Finance

How To Turn Cash Into Credit

Modified: March 1, 2024

Learn how to turn your cash into credit with our comprehensive guide on managing your finances and improving your credit score. Maximize your financial potential and unlock better opportunities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Importance of Credit

- Differences Between Cash and Credit

- Benefits of Building Credit

- Steps to Turn Cash into Credit

- Opening a Bank Account

- Applying for a Secured Credit Card

- Making Small Purchases and Paying Them Off

- Building a Positive Payment History

- Graduating to an Unsecured Credit Card

- Managing Credit Responsibly

- Tips for Success in Turning Cash into Credit

- Conclusion

Introduction

Welcome to the world of personal finance, where having good credit can open doors to countless opportunities. Whether you’re dreaming of buying your first home, starting a business, or simply securing better interest rates on loans and credit cards, a strong credit score is essential. But what if you don’t have any credit history? How can you turn your hard-earned cash into a valuable credit asset?

Many people rely solely on cash for their daily expenses, which can be practical and efficient. However, relying solely on cash means missing out on the benefits and convenience offered by credit. Building credit is not only about establishing a track record of responsible borrowing but also about showing lenders and financial institutions that you can manage credit effectively. This article will guide you on how to turn your cash into credit and unlock the financial opportunities that come with it.

Before we dive into the steps of building credit, let’s first understand the key differences between cash and credit.

Understanding the Importance of Credit

Credit plays a crucial role in our modern financial system. It is a measure of your ability to borrow money and repay it over time. Lenders, landlords, insurance companies, and even potential employers may use your credit history to evaluate your financial responsibility and trustworthiness.

Having a good credit score can provide several advantages. First and foremost, it increases your chances of being approved for loans and credit cards. Lenders are more likely to offer favorable terms, such as lower interest rates and higher credit limits, to individuals with good credit. A strong credit score can also help you secure better insurance rates, qualify for rental properties, and even land a job, as some employers consider credit history as part of their hiring process.

On the other hand, a poor credit score can make it challenging to access credit or result in higher interest rates, limiting your financial options and costing you more money in the long run. Understanding the importance of credit is the first step towards building a solid financial foundation and enjoying the benefits that come with it.

Now that we’ve established why credit is essential, let’s explore the key differences between cash and credit.

