Finance

How To Use IPhone Credit Card Reader

Published: October 27, 2023

Learn how to use the iPhone credit card reader for your finance needs. Simplify your transactions and accept payments on the go.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In today’s fast-paced digital world, convenience is key. And when it comes to accepting payments for your business, having a mobile payment solution is essential. The advent of smartphone technology has revolutionized the way we do business, making it easier than ever to process credit card payments on the go.

One of the most popular options for mobile payment solutions is the iPhone credit card reader. This small device, coupled with a user-friendly app, allows businesses of all sizes to accept credit card payments directly through their iPhone.

In this article, we will take a closer look at how to use an iPhone credit card reader, its benefits, compatibility, setup process, and how to accept payments. This guide will equip you with the knowledge and steps needed to harness the power of mobile payments and maximize convenience for your business.

Whether you are a small business owner, a freelance entrepreneur, or a service provider on the go, an iPhone credit card reader can greatly enhance your ability to accept payments quickly and securely. No longer do you need to rely on cash or checks; with an iPhone credit card reader, you can give your customers the option to pay using their credit or debit cards, even when you’re away from your traditional brick-and-mortar location.

So, if you are ready to unlock the potential of mobile payments and streamline your business operations, let’s dive into the world of the iPhone credit card reader and learn how to utilize this powerful tool to your advantage.

What is an iPhone Credit Card Reader?

