Finance

What Is A Power Checking Account

Modified: February 21, 2024

Looking for a finance solution? Learn more about power checking accounts and how they can help with your financial goals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Power Checking Account

- Features and Benefits of a Power Checking Account

- How to Open a Power Checking Account

- Comparison of Power Checking Accounts with Regular Checking Accounts

- Tips for Maximizing the Benefits of a Power Checking Account

- Common Misconceptions about Power Checking Accounts

- Conclusion

Introduction

Managing your finances effectively is essential for achieving your financial goals and enjoying peace of mind. One important aspect of financial management is finding the right banking products that can help you make the most of your money. One such product that can greatly benefit individuals is a Power Checking Account.

A Power Checking Account is a type of bank account that offers a range of features and benefits designed to optimize your banking experience. It combines the convenience of a traditional checking account with enhanced perks to help you maximize your financial potential.

In this article, we will explore the ins and outs of Power Checking Accounts, providing you with a comprehensive understanding of what they are and how they can benefit you. We will delve into the various features and benefits that make Power Checking Accounts stand out, as well as provide tips on how to open one and make the most of it.

Whether you’re a financial novice or an experienced investor, having a Power Checking Account can be a game-changer in managing your money effectively. Let’s dive into the details and discover how a Power Checking Account can empower your financial journey.

Definition of a Power Checking Account

A Power Checking Account is a specialized type of checking account that offers additional features and benefits beyond those of a regular checking account. It is designed to provide customers with enhanced tools and services to optimize their banking experience and help them achieve their financial goals.

One of the key features that sets a Power Checking Account apart is the ability to earn higher interest rates on your deposits compared to a regular checking account. This means that the money you keep in your account can grow at a faster rate, helping you maximize your savings potential.

In addition to higher interest rates, Power Checking Accounts often come with added perks such as ATM fee reimbursements, unlimited check-writing privileges, and access to exclusive banking services. These benefits are meant to provide convenience and flexibility to account holders, making it easier to manage their finances effectively.

Another defining characteristic of a Power Checking Account is the ability to earn various rewards and incentives based on your account activity. This may include cashback rewards on debit card purchases, bonus interest for maintaining a certain balance, or even discounts on loans and other financial products.

Furthermore, a Power Checking Account may offer additional security measures to protect your funds. This can include features like identity theft protection, overdraft protection, and fraud monitoring, giving you peace of mind knowing that your money is safe.

It’s important to note that the specific features and benefits offered by Power Checking Accounts can vary depending on the financial institution. Therefore, it is crucial to carefully compare the options available to find a Power Checking Account that aligns with your financial needs and goals.

In the next section, we will explore the various features and benefits that you can expect from a Power Checking Account, helping you understand why it can be a valuable tool in managing your finances.

Features and Benefits of a Power Checking Account

A Power Checking Account offers a range of features and benefits that go beyond what a regular checking account provides. These features are designed to help you optimize your banking experience and make the most of your financial resources. Let’s take a closer look at some of the key features and benefits of a Power Checking Account:

1. Higher Interest Rates:

One of the primary advantages of a Power Checking Account is the opportunity to earn higher interest rates on your deposits. This means that your money grows at a faster rate, helping you maximize your savings potential. With higher interest rates, your account balance can generate more income over time, allowing you to achieve your financial goals more quickly.

2. ATM Fee Reimbursements:

Many Power Checking Accounts offer ATM fee reimbursements, which means that you can use any ATM without incurring fees. This is particularly advantageous for those who frequently use ATMs and want the convenience of accessing cash whenever and wherever they need it, without worrying about extra fees eating into their funds.

3. Exclusive Banking Services:

Power Checking Accounts often come with access to exclusive banking services, such as dedicated customer support, discounted loan rates, and priority services at the bank. These additional perks can help you streamline your banking experience and provide peace of mind knowing that you have personalized assistance and specialized offerings.