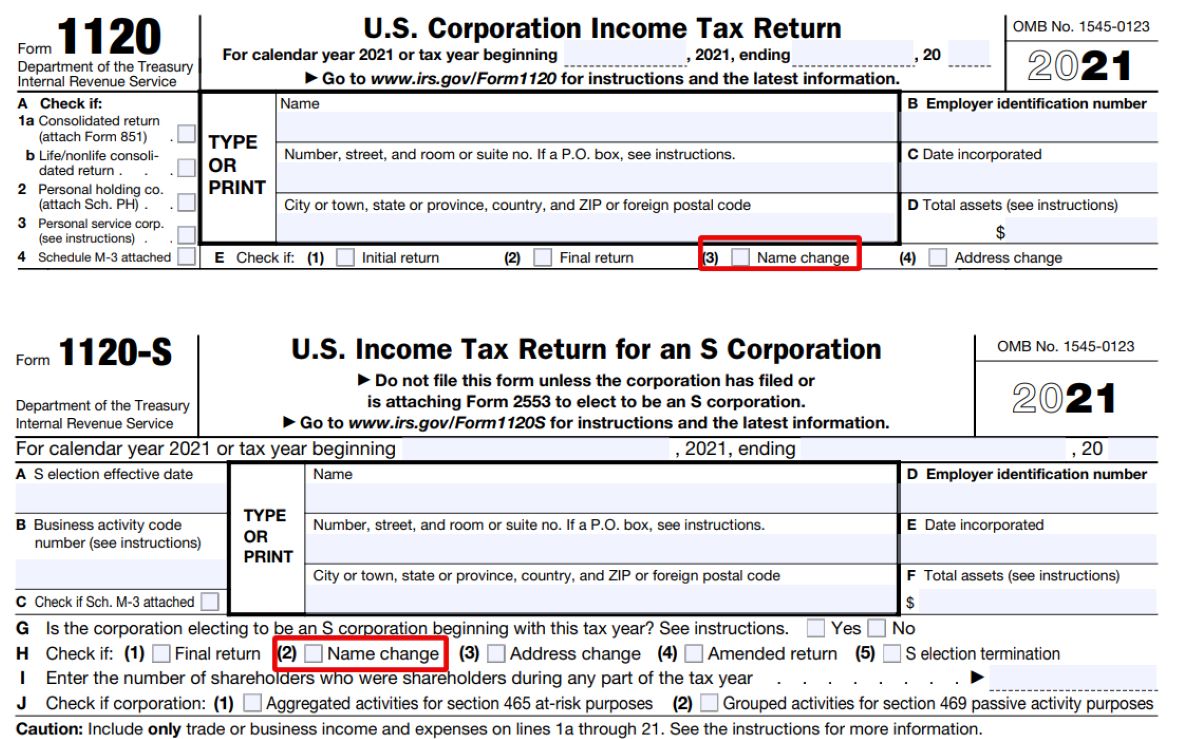

Differences Between Cash and Credit

While both cash and credit are forms of payment, they have significant differences in terms of accessibility, convenience, and financial impact.

1. Accessibility: Cash is universally accepted and instantly accessible. You can use it for transactions at any establishment that accepts physical currency. However, certain purchases, such as online shopping, may require an alternative payment method like credit cards.

Credit, on the other hand, provides a borrowing capacity that allows you to make purchases and payments without immediate cash on hand. It offers flexibility and the ability to buy now and pay later, opening up a wider range of purchasing opportunities.

2. Convenience: Cash provides a sense of control and simplicity. You pay for what you need without the worry of accumulating debt or interest charges. It allows you to budget and track your expenses more easily. However, carrying around large amounts of cash can be inconvenient and pose security risks.

Credit, on the other hand, offers convenience and flexibility. With a credit card, you can make purchases online, over the phone, or in-person without the need for physical currency. Credit cards also provide benefits such as rewards programs and consumer protections.

3. Financial Impact: Cash transactions have no impact on your credit history or score since there is no borrowing involved. However, relying solely on cash means you’re not building a credit profile, and you may miss out on the advantages that come with good credit.

Credit transactions, on the other hand, have a direct impact on your credit history and score. Each timely payment and responsible use of credit can improve your creditworthiness and open doors to better financial opportunities down the line.

Understanding these differences is crucial in deciding how to leverage cash and credit to your advantage. Building credit can provide long-term benefits and financial flexibility that cash transactions cannot offer. Now that you comprehend the differences between cash and credit, let’s dive into the benefits of building credit.

Benefits of Building Credit

Building credit is not just about having access to loans and credit cards. It offers a range of benefits that can positively impact many aspects of your financial life. Here are some key advantages of building credit:

1. Access to Better Loan Terms: Lenders consider your credit score when deciding the terms of a loan. With a good credit score, you can qualify for lower interest rates, higher loan amounts, and more favorable repayment terms. This can save you thousands of dollars in interest payments over the life of a loan.

2. Improved Renting Opportunities: Many landlords and property management companies use credit checks as part of their screening process when selecting tenants. A positive credit history can increase your chances of being approved for a rental property and may even allow you to negotiate lower rent or better lease terms.

3. Lower Insurance Premiums: In certain states, insurance companies use credit scores to determine premiums for auto, home, and even health insurance. Maintaining a good credit score can result in lower premiums, saving you money on insurance costs.

4. Higher Credit Card Limits and Perks: Building a strong credit history may lead to credit card companies increasing your credit limit over time. This can provide greater purchasing power and more flexibility in managing your expenses. Additionally, credit cards often come with various rewards programs, cashback incentives, and travel perks that can enhance your financial lifestyle.

5. Easier Approval for Rental Applications: When applying for an apartment or rental property, landlords often conduct credit checks to assess your financial responsibility. Having good credit can make the application process smoother and increase your chances of securing the desired rental unit.

6. Better Employment Opportunities: In some industries, employers may conduct credit checks as part of their hiring process. A solid credit history demonstrates financial responsibility and can enhance your chances of landing certain job opportunities.