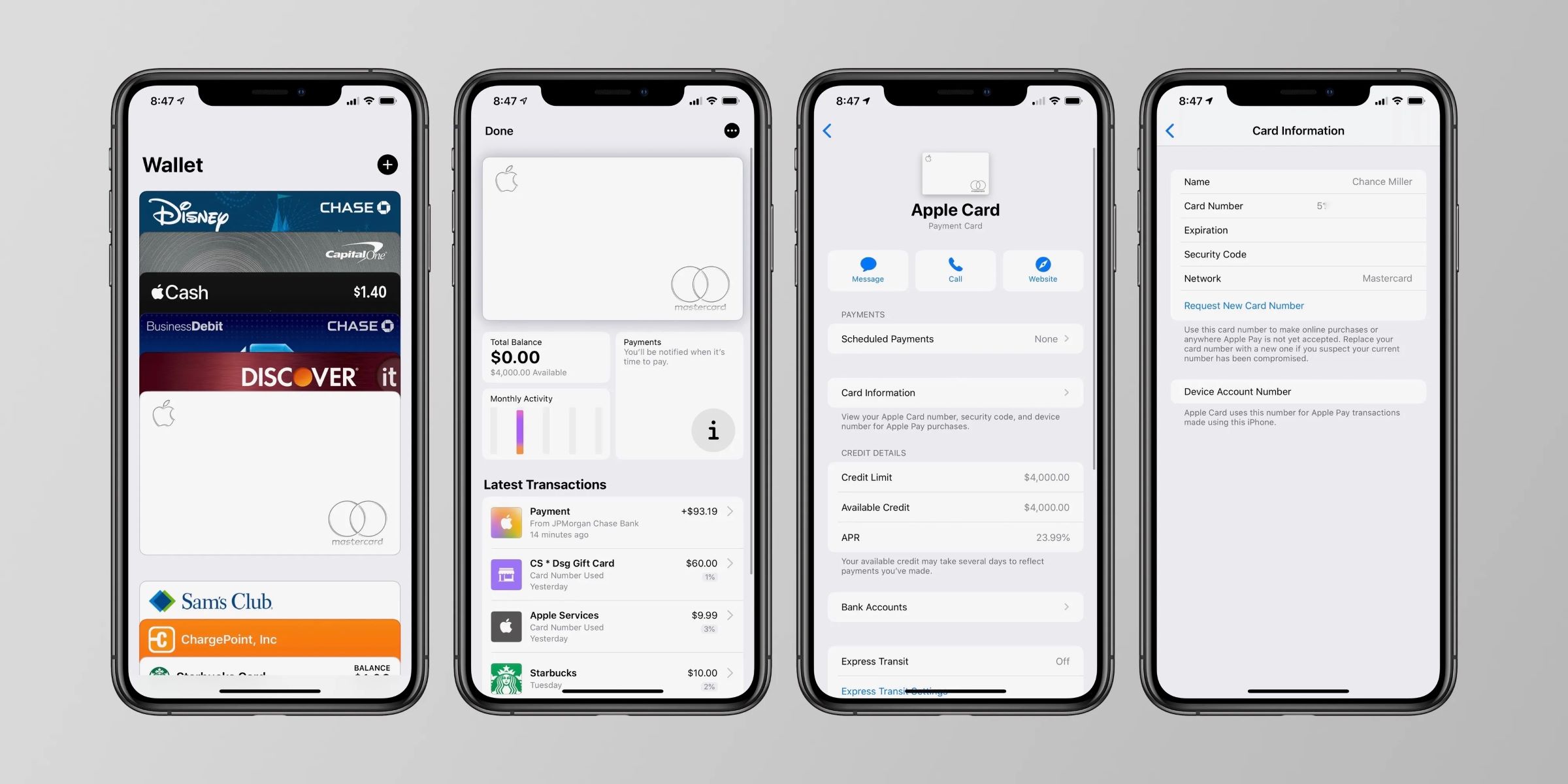

An iPhone credit card reader is a small device that can be plugged into the headphone jack or lightning port of your iPhone. It allows you to accept credit and debit card payments directly through your device. When used in conjunction with a compatible app, the credit card reader transforms your iPhone into a portable point-of-sale (POS) system.

The credit card reader works by reading the magnetic stripe or chip on the customer’s credit card and securely transmitting the payment information to the app. The app then processes the transaction and completes the payment, providing you with a convenient way to accept payments on the go.

These devices are typically compact and lightweight, making them easy to carry around and use wherever your business takes you. They can be a valuable tool for small businesses, independent contractors, and service providers who need a portable and efficient payment solution.

Not only do iPhone credit card readers accept physical card payments, but many also support contactless payment methods such as Apple Pay, Google Pay, and other digital wallets. This allows you to cater to customers who prefer to make payments using their mobile devices, providing a seamless and convenient experience.

With an iPhone credit card reader, you can eliminate the need for clunky cash registers and stationary card terminals. Instead, you have the flexibility to accept payments anywhere, whether you’re running a booth at a trade show, making deliveries, or offering on-site services.

It’s important to note that iPhone credit card readers typically require an internet connection or a cellular data plan to process transactions. This connectivity ensures that the payment information is securely transmitted and verified in real time, providing peace of mind for both you and your customers.

Now that you understand what an iPhone credit card reader is, let’s explore the benefits of incorporating this technology into your business.

Benefits of Using an iPhone Credit Card Reader

Using an iPhone credit card reader offers numerous benefits for businesses. Here are some of the key advantages:

- Convenience: An iPhone credit card reader allows you to accept payments anywhere, anytime. Whether you’re at a trade show, working remotely, or providing on-site services, you can easily process transactions without the need for a traditional cash register or stationary card terminal.

- Improved Cash Flow: By accepting credit and debit card payments, you can provide more payment options for your customers. This increases the likelihood of a sale and can lead to improved cash flow for your business. Plus, you won’t need to wait for checks to clear or make frequent trips to the bank to deposit cash.

- Enhanced Professionalism: Having the ability to accept card payments adds a level of professionalism to your business. It gives your customers confidence that you are a legitimate and established business, capable of providing modern payment solutions.

- Reduced Risk of Fraud: When you accept card payments through an iPhone credit card reader, you benefit from the security features and encryption protocols built into the technology. This helps to reduce the risk of fraud and protects both you and your customers from potential data breaches.

- Efficiency and Accuracy: Utilizing an iPhone credit card reader streamlines your payment process. You can quickly and accurately process transactions, eliminating the need for manual calculations and reducing human error.

- Access to Reporting and Analytics: Many credit card reader apps provide detailed reporting and analytics features. These tools help you track sales, identify trends, and make informed business decisions based on data. Having access to this valuable information can greatly assist in managing and growing your business.

- Integration with Other Business Tools: iPhone credit card readers often integrate with other business tools, such as inventory management systems or accounting software. This integration can simplify your workflows and provide a seamless experience for managing transactions and data.

By utilizing an iPhone credit card reader, you can enjoy these benefits and optimize your payment processes, ultimately enhancing the overall efficiency and success of your business.

Compatibility and Requirements

Before you start using an iPhone credit card reader, it’s important to ensure that your device and other requirements are compatible. Here are the compatibility factors and requirements to consider:

- iPhone Model: The credit card reader’s compatibility will depend on the iPhone model you have. Most credit card readers are designed to work with newer iPhone models, including iPhone 7 and later. However, it’s always best to check the specific compatibility information provided by the manufacturer or the app developer.