4. Rewards and Incentives:

Another notable benefit of Power Checking Accounts is the opportunity to earn rewards and incentives based on your account activity. This can include cashback rewards on debit card purchases, bonus interest for maintaining a certain balance, or even discounts on loans and other financial products. These incentives add value to your banking relationship and can help you make the most of your money.

5. Enhanced Security Measures:

A Power Checking Account often comes with additional security measures to protect your funds. This can include features like identity theft protection, overdraft protection, and fraud monitoring. These security measures provide peace of mind, ensuring that your money is safeguarded and minimizing the risk of unauthorized access.

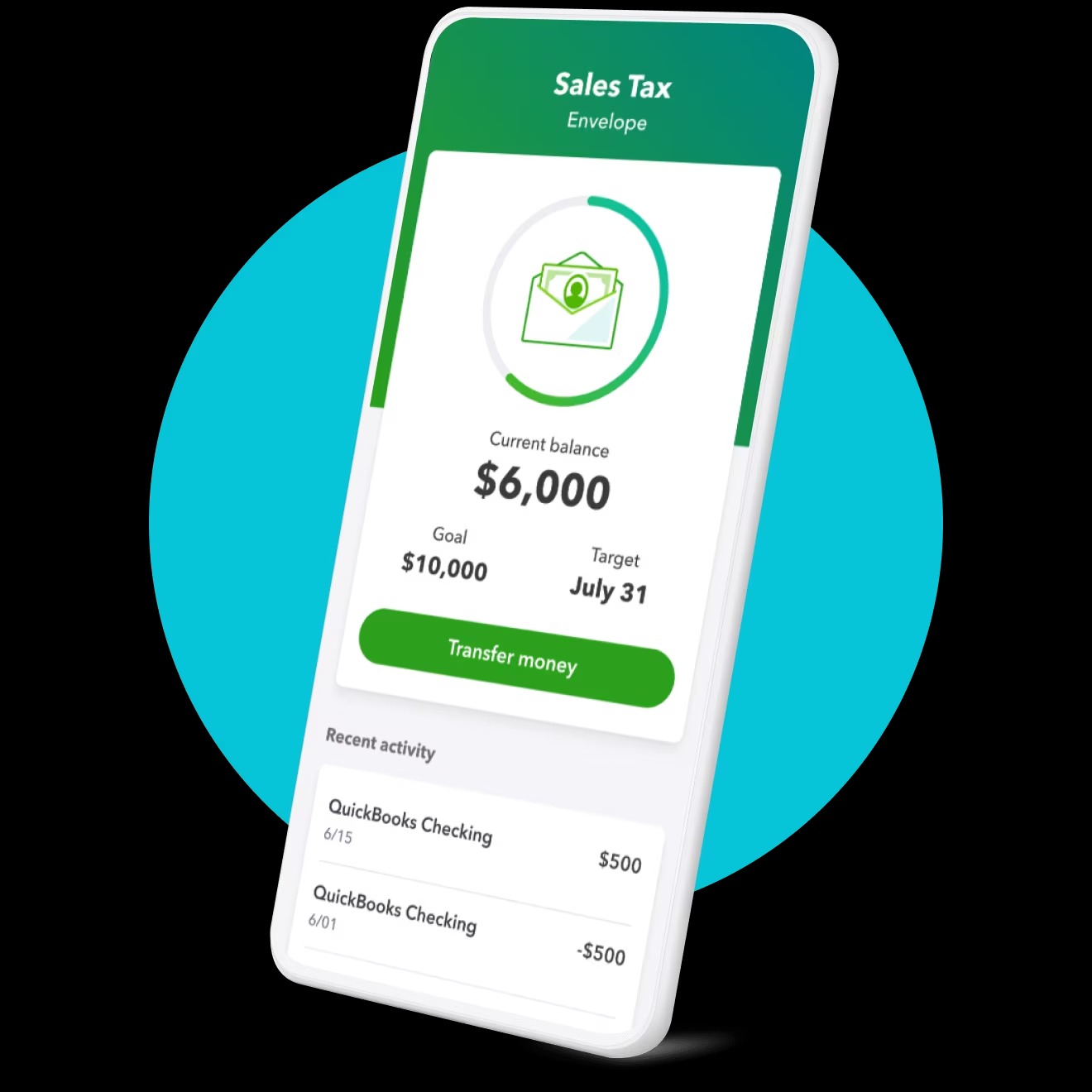

6. Convenient Account Management:

Power Checking Accounts typically offer advanced online and mobile banking tools that make managing your finances more convenient. You can easily view your account balance, transfer funds, pay bills, and track your expenses from the comfort of your home or on the go. This convenience allows you to have better control over your finances and save time.

By harnessing these features and benefits, a Power Checking Account can help you optimize your banking experience and achieve your financial goals more efficiently. In the next section, we will explore the process of opening a Power Checking Account and the factors to consider in selecting the right one for you.

How to Open a Power Checking Account

If you’re interested in opening a Power Checking Account, the process is similar to opening a regular checking account. However, there are a few factors to consider in order to find the right Power Checking Account for your needs. Here are some steps to guide you through the process:

1. Research Financial Institutions:

Start by researching different financial institutions that offer Power Checking Accounts. Look for reputable banks or credit unions that align with your financial goals and values. Consider factors such as customer reviews, fees, interest rates, and available perks when comparing different institutions.

2. Compare Account Terms and Conditions:

Take the time to compare the terms and conditions associated with different Power Checking Accounts. Look for specifics such as minimum balance requirements, monthly maintenance fees, transaction limits, and any additional perks or benefits that are important to you. This will help you narrow down your options and find the account that best fits your needs.

3. Gather Required Documents:

Before opening a Power Checking Account, you will typically need to provide certain documents. These may include identification such as a valid government-issued ID, proof of address, and social security number. Some financial institutions may also require proof of employment or income.