7. Peace of Mind During Emergencies: Having access to credit can provide a safety net during unexpected emergencies or financial hardships. Whether it’s a sudden medical expense or a car repair, having established credit allows you to address these situations promptly without having to rely solely on cash on hand.

By building credit, you open doors to financial opportunities and improve your overall financial well-being. It’s time to explore the steps you can take to turn your cash into credit.

Steps to Turn Cash into Credit

Building credit from scratch may seem like a daunting task, but with the right approach, it can be achieved step by step. Here are the key steps to turn your cash into credit:

- Opening a Bank Account: Start by opening a checking or savings account at a reputable bank. This establishes a financial relationship and demonstrates stability to potential lenders.

- Applying for a Secured Credit Card: A secured credit card requires a cash deposit as collateral, which becomes your credit limit. Use the card responsibly and make regular payments to start building a positive credit history.

- Making Small Purchases and Paying Them Off: Use your secured credit card for small purchases that you can easily pay off each month. This demonstrates responsible credit usage and establishes a payment history.

- Building a Positive Payment History: Consistently make on-time payments for all your credit obligations, including loans, credit cards, and utility bills. Timely payments are a crucial factor in building a good credit score.

- Graduating to an Unsecured Credit Card: After using a secured credit card responsibly, you may qualify for an unsecured credit card. This type of card doesn’t require a cash deposit as collateral and offers greater flexibility with your credit limit.

- Managing Credit Responsibly: Use your credit card(s) wisely and avoid maxing out your credit limit. Keep your credit utilization ratio (the amount you owe compared to your total credit limit) below 30% to maintain a positive credit score.

By following these steps, you can gradually build a solid credit history and demonstrate your creditworthiness to lenders and financial institutions. However, it’s important to note that building credit is a marathon, not a sprint. It takes time and responsible credit management to achieve and maintain a solid credit profile.

Now that you know the steps to turn your cash into credit, let’s explore some tips for success in this journey.

Opening a Bank Account

Opening a bank account is the first crucial step in your journey to turn cash into credit. A bank account provides a solid foundation for your financial transactions and demonstrates stability to potential lenders. Here are some important points to consider:

- Choose a Reputable Bank: Research and choose a reputable bank that offers the services and features that align with your financial needs. Look for banks that have a strong presence, good customer service, and a range of account options.

- Explore Different Account Types: Decide whether a checking account, savings account, or a combination of both suits your needs. A checking account allows for regular transactions and bill payments, while a savings account helps you save and earn interest on your balance.

- Gather the Required Documents: Visit the chosen bank with the necessary identification documents like your Social Security number, driver’s license, passport, or other government-issued ID. Each bank may have specific requirements, so it’s essential to check in advance.

- Consider Fees and Account Features: Read the terms and conditions of the account carefully, including any associated fees, minimum balance requirements, and ATM access. Look for accounts with no or low fees to minimize your costs.

- Set Up Direct Deposit: If possible, set up direct deposit for your income to be deposited directly into your bank account. This adds stability and shows potential lenders that you have a regular source of funds.

- Monitor Your Account Regularly: Once your account is open, make it a habit to monitor your transactions and account balance regularly. This will help you stay on top of your finances and identify any unauthorized activity.

Opening a bank account provides the groundwork for building a strong financial foundation. It also allows you to access additional banking services, such as applying for loans or credit cards in the future. Once you have your bank account set up, you can move on to the next step in turning your cash into credit.

Applying for a Secured Credit Card

Once you have a bank account and are ready to start building your credit, the next step is to apply for a secured credit card. A secured credit card is a valuable tool for establishing and improving your credit history. Here’s what you need to know about applying for a secured credit card:

- Understand the Concept: A secured credit card requires a cash deposit as collateral, which becomes your credit limit. The deposit protects the issuer if you fail to make payments. The credit limit is typically equal to or a percentage of the deposit.

- Research Different Card Options: Research various secured credit card options to find one that best suits your needs. Look for cards with low fees, reasonable interest rates, and a reputable issuer.

- Review the Terms and Conditions: Carefully read the terms and conditions of the card before applying. Look for the annual fee, interest rate, grace period, and any other fees associated with the card. Make sure you understand the responsibilities and terms of use.