- Operating System: Your iPhone should have the minimum required operating system version to support the credit card reader and its accompanying app. Typically, iOS 11 or later is required. To check your operating system version, go to Settings > General > About > Software Version.

- Headphone Jack or Lightning Port: Depending on the credit card reader model, it will either connect to the iPhone’s headphone jack or the lightning port. Ensure that your iPhone has the appropriate port for the credit card reader you plan to use. If your iPhone model doesn’t have a headphone jack, you may need to use an adapter or consider a credit card reader that connects through the lightning port.

- Internet Connection: An active internet connection is necessary to process credit card transactions using the credit card reader and app. This can be through Wi-Fi or cellular data, depending on your location and preference. A stable and secure internet connection is essential for seamless payment processing.

- Compatible Payment Processor: To use an iPhone credit card reader, you’ll need to have an account with a compatible payment processor. Popular payment processors, such as Square, PayPal Here, and SumUp, offer their own credit card readers and accompanying mobile apps. Ensure that the credit card reader you choose is compatible with your preferred payment processor.

- Account Setup: Before you can start using the credit card reader, you’ll need to set up an account with the payment processor and link it to the app. This usually involves providing some basic business information and verifying your identity. Follow the instructions provided by your chosen payment processor to complete the account setup process.

It’s important to research and confirm compatibility with the specific credit card reader model and app you plan to use. Check the manufacturer’s website or the app’s documentation for detailed compatibility information and any additional requirements.

By ensuring that your device and other requirements are compatible, you can seamlessly integrate the iPhone credit card reader into your business operations and start accepting payments with ease.

Steps to Set Up an iPhone Credit Card Reader

Setting up an iPhone credit card reader is a straightforward process. Here are the basic steps to get started:

- Choose a Compatible Credit Card Reader: Select a credit card reader that is compatible with your iPhone model and meets your business needs. Popular options include Square Reader, PayPal Here, and SumUp. Purchase the credit card reader from an authorized retailer or directly from the manufacturer.

- Download the App: Visit the App Store on your iPhone and search for the app associated with your chosen credit card reader. Download and install the app on your device. Ensure that you are downloading the official app from the correct developer to avoid counterfeit or fraudulent apps.

- Create an Account: Open the app and follow the prompts to create an account with the associated payment processor. Enter your business and personal information as required, and complete any identity verification steps. This will enable you to start accepting payments through the app.

- Connect the Credit Card Reader: Depending on the specific credit card reader model, connect it to your iPhone’s headphone jack or lightning port. Ensure a secure connection to avoid any issues during payment processing.

- Pair the Credit Card Reader: Launch the app on your iPhone and follow the instructions provided to pair the credit card reader with your device. This typically involves a simple Bluetooth or wireless connection process. Make sure your iPhone’s Bluetooth is turned on, and follow the on-screen prompts to complete the pairing.

- Configure Settings: Within the app, navigate to the settings or preferences section to customize various options according to your business requirements. This may include setting up tax rates, adding product or service categories, enabling tipping features, and configuring receipt options.

- Test the Reader: It’s always a good practice to test your credit card reader before conducting actual transactions with customers. Use the test mode or a dummy card to ensure that the reader is functioning properly and that you can successfully process a payment. This gives you the confidence that your device and app are working as expected.

- Keep Software Updated: Regularly check for app updates and install them to ensure you have the latest features and security enhancements. Keeping the app and your iPhone’s operating system up to date helps maintain compatibility with the credit card reader and ensures a smooth payment experience.

Once you have completed these steps, you are ready to start accepting credit and debit card payments using your iPhone credit card reader. Familiarize yourself with the app’s interface and features to ensure a seamless payment process for your customers.

Remember to follow any specific instructions provided by the credit card reader manufacturer or the app developer for the best setup and usage experience. Each device and app may have unique requirements or additional steps, so consult the user guide or online resources for more detailed instructions if needed.

How to Use the iPhone Credit Card Reader App

Once you have set up your iPhone credit card reader, using the accompanying app is a breeze. Follow these steps to effectively utilize the app and process credit and debit card payments:

- Open the App: Locate the app on your iPhone’s home screen and tap on it to launch the application. In most cases, you will need to sign in with your account credentials or use biometric authentication to access the app.

- Enter Payment Information: To process a payment, enter the payment amount on the app’s interface. This can typically be done by manually typing in the amount or by using a pre-set product or service list within the app. You may also have the option to add notes or descriptions to the transaction for reference.