4. Visit a Branch or Apply Online:

Once you have chosen a financial institution and gathered the necessary documents, you can either visit a branch in person or apply online to open your Power Checking Account. If you prefer the convenience of digital banking, many banks offer a seamless online application process that allows you to open an account from the comfort of your own home.

5. Fund Your Account:

After your application is approved, you will need to fund your Power Checking Account. You can typically do this by transferring funds from another bank account, depositing a check, or making a cash deposit at a branch or ATM. The specific funding options will depend on the policies of the financial institution.

6. Activate Your Account:

Once your account is funded, you will need to activate it. This typically involves logging into your online banking portal, setting up a secure password, and verifying your identity. Some financial institutions may send you a debit card or checks to use with your Power Checking Account, which you will need to activate as well.

By following these steps, you can successfully open a Power Checking Account and start enjoying the enhanced features and benefits it offers. In the next section, we will compare Power Checking Accounts with regular checking accounts to help you understand the differences between the two.

Comparison of Power Checking Accounts with Regular Checking Accounts

When it comes to managing your finances, choosing the right type of checking account is crucial. While both Power Checking Accounts and regular checking accounts serve the purpose of providing a safe and accessible place to store your money, there are some key differences between the two. Let’s compare Power Checking Accounts with regular checking accounts to help you make an informed decision:

Interest Rates:

One of the main differences between the two types of accounts is the interest rates offered. Regular checking accounts typically offer very low or no interest on your deposits, meaning your money doesn’t earn much (if any) additional income. In contrast, Power Checking Accounts often provide higher interest rates, allowing your money to grow at a faster pace and potentially increase your savings over time.

Fees and Minimum Balance Requirements:

Regular checking accounts may have monthly maintenance fees and require minimum balance thresholds to avoid these fees. These fees can eat into your funds if you don’t meet the requirements. Power Checking Accounts, on the other hand, may have higher minimum balance requirements to earn the enhanced benefits but often offer fee waivers or lower fees compared to regular checking accounts.

