Analysis: Analyzing financial statements requires considering all statements together, including the balance sheet, income statement, and statement of cash flows. A holistic approach provides a comprehensive understanding of the nonprofit’s financial position and performance.

- Financial Ratios and Indicators: Utilize key financial ratios and indicators to gain insights into liquidity, solvency, efficiency, revenue trends, expense trends, and financial sustainability. These ratios and indicators help evaluate the organization’s financial stability, operational efficiency, and long-term viability.

- Comparisons: Compare financial ratios and indicators to industry benchmarks or the nonprofit’s historical performance. This allows for meaningful analysis of trends over time and provides context for assessing the nonprofit’s financial performance relative to its peers.

- Context Matters: Consider the nonprofit’s mission, strategic goals, and external factors when interpreting financial statements. Understanding the unique factors that impact the organization’s financial situation will provide a more accurate assessment of its financial health.

- Non-Financial Factors: Remember that financial statements only provide part of the picture. Consider non-financial factors, such as program impact, governance practices, compliance with regulations, and alignment with the organization’s mission. These factors contribute to a comprehensive assessment of the nonprofit’s overall performance and effectiveness.

- Regular Review: Analyze financial statements regularly to monitor trends and identify areas for improvement. Regular review allows for proactive decision-making and helps ensure ongoing financial stability and sustainability.

- Engage Experts: If necessary, seek the expertise of financial professionals, such as accountants or finance consultants, to assist with the analysis of nonprofit financial statements. Their specialized knowledge can provide valuable insights and guidance.

By keeping these key takeaways in mind, stakeholders can develop a deeper understanding of the nonprofit’s financial position, make informed decisions, identify areas for improvement, and ensure transparency and accountability in the management of nonprofit organizations.

Conclusion

Understanding nonprofit financial statements is crucial for stakeholders to assess the financial health and sustainability of nonprofit organizations. By analyzing the balance sheet, income statement, and statement of cash flows, stakeholders can gain insights into the organization’s financial position, performance, and cash management practices.

The balance sheet provides a snapshot of the nonprofit’s assets, liabilities, and net assets, reflecting its financial condition at a specific point in time. The income statement summarizes revenues, expenses, gains, and losses, giving an overview of financial performance. The statement of cash flows tracks cash inflows and outflows, helping assess the organization’s cash flow generation and management.

Notes to the financial statements provide additional information, clarifying accounting policies, significant events, related party transactions, and contingencies. These notes add context and transparency to the financial statements, aiding stakeholders in making informed decisions.

When analyzing nonprofit financial statements, stakeholders can utilize common financial ratios and indicators to assess liquidity, solvency, efficiency, revenue and expense trends, and financial sustainability. By comparing these ratios to benchmarks or past performance and considering the organization’s mission and external factors, stakeholders evaluate the nonprofit’s financial performance in a broader context.

In conclusion, analyzing nonprofit financial statements is an essential practice for donors, board members, regulators, and other stakeholders. It enables informed decision-making, ensures transparency and accountability, and contributes to the overall financial health and effectiveness of nonprofit organizations. By understanding and interpreting the financial statements, stakeholders can support the missions of nonprofits and work towards positive social impact.