- Select Payment Method: Choose the type of payment method the customer is using. This can be a credit card, debit card, or contactless payment method such as Apple Pay or Google Pay. If the customer is using a physical card, insert it into the credit card reader or ask them to hold their mobile device near the reader to process a contactless payment.

- Process the Payment: Once you have selected the payment method, the app will communicate with the credit card reader to securely transmit the payment information. Follow the prompts on the app’s interface to complete the payment processing. This may involve the customer entering their card PIN, signing on the screen, or simply waiting for a contactless transaction to authenticate.

- Confirm the Transaction: Once the payment has been processed successfully, the app will display a confirmation screen. Verify all details, including the transaction amount, payment method, and any additional information such as a digital receipt or email address for sending receipts. It’s essential to ensure accuracy before finalizing the transaction.

- Provide a Receipt: Give the customer the option to receive a receipt. Depending on the app and your preferred method, you can either email a digital receipt to the customer or provide a printed receipt if you have a compatible printer connected to your iPhone. Ensure that the customer is satisfied with the transaction and has received all the necessary documentation.

- Handle Refunds and Void Transactions: In the event of a refund or void transaction, consult the app’s interface for the specific refund or void process. Generally, you will navigate to the transaction history, select the relevant transaction, and follow the given steps to process the refund or void the payment. Always adhere to your business’s refund policy and provide the customer with appropriate confirmation of the refund.

As you become more familiar with the app’s features and functionality, you will discover additional options and settings to optimize your payment process. Take the time to explore these features, such as generating transaction reports, setting up tipping options, or integrating with other business tools, to enhance your overall payment management capabilities.

Remember to keep the app updated to ensure you have access to the latest features, security patches, and improvements. Regularly check for updates within the App Store and install them as soon as they become available.

By following these steps and leveraging the capabilities of the iPhone credit card reader app, you can efficiently process payments, enhance customer satisfaction, and simplify your financial transactions.

Accepting Payments with the iPhone Credit Card Reader

Once you have set up the iPhone credit card reader and familiarized yourself with the app, you’re ready to start accepting payments. Here are the steps to effectively accept credit and debit card payments using your iPhone credit card reader:

- Initiate the Payment: When a customer is ready to make a payment, inform them that you accept card payments and ask if they would like to pay using a credit or debit card. Make sure the credit card reader is connected to your iPhone and launch the app.

- Enter the Payment Amount: Using the app’s interface, enter the total payment amount for the transaction. You can either manually type in the amount or select a product or service from a pre-set list within the app. Double-check for accuracy.

- Select the Payment Method: Ask the customer if they will be using a physical card or a contactless payment method such as Apple Pay or Google Pay. If they are using a physical card, guide them to insert the card into the credit card reader or ask them to hold their mobile device near the reader for contactless payment.

- Securely Process the Payment: Once the payment method is selected, the app will securely communicate with the credit card reader to process the payment. Follow the prompts on the screen to complete the payment processing. This may include the customer entering their card PIN, signing on the screen, or waiting for a contactless transaction to authenticate.

- Verify the Transaction: After the payment is processed, the app will display a confirmation of the transaction. Double-check the details, including the payment amount, payment method, and any additional information associated with the transaction. Ensure that all information is accurate before finalizing the transaction.

- Provide a Receipt: Offer the customer the choice to receive a receipt. Depending on your preference and setup, you can either email a digital receipt to the customer or provide a printed receipt if you have a compatible printer connected to your iPhone. Make sure to ask the customer for their preferred method and deliver the receipt accordingly.

- Securely Store Transaction Records: It’s important to maintain proper transaction records for your business. Most credit card reader apps have a transaction history feature where you can view and export transaction details. Regularly back up this information in a secure manner, ensuring that you comply with any legal or regulatory requirements for record keeping.

- Ensure Customer Satisfaction: Throughout the payment process, prioritize providing excellent customer service. Be attentive to the customer’s needs, answer any questions they may have, and address any concerns promptly. Ensure that the transaction is completed smoothly and that the customer leaves satisfied with the payment experience.

By following these steps, you can efficiently process credit and debit card payments using your iPhone credit card reader. Familiarize yourself with the app’s features and navigation to provide a seamless experience for both you and your customers.

Remember to adhere to your business’s refund policy and handle refunds or void transactions, if necessary, following the app’s specific process. It’s crucial to maintain transparency and clarity in your payment transactions to build trust with your customers.

By accepting payments with an iPhone credit card reader, you can provide a convenient and secure payment option for your customers, ultimately enhancing their overall satisfaction and allowing your business to thrive.