- Apply for the Card: Visit the issuer’s website or visit a local branch to begin the application process. Provide the necessary personal information, including your name, address, Social Security number, employment details, and financial information.

- Submit the Security Deposit: The issuer will require you to submit a security deposit, usually equal to the desired credit limit. The deposit is typically held in a separate account and may earn interest over time, depending on the issuer’s policies.

- Receive and Activate the Card: Once your application is approved, you’ll receive your secured credit card by mail. Follow the instructions to activate it, and it’ll be ready for use.

Using a secured credit card responsibly is essential in building your credit. Make sure to keep your purchases small and manageable, and pay off the balance in full every month. This demonstrates responsible credit usage and builds positive payment history.

Remember, the purpose of a secured credit card is to establish a solid credit history and eventually build enough credit to graduate to an unsecured credit card. With responsible credit management, you’ll be ready to take the next step in turning your cash into credit.

Making Small Purchases and Paying Them Off

Now that you have a secured credit card, it’s time to start using it strategically to build your credit history. Making small purchases and paying them off consistently is a key step in demonstrating responsible credit usage and establishing a positive payment history. Here’s how to make the most of this step:

- Keep Purchases Small and Manageable: Use your secured credit card for small, everyday purchases that you can easily afford to pay off in full each month. This could include groceries, gas, or other routine expenses. Keeping your purchases small helps you manage your spending and ensures that you can pay off the balance in full.

- Avoid Maxing Out Your Credit Limit: It’s important to keep your credit utilization ratio low, which is the amount of credit you’ve used compared to your total credit limit. Aim to keep your utilization ratio below 30% to show responsible credit management. For example, if your credit limit is $500, try to keep your balance below $150.

- Pay Your Balance in Full and On Time: Make it a habit to pay off your credit card balance in full each month to avoid interest charges. Paying on time is crucial for building a positive payment history and demonstrating your ability to manage credit responsibly.

- Set Up Payment Reminders: Consider setting up payment reminders or auto-payments to ensure that you never miss a due date. Late payments can have a negative impact on your credit score, so it’s important to stay organized and make payments promptly.

- Monitor Your Credit Card Statements: Regularly review your credit card statements to verify the charges and identify any fraudulent activity. This allows you to address any discrepancies promptly and protect your credit.

- Avoid Taking Cash Advances: While your secured credit card may allow cash advances, it’s best to avoid them. Cash advances often come with high fees and interest rates, which can quickly accumulate debt and negatively impact your credit.

By making small purchases and paying them off regularly, you’ll demonstrate responsible credit usage and establish a positive payment history. These positive payment habits lay the foundation for building your credit score and progressing towards unsecured credit cards and other financial opportunities.

Next, we’ll explore the importance of building a positive payment history and how it contributes to your creditworthiness.

Building a Positive Payment History

Building a positive payment history is crucial for establishing good credit. Lenders and credit reporting agencies consider your payment history as a significant factor in determining your creditworthiness. A strong payment history demonstrates your ability to manage credit responsibly. Here are some key points to keep in mind when building your payment history:

- Pay Your Bills on Time: Pay all your credit card bills, loans, and utility bills on time to establish a track record of timely payments. Late payments can have a negative impact on your credit score and may remain on your credit report for up to seven years.

- Set Up Payment Reminders: Consider setting up payment reminders or auto-payments to ensure you never miss a due date. This helps you stay organized and ensures that your payments are made on time.

- Pay in Full: Whenever possible, aim to pay off your credit card balances in full each month to avoid interest charges. By paying your balance in full, you demonstrate responsible credit usage and maintain a lower credit utilization ratio.

- Keep Credit Card Balances Low: Keeping your credit card balances low compared to your credit limits shows that you can manage credit responsibly. Aim to keep your credit utilization ratio below 30% to maintain a positive impact on your credit score.

- Avoid Collection Accounts: Be diligent in paying all your financial obligations. Unpaid debts that are sent to collections can severely damage your credit. If you’re having trouble making payments, consider contacting your creditors to explore alternative payment arrangements.