Perks and Benefits:

Power Checking Accounts typically come with additional perks and benefits that regular checking accounts may not offer. These enhancements can include ATM fee reimbursements, cashback rewards on debit card purchases, discounts on loans or other financial products, extended customer support, and much more. Regular checking accounts may have fewer, if any, added benefits.

Account Management Tools:

Power Checking Accounts often come with advanced online and mobile banking tools that provide convenient account management options. From easily checking your account balance to transferring money, paying bills, and even setting up automatic savings transfers, these tools make it simpler to stay on top of your finances. Regular checking accounts may offer basic online banking features but may lack some of the more advanced functionalities.

Access to Exclusive Services:

Power Checking Account holders may have access to exclusive banking services that regular checking account holders do not. These may include personalized financial advice, discounted loan rates, priority customer support, and specialized wealth management services. Regular checking accounts typically do not provide these personalized offerings.

It’s important to carefully consider your financial needs and goals when choosing between a Power Checking Account and a regular checking account. If you are someone who maintains a higher balance and wants to maximize your savings potential, a Power Checking Account may be a more suitable option. However, if you prefer a basic checking account without the additional features and requirements, a regular checking account may better fit your needs.

In the next section, we will provide tips for maximizing the benefits of a Power Checking Account, helping you make the most of this specialized banking product.

Tips for Maximizing the Benefits of a Power Checking Account

Once you have opened a Power Checking Account, there are several strategies you can employ to maximize the benefits and get the most out of your account. Here are some tips to help you make the most of your Power Checking Account:

1. Maintain the Minimum Balance:

To fully benefit from a Power Checking Account, it’s important to maintain the minimum balance required to earn the enhanced perks and benefits. This may include keeping a certain amount of money in your account on a regular basis. By doing so, you can take advantage of higher interest rates and fee waivers that come with maintaining the minimum balance.

2. Utilize ATM Fee Reimbursements:

If your Power Checking Account offers ATM fee reimbursements, make sure to take advantage of this perk. Instead of restricting yourself to specific ATMs, you can use any ATM without worrying about incurring extra fees. This can save you money over time, especially if you frequently need to withdraw cash or use ATMs.

3. Maximize Cashback Rewards:

If your Power Checking Account provides cashback rewards on debit card purchases, make it a habit to use your debit card for everyday expenses. By doing so, you can earn cashback rewards on your everyday spending, turning your regular purchases into added savings. Keep track of any specific categories or spending thresholds that may apply to optimize your cashback earnings.

4. Take Advantage of Exclusive Banking Services:

Explore the exclusive banking services and perks that come with your Power Checking Account. If there are discounts on loans, financial planning services, or specialized customer support available, make use of these offerings. Take advantage of the specialized services that can help you achieve your financial goals and make the most of your banking relationship.

5. Set Up Automatic Savings Transfers:

To grow your savings effortlessly, consider setting up automatic transfers from your Power Checking Account to a savings account. Determine a specific amount to transfer each month and schedule the transfer. This way, you can consistently build your savings without having to think about it actively. It helps to boost your savings without much effort.

6. Stay Engaged with Online Banking Tools:

Take advantage of the advanced online and mobile banking tools offered by your Power Checking Account. Regularly log in to your online banking portal or mobile app to monitor your account, review transactions, and track your spending. By staying engaged with your account, you can better manage your finances, identify areas for improvement, and make informed financial decisions.

By following these tips, you can make the most of your Power Checking Account and maximize its benefits. Remember to regularly review your account to ensure that you are optimizing the features and perks that come with it. In the next section, we will address some common misconceptions about Power Checking Accounts.