Troubleshooting and FAQ

While using an iPhone credit card reader can greatly simplify your payment process, you may encounter some challenges along the way. Here are some common troubleshooting tips and frequently asked questions to help you address any issues that may arise:

Troubleshooting:

- Reader Not Connecting: If your credit card reader is not connecting to your iPhone, ensure that the device is securely plugged into the headphone jack or lightning port. If using Bluetooth connectivity, make sure your iPhone’s Bluetooth is turned on and try restarting both the reader and your iPhone.

- Payment Declined: If a payment is declined, verify that the entered payment amount is correct, and ensure the customer’s card is not expired or out of funds. In some cases, contacting the customer’s bank to confirm the issue may be necessary.

- Slow Response Time: If you experience a slow response time or lag when processing transactions, check your internet connection. Ensure you have a stable Wi-Fi connection or consider using a cellular data plan if available. Additionally, closing any unnecessary apps running in the background may improve overall performance.

- App Crashes or Freezes: If the app crashes or freezes during a transaction, try closing and relaunching the app. If the issue persists, check for any available updates for both the app and your iPhone’s operating system. If necessary, uninstall and reinstall the app to resolve any potential software conflicts.

- Card Compatibility: If a customer’s card is not being recognized or read by the credit card reader, inspect the card for any visible damage or dirt. Clean the card if necessary and try again. If the issue persists, ask the customer to use an alternative payment method or provide manual entry of their card details in the app.

FAQ:

- Is it safe to use an iPhone credit card reader? Yes, iPhone credit card readers use encrypted technology to securely transmit and process payment information, reducing the risk of fraud. However, it is important to follow best security practices, such as keeping the app and your iPhone’s operating system updated, and safeguarding customer data.

- Can I use multiple credit card readers with one app? It depends on the app and payment processor you are using. Some apps and payment processors support multiple credit card readers, allowing you to process transactions simultaneously on multiple devices. Check the app’s documentation or contact the payment processor’s support team to confirm if this feature is available.

- What are the fees associated with using an iPhone credit card reader? Fees vary depending on the payment processor and the specific plan you choose. Common fees include a per-transaction fee, a percentage of the transaction amount, and monthly subscription fees for additional features. It is essential to review the fee structure of the chosen payment processor and understand their pricing model before committing.

- Can I issue refunds using the iPhone credit card reader app? Yes, most credit card reader apps have built-in refund capabilities. You can usually initiate a refund by navigating to the transaction history and selecting the appropriate transaction. Follow the prompts within the app to process the refund, ensuring compliance with your business’s refund policy.

- Is offline mode available with iPhone credit card readers? Some credit card reader apps offer an offline mode that allows you to process payments even without an internet connection. However, be aware that transaction processing time may be longer, and you will need to ensure that the payment information is securely uploaded to the app once you regain an internet connection.

If you encounter any technical issues or have specific questions about your iPhone credit card reader or app, it is recommended to reach out to the app’s support team or the payment processor’s customer service. They will be able to provide you with personalized assistance and help you resolve any issues efficiently.

By being familiar with troubleshooting techniques and having answers to frequently asked questions, you can overcome any challenges and make the most out of your iPhone credit card reader and app.

Conclusion

The use of an iPhone credit card reader is a game-changer for businesses of all sizes. With the convenience and portability it offers, you can accept credit and debit card payments wherever your business takes you. By following the steps outlined in this article, you can set up your iPhone credit card reader, use the accompanying app, and efficiently process payments.

The benefits of using an iPhone credit card reader are numerous. It provides convenience to both you and your customers, improves cash flow, enhances professionalism, reduces the risk of fraud, and offers efficiency and accuracy in your payment processes. Additionally, the integration with reporting and analytics tools allows you to gain valuable insights into your business.

Compatibility and requirements, such as your iPhone model and operating system version, headphone jack or lightning port, internet connection, and compatible payment processor, should be taken into consideration before purchasing an iPhone credit card reader.

While using the app, ensure a smooth payment process by entering the correct payment amount, selecting the appropriate payment method, securely processing the payment, verifying the transaction details, and providing a receipt. In case of troubleshooting issues, such as connectivity or declined payments, follow the suggested troubleshooting tips or consult the app’s support team.

In conclusion, embracing the use of an iPhone credit card reader revolutionizes the way you accept payments. It offers a flexible and secure payment solution, allowing you to provide exceptional service to your customers. By staying up to date with the latest features and best practices, you can leverage the power of mobile payments to enhance the success and growth of your business.