- Address Late Payments Promptly: If you do miss a payment, address it as soon as possible. Contact your creditor, explain the situation, and make the payment as soon as you can. Some creditors may be willing to waive a late fee or adjust the reporting to credit agencies.

- Be Consistent: Building a positive payment history takes time and consistency. Make it a habit to pay your bills on time and maintain responsible credit usage. Over time, this will establish a strong payment history and contribute to a healthier credit score.

Building a positive payment history sets the stage for future financial opportunities. Lenders and financial institutions will see your responsible payment behavior and be more inclined to offer better loan terms, credit limits, and interest rates.

Now that you understand the importance of building a positive payment history, let’s explore the next step in turning your cash into credit – graduating to an unsecured credit card.

Graduating to an Unsecured Credit Card

Graduating to an unsecured credit card is an important milestone in your journey to turn your cash into credit. An unsecured credit card does not require a cash deposit as collateral and offers more flexibility in terms of credit limits and rewards. Here’s how you can work towards obtaining an unsecured credit card:

- Build a Positive Credit History: Focus on building a strong credit history by making timely payments, keeping credit card balances low, and managing your credit responsibly. Lenders will review your credit history to determine your creditworthiness.

- Monitor Your Credit Score: Regularly monitor your credit score to track your progress. As your credit score improves, you’ll have a better chance of qualifying for an unsecured credit card.

- Check with Your Secured Credit Card Issuer: Reach out to the issuer of your secured credit card to inquire about graduating to an unsecured card. Some issuers may offer options to convert your secured card to an unsecured card after demonstrating responsible credit management.

- Apply for Unsecured Credit Cards: If your secured credit card issuer does not offer an option to transition, or if you’re looking for other options, you can explore applying for unsecured credit cards from different issuers. Look for cards that are designed for individuals with limited or fair credit history.

- Compare Terms and Fees: Review the terms, fees, and benefits of various unsecured credit cards. Look for low or no annual fees, competitive interest rates, and rewards programs that align with your spending habits and financial goals.

- Submit Your Application: Apply for the unsecured credit card that suits your needs and financial situation. Provide the required information, including your updated income details, employment information, and personal identification.

- Manage Your Unsecured Credit Card Responsibly: Once you’re approved for an unsecured credit card, continue to use it responsibly. Make timely payments, keep your balances low, and avoid excessive credit utilization. This will help maintain and further improve your credit history.

Graduating to an unsecured credit card signifies that you have successfully built a positive credit history and demonstrated responsible credit management. As you continue to use your unsecured card responsibly, you’ll have more opportunities to further strengthen your creditworthiness and access additional financial products and services.

Now that you’ve transitioned to an unsecured credit card, it’s essential to manage your credit responsibly for long-term financial success. Let’s explore some tips to help you achieve that in the next section.

Managing Credit Responsibly

Once you have an unsecured credit card, it’s crucial to continue managing your credit responsibly. Here are some tips to help you maintain good credit habits and make the most of your credit card:

- Make Timely Payments: Pay your credit card bills on time each month. Late payments can negatively impact your credit score and result in late fees. Consider setting up automatic payments or setting reminders to ensure you never miss a due date.

- Avoid Carrying High Balances: Try to keep your credit card balance low relative to your credit limit, ideally below 30%. Carrying high balances can increase your credit utilization ratio and negatively impact your credit score.

- Pay in Full: Whenever possible, pay off your credit card balance in full each month to avoid accruing interest charges. This helps you save money and maintain a healthy financial outlook.

- Use Credit Sparingly: While having access to credit is essential, it’s important to use it sparingly and only for necessary purchases. Avoid overspending and impulse buying, as it can lead to a pile-up of debt that becomes difficult to manage.

- Regularly Review Your Statements: Take the time to review your credit card statements each month. This helps guard against fraudulent charges and gives you an opportunity to track your spending and ensure accuracy.

- Monitor Your Credit: Keep an eye on your credit reports and scores regularly. Monitoring your credit allows you to catch any errors or signs of identity theft promptly. There are several free credit monitoring services available online.

- Resist Opening Multiple Credit Accounts: While it may be tempting to apply for multiple credit cards or loans, resist the urge. Opening too many accounts within a short period can negatively impact your credit score and make it harder to manage your finances.