Common Misconceptions about Power Checking Accounts

Power Checking Accounts offer a range of benefits and features that can greatly enhance your banking experience. However, there are some common misconceptions surrounding these accounts that may cause confusion or hesitation. Let’s debunk some of the most common misconceptions about Power Checking Accounts:

1. Power Checking Accounts are only for wealthy individuals:

Contrary to popular belief, Power Checking Accounts are not exclusive to wealthier individuals. While some accounts may have higher minimum balance requirements, there are options available for individuals at different income levels. It’s important to research and compare different Power Checking Accounts to find one that aligns with your financial situation and goals.

2. Power Checking Accounts have excessive fees:

While it’s true that some Power Checking Accounts may have fees associated with them, it is a misconception to assume that all of them have excessive fees. In fact, many financial institutions offer Power Checking Accounts with lower fees and even fee waivers if certain requirements are met. It’s essential to carefully review the account terms and conditions to understand the fee structure before opening an account.

3. Power Checking Accounts are the same as regular checking accounts:

While Power Checking Accounts share some similarities with regular checking accounts, such as the ability to write checks and make electronic transactions, they offer additional features and benefits that set them apart. These may include higher interest rates, ATM fee reimbursements, rewards and incentives, and exclusive services. It’s important to carefully evaluate the differences between Power Checking Accounts and regular checking accounts to make an informed decision.

4. Power Checking Accounts are complicated to open and manage:

Opening and managing a Power Checking Account is typically no more complicated than a regular checking account. Many financial institutions offer a streamlined application process, whether it’s online or in-person. Additionally, the account management tools provided by Power Checking Accounts are designed to be user-friendly and convenient, making it easy to manage your funds and track your transactions.

5. Power Checking Accounts have limited access to ATMs:

Another misconception is that Power Checking Accounts have limited ATM access. In reality, many Power Checking Accounts offer widespread ATM networks, allowing you to withdraw cash or make deposits at a variety of ATMs. Additionally, some accounts even provide ATM fee reimbursements, meaning that you can use any ATM without worrying about extra fees.

6. Power Checking Accounts are not worth the effort:

Some individuals may be hesitant to open a Power Checking Account, believing that the benefits are not worth the effort. However, the enhanced interest rates, perks, and rewards associated with Power Checking Accounts can provide significant financial advantages in the long run. By carefully selecting an account that aligns with your financial goals and utilizing the various features, you can make the most of your banking experience and maximize your savings potential.

By debunking these common misconceptions, it becomes clear that Power Checking Accounts can be a valuable tool for individuals looking to optimize their banking experience and make the most of their finances. In the next section, we will conclude our discussion on Power Checking Accounts and summarize their benefits.

Conclusion

A Power Checking Account can be a game-changer in managing your finances effectively. By offering higher interest rates, additional perks and benefits, and exclusive banking services, Power Checking Accounts are designed to help you optimize your banking experience and achieve your financial goals.

Throughout this article, we have explored the definition of a Power Checking Account, taking a closer look at its features and benefits. We have discussed the process of opening a Power Checking Account and provided tips for maximizing the benefits of this specialized account. Additionally, we addressed common misconceptions surrounding Power Checking Accounts to provide a clear understanding of their advantages.

It is important to remember that not all Power Checking Accounts are created equal. Different financial institutions may offer varying perks, interest rates, and fees, so it is crucial to carefully compare your options before making a decision. Consider your financial goals, banking preferences, and the features that are most important to you.

Whether you want to earn higher interest on your deposits, enjoy ATM fee reimbursements, or access exclusive banking services, a Power Checking Account can provide the tools you need to make the most of your money. By utilizing the tips provided and staying actively engaged with your account, you can maximize the benefits and achieve your financial objectives more efficiently.

In conclusion, a Power Checking Account offers a range of advantages that can greatly enhance your banking experience. It provides an opportunity to grow your savings, earn rewards and incentives, and access exclusive services. By choosing the right Power Checking Account and utilizing its features effectively, you can take control of your finances and work towards a more secure and prosperous financial future.