- Be Mindful of Credit Inquiries: Each time you apply for credit, a hard inquiry is made on your credit report. Too many inquiries can lower your credit score. Be strategic and only apply for credit when necessary.

- Stay Organized: Keep track of your credit card statements, payment due dates, and other financial obligations. Staying organized helps you stay on top of your finances and ensures you maintain a good credit history.

- Practice Patience: Building and maintaining good credit takes time, so be patient. Continue to manage your credit responsibly, and your credit score will gradually improve, providing you more financial opportunities in the future.

By managing your credit responsibly, you’ll continue to strengthen your credit history, maintain a good credit score, and increase your financial stability. Responsible credit usage opens doors to better interest rates, higher credit limits, and more favorable loan terms.

Now that you have a solid understanding of how to manage your credit, let’s explore some additional tips for success in turning your cash into credit.

Tips for Success in Turning Cash into Credit

Building and maintaining good credit requires a consistent and responsible approach. Here are some additional tips to help you succeed in turning your cash into credit:

- Start Early: It’s never too early to start building credit. The earlier you establish a credit history, the better prepared you’ll be for future financial goals like buying a home or starting a business.

- Keep Track of Deadlines: Stay organized and make note of important dates such as payment due dates, annual fee payments, or periodical credit score check-ups. Meeting deadlines is critical in maintaining a positive credit history.

- Be Mindful of Credit Utilization: Aim to keep your credit utilization ratio below 30%. High credit utilization can negatively impact your credit score. Regularly pay down your balances and consider requesting a credit limit increase to maintain a healthy utilization level.

- Limit New Credit Applications: Each time you apply for credit, it results in a hard inquiry on your credit report. Limit new credit applications to only when necessary to avoid multiple inquiries that can temporarily lower your credit score.

- Monitor Your Credit Reports: Regularly review your credit reports from all three major credit bureaus – Equifax, Experian, and TransUnion. Look for any inaccuracies, discrepancies, or signs of identity theft. Report any issues promptly to ensure the accuracy of your credit information.

- Patience is Key: Building good credit takes time and consistent, responsible financial habits. Be patient and stay committed to managing your credit wisely. Over time, your efforts will be rewarded with a positive credit history and improved credit score.

- Seek Guidance from Professionals: If you’re struggling to turn your cash into credit or have specific questions about your unique financial situation, consider seeking guidance from financial professionals, such as credit counselors or financial advisors. They can provide valuable insights and tailored advice to help you achieve your credit goals.

- Keep Learning about Personal Finance: Stay informed about personal finance topics, such as credit scores, budgeting, and debt management. The more you educate yourself, the better equipped you’ll be to make informed financial decisions and reach your credit-building goals.

Remember that building credit is a continuous process that requires patience, discipline, and responsible financial habits. With time and consistent effort, you can turn your cash into credit and unlock a world of financial opportunities.

Congratulations on taking the first steps toward building your credit and setting yourself up for a healthier financial future!

If you found this article helpful, feel free to share it with others who may also benefit from learning how to turn cash into credit.

Conclusion

Building credit is a valuable endeavor that can open doors to countless financial opportunities. By following the steps outlined in this article, you can successfully turn your cash into credit and establish a solid credit history.

Understanding the importance of credit and the differences between cash and credit is the foundation of this process. Building credit offers numerous benefits, including better loan terms, access to rental properties, lower insurance premiums, and improved employment prospects.

The steps to turn cash into credit involve opening a bank account, applying for a secured credit card, making small purchases and paying them off, building a positive payment history, graduating to an unsecured credit card, and managing credit responsibly. These steps require diligence, responsibility, and patience.

Throughout this journey, it’s crucial to monitor your credit, make timely payments, maintain low credit card balances, and practice responsible credit management. By doing so, you’ll gradually build a positive credit history and increase your creditworthiness.

Remember, building credit is a marathon, not a sprint. It takes time and commitment to establish a strong credit profile. As you continue to manage your credit responsibly, you’ll have access to better financial options and opportunities that can greatly improve your financial well-being.

So, don’t delay! Start taking the necessary steps today to turn your cash into credit and pave the way for a brighter financial future.